My independently-researched version:

iTulip's:

iTulip's:

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

iTulip's:

iTulip's:

The U.S. Treasury statistics issued today list 29 foreign holders of their securities. Between them, the three above account for $110.3 billion of the $110.6 billion increase. What is is to have friends, I suppose.

The U.S. Treasury statistics issued today list 29 foreign holders of their securities. Between them, the three above account for $110.3 billion of the $110.6 billion increase. What is is to have friends, I suppose.

As I said in my recent letter to the Spectator, "a return to 6,000 points should be unsurprising, and a low of 4,000 not impossible."

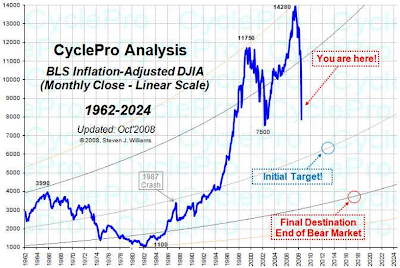

I'm still working on looking at the Dow in real (CPI-adjusted) terms. Meanwhile, note that in two previous cycles, the Dow dropped to a third of its former peak: from 15 to 5, from 30 to 10 (see red dots).

I'm still working on looking at the Dow in real (CPI-adjusted) terms. Meanwhile, note that in two previous cycles, the Dow dropped to a third of its former peak: from 15 to 5, from 30 to 10 (see red dots). UPDATE

UPDATE Tyler concurs, with respect to the UK economy, because of our dependence on income from financial services and associated services:

"Brown's boom was built on a group of industries that are now facing an Almighty bust..."

I've battled Windows Vista to produce the above graph, which takes the Dow at the beginning of October each year from 1928 on and adjusts it for CPI.

I've battled Windows Vista to produce the above graph, which takes the Dow at the beginning of October each year from 1928 on and adjusts it for CPI."Faites vos jeux, Mesdames et Messieurs." Too rich for me, I think.

UPDATE

Karl Denninger is now talking about the S&P 500 falling to 500 points, a level it first broke above in March 1995; this would mean a further c. 50% drop from its close on Friday.

And he gives his reasons (plausible to me) why the American economy is in worse shape to overcome the setback, than it was in the 1930s.

htp: Karl Denninger

The result:

At least $125bn is to go to nine of America's largest banks, including Citigroup, JPMorgan Chase and Bank of America, in exchange for capital under the rescue plan.

The power:

(9) TROUBLED ASSETS-

The term `troubled assets' means--

(A) residential or commercial mortgages and any securities, obligations, or other instruments that are based on or related to such mortgages, that in each case was originated or issued on or before March 14, 2008, the purchase of which the Secretary determines promotes financial market stability; and

(B) any other financial instrument that the Secretary, after consultation with the Chairman of the Board of Governors of the Federal Reserve System, determines the purchase of which is necessary to promote financial market stability, but only upon transmittal of such determination, in writing, to the appropriate committees of Congress.

...not "prior approval", you'll note. For those that think they understand law, here is the full text of the genetically-modified bill as enacted on 3rd October 2008.

And here's an intriguing clause in Section 119:

(2) LIMITATIONS ON EQUITABLE RELIEF.—

(A) INJUNCTION.—No injunction or other form of equitable relief shall be issued against the Secretary for actions pursuant to section 101, 102, 106, and 109, other than to remedy a violation of the Constitution.

Excuse my ignorance, but is this a watered-down version of the infamous "non-reviewable" Paulosn proposal ("Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.")?

If that means a midpoint of 8,500 and the overcorrection is 20%, then the momentary low point could be around 6,800, which at least suggests that the gap between my two red lines is approximately correct.

Friday's lowest point during the day was 7,773.71, still 10% away from the theorised minimum; and the Dow closed at 8,451.19. Yesterday it remained above the latter figure throughout, and rose to 9,387.61.

In short, Grantham must be reading this as a bear market rally, and it's not very silly to think that the Dow could come back to 7,000 at some point.

Good luck to the day traders, I haven't the nerve and speed to try to make a fortune on the bucking-bronco stage of the market.

This is a measure of monetary inflation. Increases here will eventually work their way into prices and wages. An explanation is offered here. Note that there has been nothing close to the highlighted "spike" in the last 25 years.

This is a measure of monetary inflation. Increases here will eventually work their way into prices and wages. An explanation is offered here. Note that there has been nothing close to the highlighted "spike" in the last 25 years. It's the interconnectedness that's pulling us all down: the centralisation of money and power has made us vulnerable. As I said in December:

It's the interconnectedness that's pulling us all down: the centralisation of money and power has made us vulnerable. As I said in December:

Some people are now revisiting Kondratieff''s theory of economic cycles. Seems to fit winter, at the moment. The above image is modified from this source: smart fellows.

Some people are now revisiting Kondratieff''s theory of economic cycles. Seems to fit winter, at the moment. The above image is modified from this source: smart fellows.Marc Faber recently said that the US needed $5 trillion to resolve the crisis, i.e. 7 times more than the amount approved by Congress. Britain's bailout fund is proportionately 7 times greater, and so, crippling cost to the taxpayer aside, maybe it could work.

And it has political implications. The average Brit is so innumerate that he doesn't know how to calculate 75% of 100, so don't expect him to understand that it wasn't simply "the banks" to blame, but the relaxation of Government monetary controls. Don't discount the possibility that, however undeservedly, Gordon Brown may win the next election.