I'm a bit behind on my listening to Financial Sense Newshour, but as ever, the issues we're talking about aren't momentary. Jim Puplava's view (8 September) is that this crisis isn't the big one: the US will reflate its way out. It can't do that on its own without sacrificing the dollar, so (as has been happening for a long time) there will be cooperation with other nations' central banks. In effect, we are in an international currency inflation cartel, since no trading nation wants a hard currency that leaves its industries high and dry.

But, says Jim, the next recovery will be shorter, and the next fall back much worse. He sees this as happening around 2009/2010, which coincides with the time of Peak Oil, in which he is a big believer. That's when he feels the energy and credit crunches may come together. He sees gold and silver soaring to levels that currently seem fantastic.

For us ordinary people, that may be less interesting than the effects of energy shortage on our daily transportation and domestic heating.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Sunday, September 16, 2007

Thursday, September 13, 2007

Clausewitz reversed

The Prussian military theorist Von Clausewitz said that war was the continuation of politics by other means; some have since substituted the word "economics" for "politics".

But such is the complexity of modern industrial society, and the horrific potential of modern military technology, that we may invert the relationship: economic ownership and infrastructure may be the new weapons with which to wage war.

It is not hard to see the power potential in China's increasing stake in the US economy - not only US government bonds, but increasingly, other assets such as equities. Already, the bond market feels the jerk of the chain, and within the last couple of years Britain has stepped in to provide some much-needed slack to America. But the growth of "sovereign wealth funds" could see future governments using their investments to interfere in the equity markets, too. What price free trade then?

And there are other gaps in the armour. For example, America's recent allegations against China of cyber-warfare have highlighted our daily dependence on electronic technology.

Two Chinese colonels, Qiao Liang and Wang Xiangsui, have produced a book examining such possibilities: "Unrestricted Warfare" (1999). Some translated extracts are available here, and the Wikipedia article is here.

This is not to say that China is actually hostile; only that, like the rest of us, she has her own agenda, and her own contingency plans. Much of warfare is not outright battle, but the use of threats and potential threats to gain strategic advantage. Pushing your opponent into desperation can backfire disastrously. As Sun Tzu said, "To a surrounded enemy, you must leave a way of escape."

But we must recover our economic balance, or risk having the imbalance used against us.

But such is the complexity of modern industrial society, and the horrific potential of modern military technology, that we may invert the relationship: economic ownership and infrastructure may be the new weapons with which to wage war.

It is not hard to see the power potential in China's increasing stake in the US economy - not only US government bonds, but increasingly, other assets such as equities. Already, the bond market feels the jerk of the chain, and within the last couple of years Britain has stepped in to provide some much-needed slack to America. But the growth of "sovereign wealth funds" could see future governments using their investments to interfere in the equity markets, too. What price free trade then?

And there are other gaps in the armour. For example, America's recent allegations against China of cyber-warfare have highlighted our daily dependence on electronic technology.

Two Chinese colonels, Qiao Liang and Wang Xiangsui, have produced a book examining such possibilities: "Unrestricted Warfare" (1999). Some translated extracts are available here, and the Wikipedia article is here.

This is not to say that China is actually hostile; only that, like the rest of us, she has her own agenda, and her own contingency plans. Much of warfare is not outright battle, but the use of threats and potential threats to gain strategic advantage. Pushing your opponent into desperation can backfire disastrously. As Sun Tzu said, "To a surrounded enemy, you must leave a way of escape."

But we must recover our economic balance, or risk having the imbalance used against us.

Monday, September 10, 2007

Slither

Gold $7.04, the British pound bumping up against $2.03. Is the system settling for a controlled skid?

UPDATE

A day later, gold is up another 1%, (or would that be, the dollar is down 1% against it?), the pound is marginally nearer $2.03, and the Dow is rising.

UPDATE

A day later, gold is up another 1%, (or would that be, the dollar is down 1% against it?), the pound is marginally nearer $2.03, and the Dow is rising.

Saturday, September 08, 2007

Michael Panzner agrees with Marc Faber

In Blogging Stocks, September 7:

We're in a rare moment in history where cash is king... My prediction is that the Standard & Poor's 500 could fall at least another 10% from here. I think the economy is weakening and the crisis in the credit markets will worsen from here... this is not the time for a buy-and-hold strategy. But if you must stay in stocks, look at more defensive sectors like food, beverage and healthcare... Gold...

Read the whole item - and see the video - here.

We're in a rare moment in history where cash is king... My prediction is that the Standard & Poor's 500 could fall at least another 10% from here. I think the economy is weakening and the crisis in the credit markets will worsen from here... this is not the time for a buy-and-hold strategy. But if you must stay in stocks, look at more defensive sectors like food, beverage and healthcare... Gold...

Read the whole item - and see the video - here.

Dow 9,000 prediction revisited

September 8: since August 31, the Dow has slipped further to close at 13,113.38 on Friday; gold has risen to $701 (London PM gold fix). Adjusted for the rise in the price of gold, the Dow is now the equivalent of 12,117.25. So in terms of Robert McHugh's prediction, it has lost 10.98% since July 6. Time for another quiet release of gold by central banks?

Thursday, September 06, 2007

Wednesday, September 05, 2007

US bond pressure mounts

...and China has been selling off US Treasury bills, according to Gary Dorsch of Global Money Trends, featured in GoldSeek today:

"Beijing sees a “veto proof” protectionist bill sailing thru the US Congress later this year, and has been a net seller of US T-bonds for three straight months by a record amount of $14.7 billion, the longest period of sales by China since November 2000."

UPDATE

More on this from the Daily Telegraph here.

"Beijing sees a “veto proof” protectionist bill sailing thru the US Congress later this year, and has been a net seller of US T-bonds for three straight months by a record amount of $14.7 billion, the longest period of sales by China since November 2000."

UPDATE

More on this from the Daily Telegraph here.

Selling the family gold?

According to The Mogambo Guru on 30 August, "...gold suddenly plummeted on Thursday, making me laugh nervously, as things have now gotten so bad that central banks are apparently actually increasing their selling of sovereign gold to get the money to pay current bills! Hahaha!"

This would be interesting information for gold bugs. Unfortunately, the World Gold Council has not updated its list of gold holdings since June. Any information, anybody?

UPDATE

Physical gold has enjoyed record purchases in some regions, according to The Market Oracle yesterday.

This would be interesting information for gold bugs. Unfortunately, the World Gold Council has not updated its list of gold holdings since June. Any information, anybody?

UPDATE

Physical gold has enjoyed record purchases in some regions, according to The Market Oracle yesterday.

Monday, September 03, 2007

Scare stories - "the S&P to fall to 700"

Dan Denning, in today's Daily Reckoning Australia, considers whether it may be a good time to unload your investments, and refers to reports of large bets made that the S&P 500 may drop to 700 (currently it's around 1,474) - or possibly rise to 1,700! It's got the conspiracy theorists exercised, although experts say it's a technical matter (see The Street); but the sums involved are large. Stormy weather ahead?

Sunday, September 02, 2007

The outlook from Financial Sense

Some voices and topics from Financial Sense, 25 August:

inflation, deflation, gold, cash...

Jim Puplava: ...I've had Bob Prechter on this program and Bob is a deflationist and Bob believes that we get deflation first and then hyperinflation where I guess my views are we get hyperinflation and then what follows will be deflation. And that's the way it has unfolded with great debtor nations. And I think history will repeat itself here with the US. There is too much debt here and it has to be inflated away...

...I really believe that the full force of these storms aren't going to hit until somewhere between 2009 and 2010 when this really comes home to roost. And all of these debt problems, the problems that we have with energy today, availability, peak oil, the geopolitical problems in the Middle East – I do not expect the next decade to be a pleasant one, John. I wish I could say otherwise because as a father with three children, one to get married shortly and looking forward to grandchildren, you know, this is something that you don't like to think about...

credit bubble, credit crunch, commodities, East delinking from West...

Doug Noland: ...the economy is much more vulnerable than many believe because of the credit that was going to the upper end; and I think the upper end mortgage area is where we had the greatest excesses.

So I think when all is said and done, subprime losses are going to be small compared to the losses we see in jumbo and Alt-A, and especially, unfortunately out in California...

...there’s desperation out there to find buyers for mortgages... Washington generally doesn’t understand the risk of Fannie and Freddie [US government-sponsored entities - "GSEs" - that offer mortgages], so of course they would think it’s their role to step in and provide the liquidity.

But... their total exposure is over 4 trillion dollars now. And this is a huge problem, and I fully expect down the road these institutions to be nationalized. And I think the US taxpayer is going to pay a huge bill for this... To be honest, I don’t mind the GSEs if they want to play a role in affordable housing; if they wanted to try to rectify some of the problems at the lower end because of the lack of the availability of credit in subprime. But to think that the GSEs should start doing jumbo mortgages, to try to be the buyer of last resort for California mortgages, my God, it’s hard to believe that makes sense to anyone because that’s just a potential disaster. It’s also reminiscent of the S&L – the Savings and Loan problem that, you know, was a several billion dollar problem during the 80s that they allowed to grow to several hundred billion by the early 90s. And definitely, the tab of the GSEs is growing rapidly right now...

...even if the central banks add a trillion dollars of liquidity to help out this deleveraging we still have this issue of how are we going to generate the trillions of additional credit going forward to keep incomes levitated, to keep corporation earnings levitated, to keep asset prices levitated, to keep the global economy chugging along...

...The global economy may be something of a different story because we have credit bubbles all over the world. Like the Chinese bubble right now is pretty much oblivious to what’s going on in the US and in Europe. You can see a scenario where, you know, you have serious credit breakdown but let’s say Chinese demand keeps energy and resource prices higher than one would expect. So I’m going to be watching this very carefully because we’re going to see some very unusual dynamics as far as liquidity and inflation effects between different asset classes and different types of price levels throughout the economy.

inflation, deflation, gold, cash...

Jim Puplava: ...I've had Bob Prechter on this program and Bob is a deflationist and Bob believes that we get deflation first and then hyperinflation where I guess my views are we get hyperinflation and then what follows will be deflation. And that's the way it has unfolded with great debtor nations. And I think history will repeat itself here with the US. There is too much debt here and it has to be inflated away...

...I really believe that the full force of these storms aren't going to hit until somewhere between 2009 and 2010 when this really comes home to roost. And all of these debt problems, the problems that we have with energy today, availability, peak oil, the geopolitical problems in the Middle East – I do not expect the next decade to be a pleasant one, John. I wish I could say otherwise because as a father with three children, one to get married shortly and looking forward to grandchildren, you know, this is something that you don't like to think about...

credit bubble, credit crunch, commodities, East delinking from West...

Doug Noland: ...the economy is much more vulnerable than many believe because of the credit that was going to the upper end; and I think the upper end mortgage area is where we had the greatest excesses.

So I think when all is said and done, subprime losses are going to be small compared to the losses we see in jumbo and Alt-A, and especially, unfortunately out in California...

...there’s desperation out there to find buyers for mortgages... Washington generally doesn’t understand the risk of Fannie and Freddie [US government-sponsored entities - "GSEs" - that offer mortgages], so of course they would think it’s their role to step in and provide the liquidity.

But... their total exposure is over 4 trillion dollars now. And this is a huge problem, and I fully expect down the road these institutions to be nationalized. And I think the US taxpayer is going to pay a huge bill for this... To be honest, I don’t mind the GSEs if they want to play a role in affordable housing; if they wanted to try to rectify some of the problems at the lower end because of the lack of the availability of credit in subprime. But to think that the GSEs should start doing jumbo mortgages, to try to be the buyer of last resort for California mortgages, my God, it’s hard to believe that makes sense to anyone because that’s just a potential disaster. It’s also reminiscent of the S&L – the Savings and Loan problem that, you know, was a several billion dollar problem during the 80s that they allowed to grow to several hundred billion by the early 90s. And definitely, the tab of the GSEs is growing rapidly right now...

...even if the central banks add a trillion dollars of liquidity to help out this deleveraging we still have this issue of how are we going to generate the trillions of additional credit going forward to keep incomes levitated, to keep corporation earnings levitated, to keep asset prices levitated, to keep the global economy chugging along...

...The global economy may be something of a different story because we have credit bubbles all over the world. Like the Chinese bubble right now is pretty much oblivious to what’s going on in the US and in Europe. You can see a scenario where, you know, you have serious credit breakdown but let’s say Chinese demand keeps energy and resource prices higher than one would expect. So I’m going to be watching this very carefully because we’re going to see some very unusual dynamics as far as liquidity and inflation effects between different asset classes and different types of price levels throughout the economy.

Saturday, September 01, 2007

Agriculture on the up

Meanwhile, cattle are moving off the Argentine pampas to make way for crops of soybeans and corn. The cattle are being crossbred to cope with the rougher conditions they'll face.

Friday, August 31, 2007

What Bank of England?

Further to yesterday's piece on the licence to the European Central Bank to seize the Bank of England's assets, here are two relevant articles from the Maastricht Treaty. The Campaign for an Independent Britain was stating no more than the truth. (In the extracts, red highlighting is mine.)

ARTICLE 30

Transfer of foreign reserve assets to the ECB

30.1. Without prejudice to Article 28, the ECB shall be provided by the national central banks with foreign reserve assets, other than Member States’ currencies, ECUs, IMF reserve positions and SDRs, up to an amount equivalent to ECU 50,000 million. The Governing Council shall decide upon the proportion to be called up by the ECB

following its establishment and the amounts called up at later dates. The ECB shall have the full right to hold and manage the foreign reserves that are transferred to it and to use them for the purposes set out in this Statute.

30.2. The contributions of each national central bank shall be fixed in proportion to its share in the subscribed capital of the ECB.

30.3. Each national central bank shall be credited by the ECB with a claim equivalent to its contribution. The Governing Council shall determine the denomination and remuneration of such claims.

30.4. Further calls of foreign reserve assets beyond the limit set in Article 30.1 may be effected by the ECB, in accordance with Article 30.2, within the limits and under the conditions set by the Council in accordance with the procedure laid down in Article 42.

30.5. The ECB may hold and manage IMF reserve positions and SDRs and provide for the pooling of such assets.

30.6. The Governing Council shall take all other measures necessary for the application of this Article.

ARTICLE 42

Complementary legislation

In accordance with Article 106(6) of this Treaty, immediately after the decision on the date for the beginning of the third stage, the Council, acting by a qualified majority either on a proposal from the Commission and after consulting the European Parliament and the ECB or on a recommendation from the ECB and after consulting the European Parliament and the Commission, shall adopt the provisions referred to in Articles 4, 5.4, 19.2, 20, 28. 1, 29.2, 30.4 and 34.3 of this Statute.

(Remember that "consulting" may mean no more than finding out how much we hate their plan, before they go ahead and implement it anyway.)

ARTICLE 30

Transfer of foreign reserve assets to the ECB

30.1. Without prejudice to Article 28, the ECB shall be provided by the national central banks with foreign reserve assets, other than Member States’ currencies, ECUs, IMF reserve positions and SDRs, up to an amount equivalent to ECU 50,000 million. The Governing Council shall decide upon the proportion to be called up by the ECB

following its establishment and the amounts called up at later dates. The ECB shall have the full right to hold and manage the foreign reserves that are transferred to it and to use them for the purposes set out in this Statute.

30.2. The contributions of each national central bank shall be fixed in proportion to its share in the subscribed capital of the ECB.

30.3. Each national central bank shall be credited by the ECB with a claim equivalent to its contribution. The Governing Council shall determine the denomination and remuneration of such claims.

30.4. Further calls of foreign reserve assets beyond the limit set in Article 30.1 may be effected by the ECB, in accordance with Article 30.2, within the limits and under the conditions set by the Council in accordance with the procedure laid down in Article 42.

30.5. The ECB may hold and manage IMF reserve positions and SDRs and provide for the pooling of such assets.

30.6. The Governing Council shall take all other measures necessary for the application of this Article.

ARTICLE 42

Complementary legislation

In accordance with Article 106(6) of this Treaty, immediately after the decision on the date for the beginning of the third stage, the Council, acting by a qualified majority either on a proposal from the Commission and after consulting the European Parliament and the ECB or on a recommendation from the ECB and after consulting the European Parliament and the Commission, shall adopt the provisions referred to in Articles 4, 5.4, 19.2, 20, 28. 1, 29.2, 30.4 and 34.3 of this Statute.

(Remember that "consulting" may mean no more than finding out how much we hate their plan, before they go ahead and implement it anyway.)

On the nose?

Aubie Baltin in DollarDaze gives it out straight from the shoulder: a 50% drop in US real estate that will take 10 years to turn around; a 30-50% drop on the Dow; we should be positioned 50:50 cash and gold bullion.

This last chimes with others who say there's bubbles everywhere but can't predict whether the Federal Reserve will feel forced to hyperinflate the currency.

This last chimes with others who say there's bubbles everywhere but can't predict whether the Federal Reserve will feel forced to hyperinflate the currency.

The Dow 9,000 prediction

In SafeHaven on 9 July 2007, Robert McHugh predicted the Dow would drop to 9,000 "over the intermediate-term, although if the PPT responds by hyperinflating the money supply, it could be 9,000 in real dollars (gold adjusted), not nominal." This would mean a drop of 33.88% from its 6 July value. Others have also forecast a fall in the Dow and/or the dollar. I plan to test this assertion from time to time.

The situation is complicated by monetary inflation in the USA, and in other countries that are trying to maintain the exchange rate of their currencies against the dollar, in order to protect their trade with America. So we'll take the Dow as it was on 6 July (the chart McHugh was using) and adjust for relative currency movements and the price of gold.

Starting points for 6 July 2007: the Dow was 13,611.69; gold (London AM fix) $647.75/oz.; using the interbank rates as given by O&A, one US dollar bought 122.7160 Japanese yen, 0.49630 British pounds, 0.73450 Euros, 7.60760 Chinese yuan/renminbi.

Situation as at c. 7 a.m. GMT 31 August 2007: Dow 13,238.73; gold $666.30; dollar buys 115.73200 Japanese yen, 0.49660 British pounds, 0.73280 Euros, 7.55580 Chinese yuan/renminbi. Adjusting for movements in currencies and the price of gold, we reinterpret the Dow today as being worth:

12,870.16 against gold

12,485.29 against the Japanese yen

13,246.73 against the British pound

13,208.09 against the Euro

13,148.59 against the Chinese yuan/renminbi

At present and in purchasing terms, the Dow since 6 July 2007 has fallen most (8.275%) against Japan, next against gold (5.45%), then China (3.40%), Europe (2.97%) and the UK (2.68%). I see this last as a measure of Britain's own weakness.

So within two months, and against the yen, the Dow has already fallen by about one-quarter of McHugh's predicted overall drop.

September 8: since August 31, the Dow has slipped further to close at 13,113.38 on Friday; gold has risen to $701 (London PM gold fix). Adjusted for the rise in the price of gold, the Dow is now the equivalent of 12,117.25. So in terms of Robert McHugh's prediction, it has lost 10.98% since July 6. Time for another quiet release of gold by central banks?

September 18: At the time of writing (6 p.m. British Summer Time), the Dow stands at 13,493 and gold at $713.70/oz. Adjusted for the change in the price of gold, the Dow has fallen by just over 10% since July 6.

September 21: Dow currently 13,839.54, gold (10.03 a.m. NY time) $736.30. Adjusted for the change in the gold price, the Dow would be worth 12,175.15, or down 10.55% since July 6.

Putting it another way, gold has risen 13.67% against the dollar in 77 days; that's getting on for 90% annualised. Is this lift-off for Doug Casey's trip to the moon?

September 29: July 6 to present: Dow up from 13,611.69 to 13,895.63; gold up from $647.75/oz. to $743.10. So the "gold-priced Dow" is down 11.01% in 84 days.

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

October 27: The Dow is currently at 13,806.70, up slightly from its July 6 valuation of 13,611.69. But gold has risen from $647.75 to $783.50 in the same period - up 21% in 113 days, or around 85% annualised. This means the "gold-priced Dow" is worth 11,414.54. At this rate, Robert McHugh's prediction will be fulfilled by March 8 next year.

November 2: Dow at 13,595.10, gold $806 per ounce. Since July 6, Dow has appeared to hold its ground, but the "gold-priced Dow" has dropped to 10,925.83 - a fall of over 49% annualised. And at this rate, gold will have doubled in dollar terms by July 2008.

November 7: Dow at 13,660.94, gold $833.80/oz. "Gold-priced Dow" has therefore gone down since July 6, from 13,611.69 to (effectively) 10,612.71, a drop of 22% (or 52% p.a. annualised).

To put it another way, the Dow has stood still and gold has risen 29% (or 112% p.a. annualised) over the last 123 days.

January 13, 2008: Last year, Robert McHugh predicted that the Dow would drop to 9,000, if not in nominal terms then in relation to gold. The Dow was then 13,238.73 and gold $666.30/oz, which means that it took 19.87 ounces of gold to buy the Dow. McHugh's prediction implies the Dow dropping to 13.51 gold ounces (a fall of 6.36 ounces).

The Dow is now 12,606.30 and gold $894.90, so the Dow is now worth 14.09 gold ounces. It has fallen by 5.78 ounces out of the predicted 6.36, so the prediction is 90.9% fulfilled so far.

McHugh will be fully correct if, for example, the Dow remains unchanged and gold rises to $933/oz; or if gold stalls, the Dow will need to fall to 12,090.

January 18, 2008: Dow 12,082.31, gold $880.50/oz, so the Dow is now worth 13.72 ounces of gold as against Robert McHugh's prediction of 13.51.

Nearly there, and the new announcement of a $145 billion reflation may push gold that extra yard.

January 22, 2008: As at the time of writing, the Dow is 11,820.24 and gold $875.90/oz. The Dow/gold ratio is therefore below 13.51 and has (perhaps fleetingly) fulfilled Robert McHugh's prediction.

Whether the Dow falls below 9,000 nominal in the course of a severe recession is something we shall have to see.

The situation is complicated by monetary inflation in the USA, and in other countries that are trying to maintain the exchange rate of their currencies against the dollar, in order to protect their trade with America. So we'll take the Dow as it was on 6 July (the chart McHugh was using) and adjust for relative currency movements and the price of gold.

Starting points for 6 July 2007: the Dow was 13,611.69; gold (London AM fix) $647.75/oz.; using the interbank rates as given by O&A, one US dollar bought 122.7160 Japanese yen, 0.49630 British pounds, 0.73450 Euros, 7.60760 Chinese yuan/renminbi.

Situation as at c. 7 a.m. GMT 31 August 2007: Dow 13,238.73; gold $666.30; dollar buys 115.73200 Japanese yen, 0.49660 British pounds, 0.73280 Euros, 7.55580 Chinese yuan/renminbi. Adjusting for movements in currencies and the price of gold, we reinterpret the Dow today as being worth:

12,870.16 against gold

12,485.29 against the Japanese yen

13,246.73 against the British pound

13,208.09 against the Euro

13,148.59 against the Chinese yuan/renminbi

At present and in purchasing terms, the Dow since 6 July 2007 has fallen most (8.275%) against Japan, next against gold (5.45%), then China (3.40%), Europe (2.97%) and the UK (2.68%). I see this last as a measure of Britain's own weakness.

So within two months, and against the yen, the Dow has already fallen by about one-quarter of McHugh's predicted overall drop.

September 8: since August 31, the Dow has slipped further to close at 13,113.38 on Friday; gold has risen to $701 (London PM gold fix). Adjusted for the rise in the price of gold, the Dow is now the equivalent of 12,117.25. So in terms of Robert McHugh's prediction, it has lost 10.98% since July 6. Time for another quiet release of gold by central banks?

September 18: At the time of writing (6 p.m. British Summer Time), the Dow stands at 13,493 and gold at $713.70/oz. Adjusted for the change in the price of gold, the Dow has fallen by just over 10% since July 6.

September 21: Dow currently 13,839.54, gold (10.03 a.m. NY time) $736.30. Adjusted for the change in the gold price, the Dow would be worth 12,175.15, or down 10.55% since July 6.

Putting it another way, gold has risen 13.67% against the dollar in 77 days; that's getting on for 90% annualised. Is this lift-off for Doug Casey's trip to the moon?

September 29: July 6 to present: Dow up from 13,611.69 to 13,895.63; gold up from $647.75/oz. to $743.10. So the "gold-priced Dow" is down 11.01% in 84 days.

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

October 27: The Dow is currently at 13,806.70, up slightly from its July 6 valuation of 13,611.69. But gold has risen from $647.75 to $783.50 in the same period - up 21% in 113 days, or around 85% annualised. This means the "gold-priced Dow" is worth 11,414.54. At this rate, Robert McHugh's prediction will be fulfilled by March 8 next year.

November 2: Dow at 13,595.10, gold $806 per ounce. Since July 6, Dow has appeared to hold its ground, but the "gold-priced Dow" has dropped to 10,925.83 - a fall of over 49% annualised. And at this rate, gold will have doubled in dollar terms by July 2008.

November 7: Dow at 13,660.94, gold $833.80/oz. "Gold-priced Dow" has therefore gone down since July 6, from 13,611.69 to (effectively) 10,612.71, a drop of 22% (or 52% p.a. annualised).

To put it another way, the Dow has stood still and gold has risen 29% (or 112% p.a. annualised) over the last 123 days.

January 13, 2008: Last year, Robert McHugh predicted that the Dow would drop to 9,000, if not in nominal terms then in relation to gold. The Dow was then 13,238.73 and gold $666.30/oz, which means that it took 19.87 ounces of gold to buy the Dow. McHugh's prediction implies the Dow dropping to 13.51 gold ounces (a fall of 6.36 ounces).

The Dow is now 12,606.30 and gold $894.90, so the Dow is now worth 14.09 gold ounces. It has fallen by 5.78 ounces out of the predicted 6.36, so the prediction is 90.9% fulfilled so far.

McHugh will be fully correct if, for example, the Dow remains unchanged and gold rises to $933/oz; or if gold stalls, the Dow will need to fall to 12,090.

January 18, 2008: Dow 12,082.31, gold $880.50/oz, so the Dow is now worth 13.72 ounces of gold as against Robert McHugh's prediction of 13.51.

Nearly there, and the new announcement of a $145 billion reflation may push gold that extra yard.

January 22, 2008: As at the time of writing, the Dow is 11,820.24 and gold $875.90/oz. The Dow/gold ratio is therefore below 13.51 and has (perhaps fleetingly) fulfilled Robert McHugh's prediction.

Whether the Dow falls below 9,000 nominal in the course of a severe recession is something we shall have to see.

Thursday, August 30, 2007

More on the Euro as the dollar's replacement

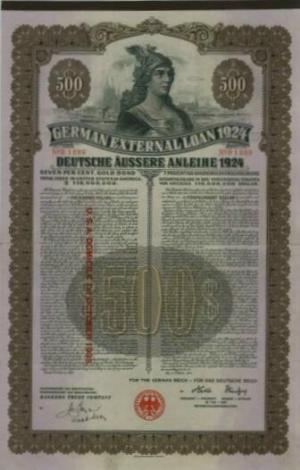

From the website of the Campaign for an Independent Britain, a point about Britain's gold reserves. This strengthens the speculation that the Euro might become gold-related and take the reserve-currency mantle from the US dollar.

Is it really true that Britain's gold reserves would be transferred to Germany in the event of monetary union?

The arrangements for Economic and Monetary Union are set out in a Protocol annexed to the Maastricht Treaty signed by the British Government in 1992. Article 30 of the Protocol would require Britain, on joining EMU, to transfer around £8,000 million of our gold and dollar reserves irrevocably to the European Central Bank in Frankfurt, Germany.

Article 42 provides that more of our remaining reserves could be transferred to the European Central Bank if a majority of the other EMU countries required it.

Britain would not be able to veto this process.

If so, perhaps holders of these German gold bonds from between the two World Wars might end up with Britain's bullion!

Is it really true that Britain's gold reserves would be transferred to Germany in the event of monetary union?

The arrangements for Economic and Monetary Union are set out in a Protocol annexed to the Maastricht Treaty signed by the British Government in 1992. Article 30 of the Protocol would require Britain, on joining EMU, to transfer around £8,000 million of our gold and dollar reserves irrevocably to the European Central Bank in Frankfurt, Germany.

Article 42 provides that more of our remaining reserves could be transferred to the European Central Bank if a majority of the other EMU countries required it.

Britain would not be able to veto this process.

If so, perhaps holders of these German gold bonds from between the two World Wars might end up with Britain's bullion!

UPDATE

The suit for German gold was brought by a farmer called Ronnie Fulwood. Here's the (English edition) German Spiegel article from 2004. His attorneys seem to have a history of long-shot claims, as this blog from May 2007 explains.

Money safety update - American banks

"I warn you, Sir! The discourtesy of this bank is beyond all limits. One word more and I—I withdraw my overdraft." (Punch, June 27, 1917)

"I warn you, Sir! The discourtesy of this bank is beyond all limits. One word more and I—I withdraw my overdraft." (Punch, June 27, 1917)I recently looked at the security of deposits in British banks, but what about the USA? As with my earlier post this morning, we find concise information included in a different argument, in this case about the American liquidity crisis.

In the USA, it seems that up to $100,000 in checking and savings accounts (per depositor per "member bank") is covered by the Federal Deposit Insurance Corporation. There were two separate funds - one for banking, the other for savings (following the $150 billion losses in the savings & loan crisis a generation ago) - but they have been merged as from the end of March 2006.

There are three compensation methods used. One is direct payment to the investor, termed a "straight deposit payoff". The other two involve transfer of business to a healthy bank, with some financing from FDIC: these are known as "purchase and assumption" (P&A) and "insured deposit transfer" - full details here and here. (N.B. although FDIC prefers not to make a straight deposit payoff, as it is the most expensive solution for them, it remains an option - Sutton and Hagmahani's brief account skates over this point.)

The $100k upper limit for depositor protection is more generous than in the UK - and it seems to be 100% insured, unlike for the poor British saver. But, the authors warn, FDIC "only works when bank failures are isolated events, and will not work in a systemic crisis...or for that matter one really big bank failure."

Taking a more general view, the article explains that the subprime mess has reduced liquidity in the system, causing it to work inefficiently, which is why the Federal Reserve has pumped in more cash - accepting "toxic waste" collateral in return, and offering a discount on its loan rate to banks.

The authors have two objections to this assistance:

- it rewards bad behaviour and encourages a repetition ("moral hazard")

- accepting unrealizable obligations as collateral is inflationary, since it turns nothingness into money

Their prediction: a fall in the value of the dollar, and if the banks disguise their problems and fail to clean house, at worst a collapse of the financial system. The Fed has bought some time, but that time has to be used for urgent reform.

Doug Casey: business cycles and subprime loans

I noticed years ago that you get the crispest explanations from someone who's busy trying to get to their main point - Isaac Asimov's "Extraterrestrial Civilizations" (1979) is an excellent example. Even if you disagree with the conclusion, you have learned so much on the journey, and so quickly.

Doug Casey in DollarDaze yesterday summarises the theorised relationship between the money supply and the business cycle, plus subprime mortgages and hedge fund gearing, as part of the argument for gold mining stocks. Again, you may not agree with him that gold "is going to the moon", but in the meantime he has given us a clear and concise exposition of two important economic topics.

Wednesday, August 29, 2007

2012: Olduvai Theory, sunspots and energy planning

|

| Wm. Robert Johnston's reconstruction of the last Ice Age (at 16,000 BC) |

A fascinating article by Brian Bloom in The Market Oracle on 6 August. He ties together a number of threads:

- Regular periodic stockmarket cycles

- Richard Duncan's Olduvai Theory (we've passed the peak of the per capita energy use that built our civilisation)

- The possible role of sunspots in cycles of climate change (allegedly we're heading for a deep global freeze in 50 years' time)

- The sun's movement in relation to the Milky Way, tentatively linked to a 100,000-year glaciation cycle

... and relates them to economic and political issues to suggest that we need to take urgent action to reduce debt and become more energy-efficient.

In case you are tempted to dismiss frontier thinking of this kind, it's worth remembering that many highly successful investors are intrigued by long-wave patterns. For example, Marc Faber is interested in the Kondratieff cycle, among others:

...business cycles do exist. Some economists claim that they occur, according to Juglar, every eight to twelve years. But according to Kondratieff and Schumpeter, you have these long waves that occur. You have a rising wave of about 15 to 25 years, then there is a plateau and downward again for 15 to 25 years. And then you have a drop and the entire cycle starts again. You have all kinds of cycle theory. I am not so sure you can measure the timing of the peak and the bottom, but definitely cycles do exist.

(Interview with Jim Puplava on Financial Sense, February 22, 2003)

In case you are tempted to dismiss frontier thinking of this kind, it's worth remembering that many highly successful investors are intrigued by long-wave patterns. For example, Marc Faber is interested in the Kondratieff cycle, among others:

...business cycles do exist. Some economists claim that they occur, according to Juglar, every eight to twelve years. But according to Kondratieff and Schumpeter, you have these long waves that occur. You have a rising wave of about 15 to 25 years, then there is a plateau and downward again for 15 to 25 years. And then you have a drop and the entire cycle starts again. You have all kinds of cycle theory. I am not so sure you can measure the timing of the peak and the bottom, but definitely cycles do exist.

(Interview with Jim Puplava on Financial Sense, February 22, 2003)

More on Marc Faber and agricultural land

Zee News reports Dr Faber's continuing support for the agricultural sector, in which he himself has invested:

Faber... owns agricultural land and plantation stocks in Indonesia, Thailand and Malaysia.

Faber... owns agricultural land and plantation stocks in Indonesia, Thailand and Malaysia.

Gold and farmland: further points

The Daily Reckoning Australia has very stimulating thoughts today.

(1) Dan Denning quotes a friend (David Evans) on the divergence between physical gold and shares in gold mining companies:

If the price of gold rises a lot, gold shares have greater leverage and will tend to go up more than gold bars (the cost of mining the gold stays constant, but the price of the mined gold goes up). When the general public gets involved and everyone just wants gold, gold bars tend to appreciate faster... The obvious strategy is to own gold shares now, and when every man and his dog is clamouring for gold, sell your gold shares and buy gold bars to enjoy the last part of the ride.

So when I looked at gold dropping with the Dow, maybe I should have also taken a peek at what gold shares were doing at the same time. For example, Newmont Mining opened yesterday at $40.30 and closed up at $41.07, whereas gold for delivery in December fell by $2.70.

(2) Chris Mayer looks at agricultural land in Brazil and Argentina, in the light of a hungry and resource-limited China:

In Brazil and Argentina, you have one of the few places left in the world where you can acquire large tracts of land in temperate climates with plenty of rainfall to support large-scale agriculture. Already, the two countries produce about one-third of the world’s agricultural commodities. As China is the world’s workshop and India its back office, so has South America become its breadbasket.

Maybe this is why Hugh Hendry and his colleagues have just launched the Eclectica Agriculture Fund.

(1) Dan Denning quotes a friend (David Evans) on the divergence between physical gold and shares in gold mining companies:

If the price of gold rises a lot, gold shares have greater leverage and will tend to go up more than gold bars (the cost of mining the gold stays constant, but the price of the mined gold goes up). When the general public gets involved and everyone just wants gold, gold bars tend to appreciate faster... The obvious strategy is to own gold shares now, and when every man and his dog is clamouring for gold, sell your gold shares and buy gold bars to enjoy the last part of the ride.

So when I looked at gold dropping with the Dow, maybe I should have also taken a peek at what gold shares were doing at the same time. For example, Newmont Mining opened yesterday at $40.30 and closed up at $41.07, whereas gold for delivery in December fell by $2.70.

(2) Chris Mayer looks at agricultural land in Brazil and Argentina, in the light of a hungry and resource-limited China:

In Brazil and Argentina, you have one of the few places left in the world where you can acquire large tracts of land in temperate climates with plenty of rainfall to support large-scale agriculture. Already, the two countries produce about one-third of the world’s agricultural commodities. As China is the world’s workshop and India its back office, so has South America become its breadbasket.

Maybe this is why Hugh Hendry and his colleagues have just launched the Eclectica Agriculture Fund.

Subscribe to:

Posts (Atom)