*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Monday, January 07, 2008

Inflation or deflation: an expert writes

Also heartening to see my suggestion re insider jiggery-pokery echoed here:

As an aside, I still don't know what to make of the triangle / diamond in Goldman's chart (see Figure 4) other than they plan to squeeze stocks higher under the cover of low volumes over Christmas holidays in justifying their bonuses.

Friday, January 04, 2008

Gold and the Dow

Taking the present values - Dow 13,056.72, gold $864.80 - the formula works out at 15.098, which suggests that the Dow is still well above trend.

Some would see this as indicating a coming gold spike; but another way to rebalance is for the Dow to fall. As credit deflation takes hold, I suggest that in 2008, both gold and the Dow will drop below their current levels, but the Dow more than gold.

UPDATE

Gary Dorsch is looking at the same ratio ("By the end of 2008, the DJI to Gold ratio might tumble towards 10 oz’s of gold"), but thinks the rebalance could happen the other way, through destructive inflation.

If so (and he doubts that it's possible), Karl Denninger thinks you'd still be better off betting on the Dow, using call options:

So tell me again - if you believe in "hyperinflation" - why do you want to buy the clear LOSER of an asset that metals represent, when you can buy index CALLs and, if your thesis is correct, you will make an absolute stinking FORTUNE!

(Of course if you're wrong and the DOW is under 16,000 by the end of the year, that $20,000 is totally flushed. That's the price of poker - but again - just how sure are you that "The Fed" is going to "hyperinflate"? And by the way, no, I don't think they are - in fact, I don't think they CAN.)

SECOND UPDATE

Gary Tanashian sets a target of $920 for gold, but anticipates a drop-back anytime; but longer term, Julian Phillips can't imagine governments NOT hyperinflating, to avoid the horrors of deflation.

The astrologers continue to mutter and gesture over their charts.

Wednesday, January 02, 2008

Bad news: we depend on the banks

When things turn vengeful, let's take a careful look at the banks, and those who give them their orders. Not for the first time, they've lifted us up, and are making ready to drop us from a great height.

As the song from Mary Poppins has it:

If you invest your tuppence

Wisely in the bank

Safe and sound

Soon that tuppence,

Safely invested in the bank,

Will compound

And you'll achieve that sense of conquest

As your affluence expands

In the hands of the directors

Who invest as propriety demands

[...]

You can purchase first and second trust deeds

Think of the foreclosures!Bonds! Chattels! Dividends! Shares!

Bankruptcies! Debtor sales!

... for the whole lyric see here.

The scene ends, happily enough, with a run on the bank as young Michael loudly demands the return of his twopence.

Wednesday, December 26, 2007

Uncertainty

A couple of things seem pretty clear to me: first, that I haven't lived long enough to have enough experience to know whether the bulls or bears are right about just how far the ripples will spread from the credit market problem; second, that there's never been an economic cycle just like this one, so even the people who have lived long enough to know who's right are speculating at best. (highlight mine.)

So it's not just me that's confused. And we're in distinguished company: Marc Faber also says we are in a new situation, with the possibility of a first-time-ever worldwide bust.

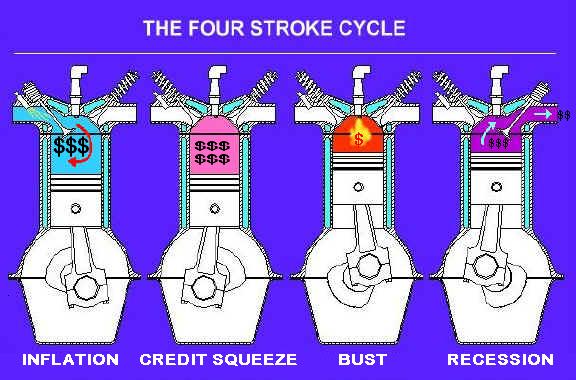

If we're into guesswork, then mine is that for a while, the monetary inflation will offset the credit (or "fiduciary money", as I'm learning to call it) deflation.

And then? Here's what worries me, in my amateurish, hunchy fashion: balance can be achieved in different ways (an empty seesaw is not the same as one with an elephant at each end). There's been a massive buildup of energy within the system, and the question is, can the Xbox take it?

Sunday, December 23, 2007

Visions of 2008

USA

a marked deflation in property prices

a reduced demand for luxury goods and services

reduced imports of the above

consequent recession abroad

further interest rate cuts

higher unemployment

higher taxes

higher State and Federal budget deficits

a sell-off in equities

increased demand for bonds

a weakening currency

higher prices for food, fuel and clothing

increase in the price of good-quality agricultural land

consumer price inflation indices will not be able to continue to mask the real increases in costs of living, and this will have further consequences for public finances

public enquiries, leading eventually to a thorough reform of the financial system

UK

much the same as above, except I don't think our house prices will fall so far - the US subprime mess will hit investments, but we will drop our interest rates to devalue the pound to maintain stability against the dollar

Gold

will continue to fluctuate interestingly, but although some smart money is after it, there will be less spare money around generally, and other commodities will offer interesting opportunities for inflation-beaters. It's already above its inflation-adjusted long-term trend, and lenders will make sure that the real value of their loans is not destroyed by hyperinflation

... in short, slumpflation.

UPDATE

*and, by way of comparison, here is Karl Denninger's outlook in his Dec 24 post.

... plus a more sanguine assessment by Nadeem Walayat.

A Merry Christmas to all, and thanks for your visits and comments.

Saturday, December 22, 2007

IN, not DE

Thursday, December 06, 2007

A moment of sanity

My grandfather used to say, things are never as good as you hope or as bad as you fear. As I reported some while ago, members of the Chicago Stock Exchange in 1934 papered their club room with what they thought were now worthless stock certificates, but within five years were steaming them off the walls again.

The Thirties crash hit debtors, unwary investors (especially those trading with borrowed money) and insolvent banks. The lessons from this are easy to learn.

Wednesday, December 05, 2007

Unreal

Two problems: one is, I can't visualise anything with many zeroes, so it's not real for me. More importantly, if there's a major meteor-strike financial bust (i.e. deflation), I'd have thought cash in hand is what everyone will want.

Unless a crazed government opts for hyperinflation. In which case, I'd rather have pallets of canned baked beans, boxes of ammunition and many brave, loyal friends. You can't eat gold.

But as with all truly terrible imaginings, the mind bounces off this like a tennis ball from a granite boulder, and we turn back to normal life with determined optimism.

Tuesday, November 27, 2007

"Legal tender for all debts, public and private"

Karl Denninger is emphatic that there's going to be a deflation, not inflation, and investing in metals won't save us.

Karl Denninger is emphatic that there's going to be a deflation, not inflation, and investing in metals won't save us.Part of his argument is that the money supply is determined not just by how much there is in the economy, but also by how fast it changes hands (its "velocity"). If the heartbeat of economic activity slows, the monetary pressure will reduce.

Denninger shares the growing concern that subprime losses could be of the order of $1 trillion, and believes

... we are literally weeks or a handful of months away from an utter implosion in the equity markets.

I believe we are very, very close to the precipice - and that nothing Bernanke or Paulson can do now will change the outcome. The opportunity to address this and stop it expired a few years ago, with the cumulative damage growing the longer regulators fail to act.

In which case, it's time to hold cash, which on American notes says is good "for all debts".

This reminds me of another quotation I can't source: "Would that I could be so certain of anything as he is of everything." I suspect he may be right on this one; then again, I would, since I've been feeling it in my bones for about a decade, before the official policy became to inflate our way out of all troubles.

Sunday, November 25, 2007

Long or short crisis? Inflation or deflation?

An interesting post from Michael Panzner, commenting on the views of derivatives expert Satyajit Das. The latter thinks we're in for a 70s-style inflationary grind, whereas Mr Panzner leans towards a 30s-style deflation.

I am reminded of Borges' short story, "Pierre Menard, Author of the Quixote". In this, a modern author attempts to re-produce the 16th century novel "Don Quixote" by Cervantes: not copying - writing it again exactly, but as though for the first time ever. Since Menard is writing in a different period of history, the same words have quite different meanings, implications and associations. To pen the identical lines today, spontaneously, would involve a monstrous effort. So Borges' tale is a wonderful parable about the near-impossibility of our truly understanding the mindset of the past, and how history can never be quite repeated, because the present includes a knowledge of the past that it takes for its model.

For those reasons, we'll never have the Thirties again, or the Seventies; but we might have a retro revival. And the differences may be as significant as the similarities.

Ken Kesey's bus (named "Furthur"), and part of the commercialised modern follow-up

Ken Kesey's bus (named "Furthur"), and part of the commercialised modern follow-upSaturday, November 10, 2007

Avast behind!

Pearce Financial (Financial Sense, yesterday), like Marc Faber, believes that the East is dangerously overheated and deflation could hit commodities as well as shares; also, the dollar could rise again, and the Japanese yen might break free from its moorings.

I'd like some help with understanding this last, as tides of returning dollars and yen would seem to argue inflation in their home countries.

Karl Denninger (Market Ticker, yesterday) explains it as a relativistic effect:

Our problems are bad. The problems that will be faced overseas are FAR WORSE. Overseas economies are dependant on us, not the other way around. When this sinks in the other currencies against which the DX is measured will collapse; this will appear to raise the dollar, but in fact it is the sinking of other currencies.

"Tom the cabin boy smiled, and said nothing."

Friday, November 09, 2007

Tough, but believable

He thinks it's not too late for the US to recover its economic base. I hope the same for my country.

Wednesday, October 31, 2007

Uncle Sam and John Bull

Tuesday, October 16, 2007

Hubble-bubble

The American astronomer Edwin Hubble found the evidence for an expanding universe, in the phenomenon of "red shift". Objects moving at high speed change colour, because their velocity stretches the light waves. Looking at galaxies, he saw that the further away the object, the more its spectrum shifted, so the faster it was going.

Why? Imagine you put a line of ink dots at intervals of an inch on a toy balloon, and then inflate it so that the space between each dot doubles. Dot A is now 2 inches from Dot B, and the latter is two inches from Dot C. So from A's perspective, B has receded by one inch, but C by two inches.

The implication is that as the universe continues to expand steadily, the objects furthest from us will eventually accelerate beyond the speed of light, and in Einsteinian terms will not be part of our universe any longer - we will never see anything from them again.

The financial universe is, as everyone who takes an interest knows, expanding. And everything is fine as long as the expansion continues, and while people are still prepared to use the inflating money.

One way the money supply expands is through loans. Banks only have to keep a fraction of their deposits ready for return to savers - the rest they can lend out. Some of that loaned money gets deposited into a different account - where again, part is kept and the rest loaned out. So the amount of money in the economy is multiplied by this "fractional reserve banking".

But unlike the cosmos, money can also contract. If more people than expected want their money back, loans get called in prematurely. It becomes a game of musical chairs. If there's growing concern that the system can't return all the cash demanded, two or three chairs are removed at a time and a panic starts. Rick Ackerman in GoldSeek (26 September) underscores this point.

"Captain Hook" in yesterday's Financial Sense suggests that we may be approaching such a time in the near future. The bubble may burst.

The problem for the rest of us is that if we believe the money supply will continue to expand, we want to get out of money and into anything that is more likely to hold its value; but if we anticipate deflation, then cash is king.

So, is it endless expansion, or inflation followed by a bust? Hubble, or bubble?

Monday, September 24, 2007

Golden bubble

A bubble shot through by a bullet - experiment described here

A bubble shot through by a bullet - experiment described hereWhen it comes to metals, we see hedge fund speculation, hoarding and squeezing everywhere. Not only have some metals markets been driven far, far higher in this cycle compared to all past cycles; we see the same phenomenon across all metals. It is the combination of both the amplitude and breadth of the metals bubble that probably makes it the biggest speculation to the point of manipulation in the history of commodities. (Page 50)

... it is likely that the net nominal return to portfolios from investing in physical “stuff” has not been more than 1% per annum. By contrast, in a 3% inflation environment, bonds have yielded somewhere between 5% and 9% and equities have yielded somewhere between 8% and 11%. In effect, you gave up an immense amount of yield if you diversified out of bonds and stocks into commodities. You did gain by reducing overall portfolio volatility, but that gain was not large enough to offset the loss in yield. Diversifying with “stuff” did not enhance risk-adjusted returns. (Page 57)

Saturday, September 22, 2007

Sunday, September 02, 2007

The outlook from Financial Sense

inflation, deflation, gold, cash...

Jim Puplava: ...I've had Bob Prechter on this program and Bob is a deflationist and Bob believes that we get deflation first and then hyperinflation where I guess my views are we get hyperinflation and then what follows will be deflation. And that's the way it has unfolded with great debtor nations. And I think history will repeat itself here with the US. There is too much debt here and it has to be inflated away...

...I really believe that the full force of these storms aren't going to hit until somewhere between 2009 and 2010 when this really comes home to roost. And all of these debt problems, the problems that we have with energy today, availability, peak oil, the geopolitical problems in the Middle East – I do not expect the next decade to be a pleasant one, John. I wish I could say otherwise because as a father with three children, one to get married shortly and looking forward to grandchildren, you know, this is something that you don't like to think about...

credit bubble, credit crunch, commodities, East delinking from West...

Doug Noland: ...the economy is much more vulnerable than many believe because of the credit that was going to the upper end; and I think the upper end mortgage area is where we had the greatest excesses.

So I think when all is said and done, subprime losses are going to be small compared to the losses we see in jumbo and Alt-A, and especially, unfortunately out in California...

...there’s desperation out there to find buyers for mortgages... Washington generally doesn’t understand the risk of Fannie and Freddie [US government-sponsored entities - "GSEs" - that offer mortgages], so of course they would think it’s their role to step in and provide the liquidity.

But... their total exposure is over 4 trillion dollars now. And this is a huge problem, and I fully expect down the road these institutions to be nationalized. And I think the US taxpayer is going to pay a huge bill for this... To be honest, I don’t mind the GSEs if they want to play a role in affordable housing; if they wanted to try to rectify some of the problems at the lower end because of the lack of the availability of credit in subprime. But to think that the GSEs should start doing jumbo mortgages, to try to be the buyer of last resort for California mortgages, my God, it’s hard to believe that makes sense to anyone because that’s just a potential disaster. It’s also reminiscent of the S&L – the Savings and Loan problem that, you know, was a several billion dollar problem during the 80s that they allowed to grow to several hundred billion by the early 90s. And definitely, the tab of the GSEs is growing rapidly right now...

...even if the central banks add a trillion dollars of liquidity to help out this deleveraging we still have this issue of how are we going to generate the trillions of additional credit going forward to keep incomes levitated, to keep corporation earnings levitated, to keep asset prices levitated, to keep the global economy chugging along...

...The global economy may be something of a different story because we have credit bubbles all over the world. Like the Chinese bubble right now is pretty much oblivious to what’s going on in the US and in Europe. You can see a scenario where, you know, you have serious credit breakdown but let’s say Chinese demand keeps energy and resource prices higher than one would expect. So I’m going to be watching this very carefully because we’re going to see some very unusual dynamics as far as liquidity and inflation effects between different asset classes and different types of price levels throughout the economy.

Thursday, August 30, 2007

Doug Casey: business cycles and subprime loans

Thursday, August 23, 2007

Twang money revisited

"Prudent Bear’s Doug Noland has for years been pointing out that one of the drivers of the credit bubble has been the ever-broadening definition of money. As the global economy expanded without a hic-up, more and more instruments came to be used as a store of value or medium of exchange or even a standard against which to value other things—in other words, as money."

Now that lenders are pulling in their horns, central banks are creating more cash to replace the "loss", and the result must be a dilution of value in the currency.

Saturday, August 11, 2007

Doug Casey: sounding grim and clear

At some point there’s going to be a panic out of the dollar. When it happens, it’s likely to be the biggest financial upset since the 1930s. Part of the question is what they’ll panic into. The euro? As I have said many times, if the dollar is an “I owe you nothing,” the euro is a “Who owes you nothing?”...

If an American doesn’t get significant assets outside the U.S. now, it may be impossible in the future. The best thing to do is buy real estate abroad, since it’s currently not reportable, like bank and brokerage accounts, and they can’t very well make you repatriate it...

We’re now experiencing a lot of monetary inflation, which eventually will be reflected in price inflation. What’s really going to tip this over the edge, however, is the rest of the world deciding to get out of dollars. A lot of those $6 trillion abroad are going to come back to the U.S., and real goods are going to be packed up and shipped abroad. Inflation will explode...

Markets are about trade... At some point the Chinese will want payment in something other than dollars. In the meantime the yuan will go higher...

What do I think is likely? Certainly a depression, probably of the inflationary type. But if there are widespread defaults in the mortgage market because of a housing bust, hundreds of billions of dollars worth of buying would disappear, which is deflationary. You could have both things happening at once, in different parts of the economy...

I hate making predictions, but if things continue down this path, I think we could see gold going over $1,000 within the next 12 months, and maybe even before year-end. And then the mania starts for the mining stocks.

Terry Gilliam's take on the old tale

Terry Gilliam's take on the old tale