Monday, April 07, 2008

It really, really is a swindle

Where are the police?

UPDATE

I've been directed (see comments) to this video, "Money as debt", by Canadian Paul Grignon:

Here are the artist's own comments; here's the dedicated website; here's his professional artist's website; and here's a link to the Idaho Observer, with a little extra detail on the making of the film - cut off the last part of the address to see more of the Observer's output.

Whether it's right or wrong, simplistic or not, I'm heartened to see practical idealism like this.

FURTHER UPDATE

Karl Denninger explains why the money-lenders won't permit inflation to run away and destroy the basis of their wealth. And why this means the economy will hit the buffers.

If history repeats itself

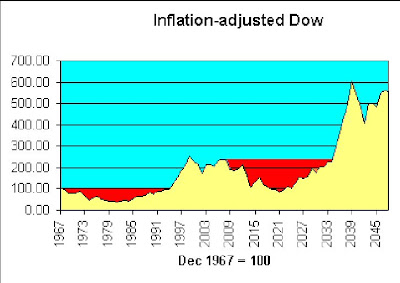

What I didn't think to do then, is to illustrate the shape of the Dow if it continues to be as volatile as in the last 40 years. So here goes - same average growth, same inflation rate etc:

It's the volatility that does you in. As Keynes said, "In the long run..."

It's the volatility that does you in. As Keynes said, "In the long run..."

Matter of fact, if history repeats itself, there's a point around 2021 where in real terms, we're behind where we were in 1967. This time, I will buy beads and wear flares. I'd still be younger than Robert Graves was last time round.

Chirpy

Here he says that America's freedom and creativity will overcome present problems, as they have in the past; here he says the housing market can't be too bad if workers are unwilling to sell their houses in a falling market; and here he claims to love America's trade deficit.

Is he right? Or just seeing affairs from the point of view of a man who's had a good dinner and is assured that, in his case, good dinners will never stop coming? I've often thought that war movies should end prematurely and at different points for a random selection among, say, 20% of the audience, to remove the Olympian perspective.

But it is nice to read someone who thinks it's not all gloom and doom.

Sunday, April 06, 2008

Banks, usury and slavery

Since 1963, the M4 money supply has grown by an average of slightly under 13.5% per year. So that would be about 11% p.a. relative to GDP.

This means that bank lending, as a proportion of GDP, doubles every 7 years.

How long can this continue? How long before we are completely robbed and enslaved? Or am I asking a fool's question?

Saturday, April 05, 2008

Awaiting the caning

Karl Denninger reports here that the Dow's price-earnings ratio may be overestimated by a factor of 4. And here, that financial institutions will have to bring Structured Investment Vehicles back onto their books within 12 months.

Karl Denninger reports here that the Dow's price-earnings ratio may be overestimated by a factor of 4. And here, that financial institutions will have to bring Structured Investment Vehicles back onto their books within 12 months.The reckoning - the painful correction - approaches.

Doug Noland (April 4) agrees:

It is my view that our economy will require a massive reallocation of resources. We will have to create much less non-productive (especially mortgage and asset-based) Credit and huge additional quantities of tradable goods. In the “services” sector, there will no choice but to “liquidate” labor and redirect its efforts. Throughout finance, there will be no alternative than to “liquidate” bad debt, labor and insolvent institutions – again in the name of a necessary redirecting of resources. After an unnecessarily protracted boom, there will be scores of enterprises that will prove uneconomic in the new financial and economic backdrop. “Liquidation” will be unavoidable.

Will our wise leaders in the UK learn from this?

P.S. How come (Denninger, here) the Dow p/e appears out of whack by 53:13, but the S&P 500 only 20:14? The latter implies only a possible 30% drop, which is a bit less apocalyptic than the 75+% of the Dow!

Generally the Dow and the S&P have followed similar trajectories over various periods, with a little widening in the last 12 months:

Friday, April 04, 2008

Thursday, April 03, 2008

Fishy business in the gold market

Does asset inflation help support stock prices?

You are right, but I believe that this time around it will be equities, rather than commodities or real estate that will provide the hedge against coming inflation. Tobin's Q will prevail due to the juxtaposition of equity prices vs. the other two asset classes (which already had their surges) and the market's increasing valuation sophistication compared to the last time we saw hyperinflation in developed economies (i.e. the 1970s). So I've been buying stocks as an inflation hedge, despite the statistical evidence that this is foolish...

Wikipedia offers an explanation of Tobin's Q here. Essentially, Q is a measure of the relationship between the value of all a company's shares, and the value of the company's assets. If Q is greater than 1, there is some reason (real or imaginary) why the company has extra value to offer; if less than 1, a share investor could buy a company's underlying assets at a discount.

In 2006, Michael Alexander wrote a series of articles for Safe Haven, about stock cycles. Below, from the second in the series, is his graph for Q in several bear markets, including the one which he suggests began in 2000:

According to this, Q was already below 1 in 2006, and since the market is now back to about where it was a couple of years ago, that would suggest that shares are now fairly valued in relation to company assets.

But if history repeats itself, the current bear market has a long way to go, since the other three lasted 15 - 20 years. And in each of the previous cycles, Q slumped below 0.4.

Another complicating factor, thanks to the lending boom, is the real estate bubble. Steve Moyer is firmly of the opinion that real estate is very heavily overvalued, even now. So a collapse in that market would push Tobin's Q back up for many companies, a technical indication that share prices would have to drop steeply to get back to fair value (let alone overshoot to below Q=0.5).

In this context, it's worth noting that one of Mike Alexander's books, published in 2000, is titled "Stock Cycles: Why stocks won't beat money markets over the next twenty years".

Wednesday, April 02, 2008

Is inflation negatively correlated with real stock values?

Obviously, this isn't exactly news - a quick Google leads me to this book by Alicia Haydock Munnell, where she says "The long-run negative correlation between stock prices and the rate of inflation has been confirmed in several statistical studies." Yet another academic study says "The bivariate results for the real stock returns-inflation pair weakly support a negative correlation in the 1970s and 1980s."

But what if we compare real stock prices with changes in the inflation rate? So I've done something childishly simple - perhaps childishly wrong, I await your correction:

First ("L2/J2"), I divided the FTSE index by the RPI index (end December figures in both cases); since the FTSE has grown in real terms by only about 1.6% p.a. since 1970, I think this should reduce some of the statistical noise - in effect, we have the inflation-adjusted value of the FTSE for each year end.

Then I looked at how much the RPI index had changed, year on year, expressed as a percentage.

Then I used Excel to calculate the correlation between the two sets of data. The figure (as you see at the bottom of the sheet) is (0.711). I may be mistaken but I think this shows that there is a strong negative correlation between changes in the inflation rate, and changes in the inflation-adjusted capital value of the FTSE.

(By contrast, the correlation between the annual percentage increase in RPI, and the annual percentage increase/decrease in the FTSE, is only 0.275576.)

Tuesday, April 01, 2008

Panic overstated?

40 years on from the Summer of Love. Here's a chart I made to show the capital value of the Dow at the end of each calendar year.

I used Yahoo! for Dow valuations (ex dividends); rebased them so that Dec 1967 = 100; and adjusted for cumulative inflation as per Inflation Data's calculator.

Theoretically, someone investing a sum in the Dow at the end of 1967 would have had to wait 28 years to see it return to its original (inflation-adjusted) value.

But over the whole 40 years, the averaged return is 2.175% per annum compounded, which is very close to the 2.2% p.a. real capital growth on the S&P 500 (1871-2006) illustrated in the previous post.

These long views suggest that the Dow's recent 12-year zoom is merely a kind of rebalancing. In this context, it's interesting to see that as of September 2007, the price-earnings ratio of the S&P 500 is not far off its average over the period since 1871. The fall in stock valuations since then should have brought the p/e ratio even closer to the norm.

By way of comparison, here below is the result of a similar exercise for the FTSE, though I have been unable to go back further than 1970. Again, it's the close at end December each year up to 2007, adjusted in this case for RPI. FTSE stats from Wren Research, RPI from here and (for the latest 2 years) here.

The overall shape looks fairly similar to that of the Dow over the same period. Average capital gain over 37 years is c. 1.6% p.a. compounded.

Dow & S&P500 adjusted for inflation - importance of dividends

Source: The Big Picture

Source: The Big PictureSource: Inflation Data

Monday, March 31, 2008

Saturday, March 29, 2008

Thursday, March 27, 2008

Recent newspage updates

From "The Big Picture" blog

From "The Big Picture" blogDumping of US treasuries imminent, starting with Korea, says Burnick

Don Boudreaux interviewed (by a colleague) on his liberal econ book "Globalization"

"Not until total debt comes down to a realistic number can a real recovery take place. If debt is to be destroyed to that magnitude the deflation will be monstrous."

Mish: "Germany fears global meltdown"

Hutchinson: new financial system by 2013

Derivatives: Banking capital "insufficient to handle even one per cent of potential losses."

"Matt" on US M3, the money supply, inflation

California realtors report house prices collapsing (htp: Drudge Report, LA Times)

Skills shortgage hampering US job repatriation, says AT&T chief (htp: Drudge Report)

KPMG criticised for allegedly poor auditing of failed US mortgage firm (htp: Drudge Report)

2008 US durable goods report: semiconductors down sharply since New Year (htp: Karl Denninger)

Monty Guild: stock rally if mortgage bond market stabilises; invest in non-leveraged areas

Wednesday, March 26, 2008

USA - Economy (latest in RED)

"Matt" on US M3, the money supply, inflation

California realtors report house prices collapsing (htp: Drudge Report, LA Times)

Skills shortgage hampering US job repatriation, says AT&T chief (htp: Drudge Report)

2008 US durable goods report: semiconductors down sharply since New Year (htp: Karl Denninger)

Brad Setser presentation (Sept 2006): "Chinese Financing of the United States"

"Naked Capitalism"blog: "China now buys a lot of US debt through London..."

In 2007, UK increased holding of US public debt by 224% to $300 bn, Japan reduced by $50 bn

Major sectors of US economy already in foreign hands

Sub-prime and Credit Crunch (latest in RED)

"Not until total debt comes down to a realistic number can a real recovery take place. If debt is to be destroyed to that magnitude the deflation will be monstrous."

Mish: "Germany fears global meltdown"

Hutchinson: new financial system by 2013

Derivatives: Banking capital "insufficient to handle even one per cent of potential losses."

California realtors report house prices collapsing (htp: Drudge Report, LA Times)

KPMG criticised for allegedly poor auditing of failed US mortgage firm (htp: Drudge Report)

More on the "sucker clause"

Denninger: JPM may have been forced to bid more for Bear Stearns by trick clause

Subprime explained using stickman cartoons (htp: Neatorama)

"Wat Tyler": UK GDP to fall 1.3%

Wagner: Goldman thinks recession means 30% house price drop, 39% mortgages in negative equity

Amerman: 2007 subprime a prelude to much bigger potential crisis

Denninger: house prices to fall 15% - 50%

China's need to expand territory (latest in RED)

Chinese incursions into Arunachal Pradesh (2007 story)

"China Watch" from Jane's Intelligence Review

Official Chinese government website (incl. environment & international issues)

China angling for territory swap with India

Russia's north-eastern border with China: future tensions?

"Maps published in China show Burma as part of Chinese territory"

Unsustainable exploitation of Tibet's natural resources by China

Lovelock: "China uninhabitable by 2040"

Dr William Gray disagrees, predicts cooling within next 10 years (audio)

Chinese agricultural production "could drop 10% by 2050" because of climate change

Climate change in Tibet threatening East Asia's water supply

Investment (latest in RED)

From "The Big Picture" blog

From "The Big Picture" blogMonty Guild: stock rally if mortgage bond market stabilises; invest in non-leveraged areas

Faber: historically, volatility bad for investors - stay out, take your girl on holiday

Falling US dollar threatens yen "carry trade", could trigger investment crisis

Gold a haven in crisis, NOT a long-term inflation-adjusted investment

Henry To: Cash-to-equity ratio at 20-year high, US stock market "oversold"

Denninger: Deleveraging of hedge funds may hit equities, commodities

Saturday, March 22, 2008

Inflation - UK (latest in RED)

Prof. Costas Milas: M4 money supply growth up to 10% p.a. not significantly inflationary

M4 expansion offset by declining velocity of money (see 2005 slide below) (plus UK M4 in £billions, below, right)

.

.

.

.

.

.

.

.

.

BoE Bulletin (Q3 2007): "Interpreting Movements in Broad Money"

Monday, March 17, 2008

Intermission

Sunday, March 16, 2008

Wise after the event

I'm don't know what the economics editor of one of the UK's most successful papers earns, but I'd be happy for him to earn double if he could tell us all this "it was so obvious" stuff BEFORE the crisis.

Not that it couldn't have been foreseen. In the late 90s, I was so concerned at US debts and the massive zoom in tech stocks driving the FTSE and Dow into the stratosphere, and so apprehensive of what I thought would be the inevitable aftermath, that I warned clients not to get into the frenzy, reminded them they had an option to switch into cash, moved my wife's pension savings into cash, and (despite the awfulness of modern British schools) resumed teaching as well as holding onto the financial advice business.

Am I wise? No, I listened to what many others were saying, and wasn't blinded by greed. But I wouldn't have learned it from the papers.

And the smugness! "Above all, the current crisis will force us to relearn one of the oldest lessons of all, one from neither the Seventies nor the Thirties but the wisdom of the centuries: that what you owe, you must one day repay." The credit bubble was created by banks, permitted by regulators and governments, and exploited by financial engineers and intermediaries - yet it is the private debtor and the taxpayer that will pay. Don't hold your breath waiting to see unemployed bankers selling the Big Issue.

Back to 2003

I am updating expectations for this Bear Market; I no longer believe 1070 on the SPX will hold, and have now moved to the camp that sees the potential for the S&P to retrace all of the 2003-2007 Bull Market's gains, taking us back to around 800 on the SPX.

In the UK, the FTSE closed at 3,287.00 on 12 March 2003.

Forgive us our debts, Part 2

Caronte, you say:

Suppose it is believed with absolute certainty that every 50 years, say every year divisible by 50, all debts are forgiven. There would follow a bunching of loan demand as the forgiveness date nears, while willing lenders would simultaneously vanish. The market would no longer match credit demand and supply, total welfare would suffer. Debt forgiveness would only avoid this problem if it was done by stealth, unpredictably, once and for all and never again. Like forgiveness of tax evasion or illegal buildings. Difficult to persuade debtors, (or builders, or taxpayers), that forgiveness would not occur again. Lots of people would be encouraged to borrow beyond what they can afford (or evade tax) – the moral hazard implication. Unsustainable indebtedness would multiply rather than disappear. Moreover, a defaulting borrower does not need forgiveness if she genuinely cannot pay: can’t pay, won’t pay, period. If the defaulting borrower has some residual wealth, though less than the outstanding loan, who is to deprive the creditor of that? What legal or moral right would support state action without creditor compensation?

I say:

Caronte, welcome, and many thanks for the length and thoughtfulness of your response. I don't pretend to have your economic expertise, but I still think there's a debate to be had. I'll try to tackle some of your points, not necessarily in strict order.

I suppose that in ancient Israel, the economy was not so monetised as today, so the advent of the year of Jubilee may not have been so disruptive as it would today. I don't really advocate a periodic debt cancellation - though I'm beginning to wonder about the necessity of charging interest. (Isn't it the case that some Swiss banks do in fact charge you for looking after your money securely, instead of making investments with it or lending it out to others?)

Competition between lenders may help keep down interest rates, but it's the ballooning of asset prices - and the consequent increase in the size of mortgage required - that causes the damage. So many are now locked into monster mortgages that a significant rise in interest rates - which otherwise might be appropriate for tackling inflation - is politically very unfeasible.

I argue that the price of houses is pretty much beyond the buyer's control, except that there's a point where a purchase is either not affordable (we seem to have reached that stage) or, as with subprime, fudged at the outset with disastrous consequences later. So I suggest the expansion of credit (for which, as you say, regulators also share responsibility), and the terms set by fee-hungry lenders and intermediaries, are more to blame than the family that wants a roof over its head it can call its own. Finance for cars and consumer goods is something else; a house is a necessity, and surely, owning one is not an unreasonable aspiration.

Banks should be, but are not being made to face the consequences - look how governments are propping-up Northern Rock and Bear Stearns.

Debt reduction does not seem unreasonable to me. If a life insurance company fails, the book of life business can be passed on to another provider, who is only required to underwrite 90% of the outstanding life cover. So why not for lenders who (through greed and stupidity) have gotten their sums wrong? A 10% reduction in the capital only represents a couple of years' interest. Better a borrower who repays a reasonable proportion of the loan, plus interest, than simply mail back the keys and leave the bank with illiquid stock it doesn't know how to manage.

Here in the UK, you can enter an agreement with creditors and as long as you keep up the scheduled payments, interest charging stops altogether. Maybe that would be another way forward - the monthly repayment would be lower and the borrower would see his equity in the house increase over time.

We've been watching enslavement by money-owners who have been licensed to print almost unlimited amounts of their own money, but the poor man only feels it going past and can save none, so remains in debt-bondage. Better any reasonable rearrangement, than "I owe my soul to the company store".

Saturday, March 15, 2008

Market timing

The forecast price-earnings ratios of the S&P 500 for 2008 range from 18.69 to 22.20. This does not bode well for long-term retirement investments made now. If the p/e ratio from the current c. 20 to 16, this would imply a share price decline of 20%, and even then you'd outlive your income in 30% of cases. A p/e of 12 requires shares to drop now by 40%, and that still means a one-in-five chance of running out of cash.

It looks as though, rather than fear a major crash, we should hope for one - as long as we're in cash or something else that's relatively safe and liquid.

Forgive us our debts

"Hatfield Girl" gives a very vivid picture of our slow slide into dingy, shabby poverty, and it has to be every sane person's earnest wish that we (or our fellow citizens) don't return to the conditions so many suffered before the Second World War. Yet what is causing all this but the heavy chains of debt?

A disclaimer: I often feel that I not only know nothing, but never shall know anything, despite much effort. Then I see how the world is going, and wonder who knows better.

Having said that, I'm trying to work out why, as Karl Denninger says, we don't make the banks eat some of the debt they laid on us. In the comments to the Hatfield Girl piece linked above, "Caronte" refers to "moral hazard", a point I entirely accept. But I say that debt cancellation (or rather, reduction) would be a suitable punishment for the principal offender.

In our society, the relationship between mortgage lender and borrower is unequal. You have to live somewhere, and if you don't buy, you have to rent - and rents will tend to reflect the purchase price of houses.

So what determines the price of houses? Supply and demand. And a major element of demand is how much money is available. By adjusting the ratio of deposits to loans as it suits them, lenders can multiply the money supply, as everyone knows (I say everyone, but actually I don't think the public is fully aware of the simplicity and enormity of this scam). Since 2000 or so, the money in the economy doubled, and so, un-oddly I think, did the price of houses.

The lender can decide how much to lend into the market generally, and consequently influence it; the buyer cannot decide, on an individual basis, to halve the value of the type of house he wants in the area where he needs to live.

So by what right should lenders inflate asset prices, fix on them loans of money they created virtually ex nihilo, then deflate asset prices by reducing lending in difficult times, and expect the borrower to bear the full weight of the consequences?

The borrower may have colluded with the lender to take on an unsustainable debt (or one that exposed the borrower to excessive deflation risk), but for reasons already given I suggest it was a shotgun marriage (or a mass marriage, like those Moonie wedding rallies) with the lender handling the Purdey. For subprime borrowers, I think it's fair to argue that the class of people involved means that the lenders had far better knowledge of the implications, and so are far more culpable.

Rather than prop up the worst of the lenders, let them go down. Why should the taxpayer assume the burden? Pay off the depositors, but shrink the lending book - which is mostly funny money, less substantial in its origins than candy floss - a drop of ink on 80-gram paper.

To quote the inscription on the statue of Justice above the Central Criminal Court, "Defend the children of the poor and punish the wrongdoer." The trespasses of the mighty are less to be forgiven.

The silent watchdog

The long-serving Comptroller Generals, both in the USA and here the UK, have recently retired. The difference between them is that the American, David Walker, has spent two years on an increasingly well-publicised Cassandra mission to warn the public of future dire financial dislocation, because of unfunded liabilities such as medical care and pensions. I may be doing a disservice to Sir John Bourn, but I can't remember any media fuss about him going on such a tour here.

Looking at the website for the National Audit Office, I see that in the FAQs, the spelling of "comptroller" comes second, after a dry summary of the NAO's role. However, the "find" option on my Windows toolbar can find no occurrence of the following words in that web page:

disaster

bankruptcy

poverty

IMF

inflation

Some barking from its kennel would now be most welcome.

Thursday, March 13, 2008

In the know

Housing stall, after all?

If the financial victim next door has to sell his house at a 50% discount, that's all the more reason for you not to sell yours. If no-one sells voluntarily, how do you determine a real, as opposed to forced-sale value? So one effect of the housing drop could be a general slump in sales - with maybe a rise in home swaps for those who need to go to a different geographical area, perhaps for job reasons.

But what about people caught in negative equity? Here in the UK, ditching the house for less than the outstanding loan could leave you being chased for the balance, for years, unless you opt for bankruptcy. However, in the USA, many mortgages are on the roof but not on the borrower, leaving the lender short if the homeowner mails the keys back. Denninger has said more than once that borrowers need to consider this option solely on its financial/legal merits, as he thinks many lenders lost the moral argument when they knowingly advanced far too much to people who they knew couldn't maintain the loans. Now this could really upset the applecart.

Michael Panzner features a piece by FT columnist Martin Wolf. Wolf wonders what may happen if a high proportion of negative-equity homeowners default. The economic impact may be closer to Nouriel Roubini's $3 trillion, than to Goldman Sachs' more sanguine $1 trillion (the latter itself is a massive increase on the sort of figures bandied about before Christmas). Wolf sees two options:

There are two ways of adjusting the prices of housing to incomes: allow nominal prices to fall or raise nominal incomes. The former means mass bankruptcy and a huge fiscal bail out; the latter imposes the inflation tax.

But either option is so unattractive that (despite Denninger's image of paddling furiously as we head for the waterfall) there is a very strong incentive for fudge and delay. We've seen central banks pump many billions into the system in the last few days; and the ratings agencies seem to be trying their best to help maintain the status quo by not downgrading lenders as quickly and severely as some think they deserve. But again, housing is intrinsically illiquid, and houses aren't turned over rapidly like shares, which is why we have "mark to model" instead of "mark to market". What's the rush to crystallise a terrible loss now? Better a Micawberish hope that "something will turn up" than a grim Protestant insistence on an immediate collapse which would benefit very few people.

The real threat is this "jingle mail", and the potential consequences seem so dire that something creative may be done. Bankruptcy rules might be modified to protect lenders; maybe portions of recent loans may be written-off. How about part-ownership, part-rent, as with UK housing associations - having escaped the trailer park, many first-time homeowners may want to keep their foot on that first rung of the ladder. Not everyone will want to pour engine oil into the carpet and trash the light fittings.

So I think we will have fudge, delay and attempts at more creative solutions, and a long stall in the housing market. Unless there's another hammer blow that the system simply can't take, such as an explosion in the financial derivatives market, as arch-doomster Marc Faber expects and (in his inherited Swiss Protestant way) hopes. In that case, every sign we've seen so far is that our governments will run the money-presses white-hot rather than face major deflation. We all have an incentive to paddle away from the brink.

Wednesday, March 12, 2008

Put your hand in a parting wave

Unbelievable, unimaginable

Michael Panzner reproduces an article by Paul Farrell in MarketWatch about the absolutely enormous international derivative market, currently estimated at $516 trillion. Those numbers are beyond imagining, but if 2% goes bad, that's equivalent to 20% of the world's annual GDP up the chimney.

Tuesday, March 11, 2008

Lessons from Japan

• Condition 1. Bad loans made during the boom years must be written off as losses during the bust. This cleanses the banking system from the toxins of the boom.

• Condition 2. Weak businesses should be liquidated during the bust, rather than propped up by the government or the banks. These bankruptcies and liquidations shift scarce resources to more productive uses

• Condition 3. Finally, Interest rates must rise sufficiently to restore proper valuations in the capital markets, and therefore allow stocks and bonds to fall in value relative to consumer goods. This realigns properly the price ratio of capital goods to consumer goods.

Now, I suppose, it's our turn.

Money has poured out of Japan over the years, looking for better yields elsewhere, but Petrov is not at all sure that when the "carry trade" reverses, the Japanese market will rise. He thinks a more interesting bet is on the rise of the Yen in the foreign exchange market. And that's a poker game I don't have the confidence to join.

Pure gold

1. He thinks that we're only part way through the stock market decline:

Have you ever noticed that the "crooners" on Television never tell you to get out at or near the top, and call it a "buying opportunity" all the way down? Well gee, the last time they did this it only took 7 years before you were back to "even", and of course that's before price inflation ate up all your money.

I think he's right - mostly, the financial sections in the papers seem to me hardly better than celeb gossip.

2. Following on from this, he offers a technical tip on spotting turning points between bull and bear markets

... you buy the SPY (or a S&P 500 mutual fund such as VFINX) when the 20 week moving average crosses the 50 week moving average by more than 1%, and you go to cash (or treasuries) when the 20 week moving average crosses the 50 week moving average in the downward direct by more than 1%.

Being in the right asset class at the right time, as judged by this measure, beats those who stay in the market all the time. Denninger does warn that although it's been true for the last 20 years, it may not hold true forever.

Why safe investments aren't

Monday, March 10, 2008

Property slump or stall?

This BBC survey says the average semi (a standard unit of housing, one would think) is "worth" slightly over £200,000; official statistics put household income at £33,492. So houses cost around six times earnings.

That suggests a 50% drop is due. But as Keynes observed with wages, house prices tend to be "sticky downward": no-one is in a hurry to realize a big loss on their home equity. Death, divorce and redundancy may force some sales; others may choose to wait, or go for house swaps.

Or wages could double. Up till recently, it was a standard assumption that "inflation" would run at 2.5% p.a. and wage increases 2% above that. Using the "Rule of 72", it would take 16 years of 4.5% wage increases to double nominal incomes.

Whether wages will always rise in real terms, is another matter. One of the effects of globalization is to hold down wages in the developed countries; and food and energy costs look as though they will continue to rise as the rest of the world gets richer and more populous.

Marc Faber speaks on the crisis

Bernanke's policies will destroy the dollar; he should have gone to Zimbabwe. Property assets in a bubble, but bonds (except maybe for some carefully-researched junk bonds!) also likely to be a victim of inflation. Emerging markets worse than the Dow. Deflation may hit the dollar through devaluation, rather than the nominal value of US equities. Commodities (e.g. gold) were at an inflation-adjusted 200-year low in the late 90s, so even after the recent rises they're not overvalued. Derivatives (NOT the packaged ones) will blow up in the next 3 - 6 months. He hope a major bank will fail and reintroduce discipline into the system.

Have you noticed how cheerful gloomy types get when disaster hits?

Sunday, March 09, 2008

Another toiler in the vineyard

That's not an ironic comment. It seems to me that America's most precious heritage is not her wealth, but her love of liberty and her distrust of power. She has been seduced by Mammon and Empire, and the undoubted difficulties we face may turn out to be the last-minute rescue, the ram caught in the thicket.

Deus ex machina

- He complains that 23A exemption letters and the recent TAF facility are being used to hide the scale of banking problems from the public.

- He points out that over the last 100 years, local house prices trend to 3 times median local income (work that out for your own house).

- He lists action points to make the system transparent and honest - even though some lenders will be immediately destroyed, like the little slips of flash-burn paper used by spies in Sixties movies.

- Imagine the conversation between interns on receipt of Denninger's fax;

- List the not-to-be-published reasons why nobody who could solve the problem, will;

- Compose the official reply.

Saturday, March 08, 2008

Another Ranter

Employment figures, the Thornburg collapse, Carlysle Group troubles, sky-high oil prices, rampant inflation, the dollar-crash, and neverending Fed bailouts of fast failing super banks are pounding the stake deeper and deeper into the global debt-vampire's heart. He will find his much-deserved rest before long. Unfortunately, the portfolios of careless and gullible retail investors, consisting largely of Dracula's debt-spawn, will die along with their master.

I'd give him a "Highly Commended" in the Sackerson's Prose Prize competition for that first, rolling sentence. But he gets pretty apocalyptic, too:

The next Dow-bottom will plumb depths not seen since the early 1990's, maybe even the 1980's!

The early 90s saw the Dow around the 3,000 - 5,000 range. Eat that, Robert McHugh.

Then he shoots for the moon:

... gold can easily go past $3,000 per ounce this year

- and makes a reckless recommendation:

If anyone still has money in any stocks or mutual funds, it's time to exit.

Overstated, I think - but completely wrong? Maybe not.

Another 42 stars?

Except I don't think the EU or its North American equivalent are driven by sinister motives; just venal ones. Concentrating wealth and power makes very juicy opportunities, provided you can simplify the command structure. All that consulting the common people and getting their agreement is so tedious.

Democracy is inconvenient, by design. I think the thirteen stripes on "Old Glory" remain there, not just as a historical quirk, but to remind the Federal Government that it's very important to say "please" and "thank you". Even in the first go at making the nation, Maryland, Delaware and New Jersey chose to delay the ratification of the Articles of Confederation, until certain issues had been resolved to their satisfaction.

Here's to the awkward squad.

Survivalism

I sent a circular to my clients in the late 90s, urging them to take out redundancy insurance, because I thought the coming stockmarket crash would be followed by recession; but of course I didn't anticipate that the government would use monetary inflation to defer the reckoning (and, I now fear, make it worse). Articles like Coffey's are straws in the wind, I think.

Diversity, dispersion and disconnection

The dollar will bounce around before starting to take off. So far, we've not seen people figure out the "rest of world will be f***ed", but if you think the exchange rate problems won't lead to that, you're sadly mistaken. Beware.

The bigger they are, the harder they fall

Unlike past housing crises, the banking sector is far less well equipped to cope with the fallout because of the wave of banking consolidation in the last decade. [...] This means the pain has become concentrated among a small handful of institutions, all of whom play a crucial role in keeping all markets liquid.

I recently quoted this Contrary Investor article, which includes a graph of the ballooning exposure of American banks to credit default swaps (CDS), under which arrangement everybody insures everybody else. The risk is 99%+ concentrated into only SIX banks.

Who benefits from such concentrations? I commented on Panzner's site:

Concentration of finance into an ever-smaller number of giant banks is inherently dangerous. You reduce the risks of small hazards, but you increase the potential damage from a Black Swan / fat tail event. Systemic safety is in diversity, dispersion and disconnection.

There is increasingly a conflict of interest between those who benefit from concentrations of power and wealth (think of the bonuses and cushy jobs), and the general populace. Wasn't the US Constitution itself specifically designed to prevent such concentrations?

In my view, the sub-prime contagion is not only spreading to other sectors of the economy, but beginning to call into question how big government, high finance and monstrous companies impact on the fundamental values of our (systematic and real in the USA, ramshackle and sham here in the UK) democracies.

It seems to me that small-scale democracy-cum-economy is not only an historical reaction to the centralist authoritarianism of George III (who meant well, I am sure), but a kind of imitation of Nature, which has endured the most massive disruptions (a planet encased in ice, or burning from a massive meteor strike) because of my alliterative trio of survival traits: diversity, dispersion and disconnection.

Friday, March 07, 2008

Ten years after the stock market bounce

Thursday, March 06, 2008

From soup to nuts

Nobody had to invest in tech stocks, but we all have to live somewhere. A bubble in housing is really pernicious, because it has implications for almost everyone.

Low interest rates inflated property prices, which led to much larger mortgages. Deflating valuations by raising interest rates would trap many mortgage-holders who have taken on big loans and kept up a good credit history so far.

Therefore, unless the government is willing to deal with the political pain of accelerated mortage defaults, interest rates must now stay low-ish for a long time. So I guess that credit risk will be adjusted not by price, but by access: it will simply get harder to find a willing lender. If there is less lending, then that (it seems to me) is deflationary.

I don't believe that the burden of the monster mortgage will be reduced by rapid general inflation of both wages and prices as in the 70s and 80s. Increased world demand for food and energy will inflate prices, but globalisation means that for many - especially the poorer sort - wages won't keep up. The cost of housing will be a generation-long millstone around the neck.

Inflating the currency won't help. It will reduce the wealth of savers, but if we are importing not only luxuries but (increasingly) necessities, inflated wages will be gobbled up by inflated import prices.

Some may argue that currency debasement will make our exports more competitive. But for a long time now, manufacturing industry has been disappearing like snow in midsummer. Even if our export prices should become more competitive because of foreign exchange rates, domestic productive capacity has shrivelled: whole factories and shipyards have gone abroad, and the related human resources have withered, too. You can't reconstruct the proletariat and their workplaces overnight. Gone are the days when the Midlands engineering worker tinkered with metal in his garden shed, showing his son how to use the tools. Half a mile from where I live, one of the big engineering plants set up by the Birmingham-based Lucas family was taken over first by the Italian Magneti Marelli, then by the Japanese super-corp Denso, and now it's been stripped of its machines and will be demolished to make way for... housing. Goodness know how the mortgages on them will be paid.

I think Karl Denninger is right: the banks must be made to eat some of the debt they fed us. Either they will be ruined, or we shall be.

They knew it was coming

Tuesday, March 04, 2008

Eat what you cooked

I wouldn't say it's impossible. America has more resilience and capacity to renew than its envious enemies wish to believe.

Good luck.

Sunday, March 02, 2008

Subprime hitting GSEs

But over a period, Denninger has moved on from trying to exploit such market weaknesses, to urging his fellow citizens to protest about the corruption of the financial system. His tone is now getting darker - like Jeffrey Nyquist, he's beginning to worry about international relations, for example the way that China's population pressure may threaten Russia's land. Lhasa 1950, Khabarovsk and Irkutsk when?