Saturday, November 03, 2007

Stuffed at both ends

I overheard a classroom assistant talking about her monster mortgage and how it's gone up another £300 a month - just as the Council is planning to cut the pay of thousands of workers in order to tackle its huge budget deficit. Should she sell? Just as everybody else is considering the same course of action?

We look at our situation and grumble that we're stuffed, but Dr Housing Bubble (Financial Sense, yesterday) demonstrates how we're force fed with credit and high prices at the front end, too.

The figures will differ from one person to another. Do your own math, and work out what you should do - soon.

Bubble priced

... says Genesis (Karl Denninger) on his site, Market Ticker yesterday. He has already organised a petition, and is now calling for a shatteringly large class-action suit against American banks.

"Dow 9,000" prediction: accelerating decline

November 2: Dow at 13,595.10, gold $806 per ounce. Since July 6, Dow has appeared to hold its ground, but the "gold-priced Dow" has dropped to 10,925.83 - a fall of over 49% annualised. And at this rate, gold will have doubled in dollar terms by July 2008.

China Olympics: Starter's Gun For Inflation

Robert Gottliebsen in Australia's Business Spectator (Thursday) gives thanks for Ben Bernanke's inflationary rescue of the banking system, but points out that the flight from devaluing US securities is driving demand for assets elsewhere. And there are longer-term consequences to face:

Before the latest US crisis developed my friends in China told me that many Chinese manufacturing businesses would try to raise prices by 10 per cent in 2008 -- probably after the Olympics. That determination will now be intensified because the manufacturers are not only receiving lower returns but are being forced to pay more for oil and commodities. Those seeking shelter from the US dollar will drive up prices.

Bernanke’s actions, even though they are justified, are going to inflame US inflationary pressures. So later in 2008 and in 2009 he will need to reverse the current process and increase interest rates. That will not be good for stock markets or commodities because it will reverse the current forces. But just how serious it will be for the US will depend on whether the current Bernanke medicine worked and the banking breakdown was repaired.

I think there is a chance it will work because rising stock markets are a powerful drug. But no one can be certain, and this is a very dangerous period.

Friday, November 02, 2007

Twang money - again

Fiat currency can be expanded at will, but in a credit crunch can contract as easily, so I've previously nicknamed it "twang money". But it turns out there actually once was a medium of exchange known as "twang money" - the Hungarian pengo. It ended up as the worst case of inflation in history: someone writes in to today's Daily Mail (page 77) to say that by 1946, all the Hungarian banknotes in circulation, taken together, were worth one-thousandth of a US cent.

However, consider the potential uses of many tons of durable paper with run-resistant colours: wallpaper, sweet wrappers, firelighters... So for me, the story is about the buying opportunity when pessimism ignores intrinsic value.

The Clashing Rocks

It's said that the Chinese pictogram for "crisis" combines the ideas of "threat" and "opportunity". Hutchinson offers ideas for those who want to take advantage: invest in...

- Japan

- gold

- natural resources

- Canadian oil

- - and a Korean bank.

Thursday, November 01, 2007

"Wall of Worry" poll results

The results are almost exactly divided: 8 at the top end for equities, 8 at the bottom for bonds, 7 voting for a 50:50 split, and one for 65% equities/35% bonds.

Another snort to keep going

... From my perspective, almost all the items above slightly favor the reflation trade over gloom-and-doom. However, the edge is small enough to remain diversified while keeping a close eye on the stock market's 50 and 200-day moving averages.

This would chime with Jim Puplava's assessment that "more of the same" will buy us a little more time until the system is exhausted, which he expects to happen around 2009 onwards.

Wednesday, October 31, 2007

There's never just one cockroach in the kitchen

Crazy like a fox?

Uncle Sam and John Bull

Tuesday, October 30, 2007

Merrill in a panic

Charles Merrill, a relation of the Merrill Lynch founder, has become a gold squirrel.

More surprises from Warren Buffett

And he doesn't have an accountant! (How many enemies can you make in one day?)

Money vs The People

In Financial Sense yesterday, Robert McHugh comments:

When the Master Planners devalued the dollar over the past five years, they raised the cost of living for everyone. The Middle Class is getting annihilated from this silent event. Incomes are not keeping up. This was done because this administration “equates stock market success with economic success and has directed their efforts to drive up equities at literally any cost,” to quote one of our subscribers.

...but Tony Allison looks forward to a more energy-efficient future:

Change is seldom welcomed by most humans, but it can often bring about positive results. It is impossible to know what year the effects of peak oil production will barge into our living rooms, but change is on the way. The adjustment period to a permanent supply crunch will likely be very difficult, but some effects may be beneficial. For example, we could see a re-birth in local farming and manufacturing, as food and industrial products become exceedingly expensive to transport. We would see more public transit, more freight train transportation, more bicycles, more energy efficiencies of all kinds working their way into society.

Buffett goes South and East

Abroad elsewhere, he's looking for high-dividend companies - a combination of the standard value investing formula and hedging against the dollar.

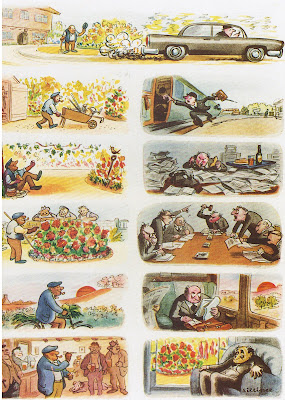

Every Picture Tells A Story

Monday, October 29, 2007

Vote early, vote often

Volume - shares and gold

David Yu (Safe Haven, yesterday) comments on the unusually high volume of trade on the NASDAQ recently, and so expects a fallback sometime.

Peter Degraaf (GoldSeek, Friday) thinks gold can't be shorted or held down forever. He reminds us of the extraordinary volumes of bullion traded in 1967-68, and the explosive rise in the price when the containment attempt finally failed. Degraaf believes Frank Veneroso's theory that central banks are surreptitiously dumping gold again today, playing the same game - and expects the same result.

Faber: why the dollar may bounce back

Faber said if bubbles in emerging markets deflated, the dollar may rebound from all-time lows against the euro as fund managers who have invested in emerging markets shift investments to the United States.

China: a positive view - and a challenge to India

Like James Kynge, Gu makes the point that the big profits are made by the multinationals - the cheap labour input from China is only a small factor. (Surely this shows that there is a very strong incentive for China to develop its own marketing and management class.)

Gu explains that although India's labour costs are even lower than China's, India hasn't yet developed its supply chain and infrastructure to the same degree:

... China, over the last 26 years has gotten all of them in one place. For example, in consumer electronics you can set up your shop in Guangdong, then you get more than 10,000 component makers.

So, the gauntlet is thrown at India's feet.

Rapid fire

Duff McDonald in New York Magazine (Saturday) goes through various doomsters' scenarios. How many bullets can we dodge, especially when the system is becoming automated?

By the way, he says CNBC calls Peter Schiff "Dr Doom" - surely that would be Marc Faber?

... and the brakes have been greased

Trouble ahead

Market Ticker reports that a bank has borrowed $75 million at exceptionally high interest rates, suggesting that the collateral they were offering wasn't sound enough to be acceptable. And there are futures contracts being taken out that indicate some traders expect a major financial dislocation.

In other words, this bet is one that the credit markets will go supercritical.

And it wasn't made by just one firm, one speculator, or one guy.

A few months ago I pointed out that every big equity market dump - every last one of them - has started in the credit markets. It always starts there, simply because of the volume of business transacted and the sensitivity to problems. In the equity markets one company can go "boom" and it doesn't mean much. But in the credit markets "systemic risk" - that is, a refusal to trust people as a foundational principle - once it takes hold is very, very difficult to tamp back down.

Read the whole post here. And here's the evidence (source):

Saturday, October 27, 2007

"Dow 9,000", UK loans to US, poll, doom

I also suspect that a major theme this century will be the contest between Marxism and Islam. I hope for a bloodless final end to the former, which has caused such suffering to so many millions in the last century; and the ascendancy of the civilised, cultured, intellectual and tolerant traditions within the latter.

Friday, October 26, 2007

Kicking through the slush

Sovereign wealth funds and national prosperity

Without pretending to technical expertise in this area, I can envisage implications for a growing ownership of equities by governments. One effect may be to reduce volatility in large-capitalisation stocks, since national treasuries can take a longer view than the individual investor.

But there must also be concern about the possible use of ownership for political purposes. For example, I wonder at the UK's having allowed foreign enterprises to take over some of our energy and water supply companies.

I began this blog for investors, but increasingly I think the real story is not about how some may make (or protect) their fortunes, but about the implications for ordinary citizens.

Today I drove past the site of the former Rover car plant in Longbridge, Birmingham. The firm was on its way out years ago and a venture capital company called Alchemy offered to take it over, cut its size and specialise in a line of sports cars. The rest of the land could be redeveloped - housing and retail. The surplus workers would have their pension rights and redundancy payouts honoured, and some could still look around for employment in other plants.

But there was an election coming (2000), so the government chose to encourage a management buyout instead. Thousands of jobs were saved, supposedly. Besides, it was said (I seem to recall) that the site was too polluted for residential development, anyhow.

Well, Rover did go bust anyway (after a £6.5 million "bridging loan" to prevent its collapse immediately before the 2005 General Election). The workers didn't get the redundancy payments they'd have had from Alchemy in 2000, and their pensions were hit too. Anyone still interested in car work elsewhere would then be five years older, in an industry that some believe discriminated on the basis of age prior to new legislation in 2006.

A Chinese firm, SAIC, has picked over the carcase, with special attention to any designs and other paperwork that might help with setting up an alternative in the Far East. And now the site is being cleared - for residential and retail development.

Where, in all this, were the working people's long-term interests really considered, even by their political representatives?

Friday, October 19, 2007

Normal service will be resumed as soon as possible

Off for a short break - back soon. But what a time to pick - the Federal Reserve having just granted maybe $100 billion of special exemptions to major banks (see yesterday's post).

Dollars, gold and words

Gary Dorsch (October 18) explains that a falling dollar helps the S&P 500, "which earn roughly 44% of their revenue from overseas, mostly in Euros", and supports house prices in the US; but it also raises the price of oil, gold and agricultural commodities. While the US seems set to cut rates further, the Eurozone may raise theirs to control inflation. In five years, the Brazilian real has doubled against the dollar! Oh, to have been a currency trader.

Meanwhile, Doug Galland at Casey Research explains that gold was dipping together with shares, because institutional investors were scrambling for cash in the unfolding credit crisis. His view is that in the longer term, these sectors will diverge and gold will soar. He supplies an eloquently simple graph:

Speaking of eloquence, financial writers know their business but many need to hone their writing, so I propose a new prize: Sackerson's Prose Trophy. The first winner is Doug Galland, with the following simile:

Though admittedly impatient to see the gold show get on the road, we were largely unconcerned by gold’s behavior. That’s because our eyes remained firmly fixed on the perfect trap set over the years for Bernanke’s Fed.

Like hunters of antiquity watching large prey grazing toward a large covered pit, the bottom of which is decorated with sharpened sticks, we watched the handsomely attired and well-groomed Bernanke and friends shuffle ever closer to the edge, their attention no doubt occupied by pondering the flavor of champagne to be served with the evening’s second course.

One minute pondering bubbly, the very next standing, wide-eyed and hyperventilating, on thin cover with decades of fiscal abuse cracking precariously under their collective Italian leather loafers. We can’t entirely blame Bernanke for the dilemma he now finds himself in; it was more about showing up to work at the wrong place at the wrong time.

The second paragraph is splendid in its anticipation, and the phrasing conveys both the anguished expectation of the hunters and the relaxed, expansive mood of the prey. The denouement is a little disappointing: "pondering" is a repetition and the syntax is too florid; a short sentence would be better, contrasting the suddenness of the fall with the slowness of the approach.

Further nominations for Sackerson's Prose Trophy are welcomed.

Thursday, October 18, 2007

The (scientific) pursuit of happiness

It seems that happiness, like health, is not what you have, but something you do.

In November 2005 I watched a BBC2 TV series by the psychologist Dr Richard Stevens, called "Making Slough Happy". He showed that you can increase your happiness in practical ways, and he demonstrated them on volunteers in Slough. It worked, even for the grumpies.

For more background, please click on the title below - but you may prefer to start the program straight away.

Happiness tools

1. Take half an hour of exercise three times a week

2. Count your blessings. At the end of each day, reflect on at least five things you are grateful for

3. Have an hour-long, uninterrupted, conversation with your partner or closest friends each week

4. Plant something: even if it’s in a window box or pot. Keep it alive!

5. Cut your TV viewing by half

6. Smile at and say hello to a stranger at least once a day

7. Make contact with at least one friend or relation you have not been in contact with for a while and arrange to meet

8. Have a good laugh at least once a day

9. Give yourself a treat every day. Take time to really enjoy this

10. Do an extra good turn for someone each day

Barclays emergency $20 billion financing move

Similar permissions have recently been granted to Citigroup, JPMorgan Chase, Bank of America and Deutsche Bank (see page 3).

Any comments?

UPDATE

Now RBS also, for up to $10 billion! (Thanks again to AntiCitizenOne for the alert.)

Wednesday, October 17, 2007

Will US protectionism pull the trigger?

An article by D R Schoon in GoldSeek (26 September) alerts us to a bill heading for a vote in the US Congress this autumn. It seeks to impose a 20% tariff on Chinese imports.

... China will retaliate; and, dumping $1.33 trillion of US Treasuries on the open market will be an all too easy and accessible option. It would destroy the US dollar and deal the US economy a body blow from which it would take years to recover...

Now unless US politicians are really abysmally stupid, they must have a backup plan to stop a torrent of dollars pouring back into the States - exchange controls? Repudiating the debt? If Russia's default forced the bailout of LTCM to prevent systemic crisis, what would a giant American default do?

We must hope for cool heads all round. US multinationals are already urging calm.

Tuesday, October 16, 2007

Hubble-bubble

The American astronomer Edwin Hubble found the evidence for an expanding universe, in the phenomenon of "red shift". Objects moving at high speed change colour, because their velocity stretches the light waves. Looking at galaxies, he saw that the further away the object, the more its spectrum shifted, so the faster it was going.

Why? Imagine you put a line of ink dots at intervals of an inch on a toy balloon, and then inflate it so that the space between each dot doubles. Dot A is now 2 inches from Dot B, and the latter is two inches from Dot C. So from A's perspective, B has receded by one inch, but C by two inches.

The implication is that as the universe continues to expand steadily, the objects furthest from us will eventually accelerate beyond the speed of light, and in Einsteinian terms will not be part of our universe any longer - we will never see anything from them again.

The financial universe is, as everyone who takes an interest knows, expanding. And everything is fine as long as the expansion continues, and while people are still prepared to use the inflating money.

One way the money supply expands is through loans. Banks only have to keep a fraction of their deposits ready for return to savers - the rest they can lend out. Some of that loaned money gets deposited into a different account - where again, part is kept and the rest loaned out. So the amount of money in the economy is multiplied by this "fractional reserve banking".

But unlike the cosmos, money can also contract. If more people than expected want their money back, loans get called in prematurely. It becomes a game of musical chairs. If there's growing concern that the system can't return all the cash demanded, two or three chairs are removed at a time and a panic starts. Rick Ackerman in GoldSeek (26 September) underscores this point.

"Captain Hook" in yesterday's Financial Sense suggests that we may be approaching such a time in the near future. The bubble may burst.

The problem for the rest of us is that if we believe the money supply will continue to expand, we want to get out of money and into anything that is more likely to hold its value; but if we anticipate deflation, then cash is king.

So, is it endless expansion, or inflation followed by a bust? Hubble, or bubble?

Backfire

Michael Panzner (Financial Armageddon, 11 October) comments on (and graphs) the increasingly synchronized movements of some speculative markets, including gold and tech shares. The range between these assets is tightening and may indicate that a turning point is due.

This would gel with other information: Marc Faber has said that he sees bubbles everywhere, including gold. True, it's also been reported recently that he's been buying into gold, but remember that he is something of an investment gunslinger and will have his own view about when to get out, too.

And Frank Veneroso thinks that the gold price rise is at least partly owing to heavy speculative backing from funds that may have to get out in a hurry, if a general market drop forces them to realize assets to settle accounts.

My feeling? We dudes shouldn't try to outdraw seasoned hands.

Sunday, October 14, 2007

Back to Eden

Can we make a paradise here, instead of looking for it in a different country?

Saturday, October 13, 2007

Round and round

"from the Chrysopoeia ('Gold Making') of Cleopatra during the Alexandrian Period in Egypt. The enclosed words mean 'The All is One.'"

That sinking feeling

Friday, October 12, 2007

Peter Schiff grows

As well a well-wrought urn becomes

The greatest ashes, as half-acre tombs.

How would money buy this?

|

| http://janestreetclayworks.com/2011/02/15/preview-the-history-of-bricks/1925-drawing-to-raleigh/ |

Many a truth is spoken in jest: at his request, Herriman's ashes were scattered in Monument Valley, Utah. Here is his love, expressed in a backhanded way that reveals more than it conceals.

This week, again, I spent time with clients talking not about money and how to invest it, but about what they wanted from life. It's so easy to let your mind become trapped in attempts to beat the top score on the pinball machine.

The hard stuff

Wednesday, October 10, 2007

Inflation, here we come

Jordan Roy-Byrne's article featured in Financial Sense last week examines various types of inflation and gives graphs, facts and his thoughts on future trends. He concludes:

UK Inheritance Tax threshold unchanged

The threshold per person remains at £300,000, as this article by Labour Home itself explains. What has changed is that the allowance is transferable on death, if you are married or in a civil partnership.

A similar effect would previously have been achieved by any competent solicitor, will writer or estate planner, by including a Nil Rate Band Will Trust in your Will. Similar, but not quite the same: the Nil Rate Band trust means giving assets away to a third party (not to one's partner) after the first death. Making the allowance transferable lets the surviving partner enjoy the use of assets worth up to £600,000, without the threat of estate tax afterwards.

This will reduce the amount of tax raised from IHT, since it helps those who a) haven't written the right kind of will/trust arrangement or b) couldn't do so because of the continuing needs of the surviving partner (who might, for example, be disabled or in a privately-paid nursing home).

But it's certainly not what it sounded like, which was an IHT allowance of £600,000 per person, or £1.2 million altogether.

Thanks to Dizzy Thinks and The Spectator Coffee House blog for the alerts.

Friday, October 05, 2007

Which will fall faster: the pound or the dollar?

Wednesday, October 03, 2007

"How much money do we need?" revisited

Our old pen-pal Jack Lessinger has a new book out: “Change.”

...His book outlines the development of the US property market over the past two centuries in terms of what he calls “paradigmatic economic changes.” He notes that the shrewd investor always had to stay ahead of the trend. That meant, looking beyond what the then-current paradigm to what people were likely to want in the future. Instead of investing in the old colonial regions along the East Coast, for example, an investor in the early 19 th century should have looked to the frontier. There, he would have found cheap land…and could have watched it soar for the next 50 years. He should have seen the huge development that would take place in Chicago and St. Louis, for example.

Later, after WWI, the landscape changed dramatically. New technology had created a new idea about how people should live – in the suburbs. For the next 50 years, fortunes could have been made simply by anticipating the growth of the suburbs – further and further out from the urban centres.

Our consumer economy did not exist before 1900, says Lessinger. Since then, it has grown and grown – “Sexy young women, smiling from the billboards , urging strait-laced and penny-pinching citizens to save less and spend more. Buy, buy , buy screamed the advertisers. Buy Coca Cola and be happy. Buy Dentine gum and be kissable. Buy Camels and be manly. The consumer economy blossomed. Houses grew bigger and more lavish, cars roomier, faster and more comfortable. What a great time to be alive!”

But buy, buy, buy is going bye-bye, says Jack. The consumer economy is unsustainable. People don’t have the money for it. It is based on cheap energy and cheap credit, both of which are running out. He thinks it will disappear by 2020.

“Get ready for an existential leap…” he warns.

The next Big Thing in American society will be a huge interest in downscaling, downshifting, and simplifying. When the baby boomers realise that their houses won’t allow them to Live Large, says another friend, they’ll begin to appreciate Living Small.

Jack comes at the subject from a different direction than we would, but his book made us think. You can find out more at jacklessinger.com.

I've been thinking how to "get out from under" for a long time. Maybe I'd better act before it becomes the fashion. Jim Puplava thinks the Fed has just bought us another two years, at a cost - to those who stay on too long.

Besides, I like beer and darts.

Tuesday, October 02, 2007

Secret taxation

This is a payslip for a supply teacher, showing income and deductions. On an emergency tax coding, tax is levied at basic rate (22%) on all earnings after pension contributions have been made. National Insurance is paid at the reduced rate of 9.4%, because the teacher is in his/her occupational pension. Total tax and NI: £399.61 / £1,472.20 gross pay = 27.14%.

This is a payslip for a supply teacher, showing income and deductions. On an emergency tax coding, tax is levied at basic rate (22%) on all earnings after pension contributions have been made. National Insurance is paid at the reduced rate of 9.4%, because the teacher is in his/her occupational pension. Total tax and NI: £399.61 / £1,472.20 gross pay = 27.14%.Oh no, it isn't.

The tax that dare not speak its name is employer's National Insurance, which would be around £93.37. It's an extra cost that the employee never sees, but it's money that could be paid in wages if it were not deducted at source. Therefore, the gross (pre all stoppages) pay is higher than shown, and so are the deductions.

So why don't we see payslips that tell the whole story, say something like this? ...

The reason is obvious, isn't it? Especially when you show the appropriate marginal rate.

The reason is obvious, isn't it? Especially when you show the appropriate marginal rate. And if this was a payslip for someone not in an occupational pension, the marginal rate of N.I. would be 11% for the employee, and 12.8% for the employer. In other words, £100 extra payslip-declared salary would actually cost the employer a total of £112.80, with marginal-rate deductions of £22 in income tax and £23.80 in N.I. ! In that case, the real effective marginal rate of revenue-raising would be 45.80/112.80, or 40.6%.

The average wage earner is, in fact, a 40% taxpayer, without knowing it.

Is it illegal to show the truth on your employees' wage slips? Don't you think it would make the ordinary person start to take the taxation issue seriously?

Gold price manipulation: Mylchreet backs Veneroso

"Central banks have 10-15,000 tonnes of gold less than their officially reported reserves of 31,000" the Chevreux report announced. "This gold has been lent to bullion banks and their counterparties and has already been sold for jewelry, etc. Non-gold producers account for most [of the borrowing] and may be unable to cover shorts without causing a spike in the gold price."

In other words, "covert selling (via central bank lending) has artificially depressed the gold price for a decade [and a] strongly rising Gold Price could have severe consequences for US monetary policy and the US Dollar."

The conclusion? "Start hoarding," said Paul Mylchreet...

The United States Federal Reserve: why the secrecy?

Monday, October 01, 2007

Lasting Power of Attorney: the next step in the Long March

Though I'm not sure how many people who take out an LPA are aware that the withdrawal of "treatment" includes denying water, so patients in hospital can be made to die slowly of thirst ("Since a landmark House of Lords judgment in 1993, providing food and water to those who cannot eat or drink for themselves counts as treatment as well."). And no-one can be certain what is felt by someone who is apparently in a coma.

Doesn't this conflict with the Hippocratic Oath?

What oath? Wikipedia says:

In the 1970s, cultural and social forces induced many American medical schools to abandon the Hippocratic Oath as part of graduation ceremonies, usually substituting a version modified to something considered more politically up to date, or an alternate pledge like the Oath or Prayer of Maimonides.

A Catholic scholar details the Oath and its history here.

The Act is here; the government's own take on it is here.

We seem to be approaching a time when anybody except a criminal may be lawfully killed.

Sunday, September 30, 2007

Is that charitable trust trustworthy?

But there's something about the name of this one - similar to other charities somehow. So I google it. Page after page on Google, each leading you directly to their site.

But now for blogpower! I look to see what my fellow bloggers say. Here's one, and it's most interesting. I say no more, since I have no money to fight in court.

I shall now add Elmer to my links, and the US charity evaluation site, Charity Navigator.

Another case where bloggers have proved to be useful, I would say.

Saturday, September 29, 2007

How much money do we need?

The mortgage conundrum

Thrift and Prudence: essay competition

Cartoon by Charles Keene (1823-1891) in "Punch" magazine

Cartoon by Charles Keene (1823-1891) in "Punch" magazineContrary to Mr Gordon Brown's claim to be prudent, many believe that the British Government (as well as that of the USA) wastes public money. One such critic is "Wat Tyler" in the British blog, Burning Our Money.

What if the people we criticise said, put up or shut up?

So, if you want better value for money in public finance, how would you get it? How would you achieve the same results for less money, or how would you improve quality without increasing expenditure?

If you wish to submit a longer piece, please submit your email in the comments - I shall then add you as an author to this blog pro tem (but will keep your email address off the blog unless you wish it to be published).

Dow 9,000 update

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

Thursday, September 27, 2007

Faber: bubble in commodities, but buy gold

Very simply, it will end in a catastrophe. We never had, in the history of capitalism, a global, synchronised, boom. If you travel around the world, everywhere you go, there are booming conditions.

Now if you look at the last 200 years of financial history, you had investment booms and mania in relatively small sectors in the economy: in the US in canals and railroad in the 19th century, some regional real estate markets. And then in the 1920s you had the stockmarket boom, and in the late 80s you have a silver, gold and energy share boom, and in the year 2000 we had a boom in tech stocks and in Japan in the 80s in Japanese shares. And each time these bubbles burst, they had an impact but the impact was largely sectorial or regional and not affecting the whole world.

Now, we have a bubble everywhere. We have a bubble in real estate prices, we have a bubble in stock, we have a bubble in art prices, we have a bubble in commodities.bigger the bubble, the bigger the bang will be. If someone argues we're in a global synchronised boom, I agree entirely. The consequence will be that the next boss will be a global synchronised boss.

By the way, I like that mistranscription, it conveys his Europeanness.

The southern Germans are comfortable with the themes of pain and loss, as you'll know if you've looked at the Meglinger painting on Dr Faber's GloomBoomDoom site. D.H. Lawrence wrote of the sensual agony in the little roadside shrines in interwar Bavaria. This is not simple morbidity - unlike modern crime/action films - but a sign that you can rise above suffering, instead of avoiding it.

A Viennese taxi driver explained to us the difference between Austrians and northern Germans: "They say, it's bad, but it's not hopeless; we say, it's hopeless, but it's not so bad."

Back to our muttons. Here he is again, quoted from various sources via Resourcexinvestor:

"Investors have to look for assets which cannot multiply as fast as the pace at which the Fed prints money."

... He advised buying gold to defend against monetary inflation... he recommends holding physical gold bullion investments in gold-friendly countries such as Hong Kong, India and Switzerland. He counsels against holding gold in the US for fear that it might be nationalized by the government.

Wednesday, September 26, 2007

Crescendo crisis

Bully for the fund managers. But I say again, consider the implications for the West, which is losing control of its debt and now looks set to start losing control of its assets.

Tuesday, September 25, 2007

Frank Veneroso elaborates on the gold bubble

1. Are you still of that opinion?

2. What do you think is the present situation regarding gold holdings by central banks?

3. What evidence do we now have?

I believe that we are near the end of a commodity bubble that is the largest in all history. The greatest extreme is in metals. Hedge funds have accumulated futures, forwards and physical on a scale that simply has no precedent. The greatest excesses are in base metals but these same funds all hold large gold positions. I believe that individual funds may hold positions in copper or gold that are as large in value as the ETF. I know that sounds unbelievable. But I have a great deal of evidence.

If this is so, the price of gold should be much higher. My only explanation for why it is not is that central bank holdings must be very large for this to happen.

I should add, I believe there will be a coming crash in the metals sector that will surface. There will be an unprecedented investor revulsion toward this sector.

Gold’s fundamentals are totally different from those of base metals and silver. However, because the same funds also hold gold, I cannot see how gold can escape forced liquidations from these portfolios.

Frank Veneroso — Perhaps the most highly regarded market economist of our time, Frank Veneroso has advised countless governments, as well as the World Bank, on economic policy, served as a senior partner in one of the world's largest hedge funds, and is a confidant and private advisor to many of today's most influential investors and economic leaders.

He was among only a handful of analysts who clearly predicted the Tech Wreck, and followed it up with a deadly-accurate forecast of today's gold bull market.

Now, Mr. Veneroso is stunning the world with predictions of a major train wreck in no less than two high-flying sectors of the global economy. Virtually no one is expecting these dramatic events...

Red Dragon, White Collar

http://www.apmforum.com/columns/china20.htm

http://www.danwei.org/

http://www.china-britain.org/

Stay here and go East

"US companies aren't going to make much money by selling more product to Americans. Americans don't have any money... A company with a good product - especially a good brand - can make a lot of money now by doing two things. One is lowering its costs by outsourcing labour to Asia...not just manufacturing, but even high-level things like design, research, marketing, legal work. The other thing it has to do is to sell its products to this huge rising market of the Asian middle class.

Monday, September 24, 2007

Golden bubble

A bubble shot through by a bullet - experiment described here

A bubble shot through by a bullet - experiment described hereWhen it comes to metals, we see hedge fund speculation, hoarding and squeezing everywhere. Not only have some metals markets been driven far, far higher in this cycle compared to all past cycles; we see the same phenomenon across all metals. It is the combination of both the amplitude and breadth of the metals bubble that probably makes it the biggest speculation to the point of manipulation in the history of commodities. (Page 50)

... it is likely that the net nominal return to portfolios from investing in physical “stuff” has not been more than 1% per annum. By contrast, in a 3% inflation environment, bonds have yielded somewhere between 5% and 9% and equities have yielded somewhere between 8% and 11%. In effect, you gave up an immense amount of yield if you diversified out of bonds and stocks into commodities. You did gain by reducing overall portfolio volatility, but that gain was not large enough to offset the loss in yield. Diversifying with “stuff” did not enhance risk-adjusted returns. (Page 57)