Wednesday, October 17, 2007

Will US protectionism pull the trigger?

An article by D R Schoon in GoldSeek (26 September) alerts us to a bill heading for a vote in the US Congress this autumn. It seeks to impose a 20% tariff on Chinese imports.

... China will retaliate; and, dumping $1.33 trillion of US Treasuries on the open market will be an all too easy and accessible option. It would destroy the US dollar and deal the US economy a body blow from which it would take years to recover...

Now unless US politicians are really abysmally stupid, they must have a backup plan to stop a torrent of dollars pouring back into the States - exchange controls? Repudiating the debt? If Russia's default forced the bailout of LTCM to prevent systemic crisis, what would a giant American default do?

We must hope for cool heads all round. US multinationals are already urging calm.

Tuesday, October 16, 2007

Hubble-bubble

The American astronomer Edwin Hubble found the evidence for an expanding universe, in the phenomenon of "red shift". Objects moving at high speed change colour, because their velocity stretches the light waves. Looking at galaxies, he saw that the further away the object, the more its spectrum shifted, so the faster it was going.

Why? Imagine you put a line of ink dots at intervals of an inch on a toy balloon, and then inflate it so that the space between each dot doubles. Dot A is now 2 inches from Dot B, and the latter is two inches from Dot C. So from A's perspective, B has receded by one inch, but C by two inches.

The implication is that as the universe continues to expand steadily, the objects furthest from us will eventually accelerate beyond the speed of light, and in Einsteinian terms will not be part of our universe any longer - we will never see anything from them again.

The financial universe is, as everyone who takes an interest knows, expanding. And everything is fine as long as the expansion continues, and while people are still prepared to use the inflating money.

One way the money supply expands is through loans. Banks only have to keep a fraction of their deposits ready for return to savers - the rest they can lend out. Some of that loaned money gets deposited into a different account - where again, part is kept and the rest loaned out. So the amount of money in the economy is multiplied by this "fractional reserve banking".

But unlike the cosmos, money can also contract. If more people than expected want their money back, loans get called in prematurely. It becomes a game of musical chairs. If there's growing concern that the system can't return all the cash demanded, two or three chairs are removed at a time and a panic starts. Rick Ackerman in GoldSeek (26 September) underscores this point.

"Captain Hook" in yesterday's Financial Sense suggests that we may be approaching such a time in the near future. The bubble may burst.

The problem for the rest of us is that if we believe the money supply will continue to expand, we want to get out of money and into anything that is more likely to hold its value; but if we anticipate deflation, then cash is king.

So, is it endless expansion, or inflation followed by a bust? Hubble, or bubble?

Backfire

Michael Panzner (Financial Armageddon, 11 October) comments on (and graphs) the increasingly synchronized movements of some speculative markets, including gold and tech shares. The range between these assets is tightening and may indicate that a turning point is due.

This would gel with other information: Marc Faber has said that he sees bubbles everywhere, including gold. True, it's also been reported recently that he's been buying into gold, but remember that he is something of an investment gunslinger and will have his own view about when to get out, too.

And Frank Veneroso thinks that the gold price rise is at least partly owing to heavy speculative backing from funds that may have to get out in a hurry, if a general market drop forces them to realize assets to settle accounts.

My feeling? We dudes shouldn't try to outdraw seasoned hands.

Sunday, October 14, 2007

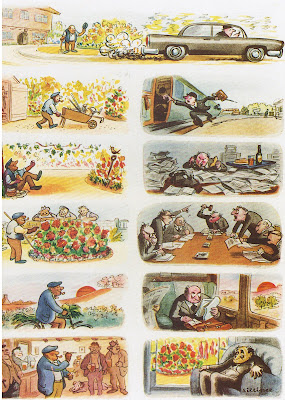

Back to Eden

Can we make a paradise here, instead of looking for it in a different country?

Saturday, October 13, 2007

Round and round

"from the Chrysopoeia ('Gold Making') of Cleopatra during the Alexandrian Period in Egypt. The enclosed words mean 'The All is One.'"

Here's a piece by Brian Pretti yesterday, on the Federal Reserve and its attempts to shore up the system with interest rate cuts.

His prose is a little sparky and luxuriant, but his point is that even though the official interest rate may drop, the lending market has become more bearish and there may be higher rates (or more stringent terms) for riskier loans. He feels that lending has not previously enjoyed the discipline of a proper open market, which is why pension funds ended up buying pigs in pokes (subprime packages dressed up as a form of reasonably secure bond).

But why is so much wealth tied up in housing, anyway? I've previously suggested that lenders like to put money into houses because they rise in value, yet that rise is mainly the result of increased lending. It's what looks like an infinite loop, but there are other factors involved, that will lead to braking and possible breakdown.

Over a long period, house prices have increased:

a) because wages tend to increase faster than RPI; but in a global economy, Western wages are stalling; and in an ageing population, social costs (and therefore taxes) are rising.

b) because, sometime after WWII, we moved from a pattern of one significant income earner per couple, to two, who could bid more as DINKYs (dual income, no kids yet); but unless we learn to live as threesomes (TRINKYs) or in larger communes (FAMILIES), this driver has gone as far as it can.

c) because interest rates fell a long way, so people could service much larger mortgages; but now interest rates can't go up much, without widespread repossessions and bankruptcies - of registered voters. And whenever things get difficult, the temptation will be to drop rates further, which expands the lending and ultimately tightens the noose.

d) because lenders got rich and reckless in the boom; they might have offloaded the loans, but they may still have to pay a price for their deceits.

Meanwhile, we have diverted money into real estate that should have been powering business: R&D, startups, expanding small firms. Instead, large concerns are wiping out their potential successors: shopkeepers' children are stacking shelves for hypermarkets.

Democracy is rooted in a degree of economic independence and social equality. In effect, by permitting excessive concentration of capital, we are in danger of enslaving the next generation: the first of the "mind-forged manacles" is the limiting of their aspirations.

That sinking feeling

It is now 100 days since July 6, our starting point for measuring the Dow's fall. Against gold, the decline is substantial.

What about currency risk? According to O&A historical figures (using interbank rates), the US dollar has declined against the British pound by only 0.8%; and against the Chinese yuan, only 1.2%. But in the same period, the dollar has lost over 4% against the Euro, and 4.3% against the Japanese yen. Annualised, that's a drop of about 15% per year in yen terms. (Which currency has Warren Buffett bought this year?)

Gold? Acording to the World Gold Council (WGC), in the twelve months to 26 September, the Eurozone has sold 475.75 tonnes. (This zone includes Sweden and Switzerland; the latter has disposed of 113 tonnes out of that total, or nearly 9% of its stock. How strong is the Swiss franc? Is sound money a bad idea?)

The WGC September account reports that the US still holds 8,133.5 tonnes of gold, exactly the same amount as reported for Q1 2005, two and a half years ago. Allegedly: never forget that "credit" is Latin for "he believes it."

But maybe that's so; maybe Uncle Sam has, er, requested that other countries reduce their bullion stock in order to, um, maintain price stability. After all, the dollar has fallen 13.4% against gold already.

The competitive struggle to lose currency value continues.

Friday, October 12, 2007

Peter Schiff grows

A short, cogent, scholarly essay by Peter Schiff in Financial Sense today, explaining why a falling dollar isn't a quick exit from America's economic problems.

As well a well-wrought urn becomes

The greatest ashes, as half-acre tombs.

As well a well-wrought urn becomes

The greatest ashes, as half-acre tombs.

How would money buy this?

|

| http://janestreetclayworks.com/2011/02/15/preview-the-history-of-bricks/1925-drawing-to-raleigh/ |

Many a truth is spoken in jest: at his request, Herriman's ashes were scattered in Monument Valley, Utah. Here is his love, expressed in a backhanded way that reveals more than it conceals.

This week, again, I spent time with clients talking not about money and how to invest it, but about what they wanted from life. It's so easy to let your mind become trapped in attempts to beat the top score on the pinball machine.

The hard stuff

Richard Greene in Financial Sense on Wednesday paints a very worrying, but credible picture of accelerating financial instability and official attempts to disguise the crisis. He looks at the worst case, and says that nothing beats holding the bullion yourself:

In this scenario you don’t accept futures, you don’t accept ETFs, you don’t accept any paper promises; you only accept the real physical gold and silver in your possession. It may take more time for this to occur in the US, but overseas this IS occurring right now, particularly in the Far East and the Middle East. This is exactly what has been necessary to break the fraud and suppression of the gold and silver price that has kept them from reaching a fair free market value. It is happening as we speak...

...if defaults and bankruptcies became prevalent the banks could easily cancel your credit cards, not have any of your cash on hand, and deny you access to your own assets. We don’t expect this worst case scenario to play out soon but then again we find it incredible how few are prepared; and it is a substantial risk. So again to play it safe: have some of that green funny money on hand, definitely have some gold and silver, and have a nice stockpile of canned foods on hand to deal with unexpected emergencies. Do it now! If these things come to pass don’t be surprised to see gold moving up hundreds of dollars per day.

The red highlight is mine - I've suspected for some time that the gold price is being held down by undisclosed releases of bullion onto the market, by central banks.

Meanwhile, I'm interested to test sentiment about the markets - please see the poll on the sidebar and have a go.

Wednesday, October 10, 2007

Inflation, here we come

Jordan Roy-Byrne's article featured in Financial Sense last week examines various types of inflation and gives graphs, facts and his thoughts on future trends. He concludes:

It is my belief that the Fed's recent cut is the wake up call that will finally stimulate rising inflation expectations. Moreover, the public awakening towards inflation is coming at a time when monetary inflation, commodity inflation, currency inflation and wage inflation, already at significant highs, are set to rise even further.

He predicts a sharp acceleration when gold breaches $1,020 per ounce - itself a price level about 38% higher than today.

Although his remarks have most relevance for an American audience, it is worth remembering the recent Telegraph article (5th October) that forecast sterling dropping even faster than the dollar. Our determination to be as financially reckless as our Transatlantic cousins may result in our facing similar problems.

The good news? Our enormous holding of US Treasury stock may turn out to have been a reasonable investment, in sterling terms. The bad news? Perhaps we should have put that money into bonds denominated in a stronger currency. The Euro, maybe?

UK Inheritance Tax threshold unchanged

The Inheritance Tax announcement yesterday by "Chancellor" Darling is misleading. It has the flavour of a Gordon Brown dodge - hence my inverted commas.

The threshold per person remains at £300,000, as this article by Labour Home itself explains. What has changed is that the allowance is transferable on death, if you are married or in a civil partnership.

A similar effect would previously have been achieved by any competent solicitor, will writer or estate planner, by including a Nil Rate Band Will Trust in your Will. Similar, but not quite the same: the Nil Rate Band trust means giving assets away to a third party (not to one's partner) after the first death. Making the allowance transferable lets the surviving partner enjoy the use of assets worth up to £600,000, without the threat of estate tax afterwards.

This will reduce the amount of tax raised from IHT, since it helps those who a) haven't written the right kind of will/trust arrangement or b) couldn't do so because of the continuing needs of the surviving partner (who might, for example, be disabled or in a privately-paid nursing home).

But it's certainly not what it sounded like, which was an IHT allowance of £600,000 per person, or £1.2 million altogether.

Thanks to Dizzy Thinks and The Spectator Coffee House blog for the alerts.

The threshold per person remains at £300,000, as this article by Labour Home itself explains. What has changed is that the allowance is transferable on death, if you are married or in a civil partnership.

A similar effect would previously have been achieved by any competent solicitor, will writer or estate planner, by including a Nil Rate Band Will Trust in your Will. Similar, but not quite the same: the Nil Rate Band trust means giving assets away to a third party (not to one's partner) after the first death. Making the allowance transferable lets the surviving partner enjoy the use of assets worth up to £600,000, without the threat of estate tax afterwards.

This will reduce the amount of tax raised from IHT, since it helps those who a) haven't written the right kind of will/trust arrangement or b) couldn't do so because of the continuing needs of the surviving partner (who might, for example, be disabled or in a privately-paid nursing home).

But it's certainly not what it sounded like, which was an IHT allowance of £600,000 per person, or £1.2 million altogether.

Thanks to Dizzy Thinks and The Spectator Coffee House blog for the alerts.

Friday, October 05, 2007

Which will fall faster: the pound or the dollar?

An article in the Telegraph (referred to by today's Daily Reckoning) says that the pound sterling could drop about 14% against the dollar by 2009.

Which one is the basket case economy?

Wednesday, October 03, 2007

"How much money do we need?" revisited

The Daily Reckoning supports the drift of my question:

Our old pen-pal Jack Lessinger has a new book out: “Change.”

...His book outlines the development of the US property market over the past two centuries in terms of what he calls “paradigmatic economic changes.” He notes that the shrewd investor always had to stay ahead of the trend. That meant, looking beyond what the then-current paradigm to what people were likely to want in the future. Instead of investing in the old colonial regions along the East Coast, for example, an investor in the early 19 th century should have looked to the frontier. There, he would have found cheap land…and could have watched it soar for the next 50 years. He should have seen the huge development that would take place in Chicago and St. Louis, for example.

Later, after WWI, the landscape changed dramatically. New technology had created a new idea about how people should live – in the suburbs. For the next 50 years, fortunes could have been made simply by anticipating the growth of the suburbs – further and further out from the urban centres.

Our consumer economy did not exist before 1900, says Lessinger. Since then, it has grown and grown – “Sexy young women, smiling from the billboards , urging strait-laced and penny-pinching citizens to save less and spend more. Buy, buy , buy screamed the advertisers. Buy Coca Cola and be happy. Buy Dentine gum and be kissable. Buy Camels and be manly. The consumer economy blossomed. Houses grew bigger and more lavish, cars roomier, faster and more comfortable. What a great time to be alive!”

But buy, buy, buy is going bye-bye, says Jack. The consumer economy is unsustainable. People don’t have the money for it. It is based on cheap energy and cheap credit, both of which are running out. He thinks it will disappear by 2020.

“Get ready for an existential leap…” he warns.

The next Big Thing in American society will be a huge interest in downscaling, downshifting, and simplifying. When the baby boomers realise that their houses won’t allow them to Live Large, says another friend, they’ll begin to appreciate Living Small.

Jack comes at the subject from a different direction than we would, but his book made us think. You can find out more at jacklessinger.com.

I've been thinking how to "get out from under" for a long time. Maybe I'd better act before it becomes the fashion. Jim Puplava thinks the Fed has just bought us another two years, at a cost - to those who stay on too long.

Besides, I like beer and darts.

Our old pen-pal Jack Lessinger has a new book out: “Change.”

...His book outlines the development of the US property market over the past two centuries in terms of what he calls “paradigmatic economic changes.” He notes that the shrewd investor always had to stay ahead of the trend. That meant, looking beyond what the then-current paradigm to what people were likely to want in the future. Instead of investing in the old colonial regions along the East Coast, for example, an investor in the early 19 th century should have looked to the frontier. There, he would have found cheap land…and could have watched it soar for the next 50 years. He should have seen the huge development that would take place in Chicago and St. Louis, for example.

Later, after WWI, the landscape changed dramatically. New technology had created a new idea about how people should live – in the suburbs. For the next 50 years, fortunes could have been made simply by anticipating the growth of the suburbs – further and further out from the urban centres.

Our consumer economy did not exist before 1900, says Lessinger. Since then, it has grown and grown – “Sexy young women, smiling from the billboards , urging strait-laced and penny-pinching citizens to save less and spend more. Buy, buy , buy screamed the advertisers. Buy Coca Cola and be happy. Buy Dentine gum and be kissable. Buy Camels and be manly. The consumer economy blossomed. Houses grew bigger and more lavish, cars roomier, faster and more comfortable. What a great time to be alive!”

But buy, buy, buy is going bye-bye, says Jack. The consumer economy is unsustainable. People don’t have the money for it. It is based on cheap energy and cheap credit, both of which are running out. He thinks it will disappear by 2020.

“Get ready for an existential leap…” he warns.

The next Big Thing in American society will be a huge interest in downscaling, downshifting, and simplifying. When the baby boomers realise that their houses won’t allow them to Live Large, says another friend, they’ll begin to appreciate Living Small.

Jack comes at the subject from a different direction than we would, but his book made us think. You can find out more at jacklessinger.com.

I've been thinking how to "get out from under" for a long time. Maybe I'd better act before it becomes the fashion. Jim Puplava thinks the Fed has just bought us another two years, at a cost - to those who stay on too long.

Besides, I like beer and darts.

Tuesday, October 02, 2007

Secret taxation

This is a payslip for a supply teacher, showing income and deductions. On an emergency tax coding, tax is levied at basic rate (22%) on all earnings after pension contributions have been made. National Insurance is paid at the reduced rate of 9.4%, because the teacher is in his/her occupational pension. Total tax and NI: £399.61 / £1,472.20 gross pay = 27.14%.

This is a payslip for a supply teacher, showing income and deductions. On an emergency tax coding, tax is levied at basic rate (22%) on all earnings after pension contributions have been made. National Insurance is paid at the reduced rate of 9.4%, because the teacher is in his/her occupational pension. Total tax and NI: £399.61 / £1,472.20 gross pay = 27.14%.Oh no, it isn't.

The tax that dare not speak its name is employer's National Insurance, which would be around £93.37. It's an extra cost that the employee never sees, but it's money that could be paid in wages if it were not deducted at source. Therefore, the gross (pre all stoppages) pay is higher than shown, and so are the deductions.

So why don't we see payslips that tell the whole story, say something like this? ...

The reason is obvious, isn't it? Especially when you show the appropriate marginal rate.

The reason is obvious, isn't it? Especially when you show the appropriate marginal rate. And if this was a payslip for someone not in an occupational pension, the marginal rate of N.I. would be 11% for the employee, and 12.8% for the employer. In other words, £100 extra payslip-declared salary would actually cost the employer a total of £112.80, with marginal-rate deductions of £22 in income tax and £23.80 in N.I. ! In that case, the real effective marginal rate of revenue-raising would be 45.80/112.80, or 40.6%.

The average wage earner is, in fact, a 40% taxpayer, without knowing it.

Is it illegal to show the truth on your employees' wage slips? Don't you think it would make the ordinary person start to take the taxation issue seriously?

Gold price manipulation: Mylchreet backs Veneroso

I've previously noted Frank Veneroso's theory that central banks have been offloading gold to keep its price down, a ploy that obviously cannot work forever. Now here's Paul Mylchreet saying the same thing:

"Central banks have 10-15,000 tonnes of gold less than their officially reported reserves of 31,000" the Chevreux report announced. "This gold has been lent to bullion banks and their counterparties and has already been sold for jewelry, etc. Non-gold producers account for most [of the borrowing] and may be unable to cover shorts without causing a spike in the gold price."

In other words, "covert selling (via central bank lending) has artificially depressed the gold price for a decade [and a] strongly rising Gold Price could have severe consequences for US monetary policy and the US Dollar."

The conclusion? "Start hoarding," said Paul Mylchreet...

"Central banks have 10-15,000 tonnes of gold less than their officially reported reserves of 31,000" the Chevreux report announced. "This gold has been lent to bullion banks and their counterparties and has already been sold for jewelry, etc. Non-gold producers account for most [of the borrowing] and may be unable to cover shorts without causing a spike in the gold price."

In other words, "covert selling (via central bank lending) has artificially depressed the gold price for a decade [and a] strongly rising Gold Price could have severe consequences for US monetary policy and the US Dollar."

The conclusion? "Start hoarding," said Paul Mylchreet...

The United States Federal Reserve: why the secrecy?

The posts themselves are far from jocular and those who may be tempted to dismiss them as conspiracy theorising must still recognise that there is nevertheless a case, of sorts, to answer; or at least, the scent of a story for the financial bloodhounds.

The first, from March this year, looks at the process by which the Federal Reserve came to be proposed, named and brought into being.

The second, today's, is a restrained fisking of an attempt by a teacher of economics to discount conspiracy theory in relation to "the Fed".

Monday, October 01, 2007

Lasting Power of Attorney: the next step in the Long March

The great day has arrived. The Mental Capacity Act 2005 is now in effect.

Though I'm not sure how many people who take out an LPA are aware that the withdrawal of "treatment" includes denying water, so patients in hospital can be made to die slowly of thirst ("Since a landmark House of Lords judgment in 1993, providing food and water to those who cannot eat or drink for themselves counts as treatment as well."). And no-one can be certain what is felt by someone who is apparently in a coma.

Doesn't this conflict with the Hippocratic Oath?

What oath? Wikipedia says:

In the 1970s, cultural and social forces induced many American medical schools to abandon the Hippocratic Oath as part of graduation ceremonies, usually substituting a version modified to something considered more politically up to date, or an alternate pledge like the Oath or Prayer of Maimonides.

A Catholic scholar details the Oath and its history here.

The Act is here; the government's own take on it is here.

We seem to be approaching a time when anybody except a criminal may be lawfully killed.

Though I'm not sure how many people who take out an LPA are aware that the withdrawal of "treatment" includes denying water, so patients in hospital can be made to die slowly of thirst ("Since a landmark House of Lords judgment in 1993, providing food and water to those who cannot eat or drink for themselves counts as treatment as well."). And no-one can be certain what is felt by someone who is apparently in a coma.

Doesn't this conflict with the Hippocratic Oath?

What oath? Wikipedia says:

In the 1970s, cultural and social forces induced many American medical schools to abandon the Hippocratic Oath as part of graduation ceremonies, usually substituting a version modified to something considered more politically up to date, or an alternate pledge like the Oath or Prayer of Maimonides.

A Catholic scholar details the Oath and its history here.

The Act is here; the government's own take on it is here.

We seem to be approaching a time when anybody except a criminal may be lawfully killed.

Sunday, September 30, 2007

Is that charitable trust trustworthy?

I have received another charity mailing, this time from the World Children's Fund. There's so many that I feel guilt at not being able to give to all. And aren't they well-presented these days?

But there's something about the name of this one - similar to other charities somehow. So I google it. Page after page on Google, each leading you directly to their site.

But now for blogpower! I look to see what my fellow bloggers say. Here's one, and it's most interesting. I say no more, since I have no money to fight in court.

I shall now add Elmer to my links, and the US charity evaluation site, Charity Navigator.

Another case where bloggers have proved to be useful, I would say.

But there's something about the name of this one - similar to other charities somehow. So I google it. Page after page on Google, each leading you directly to their site.

But now for blogpower! I look to see what my fellow bloggers say. Here's one, and it's most interesting. I say no more, since I have no money to fight in court.

I shall now add Elmer to my links, and the US charity evaluation site, Charity Navigator.

Another case where bloggers have proved to be useful, I would say.

Saturday, September 29, 2007

How much money do we need?

The mortgage conundrum

Much of the nation's wealth seems to be tied up in our houses, which don't appear to be very productive from an economic standpoint. There is a kind of circular logic:

1. Houses cost a lot, so you have to borrow a great deal of money to buy a house.

2. Houses cost a lot, because you can borrow a great deal of money to buy a house.

Having regard for the wider consequences of your proposals, what is the optimum solution?

Thrift and Prudence: essay competition

Cartoon by Charles Keene (1823-1891) in "Punch" magazine

Cartoon by Charles Keene (1823-1891) in "Punch" magazineContrary to Mr Gordon Brown's claim to be prudent, many believe that the British Government (as well as that of the USA) wastes public money. One such critic is "Wat Tyler" in the British blog, Burning Our Money.

What if the people we criticise said, put up or shut up?

So, if you want better value for money in public finance, how would you get it? How would you achieve the same results for less money, or how would you improve quality without increasing expenditure?

If you wish to submit a longer piece, please submit your email in the comments - I shall then add you as an author to this blog pro tem (but will keep your email address off the blog unless you wish it to be published).

Dow 9,000 update

July 6 to present: Dow up from 13,611.69 to 13,895.63; gold up from $647.75/oz. to $743.10. So the "gold-priced Dow" is down 11.01% in 84 days.

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

Thursday, September 27, 2007

Faber: bubble in commodities, but buy gold

Marc Faber in ABC News, Tuesday:

Very simply, it will end in a catastrophe. We never had, in the history of capitalism, a global, synchronised, boom. If you travel around the world, everywhere you go, there are booming conditions.

Now if you look at the last 200 years of financial history, you had investment booms and mania in relatively small sectors in the economy: in the US in canals and railroad in the 19th century, some regional real estate markets. And then in the 1920s you had the stockmarket boom, and in the late 80s you have a silver, gold and energy share boom, and in the year 2000 we had a boom in tech stocks and in Japan in the 80s in Japanese shares. And each time these bubbles burst, they had an impact but the impact was largely sectorial or regional and not affecting the whole world.

Now, we have a bubble everywhere. We have a bubble in real estate prices, we have a bubble in stock, we have a bubble in art prices, we have a bubble in commodities.bigger the bubble, the bigger the bang will be. If someone argues we're in a global synchronised boom, I agree entirely. The consequence will be that the next boss will be a global synchronised boss.

By the way, I like that mistranscription, it conveys his Europeanness.

The southern Germans are comfortable with the themes of pain and loss, as you'll know if you've looked at the Meglinger painting on Dr Faber's GloomBoomDoom site. D.H. Lawrence wrote of the sensual agony in the little roadside shrines in interwar Bavaria. This is not simple morbidity - unlike modern crime/action films - but a sign that you can rise above suffering, instead of avoiding it.

A Viennese taxi driver explained to us the difference between Austrians and northern Germans: "They say, it's bad, but it's not hopeless; we say, it's hopeless, but it's not so bad."

Back to our muttons. Here he is again, quoted from various sources via Resourcexinvestor:

"Investors have to look for assets which cannot multiply as fast as the pace at which the Fed prints money."

... He advised buying gold to defend against monetary inflation... he recommends holding physical gold bullion investments in gold-friendly countries such as Hong Kong, India and Switzerland. He counsels against holding gold in the US for fear that it might be nationalized by the government.

Very simply, it will end in a catastrophe. We never had, in the history of capitalism, a global, synchronised, boom. If you travel around the world, everywhere you go, there are booming conditions.

Now if you look at the last 200 years of financial history, you had investment booms and mania in relatively small sectors in the economy: in the US in canals and railroad in the 19th century, some regional real estate markets. And then in the 1920s you had the stockmarket boom, and in the late 80s you have a silver, gold and energy share boom, and in the year 2000 we had a boom in tech stocks and in Japan in the 80s in Japanese shares. And each time these bubbles burst, they had an impact but the impact was largely sectorial or regional and not affecting the whole world.

Now, we have a bubble everywhere. We have a bubble in real estate prices, we have a bubble in stock, we have a bubble in art prices, we have a bubble in commodities.bigger the bubble, the bigger the bang will be. If someone argues we're in a global synchronised boom, I agree entirely. The consequence will be that the next boss will be a global synchronised boss.

By the way, I like that mistranscription, it conveys his Europeanness.

The southern Germans are comfortable with the themes of pain and loss, as you'll know if you've looked at the Meglinger painting on Dr Faber's GloomBoomDoom site. D.H. Lawrence wrote of the sensual agony in the little roadside shrines in interwar Bavaria. This is not simple morbidity - unlike modern crime/action films - but a sign that you can rise above suffering, instead of avoiding it.

A Viennese taxi driver explained to us the difference between Austrians and northern Germans: "They say, it's bad, but it's not hopeless; we say, it's hopeless, but it's not so bad."

Back to our muttons. Here he is again, quoted from various sources via Resourcexinvestor:

"Investors have to look for assets which cannot multiply as fast as the pace at which the Fed prints money."

... He advised buying gold to defend against monetary inflation... he recommends holding physical gold bullion investments in gold-friendly countries such as Hong Kong, India and Switzerland. He counsels against holding gold in the US for fear that it might be nationalized by the government.

Wednesday, September 26, 2007

Crescendo crisis

Today's Daily Reckoning UK directs us to this article on FT.com, which says that sovereign wealth funds will support (if not boost) share prices in a "crescendo of investing".

Bully for the fund managers. But I say again, consider the implications for the West, which is losing control of its debt and now looks set to start losing control of its assets.

Bully for the fund managers. But I say again, consider the implications for the West, which is losing control of its debt and now looks set to start losing control of its assets.

Tuesday, September 25, 2007

Frank Veneroso elaborates on the gold bubble

I am impressed by the courtesy of important people.

Frank Veneroso — Perhaps the most highly regarded market economist of our time, Frank Veneroso has advised countless governments, as well as the World Bank, on economic policy, served as a senior partner in one of the world's largest hedge funds, and is a confidant and private advisor to many of today's most influential investors and economic leaders.

He was among only a handful of analysts who clearly predicted the Tech Wreck, and followed it up with a deadly-accurate forecast of today's gold bull market.

Now, Mr. Veneroso is stunning the world with predictions of a major train wreck in no less than two high-flying sectors of the global economy. Virtually no one is expecting these dramatic events...

After reporting on his April 2007 presentation to World Bank people (see yesterday's post, "Gold bubble"), I emailed Frank Veneroso, and have received a reply from him today. I wanted to follow up on his essay of May 2001. Here's what I asked:

In 2001, you wrote a very intriguing article, posted on GATA, theorising that central banks actually hold much less physical gold than they pretend, because of loan-outs and possibly surreptitious selling. If I may, I should like to ask a few questions:

1. Are you still of that opinion?

2. What do you think is the present situation regarding gold holdings by central banks?

3. What evidence do we now have?

1. Are you still of that opinion?

2. What do you think is the present situation regarding gold holdings by central banks?

3. What evidence do we now have?

Here is his reply:

That was my opinion. It still is. However I gave ranges regarding that amount. I now believe that central bank loan outs and undisclosed sales were at the low end of my expectations. Why? I have no direct evidence. My evidence is the following.

I believe that we are near the end of a commodity bubble that is the largest in all history. The greatest extreme is in metals. Hedge funds have accumulated futures, forwards and physical on a scale that simply has no precedent. The greatest excesses are in base metals but these same funds all hold large gold positions. I believe that individual funds may hold positions in copper or gold that are as large in value as the ETF. I know that sounds unbelievable. But I have a great deal of evidence.

If this is so, the price of gold should be much higher. My only explanation for why it is not is that central bank holdings must be very large for this to happen.

I should add, I believe there will be a coming crash in the metals sector that will surface. There will be an unprecedented investor revulsion toward this sector.

Gold’s fundamentals are totally different from those of base metals and silver. However, because the same funds also hold gold, I cannot see how gold can escape forced liquidations from these portfolios.

I believe that we are near the end of a commodity bubble that is the largest in all history. The greatest extreme is in metals. Hedge funds have accumulated futures, forwards and physical on a scale that simply has no precedent. The greatest excesses are in base metals but these same funds all hold large gold positions. I believe that individual funds may hold positions in copper or gold that are as large in value as the ETF. I know that sounds unbelievable. But I have a great deal of evidence.

If this is so, the price of gold should be much higher. My only explanation for why it is not is that central bank holdings must be very large for this to happen.

I should add, I believe there will be a coming crash in the metals sector that will surface. There will be an unprecedented investor revulsion toward this sector.

Gold’s fundamentals are totally different from those of base metals and silver. However, because the same funds also hold gold, I cannot see how gold can escape forced liquidations from these portfolios.

Mr Veneroso has kindly given his permission to publish the above comments.

From the prospectus for a conference in New Orleans in 2006:

Frank Veneroso — Perhaps the most highly regarded market economist of our time, Frank Veneroso has advised countless governments, as well as the World Bank, on economic policy, served as a senior partner in one of the world's largest hedge funds, and is a confidant and private advisor to many of today's most influential investors and economic leaders.

He was among only a handful of analysts who clearly predicted the Tech Wreck, and followed it up with a deadly-accurate forecast of today's gold bull market.

Now, Mr. Veneroso is stunning the world with predictions of a major train wreck in no less than two high-flying sectors of the global economy. Virtually no one is expecting these dramatic events...

Red Dragon, White Collar

Just a few tasters of the emerging advertising and media class in China:

http://www.apmforum.com/columns/china20.htm

http://www.danwei.org/

http://www.china-britain.org/

http://www.apmforum.com/columns/china20.htm

http://www.danwei.org/

http://www.china-britain.org/

Stay here and go East

Whole new industries are waking up to a New China, with a middle class...and millions of rich people too... We spoke to a young man here who believes that the key to making money in large US companies actually lies in Asia.

"US companies aren't going to make much money by selling more product to Americans. Americans don't have any money... A company with a good product - especially a good brand - can make a lot of money now by doing two things. One is lowering its costs by outsourcing labour to Asia...not just manufacturing, but even high-level things like design, research, marketing, legal work. The other thing it has to do is to sell its products to this huge rising market of the Asian middle class.

"If it does these two things, it will have lower costs and higher revenues. If it doesn't do these two things, it will be stuck with high costs...and a stagnant market - at best. Actually, as the housing problem deepens in the United States, you'd expect domestic sales to fall."

He's probably right. While the average American will probably grow poorer - in both relative and absolute terms - many US companies will probably do quite well. Many already are.

I've suggested before now, that the white-collar people here are next in the firing line. Those mushrooming Third World (first-class) universities aren't just turning out engineering graduates. James Kynge pointed out that maybe 85% of the end-price of our Chinese imports is added on by sales and marketing. There's a strong incentive for developing Madison Avenue East. Not to mention Great Wall Street.

The good news for investors is that you may be able to make some money stock-picking the right Western companies, where access to shares is easier, accounts are not quite so dodgy, the government doesn't generally have its hand up the corporate puppet, and even governments have (to some degree) to obey the law and respect private property.

Returning to the gold-bubble question, Bill repeats the argument that gold is a haven in a storm, and mooring is getting cheaper:

There are times when the investing world becomes so dangerous that the most likely rate of return for the average investor will be negative. That is a good time to hold gold; your rate of return will almost certainly be better than actually investing! Gold is a hedge against the unknown... But like any insurance, it costs money. When you hold gold, you give up the yield you would otherwise get from stock dividends or bond coupons. Now that Bernanke has cut short-term rates, the cost of holding gold has gone down.

Is now the time to buy gold? The money supply in the United States is rising at a rate nearly five times the growth of the economy itself. The Fed, claiming that inflation is now under control, has just cut the price of credit to member banks by half a percentage point. The economic explorer has to rub his eyes and look twice; he can't quite believe it. How can inflation be under control when prices for key commodities - notably the keyest commodity, oil - are at record levels? He doesn't have an answer, but he can put two and two together. Whatever kind of 'flation' the Fed has been cooking up, we're going to get more of it. So put on your best bib and tucker, dear reader.

Monday, September 24, 2007

Golden bubble

A bubble shot through by a bullet - experiment described here

A bubble shot through by a bullet - experiment described hereHere's a counter-blast to gold-bugs and fans of other metals:

In this long and dense presentation to the World Bank, delivered in April 2007 and revised/updated in July, Frank Veneroso says that commodities, including gold, nickel and copper, are already in a big bubble. He thinks an estimated $2 trillion in hedge funds, plus leveraging, is pumping the prices:

When it comes to metals, we see hedge fund speculation, hoarding and squeezing everywhere. Not only have some metals markets been driven far, far higher in this cycle compared to all past cycles; we see the same phenomenon across all metals. It is the combination of both the amplitude and breadth of the metals bubble that probably makes it the biggest speculation to the point of manipulation in the history of commodities. (Page 50)

Short runs costs have risen, but not long run costs. New sources are being exploited. And if recession hits, demand will drop:

... the historical pattern... for all commodities, suggests that, rather than seeing well above trend metals demand growth in the years to come as the consensus now projects, we are more likely to see outright declines in global demand for these metals as demand destruction takes hold. (Page 56)

For institutional investors, the "barren breed of metal" is unproductive compared to other assets:

... it is likely that the net nominal return to portfolios from investing in physical “stuff” has not been more than 1% per annum. By contrast, in a 3% inflation environment, bonds have yielded somewhere between 5% and 9% and equities have yielded somewhere between 8% and 11%. In effect, you gave up an immense amount of yield if you diversified out of bonds and stocks into commodities. You did gain by reducing overall portfolio volatility, but that gain was not large enough to offset the loss in yield. Diversifying with “stuff” did not enhance risk-adjusted returns. (Page 57)

So prices have been boosted by the futures market. And commodities as a market are small enough to be susceptible to "manipulation and collusion".

Readers of this blog will recall that Marc Faber recently said he saw bubbles everywhere, including commodities. Even if cash isn't king, it may be a pretender to the throne.

Subscribe to:

Posts (Atom)