Tuesday, June 03, 2008

Democracy - a cut flower

I put the above comment about the British system on the ever-elegant Angels in Marble. Is it too cynical?

What does democracy mean here? What should it be like?

Is democracy the best system, or should we turn to authoritarianism, which seems to be working for the Russians and Chinese, as an increasing number of opinion-formers seem to be suggesting?

Is that happening anyway? Are the people watching the bottom rung of the ladder of power rise out of reach?

Monday, June 02, 2008

Why interest rates should increase - and (IMO) probably won't

Willem Buiter gives a beautifully clear and concise view of the factors affecting inflation and argues for an increase in lending rates.

But the hard, narrow path upward is often avoided, especially in "democracies" where the governing party feels its hold on power slipping.

Besides, a depreciating pound is helping maintain orders for what remains of our manufacturing industry. Why halt the pound's fall?

Maybe we should start doing our FTSE charts in Euros, so we can see the real effect of rotting currency. Like Alice and the Red Queen, when the stockmarkets stand still, they are actually falling back, once you price them against the rest of the world's money.

I note that Mish used the Red Queen's Race analogy two years ago, and presciently outlined the monetary and economic dilemma for the USA - and, I suspect, the UK:

Bernanke is trapped in "Wonderland" but unlike Alice has no way out.Bernanke gets to choose between hyperinflation and deflation. The moment he can not run fast enough, the US economy will implode. If he runs too fast, the value of the US dollar as well as the FED's power will both come to a very abrupt stop.

Sunday, June 01, 2008

A long way to go yet

These and other observations recently from Morgan Stanley's Teun Draaisma are reported here in FT Alphaville.

The return of the gods

Yes, rule us as you wish, as long as our kettles and TVs work, as long as there is petrol for our cars and the trains run on time. What we want is broth for our bellies, now, like Esau.

We may have to re-learn our lessons the hard way, as Kipling warned... and Cavafy:

Without consideration, without pity, without shame

they have built big and high walls around me.

And now I sit here despairing.

I think of nothing else: this fate gnaws at my mind;

for I had many things to do outside.

Ah, why didn’t I observe them when they were building the walls?

But I never heard the noise or the sound of the builders.

Imperceptibly they shut me out of the world.

Oil speculation?

But Karl Denninger reckons it's just money looking for a home, like the boll weevil, and ultimately deflation caused by credit writedowns should reverse the trend.

Saturday, May 24, 2008

The Oil Controversy

I should like to see what energy commentators like Nick Drew wish to say to this. From what I've read, remaining oil stocks are likely to be of lesser quality and will cost far more to extract than God's gift to the Saudis (which, I understand, is already being exploited at a rate that is damaging the field).

Granted, oil is massively over-taxed. Americans would head for their gun rooms if they had to pay £5 a gallon.

Meanwhile, the FTSE continues to float cheerily above 6,000 and the Dow above 12,000 - for how much longer?

Sunday, May 18, 2008

It's going to be bad...

We in the UK will not be immune from the general economic malaise to follow, even if unregulated immigration and a slower past housebuilding program help keep our housing assets from falling quite so far.

Saturday, May 17, 2008

Any room for dissent?

And with a disgraceful click, the supposedly diverse panel closed ranks behind China, despite some attempt by the chairman to generate at least a little debate. We heard that we have been indulging in "China-bashing" lately, and now that this earthquake has happened, we should stop all this nonsense about China's human rights and/or ecological violations.

I began to wonder whether there might be some business and party-political interests to declare, for I've rarely heard such a combination of unanimity and superficial reasoning. The message seemed to be, "Stop talking about Tibet, look at this crisis instead."

That's imposing a false perspective. China's own news media currently reckon the death toll from this terrible quake to be under 29,000; but "According to various estimates, up to 1.2 million Tibetans have died due to the Chinese occupation and various political campaigns since the Dalai Lama fled his homeland in March 1959." So in cold mathematical terms, Tibet has suffered a death toll 40 times as great - and far more avoidable. Why should a recent misfortune be the pretext for ignoring a long-standing injustice?

And as for rubbishing ecological concerns, there will come a time (and quite soon) when we have forgotten in which year this quake happened, but we will be dealing with the multifarious fallout of China's economic, demographic and ecological problems. For China is a distressed giant thrashing about in the small house of this world.China's population last year was estimated at about 1.3 billion, and in the next ten years or so is expected to increase by maybe another 100 million. Over the last 60 years, life expectancy has more than doubled and infant mortality has reduced. So despite the one-child-per-family policy (not universally applied in China), the population continues to grow.

And, as time goes by, it is becoming a demographically unbalanced population. Thanks to the preference for sons, there is a disparity between male and female. Should China decide to become warlike in the conventional manner, she will have an almost limitless supply of expendable single men. (Meanwhile, Russia's population threatens to decline to such a degree that reversing the trend was "a key subject of Vladimir Putin's 2006 state of the nation address".)

Less frightening for us, but surely very worrying for the Chinese, must be the growing imbalance of numbers between young and old. Imagine a young Chinese couple who have their one child, but face supporting four elderly parents. And when that child grows up, perhaps up to 6 parents-cum-grandparents (up to 12, after marriage). And the healthcare costs!

And with a smaller proportion of girls surviving to breeding age, the demographic waist will be pinched further. Perhaps the one-child policy will eventually be abandoned.

Meanwhile, China's burgeoning populace must be fed, but how? Changes in diet and the progressive loss of arable land, and reducing yields from such land as is still fertile, have been a serious concern for a long time (see e.g. here).

Then there's the demand for water, and energy, and how to have breathable air while exploiting China's giant coal reserves and rapidly expanding heavy industry.

It's far too simple to make China into a villainess, but she faces enormous difficulties on the road away from her past abject poverty and suffering. These translate into mighty pressures that the rest of the world will feel. We must find a way to assist China in the solution of her problems - but self-censoring discussion of her external relations will not help us find realistic answers.

Check your bank deposit security

Wednesday, May 14, 2008

Sunday, May 11, 2008

The sky is dark, wings are flapping

Karl Denninger notes that in both the US and Japan, there are moves to force full disclosure of the banks' poor-grade assets; Jim in San Marcos reprises some observations of what happens when mutual funds (collective investments) are told by worried investors to "switch to cash" or simply pay out.

Look out for a hole in the henhouse roof, and a cloud of feathers.

Saturday, May 10, 2008

Nationalism and internationalism

I don't think nationalism will be confined to losers in the game, or rejected by those who claim to love all mankind. Once there was Bukharin/Stalin's "Socialism in one country"; soon it'll be "China first". I can't blame the latter - they have worked so hard for what they've got, and won't understand why we think we can whinge it all back from them.

Speaking as the man in the street, my perception is that we have had a long period in which global businesses and a carpetbagging international managerial class developed and made fortunes. The liberal economists say this system is great for all of us, and should stay that way; perhaps so, if we had honest money and sound national budgets, so the correction mechanisms could steer the course of international trade more steadily.

But thanks to criminal negligence, incompetence and greed by those who could have maintained the integrity of the economic system, I think the aspirant working class and lower middle class in the developed world are paying heavily, and will pay more heavily. As they give up on their aspirations, we shall see a ballooning underclass, increasing the drag on national economic performance; but the situation may prove impossible to change for electoral reasons in a sort-of-democracy. The gap between rich and poor in our countries has widened, but will widen further: "Devil take the hindmost."

At the same time, on both sides of the Atlantic, people suspect a sell-out by the political class, which is intertwined (professionally and often maritally, or extra-maritally) with the business, media and public relations people. I have often said that I think we are seeing the reconstruction of the aristocracy in Europe. Many Americans also fear that their society is moving away from its historic and constitutional foundations.

The implications for democracy, social cohesion and international relations are worrying.

Tuesday, May 06, 2008

Bust - or false boom and mega-bust?

This also chimes with what Marc Faber said last year: the crisis should be allowed to burn through and take out some of the players. Of course, those who are in a position to "allow", are part of the club that includes the players, and there's the rub.

Monday, May 05, 2008

Still room for wonder

It's a little early but the programme should soon appear online here.

UPDATE - now online here (requires RealPlayer to view).

Quote of the day

says Mish, daringly criticising Warren Buffett, who has declared a $billion-plus loss on short bets in the market.

Sunday, May 04, 2008

The system does not care

Not all the individuals can be blamed - you can lose your job for going beyond your brief, or shortcutting protocol.

But don't expect a pantomime horse to win the Derby, and don't expect compassion and commitment from these reified functions that we used to perform for ourselves.

Maybe only embarrassment will make a difference. Please pass on the link to Callum's site.

http://calumcarr.blogspot.com/2008/05/those-who-read-yesterdays-post-nhs-mega.html

Saturday, May 03, 2008

Brummies

First, I think the affected contempt for Brummies is a displaced scorn for industrial labour perhaps impermissible to express so baldly in relation to Yorkshiremen and Lancastrians. Imagine such contempt shown for miners!

This is not universal: German engineers put Ing. in front of their names, and may have a kudos similar to that of the medical profession; but British engineers are treated with patrician condescension. Think squaddies in oil-stained Khakis. No place for officers there.

Or picture Repton-educated (though expelled) Jeremy Clarkson, cheerfully displaying his ignorance as he drives the latest wonder constructed by "four blokes bashing metal in an industrial unit". Decades of regarding going into industry as the wooden spoon in life's competition, has brought Britain to our current sorry pass.

Thickos associated with Birmingham include Matthew Boulton, James Brindley, Sir Arthur Conan Doyle, JRR Tolkien, John Baskerville, Sir Edward Burne-Jones etc.

But mostly, Birmingham was too busy making its own and the nation's prosperity - the "cheap tin trays" of Masefield's "Cargoes". Ugh, the proles. Who also made the chain, the anchors, the presses, the lathes and so on that liberated us from guarding sheep as we read our Bibles with frozen fingers.

There may be a London-centric jealousy because Birmingham is not Britain's Second City, but, technically speaking, its first in geographical area and population. It is the largest local authority by a country mile (the "Mayor of London" controls a larger budget, but that "London" is an sort of urban conglomeration imprecisely related to the City of London, the surrounding boroughs, and other local authorities in the greater metropolitan area).

As to accents, few outsiders could pass for Brummies. Attempts to imitate the accent usually sound like a Scouser being strangled; and what is often thought of as a Brummie accent (say, Timothy Spall's Barry in "Auf Wiedersehen, Pet", or Julie Walters' Mrs Overall in "Acorn Antiques") is more like West Bromwich.

The Black Country abounds in accents; when I first came to Birmingham a Black Country-born history teacher told me that it was once possible to identify by his speech not only the village of the interlocutor, but sometimes even his street.

My personal preference is Sedgley, an exceptionally musical tone. Their pronunciation of the word "flowers" makes me think there must indeed have been a Golden Age in which men sang rather than spoke.

Pay up, or default

We have recognized $300 billion of losses but it has all been derivative loss. The $2.5-$3 trillion in credit loss from housing is still to come, plus all the credit card and other debt that cannot be paid down, likely a couple hundred billion more - at best.

= c. 20% of US GDP.

Friday, May 02, 2008

The system is now out of control

Thursday, May 01, 2008

The pocket calculator reveals the truth

A spendidly indignant Karl Denninger explains how the $600 "stimulus cheque" sent to American taxpayers will be more - much, much more - than paid for, by higher borrowing costs.

Where are the forthright Cassandras on this side of the Atlantic? Are they silent because nobody here believes in our country?

The "little hand-mill"

Official figures going back to 1963 show that bank lending has NEVER stopped increasing.

Official figures going back to 1963 show that bank lending has NEVER stopped increasing.Lowest: 1.1% annualised, for the quarter ending 31 December 1966.

Highest: 44.9% annualised, for the quarter ending 30 June 1972.

Median: 11.9%

Mean: 13.45%

Is it my imagination, or does the graph spike regularly before stockmarket crashes and recessions?

Original BoE data here.

In the late 60s, my school magazine carried a major bank's advert, for 16-year-old school leavers to join them. I aimed at a degree instead. Perhaps I'd have chosen differently if the ad had read "39 thieves looking to recruit trainee".

Do recessions lead to inflation?

However, this picture suggests to me that recessions follow periods of higher inflation, and maybe where that inflation continues during the recession, it could be put down to a sort of residual momentum. Why should prices fall at precisely the moment the NBER says a recession has started? Even a cut flower will maintain its bloom for a while.

However, this picture suggests to me that recessions follow periods of higher inflation, and maybe where that inflation continues during the recession, it could be put down to a sort of residual momentum. Why should prices fall at precisely the moment the NBER says a recession has started? Even a cut flower will maintain its bloom for a while.

On the other hand, it seems clear from the above graph that prices do generally seem to fall after a recession. Perhaps this is because of the recently reinforced lesson about thrift, so people become less keen to spend too much on stuff they don't need.

But it's also possible that the recession has cleansed certain inefficiencies in the use of capital - businesses that should have folded faster - and as that capital gets better employed elsewhere, it does its work of improving productivity.

Which it needs to, when people have become more cost-conscious. I recall reading about an American who found a way to sell dresses for a dollar in the Great Depression - he used a machine to stamp out the outline of 100 at a time, so only the machine sewing was needed, not the measuring and cutting. So it was still possible to buy a dress for your sweetheart when money was tight.

But the little hand-mill of monetary inflation continues to grind...

Wednesday, April 30, 2008

Tibet and China: clash of cultures

[...]

The Chinese protesters thought that, being Chinese, I should be on their side. The participants on the Tibet side were mostly Americans, who really don’t have a good understanding of how complex the situation is. Truthfully, both sides were being quite closed-minded and refusing to consider the other’s perspective. I thought I could help try to turn a shouting match into an exchange of ideas. So I stood in the middle and urged both sides to come together in peace and mutual respect. I believe that they have a lot in common and many more similarities than differences.

But the Chinese protesters — who were much more numerous, maybe 100 or more — got increasingly emotional and vocal and wouldn’t let the other side speak. They pushed the small Tibetan group of just a dozen or so up against the Duke Chapel doors, yelling “Liars, liars, liars!” This upset me. It was so aggressive, and all Chinese know the moral injunction: Junzi dongkou, bu dongshou (The wise person uses his tongue, not his fists).

Read the rest of Grace Wang's Washington Post article here.

Tuesday, April 29, 2008

GloomBoomZoom vs. GloomBoomDoom

Here it looks as though Dr Marc Faber is expecting inflation:

Dr Marc Faber has argued that even in the United States, where property prices are in decline, in an environment of high inflation he would rather own a US$1 million home than hold the same amount of cash or bonds, because the house would better preserve value.

... but here, its extreme opposite:

The view Marc is putting forward is the opposite one - that deflation will be the clear winner, dragging the whole world economy into a slump, with lower prices for commodities as well as stocks and property...

...In a real downturn, the United States (and other developed nations) would stop importing so much oil...and so much merchandise from China, which would have the consequence of reducing energy consumption by China too. Result: lower energy prices and a worldwide recession...maybe even the worst worldwide depression in history.

I think the giveaway in the first, is in the qualifying phrase "in an environment of high inflation". All I've read so far about Marc Faber indicates that his real position is represented by the second.

In my (amateur?) view, we're heading for a bust, and unless it can be avoided (which would be wonderful news), then the sooner, the better. Ideally, it would have happened in 2000 - in fact, it did, but we then got the reckless monetary reflation of 2003-2007.

Why soon? Because the longer it goes on, the more the transfer of productive capacity to the Far East, so that when recovery comes, we in the West won't be equipped to restart.

Sunday, April 27, 2008

Saturday, April 26, 2008

Cure, effect, cause

The authors say that the effect would be better if this reflation came in the form of additional direct government spending, though they acknowledge that it still wouldn't immediately halt the economic decline:

It is somewhat discouraging to see that even a relatively large stimulus plan will fail to prevent a substantial loss of output. But over the medium term, as the devaluation of the dollar and reduced spending begin to exert a moderating effect on the current account deficit, foreign trade will boost output and employment, providing the impetus for renewed growth.

Karl Denninger begs to differ (though in his case, he's still talking about transfers of money, rather than direct government expenditure):

But now we have reached the point where we need $5 in debt to create $1 worth of GDP. As debt levels rise this ratio goes parabolic and ultimately becomes impossible to sustain. That we have reached a 5:1 ratio means that the game is basically up, and the rapidly rising rate of defaults across all areas of consumer debt mean that this "engine" to fuel "growth" simply can't find any more fuel, despite the desires of the bankers and merchants to "make it so."

The Levy paper has echoes of FDR's 30s rescue, but Denninger is more concerned to compare the present mortgage bubble with the one that led to the Crash of '29:

...we've done this before... We saw, in fact, nearly the exact same pattern of practice, fraud and theft that were featured in the housing bubble during the years just before The Depression, and those "standards" in fact were a primary causative factor OF The Depression!

So maybe both parties are correct.

It's also possible that the Uk has got it wrong even worse than Uncle Sam. $600 bn is about £300 bn sterling, but adjusted for relative population size that's only equivalent to £60 bn pumped into the UK economy. We're already talking about a possible £100 bn-worth of mortgage garbage being swapped by HMG for government bonds - and our current fussing over Gordon Brown's crumbling reputation suggests that Prudence wouldn't dare try to reflate with even more direct government spending.

Besides, we are starting with a higher debt-to-GDP ratio than the USA, a State that consumes a bigger proportion of the economy, and a populace that suffers a significantly lower level of personal income on a Purchasing Power Parity basis.

Maybe that's why the pound is matching the dollar in its downward trajectory, and may even overtake it.

I've been wondering recently whether the ordinary investor of the future will be more interested to play in the foreign exchange markets, rather than stocks whose value is lied about, manipulated by rumour and sovereign wealth funds, and nibbled half to death by fees, commissions, taxes and inflation.

UPDATE - Karl Denninger is emphatic that it can't work:

Sack, no.

You can't spend $600 billion in deficits without it coming back SOMEWHERE.

Government spending is not a net positive. You can't only get to a net positive via growth in GDP.

Debt-initiated spending only returns $1 for every $5 taken on in debt.

Wednesday, April 23, 2008

Mortgage bond re-rating: reversing the rescue?

Tuesday, April 22, 2008

Second blow

Then a thought: when the recession really bites, the price war will be unrestrained. I don't know what is still manufactured in Britain, but in the second phase, when the poor become acutely cost-conscious, I can't see domestic manufacturers staying in business.

Of course, with social benefits still generous, we're not there yet (they're still buying their kids Xboxes and Lacoste trainers, while SoSecurity lay on taxis to take the tearaways to school-for-the-expelled); but wait for the tax and benefit reviews when public finances finally unravel.

And if I ever do get another new car (the Fiat Brava is kept going on a radiator refill every Saturday), maybe it's the Tata Nano for me.

I'm looking at checkmate and trying not to believe it. But that's my problem; the difference between Western waster education and Chinese school is too clear. And we'll be a sort of nationwide museum of once-were-workers. But I don't want to live in the past.

Quality down, as well as prices up

Monday, April 21, 2008

£50 billion liquidity injection - what does it mean?

In 1936, the Aga Khan was presented with his weight in gold, then 220 lb, or c. 100 kg. Gold currently sells for £14,891.58 per kilo, making the Aga Khan's weight in gold worth £1.49 million in today's prices. However, 100 kg of £50 notes is worth £3.85 million. The £50 notes would weigh as much as 13,027 Aga Khans, but would be worth 33,576"gold-priced Aga Khans".

Or, in pre-crash property terms: it is reported that Sheikh Hamad paid £100 million last year for a penthouse overlooking Hyde Park. Mervyn King has just pledged 500 "Hamads" (or over 700 "Updown Courts", if you prefer).

Or, in height terms:

1 ream of paper (500 sheets) is 5.4 cm thick. So 1 billion £50 notes would make a pile 108 kilometres, or 67.1 miles, high.

Were the Aga Khan of that time to have been the height of the average British man of today (5 ft 9 in, or 1.753 metres), £50 billion would equate to a stack of "gold-priced Aga Khans" (without shoes) almost 59 kilometres high. *

The lowest layer of the Earth's atmosphere, the troposphere, varies from 8km at the poles to 16km over the equator; the ionosphere starts at an altitude of about 80 km, and the US Air Force considers "space" to begin at 81 km.

Perhaps it would be simpler to use a new unit: the "government fudge", one box of which costs £50 billion.

By the way: hands up all those who believe the Prescott bulimia story, of which up to now there was not one breath? Now, hands up all those who have an explanation as to why this story should appear this weekend?

* I think this shows that the Aga Khan was worth twice his height in £50 notes.

Sunday, April 20, 2008

Saturday, April 19, 2008

On freedom

Like a musical string, its harmony relies on bounds. It is the tension between tyranny and anarchy, a common land affording refuge from public and private oppression. It is not lawless. Liberty is to defy another's rule; freedom, to obey one's own; free doom, the "freo la3e" of La3amon's Brut. No law, no freedom.

And now, confusedly and perhaps too late, we must begin to defend our freedom. Here in the once United Kingdom, our self-rule is fragmenting and being sold piecemeal to an unlicked bear-whelp of an aggregated foreign power; in the United States, many of the people and a handful of their representatives are calling for a rally around the principles of the Constitution, while the government becomes forgetful of its foundation. In both, there is economic mismanagement and perilous concentration of wealth. The Big Brother of a political power cutting itself free from popular franchise has his arm round the shoulder of Big CEO, whose business no longer depends on the community from which it sprang. The land will be cleared or peopled at its masters' pleasure; they will move us between their pastures for their profit. The movement will show us that the earth is not ours. We shall be rootless. We shall be dispossessed, wanderers, desperate hired men, like the landless Gregora of Scotland.

This is where we were some two centuries ago. It must all be fought for again, but perhaps, like the valiant tailor, we shall again find a way to overcome the rich and powerful who ravage our lands. Long before the battle, the American Revolution began to assemble its forces among a rabble of pamphleteers, philosophers, dissident clergy, smallholders, inventors, dreamers and adventurers. Every voice, however small, adds to the chorus.

My brother became an American citizen yesterday. Part of the ceremony was a homily, in which the presiding official said (was it a quotation from Jefferson?) that liberty was not passed down to one's children by nature, but by one's actions.

Although my brother has his own views on religion, and although I feel that America has, and has always had, much to learn in its foreign relations, it is without irony that I wish a blessing on America and the American people, and my newly American family.

UPDATE

Not Jefferson:

"Freedom is never more than one generation away from extinction. We didn't pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same, or one day we will spend our sunset years telling our children and our children's children what it was once like in the United States where men were free."

Ronald Reagan 40th president of US (1911 - 2004)

Friday, April 18, 2008

Denninger calls for a borrower's strike

Hi ho-ho, hi ho-ho

For the playful, you can join the game here.

Thursday, April 17, 2008

China sponsors African dams, for minerals

Tibetology

But is it possible that some of our own museums have an agenda or two?

Big Brother has a thin skin

htp: Schadenfreude

Wednesday, April 16, 2008

Weaknesses in US depositor protection

htp: Michael Panzner's "Financial Armageddon" blog.

Saturday, April 12, 2008

And after Tibet?

Friday, April 11, 2008

Defying gravity

So it's not just my perception. Read Karl "hold cash" Denninger's latest.

Thursday, April 10, 2008

The boom that wasn't

There is only one way that home prices where they are, even today, are sustainable - that would be for wages to rise by 30% across the board. That, of course, isn't going to happen, and if it did it wouldn't do you a bit of good because prices would simply rise to the same degree, leaving us exactly where we are now!..

There never was a "boom" in earnings power for middle America. The median family income - including all quintiles - was actually down $500 or so over the last eight years. If you exclude the top quintile it was down materially - 5% or so. And that's in nominal, not constant, dollars...

We're now going to adjust spending and investment levels to incomes because there is no way for us to adjust incomes to spending levels! The big productivity gains that came from computerization are finished, and we've already offshored nearly all of our manufacturing, so there's no more "cheap labor improvement" available either...

If we can keep the government from screwing things up with more vote-buying attempts we'll get through the other end of this, although people's standards of living will change. You won't be able to afford to milk your house for the second Lexus and six plasma TVs, but is this really such a disaster? I think not.

Read the whole thing in all its beauty here.

Next task, when I have the time, is to see what happened to the middle quintiles in the UK.

Monday, April 07, 2008

It really, really is a swindle

Where are the police?

UPDATE

I've been directed (see comments) to this video, "Money as debt", by Canadian Paul Grignon:

Here are the artist's own comments; here's the dedicated website; here's his professional artist's website; and here's a link to the Idaho Observer, with a little extra detail on the making of the film - cut off the last part of the address to see more of the Observer's output.

Whether it's right or wrong, simplistic or not, I'm heartened to see practical idealism like this.

FURTHER UPDATE

Karl Denninger explains why the money-lenders won't permit inflation to run away and destroy the basis of their wealth. And why this means the economy will hit the buffers.

If history repeats itself

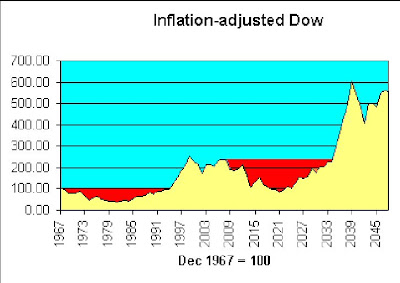

What I didn't think to do then, is to illustrate the shape of the Dow if it continues to be as volatile as in the last 40 years. So here goes - same average growth, same inflation rate etc:

It's the volatility that does you in. As Keynes said, "In the long run..."

It's the volatility that does you in. As Keynes said, "In the long run..."

Matter of fact, if history repeats itself, there's a point around 2021 where in real terms, we're behind where we were in 1967. This time, I will buy beads and wear flares. I'd still be younger than Robert Graves was last time round.

Chirpy

Here he says that America's freedom and creativity will overcome present problems, as they have in the past; here he says the housing market can't be too bad if workers are unwilling to sell their houses in a falling market; and here he claims to love America's trade deficit.

Is he right? Or just seeing affairs from the point of view of a man who's had a good dinner and is assured that, in his case, good dinners will never stop coming? I've often thought that war movies should end prematurely and at different points for a random selection among, say, 20% of the audience, to remove the Olympian perspective.

But it is nice to read someone who thinks it's not all gloom and doom.

Sunday, April 06, 2008

Banks, usury and slavery

Since 1963, the M4 money supply has grown by an average of slightly under 13.5% per year. So that would be about 11% p.a. relative to GDP.

This means that bank lending, as a proportion of GDP, doubles every 7 years.

How long can this continue? How long before we are completely robbed and enslaved? Or am I asking a fool's question?

Saturday, April 05, 2008

Awaiting the caning

Karl Denninger reports here that the Dow's price-earnings ratio may be overestimated by a factor of 4. And here, that financial institutions will have to bring Structured Investment Vehicles back onto their books within 12 months.

Karl Denninger reports here that the Dow's price-earnings ratio may be overestimated by a factor of 4. And here, that financial institutions will have to bring Structured Investment Vehicles back onto their books within 12 months.The reckoning - the painful correction - approaches.

Doug Noland (April 4) agrees:

It is my view that our economy will require a massive reallocation of resources. We will have to create much less non-productive (especially mortgage and asset-based) Credit and huge additional quantities of tradable goods. In the “services” sector, there will no choice but to “liquidate” labor and redirect its efforts. Throughout finance, there will be no alternative than to “liquidate” bad debt, labor and insolvent institutions – again in the name of a necessary redirecting of resources. After an unnecessarily protracted boom, there will be scores of enterprises that will prove uneconomic in the new financial and economic backdrop. “Liquidation” will be unavoidable.

Will our wise leaders in the UK learn from this?

P.S. How come (Denninger, here) the Dow p/e appears out of whack by 53:13, but the S&P 500 only 20:14? The latter implies only a possible 30% drop, which is a bit less apocalyptic than the 75+% of the Dow!

Generally the Dow and the S&P have followed similar trajectories over various periods, with a little widening in the last 12 months:

Friday, April 04, 2008

Thursday, April 03, 2008

Fishy business in the gold market

Does asset inflation help support stock prices?

You are right, but I believe that this time around it will be equities, rather than commodities or real estate that will provide the hedge against coming inflation. Tobin's Q will prevail due to the juxtaposition of equity prices vs. the other two asset classes (which already had their surges) and the market's increasing valuation sophistication compared to the last time we saw hyperinflation in developed economies (i.e. the 1970s). So I've been buying stocks as an inflation hedge, despite the statistical evidence that this is foolish...

Wikipedia offers an explanation of Tobin's Q here. Essentially, Q is a measure of the relationship between the value of all a company's shares, and the value of the company's assets. If Q is greater than 1, there is some reason (real or imaginary) why the company has extra value to offer; if less than 1, a share investor could buy a company's underlying assets at a discount.

In 2006, Michael Alexander wrote a series of articles for Safe Haven, about stock cycles. Below, from the second in the series, is his graph for Q in several bear markets, including the one which he suggests began in 2000:

According to this, Q was already below 1 in 2006, and since the market is now back to about where it was a couple of years ago, that would suggest that shares are now fairly valued in relation to company assets.

But if history repeats itself, the current bear market has a long way to go, since the other three lasted 15 - 20 years. And in each of the previous cycles, Q slumped below 0.4.

Another complicating factor, thanks to the lending boom, is the real estate bubble. Steve Moyer is firmly of the opinion that real estate is very heavily overvalued, even now. So a collapse in that market would push Tobin's Q back up for many companies, a technical indication that share prices would have to drop steeply to get back to fair value (let alone overshoot to below Q=0.5).

In this context, it's worth noting that one of Mike Alexander's books, published in 2000, is titled "Stock Cycles: Why stocks won't beat money markets over the next twenty years".

Wednesday, April 02, 2008

Is inflation negatively correlated with real stock values?

Obviously, this isn't exactly news - a quick Google leads me to this book by Alicia Haydock Munnell, where she says "The long-run negative correlation between stock prices and the rate of inflation has been confirmed in several statistical studies." Yet another academic study says "The bivariate results for the real stock returns-inflation pair weakly support a negative correlation in the 1970s and 1980s."

But what if we compare real stock prices with changes in the inflation rate? So I've done something childishly simple - perhaps childishly wrong, I await your correction:

First ("L2/J2"), I divided the FTSE index by the RPI index (end December figures in both cases); since the FTSE has grown in real terms by only about 1.6% p.a. since 1970, I think this should reduce some of the statistical noise - in effect, we have the inflation-adjusted value of the FTSE for each year end.

Then I looked at how much the RPI index had changed, year on year, expressed as a percentage.

Then I used Excel to calculate the correlation between the two sets of data. The figure (as you see at the bottom of the sheet) is (0.711). I may be mistaken but I think this shows that there is a strong negative correlation between changes in the inflation rate, and changes in the inflation-adjusted capital value of the FTSE.

(By contrast, the correlation between the annual percentage increase in RPI, and the annual percentage increase/decrease in the FTSE, is only 0.275576.)

Tuesday, April 01, 2008

Panic overstated?

40 years on from the Summer of Love. Here's a chart I made to show the capital value of the Dow at the end of each calendar year.

I used Yahoo! for Dow valuations (ex dividends); rebased them so that Dec 1967 = 100; and adjusted for cumulative inflation as per Inflation Data's calculator.

Theoretically, someone investing a sum in the Dow at the end of 1967 would have had to wait 28 years to see it return to its original (inflation-adjusted) value.

But over the whole 40 years, the averaged return is 2.175% per annum compounded, which is very close to the 2.2% p.a. real capital growth on the S&P 500 (1871-2006) illustrated in the previous post.

These long views suggest that the Dow's recent 12-year zoom is merely a kind of rebalancing. In this context, it's interesting to see that as of September 2007, the price-earnings ratio of the S&P 500 is not far off its average over the period since 1871. The fall in stock valuations since then should have brought the p/e ratio even closer to the norm.

By way of comparison, here below is the result of a similar exercise for the FTSE, though I have been unable to go back further than 1970. Again, it's the close at end December each year up to 2007, adjusted in this case for RPI. FTSE stats from Wren Research, RPI from here and (for the latest 2 years) here.

The overall shape looks fairly similar to that of the Dow over the same period. Average capital gain over 37 years is c. 1.6% p.a. compounded.

Dow & S&P500 adjusted for inflation - importance of dividends

Source: The Big Picture

Source: The Big PictureSource: Inflation Data

Monday, March 31, 2008

Saturday, March 29, 2008

Thursday, March 27, 2008

Recent newspage updates

From "The Big Picture" blog

From "The Big Picture" blogDumping of US treasuries imminent, starting with Korea, says Burnick

Don Boudreaux interviewed (by a colleague) on his liberal econ book "Globalization"

"Not until total debt comes down to a realistic number can a real recovery take place. If debt is to be destroyed to that magnitude the deflation will be monstrous."

Mish: "Germany fears global meltdown"

Hutchinson: new financial system by 2013

Derivatives: Banking capital "insufficient to handle even one per cent of potential losses."

"Matt" on US M3, the money supply, inflation

California realtors report house prices collapsing (htp: Drudge Report, LA Times)

Skills shortgage hampering US job repatriation, says AT&T chief (htp: Drudge Report)

KPMG criticised for allegedly poor auditing of failed US mortgage firm (htp: Drudge Report)

2008 US durable goods report: semiconductors down sharply since New Year (htp: Karl Denninger)

Monty Guild: stock rally if mortgage bond market stabilises; invest in non-leveraged areas

Wednesday, March 26, 2008

USA - Economy (latest in RED)

"Matt" on US M3, the money supply, inflation

California realtors report house prices collapsing (htp: Drudge Report, LA Times)

Skills shortgage hampering US job repatriation, says AT&T chief (htp: Drudge Report)

2008 US durable goods report: semiconductors down sharply since New Year (htp: Karl Denninger)

Brad Setser presentation (Sept 2006): "Chinese Financing of the United States"

"Naked Capitalism"blog: "China now buys a lot of US debt through London..."

In 2007, UK increased holding of US public debt by 224% to $300 bn, Japan reduced by $50 bn

Major sectors of US economy already in foreign hands

Sub-prime and Credit Crunch (latest in RED)

"Not until total debt comes down to a realistic number can a real recovery take place. If debt is to be destroyed to that magnitude the deflation will be monstrous."

Mish: "Germany fears global meltdown"

Hutchinson: new financial system by 2013

Derivatives: Banking capital "insufficient to handle even one per cent of potential losses."

California realtors report house prices collapsing (htp: Drudge Report, LA Times)

KPMG criticised for allegedly poor auditing of failed US mortgage firm (htp: Drudge Report)

More on the "sucker clause"

Denninger: JPM may have been forced to bid more for Bear Stearns by trick clause

Subprime explained using stickman cartoons (htp: Neatorama)

"Wat Tyler": UK GDP to fall 1.3%

Wagner: Goldman thinks recession means 30% house price drop, 39% mortgages in negative equity

Amerman: 2007 subprime a prelude to much bigger potential crisis

Denninger: house prices to fall 15% - 50%

China's need to expand territory (latest in RED)

Chinese incursions into Arunachal Pradesh (2007 story)

"China Watch" from Jane's Intelligence Review

Official Chinese government website (incl. environment & international issues)

China angling for territory swap with India

Russia's north-eastern border with China: future tensions?

"Maps published in China show Burma as part of Chinese territory"

Unsustainable exploitation of Tibet's natural resources by China

Lovelock: "China uninhabitable by 2040"

Dr William Gray disagrees, predicts cooling within next 10 years (audio)

Chinese agricultural production "could drop 10% by 2050" because of climate change

Climate change in Tibet threatening East Asia's water supply