The Market Oracle yesterday and Gold Seek today both feature an article by Michael Kosares from his own site (USA Gold) on why he thinks you should own gold.

The Market Oracle yesterday and Gold Seek today both feature an article by Michael Kosares from his own site (USA Gold) on why he thinks you should own gold.One reason is the fecklessness of the US Government:

"...the national debt stands at $8.9 trillion - nearly $30,000 for every man, woman and child in the United States. And there appears to be no end in sight to the fiscal madness. The debt clock ticks non-stop at the rate of about $1.3 billion per day.

I should point out that there is a difference between the "deficit" and "additions to the national debt." The deficit often quoted by politicians and the mainstream press is discounted by borrowings from the social security fund - a machination meant to dilute the real budget deficit which is the actual addition to the national debt."

I only knew recently about this business of putting their hands in the social security till and leaving an IOU. That is disturbing, because of the desperation it implies. Wasn't it the financial cost of the First World War that led to the raid on British social security funds and the switch to a rob-Peter-to-pay-Paul system?

Kosares starts his article with two quotes (I've added the sources):

"[U]nder the placid surface there are disturbing trends: huge imbalances, disequilibria, risks -- call them what you will. Altogether the circumstances seem to me as dangerous and intractable as any I can remember, and I can remember quite a lot. What really concerns me is that there seems to be so little willingness or capacity to do much about it. . . We are skating on thin ice." - Paul Volcker, Former Chairman of the Federal Reserve (Washington Post, 10 April 2005)

"[W]e live in a globalized environment and in a country which has enormous fiscal and external deficits. So you have to figure out some way -- which I have not done I might add -- to protect yourself if we should have a real currency problem here." - Robert Rubin, Former Treasury Secretary (interview with Kim Schoenholtz, Citigroup New York, 10 October 2006)

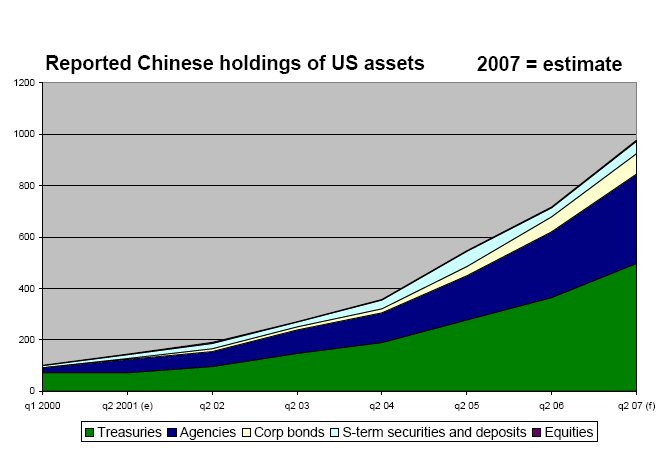

He discusses 6 trends: the US National Debt, the trade deficit, dropping real rates of investment return, derivatives, debt to foreigners, the US dollar's decline.

The conclusion, obviously, is that in times of doubt and distrust, gold will act as a haven for real wealth, as it has done in the past. "Price appreciation... is a sidebar to gold ownership. The main story is gold's asset preservation qualities."