*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Tuesday, April 20, 2010

What I ate on my holidays

Monday, April 19, 2010

Planes and weather

Wednesday, April 14, 2010

Hyperinflation or bust (actually, both)

These considerations, useful for the wealthy investor, will matter less to the ordinary person, who will be too busy coping with a suddenly unpredictable world of goods, services and employment.

A letter to UKIP

Economic mismanagement of the UK by both Conservative and Labour governments

First, please accept my congratulations to yourself and your colleagues on your distinguished manifesto launch – clear policies, frank answers (“We’re skint” resonates) and vigorous rebuttals.

If your aim and hope is a hung (or “balanced”) Parliament, so that the voice of the people may briefly be heard at this critical juncture in our history, may I draw your attention to a point which may help deflate Conservative triumphalism? The Tories are now letting it be understood how well they managed the economy in the Nineties – you may have seen the egregious praise heaped on Ken Clarke by David Dimbleby in the 1st April edition of “Question Time”. Clarke himself damned George Osborne with perfunctory praise and clearly expects to be given a second run at the job sometime.

But I would argue that New Labour did not inherit a thriving economy in 1997; they inherited a booming economy. This led inevitably to the stockmarket bust starting January 2000, which was turned round from 2003 on by the same disastrous trick as was played under the Conservatives, namely an increase in the money supply at a rate generally far above the growth of GDP. For detail, please see the enclosed copy of a letter sent recently to the Guardian’s economics editor, Larry Elliott.

Finally, I note that you said UKIP would consider not standing against a LibDem candidate with proven Eurosceptic views. Would John Hemming MP (for Birmingham Yardley) qualify, as he was one of the signatories to Bob Spink’s EDM 20 (18.11.2009), which called for a referendum on the EU?

Best wishes

CC: Mr Nigel Farage, Mr David Campbell Bannerman

Tuesday, April 13, 2010

Hoo-ha

Monday, April 12, 2010

Had enough of teaching (or other job)?

_____________________________________

Can you really afford to quit?

Article Published in The TES on 21 November, 1997 By: Rolf Norfolk

First work out the cost. The job might not seem so bad after all - or there may turn out to be other solutions, says Rolf Norfolk

Are you fed up and dreaming of the days when early retirement was much easier to obtain? If so, first you have to decide whether you really have a problem with your job or if it is just a grumble. If you do have a serious worry, it may help to review the following options and consider whether you are prepared to meet the cost of changing your situation.

1. If your promoted post has become too much for you, ask for a demotion. Think twice about this, as it involves a pay cut and it is hardly a recommendation for re-promotion later. Regardless of current regulatory proposals, a step-down is already provided for in your pension scheme so long as it is in the interest of the efficient running of the school and your new post is with the same employer.

You have two options: first, you can split the pension account, so that service in the higher-paid post is preserved (and increased in line with inflation), and then there is a separate calculation for the new job, based on the lower salary and the remaining period served. At retirement, the two figures are added together. Alternatively, you can carry on paying pension contributions as though the demotion hadn't happened, and have all your service relate to your old salary. The potential drawback is that the notional salary is fixed, not inflation-linked. Such considerations need not worry those close to retirement, since a teacher's pension relates to the best year's income in the final three years; in the past some heads have therefore returned to teaching at the age of 58.

2. If the classroom demands are too much, try teaching part-time. This does not wreck your accrued pension because although your pension depends on not only the exact time you have served but your salary at retirement, if you work part-time the notional salary on which your pension is based is what you would be earning if you were a full-timer. But obviously from then, as a part-timer, you will be adding years and days of service more slowly. New regulations are, however, now going through Parliament to improve pension calculations for part-timers.

3. If your face does not fit, move to another school. Life is too short to put up with managers who don't like you. Or you could retrain for a different sector of the education service.

4. Sell your big house and move down. Or sell your investments. Or remortgage. Use your assets to pay for a very long holiday (or to subsidise part-time or lower-paid employment) before you take your pension as of right at 60. If you can, but aren't willing, you've just found out exactly how bad the problem isn't.

5. Apply for ill-health early retirement. Occupational disability doesn't imply being half-dead. But it's not a dodge, either. You have to pass (or, more accurately, fail) medical tests, and the Government has changed the rules to make this harder. For those who get it, the really tough bit is the financial impact. With the Teachers' Superannuation Scheme, ill-health pensions relate only to actual service (plus possibly a bit extra), so even with 20 years' service you would lose at least two-thirds of your income. While you still can, you should therefore consider permanent health insurance, which pays an extra, tax-free income during incapacity. Alternatively, some critical illness insurances include a lump sum pay-out if you are diagnosed as occupationally unfit.

In recent years one in four teacher retirements has been through illness, but although this is more than in previous decades it is still only about the same as for the general population. Often the root cause is unrelated to working conditions (one client of mine is going deaf); but if you are over-stressed, you should try to solve your problem, not have a chronic illness because of it.

6. For young teachers: create your own early retirement account. If you invest the same as your pension contribution (6 per cent) from ages 22 to 55, you will have enough to sustain you for five years on about 40 per cent of salary, until your pension at 60 (additional voluntary contributions are not likely to be appropriate for this, since they can't be deliberately exhausted in five years). Those anticipating unwaged child-rearing years should save more (say 7 per cent) when they can.

7. Resign half-way through your career. This is drastic. Very few teachers can do this and earn the same money elsewhere. Besides, your job is not threatened by Third World competition or the microchip - not many others can say that. And thinking of retirement, only a minority of the public can hope to retire as early (60 is still relatively young) and as securely-provided for as a teacher.

Are you giving up to do something better, or running away from a problem you have failed to address? If the latter, turn and defeat the monster.

As H G Wells's Mr Polly discovered, if you don't like your life, you can change it.

Rolf Norfolk is an independent financial adviser working in the Midlands. He is a former secondary teacher.

This article is not intended as personal advice. Anyone interested in the points raised should consult a financial adviser.

Survivalism goes mainstream

Years ago, it'd be American gun nuts - the type that quotes Ruby Ridge and Waco as revealing the soul of government. They'd be researching the continental US to find rural areas safe from floods, earthquakes and tornadoes; they'd be building houses quickly and cheaply from straw bales (it works very well, apparently). Pioneering without the Apache has a superficial romantic attraction.

But there is a new Apache: your fellow man. In northeastern Ohio, a sheriff's department has suffered such severe budget cuts that it now has only one police car to cover an area twice the size of the British West Midlands. A judge has advised residents to arm themselves, to be careful and vigilant and make connections with their neighbours. (htp: John Lott)

In Australia, an investor education website has turned from advising us how to build a balanced portfolio, to considering what happens when complex societies collapse:

Marc Faber is recommending that investors have half of their investments exposed to Asia. That is a very useful advice for very high net worth people who have the money and connections to resettle. But for the rest, it is very important to have your own plan B if something happens in your local area...

Your entire country will not be likely to collapse overnight. But if you are unlucky, your local region can be the one that descend into chaos first. The hard question to ask is: do you trust that your government [...] will have the resources, and competence to cope with large-scale crisis? We are not talking about small-scale crisis that affects small communities- we are talking about a scale large enough to affect at least hundreds of thousands of people.

If you are going to plan for Plan B, then you will have to increase the margins in your life and acquire skills outside the area of your specialisation.

Here in the UK, the Fleet Street Letter (an investor publication established in 1938 and edited by Lord Rees-Mogg, formerly editor of the Times) is striking a dramatic note with its headline "The Great Financial Deception of 2010". The thesis of the latest edition is that:

- British government credit will be downgraded (leading to a very damaging rise in interest rates)

- The FTSE will halve within the next three months

- A consumer sea-change from reckless spending to saving/paying off debt will tip Britain into deep and prolonged recession

- Residential and commercial property will halve in value within the next 10 years

Our handkerchief of an urban lawn won't grow enough to support us, and I'm still debating what to do for the best if the worst looks like happening. But one thing is clear: forming and strengthening community links will be a vital part of our survival plan.

Sunday, April 11, 2010

A letter to Larry Elliott

_______________________________________

URGENT

Mr Larry Elliott, Economics Editor

The Guardian

Kings Place

90 York Way

London N1 9GU

Dear Mr Elliott

Like yourself, I am concerned at the fate of ordinary people in the hands of the “New Olympians”, as you correctly call them. Unfortunately, the people now seem likely to elect a fresh government on the basis of a big lie, namely that New Labour inherited a thriving economy and threw away a golden opportunity. But I don’t see anyone in the electronic or print media nailing the lie. Will you help do this?

If you accept the monetarist analysis, politicians of both stripes have been goosing the economy since the early Seventies to get a feelgood factor in time for re-election. Banks (permitted / encouraged by politicians) have been lending money faster into the economy than the economy was growing.

It’s quite easy to show this from Bank of England online money supply stats (available from 1963 on) and official figures for GDP. I charted the relationship recently like this:

The result was a series of bubbles in asset prices, even though GDP growth has been trending downward since the mid 1970s. Now, and for decades ahead of us, we’ll be paying the price, because we can’t increase debt forever.

Politicians might argue in their defence that they didn’t know – remember, Keith Joseph had to explain monetarist principles to Margaret Thatcher after she became PM – but both Thatcher and Major were familiar with monetarism by the Nineties, as, one assumes, were the Opposition. New Labour inherited a debt-fuelled boom in stock and real estate prices, one that was bound to end in a bust at some time. True, they didn’t fix the Quattro, but they weren’t the ones who fired it up. Now the engine’s burning out.

The record of the last Conservative government is far worse than New Labour’s: from 1979 to 1990 (when the economy had one of its heart attacks because of the unhealthy diet of financial additives), GDP grew annually by an average of 8% or so, but M4 by 19% p.a., a difference of 11% p.a. - compound. The New Labour years have seen something like 5% GDP growth and 10% M4 growth p.a., in other words a discrepancy of only half that experienced during the boom years of the 1980s.

But it’s been going on for longer than that. In 1972, UK M4 increased by 35% (see spike on graph) – and 17% the year before - so it’s quite possible that the OPEC oil price hike was not merely (or mainly) revenge for the Six Day War etc but a repricing in anticipation of the consequent devaluation of the pound and dollar. Then we got inflation, the IMF (who, it is rumoured, demanded the resignation of Harold Wilson as a precondition of their assistance), retrenchment and recession under Callaghan, the Winter of Discontent and finally the Tories with their phony, but spectacular, recovery.

You’ll have gathered that although I don’t hold any brief for the Conservatives, I feel the same way about recent Labour governments too. But I’m darned if I’ll let the next lot be swept in on a tidal wave of misrepresentation, assisted by a news media that has largely nailed its colours to their mast. All that means is that the lessons will not be learned and the crooked game will, essentially, continue.

Except that it can’t, not indefinitely. Another clear implication of the M4-to-GDP correlation is that as the debt increases, GDP slows. There’s a number of people now saying that Western economies are approaching the point where additional debt will actually cause GDP to shrink – see this graph from Nathan Martin, for example:

.jpg) (Source: http://economicedge.blogspot.com/2010/03/most-important-chart-of-century.html)

(Source: http://economicedge.blogspot.com/2010/03/most-important-chart-of-century.html)This isn’t just wild blogger stuff – see the work of Australian economist Steve Keen, one of perhaps only 12 professional economists in the world who predicted the credit crunch. Keen explains that classical economics ignores debt, which is why 20,000 economists didn’t see the truck coming.

Can you, are you prepared to, get the people to see what’s going on before they cast their votes?

Yours faithfully

Sex, war and conquest

But men without women are altogether more troublesome than women without men, especially when they are young.

All kinds of speculation is now seething about what might happen; a war to cull the surplus males, a rise in crime, a huge expansion in the prostitution that is already a major industry in every Chinese city, a rise in homosexuality.

I've put in a comment but who knows if it'll get through:

"All kinds of speculation is now seething about what might happen; a war to cull the surplus males..."

Yes, but not Chinese males, I think.

Meantime, I recall that Chinese who settle in Tibet are permitted more than one child. I would also think there's a lot of grabbing Tibetan girls as wives, while Tibetan males are pushed off to wander around their country looking for casual employment by a growing class of Chinese entrepreneurs, the latter enabled and abetted by the Party and funneled money.

Next stop for this treatment, Arunachal Pradesh, I'd guess.

Saturday, April 10, 2010

Sovereign debt default risk

It's worth noting that despite recent improvement, the UK is still out of the "AAA" bracket - by two rungs.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Whose bonds would you buy?

It's worth noting that despite recent improvement, the UK is still out of the "AAA" bracket.

Wednesday, April 07, 2010

Circles and straight lines

The above chart from here (htp: Global Perspectives) is another of those attempts to perceive underlying order in the apparently random movement of the market and the economy. I've tried the same myself and suggested that the period from 2000 on may be like 1966 - 1982 (the last top and bottom of the market when adjusted for inflation). The interesting thing about the above picture is that the c. 16-year cycle appears to work over a much longer time - starting with the later part of the nineteenth century.

The above chart from here (htp: Global Perspectives) is another of those attempts to perceive underlying order in the apparently random movement of the market and the economy. I've tried the same myself and suggested that the period from 2000 on may be like 1966 - 1982 (the last top and bottom of the market when adjusted for inflation). The interesting thing about the above picture is that the c. 16-year cycle appears to work over a much longer time - starting with the later part of the nineteenth century.The cycle is not very regular - it varies from about 12 - 20 years - but tends to support my feeling that the real bottom this time may lie in the next 5 - 10 years.

Another quibble is that while some aspects may have a circular form, there are also linear developments that could change everything. One such is China's awakening from its centuries-long economic slumber, with the result that the world's financial centre of gravity is shifting from West to East; another, related to the first, is the unprecedented growth of debt in Western economies. A third is the development of computer technology and lightspeed communications, so that knowledge and expertise that took centuries to acquire can be transferred rapidly to developing economies. What we have lost through folly, we may not be able to regain through hard work.

This is why some commentators have switched their attention to the social, political and military implications of a permanent power shift - from democracies to authoritarian governments of one kind or another. Michael Panzner has tried to follow up the success of his Financial Armageddon with just such a conspectus, but events in the next decades will be determined by even more complex and subtle factors than the ones that led to the crashing end of the twentieth century's money system.

It would be a neat finish to observe that the Titanic had a casino and that the latter didn't have any effect on the iceberg - but (perhaps fortunately for haters of the glib), the ship didn't have a gambling joint. Though there was multimillionaire John Jacob Astor and his cronies, playing high stakes card games in the smoking room.

In short, for those who are focused on the money, I still believe worse is to come than has happened already. Others should remember it's not all about money.

_____________________________________

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The turning point may be 2016 - 2020

The above chart from here (htp: Global Perspectives) is another of those attempts to perceive underlying order in the apparently random movement of the market and the economy. I've tried the same myself and suggested that the period from 2000 on may be like 1966 - 1982 (the last top and bottom of the market when adjusted for inflation). The interesting thing about the above picture is that the c. 16-year cycle appears to work over a much longer time - starting with the later part of the nineteenth century.

The above chart from here (htp: Global Perspectives) is another of those attempts to perceive underlying order in the apparently random movement of the market and the economy. I've tried the same myself and suggested that the period from 2000 on may be like 1966 - 1982 (the last top and bottom of the market when adjusted for inflation). The interesting thing about the above picture is that the c. 16-year cycle appears to work over a much longer time - starting with the later part of the nineteenth century.The cycle is not very regular - it varies from about 12 - 20 years - but tend to support my feeling that the real bottom this time may lie in the next 5 - 10 years.

Another quibble is that while some aspects may have a circular form, there are also linear developments that could change everything. One such is China's awakening from its centuries-long economic slumber, with the result that the world's financial centre of gravity is shifting from West to East; another, related to the first, is the unprecedented growth of debt in Western economies. A third is the development of computer technology and lightspeed communications, so that knowledge and expertise that took centuries to acquire can be transferred rapidly to developing economies. What we have lost through folly, we may not be able to regain through hard work.

This is why some commentators have switched their attention to the social, political and military implications of a permanent power shift - from democracies to authoritarian governments of one kind or another. Michael Panzner has tried to follow up the success of his Financial Armageddon with just such a conspectus, but events in the next decades will be determined by even more complex and subtle factors than the ones that led to the crashing end of the twentieth century's money system.

It would be a neat finish to observe that the Titanic had a casino and that the latter didn't have any effect on the iceberg - but (perhaps fortunately for haters of the glib), the ship didn't have a gambling joint. Though there was multimillionaire John Jacob Astor and his cronies, playing high stakes card games in the smoking room.

In short, for those who are focused on the money, I still believe worse is to come than has happened already. Others should remember it's not all about money.

Monday, April 05, 2010

Paging Lord Tebbit...

Are Conservatives really conservative, in the sense of wishing to preserve the country? A message I have been trying to get out for some time, is that the financial bust that has scarcely begun, has its roots in excessive growth of the money supply not only under Labour but also under Conservative administrations.

Regrettably, The Bank of England’s website gives figures for M4 only as far back as 1963, but comparing annual changes in M4 with GDP, it’s clear that that banks have run riot for most of the last 47 years. Far more has been lent into the economy than could be justified by growth in economic activity, and the result has been a debt-fuelled ballooning of asset valuations.

From 1979 to 1990, GDP grew annually by an average of 8% or so, but M4 by 19% p.a., a difference of 11% p.a. compound. The New Labour years have seen something like 10% M4 growth and 5% GDP growth p.a., in other words a discrepancy of only half that experienced during the boom years of the 1980s.

Perhaps one could argue ignorance as a plea in mitigation by both political parties; after all, only some 12 professional economists out of an estimated 20,000 worldwide predicted the credit crunch (because debt does not feature highly in classical economic theory) – though I was relaying warnings from mid-2007 onwards, via my blog. But surely ignorance can be no excuse now.

What, then, do the Conservatives propose to do to deal with a banking system that has brought us to the verge of final national destruction?

Tuesday, March 30, 2010

Housing - plenty of room to drop

In a nutshell

"Jim in San Marcos"

Sunday, March 28, 2010

Tossers

- We're from the Labour Party, can we count on your support?

- No. I can't vote for any of the major parties, because they won't give us a vote on membership of the EU. I believe that membership of the EU without a referendum is ultra vires.

- Ah, so I'll put you down as UKIP, then.

- No. I don't want in or out, I want a referendum.

- I recall we had one in the...

- No. That was on membership of the Common Market, not membership of the EU.

After asking whether my wife (they used her first name) was in, and my telling them that she was but was otherwise engaged, they left.

See you all again in five years' time, no doubt.

Thr triumph of bureaucracy

Debt: we will have to default

Saturday, March 27, 2010

Funny money and the politics of the Millennium

The exchange below is part of a comment thread from the redoubtable Angels in Marble blog, which recently featured a post about the horrors of school dinners:

NOMAD: My memories of school dinners in the 40s and 50s are quite positive and all in all good value for about 1/3d. We all got fed adequately - and even on occasion there was enough left over for seconds...

HATFIELD GIRL: 1/3d, Nomad? You'll be recalling dividing £67/13/6d by £14/11/5d next. (no writing down, of course).

ROLF: "dividing £67/13/6d by £14/11/5d"= 4, remainder £9/7/10d, I think (not writing down, as you said).Now I teach children who still can't grasp multiplying by 10. The easier you make it, the dafter they get.

...

£14/11/5d is 8/7d short of £15.

4 x £15 = £60.

So the remainder is (£67/13/6d - £60) + (4 x 8/7d).

= £7/13/6 + 32s + 28d

= £7/13/6 + 32s + 2/4d

=£7/13/6 + 34s + 4d

=£7 + 13s + 6d + 34s + 4d

=£7 + 47s + 10d

=£9 + 7s + 10d, or £9/7/10d.

We NEVER had to do something like that, and as I say, children who can't divide by 12 also can't divide by 10.

The duodecimal system is very good for dividing sums of money by time periods or groups of people, and was appropriate when people were paid in pennies per day or shillings per week.

The x12 and x20 system is not responsible for the rip-roaring inflation of the 20th century that has systematically robbed savers and now pretty much bankrupted the nation (except for a fantastically rich and corrupt elite).

I would also point out that there are 60 seconds in a minute, 60 minutes in an hour, 24 hours in a day - because government hasn't yet found a way to inflate time.

There are also 360 degrees in a circle, still used for navigation the world over.

If ever we do for the pound what France did for the franc in January 1960 (100 old = 1 new), the duodecimal system may come into its own again.

The rule of 10 is just part of the great plan to erase the past and all links to it, so that we may have Year Zero and the socialist millennium.

Thursday, March 25, 2010

Voters to strike on May 6th?

Bremner asks the audience (500+) how many will be voting Labour; I saw maybe three or four hands. Then Conservative; ditto.

The general feeling, after the fun section, is numb helplessness. An old Scot called from the audience that our democracy is a sham; nem. con. Nellist also made the point that there is essentially no difference between the major parties, and that it's all about management now, not political philosophies.

I think we might see a voters' strike come Election Day. I can't see who I can vote for, and I'm not prepared to vote Labour Buggins out just to get Tory Buggins in. Not that my 1/74,000th share of the electoral roll could make the slightest difference.

Wednesday, March 24, 2010

When the penny dropped

Tony Blair receives a standing ovation from the entire House of Commons at the end of Prime Minister's Questions, 27 June 2007. David Cameron praises Blair's achievements and wishes him well in whatever he does in the future. BBC2 is criticised for failing to broadcast the ovation.

Tony Blair receives a standing ovation from the entire House of Commons at the end of Prime Minister's Questions, 27 June 2007. David Cameron praises Blair's achievements and wishes him well in whatever he does in the future. BBC2 is criticised for failing to broadcast the ovation.

Tuesday, March 23, 2010

Do they work for us at all?

Monday, March 22, 2010

Notes and Queries (2)

Hawk: one who hawks, or peddles, his political influence to business interests via the services of a lobbying organisation.

Dove: one who seeks to wash away the sins of Honourable Members, e.g. by retrospectively redefining terms in order to exculpate his colleagues from charges of theft by false accounting. The term is derived from the name of a popular brand of soft soap.

Notes and Queries (1)

Sunday, March 21, 2010

Bad news round-up

Speaking of the IMF, Richard Daughty rehearses his theme of reckless money multiplication, the inevitable bust and the wisdom (so he thinks) of investing in commodities such as gold, silver and oil. He castigates the IMF and its proposed imitator, the European Monetary Fund, for their part in the inflationary process.

Nathan Martin uses official statistics to show how as debt increases, the additional stimulus to GDP gets less. The break point on the graph seems to be 2015, after which extra debt will reduce GDP.

Warren Pollock delivers a punchy two minutes from the Metropolitan Museum of Art, comparing the past civilisations inside with the doomed one outside, currently enjoying sunshine, hot dogs and a cappella music.

I read all the above people frequently. Each has his own take, his own style, but all seem technically proficient in finance while retaining their integrity, their indignation and their hope that something can be done. Their views are echoed in this week's article by University of Montreal economics professor Rodrigue Tremblay, whose conclusion in part reads:

It seems to me that the U.S. financial system, and even the world financial system, have to be profoundly reformed, if they are to serve the real economy, rather than the contrary. If such a reform does not come about, however, I am afraid that we have entered a period of economic difficulties that may last many, many years. In fact, I think that the world economy stands today at the edge of a large precipice.

Saturday, March 20, 2010

House prices could fall 40%

The above graph is from the Financial Times Alphaville website, as part of an article that discusses Britain's exceptionally poor situation compared with other major economies.

The above graph is from the Financial Times Alphaville website, as part of an article that discusses Britain's exceptionally poor situation compared with other major economies.I bought the house we're in, in 1984. I was stunned when, several years ago, a friend told me what it was worth then. House prices have felt like a fantasy for years - maybe that's why people started to borrow against them for consumer spending sprees. Buying with a credit card (or line of credit on your home) never seems as difficult as parting with folding money. It was all a lovely dream.

Now, we're waking up. Britain's underlying troubles seem to me at least as bad as in the early 80s and the early 90s, so it appears logical that when the government faces up to the challenges (instead of credit-spending its way onwards, as is still happening) house prices will go below the "average" line to match the previous lows.

I think it will be a buyer's market for years to come. So for downshifters, it may be worth selling at what seems a painful discount now, to make sure you have the cash to go buy something cheaper (also at a discount, naturally).

Having said that, I have also observed before that the housing market is segmented according to location and price bracket. Prices may well change more (or houses may trade more slowly) in some categories than in others. To see what houses have actually sold for in the UK, look here; for sold prices in the USA, see Domania here.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Sunday, March 14, 2010

Vote for the Apathy Party

The three Birmingham constituencies aggregated above have over 180,000 registered voters between them, though over 40% failed to use their vote in the last couple of General Elections. Had non-voters come to the polling station and all voted for "None of the above", they would have won in 2005 and 2001, and come second to Labour's "landslide" victory in 1997.

The three Birmingham constituencies aggregated above have over 180,000 registered voters between them, though over 40% failed to use their vote in the last couple of General Elections. Had non-voters come to the polling station and all voted for "None of the above", they would have won in 2005 and 2001, and come second to Labour's "landslide" victory in 1997.One person's vote is worth c. 1/36,000th of the active voters, and less than 1/60,000th of potential voters*.

Little wonder that modern politics is a matter of computer-assisted psephology, spin and deception.

*Nationwide, the average is 69,935 voters per constituency (2007 Boundary Commission review)

Saturday, March 13, 2010

"Consent has not been given" - the EU and cross-party collusion

_________________________________________________

Email to Nick Clegg MP via his website, 17 February 2010:

Dear Mr Clegg

I was recently doorstepped by your colleague John Hemming MP, now that my address falls into the Yardley constituency, following recent changes by the Boundary Commission.

Mr Hemming asked whether there were any issues I would like addressed, and my immediate response was Europe, and when we would be allowed a referendum on our membership. He referred me to his support for EDM 20 (18.11.2009) and this, coupled with his courtesy in actually asking for my vote and opinion in person, are factors that, ceteris paribus, would persuade me to vote for him in the next General Election.

However, seeing the behaviour of the other major political parties on that topic, Mr Hemming’s stance will be entirely futile if an EU referendum is not also LibDem policy. Can you give me any assurances that will make it worth while to vote LibDem rather than UKIP in 2010?

______________________________________________________

Reply from Douglas Dowell, 10 March 2010:

Dear Mr xxx

Many thanks for your email to Nick Clegg MP. Nick has asked me to contact you on his behalf. I apologise for the delay in responding but I hope you’ll understand that, due to the sheer volume of correspondence that Nick has been receiving, it can take some time for us to reply.

Liberal Democrats understand that EU membership is controversial and that many people have concerns about it. However, we believe that membership is vital to Britain and we would point out that an exit would be very far from cost-free. It is true that countries such as Norway and Iceland, by virtue of their membership of the European Economic Area, have access to the single market without EU membership: but they have to pay for it. EEA countries pay into the EU’s funds, as do members, but have no ability to amend or change the laws which are enacted at EU level except, in theory, an ability to reject outright – which would be a potential occasion for the EU to terminate the EEA agreement. This is no real choice – simply a requirement to implement most EU laws without a vote on those laws. This is not a model Liberal Democrats want for Britain.

However, we also recognise that the European Union has evolved significantly since the last public vote on membership in 1975. Liberal Democrats therefore remain committed to an in/out referendum on EU membership the next time a British Government signs up for fundamental change in the relationship between the UK and the EU. This is the vote on Europe that really matters – not a dishonest vote on any particular treaty, but a chance for the European question to be settled once and for all.

Thank you once again for emailing.

Best wishes,

Douglas Dowell

Office of Nick Clegg MP

Leader of the Liberal Democrats

____________________________________________________

My response to Mr Dowell, 10 March 2010:

Dear Mr Dowell

Thank you for your courteous and detailed reply.

Your para 2 gives one side of the argument, which is fine, and I'm sure there are arguments to be made on the other side also. The thrust of my question is not primarily about for and against EU membership; if we had an honest debate and a referendum, I would abide by the result of the people's decision, whichever way it went.

In my view, this is the biggest constitutional shift since 1688. The issue is so great that it cannot be limited to an imprecisely-worded rider to a raft of manifesto commitments and aspirations. The fact is, we haven't been asked and the status quo, half in and half out, is one we have come to without proper democratic authorisation. It is like finding oneself being married by proxy, without banns, vows or exchange of tokens. Consent has not been given.

It is nothing like adequate to promise a vote "next time" there is some "fundamental" change. You will be aware of the ratchet-like legal process that has already commenced, and the way in which EU Commissioners and others find their positions and pensions conditional on their active support of ever-closer union.

From the street, it looks as though all three major political parties have colluded to repudiate democracy, and some would say that the political class as a whole has therefore lost the moral right to claim to represent us. This disconnection between rulers and ruled, together with the growing gap between the financial class and the consumers and workers they have abused, may threaten economic and social stability within the next generation.

I simply cannot use my vote to legitimise any party that refuses me a vote when it most matters. The LibDems appear to take the franchise seriously, with your call for the STV/Alternative Vote, and you have worked hard to build connections with local communities; why so shy of a referendum?

Sincerely

_______________________________________________

No further response yet.

Sunday, March 07, 2010

House prices - Wave 2

If you add up the nominal assets of the three banks - $903 million - and downgrade them to their real value as implied by the losses borne by FDIC - $602.3 million - you will find the collective assets were overvalued by 49.9%. In other words, current estimated real estate values should be cut by 33.3%.

These were banks operating in (now) economically distressed states - Florida, Illinois (both with official unemployment rates at or exceeding 11%), Maryland (over 7 % unemployment), so you can't necessarily apply that regrading to the whole of the USA.

Nevertheless, those states are relatively heavily populated, and so are the others now showing high rates of unemployment - see this US population map. So it may well be that the US housing market in general may need to be reassessed. If, as Denninger says, he is "generous" in estimating houses to be overvalued by 25%, that means we need to cut nominal prices by 20%.

This is borne out to some extent by reported house sale prices - see this real estate website - though the Northwest has shown a rise (why?).

And then we have to consider properties repossessed by lenders but not sold, and owners who are sitting on their properties and refusing to sell.

The UK, with its much more densely-populated land, maybe somewhat different; but I think that when all the recent financial stimuli stop and we get past the next General Election, we may see clearer evidence of declining valuations here, too.

ADDENDUM (10 March):

A counter-argument would be that the FDIC has applied a "forced-sale" valuation, as with individual or company insolvency. On the other hand, the FDIC must be in no hurry to overstate its obligations/losses - its own finances are already very shaky - and there are already many forced residential property sales actually ongoing, so the regrading of assets may to some extent reflect actual market conditions.

Wednesday, March 03, 2010

Grit your teeth, Scrooge

From "Naked Capitalism"

From "Naked Capitalism"

Tuesday, March 02, 2010

Hope

A passionate polemic, seductive in its combination of apparent political and financial savviness, high-level generalization, defrocked moral preaching, enemy-finding, self-pitying despair, self-castigation. Clearly one who has adopted Marcuse's Marxian-Freudian notion of "introjection". And one who secretly welcomes gotterdammerung because (surely) it is the necessary precondition of rebirth and the Golden Society. Don't believe his reference to species extinction - if he believed that he wouldn't bother to praise the international South American bartering system.

Yes, the system is in crisis - but it's fixable. The US medical system is about 3 times more expensive per capita than in the UK, there's a lot of room to cut costs. When the dollar crashes and house prices hit the floor, people won't have to earn the same money as before to make a living, and they'll begin to compete in the global market. And we surely don't really need the level of material possessions we have now, nice though it can be.

Where I do agree with this Jeremiah, is that a load of fat b*st*rds will have to be trimmed.

Put me down as a hope fiend.

Monday, March 01, 2010

Democracy: why bother?

Salami-slicing the franchise

A brief discussion from the blog of Chris Whiteside, Conservative Parliamentary candidate for Whiteside, Cumbria:

A brief discussion from the blog of Chris Whiteside, Conservative Parliamentary candidate for Whiteside, Cumbria:At today's Conservative conference David Cameron promised real action in six key areas to help get Britain back on its feet

[...]

6: Change politics

Reduce the number of MPs, cut Whitehall and quangos by a third, and let taxpayers see where their money is being spent.

_________________________________________________

Comments to the above:

At 8:32 AM, Sackerson said...

6. Isn't reducing the number of MPs another step in the de-democritization of the UK?

At 1:53 AM, Chris Whiteside said...

Sackerson: a 10% reduction in the number of MPs won't have that effect, no.

At 8:38 AM, Rolf said...

Chris: thanks for your courtesy in responding. I have to disagree: a 10% reduction in MPs is an 11% increase in constituency voter numbers and so a corresponding decrease in the value of my individual vote. And where will it end?

KING LEAR

Ourself, by monthly course,

With reservation of an hundred knights, by you to be sustain'd,

Shall our abode make with you by due turns.

GONERIL (Murmurs to Regan) He may enguard his dotage with their powers,

And hold our lives in mercy.

(To King Lear) It is not well! Dismissing half your train, come then to me.

KING LEAR (To Goneril) What, fifty of my followers at a clap!

REGAN I entreat you to bring but five and twenty:

To no more will I give place or notice.

KING LEAR What, must I come to you with five and twenty, Regan? Said you so?

REGAN Speak't again, my lord; no more with me.

KING LEAR (To Goneril) I'll go with thee:

Thy fifty yet doth double five and twenty, and thou art twice her love.

GONERIL What need you five and twenty

REGAN or ten!

GONERIL or five!

REGAN What need one?

(For those who attended school after the educational reforms of the 1980s, Shakespeare was an English writer and used to be regarded as an essential element of our cultural heritage. Yes, a bit like Carol Ann Duffy, as you say, Blenkinsop Minor; but only a bit.)

Sunday, February 28, 2010

Daniel Hannan and the EU

Should we have paid-off everyone's mortgage?

Probably not. Sudden and simplistic measures can be horribly destructive. But can we permit a system to continue, that is built on inflating (or maintaining the absurdly high level of) the cost of our dwellings? In cartoon-mythical ancient times, all a tribe of cavemen had to do was get rid of the bear - all in a day's work - and now the right to live in your own space takes years and years of toil.

Back to Thoreau and Walden?

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this bl

og.

og.

Big market fall expected, over several years

This from "Jesse", a sober and savvy commentator who deplores the schadenfreude crowd. Do read the rest.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Saturday, February 20, 2010

Matt Taibbi on the reinflated bubble

Slashing interest rates to get us through the emergency has made ordinary savings accounts unproductive and forced money into investments instead, even when analysis says stay out:

"One trader, who asked not to be identified, recounts a story of what happened with his hedge fund this past fall. His firm wanted to short — that is, bet against — all the cr*p toxic bonds that were suddenly in vogue again. The fund's analysts had examined the fundamentals of these instruments and concluded that they were absolutely not good investments.

"So they took a short position. One month passed, and they lost money. Another month passed — same thing. Finally, the trader just shrugged and decided to change course and buy.

""I said, '**** it, let's make some money,'" he recalls. "I absolutely did not believe in the fundamentals of any of this stuff. However, I can get on the bandwagon, just so long as I know when to jump out of the car before it goes off the damn cliff!"

"This is the very definition of bubble economics — betting on crowd behavior instead of on fundamentals. It's old investors betting on the arrival of new ones, with the value of the underlying thing itself being irrelevant. And this behavior is being driven, no surprise, by the biggest firms on Wall Street."

It takes nerve to stay out of the market when it's rising and when you think you may lose value on your cash held at bank. But unless you're confident that you'll be able to "jump out of the car before it goes off the cliff" (and remember, you don't have access to instant dealing like the City pros), maybe sitting on your hands is the thing to do.

And if price inflation worries you, don't forget, both the US and UK governments still sell guaranteed inflation-proofed investments of their own.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

"Consumer choice" and liberty

Sir: Your editorial (“People Power”, 20 February) welcomes Conservative proposals to extend consumer choice in schools and hospitals, and I hope this will open a wider debate about these imperfect and possibly outdated reifications of learning and health. For example, might we see less bureaucratic resistance to, and more financial support for home education?

But if the Conservatives have rediscovered their appetite for freedom and democracy, why, as Greece, fons et origo of those principles, lies tormented on the Procrustean metanarrative of the EU, are we denied a voice in the ultimate political question, that of national self-determination? Absent a referendum on membership of the Romantic and revolutionary project, we shall be limited-list libertarians, like council house dwellers selecting the hue of their front doors from officially-compiled colour charts.

Are we to be consulted, or must we refuse to vote at all in the coming General Election?

Friday, February 19, 2010

Jerking the chain: China preparing a proxy US bond dump?

In response to a comment, I suggested that the reason for this supposed system of proxy purchases was to allay the fears of the American public.

It occurs to me now, belatedly, that the recent reduction in direct Chinese holdings, coupled with the increase in holding by the UK, may be a preparation for a self-protective (or even punitive) dump of Treasuries using the same intermediaries. If their direct holdings remained relatively unchanged, the Chinese could (if their nominees stayed quiet) deny responsibility and forestall a backlash from American public opinion.

The Beginning of the End?

I laughed, until I started an on-line exchange with an instructor at a private college. I learned that there is a new breed of teacher, coming mostly from colleges of education. They use phrases such as 'training life-long learners', 'having students take charge of their education', 'learning to use the correct tools, rather than learning how to do things', 'cite sources, rather than memorizing' and 'communicating with podcasts, instead of writing'.

I have seen these methods tried in mathematics and science education, and they simply do not work. Even if they do work in other subjects (doubtful), the bad training carries over to the technical fields, hampering the learning anyway. That should be the end of the matter, except that these ideas are dangerously attractive:

Weak or lazy students like them, since they can get good grades without actually mastering anything. They also get the comfortable illusion of learning, without the pain.

Administrators like the idea, since they can then eliminate or reduce the cost of libraries and textbooks, and replace experts in subject matter with general 'communicators'. All teaching is then a higher art, being removed from 'mere content delivery'. This last is a phrase that I heard used by a colleague in our college of education.

Lastly, parents and politicians love the idea, since education costs can be brought down, and performance is way up, at least on paper. Never mind that the Pacific Rim countries, still using the 'old-fashioned' techniques, are outperforming us, year after year.

How much longer until we have the world of Ray Bradbury's 'Fahrenheit 451', when books are actually banned, because reading makes some people feel inferior?

Thursday, February 18, 2010

A dire warning

Whether or not gold is the right prescription, I am very much afraid that he may be making the right diagnosis and prognosis. Do have a look.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

A dire warning

Whether or not gold is the right prescription, I am very much afraid that he may be making the right diagnosis and prognosis. Do have a look.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

What use are news organisations?

The readers of the Boston Evening Transcript

Sway in the wind like a field of ripe corn.

T.S. Eliot

What goes up...

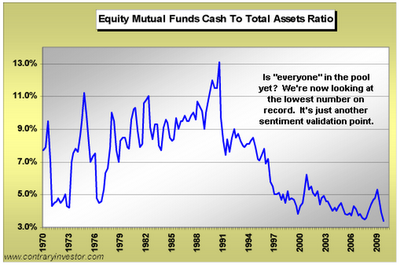

Reading "Jesse", I see an interesting graph (reproduced right). This looks at what proportion of US mutual fund (UK: think unit trust) money is held in cash. According to the graph, funds are more nearly "fully invested" than at any point since 1970.

Reading "Jesse", I see an interesting graph (reproduced right). This looks at what proportion of US mutual fund (UK: think unit trust) money is held in cash. According to the graph, funds are more nearly "fully invested" than at any point since 1970.So, where will the money come from to power further gains on the index? Or is it (as I fear) a sign that the private investor is trustingly holding the baby, just as the institutional investor (who only holds 20% of total US shares) is about to "pop out to get something, he'll be back in a bit"?

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Wednesday, February 17, 2010

Why inflation is bad

7Q. Who benefits from inflation?

7A. Inflation benefits those with first access to money, the banks and the already wealthy. It is a stealth tax on the middle class and poor whose wages never keep up with inflation. That problem is compounded by rising property taxes, sales taxes, etc, that eats consumers alive. Those at the bottom end of the totem pole get hit even harder. Their wages do not rise and they have no assets to inflate.

Absolutely spot-on. The theorists who say increasing the money supply doesn't matter because the effects spread throughout the system, overlook the point I've highlighted above. It's a grab.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The advance of totalitarian ideals continues

In a well-publicised and suspiciously originated piece of research conducted on behalf of MiniJust, doubt is thrown on the "efficient" working of juries. Far better, you may think, ladies and gentlemen of the jury, to leave it all to us and not worry your pretty little heads about it.

Meanwhile, the case against Cossor Ali, in which she is being tried for not acting as a police informer against her husband (despite not knowing exactly what he was going to do), continues.

Also, support for killing the terminally ill grows, according to a poll conducted by YouGov, perhaps not entirely coincidentally well-timed to announce its results just before well-loved author Terry Pratchett was permitted to use his fame and the (exceptionally-well-publicised this year) platform of the BBC's annual Richard Dimbleby Lecture to air his euthanistic views. YouGov is not, officially, a politically-sponsored organisation, but was founded in May 2000 by Stephan Shakespeare (ne Kukowski), a former Socialist Worker and Conservative Party candidate who owns some prominent political websites including ConservativeHome. He may not be directly controlled by any party (though how far do they differ these days?), but oh, for his contacts book!

An old Nazi writes:

"What is all this nonsense of wives not reporting their criminal husbands? In my day, children could inform on their parents, and quite right, too. I trust the Cossor Ali case will set a valuable precedent.

"It is refreshing to see that after the unpleasantness of the late 1930s and early 1940s, and the vilification of us and our ideas in the decades since then, the principles of right-thinking people are finally being rediscovered and properly valued. Gratifyingly, British political parties have been drawing together for decades, forming a consensus on which the New Society can be built. Once the people have asserted their power to deal with all the fleas that multiply on their backs and weaken them, we shall become clean and healthy again.

"A vital first step was the establishment of the right to make the problem of inconvenient children go away. Some 7 million such problems have been solved in the UK since 1968, the overwhelming majority on legal ground C ("The continuance of the pregnancy would involve risk, greater than if the pregnancy were terminated, of injury to the physical or mental health of the pregnant woman"). You will note, of course, that the "injury" does not have to be grave, and can therefore be interpreted to mean as little as a mild social or financial embarrassment.

"The killing of unborn cripples is covered by ground E, and I see that a fruitful extension of this principle has been called for by doctors as lately as 2006, so that newborns may be included in your cost-effective program. Quite rightly, these doctors draw attention to the interests of the family as a whole, and this offers a promising route to including the needs of society at large, especially when so many families are supported by public funds.

"Crime is another kind of disorder in which society most definitely has an interest, and Freakonomics author Steven Levitt famously argued that abortion has been a great boon in this regard. There are those who say his research is fatally flawed, but even if the details are wrong, surely he was on the right lines. The poor are a great burden, and their lives are so messy.

"But you cannot always tell in advance when someone will turn out to be one of Life's failed experiments. Once we have established postnatal abortion, pre-decline "mercy killings" and the execution by thirst of those in a persistent vegetative state, we should be in a position to reformulate the fundamental principles on which society operates.

"How much longer, for example, must felons be spared - so weakly, so expensively, so anomalously - their worthless and destructive lives? Why should the guilty not share the fate of the troublesome innocents you dispatch in such numbers? This is so illogical of you British; but then, my people used to proud of their ability to think. As Menzel said, "Das sinnige deutsche Volk liebt es zu denken und zu dichten, und zum Schreiben hat es immer Zeit." Only connect, ja?

"Before that becomes possible, (and now, it seems, may be the time) we will have to address the unreliability of courts, juries and the appeals system. I confidently expect the evolution of a form of Volksgerichthof in due course, though before that you may need to reeducate public opinion. Perhaps a first step would be revisionist histories on TV to neutralize the pernicious legacies of Magna Carta, 1688, Common Law, natural justice, equity etc. All this blether about historical rights causes nothing but delay and frustration, and comes from undesirable elements of the community. If the people come together, guided by prominent figures and facilitated by mass communication, and shout long and loudly enough, all such divisive opposition will vanish. We live and work today for a bright, efficient, socially harmonious tomorrow, not for a superstitious and contradictory past."

Tuesday, February 16, 2010

China extending secret support for USA

China NOT withdrawing support from the US?

______________________________________________"Foreign demand for US Treasury securities falls by record amount as China reduces holdings"

... That's the AP news story as relayed by the Drudge Report. But is all as it seems?

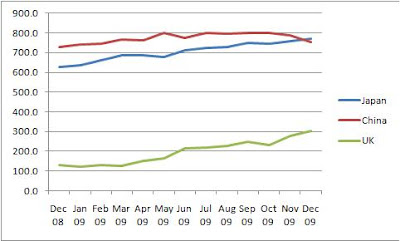

Looking at the data published by the US Treasury, China's holdings dropped by $34.2 billion between November and December 2009; but at the same time, the UK's holdings increased by $24.9 billion, and Hong Kong's increased by $6.7 billion. (The AP reporter quotes a total drop in foreign holdings of $53 billion that month , but that's for T-bills alone, NOT Treasury securities as a whole, which ROSE by $16.9 billion.)

Back in January 2009, Brad Setser analysed purchases of US Treasuries and Agencies, and concluded that the UK (and, to a lesser extent, Hong Kong) was making proxy purchases on behalf of China.

Here is the picture of US Treasury holdings by Japan, China and the UK between Dec 2008 and Dec 2009 (figures are in billions of US dollars):

Now, here is the same information, but aggregating holdings by China and the UK:

Now, here is the same information, but aggregating holdings by China and the UK:

... both have risen by 23% over the 13 months to the end of 2009 - like two horses under one yoke. (Total foreign holdings of US Treasury securities increased by 17%).

Far from "China's pulling out", the story might be read as "All hands to the pump, or we'll all sink".

UPDATE: Jake at Econompic concurs.

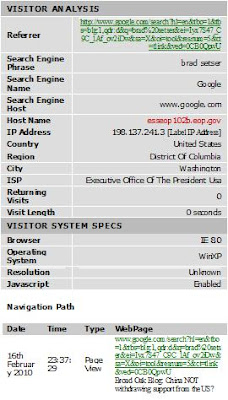

SECOND UPDATE: It seems one of POTUS' interns is also interested in this issue, to judge by a fleeting visit to this blog:

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.