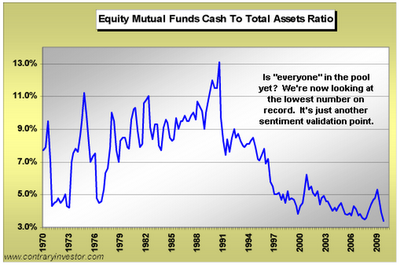

Reading "Jesse", I see an interesting graph (reproduced right). This looks at what proportion of US mutual fund (UK: think unit trust) money is held in cash. According to the graph, funds are more nearly "fully invested" than at any point since 1970.

Reading "Jesse", I see an interesting graph (reproduced right). This looks at what proportion of US mutual fund (UK: think unit trust) money is held in cash. According to the graph, funds are more nearly "fully invested" than at any point since 1970.So, where will the money come from to power further gains on the index? Or is it (as I fear) a sign that the private investor is trustingly holding the baby, just as the institutional investor (who only holds 20% of total US shares) is about to "pop out to get something, he'll be back in a bit"?

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

No comments:

Post a Comment