Here is a letter to the NYT from the insouciant Don Boudreaux. Unfortunately the comments to this piece on

Cafe Hayek are closed - I wonder why? So I'll have to note here that it stirred a memory...

‘Now, you know,’ said Mr. Bounderby, taking some sherry, ‘we have never had any difficulty with you, and you have never been one of the unreasonable ones. You don’t expect to be set up in a coach and six, and to be fed on turtle soup and venison, with a gold spoon, as a good many of ’em do!’Hard Times, by Charles DickensAnd another, from Shaw's Pygmalion:I ask you, what am I? I'm one of the undeserving poor: that's what I am. Think of what that means to a man. It means that he's up agen middle class morality all the time. If there's anything going, and I put in for a bit of it, it's always the same story: 'You're undeserving; so you can't have it.' But my needs is as great as the most deserving widow's that ever got money out of six different charities in one week for the death of the same husband. I don't need less than a deserving man: I need more. I don't eat less hearty than him; and I drink a lot more. I want a bit of amusement, cause I'm a thinking man. I want cheerfulness and a song and a band when I feel low. Well, they charge me just the same for everything as they charge the deserving. What is middle class morality? Just an excuse for never giving me anything.The American Declaration of Independence states "

all men are created equal", and of course it was obvious even then that they are not so, whether by birth, upbringing, education or natural talent. Not, in those senses; but the bold defiance of Nature and Society represented by the libertarian revolution of America, and of revolutionary France, is that they have, they should be given, equal dignity, as of right.

And unless a tenured economics professor who boasts of not voting, in a colony that rebelled on the principle of "no taxation without representation", wishes to see the poor squashed while the rich loot the country without fear of retribution, he will need to develop his thesis somewhat.

I do not see how a country can be composed exclusively of the well-off, nor can I imagine how, given all their disadvantages, the poor may rise up as one and join the middle class. There will always be inequality, so our debate should be about setting a minimum standard for the poorest, while motivating them to better themselves if they possibly can. That's certainly a circle that will take some squaring, and a benefit-trap-riddled Britain can scarcely present itself as a model answer.

But I don't see how air conditioning and two cars (what? all poor families?) quite make up for the miseries of ill-health, disability and a shorter lifespan. And it's not entirely down to consciously-made bad choices, in quite the way Mr Boudreaux implies. The ideal-world notion of rational choice has to take into acount real-world limited intelligence, inadequate information, poorer education and in many cases disharmonious emotional constitutions produced by poor parenting, lousy neighbours, failing schools and fear of crime and destitution.

Dives should not look down upon Lazarus.

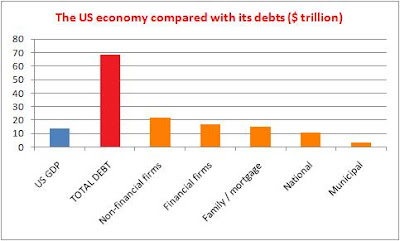

iTulip's:

iTulip's: