*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Tuesday, January 13, 2009

Drugs: a doctor writes

Don’t Legalize Drugs

Theodore Dalrymple

Advocates have almost convinced Americans that legalization will remove most of the evil that drugs inflict on society. Don’t believe them.

There is a progression in the minds of men: first the unthinkable becomes thinkable, and then it becomes an orthodoxy whose truth seems so obvious that no one remembers that anyone ever thought differently. This is just what is happening with the idea of legalizing drugs: it has reached the stage when millions of thinking men are agreed that allowing people to take whatever they like is the obvious, indeed only, solution to the social problems that arise from the consumption of drugs.

Man’s desire to take mind-altering substances is as old as society itself—as are attempts to regulate their consumption. If intoxication in one form or another is inevitable, then so is customary or legal restraint upon that intoxication. But no society until our own has had to contend with the ready availability of so many different mind-altering drugs, combined with a citizenry jealous of its right to pursue its own pleasures in its own way.

The arguments in favor of legalizing the use of all narcotic and stimulant drugs are twofold: philosophical and pragmatic. Neither argument is negligible, but both are mistaken, I believe, and both miss the point.

The philosophic argument is that, in a free society, adults should be permitted to do whatever they please, always provided that they are prepared to take the consequences of their own choices and that they cause no direct harm to others. The locus classicus for this point of view is John Stuart Mill’s famous essay On Liberty: “The only purpose for which power can be rightfully exercised over any member of the community, against his will, is to prevent harm to others,” Mill wrote. “His own good, either physical or moral, is not a sufficient warrant.” This radical individualism allows society no part whatever in shaping, determining, or enforcing a moral code: in short, we have nothing in common but our contractual agreement not to interfere with one another as we go about seeking our private pleasures.

In practice, of course, it is exceedingly difficult to make people take all the consequences of their own actions—as they must, if Mill’s great principle is to serve as a philosophical guide to policy. Addiction to, or regular use of, most currently prohibited drugs cannot affect only the person who takes them—and not his spouse, children, neighbors, or employers. No man, except possibly a hermit, is an island; and so it is virtually impossible for Mill’s principle to apply to any human action whatever, let alone shooting up heroin or smoking crack. Such a principle is virtually useless in determining what should or should not be permitted.

Perhaps we ought not be too harsh on Mill’s principle: it’s not clear that anyone has ever thought of a better one. But that is precisely the point. Human affairs cannot be decided by an appeal to an infallible rule, expressible in a few words, whose simple application can decide all cases, including whether drugs should be freely available to the entire adult population. Philosophical fundamentalism is not preferable to the religious variety; and because the desiderata of human life are many, and often in conflict with one another, mere philosophical inconsistency in policy—such as permitting the consumption of alcohol while outlawing cocaine—is not a sufficient argument against that policy. We all value freedom, and we all value order; sometimes we sacrifice freedom for order, and sometimes order for freedom. But once a prohibition has been removed, it is hard to restore, even when the newfound freedom proves to have been ill-conceived and socially disastrous.

Even Mill came to see the limitations of his own principle as a guide for policy and to deny that all pleasures were of equal significance for human existence. It was better, he said, to be Socrates discontented than a fool satisfied. Mill acknowledged that some goals were intrinsically worthier of pursuit than others.

This being the case, not all freedoms are equal, and neither are all limitations of freedom: some are serious and some trivial. The freedom we cherish—or should cherish—is not merely that of satisfying our appetites, whatever they happen to be. We are not Dickensian Harold Skimpoles, exclaiming in protest that “Even the butterflies are free!” We are not children who chafe at restrictions because they are restrictions. And we even recognize the apparent paradox that some limitations to our freedoms have the consequence of making us freer overall. The freest man is not the one who slavishly follows his appetites and desires throughout his life—as all too many of my patients have discovered to their cost.

We are prepared to accept limitations to our freedoms for many reasons, not just that of public order. Take an extreme hypothetical case: public exhibitions of necrophilia are quite rightly not permitted, though on Mill’s principle they should be. A corpse has no interests and cannot be harmed, because it is no longer a person; and no member of the public is harmed if he has agreed to attend such an exhibition.

Our resolve to prohibit such exhibitions would not be altered if we discovered that millions of people wished to attend them or even if we discovered that millions already were attending them illicitly. Our objection is not based upon pragmatic considerations or upon a head count: it is based upon the wrongness of the would-be exhibitions themselves. The fact that the prohibition represents a genuine restriction of our freedom is of no account.

It might be argued that the freedom to choose among a variety of intoxicating substances is a much more important freedom and that millions of people have derived innocent fun from taking stimulants and narcotics. But the consumption of drugs has the effect of reducing men’s freedom by circumscribing the range of their interests. It impairs their ability to pursue more important human aims, such as raising a family and fulfilling civic obligations. Very often it impairs their ability to pursue gainful employment and promotes parasitism. Moreover, far from being expanders of consciousness, most drugs severely limit it. One of the most striking characteristics of drug takers is their intense and tedious self-absorption; and their journeys into inner space are generally forays into inner vacuums. Drug taking is a lazy man’s way of pursuing happiness and wisdom, and the shortcut turns out to be the deadest of dead ends. We lose remarkably little by not being permitted to take drugs.

The idea that freedom is merely the ability to act upon one’s whims is surely very thin and hardly begins to capture the complexities of human existence; a man whose appetite is his law strikes us not as liberated but enslaved. And when such a narrowly conceived freedom is made the touchstone of public policy, a dissolution of society is bound to follow. No culture that makes publicly sanctioned self-indulgence its highest good can long survive: a radical egotism is bound to ensue, in which any limitations upon personal behavior are experienced as infringements of basic rights. Distinctions between the important and the trivial, between the freedom to criticize received ideas and the freedom to take LSD, are precisely the standards that keep societies from barbarism.

So the legalization of drugs cannot be supported by philosophical principle. But if the pragmatic argument in favor of legalization were strong enough, it might overwhelm other objections. It is upon this argument that proponents of legalization rest the larger part of their case.

The argument is that the overwhelming majority of the harm done to society by the consumption of currently illicit drugs is caused not by their pharmacological properties but by their prohibition and the resultant criminal activity that prohibition always calls into being. Simple reflection tells us that a supply invariably grows up to meet a demand; and when the demand is widespread, suppression is useless. Indeed, it is harmful, since—by raising the price of the commodity in question—it raises the profits of middlemen, which gives them an even more powerful incentive to stimulate demand further. The vast profits to be made from cocaine and heroin—which, were it not for their illegality, would be cheap and easily affordable even by the poorest in affluent societies—exert a deeply corrupting effect on producers, distributors, consumers, and law enforcers alike. Besides, it is well known that illegality in itself has attractions for youth already inclined to disaffection. Even many of the harmful physical effects of illicit drugs stem from their illegal status: for example, fluctuations in the purity of heroin bought on the street are responsible for many of the deaths by overdose. If the sale and consumption of such drugs were legalized, consumers would know how much they were taking and thus avoid overdoses.

Moreover, since society already permits the use of some mind-altering substances known to be both addictive and harmful, such as alcohol and nicotine, in prohibiting others it appears hypocritical, arbitrary, and dictatorial. Its hypocrisy, as well as its patent failure to enforce its prohibitions successfully, leads inevitably to a decline in respect for the law as a whole. Thus things fall apart, and the center cannot hold.

It stands to reason, therefore, that all these problems would be resolved at a stroke if everyone were permitted to smoke, swallow, or inject anything he chose. The corruption of the police, the luring of children of 11 and 12 into illegal activities, the making of such vast sums of money by drug dealing that legitimate work seems pointless and silly by comparison, and the turf wars that make poor neighborhoods so exceedingly violent and dangerous, would all cease at once were drug taking to be decriminalized and the supply regulated in the same way as alcohol.

But a certain modesty in the face of an inherently unknowable future is surely advisable. That is why prudence is a political virtue: what stands to reason should happen does not necessarily happen in practice. As Goethe said, all theory (even of the monetarist or free-market variety) is gray, but green springs the golden tree of life. If drugs were legalized, I suspect that the golden tree of life might spring some unpleasant surprises.

It is of course true, but only trivially so, that the present illegality of drugs is the cause of the criminality surrounding their distribution. Likewise, it is the illegality of stealing cars that creates car thieves. In fact, the ultimate cause of all criminality is law. As far as I am aware, no one has ever suggested that law should therefore be abandoned. Moreover, the impossibility of winning the “war” against theft, burglary, robbery, and fraud has never been used as an argument that these categories of crime should be abandoned. And so long as the demand for material goods outstrips supply, people will be tempted to commit criminal acts against the owners of property. This is not an argument, in my view, against private property or in favor of the common ownership of all goods. It does suggest, however, that we shall need a police force for a long time to come.

In any case, there are reasons to doubt whether the crime rate would fall quite as dramatically as advocates of legalization have suggested. Amsterdam, where access to drugs is relatively unproblematic, is among the most violent and squalid cities in Europe. The idea behind crime—of getting rich, or at least richer, quickly and without much effort—is unlikely to disappear once drugs are freely available to all who want them. And it may be that officially sanctioned antisocial behavior—the official lifting of taboos—breeds yet more antisocial behavior, as the “broken windows” theory would suggest.

Having met large numbers of drug dealers in prison, I doubt that they would return to respectable life if the principal article of their commerce were to be legalized. Far from evincing a desire to be reincorporated into the world of regular work, they express a deep contempt for it and regard those who accept the bargain of a fair day’s work for a fair day’s pay as cowards and fools. A life of crime has its attractions for many who would otherwise lead a mundane existence. So long as there is the possibility of a lucrative racket or illegal traffic, such people will find it and extend its scope. Therefore, since even legalizers would hesitate to allow children to take drugs, decriminalization might easily result in dealers turning their attentions to younger and younger children, who—in the permissive atmosphere that even now prevails—have already been inducted into the drug subculture in alarmingly high numbers.

Those who do not deal in drugs but commit crimes to fund their consumption of them are, of course, more numerous than large-scale dealers. And it is true that once opiate addicts, for example, enter a treatment program, which often includes maintenance doses of methadone, the rate at which they commit crimes falls markedly. The drug clinic in my hospital claims an 80 percent reduction in criminal convictions among heroin addicts once they have been stabilized on methadone.

This is impressive, but it is not certain that the results should be generalized. First, the patients are self-selected: they have some motivation to change, otherwise they would not have attended the clinic in the first place. Only a minority of addicts attend, and therefore it is not safe to conclude that, if other addicts were to receive methadone, their criminal activity would similarly diminish.

Second, a decline in convictions is not necessarily the same as a decline in criminal acts. If methadone stabilizes an addict’s life, he may become a more efficient, harder-to-catch criminal. Moreover, when the police in our city do catch an addict, they are less likely to prosecute him if he can prove that he is undergoing anything remotely resembling psychiatric treatment. They return him directly to his doctor. Having once had a psychiatric consultation is an all-purpose alibi for a robber or a burglar; the police, who do not want to fill in the 40-plus forms it now takes to charge anyone with anything in England, consider a single contact with a psychiatrist sufficient to deprive anyone of legal responsibility for crime forever.

Third, the rate of criminal activity among those drug addicts who receive methadone from the clinic, though reduced, remains very high. The deputy director of the clinic estimates that the number of criminal acts committed by his average patient (as judged by self-report) was 250 per year before entering treatment and 50 afterward. It may well be that the real difference is considerably less than this, because the patients have an incentive to exaggerate it to secure the continuation of their methadone. But clearly, opiate addicts who receive their drugs legally and free of charge continue to commit large numbers of crimes. In my clinics in prison, I see numerous prisoners who were on methadone when they committed the crime for which they are incarcerated.

Why do addicts given their drug free of charge continue to commit crimes? Some addicts, of course, continue to take drugs other than those prescribed and have to fund their consumption of them. So long as any restriction whatever regulates the consumption of drugs, many addicts will seek them illicitly, regardless of what they receive legally. In addition, the drugs themselves exert a long-term effect on a person’s ability to earn a living and severely limit rather than expand his horizons and mental repertoire. They sap the will or the ability of an addict to make long-term plans. While drugs are the focus of an addict’s life, they are not all he needs to live, and many addicts thus continue to procure the rest of what they need by criminal means.

For the proposed legalization of drugs to have its much vaunted beneficial effect on the rate of criminality, such drugs would have to be both cheap and readily available. The legalizers assume that there is a natural limit to the demand for these drugs, and that if their consumption were legalized, the demand would not increase substantially. Those psychologically unstable persons currently taking drugs would continue to do so, with the necessity to commit crimes removed, while psychologically stabler people (such as you and I and our children) would not be enticed to take drugs by their new legal status and cheapness. But price and availability, I need hardly say, exert a profound effect on consumption: the cheaper alcohol becomes, for example, the more of it is consumed, at least within quite wide limits.

I have personal experience of this effect. I once worked as a doctor on a British government aid project to Africa. We were building a road through remote African bush. The contract stipulated that the construction company could import, free of all taxes, alcoholic drinks from the United Kingdom. These drinks the company then sold to its British workers at cost, in the local currency at the official exchange rate, which was approximately one-sixth the black-market rate. A liter bottle of gin thus cost less than a dollar and could be sold on the open market for almost ten dollars. So it was theoretically possible to remain dead drunk for several years for an initial outlay of less than a dollar.

Of course, the necessity to go to work somewhat limited the workers’ consumption of alcohol. Nevertheless, drunkenness among them far outstripped anything I have ever seen, before or since. I discovered that, when alcohol is effectively free of charge, a fifth of British construction workers will regularly go to bed so drunk that they are incontinent both of urine and feces. I remember one man who very rarely got as far as his bed at night: he fell asleep in the lavatory, where he was usually found the next morning. Half the men shook in the mornings and resorted to the hair of the dog to steady their hands before they drove their bulldozers and other heavy machines (which they frequently wrecked, at enormous expense to the British taxpayer); hangovers were universal. The men were either drunk or hung over for months on end.

Sure, construction workers are notoriously liable to drink heavily, but in these circumstances even formerly moderate drinkers turned alcoholic and eventually suffered from delirium tremens. The heavy drinking occurred not because of the isolation of the African bush: not only did the company provide sports facilities for its workers, but there were many other ways to occupy oneself there. Other groups of workers in the bush whom I visited, who did not have the same rights of importation of alcoholic drink but had to purchase it at normal prices, were not nearly as drunk. And when the company asked its workers what it could do to improve their conditions, they unanimously asked for a further reduction in the price of alcohol, because they could think of nothing else to ask for.

The conclusion was inescapable: that a susceptible population had responded to the low price of alcohol, and the lack of other effective restraints upon its consumption, by drinking destructively large quantities of it. The health of many men suffered as a consequence, as did their capacity for work; and they gained a well-deserved local reputation for reprehensible, violent, antisocial behavior.

It is therefore perfectly possible that the demand for drugs, including opiates, would rise dramatically were their price to fall and their availability to increase. And if it is true that the consumption of these drugs in itself predisposes to criminal behavior (as data from our clinic suggest), it is also possible that the effect on the rate of criminality of this rise in consumption would swamp the decrease that resulted from decriminalization. We would have just as much crime in aggregate as before, but many more addicts.

The intermediate position on drug legalization, such as that espoused by Ethan Nadelmann, director of the Lindesmith Center, a drug policy research institute sponsored by financier George Soros, is emphatically not the answer to drug-related crime. This view holds that it should be easy for addicts to receive opiate drugs from doctors, either free or at cost, and that they should receive them in municipal injecting rooms, such as now exist in Zurich. But just look at Liverpool, where 2,000 people of a population of 600,000 receive official prescriptions for methadone: this once proud and prosperous city is still the world capital of drug-motivated burglary, according to the police and independent researchers.

Of course, many addicts in Liverpool are not yet on methadone, because the clinics are insufficient in number to deal with the demand. If the city expended more money on clinics, perhaps the number of addicts in treatment could be increased five- or tenfold. But would that solve the problem of burglary in Liverpool? No, because the profits to be made from selling illicit opiates would still be large: dealers would therefore make efforts to expand into parts of the population hitherto relatively untouched, in order to protect their profits. The new addicts would still burgle to feed their habits. Yet more clinics dispensing yet more methadone would then be needed. In fact Britain, which has had a relatively liberal approach to the prescribing of opiate drugs to addicts since 1928 (I myself have prescribed heroin to addicts), has seen an explosive increase in addiction to opiates and all the evils associated with it since the 1960s, despite that liberal policy. A few hundred have become more than a hundred thousand.

At the heart of Nadelmann’s position, then, is an evasion. The legal and liberal provision of drugs for people who are already addicted to them will not reduce the economic benefits to dealers of pushing these drugs, at least until the entire susceptible population is addicted and in a treatment program. So long as there are addicts who have to resort to the black market for their drugs, there will be drug-associated crime. Nadelmann assumes that the number of potential addicts wouldn’t soar under considerably more liberal drug laws. I can’t muster such Panglossian optimism.

The problem of reducing the amount of crime committed by individual addicts is emphatically not the same as the problem of reducing the amount of crime committed by addicts as a whole. I can illustrate what I mean by an analogy: it is often claimed that prison does not work because many prisoners are recidivists who, by definition, failed to be deterred from further wrongdoing by their last prison sentence. But does any sensible person believe that the abolition of prisons in their entirety would not reduce the numbers of the law-abiding? The murder rate in New York and the rate of drunken driving in Britain have not been reduced by a sudden upsurge in the love of humanity, but by the effective threat of punishment. An institution such as prison can work for society even if it does not work for an individual.

The situation could be very much worse than I have suggested hitherto, however, if we legalized the consumption of drugs other than opiates. So far, I have considered only opiates, which exert a generally tranquilizing effect. If opiate addicts commit crimes even when they receive their drugs free of charge, it is because they are unable to meet their other needs any other way; but there are, unfortunately, drugs whose consumption directly leads to violence because of their psychopharmacological properties and not merely because of the criminality associated with their distribution. Stimulant drugs such as crack cocaine provoke paranoia, increase aggression, and promote violence. Much of this violence takes place in the home, as the relatives of crack takers will testify. It is something I know from personal acquaintance by working in the emergency room and in the wards of our hospital. Only someone who has not been assaulted by drug takers rendered psychotic by their drug could view with equanimity the prospect of the further spread of the abuse of stimulants.

And no one should underestimate the possibility that the use of stimulant drugs could spread very much wider, and become far more general, than it is now, if restraints on their use were relaxed. The importation of the mildly stimulant khat is legal in Britain, and a large proportion of the community of Somali refugees there devotes its entire life to chewing the leaves that contain the stimulant, miring these refugees in far worse poverty than they would otherwise experience. The reason that the khat habit has not spread to the rest of the population is that it takes an entire day’s chewing of disgustingly bitter leaves to gain the comparatively mild pharmacological effect. The point is, however, that once the use of a stimulant becomes culturally acceptable and normal, it can easily become so general as to exert devastating social effects. And the kinds of stimulants on offer in Western cities—cocaine, crack, amphetamines—are vastly more attractive than khat.

In claiming that prohibition, not the drugs themselves, is the problem, Nadelmann and many others—even policemen—have said that “the war on drugs is lost.” But to demand a yes or no answer to the question “Is the war against drugs being won?” is like demanding a yes or no answer to the question “Have you stopped beating your wife yet?” Never can an unimaginative and fundamentally stupid metaphor have exerted a more baleful effect upon proper thought.

Let us ask whether medicine is winning the war against death. The answer is obviously no, it isn’t winning: the one fundamental rule of human existence remains, unfortunately, one man one death. And this is despite the fact that 14 percent of the gross domestic product of the United States (to say nothing of the efforts of other countries) goes into the fight against death. Was ever a war more expensively lost? Let us then abolish medical schools, hospitals, and departments of public health. If every man has to die, it doesn’t matter very much when he does so.

If the war against drugs is lost, then so are the wars against theft, speeding, incest, fraud, rape, murder, arson, and illegal parking. Few, if any, such wars are winnable. So let us all do anything we choose.

Even the legalizers’ argument that permitting the purchase and use of drugs as freely as Milton Friedman suggests will necessarily result in less governmental and other official interference in our lives doesn’t stand up. To the contrary, if the use of narcotics and stimulants were to become virtually universal, as is by no means impossible, the number of situations in which compulsory checks upon people would have to be carried out, for reasons of public safety, would increase enormously. Pharmacies, banks, schools, hospitals—indeed, all organizations dealing with the public—might feel obliged to check regularly and randomly on the drug consumption of their employees. The general use of such drugs would increase the locus standi of innumerable agencies, public and private, to interfere in our lives; and freedom from interference, far from having increased, would have drastically shrunk.

The present situation is bad, undoubtedly; but few are the situations so bad that they cannot be made worse by a wrong policy decision.

The extreme intellectual elegance of the proposal to legalize the distribution and consumption of drugs, touted as the solution to so many problems at once (AIDS, crime, overcrowding in the prisons, and even the attractiveness of drugs to foolish young people) should give rise to skepticism. Social problems are not usually like that. Analogies with the Prohibition era, often drawn by those who would legalize drugs, are false and inexact: it is one thing to attempt to ban a substance that has been in customary use for centuries by at least nine-tenths of the adult population, and quite another to retain a ban on substances that are still not in customary use, in an attempt to ensure that they never do become customary. Surely we have already slid down enough slippery slopes in the last 30 years without looking for more such slopes to slide down.

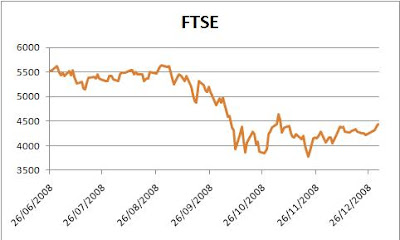

How to spot a recession

ABC of inflation

Libertarianism, individualism - or survivalism?

More here.

I've argued before now that we may need to move away from the "efficient" way to do things, towards the survivable way - click on the label below for some notes on what I call "Diversity, dispersion and disconnection."

History rhymes

You don't look that old.

Hickey: I wasn't around. They had a name for it, the "little bull market." It came about after the Federal Reserve slashed interest rates to 3.5% from 6%, and later to 1.5%...

More here.

Monday, January 12, 2009

Standing your ground

Here's a couple of shots between the redoubtable Devils' Kitchen and myself, from a couple of posts back. To me, this isn't about drugs, essentially; it's about whether we are, or can be, free.

Devil's Kitchen said...

Sackerson, "How is it reactionary to wish to protect young people from habits that impoverish and enslave them (and this is what black communities object to)? I think perhaps some libertarians haven't really defined what they mean by liberty."

I am all for proper drugs education; however, it is worth noting that I had a considerable amount of it, and it hasn't stopped me from taking just about every drug on the planet*.

And do you know what? I have never had to have any kind of hospital or other treatment; I have never lost a job; I have never even been late for work, after having taken drugs.

I have never assaulted anyone (most drugs, other than alcohol, put you in a frame of mind in which violence is the last thing you want to indulge in), nor hurt anyone, nor even caused a public nuisance whilst on drugs either.

I am not addicted to drugs either, despite heavy usage of a few of them (most are self-limiting, in that the effects begin to wane after a period heavy usage).

I have, on the other hand, laughed like a demon, make some excellent friends, danced, thrilled, been immersed in music in a way that's not possible sober, and had many fantastic times whilst on drugs.

You see, what I chose was to take the education that I was given, and the advice of friends, and my own experience, and indulge in a free and informed choice.

That is libertarianism, and it is still no business of yours what I put into my body, as long as I am willing to pay the consequences. And I am: that's why I am privately insured up to the hilt.

DK

Sackerson said...

DK: thanks for visiting, I'd have drawn a chalk circle if I'd known you were coming.

I agree that alcohol is pernicious and have argued that rather than attempt to ban it, we should reduce its availability a bit - currently you can get it from the supermarket, post office, petrol station etc. And it does make many people horribly aggressive, so there is an incentive for others to band together and act in this way.

I do understand that there are many functioning drug users (as indeed there are functioning alcoholics), and the question of product purity is certainly one of the arguments propounded for legalisation and regulation. Set against that is what might then happen. If the research referred to by Paddington above is correct, the tendency to addiction is genetic, so the principal factor is opportunity. If only 5% have the fatal flaw, and these products become as available as a six-pack of wife-beater from Tesco Express, we could go from thousands of addicts to millions.

So one issue is how do you weigh your wish for a certain kind of pleasure, against the awful suffering of some other people? Is this corner of libertarianism less a struggle to be free of oppression than it is callous selfishness?

And there is a deeper question of the founding assumptions of libertarians: are we really free and rational in any case? If half our behaviour is genetically determined, and much of the rest conditioned by social expectations, drug-taking is not the blow for liberty that it was represented to be from the 1960s onwards. You yourself say "...I chose was to take the education that I was given, and the advice of friends, and my own experience...", which makes me think that your "free and informed choice" was conditioned by the example and advice of your friends, and the opportunity to take part yourself. Indeed, this is how I started on cigarettes and it took me a decade to get back off them, so I have some idea how unfree we really are. You'll see from my next post that I query whether public schools such as Eton had a drug problem as early as the 1960s, and "as the twig is bent, so the tree will grow".

I think we are in an age where the Enlightenment philosophy is as under threat from geneticism (and determinism generally), as Creationism was when evolutionary theory was formulated. Sartre refused to accept Freud's theory of the unconscious, because it fatally undermined his own position on existentialist free will.

So I think libertarians should move from questions of law, taxation, social liberty etc to re-examine the ground they are standing on.

Sunday, January 11, 2009

The public school connection

Drugs: a rope to hang ourselves with

On the other hand, ex-Birmingham prison medic Theodore Dalrymple points out that no-one has ever died from coming off opiates; de-addiction can be achieved in a limited time; and it's criminals who turn to heroin, not heroin-users who turn to crime.

"Ah, but we only want the same treatment as smokers and drinkers," will be the cry. Well, seeing the damage that fags and booze did to my 20-years-too-early departed parents (and friends and acquaintances, and Looked After Children I've worked with), I'm inclined to agree; but not in the way the libertarians wish.

I'd be interested to know all the costs, expressed financially, of the harm done by "cigareets and whisky". I very much doubt that the tax covers the expense of the disbenefits. Here's an example, relating to alcohol: "For the UK, the external costs are likely to be in excess of the £20 billion figure and indeed taking loss of life into account and using more usual figures to value this loss could bring the total closer to £45 –50 billion for the UK as a whole. This is clearly way in excess of the revenue yield of £12 billion in 2000/01."

Instead of battening on the addictions of its citizens, the government could easily forego the £18 billion revenue on tobacco and alcohol - that's only the same cost as the ludicrously expensive and probably unnecessary NHS IT project, "Connecting for Health". Then, freed from this compromising financial interest, it could begin to tackle the problems seriously - not through the unimaginative approach of Prohibition, but through better education, and limiting the outlets of these harmful substances, as I have already suggested here.

As for other drugs, what is this campaign to encourage us to spend half our lives in a doze, daze or haze? Is there a plan to subvert society, to leave us in the land of the Lotus Eaters? Are we to sleep like the hare, while the Eastern tortoise wins the race? Is the opiate of the masses to be opiates?

B*lls to the Politics of Ecstasy; it's just an excuse for the spoiled end of the middle classes to indulge themselves further, leading (like the Pied Piper) hordes of less safety-netted proles into oblivion.

And why should libertarians support addictions, which imprison the will and distort reason?

Saturday, January 10, 2009

The next wave of bailouts

Michael Panzner reports that municipal bonds ("munis") offer a better yield than US Treasury bonds, but the difference is still not enough to pay for the extra risk. Professional investors are short-selling "munis". i.e. betting that they will fall in price. A steep fall may indicate imminent bankruptcy, and some say this is on the way for many authorities, as Mish reported at the end of December.

So, what will happen when the US Government is seen to be buying everybody's bad debts?

People (even here in the UK, where we tend to wait patiently for our wise rulers to solve all) are beginning to worry about inflation, and are thinking about investing again. An article in Elliott Wave International warns us not to be panicked into parting with our cash, and reminds us:

... there are periods when inflation does erode the value of cash. I mean, look at the seven years leading up to the October 2007 peak in U.S. stocks: big gains in the stock indexes, while inflation was eroding cash. No way did cash do as well as stocks during that time.

Right?

Wrong. Cash outperformed stocks in the seven years leading up to the 2007 stock market high. That outperformance has only increased in the time since.

Since this is the view I took and communicated to clients in the 1990s, you will understand that I didn't make much money as a financial adviser. But it was certainly good advice, even if it was based on strongly-felt intuition rather than macroeconomic analysis.

Not that analysis guarantees results, in a world where the money game's rules are changed at will by politicians with a host of agendas that they don't share with us ordinary types. But my current guess is that the stockmarket will halve again in the next few years, when compared with the cost of living.

Friday, January 09, 2009

Conspiracy, not c*ck-up

What do you mean “failure”? Your perspective is from the bottom looking up. But the financial model has been a great success from the vantage point of the top of the economic pyramid looking down. The economy has polarized to the point where the wealthiest 10% now own 85% of the nation’s wealth. Never before have the bottom 90% been so highly indebted, so dependent on the wealthy. From their point of view, their power has exceeded that of any time in which economic statistics have been kept.

You have to realize that what they’re trying to do is to roll back the Enlightenment, roll back the moral philosophy and social values of classical political economy and its culmination in Progressive Era legislation, as well as the New Deal institutions. They’re not trying to make the economy more equal, and they’re not trying to share power. Their greed is (as Aristotle noted) infinite. So what you find to be a violation of traditional values is a re-assertion of pre-industrial, feudal values. The economy is being set back on the road to debt peonage. The Road to Serfdom is not government sponsorship of economic progress and rising living standards; it’s the dismantling of government, the dissolution of regulatory agencies, to create a new feudal-type elite.

Meanwhile, Karl Denninger makes his case for the perpetrators of the credit crunch to be penalized under the US laws relating to mail fraud.

Stock market could halve again

Now, "Mish" looks at revised earnings estimates for companies and relates them to stock prices, applying various price-earnings ratios. His conclusion is broadly the same.

As Michael Panzer predicted* (reviewed here in May 2007) there's been a flight to cash, and now (as he also predicted) it looks as though inflation is set to roar. This will disguise what's happening to stocks, but underneath it I see that decline. As in the '60s-'80s. it may take some years after the apparent turnaround before real values increase again.

Provided you trust the government to pay up when due, and to calculate inflation fairly, National Savings Index-Linked Savings Certificates (or US TIPS) may be a valuable weapon in your anti-inflation armoury.

*"He predicts first a credit squeeze, which makes cash king and ruins our credit-dependent lives and businesses wholesale; then hyperinflation, as the government prints money to keep the system from complete collapse.

In this scenario, at first, stocks, corporate bonds, property, commodities (including gold), even government bonds and savings certificates, all decline in value against hard cash as everybody scrambles to settle their own debt, collect what's owed to them and continue to pay the bills. Then the hyperinflation hits and everybody tries to offload their currency."

Thursday, January 08, 2009

Snap

JAIL the fraudsters, including those in Congress, Treasury and on Wall Street. Bluntly - if we can find a predicate felony to nail you with in this mess, off you go.

REMOVE all of the overseers. This includes The Fed. Set up a new agency that is charged with enforcing all of the laws related to the financial system including The Federal Reserve Act, and empower them with subpoenas. Direct that they must act and operate "in the sunshine", with everything published on The Web. You do an evil thing, the public sees it. They try to hide it, the public sees it.

DEFAULT all the bad debt. Yes, this "booms" a lot of banks. Tough.

SET UP new banks. Take the remaining $350 billion and capitalize ten banks with $35 billion each. IPO them to the public. By law no officer, current or former, of an existing public bank may serve on these firm's boards. Now we've got the means to replace the credit creation the boomed banks can't do any more.

Uncanny. We agree pretty much exactly. Either he's an amateur, or I'm a professional.

The disenfranchised shareowner?

A startling picture of how share ownership has shrunk - pretty steadily, despite the Conservatives' pledge in the 1980s to widen it. Though I can't tell from this to what extent it's down to individuals' purchase of unit trusts, investment trusts and collective pension funds.

A startling picture of how share ownership has shrunk - pretty steadily, despite the Conservatives' pledge in the 1980s to widen it. Though I can't tell from this to what extent it's down to individuals' purchase of unit trusts, investment trusts and collective pension funds.htp: Patrick Vessey

P.S. I Like the flowers. Man.

Where to turn?

Marc Faber is predicting that precious metals will outperform equities and bonds; this commentator reckons silver will outperform gold.

Dear me.

Money Management

Not only is the deal itself troubling, but I do not see how a company can be bought with borrowed money, and then be profitable enough to pay the loans and make more.

Perhaps the whole idea of large amounts of credit is itself the problem?

Wednesday, January 07, 2009

A lesson from China

In a manufacturing recession, this is a counterintuitive move by the man who bought what was left of the German "Phoenix" steelworks and shipped it to the Yangtze, reasoning that a ready-made factory would not only get into production faster, but (at the scrap price he paid for it) without the debt burden that would ruin his competitors when (as he foresaw) the next downturn came.

The company may also push ahead with its plan to "go public" and expand its operations.

We could do with people like him, over here.

Tuesday, January 06, 2009

Time for another Jubilee

Lenders will try to achieve this blessed state of affairs, but if they succeed, they will eventually end up owning everything, and the system will go "pop" long before that point. Which is why the Bible talks about a Jubilee year of total debt forgiveness, occurring every half-century.

Getting governments to take over all bad debts interferes with that reset, and so the "pop" must be louder when it finally, inevitably happens.

They could be right, darn it

There's the new Change4Life campaign, encouraging us to eat less fat, take more exercise and live longer; and there are the perennial pushes to give up smoking and (after they've extended the licensing hours and vastly increased the number of licensed outlets) reduce alcohol consumption.

On the other hand, we have the prospect of the State pension system hitting the buffers, thanks to millions of coffin-dodgers; not to mention the cost of care homes and the bed-blocker burden on the National Health Service. And if we all became totally abstemious, we would cost the State its £10 billion annual revenue from tobacco, and £8 billion from alcohol. At first sight, if you wanted to destroy the State, you'd follow its advice - a novel strategy of subversion by civil obedience.

Hence, tabloid-style contrarianism! I haven't found the evidence, but I expect that staying healthy (and working longer) will more than pay for itself, by reducing the costs of chronic ill-health and increasing revenue from taxes on income.

Monday, January 05, 2009

Deflation, low interest rates and the poor old saver

And that's a point: the government doesn't tax you on the gains of deflation. But I'm sure they're keen to rectify that: normal inflation will be resumed as soon as possible.

Sunday, January 04, 2009

MSM admits keeping shtum

Disaster deferred (and increased), not averted

Saturday, January 03, 2009

Murky business

Setser estimates that China owns $1.425 trillion in Treasuries and Agencies, which is equivalent to about 10% of US GDP. ("Treasuries" are debts directly owed by the US Government, "agencies" are debts of the US Government's organisations, as explained in this Federal Reserve handbook from 2004.)

He ends by calling for more transparency in British accounts of these holding - that would be most welcome all round, generally. Half our problems (and, I assume, opportunities for fatcat swindlers) stem from our not knowing the real position of the world's finances.

Pop

In this piece, Charles Biderman explains that the value of a stock is set by marginal purchases, which do not reflect what you'd get if you sold all the company's shares at the same time. He estimates that from 2003-2007 the world's equities increased in notional value by $25 trillion, on nothing more than $1.5 trillion cash, a bit of borrowing and mostly, illusion: "Market cap and money aren't necessarily related."

When the illusion goes pop, so do all the gains. First out gets the most.

htp: zgirl

Elliot, Kondratieff, or normal service resumed?

The lows were certainly lower, and we have only recently learned just how close we came to a banking collapse. The question now is, are we where we "should" be - following a trend set by the last 25 years - or are there longer cycles due to make hay of the pattern of the last quarter-century? Elliot wavers and Kondratieff followers say yes.

My guess is that, after the steep stockmarket falls and the horrid crisis apparently averted, there will be a bounce in the next 1-2 years, then a decline in real (inflation-adjusted) terms for maybe another 5 years after that. Your guess?

By the way, I'd also be interested to know your views on why the bankers and brokers have been allowed to Get Away With It. To me, it seems like a big fat moral hazard and unless there is some real squealy punishment for all this bad behaviour, I'd advise any bright, conscienceless youngster to become a banker.

Currently, my preferred fantasy solution is to bust all the overextended banks, leave the shareholders with zilch, sack the senior bank managers and ban them from being company directors for at least 5 years, halve all mortgages, and give the book of business to more prudent operators including well-run building societies. In my view, this was never ever going to happen, because the FSA, the BoE and the government are also implicated. So, not so much "too big to fail", but too well-connected to fail.

But there's a price to pay, anyway: it's now clearly Us and Them. Perhaps, since they are immeasurably more powerful, we should give up trying to rectify the world and merely ape their cynicism and corruption. Moralists will demur; and so this is truly an age when we can say, "Affairs are now soul size".

Thursday, January 01, 2009

Am I the idiot, or are they?

It never made sense to me, especially as I saw such a transfer of wealth to those same rich people, who spent their money on luxury imported goods. Incomes for the middle and lower class barely kept pace with inflation, even as industry became ever more efficient.

Today, thanks to posts here and elsewhere, I finally realized what is wrong with the claim above: buying stocks does not 'invest in a company', unless you are buying stock directly from that same company. All it does is put money in the pockets of the stockbrokers, while you have a piece of paper that must rise in value by profit plus fees, and find another sucker to buy it. The real estate market is no different.

Nonetheless, all of the experts that I have talked with over the years insisted that I simply didn't understand, implying that I was an idiot. Am I?

Tuesday, December 30, 2008

Fun with extrapolation

Monday, December 29, 2008

Debt forgiveness, inflation and welching

In a simple handwave estimate, one might say that the debt will have to be discounted by at least half. That includes inflation and selective defaults...

... something has got to give. The givers will most likely be all holders of US financial assets, responsible middle class savers, and a disproportionate share of foreign holders of US debt.

While the debtors hold the means of payment in dollars and the power to decide who gets paid, where do you think the most likely impact will be felt?

I give below the US Treasury's data on foreign holdings of their government securities as at October 2008, but I also reinterpret it in the light of each country's GDP, to show relative potential impact (please click on image to enlarge).

Mind you, even a complete repudiation would only take care of $3 trillion. Funny how not so long ago, $1 trillion seemed a high-end estimate of the damage, and now it's something like seven times that. And that still leaves a long haul to get to Hodges' $53 tn - equivalent to, what, one year's global GDP?

Sunday, December 28, 2008

Saturday, December 27, 2008

Is gold a hedge against inflation?

(N.B. gold prices to the end of 1967 are annual averages, then monthly averages to the end of 1974, then the price is as on the first trading day of the month; all gold price figures from Kitco).

Friday, December 26, 2008

Nominal and real

Wednesday, December 24, 2008

"Efficiency" vs. survival

Robert Paterson, as quoted by London Banker.

Like I keep saying, it's about diversity, dispersion and disconnection - please click on the label below for my posts on this subject.

It's not about dinosaurs

1. The death of William Blake, 12 August 1827:

“Just before he died His Countenance became fair. His eyes Brighten'd and he burst out Singing of the things he saw in Heaven”

2. The experience of St Thomas Aquinas, 6 December 1273:

LXXIX: The witness went on to recall that while brother Thomas was saying his Mass one morning, in the chapel of St. Nicholas at Naples, something happened which profoundly affected and altered him. After Mass he refused to write or dictate; indeed he put away his writing materials. He was in the third part of the Summa, at the questions on Penance. And brother Reginald, seeing that he was not writing, said to him: 'Father, are you going to give up this great work, undertaken for the glory of God and to enlighten the world?' But Thomas replied: 'Reginald, I cannot go on.' Then Reginald, who began to fear that much study might have affected his master's brain, urged and insisted that he should continue his writing; but Thomas only answered in the same way: 'Reginald, I cannot - because all that I have written seems to me so much straw.' Then Reginald, astonished that ... brother Thomas should go to see his sister, the countess of San Severino, whom he loved in all charity; and hastening there with great difficulty, when he arrived and the countess came out to meet him, he could scarcely speak. The countess, very much alarmed, said to Reginald: 'What has happened to brother Thomas? He seems quite dazed and hardly spoke to me!' And Reginald answered: 'He has been like this since about the feast of St. Nicholas - since when he has written nothing at all.' Then again brother Reginald began to beseech Thomas to tell him why he refused to write and why he was so stupefied; and after much of this urgent questioning and insisting, Thomas at last said to Reginald: 'Promise me, by the living God almighty and by your loyalty to our Order and by the love you bear to me, that you will never reveal, as long as I live, what I shall tell you.' Then he added: 'All that I have written seems to me like straw compared with what has now been revealed to me.'

Relativism

Fasten your seatbelts

Tuesday, December 23, 2008

Democratic deficit

Vengeance is mine

UPDATE

And Jim Kunstler, too.

Every little thing's gonna be all right

Perhaps it's no coincidence that BBC is currently screening a remake of Terry Nation's gripping 1975 post-catastrophe series, "Survivors". But that series assumes that most people have died suddenly because of a virus, so the ecosystem has not been destroyed by desparate, starving victims. I don't think Survivors is the model we should use. If we are to survive, it'll be together, in our populous societies, because if society breaks down, you and I are unlikely to emerge as the last people standing. Lone heroes don't win; this is a fantasy.

I think spare supplies are a good idea, because there could be some disruption, which could affect the very young and elderly; so we need ways to keep warm, eat and have clean water in an emergency. And it's important to make your home secure against a rise in burglary, which is associated with economic downturns; and not to go out after dark without at least one or two companions. Weapons are another matter: "guns in the home are far more likely to be used against members of the household than against intruders."

Pace the doomsters, the UK and the USA will feed itself. We may end up eating more veg and less meat; and we may be using public transport instead of cars; personally, that would simply take me back to the 70s, when I was slimmer and fitter. Globally and locally, there is enough to feed the world, although not enough to overfeed it or encourage unproductive men to sire children.

Two aspects of the current crisis worry me:

1. The present method of organising resources may be replaced, not by one dreamed of by well-fed Western socialists, but by a cruel, remote, commanding elite as in North Korea or East Germany, who far from minimising scarcity will use it to get and maintain power.

2. The transition from this system to whatever replaces it, may be disorderly and involve suffering for many people.

This is why I think the underlying issue for us is to preserve and strengthen democracy, to increase the chances that both the journey and the journey's end are acceptable.

Monday, December 22, 2008

Why banks?

Satyajit Das (htp: Jesse)

Nope. Banks need destroying, as does all this bank-created debt. The mistake is to try to keep things as they are. How did we come to buy houses "on tick", then cars, and now our clothes and groceries? Why is there any lending for consumption, seeing how it only means reduced future consumption? Why should banks be kept going, requiring a significant proportion of our earnings, so that wages have to be high for us to live on what's left, making us uncompetitive with the developing world?

I am reminded of the pitiless response of the Comte d'Argenson to the satirist, Desfontaines:

Desfontaines: I must live.

D'Argenson : I do not see the necessity.

Sunday, December 21, 2008

The lesser of two weevils

In an apocalyptic - but carefully-reasoned - post, Karl Denninger says that when the deficit expansion stops, US government spending will have to be cut by 50 - 60%, unless there is to be a "general default" on debts.

I have no idea what a general default would look like, but in a closely-interwoven and distant-from-nature modern industrial society I can only fear it might prove utterly destructive. So we're back to contemplating the lesser, but still vast disaster.

I also have no idea how much worse it might be in the UK.

Someone else please read this unberobed OT prophet and tell me where he's wrong.

PS

While the Obama Administration cannot take a 'weak dollar' policy it is the only practical way to correct the imbalances brought about by the last 20 years of systemic manipulation. It is either that, or the selective default on sovereign debt, most likely through conflict, a hot or cold war.

Saturday, December 20, 2008

Christmas viewing

How will the future look?

Thanks to the glacial catchup by the mainstream media, the public is finally worrying about economic depression, and consoling itself with the thought that we've messed it up for everyone, so at least the Chinese won't prosper and come over here as tourists, overdressed, overpaid and taking too many pictures for their digital photoframes at home.

Thanks to the glacial catchup by the mainstream media, the public is finally worrying about economic depression, and consoling itself with the thought that we've messed it up for everyone, so at least the Chinese won't prosper and come over here as tourists, overdressed, overpaid and taking too many pictures for their digital photoframes at home.

Friday, December 19, 2008

Europe is keeping China (and America) going

Default

Wednesday, December 17, 2008

The seventh seal

With the $7 trillion dollars we have committed we could have literally given every homeowner with a mortgage a fifty percent reduction in the principal outstanding.

This would have instantaneously stopped all of the foreclosures by putting all (essentially) homes into positive equity - overnight!

So why wasn't this done?

His answer: the government is trying to cover the staggering bets of the derivatives market. With borrowed money. The Treasury has swallowed the grenade and put its fingers in its ears.

His answer: the government is trying to cover the staggering bets of the derivatives market. With borrowed money. The Treasury has swallowed the grenade and put its fingers in its ears.This is the fourth horseman of the financial apocalypse that Michael Panzner predicted, as summarized here on Bearwatch on May 10, 2007.

UPDATE: Jesse comments on another fresh sum - tens of billions - needed to cover AIG's losses. As he says, there is an air of expectancy; but also of unreality, like the announcement of a major war.

Inappropriate gloat

Working my way into the system, it all seemed that it couldn't possibly work: too many people with no discernible talent were earning too much, and prices were lower than I thought they should be, particularly fuel prices. I thought the problem was that I wasn't intelligent enough, and just didn't understand.

The one personal satisfaction that I can get from the current mess is that I was right - it doesn't make sense.

WeaselWordWatch update: "Quantitative Easing"

On yer bike

Tuesday, December 16, 2008

Unstoppable

I cannot help but think of Douglas Adams' 'Shoe Event Horizon', where eventually every shop becomes a shoe shop.

The answer is blowing in the wind

In the news

Also in the Daily Mail, Alex Brummer says Madoff has queered the pitch for hedge funds generally. Damn: I had started to look at how to set one up, using links supplied by Jim from San Marcos. If I'd started a couple of years ago, I'd have got everyone into cash and made a packet for them and myself. 2 and 20, 2 and 20.

Odds on the bankers and hedgies Getting Away With It? Pretty fair, I'd have thought - especially when you bear in mind (as Denninger points out - and Jesse, too) all the others who could be implicated. To quote Oscar Wilde: "The good ended happily, and the bad unhappily. That is what fiction means."

Monday, December 15, 2008

On Competitiveness

Change the conditions so that some players have an advantage, and eventually those players will be the only winners. How long this takes depends on the size of the advantage.

This is the basis of the mutation and natural selection portion of evolution theory.

For a generation after World War II, the US had a huge advantage: capital, undamaged manufacturing capacity, cheap energy, and most of the scientists and engineers. Thus, we 'won' the economic game, and it was attributed to Americans being 'better'.

We failed to notice that many other nations were catching up in education and technology. That the government and industry chose to dis-invest in research in the 1980's just accelerated the process.

As the playing field is now level (or even tipped against us), we should carefully consider how to gain back that advantage. We have done so before in the short term: arming in World War II, the Manhattan Project, the Space Race.

Do we have the will to do this when not faced with war, but with long-term economic decline?

The elephant in the room?

In the 1960's, the US undertook an orgy of spending on the Great Society and the Cold War (including the Vietnam War and Space Race). At the same time, the typical middle-class American lived an extravagant lifestyle, relatively speaking. This was all fueled by cheap American oil, gas and coal.

By 1973, we had used so much that OPEC had us over a barrel, and by 1975 we had our first large trade deficits, which have grown every year.

Since about 1980, not much has come out of our industry that the rest of the world seems to want to buy.

Did we go broke 30 years ago, and are just now noticing it?

There's more truth in humour ...

C.E.O. talking in his palatial office talking to a man with a wrench in his hand:

"We crunched the numbers over and over on where we could cut back, and it kept coming down to whatever it is you guys do on the assembly line..."

In a nutshell

Those who are old enough may remember having to do a precis in English. This is a very valuable, rational, intellectual exercise, which perhaps is one of the reasons it was ditched in New Teaching.

Do you think you could distil LB's observations in, say, 600 words?