Zimbabwe on Saturday welcomed the failure of a Western-backed U.N. Security Council resolution to impose sanctions over its violent presidential elections, calling it a victory over racism and meddling in its affairs. (Reuters)

Racist...

Robert Mugabe is a member of the Shona tribe (as is opposition leader Morgan Tsvangirai), which comprises 70% of the population of Zimbabwe, occupying the centre and north of the country.

The Matabele (Ndebele) tribe, who tend to live in the southern part, make up half of the remaining minority, and (not surprisingly, in view of their post-Independence massacres by Mugabe's troops) are supporters of the MDC (Movement for Democratic Change). ''The denial of food to opposition strongholds has replaced overt violence as the government's principal tool of repression,'' the ICG wrote in August 2002.

Meddling...

Zimbabwe's natural resources include "coal, chromium ore [10% of the world's reserves], asbestos, gold, nickel, copper, iron ore, vanadium, lithium, tin, platinum group metals" (CIA World Factbook), and there are 10 or so foreign-owned mining companies operating there. The Zimbabwean kleptocracy has turned from seizing farms (which they either don't know how to run, or can't be bothered to), to grabbing controlling interests in foreign-owned firms, and a 25% no-compensation stake in mining companies. Presumably, in the latter case, they'll leave the operational side to the experts.

In 2005, the Chinese government and Chinese businesses supplied T-shirts for ZANU-PF supporters, jets and trucks for the Army, and the architectural plans and blue tiles for Mugabe's new 25-bedroom mansion. The recent attempt (April 2008) to ship a load of arms in, so that Mr Mugabe could deal with his little local difficulty, was described by the Chinese as "normal military trade". Annual trade between these two countries was expected to reach $500 million this year.

Zimbabwe is touting Russia for trade and business deals, including tourism (uniformed hunting trips in Matabeleland?)

Perhaps the reason 84-year-old Mugabe is hanging on, is that he and his entourage have a tiger by the tail. How could they get out of their land-locked country alive?

How skilfully does Robert Mugabe, the Dom Mintoff of East Africa, play off great nations against one another! If only his skills benefitted his country, also.

All original material is copyright of its author. Fair use permitted. Contact via comment. Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

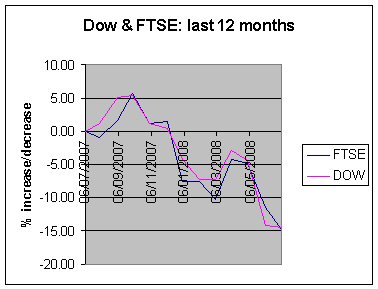

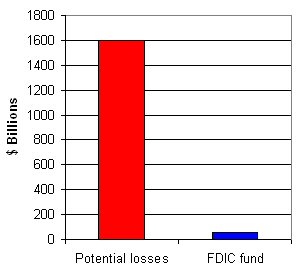

Don't scoff.

Don't scoff.

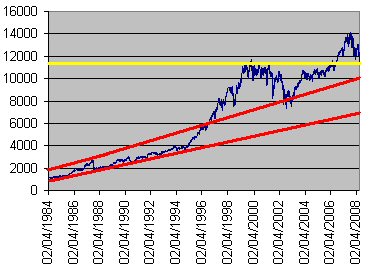

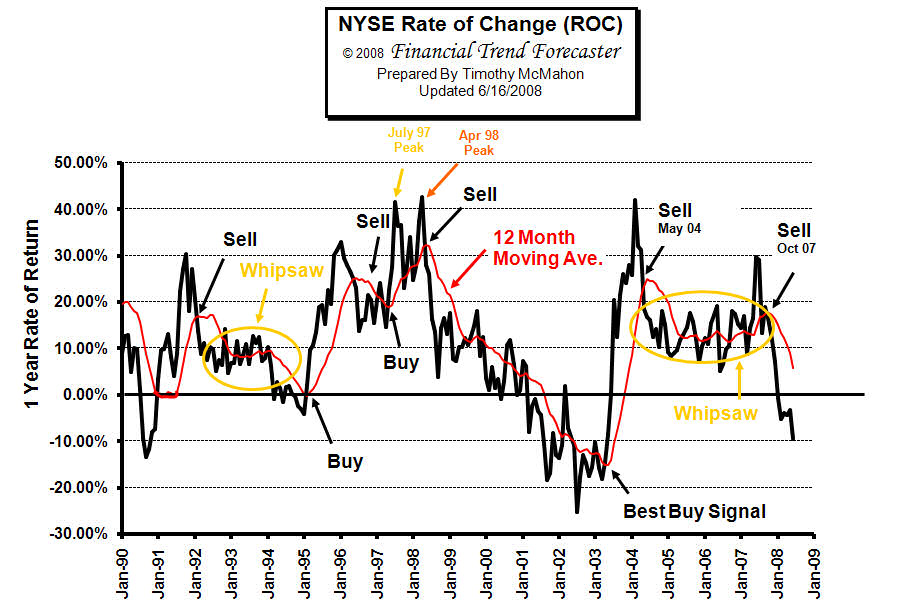

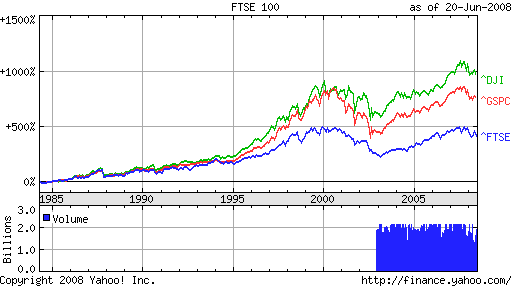

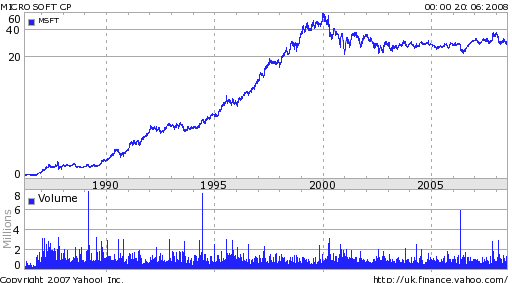

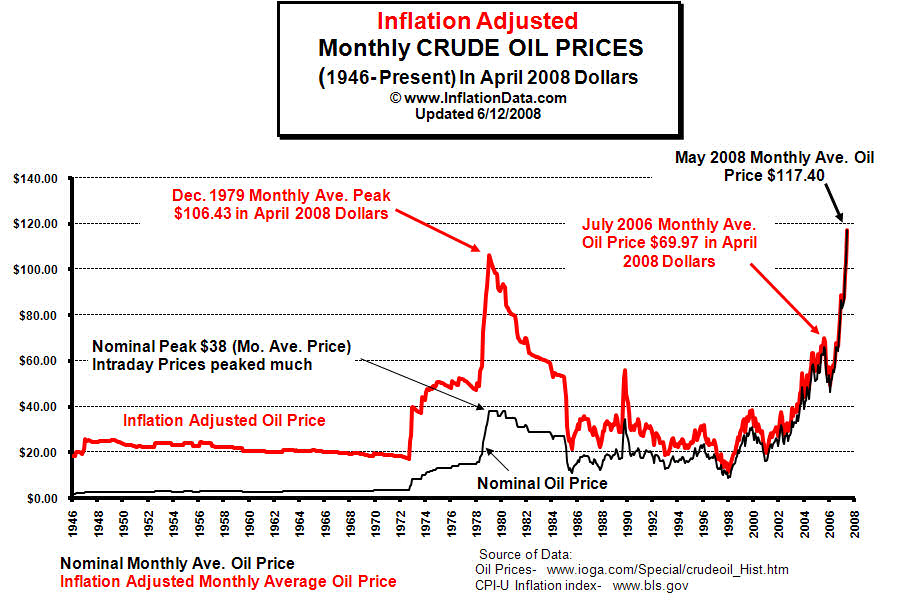

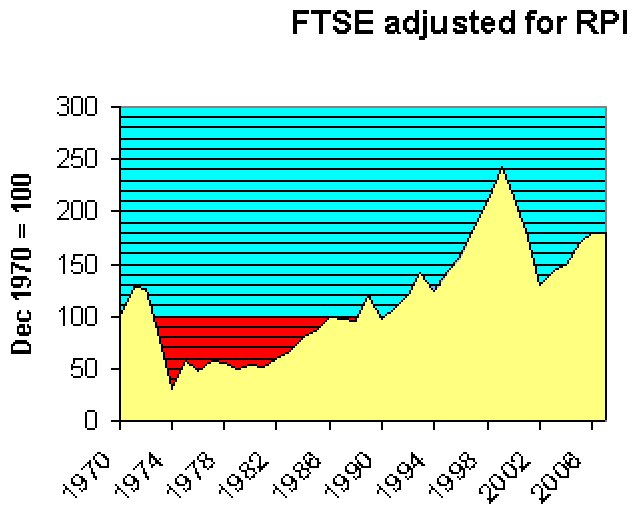

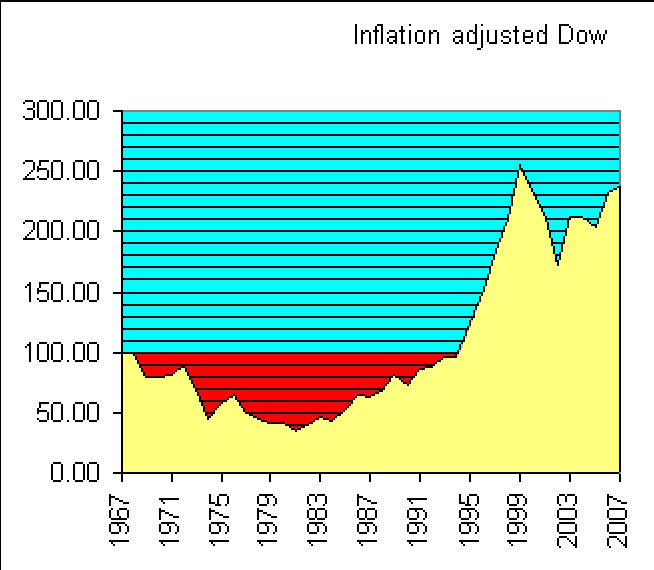

If you're an active investor, you may start thinking about opportunities. Look at the red zones. Draw a line from a deep points to a high one, and feel the greed; but draw lines from a temporary rally to another low, and feel the disappointment. You do need to get your timing right.

If you're an active investor, you may start thinking about opportunities. Look at the red zones. Draw a line from a deep points to a high one, and feel the greed; but draw lines from a temporary rally to another low, and feel the disappointment. You do need to get your timing right.