Sunday, March 28, 2010

Debt: we will have to default

Sunday, September 13, 2009

20:20 hindsight and the coming stock collapse

So, is all well again?

Denninger thinks not. To get back to where we were in 2000, either debt has to be slashed (this isn't the path chosen by the powers-that-be over the last couple of years) or GDP and incomes have to soar (how? Who are we suddenly going to sell loads more to?).

Given a choice of the impossible and the merely unpleasant, it looks as though there must be a large-scale default sometime - either of actual debt, or of current and/or future government-provided benefits (or both).

In the meantime, the monetary pumping may erode the dollar's value and cause a highly misleading leap in nominal stock prices. Like I said yesterday, I think we could be looking at a re-run of the mid-70s to 1982. I remember an old financial adviser colleague reminiscing about the stockmarket "boom" of 1974, but he didn't mention the inflationary context, which is what concerns Marc Faber - the fundamentals are still all wrong.

Monday, August 31, 2009

Splat

Saturday, August 29, 2009

Cold turkey would kill the US debt junkie

Tuesday, August 25, 2009

Debt, unemployment and escape routes

Let me try to reason out the consequences, however inexpertly.

So, as everyone scrambles to cut spending and get out of debt, unemployment will soar. Since there is a great deal of international trade, the hit will be felt internationally.

Then government finances will come properly unravelled, especially in countries that have generous social welfare provisions. Worldwide, sovereign states will look for anyone who has real money to lend.

This should result in higher interest rates, but that would make the cost of debt, and its sustainability, extremely difficult, both for states and for corporations (and the burden on the latter will tend to result in even more unemployment and more claimants on the government). A rise in rates would also hit holders of long-term government debt, which may be one of the reasons the Chinese have been swapping that for shorter-dated Treasuries. A collapse in bonds will affect the capital value of pensions and investments, oh dear.

Another way out is default on debt. But who will be hit by that? Not just foreigners, but our pensions and managed investment funds.

A third way, which given that we have history to learn from doesn't seem likely, is the true hyperinflation approach. Germany in 1923, Hungary, Argentina, Zimbabwe... do you really see this happening here?

Then there's the downgrading of debt, with corresponding falls in the traded value of the currency. We've seen some of that - what, 20% off the pound? - so maybe there's more to come from that direction. Except other countries may follow suit. In 1922, if you were a far-sighted German, I suppose you might have sold marks and bought dollars; what currency would you buy now?

Or there's "more of the same" again - talking up the economy and pumping in cash until you spend because you daren't leave it to rot in the savings account.

Which way will it go? Where will it all end?

Friday, January 23, 2009

Could US interest rates rise?

However, enormous spending by the US means that it will have to issue a further $900 billion in bonds, and Setser opines, "China isn’t going to double its Treasury holdings in 2009."

If America needs to borrow more than China is willing to lend, the money must come from somewhere else, at a time when it's getting short generally. I have also recently read reports of concerns about the credit rating for US government bonds, which also supports the idea that rates will have to rise to pay for the increased risk of default.

How far will the dollar will be supported by this tendency? At least, in relation to sterling?

The UK is supposed to be an even worse basket case in terms of overall indebtedness, and that may make it politically very difficult to match rates with the US, because it could accelerate the rate of British house repossessions and business bankruptcies, even faster than in the US. So the pound could possibly fall even further against the dollar.

Perhaps Mr Cameron is right to warn that for the UK, the money may run out soon. Then we will have to pay high interest rates after all. And at last, we may be forced to borrow from the IMF and retrench savagely. Back to 1976. And will 1979 return? Cometh the hour, cometh the strong woman?

So, what's the implication of all this for the investor? Sell bonds and buy gold (despite its already high price) now, then reverse the process when high interest rates hit us?

Thursday, January 08, 2009

Where to turn?

Marc Faber is predicting that precious metals will outperform equities and bonds; this commentator reckons silver will outperform gold.

Dear me.

Monday, December 29, 2008

Debt forgiveness, inflation and welching

In a simple handwave estimate, one might say that the debt will have to be discounted by at least half. That includes inflation and selective defaults...

... something has got to give. The givers will most likely be all holders of US financial assets, responsible middle class savers, and a disproportionate share of foreign holders of US debt.

While the debtors hold the means of payment in dollars and the power to decide who gets paid, where do you think the most likely impact will be felt?

I give below the US Treasury's data on foreign holdings of their government securities as at October 2008, but I also reinterpret it in the light of each country's GDP, to show relative potential impact (please click on image to enlarge).

Mind you, even a complete repudiation would only take care of $3 trillion. Funny how not so long ago, $1 trillion seemed a high-end estimate of the damage, and now it's something like seven times that. And that still leaves a long haul to get to Hodges' $53 tn - equivalent to, what, one year's global GDP?

Wednesday, December 24, 2008

Fasten your seatbelts

Sunday, December 21, 2008

The lesser of two weevils

In an apocalyptic - but carefully-reasoned - post, Karl Denninger says that when the deficit expansion stops, US government spending will have to be cut by 50 - 60%, unless there is to be a "general default" on debts.

I have no idea what a general default would look like, but in a closely-interwoven and distant-from-nature modern industrial society I can only fear it might prove utterly destructive. So we're back to contemplating the lesser, but still vast disaster.

I also have no idea how much worse it might be in the UK.

Someone else please read this unberobed OT prophet and tell me where he's wrong.

PS

While the Obama Administration cannot take a 'weak dollar' policy it is the only practical way to correct the imbalances brought about by the last 20 years of systemic manipulation. It is either that, or the selective default on sovereign debt, most likely through conflict, a hot or cold war.

Friday, December 19, 2008

Default

Wednesday, December 10, 2008

Here we go

Now then, cheat China (pop. 1.3 billion, army personnel 2.3 million)- or the UK (pop. 61 million, army personnel 100,000)? Tough call...

Friday, November 28, 2008

Default is mine

Sunday, November 23, 2008

The crushing weight of debt

So if that interest rate applied to all debts in the US, it would equate to 19.2% of GDP. In other words, $19.20 out of every 100 dollars earned simply pays interest. But private borrowing costs more, so the real burden is even greater.

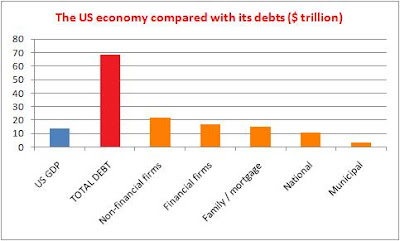

Worse still is the fact that debts have been rapidly increasing for years. A study by the Foundation for Fiscal Reform calculates that debt-to-GDP rose from 249% in 1983 to 392% earlier this year, an average increase of nearly 6% (of GDP) per year; actually, accelerating faster than that in the last few years.

So merely to go no further into debt, plus paying interest without ever repaying capital, would cost at least 25% of GDP. And if there were (please!) a plan to abolish all debt by the beginning of the next century (92 years away), that would add another 5% or so, bringing the total national debt servicing to 30% of GDP.

Having got to this breakneck speed, there is no difference between stopping and crashing.

I suspect there simply must be debt destruction - either slowly, in the form of currency devaluation, or quickly, in debt writeoffs and defaults.

Saturday, November 22, 2008

The sixfold path to Chinese hegemony