I have received another charity mailing, this time from the World Children's Fund. There's so many that I feel guilt at not being able to give to all. And aren't they well-presented these days?

But there's something about the name of this one - similar to other charities somehow. So I google it. Page after page on Google, each leading you directly to their site.

But now for blogpower! I look to see what my fellow bloggers say. Here's one, and it's most interesting. I say no more, since I have no money to fight in court.

I shall now add Elmer to my links, and the US charity evaluation site, Charity Navigator.

Another case where bloggers have proved to be useful, I would say.

Sunday, September 30, 2007

Saturday, September 29, 2007

How much money do we need?

The mortgage conundrum

Much of the nation's wealth seems to be tied up in our houses, which don't appear to be very productive from an economic standpoint. There is a kind of circular logic:

1. Houses cost a lot, so you have to borrow a great deal of money to buy a house.

2. Houses cost a lot, because you can borrow a great deal of money to buy a house.

Having regard for the wider consequences of your proposals, what is the optimum solution?

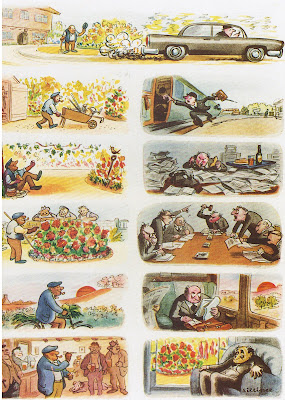

Thrift and Prudence: essay competition

Cartoon by Charles Keene (1823-1891) in "Punch" magazine

Cartoon by Charles Keene (1823-1891) in "Punch" magazineContrary to Mr Gordon Brown's claim to be prudent, many believe that the British Government (as well as that of the USA) wastes public money. One such critic is "Wat Tyler" in the British blog, Burning Our Money.

What if the people we criticise said, put up or shut up?

So, if you want better value for money in public finance, how would you get it? How would you achieve the same results for less money, or how would you improve quality without increasing expenditure?

If you wish to submit a longer piece, please submit your email in the comments - I shall then add you as an author to this blog pro tem (but will keep your email address off the blog unless you wish it to be published).

Dow 9,000 update

July 6 to present: Dow up from 13,611.69 to 13,895.63; gold up from $647.75/oz. to $743.10. So the "gold-priced Dow" is down 11.01% in 84 days.

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

Thursday, September 27, 2007

Faber: bubble in commodities, but buy gold

Marc Faber in ABC News, Tuesday:

Very simply, it will end in a catastrophe. We never had, in the history of capitalism, a global, synchronised, boom. If you travel around the world, everywhere you go, there are booming conditions.

Now if you look at the last 200 years of financial history, you had investment booms and mania in relatively small sectors in the economy: in the US in canals and railroad in the 19th century, some regional real estate markets. And then in the 1920s you had the stockmarket boom, and in the late 80s you have a silver, gold and energy share boom, and in the year 2000 we had a boom in tech stocks and in Japan in the 80s in Japanese shares. And each time these bubbles burst, they had an impact but the impact was largely sectorial or regional and not affecting the whole world.

Now, we have a bubble everywhere. We have a bubble in real estate prices, we have a bubble in stock, we have a bubble in art prices, we have a bubble in commodities.bigger the bubble, the bigger the bang will be. If someone argues we're in a global synchronised boom, I agree entirely. The consequence will be that the next boss will be a global synchronised boss.

By the way, I like that mistranscription, it conveys his Europeanness.

The southern Germans are comfortable with the themes of pain and loss, as you'll know if you've looked at the Meglinger painting on Dr Faber's GloomBoomDoom site. D.H. Lawrence wrote of the sensual agony in the little roadside shrines in interwar Bavaria. This is not simple morbidity - unlike modern crime/action films - but a sign that you can rise above suffering, instead of avoiding it.

A Viennese taxi driver explained to us the difference between Austrians and northern Germans: "They say, it's bad, but it's not hopeless; we say, it's hopeless, but it's not so bad."

Back to our muttons. Here he is again, quoted from various sources via Resourcexinvestor:

"Investors have to look for assets which cannot multiply as fast as the pace at which the Fed prints money."

... He advised buying gold to defend against monetary inflation... he recommends holding physical gold bullion investments in gold-friendly countries such as Hong Kong, India and Switzerland. He counsels against holding gold in the US for fear that it might be nationalized by the government.

Very simply, it will end in a catastrophe. We never had, in the history of capitalism, a global, synchronised, boom. If you travel around the world, everywhere you go, there are booming conditions.

Now if you look at the last 200 years of financial history, you had investment booms and mania in relatively small sectors in the economy: in the US in canals and railroad in the 19th century, some regional real estate markets. And then in the 1920s you had the stockmarket boom, and in the late 80s you have a silver, gold and energy share boom, and in the year 2000 we had a boom in tech stocks and in Japan in the 80s in Japanese shares. And each time these bubbles burst, they had an impact but the impact was largely sectorial or regional and not affecting the whole world.

Now, we have a bubble everywhere. We have a bubble in real estate prices, we have a bubble in stock, we have a bubble in art prices, we have a bubble in commodities.bigger the bubble, the bigger the bang will be. If someone argues we're in a global synchronised boom, I agree entirely. The consequence will be that the next boss will be a global synchronised boss.

By the way, I like that mistranscription, it conveys his Europeanness.

The southern Germans are comfortable with the themes of pain and loss, as you'll know if you've looked at the Meglinger painting on Dr Faber's GloomBoomDoom site. D.H. Lawrence wrote of the sensual agony in the little roadside shrines in interwar Bavaria. This is not simple morbidity - unlike modern crime/action films - but a sign that you can rise above suffering, instead of avoiding it.

A Viennese taxi driver explained to us the difference between Austrians and northern Germans: "They say, it's bad, but it's not hopeless; we say, it's hopeless, but it's not so bad."

Back to our muttons. Here he is again, quoted from various sources via Resourcexinvestor:

"Investors have to look for assets which cannot multiply as fast as the pace at which the Fed prints money."

... He advised buying gold to defend against monetary inflation... he recommends holding physical gold bullion investments in gold-friendly countries such as Hong Kong, India and Switzerland. He counsels against holding gold in the US for fear that it might be nationalized by the government.

Wednesday, September 26, 2007

Crescendo crisis

Today's Daily Reckoning UK directs us to this article on FT.com, which says that sovereign wealth funds will support (if not boost) share prices in a "crescendo of investing".

Bully for the fund managers. But I say again, consider the implications for the West, which is losing control of its debt and now looks set to start losing control of its assets.

Bully for the fund managers. But I say again, consider the implications for the West, which is losing control of its debt and now looks set to start losing control of its assets.

Tuesday, September 25, 2007

Frank Veneroso elaborates on the gold bubble

I am impressed by the courtesy of important people.

Frank Veneroso — Perhaps the most highly regarded market economist of our time, Frank Veneroso has advised countless governments, as well as the World Bank, on economic policy, served as a senior partner in one of the world's largest hedge funds, and is a confidant and private advisor to many of today's most influential investors and economic leaders.

He was among only a handful of analysts who clearly predicted the Tech Wreck, and followed it up with a deadly-accurate forecast of today's gold bull market.

Now, Mr. Veneroso is stunning the world with predictions of a major train wreck in no less than two high-flying sectors of the global economy. Virtually no one is expecting these dramatic events...

After reporting on his April 2007 presentation to World Bank people (see yesterday's post, "Gold bubble"), I emailed Frank Veneroso, and have received a reply from him today. I wanted to follow up on his essay of May 2001. Here's what I asked:

In 2001, you wrote a very intriguing article, posted on GATA, theorising that central banks actually hold much less physical gold than they pretend, because of loan-outs and possibly surreptitious selling. If I may, I should like to ask a few questions:

1. Are you still of that opinion?

2. What do you think is the present situation regarding gold holdings by central banks?

3. What evidence do we now have?

1. Are you still of that opinion?

2. What do you think is the present situation regarding gold holdings by central banks?

3. What evidence do we now have?

Here is his reply:

That was my opinion. It still is. However I gave ranges regarding that amount. I now believe that central bank loan outs and undisclosed sales were at the low end of my expectations. Why? I have no direct evidence. My evidence is the following.

I believe that we are near the end of a commodity bubble that is the largest in all history. The greatest extreme is in metals. Hedge funds have accumulated futures, forwards and physical on a scale that simply has no precedent. The greatest excesses are in base metals but these same funds all hold large gold positions. I believe that individual funds may hold positions in copper or gold that are as large in value as the ETF. I know that sounds unbelievable. But I have a great deal of evidence.

If this is so, the price of gold should be much higher. My only explanation for why it is not is that central bank holdings must be very large for this to happen.

I should add, I believe there will be a coming crash in the metals sector that will surface. There will be an unprecedented investor revulsion toward this sector.

Gold’s fundamentals are totally different from those of base metals and silver. However, because the same funds also hold gold, I cannot see how gold can escape forced liquidations from these portfolios.

I believe that we are near the end of a commodity bubble that is the largest in all history. The greatest extreme is in metals. Hedge funds have accumulated futures, forwards and physical on a scale that simply has no precedent. The greatest excesses are in base metals but these same funds all hold large gold positions. I believe that individual funds may hold positions in copper or gold that are as large in value as the ETF. I know that sounds unbelievable. But I have a great deal of evidence.

If this is so, the price of gold should be much higher. My only explanation for why it is not is that central bank holdings must be very large for this to happen.

I should add, I believe there will be a coming crash in the metals sector that will surface. There will be an unprecedented investor revulsion toward this sector.

Gold’s fundamentals are totally different from those of base metals and silver. However, because the same funds also hold gold, I cannot see how gold can escape forced liquidations from these portfolios.

Mr Veneroso has kindly given his permission to publish the above comments.

From the prospectus for a conference in New Orleans in 2006:

Frank Veneroso — Perhaps the most highly regarded market economist of our time, Frank Veneroso has advised countless governments, as well as the World Bank, on economic policy, served as a senior partner in one of the world's largest hedge funds, and is a confidant and private advisor to many of today's most influential investors and economic leaders.

He was among only a handful of analysts who clearly predicted the Tech Wreck, and followed it up with a deadly-accurate forecast of today's gold bull market.

Now, Mr. Veneroso is stunning the world with predictions of a major train wreck in no less than two high-flying sectors of the global economy. Virtually no one is expecting these dramatic events...

Red Dragon, White Collar

Just a few tasters of the emerging advertising and media class in China:

http://www.apmforum.com/columns/china20.htm

http://www.danwei.org/

http://www.china-britain.org/

http://www.apmforum.com/columns/china20.htm

http://www.danwei.org/

http://www.china-britain.org/

Stay here and go East

Whole new industries are waking up to a New China, with a middle class...and millions of rich people too... We spoke to a young man here who believes that the key to making money in large US companies actually lies in Asia.

"US companies aren't going to make much money by selling more product to Americans. Americans don't have any money... A company with a good product - especially a good brand - can make a lot of money now by doing two things. One is lowering its costs by outsourcing labour to Asia...not just manufacturing, but even high-level things like design, research, marketing, legal work. The other thing it has to do is to sell its products to this huge rising market of the Asian middle class.

"If it does these two things, it will have lower costs and higher revenues. If it doesn't do these two things, it will be stuck with high costs...and a stagnant market - at best. Actually, as the housing problem deepens in the United States, you'd expect domestic sales to fall."

He's probably right. While the average American will probably grow poorer - in both relative and absolute terms - many US companies will probably do quite well. Many already are.

I've suggested before now, that the white-collar people here are next in the firing line. Those mushrooming Third World (first-class) universities aren't just turning out engineering graduates. James Kynge pointed out that maybe 85% of the end-price of our Chinese imports is added on by sales and marketing. There's a strong incentive for developing Madison Avenue East. Not to mention Great Wall Street.

The good news for investors is that you may be able to make some money stock-picking the right Western companies, where access to shares is easier, accounts are not quite so dodgy, the government doesn't generally have its hand up the corporate puppet, and even governments have (to some degree) to obey the law and respect private property.

Returning to the gold-bubble question, Bill repeats the argument that gold is a haven in a storm, and mooring is getting cheaper:

There are times when the investing world becomes so dangerous that the most likely rate of return for the average investor will be negative. That is a good time to hold gold; your rate of return will almost certainly be better than actually investing! Gold is a hedge against the unknown... But like any insurance, it costs money. When you hold gold, you give up the yield you would otherwise get from stock dividends or bond coupons. Now that Bernanke has cut short-term rates, the cost of holding gold has gone down.

Is now the time to buy gold? The money supply in the United States is rising at a rate nearly five times the growth of the economy itself. The Fed, claiming that inflation is now under control, has just cut the price of credit to member banks by half a percentage point. The economic explorer has to rub his eyes and look twice; he can't quite believe it. How can inflation be under control when prices for key commodities - notably the keyest commodity, oil - are at record levels? He doesn't have an answer, but he can put two and two together. Whatever kind of 'flation' the Fed has been cooking up, we're going to get more of it. So put on your best bib and tucker, dear reader.

Monday, September 24, 2007

Golden bubble

A bubble shot through by a bullet - experiment described here

A bubble shot through by a bullet - experiment described hereHere's a counter-blast to gold-bugs and fans of other metals:

In this long and dense presentation to the World Bank, delivered in April 2007 and revised/updated in July, Frank Veneroso says that commodities, including gold, nickel and copper, are already in a big bubble. He thinks an estimated $2 trillion in hedge funds, plus leveraging, is pumping the prices:

When it comes to metals, we see hedge fund speculation, hoarding and squeezing everywhere. Not only have some metals markets been driven far, far higher in this cycle compared to all past cycles; we see the same phenomenon across all metals. It is the combination of both the amplitude and breadth of the metals bubble that probably makes it the biggest speculation to the point of manipulation in the history of commodities. (Page 50)

Short runs costs have risen, but not long run costs. New sources are being exploited. And if recession hits, demand will drop:

... the historical pattern... for all commodities, suggests that, rather than seeing well above trend metals demand growth in the years to come as the consensus now projects, we are more likely to see outright declines in global demand for these metals as demand destruction takes hold. (Page 56)

For institutional investors, the "barren breed of metal" is unproductive compared to other assets:

... it is likely that the net nominal return to portfolios from investing in physical “stuff” has not been more than 1% per annum. By contrast, in a 3% inflation environment, bonds have yielded somewhere between 5% and 9% and equities have yielded somewhere between 8% and 11%. In effect, you gave up an immense amount of yield if you diversified out of bonds and stocks into commodities. You did gain by reducing overall portfolio volatility, but that gain was not large enough to offset the loss in yield. Diversifying with “stuff” did not enhance risk-adjusted returns. (Page 57)

So prices have been boosted by the futures market. And commodities as a market are small enough to be susceptible to "manipulation and collusion".

Readers of this blog will recall that Marc Faber recently said he saw bubbles everywhere, including commodities. Even if cash isn't king, it may be a pretender to the throne.

Slow down - credit crunch at work?

Sunday, September 23, 2007

The big picture (as I see it)

Most of the people now managing our money - the money that we plan to retire on - are too young to remember the financial world of the 1970s. This hampers their judgement, and a debacle like subprime lending shows how they have underestimated both the likelihood and the impact of Black Swan events.

In one of George Goodman's books, the financial journalist author (aka "Adam Smith") is shown round a dealer's office by a friend, and the young people are all chirping away optimistically about how they're going to make fortunes for the company in this or that opportunity. His friend turns to him and smiles ironically. "See what I mean? Kids!" Of course, in a rising market you want optimists: the scarred old bears will tend to hang back and miss out on the bonanza. Which is why Adam Smith's friend was employing kids.

But the tide is turning.

I called it far too early (but how was I to know that governments would lose their sanity and print money as fast as their presses would work?). Here's what I wrote to a client on 21st October 1999:

As you are now around three years off the maturity date of your personal pension with XXX Life, you should be considering the security of your fund.

I went to a very interesting investment seminar yesterday, at which it was said that the American stockmarket could be as much as 50% too high, and a correction is overdue. It has already slid 20% off its highest point, by degrees, but a bigger drop could happen. If and when it does, this would have consequences for other markets around the world, since the US is the biggest stockmarket of all.

I went to a very interesting investment seminar yesterday, at which it was said that the American stockmarket could be as much as 50% too high, and a correction is overdue. It has already slid 20% off its highest point, by degrees, but a bigger drop could happen. If and when it does, this would have consequences for other markets around the world, since the US is the biggest stockmarket of all.

As you know, the XXX Fund is designed specifically as a safe haven for your investment in uncertain times, and I enclose a form for you to sign and forward to XXX Life, if you agree with my suggestion.

To those in the know, the crash of 2000 was not a surprise. What was your adviser telling you then? Yet the tone of that seminar was upbeat - the market's overpriced, so what?

If governments had maintained financial integrity, then following the mad tech boom, the Great Correction would have started in 2000 and the cleansing and healing process would be well under way. Instead, our politicians chose inflation.

If you were earning money in the mid-70s, you'll know what runaway inflation is like. To counter it, we had financially-motivated strikes: strikes for more money to restore real incomes, strikes to maintain pay differentials between different categories of worker, and strikes for pay parity by those who were left behind. Then settlement, paid for by inflating the currency further. Then more price inflation, and more strikes.

In the new globalized economy, strikes aren't going to work. Here in the UK (and Alan Greenspan has recently advocated the same), we simply allow the import of lots of poor people to undercut our indigenous skilled and semi-skilled workers. This keeps down wage rates and improves productivity. But it also earns little tax/National Insurance, and builds up massive obligations for Health, Education and Welfare (present, for those undercut; future, for all).

For a former Chancellor of the Exchequer keen on off-book financing, it's not a big issue: let the future take care of itself. For most of us, who have to move into the future without a bomb-proof PM's pension and lifelong special police protection, those debts will come home to roost.

I've often wondered how middle-class Germans coped when their money was wiped out by hyperinflation; and how the Russians on State pensions survived in the hinterlands, after the economy collapsed some years ago. Today I read (UK's "Mail on Sunday", page 31) an account by one of the few remaining whites in Robert Mugabe's Zimbabwe:

"The professional generation before me, the doctors and lawyers and the engineers who built Zimbabwe, are all starving to death on their pensions." (If you want to help them, please contact ZANE - they're on the Web. And there's millions of black Zimbabweans who are even worse off.)

But it's to the Sunday Express I have to turn, to get a serious warning about inflation for ourselves. Geraint Jones (page 10) notes that China is hinting at dumping the dollar wholesale; Saudi Arabia has refused to follow the Federal Reserve's interest rate cut; China and India are emerging as this century's budding supereconomies; oil's going up; food is getting pricier; the subprime disaster hasn't finished; mortgages are costing more.

The Express' Financial section wants to lock the stable door after the horse has bolted - much good a reformed Bank of England will do us now. Back in the main paper, Jimmy Young supports the suggestion that UK savers should be given guarantees for the first £100,000 of their deposits - again, too late: it's inflation guarantees we need - in the Germany of late 1923, 100,000 marks wouldn't get you a postage stamp.

The American Jim Puplava, on his excellent Financial Sense Newshour, thinks the latest desperate reflation will buy us a couple of years.

Use them.

Saturday, September 22, 2007

Sovereign wealth funds: debt-for-equity swapping

A $20 American Eagle gold coin from 1914

A $20 American Eagle gold coin from 1914Bill Bonner, reflecting on news from the International Herald Tribune such as this, notes yesterday that sovereign wealth funds are taking advantage of the falling dollar to buy US assets:

As the dollar goes down, Americans become poorer…and their assets become cheaper...The foreigners have huge piles of dollars which are losing value... Doesn’t it make sense for them to use the dollars to buy American assets?

The Arabs must think so... They [are] making offers on the Nasdaq…the London Stock Exchange…and the Carlyle Group, a US buyout firm.

China , meanwhile, recently took a big stake in Blackstone, another big corporate chop shop. Buying up the buyout firms is a particularly important omen, we think. It allows the foreigners to take up more and more US (and UK) assets without getting their name in the paper. And it allows Anglo-Saxons the soothing flattery of thinking that their assets are becoming more and more sought after…it takes their minds off the sour news, that foreigners are using their mountains of trashy dollars to get control over genuinely valuable assets…and that Americans will increasingly be working for foreigners…

As the dollar goes down, Americans become poorer…and their assets become cheaper...The foreigners have huge piles of dollars which are losing value... Doesn’t it make sense for them to use the dollars to buy American assets?

The Arabs must think so... They [are] making offers on the Nasdaq…the London Stock Exchange…and the Carlyle Group, a US buyout firm.

China , meanwhile, recently took a big stake in Blackstone, another big corporate chop shop. Buying up the buyout firms is a particularly important omen, we think. It allows the foreigners to take up more and more US (and UK) assets without getting their name in the paper. And it allows Anglo-Saxons the soothing flattery of thinking that their assets are becoming more and more sought after…it takes their minds off the sour news, that foreigners are using their mountains of trashy dollars to get control over genuinely valuable assets…and that Americans will increasingly be working for foreigners…

A potentially dangerous form of debt restructuring is in progress. As small businesses yield to huge corporations, increasingly foreign-owned, could Big CEO become the new Big Brother? Will the excesses of consumerism end in our descendants serving in a modern version of bonded labour?

No easy bounce back this time, says Marc Faber

Marc Faber, quoted in The Daily Reckoning Australia on Thursday but writing in late August, anticipated the Fed's strategy of interest rate cutting, and thinks it won't work.

Unlike all the Wall Street strategists who compare the current credit crisis to the credit crisis of 1998 (Long Term Capital Management), I believe that the ongoing credit problems will be far worse and of a longer-term nature. This will make it difficult for the market to reach new highs in the near future. Moreover, even if the 1998 comparison were to hold, we would still be looking at a much deeper stock market correction than the 22% sell-off we saw in 1998....

...even if the Fed were to cut rates massively now, it is unlikely that it would stimulate credit growth, which, as I have explained repeatedly in the past, must continuously expand at an accelerating rate in a credit- and asset-driven economy in order to keep the economic plane from losing altitude. Accelerating credit growth is most unlikely now, because I cannot see how financial intermediaries will ease lending standards any time soon after the losses they have recently endured and following their dismal stock performance...

The crises that build up in international financial structures always ricochet from country to country….

...For the last several years, investors have enjoyed a massive global boom. But they should not rule out a massive global panic.

Unlike all the Wall Street strategists who compare the current credit crisis to the credit crisis of 1998 (Long Term Capital Management), I believe that the ongoing credit problems will be far worse and of a longer-term nature. This will make it difficult for the market to reach new highs in the near future. Moreover, even if the 1998 comparison were to hold, we would still be looking at a much deeper stock market correction than the 22% sell-off we saw in 1998....

...even if the Fed were to cut rates massively now, it is unlikely that it would stimulate credit growth, which, as I have explained repeatedly in the past, must continuously expand at an accelerating rate in a credit- and asset-driven economy in order to keep the economic plane from losing altitude. Accelerating credit growth is most unlikely now, because I cannot see how financial intermediaries will ease lending standards any time soon after the losses they have recently endured and following their dismal stock performance...

The crises that build up in international financial structures always ricochet from country to country….

...For the last several years, investors have enjoyed a massive global boom. But they should not rule out a massive global panic.

Friday, September 21, 2007

Outburst

From the Royal Palace of Westminster

From the Royal Palace of WestminsterThis isn't quite on theme, but I turned on the radio for the four o'clock news in time to hear our new Prime Minister's latest proposal: a motto for the country, to show our "values". He is pretending that it has escaped his notice that we have one: Dieu Et Mon Droit. All part of airbrushing out the Monarchy, I assume. What is his suggestion - "In Gord we trust"?

Here's my suggestion: stop indulging your Ruritanian fantasies and do something to restore the economic stability of this once-great country. You've had ten years as the de facto general manager of Great Britain plc, with what results? A social security system that we can't afford and the claimants can't understand; an industrial base that is shrivelling like shrink-wrap on a bonfire; and a demolition derby of a democracy, in a country that mothered many other democracies and paid heavily in blood and gold to save Europe from fascism - twice.

All aboard

Dow 9,000 update

Dow currently 13,839.54, gold (10.03 am NY time) $736.30. Adjusted for the change in the gold price, the Dow would be worth 12,175.15, or down 10.55% since July 6.

Putting it another way, gold has risen 13.67% against the dollar in 77 days; that's getting on for 90% annualised. Is this lift-off for Doug Casey's trip to the moon?

Dow currently 13,839.54, gold (10.03 am NY time) $736.30. Adjusted for the change in the gold price, the Dow would be worth 12,175.15, or down 10.55% since July 6.

Putting it another way, gold has risen 13.67% against the dollar in 77 days; that's getting on for 90% annualised. Is this lift-off for Doug Casey's trip to the moon?

Tuesday, September 18, 2007

And so say all of us...

Investment experts Jim Rogers and Marc Faber agree with Jim Puplava that (a) the US will try to reflate out of its troubles, and (b) cutting interest rates to achieve this, will lead to worse trouble.

According to Bloomberg today, "Rogers said he is buying agricultural commodities and recommended investors purchase Asian currencies including the Chinese renminbi and the Japanese yen.

Faber, publisher of the Gloom, Boom & Doom Report, said he is buying gold."

DOW 9,000 update

At the time of writing, the Dow stands at 13,493 and gold at $713.70/oz. Adjusted for the change in the price of gold, the Dow has fallen by just over 10% since July 6.

According to Bloomberg today, "Rogers said he is buying agricultural commodities and recommended investors purchase Asian currencies including the Chinese renminbi and the Japanese yen.

Faber, publisher of the Gloom, Boom & Doom Report, said he is buying gold."

DOW 9,000 update

At the time of writing, the Dow stands at 13,493 and gold at $713.70/oz. Adjusted for the change in the price of gold, the Dow has fallen by just over 10% since July 6.

Sunday, September 16, 2007

Puplava: this isn't the big one

I'm a bit behind on my listening to Financial Sense Newshour, but as ever, the issues we're talking about aren't momentary. Jim Puplava's view (8 September) is that this crisis isn't the big one: the US will reflate its way out. It can't do that on its own without sacrificing the dollar, so (as has been happening for a long time) there will be cooperation with other nations' central banks. In effect, we are in an international currency inflation cartel, since no trading nation wants a hard currency that leaves its industries high and dry.

But, says Jim, the next recovery will be shorter, and the next fall back much worse. He sees this as happening around 2009/2010, which coincides with the time of Peak Oil, in which he is a big believer. That's when he feels the energy and credit crunches may come together. He sees gold and silver soaring to levels that currently seem fantastic.

For us ordinary people, that may be less interesting than the effects of energy shortage on our daily transportation and domestic heating.

But, says Jim, the next recovery will be shorter, and the next fall back much worse. He sees this as happening around 2009/2010, which coincides with the time of Peak Oil, in which he is a big believer. That's when he feels the energy and credit crunches may come together. He sees gold and silver soaring to levels that currently seem fantastic.

For us ordinary people, that may be less interesting than the effects of energy shortage on our daily transportation and domestic heating.

Thursday, September 13, 2007

Clausewitz reversed

The Prussian military theorist Von Clausewitz said that war was the continuation of politics by other means; some have since substituted the word "economics" for "politics".

But such is the complexity of modern industrial society, and the horrific potential of modern military technology, that we may invert the relationship: economic ownership and infrastructure may be the new weapons with which to wage war.

It is not hard to see the power potential in China's increasing stake in the US economy - not only US government bonds, but increasingly, other assets such as equities. Already, the bond market feels the jerk of the chain, and within the last couple of years Britain has stepped in to provide some much-needed slack to America. But the growth of "sovereign wealth funds" could see future governments using their investments to interfere in the equity markets, too. What price free trade then?

And there are other gaps in the armour. For example, America's recent allegations against China of cyber-warfare have highlighted our daily dependence on electronic technology.

Two Chinese colonels, Qiao Liang and Wang Xiangsui, have produced a book examining such possibilities: "Unrestricted Warfare" (1999). Some translated extracts are available here, and the Wikipedia article is here.

This is not to say that China is actually hostile; only that, like the rest of us, she has her own agenda, and her own contingency plans. Much of warfare is not outright battle, but the use of threats and potential threats to gain strategic advantage. Pushing your opponent into desperation can backfire disastrously. As Sun Tzu said, "To a surrounded enemy, you must leave a way of escape."

But we must recover our economic balance, or risk having the imbalance used against us.

But such is the complexity of modern industrial society, and the horrific potential of modern military technology, that we may invert the relationship: economic ownership and infrastructure may be the new weapons with which to wage war.

It is not hard to see the power potential in China's increasing stake in the US economy - not only US government bonds, but increasingly, other assets such as equities. Already, the bond market feels the jerk of the chain, and within the last couple of years Britain has stepped in to provide some much-needed slack to America. But the growth of "sovereign wealth funds" could see future governments using their investments to interfere in the equity markets, too. What price free trade then?

And there are other gaps in the armour. For example, America's recent allegations against China of cyber-warfare have highlighted our daily dependence on electronic technology.

Two Chinese colonels, Qiao Liang and Wang Xiangsui, have produced a book examining such possibilities: "Unrestricted Warfare" (1999). Some translated extracts are available here, and the Wikipedia article is here.

This is not to say that China is actually hostile; only that, like the rest of us, she has her own agenda, and her own contingency plans. Much of warfare is not outright battle, but the use of threats and potential threats to gain strategic advantage. Pushing your opponent into desperation can backfire disastrously. As Sun Tzu said, "To a surrounded enemy, you must leave a way of escape."

But we must recover our economic balance, or risk having the imbalance used against us.

Monday, September 10, 2007

Slither

Gold $7.04, the British pound bumping up against $2.03. Is the system settling for a controlled skid?

UPDATE

A day later, gold is up another 1%, (or would that be, the dollar is down 1% against it?), the pound is marginally nearer $2.03, and the Dow is rising.

UPDATE

A day later, gold is up another 1%, (or would that be, the dollar is down 1% against it?), the pound is marginally nearer $2.03, and the Dow is rising.

Saturday, September 08, 2007

Michael Panzner agrees with Marc Faber

In Blogging Stocks, September 7:

We're in a rare moment in history where cash is king... My prediction is that the Standard & Poor's 500 could fall at least another 10% from here. I think the economy is weakening and the crisis in the credit markets will worsen from here... this is not the time for a buy-and-hold strategy. But if you must stay in stocks, look at more defensive sectors like food, beverage and healthcare... Gold...

Read the whole item - and see the video - here.

We're in a rare moment in history where cash is king... My prediction is that the Standard & Poor's 500 could fall at least another 10% from here. I think the economy is weakening and the crisis in the credit markets will worsen from here... this is not the time for a buy-and-hold strategy. But if you must stay in stocks, look at more defensive sectors like food, beverage and healthcare... Gold...

Read the whole item - and see the video - here.

Dow 9,000 prediction revisited

September 8: since August 31, the Dow has slipped further to close at 13,113.38 on Friday; gold has risen to $701 (London PM gold fix). Adjusted for the rise in the price of gold, the Dow is now the equivalent of 12,117.25. So in terms of Robert McHugh's prediction, it has lost 10.98% since July 6. Time for another quiet release of gold by central banks?

Thursday, September 06, 2007

Wednesday, September 05, 2007

US bond pressure mounts

...and China has been selling off US Treasury bills, according to Gary Dorsch of Global Money Trends, featured in GoldSeek today:

"Beijing sees a “veto proof” protectionist bill sailing thru the US Congress later this year, and has been a net seller of US T-bonds for three straight months by a record amount of $14.7 billion, the longest period of sales by China since November 2000."

UPDATE

More on this from the Daily Telegraph here.

"Beijing sees a “veto proof” protectionist bill sailing thru the US Congress later this year, and has been a net seller of US T-bonds for three straight months by a record amount of $14.7 billion, the longest period of sales by China since November 2000."

UPDATE

More on this from the Daily Telegraph here.

Selling the family gold?

According to The Mogambo Guru on 30 August, "...gold suddenly plummeted on Thursday, making me laugh nervously, as things have now gotten so bad that central banks are apparently actually increasing their selling of sovereign gold to get the money to pay current bills! Hahaha!"

This would be interesting information for gold bugs. Unfortunately, the World Gold Council has not updated its list of gold holdings since June. Any information, anybody?

UPDATE

Physical gold has enjoyed record purchases in some regions, according to The Market Oracle yesterday.

This would be interesting information for gold bugs. Unfortunately, the World Gold Council has not updated its list of gold holdings since June. Any information, anybody?

UPDATE

Physical gold has enjoyed record purchases in some regions, according to The Market Oracle yesterday.

Monday, September 03, 2007

Scare stories - "the S&P to fall to 700"

Dan Denning, in today's Daily Reckoning Australia, considers whether it may be a good time to unload your investments, and refers to reports of large bets made that the S&P 500 may drop to 700 (currently it's around 1,474) - or possibly rise to 1,700! It's got the conspiracy theorists exercised, although experts say it's a technical matter (see The Street); but the sums involved are large. Stormy weather ahead?

Sunday, September 02, 2007

The outlook from Financial Sense

Some voices and topics from Financial Sense, 25 August:

inflation, deflation, gold, cash...

Jim Puplava: ...I've had Bob Prechter on this program and Bob is a deflationist and Bob believes that we get deflation first and then hyperinflation where I guess my views are we get hyperinflation and then what follows will be deflation. And that's the way it has unfolded with great debtor nations. And I think history will repeat itself here with the US. There is too much debt here and it has to be inflated away...

...I really believe that the full force of these storms aren't going to hit until somewhere between 2009 and 2010 when this really comes home to roost. And all of these debt problems, the problems that we have with energy today, availability, peak oil, the geopolitical problems in the Middle East – I do not expect the next decade to be a pleasant one, John. I wish I could say otherwise because as a father with three children, one to get married shortly and looking forward to grandchildren, you know, this is something that you don't like to think about...

credit bubble, credit crunch, commodities, East delinking from West...

Doug Noland: ...the economy is much more vulnerable than many believe because of the credit that was going to the upper end; and I think the upper end mortgage area is where we had the greatest excesses.

So I think when all is said and done, subprime losses are going to be small compared to the losses we see in jumbo and Alt-A, and especially, unfortunately out in California...

...there’s desperation out there to find buyers for mortgages... Washington generally doesn’t understand the risk of Fannie and Freddie [US government-sponsored entities - "GSEs" - that offer mortgages], so of course they would think it’s their role to step in and provide the liquidity.

But... their total exposure is over 4 trillion dollars now. And this is a huge problem, and I fully expect down the road these institutions to be nationalized. And I think the US taxpayer is going to pay a huge bill for this... To be honest, I don’t mind the GSEs if they want to play a role in affordable housing; if they wanted to try to rectify some of the problems at the lower end because of the lack of the availability of credit in subprime. But to think that the GSEs should start doing jumbo mortgages, to try to be the buyer of last resort for California mortgages, my God, it’s hard to believe that makes sense to anyone because that’s just a potential disaster. It’s also reminiscent of the S&L – the Savings and Loan problem that, you know, was a several billion dollar problem during the 80s that they allowed to grow to several hundred billion by the early 90s. And definitely, the tab of the GSEs is growing rapidly right now...

...even if the central banks add a trillion dollars of liquidity to help out this deleveraging we still have this issue of how are we going to generate the trillions of additional credit going forward to keep incomes levitated, to keep corporation earnings levitated, to keep asset prices levitated, to keep the global economy chugging along...

...The global economy may be something of a different story because we have credit bubbles all over the world. Like the Chinese bubble right now is pretty much oblivious to what’s going on in the US and in Europe. You can see a scenario where, you know, you have serious credit breakdown but let’s say Chinese demand keeps energy and resource prices higher than one would expect. So I’m going to be watching this very carefully because we’re going to see some very unusual dynamics as far as liquidity and inflation effects between different asset classes and different types of price levels throughout the economy.

inflation, deflation, gold, cash...

Jim Puplava: ...I've had Bob Prechter on this program and Bob is a deflationist and Bob believes that we get deflation first and then hyperinflation where I guess my views are we get hyperinflation and then what follows will be deflation. And that's the way it has unfolded with great debtor nations. And I think history will repeat itself here with the US. There is too much debt here and it has to be inflated away...

...I really believe that the full force of these storms aren't going to hit until somewhere between 2009 and 2010 when this really comes home to roost. And all of these debt problems, the problems that we have with energy today, availability, peak oil, the geopolitical problems in the Middle East – I do not expect the next decade to be a pleasant one, John. I wish I could say otherwise because as a father with three children, one to get married shortly and looking forward to grandchildren, you know, this is something that you don't like to think about...

credit bubble, credit crunch, commodities, East delinking from West...

Doug Noland: ...the economy is much more vulnerable than many believe because of the credit that was going to the upper end; and I think the upper end mortgage area is where we had the greatest excesses.

So I think when all is said and done, subprime losses are going to be small compared to the losses we see in jumbo and Alt-A, and especially, unfortunately out in California...

...there’s desperation out there to find buyers for mortgages... Washington generally doesn’t understand the risk of Fannie and Freddie [US government-sponsored entities - "GSEs" - that offer mortgages], so of course they would think it’s their role to step in and provide the liquidity.

But... their total exposure is over 4 trillion dollars now. And this is a huge problem, and I fully expect down the road these institutions to be nationalized. And I think the US taxpayer is going to pay a huge bill for this... To be honest, I don’t mind the GSEs if they want to play a role in affordable housing; if they wanted to try to rectify some of the problems at the lower end because of the lack of the availability of credit in subprime. But to think that the GSEs should start doing jumbo mortgages, to try to be the buyer of last resort for California mortgages, my God, it’s hard to believe that makes sense to anyone because that’s just a potential disaster. It’s also reminiscent of the S&L – the Savings and Loan problem that, you know, was a several billion dollar problem during the 80s that they allowed to grow to several hundred billion by the early 90s. And definitely, the tab of the GSEs is growing rapidly right now...

...even if the central banks add a trillion dollars of liquidity to help out this deleveraging we still have this issue of how are we going to generate the trillions of additional credit going forward to keep incomes levitated, to keep corporation earnings levitated, to keep asset prices levitated, to keep the global economy chugging along...

...The global economy may be something of a different story because we have credit bubbles all over the world. Like the Chinese bubble right now is pretty much oblivious to what’s going on in the US and in Europe. You can see a scenario where, you know, you have serious credit breakdown but let’s say Chinese demand keeps energy and resource prices higher than one would expect. So I’m going to be watching this very carefully because we’re going to see some very unusual dynamics as far as liquidity and inflation effects between different asset classes and different types of price levels throughout the economy.

Saturday, September 01, 2007

Agriculture on the up

Meanwhile, cattle are moving off the Argentine pampas to make way for crops of soybeans and corn. The cattle are being crossbred to cope with the rougher conditions they'll face.

Subscribe to:

Posts (Atom)