Monday, October 26, 2009

Fears of a stockmarket correction

But Marc Faber (htp: Jesse) thinks not - as the dollar weakens, the market adjusts upward. And he is convinced of the "Bernanke put", i.e. money will be thrown into the system to maintain the illusion that all is well. Longer-term, Faber (in that smiling way of his) gives it around 10 years before the dollar simply collapses as public finances run completely out of control.

Wednesday, October 07, 2009

"It's moving towards you..."

As in "Alien", no-one knows where it's going to come from, but there's a bad feeling around:

1. ... it's easy to see that a financial crisis is brewing. Somewhere, something is going to blow sky high...

2. I see more bubble trouble on the way. Risk assets are being bid up all over the world as investors look for higher yields.

3. "Why is liquidity going into the financial sector? It's because the real economy is dying [and] everyone is fleeing into the stocks and bonds because they're liquid at the moment..."

4. In November 2008, Chinese banks said they would no longer play by our rules. Top tier banks (Bank of China and Industrial and Commercial Bank of China) reneged on derivatives contracts. [....] This should have been headline news in every financial newspaper, but it wasn’t.

Ironically, it is Marc Faber who takes the comparatively positive viewpoint:

5. If you look at the next 10 to 20 years in the West, I don’t see how the lifestyle of the average person will improve meaningfully. On the other hand, if you look at a country like Vietnam, they have a GDP per capita annually of $800 which may go to $3,000 over the next 15-20 years.

Monday, September 28, 2009

Where to turn, for financial security?

Leo Kolivakis comments, "I happen to believe that diversification is still important, but loses its power as huge inflows are going into all sorts of public and alternative asset classes."

That's the problem: we no longer know where to turn. As Kunstler comments, "the most perplexing part is that there hardly seems any safe place to preserve one's savings."

How about the smart, nimble operators? Investment guru Marc Faber spends his time looking at liquidity flows, trying to predict the next sudden tide and get in beforehand - not a game for the type of clients I have usually advised. And even he appears to be readying himself for the worst, "a total disaster, with a collapse of our capitalistic system as we know it today."

Recently, I seem to have been reading more commentators tending to the view that we are heading for that Mises "crack-up boom" - outlined here nine years ago, for example. And worse:

"And 'mid this tumult Kubla heard from far

Ancestral voices prophesying war!"

The great pleasure gardens of China's Emperor took some 40 years to build, in the first half of the eighteenth century. Vast, complex and exquisite, they were testimony to the wealth and power of the Middle Kingdom, only to be methodically destroyed in an act of punitive vandalism by the French and English in 1860. Premier Zhou Enlai decreed that the ruins should remain unaltered, a monumental lesson for the Chinese about the Western powers.

Of all the curses on humankind, long and vengeful memory may be the worst.

Sunday, September 13, 2009

20:20 hindsight and the coming stock collapse

So, is all well again?

Denninger thinks not. To get back to where we were in 2000, either debt has to be slashed (this isn't the path chosen by the powers-that-be over the last couple of years) or GDP and incomes have to soar (how? Who are we suddenly going to sell loads more to?).

Given a choice of the impossible and the merely unpleasant, it looks as though there must be a large-scale default sometime - either of actual debt, or of current and/or future government-provided benefits (or both).

In the meantime, the monetary pumping may erode the dollar's value and cause a highly misleading leap in nominal stock prices. Like I said yesterday, I think we could be looking at a re-run of the mid-70s to 1982. I remember an old financial adviser colleague reminiscing about the stockmarket "boom" of 1974, but he didn't mention the inflationary context, which is what concerns Marc Faber - the fundamentals are still all wrong.

Saturday, September 12, 2009

Another collapsist

The question is, how bad is it for other countries (e.g. the UK) and what will trading partners do to stop their export markets being hit? If all major countries try to devalue their currency, then maybe only certain commodities will be worth holding on to while the winds blow.

And Keiser says the wealthy have been shifting their capital out of America since 9/11. He's been choosing defensive stocks, ones that will survive high unemployment, consumer boycott and anti-American sentiment. One big and possibly vulnerable name he mentions is Coca-Cola (remember Qibla Cola?) - a staple of Warren Buffett's portfolio.

Monday, August 31, 2009

Marc Faber - total breakdown ahead

... in my view, the big crisis is ahead of us. It may come in 4 or 5 years' time, maybe only in 10 years' time, but the total breakdown of the system is ahead of us and it will devastate the global economy. (4:18 on)

You have to decide whom to believe. Including Steve Keen, it's said that only 12 professional economists worldwide foresaw the crunch, although there are 10 - 15,000 practising in the US alone. So the majority verdict is useless. To me, Faber has the ring of truth.

The good news, such as it is, is that we may have a few years to prepare.

As to perceived turning points, I looked at this last December:

Monday, July 20, 2009

Doomsday scenario

Faber lives in Chiang Mai, northern Thailand, a country whose King is a proponent of national economic self-sufficiency. It's also worth noting that Chiang Mai is a fairly short air-hop from Burma, Laos and China; and that Dr Faber collects Mao memorabilia and has business interests in Vietnam. I see him as a long-term planner who covers all possible options.

As Dr Doom notes, "...a major crisis like we had should clean the system but nothing has been cleaned," so why should all be well again? But you could choose to side with Faber's co-interviewee Giles Keating of Credit Suisse; very nice accent, nice bearing - just the sort of thing the clients like.

However, witness also Karl Denninger today, commenting on a report that US Federal Government support for the economy could reach almost $24 trillion:

A couple of market technicians have noted certain "patterns" in the market that have potential downside targets of zero. That sort of thing normally results in a loud guffaw from me - even though I'm bearish I'm not that bearish - I couldn't imagine anything short of global thermonuclear war, ala "Joshua", that could lead to such an outcome.

Well I think I just found something purely economic that could lead to that outcome, and it's right here.

Be prepared. As the Greek saying goes, "There is no borrowing a sword in time of war." I'm going to go back to doing what I started to do a few months ago: draw extra cash and stash it in a locker. And some other things (though not weapons - the tiger is the endangered species, not the rabbit).

Thursday, July 02, 2009

Faber: correction, then inflation

Friday, April 10, 2009

Prepare for a bond rout

(Highlight mine.) Read the rest of Peter Schiff's interview with Marc Faber here.

PS: Faber indicates something like the following portfolio to Schiff:

Commodities (e.g. oil, agriculture): 20%

Emerging markets: 10% - 20%

Gold (in physical form): 10%

Cash (the US dollar, for now): 50%

Sunday, March 08, 2009

Marc Faber: inflation, war, gold

Also, here, from which the following extract:

The best bet for investors may be to buy a farm and escape from the cities, as a prolonged recession could lead to war, as the Great Depression did, said the Swiss national, who now lives in Thailand.

“Buy a farm and let your girlfriend work on the farm,” he said, to the applause of investors. “If the global economy doesn’t recover, usually people go to war.”

For pictures of his elegant Chiang Mai home, possibly a clue to his personality, see here - and for local Thai comment on him, see here.

Sunday, February 08, 2009

Denninger: deflation

In short:

...rallies are to be sold, cash is to be raised and prudence is to be practiced in your own personal financial affairs. Don't get creative in all things finance, get stingy and prudent. Your personal financial survival could well depend on it.

So instead of staring at the low interest on your cash balance, think of the real capital appreciation of your money as measured by what big-ticket items it will buy. And for once, the government can't easily tax your capital gain.

You may also want to hold more cash away from a bank ("Round #2 of severe bank instability gets served up on us in the second half of 2009").

And maybe diversify your currency holdings:

The Dollar will not collapse. This is not because we're in great shape or will truly recover, it is because the rest of the world is in worse shape than we are... The rest of the world is literally on the precipice of a full-on collapse. European banks are more-levered and less-transparent than our banks as just one example... I see the potential for the pound and euro to both reach par with the dollar.

I think Denninger on the one hand, and Faber/Janszen on the other, may both be correct. It's a matter of timing - deflation now, debasement of the currency later. Because nominal debt gets relatively bigger as assets and incomes decline in value, something will have to give.

Janszen, Faber: hyperinflation is government policy

(Graph reproduced by iTulip from NowAndFutures.com)

(Graph reproduced by iTulip from NowAndFutures.com)In an extended "Titanic" analogy, Eric Janszen describes what he sees as the government's response to the crisis: "send rescue", "boil the ocean" and if terrified investors refuse to relinquish the security of Treasury bonds, "sink the rafts" by devaluing the currency. Around the world, he sees a policy of inflation and even hyper-inflation. So does chipper doomster Marc Faber, who now thinks we must eventually have 200% inflation in the USA. 1974 - 82, here we come again?

Saturday, February 07, 2009

Inflation bubbling up

Further to my recent post on whether gold is overpriced, it's worth pointing out that gold can remain for long periods above trend. Those who mock new buyers of gold may have overlooked this.

UPDATE

Marc Faber: "If I look at government debt in the US, and debt in general, I think the only way they will not default physically on their debt is to inflate." (htp: Michael Panzner)

Thursday, January 08, 2009

Where to turn?

Marc Faber is predicting that precious metals will outperform equities and bonds; this commentator reckons silver will outperform gold.

Dear me.

Friday, December 26, 2008

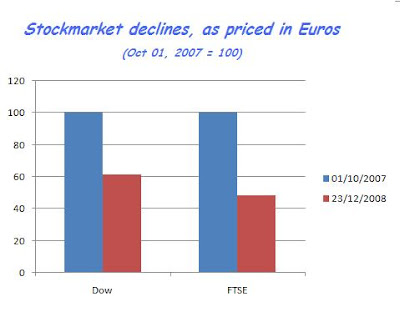

Nominal and real

Wednesday, December 24, 2008

Relativism

Saturday, December 20, 2008

How will the future look?

Thanks to the glacial catchup by the mainstream media, the public is finally worrying about economic depression, and consoling itself with the thought that we've messed it up for everyone, so at least the Chinese won't prosper and come over here as tourists, overdressed, overpaid and taking too many pictures for their digital photoframes at home.

Thanks to the glacial catchup by the mainstream media, the public is finally worrying about economic depression, and consoling itself with the thought that we've messed it up for everyone, so at least the Chinese won't prosper and come over here as tourists, overdressed, overpaid and taking too many pictures for their digital photoframes at home.

Monday, December 01, 2008

"When the going was good"

And he's a gold bug again - and says hold it outside the US, as many have long recommended.

Saturday, November 15, 2008

Looking back, looking forward

This gels with what Marc Faber was saying quite some times back, that the market had further to drop than many people thought. Equities may seem to be fair value in terms of multiples of their earnings, but when the earnings fall, valuations have to be reassessed.

Sunday, November 09, 2008

FDIC underfunded

The FDIC estimates that through 2013 there will be about $40 billion in losses to the deposit insurance fund, including an $8.9 billion loss from the failure of IndyMac Bank. The FDIC is raising insurance premiums paid by banks and thrifts to replenish its fund, which now stands at around $45.2 billion, below the minimum target level set by Congress and the lowest level since 2003.

The current target (the "Designated Reserve Ratio") is 1.25% of deposits and is discussed here. According to Mish on July 23, insured deposits in the US banking system totalled $4.24 trillion, which if unchanged now would mean the FDIC current funds represent 1.066% of the sum insured, s0 the FDIC needs to raise another c. $8 billion in premiums from banks.

The question remains, whether merely 1.25% is sufficient for present and foreseeable circumstances. Dr Marc Faber is now talking about eventual US inflation and State bankruptcy - after a near-term rally.