*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Monday, October 29, 2012

British economy continues to slump

Shortly after the desperate clutching at straws ("1% Q3 GDP increase compared with the same time last year!") comes the bank lending figure: down another 0.9% annualised on the previous (also very disappointing) quarter.

QE is just buying time. The real economy is withering on the vine. Until debt is forgiven or defaulted, no real growth will happen. Demand is frozen because of debt and the overvaluation of unproductive assets.

INVESTMENT DISCLOSURE: Mostly in cash (and index-linked National Savings Certificates), but now planning to build up some reserves of physical gold via regular saving.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Sunday, October 28, 2012

US money velocity at historic low

St Louis Fed figures show that the rate at which money changes hands is at it slowest since records began in 1959. The velocity of M2 is now 1.568, down from the historic high of 2.135 in mid-1997 - a reduction of 25.56%. The first 3 quarters of 2012 are all below the previous nadir in 1964.

Roughly speaking, for every 4 dollars spent at the end of the last Millennium, Americans are now spending 3.

But the money supply has not grown sufficiently to make up the shortfall (online figures only start from early November 1980, but the pattern is clear):

M2, the Fed explains, is a broad measure of money held by households, so in its way it reflects the state of the real or workaday economy.

The latest figure for M2 is $10.2 trillion, up from $4.03 trillion at the end of 1997, a year in which GDP was $8.33 trillion. If money velocity had not changed, current GDP would be not $15.78 trillion as it now is, but $21.8 trillion - 38% higher.

Quantitative Easing (not included in M2) is not to stimulate that kind of growth, but to avert or mitigate disaster. So far, according to the November issue of Forbes magazine, $3.3 trillion has been poured into banks and quite a lot from there into the government, just to keep things going, but Mike Whitney of Global Research reports estimates of $4 - 10 trillion more needed. Even then, the cheap cash may be shoring up stocks and bonds, but is doing little to stimulate demand or support those who try to meet it.

The much-maligned Federal Reserve is buying time, but the question is whether anyone is doing anything useful during the reprieve. Governments of both parties have spent 30 years encouraging banks to funnel money into homes - largely unproductive and illiquid assets - and the drag of debt has finally slowed demand to a halt.

Meantime, productive capacity has been haemorrhaging Eastwards, and the pool of labour skills in the US are in danger of decay. Even if much consumer and real estate debt were forgiven now, it would be a challenge to rebuild and restaff factories; but all that, I think, is what has to happen.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

US money velocity at historic low

St Louis Fed figures show that the rate at which money changes hands is at it slowest since records began in 1959. The velocity of M2 is now 1.568, down from the historic high of 2.135 in mid-1997 - a reduction of 25.56%. The first 3 quarters of 2012 are all below the previous nadir in 1964.

Roughly speaking, for every 4 dollars spent at the end of the last Millennium, Americans are now spending 3.

But the money supply has not grown sufficiently to make up the shortfall (online figures only start from early November 1980, but the pattern is clear):

M2, the Fed explains, is a broad measure of money held by households, so in its way it reflects the state of the real or workaday economy.

The latest figure for M2 is $10.2 trillion, up from $4.03 trillion at the end of 1997, a year in which GDP was $8.33 trillion. If money velocity had not changed, current GDP would be not $15.78 trillion as it now is, but $21.8 trillion - 38% higher.

Quantitative Easing (not included in M2) is not to stimulate that kind of growth, but to avert or mitigate disaster. So far, according to the November issue of Forbes magazine, $3.3 trillion has been poured into banks and quite a lot from there into the government, just to keep things going, but Mike Whitney of Global Research reports estimates of $4 - 10 trillion more needed. Even then, the cheap cash may be shoring up stocks and bonds, but is doing little to stimulate demand or support those who try to meet it.

The much-maligned Federal Reserve is buying time, but the question is whether anyone is doing anything useful during the reprieve. Governments of both parties have spent 30 years encouraging banks to funnel money into homes - largely unproductive and illiquid assets - and the drag of debt has finally slowed demand to a halt.

Meantime, productive capacity has been haemorrhaging Eastwards, and the pool of labour skills in the US are in danger of decay. Even if much consumer and real estate debt were forgiven now, it would be a challenge to rebuild and restaff factories; but all that, I think, is what has to happen.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Friday, October 26, 2012

Reasons to visit Australia 2: the Bunyip

I first read about the Bunyip in Barry Humphries' first autobiography, "More, Please." Humphries costumed himself as one in an early Australian children's TV programme, in which he would recount Aboriginal legends. Part of the get-up was a large proboscis (some say the Bunyip resembles an elephant) and partway through live transmission the nose fell off. Characteristically, the future global entertainer compounded the misfortune by explaining to the watching youngsters, as he re-fixed the appendage, that he had leprosy; transmission was abruptly terminated.

Attempts have been made to explain away the Bunyip's existence, as with other marvellous and miraculous things; even, to date its first mythical appearance (1932).

On the other hand, it may be quite real and have made its way into Aboriginal folk-memory from 50,000 years ago, when the continent was first colonised by humans. When they arrived, the giant wombat or diprotodon roamed the land, a massive creature weighing nearly 8 times as much as the modern American grizzly bear:

(Pik: Wik)

Together with other giant meaty animals, it seems to have disappeared within a few thousand years of the immigrants' arrival. But like the coelocanth, believed 65 million years extinct prior to its rediscovery alive in 1938, there could be some left.

There are two reasons why we have no complete physical evidence of this creature:

1. It is rare, choosing as its habitat remote swamps and waterholes.

2. If you meet one, you will suddenly become rarer than it.

It also helped revive the Australian film industry, thanks to the 1970 movie "The Naked Bunyip" in which a naïf sex researcher conducts appropriate investigations; the maker bypassed censorship by covering the most objectionable images with Bunyip caricatures. Coincidentally, modern legend says the Bunyip (like Barry Humphries) prefers women victims, but "any port in a storm".

Attempts have been made to explain away the Bunyip's existence, as with other marvellous and miraculous things; even, to date its first mythical appearance (1932).

On the other hand, it may be quite real and have made its way into Aboriginal folk-memory from 50,000 years ago, when the continent was first colonised by humans. When they arrived, the giant wombat or diprotodon roamed the land, a massive creature weighing nearly 8 times as much as the modern American grizzly bear:

(Pik: Wik)

Together with other giant meaty animals, it seems to have disappeared within a few thousand years of the immigrants' arrival. But like the coelocanth, believed 65 million years extinct prior to its rediscovery alive in 1938, there could be some left.

There are two reasons why we have no complete physical evidence of this creature:

1. It is rare, choosing as its habitat remote swamps and waterholes.

2. If you meet one, you will suddenly become rarer than it.

It also helped revive the Australian film industry, thanks to the 1970 movie "The Naked Bunyip" in which a naïf sex researcher conducts appropriate investigations; the maker bypassed censorship by covering the most objectionable images with Bunyip caricatures. Coincidentally, modern legend says the Bunyip (like Barry Humphries) prefers women victims, but "any port in a storm".

Thursday, October 25, 2012

Totnes beats off Costa

News just in: Costa has withdrawn its attempt to barge into Totnes against the will of thousands of residents (though not their local councillors). They'd thought they could use legal threats and cosy cooperation with the planners to override objections. Not that they've always taken the trouble to get planning permission before opening another branch. It's been a hard fight by clever, articulate people; most other communities have had to cave in.

Some may take the view of the spectacularly misguided (but he's still young, bless him) Tom Doran in The Independent (such a hackneyed use of the word "embrace", too) that opposing large-scale capitalism is a Leftist thing. If so, please define politically the 41 independent traders who offer coffee there. Liberty for the individual is not at all the same as liberty for large corporations to engulf and devour in their quest for infinite growth.

You'd think the MSM pseudosophisticates who chorus their support for Big MD dream of retiring to Birmingham city centre. Unlike about a million Brummies.

Let's hear it for Poujadism and "the defense of the common man against the elites" - surely a theme close to the hearts of libertarians.

Some may take the view of the spectacularly misguided (but he's still young, bless him) Tom Doran in The Independent (such a hackneyed use of the word "embrace", too) that opposing large-scale capitalism is a Leftist thing. If so, please define politically the 41 independent traders who offer coffee there. Liberty for the individual is not at all the same as liberty for large corporations to engulf and devour in their quest for infinite growth.

You'd think the MSM pseudosophisticates who chorus their support for Big MD dream of retiring to Birmingham city centre. Unlike about a million Brummies.

Let's hear it for Poujadism and "the defense of the common man against the elites" - surely a theme close to the hearts of libertarians.

Reasons to visit Australia 1: The Cigarette Snail

(Pic: Wik)

This little beauty is found in coral reefs and shallow waters in the Indian Ocean, but the beer isn't so good there. So come to Australia, where the last recorded fatal attack on a local was in 1935. Worldwide, only 30 deaths in 300 years, so the odds are in your favour.

The "cigarette" monicker is because it's said to poison you so fast you only have time for a smoke. That's a wild exaggeration: actually you have a few hours. And the creeping paralysis doesn't hurt too much - the stinger injects an analgesic together with the venom.

Tuesday, October 23, 2012

How language changes: "Savile row suit"

From the Duden Anglais Encylopedia of Contemporary Language (2020 Edition):

(In this example, the pronunciation has altered because of the substitution of one homonym by another.)

Savile Row Suit [sævɨl roʊ suːt] (archaic): expensive, handmade gentleman's apparel. Savile Row was one of the famous centres of the London garment trade. The work has since been outsourced to China, India and latterly Vietnam, and the street is now best known for its branches of Costa Coffee, TKMaxx and other consumer chain outlets, plus the largest unemployment benefit office in Manche Nord (formerly SEEDA/EMDI, previously "South-East England" (q.v.)).

Savile Row Suit [sævɨl raʊ suːt] (modern): expensive legal action taken to deny contemporary knowledge of, or indirect involvement in, an entertainer's sexual misdeeds. This phrase gained currency in the aftermath of the October 2012 Newsnight/Panorama controversy (current affairs programmes on the now-defunct British Broadcasting Corporation (see "Sky BEEB")) over the late Sir Jimmy Savile.

Its usage then extended to cover the sexual exploitation of "underage" girls by many popular musicians and film- and TV-programme-makers in the 20th and early 21st centuries. The usage is expected to decline in the near future, as the age of consent has since been lowered to 14 and is scheduled (pending Presidential Assent) to be abolished entirely as per old NCCL recommendations. (The NCCL, now known as Liberty, had sometime included among its officers future Labour Government ministers Patricia Hewitt and Harriet Harman, whose position on these matters may have changed.)

In any case, details of any such alleged past offences are now unpublishable in the EU following the European Privacy Directive of 2019, which incorporates many of the features demanded by the European Privacy Association and chose to go further in the light of scandals involving certain French, Belgian and Italian politicians in the late 2010s.

Among the consequences of that Directive are the "weeding" of newspapers, magazines and other ephemera from libraries (such as the Bodleian) and national collections, to expunge allegations such as the ones that appeared in the scurrilous Spiked magazine in the 1990s concerning a British (see glossary) government minister and a certain North African hotel.

(In this example, the pronunciation has altered because of the substitution of one homonym by another.)

Savile Row Suit [sævɨl roʊ suːt] (archaic): expensive, handmade gentleman's apparel. Savile Row was one of the famous centres of the London garment trade. The work has since been outsourced to China, India and latterly Vietnam, and the street is now best known for its branches of Costa Coffee, TKMaxx and other consumer chain outlets, plus the largest unemployment benefit office in Manche Nord (formerly SEEDA/EMDI, previously "South-East England" (q.v.)).

Savile Row Suit [sævɨl raʊ suːt] (modern): expensive legal action taken to deny contemporary knowledge of, or indirect involvement in, an entertainer's sexual misdeeds. This phrase gained currency in the aftermath of the October 2012 Newsnight/Panorama controversy (current affairs programmes on the now-defunct British Broadcasting Corporation (see "Sky BEEB")) over the late Sir Jimmy Savile.

Its usage then extended to cover the sexual exploitation of "underage" girls by many popular musicians and film- and TV-programme-makers in the 20th and early 21st centuries. The usage is expected to decline in the near future, as the age of consent has since been lowered to 14 and is scheduled (pending Presidential Assent) to be abolished entirely as per old NCCL recommendations. (The NCCL, now known as Liberty, had sometime included among its officers future Labour Government ministers Patricia Hewitt and Harriet Harman, whose position on these matters may have changed.)

In any case, details of any such alleged past offences are now unpublishable in the EU following the European Privacy Directive of 2019, which incorporates many of the features demanded by the European Privacy Association and chose to go further in the light of scandals involving certain French, Belgian and Italian politicians in the late 2010s.

Among the consequences of that Directive are the "weeding" of newspapers, magazines and other ephemera from libraries (such as the Bodleian) and national collections, to expunge allegations such as the ones that appeared in the scurrilous Spiked magazine in the 1990s concerning a British (see glossary) government minister and a certain North African hotel.

Monday, October 22, 2012

UK more vulnerable to systemic banking tremors than Ireland

That's gross debt, not net debt; but it's the equivalent of balancing two squirming elephants instead of two oranges. Thank you, banks.

Data from: Graham Summers, Phoenix Capital Research.

INVESTMENT DISCLOSURE: Mostly in cash (and index-linked National Savings Certificates), but now planning to build up some reserves of physical gold via regular saving.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

UK more vulnerable to systemic banking tremors than Ireland

That's gross debt, not net debt; but it's the equivalent of balancing two squirming elephants instead of two oranges. Thank you, banks.

Data from: Graham Summers, Phoenix Capital Research.

INVESTMENT DISCLOSURE: Mostly in cash (and index-linked National Savings Certificates), but now planning to build up some reserves of physical gold via regular saving.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Sunday, October 14, 2012

Mr Cameron has another vicarious emotion

Hot on the heels of Mr Cameron's vague fantasy of doing something about Europe comes this:

"Tells friends... wants... could... has discussed his views..."

Meaning Cameron has told him to tell him, just like he gave Useless Eustace Grayling's opinion to him (a feeble fire that Ken Clarke has immediately pissed on).

To be vulgar, Cameron and Gove (and Grayling, as discussed yesterday) are cock-teasers. They lift their skirts and what you see is just what you won't get, no matter how many drinks you buy them. The Daily Mail plays along because it knows which side its bread is buttered; it would turn Cameron's fart into a Hallelujah Chorus. Until it switches to sinister clown Boris Johnson.

We now have a political elite composed of overprivileged, useless chinless wonders, fainéants occupying the place of people who might achieve something for somebody apart from themselves.

They are the choking bozone layer above us and it's time we got some fresh air.

"Tells friends... wants... could... has discussed his views..."

Meaning Cameron has told him to tell him, just like he gave Useless Eustace Grayling's opinion to him (a feeble fire that Ken Clarke has immediately pissed on).

To be vulgar, Cameron and Gove (and Grayling, as discussed yesterday) are cock-teasers. They lift their skirts and what you see is just what you won't get, no matter how many drinks you buy them. The Daily Mail plays along because it knows which side its bread is buttered; it would turn Cameron's fart into a Hallelujah Chorus. Until it switches to sinister clown Boris Johnson.

We now have a political elite composed of overprivileged, useless chinless wonders, fainéants occupying the place of people who might achieve something for somebody apart from themselves.

They are the choking bozone layer above us and it's time we got some fresh air.

Saturday, October 13, 2012

The privatisation of crime by Failing Grayling

Householders are now encouraged to enter a fantasyland where they confront and subdue intruders and are authorised to use "disproportionate" force.

1. Force that is "disproportionate" is unjust in common law. You are already entitled to use force according to what seems reasonable in the circumstances, which can mean killing someone else. Should you succeed, some might advise (unofficially) that you should then go totally over the top and make a bloody mess of the perpetrator, as evidence that you were panicking and so didn't kill him in cold blood. One shot, jail; the whole magazine plus pistol-butt-smashing the face to a pulp while screaming like a banshee for ten minutes, walk free - maybe. A knife fight - far messier: they often don't die straight away, which is why deceased knife victims often have many, many wounds. You think you're going to win this?

2. You are likely to be asleep when a burglar comes in. What are the chances that you will wake in time to recognise the threat, and that you will be stronger, fitter and quicker than the intruder who is already fully pumped-up to the extent that (typically) after the break-in he raids your fridge and biscuit tin to replenish his adrenalin-haywired blood-sugar level? And what about his Number Two, who unknown to you is behind you as you are dealing with Number One? Possibly also Three and Four, and a lookout? How about when you're ill, or old, or crippled?

3. If self-defence becomes the norm, don't expect the criminal to come in unarmed.

What this is really about, is the failure of the police and the courts. If police patrolled regularly, checking gates and shop doors, you'd be protected. If first-offence burglary was punished by a stiff prison sentence - as it used to be - your property would be protected. If hanging were still a legal punishment, your life (and the lives of your loved ones) would be protected.

As it is, you're on your own, son.

That EU Nobel Peace Prize

Mel Brooks - I Want Peace (from "The Producers", Embassy Pictures, 1968)

I don't want

war. All I want is peace. Peace.

Peace!

A little piece of Poland

A little piece of France

A little piece of Portugal

And Austria perchance

A little slice of Turkey

And all that that entails

Und then a piece of England Scotland

Ireland and Wales

A little nip of Norway

A little spot of Greece

A little hunk of Hungary

Oh what a lovely feast

A little bite of Belgium

And now for some dessert

Armenia Albania

And Russia wouldn't hurt

A little piece of Poland

A little piece of France

A little piece of Portugal

And Austria perchance

A little slice of Turkey

And all that that entails

Und then a piece of England Scotland

Ireland and Wales

A little nip of Norway

A little spot of Greece

A little hunk of Hungary

Oh what a lovely feast

A little bite of Belgium

And now for some dessert

Armenia Albania

And Russia wouldn't hurt

Wednesday, October 10, 2012

What exactly is liberty?

Dick Puddlecote has another go at Prohibition (the American experience of which is widely misunderstood), and (being naturally contrarian myself) I have a geat deal of sympathy for his opposition to officialdom.

But we can easily be misled into thinking there are only two positions to take: bans, or complete lack of restriction. I think lovers of freedom need to develop a more nuanced stance. As I comment there:

It's not the making available that harmful, it's the pushing. Look how licensing laws have been progressively relaxed since the 50s, mostly for the benefit of brewers and the supermarket lobby.

And the advertising - remember the 1989 Woodpecker cider ad showing a couple of woodpeckers seated on the ground, cans in hand, with the slogan"Get out of your tree with Woodpecker Cider"? There's a reference to it in this book (p 368 in Google Books - even there the text is unavailable online) but it seems impossible to retrieve the image - it's like getting hold of the Sun's "Gotcha!" Belgrano front page.

The liberty of the individual is distinct from the liberty of powerful commercial enterprises to exploit our weaknesses, and in this context I do not consider businesses to be persons with the right to liberty.

I think libertarians need to consider how they may inadvertently be acting as unpaid agents for the more questionable sectors of corporate capitalism; and to what extent liberty is better exercised in controlling an appetite rather than giving way to it.

But we can easily be misled into thinking there are only two positions to take: bans, or complete lack of restriction. I think lovers of freedom need to develop a more nuanced stance. As I comment there:

It's not the making available that harmful, it's the pushing. Look how licensing laws have been progressively relaxed since the 50s, mostly for the benefit of brewers and the supermarket lobby.

And the advertising - remember the 1989 Woodpecker cider ad showing a couple of woodpeckers seated on the ground, cans in hand, with the slogan"Get out of your tree with Woodpecker Cider"? There's a reference to it in this book (p 368 in Google Books - even there the text is unavailable online) but it seems impossible to retrieve the image - it's like getting hold of the Sun's "Gotcha!" Belgrano front page.

The liberty of the individual is distinct from the liberty of powerful commercial enterprises to exploit our weaknesses, and in this context I do not consider businesses to be persons with the right to liberty.

I think libertarians need to consider how they may inadvertently be acting as unpaid agents for the more questionable sectors of corporate capitalism; and to what extent liberty is better exercised in controlling an appetite rather than giving way to it.

Sunday, October 07, 2012

Superficial consumer uptick, underlying concerns continue

Back in June, I noted that credit card lending had declined over the previous 12 months; now, according to the Bank of England, there has been a sharp recovery:

Similarly, the second-quarter report from ING Direct's Consumer Savings Monitor (PDF) shows a rise in consumer savings balances:

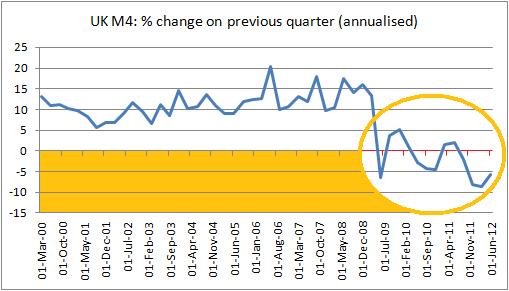

Yet the figures for UK M4 continue to decline:

So are these signs of recovering confidence? Perhaps the credit card figures reflect a temporary Jubilee Year / Olympics buildup feelgood splurge, and the plumping up of the savings cushion shows continuing underlying caution; otherwise, why not spend from savings rather than rack up plastic debt? And the M4 figures indicate a deflationary undertow beneath the surface.

But the aggregate statistics may be misleading. It could be that some who still have their heads above water, are saving hard while they can, and others are driven to buy on the card because they have no savings and cannot get more bank credit.

The next quarter may clarify the picture.

INVESTMENT DISCLOSURE: Mostly in cash (and index-linked National Savings Certificates), but now planning to build up some reserves of physical gold via regular saving.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Similarly, the second-quarter report from ING Direct's Consumer Savings Monitor (PDF) shows a rise in consumer savings balances:

Yet the figures for UK M4 continue to decline:

So are these signs of recovering confidence? Perhaps the credit card figures reflect a temporary Jubilee Year / Olympics buildup feelgood splurge, and the plumping up of the savings cushion shows continuing underlying caution; otherwise, why not spend from savings rather than rack up plastic debt? And the M4 figures indicate a deflationary undertow beneath the surface.

But the aggregate statistics may be misleading. It could be that some who still have their heads above water, are saving hard while they can, and others are driven to buy on the card because they have no savings and cannot get more bank credit.

The next quarter may clarify the picture.

INVESTMENT DISCLOSURE: Mostly in cash (and index-linked National Savings Certificates), but now planning to build up some reserves of physical gold via regular saving.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Superficial consumer uptick, underlying concerns continue

Back in June, I noted that credit card lending had declined over the previous 12 months; now, according to the Bank of England, there has been a sharp recovery:

Similarly, the second-quarter report from ING Direct's Consumer Savings Monitor (PDF) shows a rise in consumer savings balances:

Yet the figures for UK M4 continue to decline:

So are these signs of recovering confidence? Perhaps the credit card figures reflect a temporary Jubilee Year / Olympics buildup feelgood splurge, and the plumping up of the savings cushion shows continuing underlying caution; otherwise, why not spend from savings rather than rack up plastic debt? And the M4 figures indicate a deflationary undertow beneath the surface.

But the aggregate statistics may be misleading. It could be that some who still have their heads above water, are saving hard while they can, and others are driven to buy on the card because they have no savings and cannot get more bank credit.

The next quarter may clarify the picture.

INVESTMENT DISCLOSURE: Mostly in cash (and index-linked National Savings Certificates), but now planning to build up some reserves of physical gold via regular saving.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Similarly, the second-quarter report from ING Direct's Consumer Savings Monitor (PDF) shows a rise in consumer savings balances:

Yet the figures for UK M4 continue to decline:

So are these signs of recovering confidence? Perhaps the credit card figures reflect a temporary Jubilee Year / Olympics buildup feelgood splurge, and the plumping up of the savings cushion shows continuing underlying caution; otherwise, why not spend from savings rather than rack up plastic debt? And the M4 figures indicate a deflationary undertow beneath the surface.

But the aggregate statistics may be misleading. It could be that some who still have their heads above water, are saving hard while they can, and others are driven to buy on the card because they have no savings and cannot get more bank credit.

The next quarter may clarify the picture.

INVESTMENT DISCLOSURE: Mostly in cash (and index-linked National Savings Certificates), but now planning to build up some reserves of physical gold via regular saving.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Thursday, October 04, 2012

Tyranny in the name of freedom: a case history

We're watching with interest BBC's "Wartime Farm" series, about efforts to increase food production in Britain in World War Two. Last week's episode (number 4) included a sadly instructive story about a farmer who ran foul of what seems to have been the stupidity and inflexibility of centralised bureaucracy. Resisting it, he paid with his life.

The incident is covered from 23:19 in the programme, and also described in the online Radio Times. A Hampshire tenant farmer called Ray Walden had been ordered to plough up "roughly half" of his farmland for extra corn production to meet "War Ag."targets, but according to a contemporary interviewed in the programme, some of that land was too wet and unsuitable for corn. Walden refused and when served with an eviction notice (as some 2,000 farmers were, during the War) barricaded himself in his house and in the ensuing 18-hour siege shot at those trying to remove him, wounding one or two in the process. Walden was shot in the head and fatally injured.

The contemporary report by the Hampshire Chronicle, covering the events and the inquest, is here. However, significant extra details are given in this account, which tells us that (a) under wartime regulations the proceedings of the inquest were held in secret, the public and Press being excluded, and (b) no evidence was offered on the late man's behalf to explain why he had acted as he did. In the latter account the Cultivation Order is also said to have been for only four acres to be ploughed, not half the (62 acre) farm as in the BBC's version, which raises the possibility that there may have been some falsification in the evidence given at the inquest in order to make the Min of Ag's demand seem more reasonable.

Only one man, only one death - but that's all any of us has, despite the BBC's attempt in the programme to sweeten the bitter pill by reference to "the greater good". In how many areas does government act like a kind of Juggernaut, rolling over anyone who gets in its single-minded, sometimes simple-minded way?

UPDATE

A comment on this post at Orphans of Liberty:

Well, what a surprising thing to stumble upon. George Walden is an ancestor of mine, on my mother’s side. Family legend has long held that “dark forces” were at work of a more local nature, namely anti-Papism in the form of the vicar and a long-held grudge over disputed debts with a local worthy. In light of these, favours were called in and a ridiculous land demand was drawn up. All rumour and hearsay, of course. The family were most offended by the suggestion that he committed suicide.

Readers may know that anti-Catholic prejudice still ran pretty strongly in those days, as my late mother-in-law found when as a youngster she spent time in Scotland. And money is often a cause of trouble.

Subscribe to:

Posts (Atom)