Friday, July 04, 2008

Make the punishment fit the crime

Blaming the prophets

But who wants to be foretold the weather? It is bad enough when it comes, without our having the misery of knowing about it beforehand. The prophet we like is the old man who, on the particularly gloomy-looking morning of some day when we particularly want it to be fine, looks round the horizon with a particularly knowing eye, and says:

"Oh no, sir, I think it will clear up all right. It will break all right enough, sir."

"Ah, he knows", we say, as we wish him good-morning, and start off; "wonderful how these old fellows can tell!"

And we feel an affection for that man which is not at all lessened by the circumstances of its NOT clearing up, but continuing to rain steadily all day.

"Ah, well," we feel, "he did his best."

For the man that prophesies us bad weather, on the contrary, we entertain only bitter and revengeful thoughts.

"Going to clear up, d'ye think?" we shout, cheerily, as we pass.

"Well, no, sir; I'm afraid it's settled down for the day," he replies, shaking his head.

"Stupid old fool!" we mutter, "what's HE know about it?" And, if his portent proves correct, we come back feeling still more angry against him, and with a vague notion that, somehow or other, he has had something to do with it.

Jerome K Jerome: "Three Men In A Boat", Chapter 5

So, don't blame me, please, but I still think investors won't be out of the woods until 2010.

Thursday, July 03, 2008

Credit default insurance and murky dealings

According to Karl Denninger today, this is exactly what's happened in the case of UBS insuring one of its mortgage debt packages against default losses. The insurer, it's alleged, has totally inadequate capital for the insurance it's undertaken, but the insurance suited UBS because it permitted the stinking package to be left off the balance sheet.

Oh, to be a lawyer now.

Housing: have we reached the "point of maximum pessimism"?

Benjamin Graham said we should “buy from pessimists and sell to optimists”. The smart money has done the second part, maybe it should look out for the first soon.

Peter Schiff using the word "collapse"

Some hot collars in this discussion. But a question does arise for me, which is this: if the US economy has to be rebased on savings and investments, but the sinking dollar raises prices of food, fuel etc, it's going to be very hard to find the money to improve the savings rate. Especially if those who have serious money are doing what Schiff and others would recommend as their financial advisers, i.e. buying foreign stocks and holding foreign currency.

And the same goes for us in the UK, I would think.

Wednesday, July 02, 2008

Could deflation reduce the price of gold?

But people like Karl Denninger have been saying for a long time that the outcome of the credit crunch will be deflationary, and Mr Denninger is more emphatic than ever about that now. And that's not just the view of a private investor who backs his judgment with his own hard-earned money: the Bank for International Settlements (htp: Michael Panzner) also thinks deflation a serious possibility.

I recently did a little primitive chartism and thought it possible that the Dow might revert to what looks like a longer-term trend line that includes the 9,000 mark.

Turning to the price of gold, it has certainly soared over the past few years, but there's been debate about manipulation. Frank Veneroso thinks central banks have been releasing stocks of gold to keep the price down, yet at the same time it is suspected that speculators have been boosting the price, possibly using leveraging (borrowing extra cash to increase the returns).

So another way for McHugh's prediction to come true (again), would be for both the Dow and the gold price to come down together. The ratio implicit in his prediction (13.51) could imply that the Dow hits 9,000 and gold drops to about $666 per ounce, or about 30% off where it is now.

Not impossible, if leveraged speculators have to disinvest to repay their borrowings in a hurry; and it would still only be a reversion to where gold was two years ago (and even then, nearly double what it had been three years before that).

Investment challenges in a bear market

No, the test is whether you keep your money in a Bear market. Note that I didn't say "make money". I said keep your money.

If you have the same amount of money now in your investment accounts as you did at SPX 1576 in October, you are doing better than 90% of all institutional money managers and 95% of all individual investors. This puts you in the top 5% - and that's just by going to cash in October and sitting on your hands.

If you've actually made money since then, you're in the top 1%.

Tuesday, July 01, 2008

The potential for Near Eastern industrialisation

Why shouldn't the eastern seaboard of the Mediterranean bcome a manufacturing centre to rival any in the world?

- There is still a vast amount of oil in Arabia, but water, too - e.g. under the Judean desert, plus three aquifers under the Sahara.

- The dry atmospheric conditions are conducive to the long-term storage of stocks of new cars, planes etc.

- The sunny region would be very suitable for "green" energy systems, too, such as solar updraft towers.

- The Arab leaders have enormous reserves of capital.

- There are many people in those countries who would benefit enormously from the work and wealth if their countries industrialised.

- There is land a-plenty for development.

- The eastern Med is beautifully located for producers to get their goods by sea to Western European and North African markets, and the Red Sea for the Middle and Far East.

Monday, June 30, 2008

Marc Faber update: take refuge in gold

And here's an extract from Faber's monthly "Market Comment" three years ago (July 5, 2005):

... Lastly, think about the following situation. The US manufacturing sector becomes very weak. The housing market falls and consumption declines. But oil goes through the roof because the empire of eternally rising home prices has just bombed Iran (very likely, in my opinion). Now the Fed cuts interest rates and eases massively. Just think what the stock, bond, foreign exchange, and gold market will do? The initial reaction might be a flight to safety – into government bonds and gold, and out of stocks. But, thereafter, a massive sell-off in bonds could occur as inflationary pressures build from sky high energy prices and massive money printing.

I have to confess, that I am not so sure exactly how this situation would play itself out, but it is worth thinking about it.

Worth the US$ 200 annual subscription, you may think. Especially since some of it goes towards the education of poor children in northern Thailand.

Janszen says next bubble will be in energy

Read iTulip founder Eric Janszen's Harpers article.

"Caloriefornia or bust!" Any views from energy investment specialists (e.g. Nick Drew)?

A defence of blogging

From "The Spectator" magazine, inaugural issue, July 5, 1828.

Yet how swiftly do some other publications forget their humble origins, which have subsequently attained eminent status. "Private Eye" lampoons the "online community" in its column "From The Message Boards"; but in 1961, there were its founders Christopher Booker and Willie Rushton, using typewriter, Letraset, hand-drawn cartoons, scissors and glue (in Willie's mother's flat, I seem to remember) to compose their witty and scurrilous magazine; and the new technology of photo-litho offset to print it. How is this different from the homeworkers of the blogosphere, and the use of the new capabilities of the Internet? Was not Private Eye the original blogpaper?

Liberty Marr'd by its Champions

A gentleman writes, that Mr Andrew Marr, the news-reporter and erstwhile foe of judge-made privacy law, now desires to be kept privy not only certain information concerning himself, but also the knowledge that he has secured an injunction to that effect from the court.

If any correspondent should care to illuminate this dark matter, he shall find us all ears; though we grant, that ears cannot see.

Might it be item 35 here? As revealed by Guido in January?

UPDATE: Another gentleman writes in defence of Mr Marr's right to privacy

*** 2009 UPDATE: Alastair Campbell implies exposure of Andrew Marr

Sunday, June 29, 2008

Making money out of distressed financials

Several of the deal guys said that banks they contacted three months ago about buying assets are all of a sudden calling back. Three months ago they said everything was fine. The idea du jour is to buy the bank to get the bank’s real estate. Sounds screwy to me but I’ll write some more about this one tomorrow.

This reminds me of something I read many years ago in "Adam Smith" (George Goodman) and wrote about here almost exactly a year ago - buying bankrupt (or nearly so) stock that includes the rights to tangible assets.

I don't have the cash or sophistication for this one, but maybe one of you out there knows how to work out whether a bank's shares are selling at a discount to the value of its underlying assets.

There's always an angle, isn't there?

Inflation not purely a monetary phenomenon

I looked at the Bank of England's figures for M4 from end 1963 to end 2007, and by my calculation the monetary base has increased by a factor of about 240; yet prices have increased only 15 times in the same period. (*)

Currently (and time permitting) I'm also working through David Hackett Fischer's "The Great Wave". In his concluding chapter, he lists seven different causal explanations of inflation, and none of them quite fits the observed facts, not even monetarism. For example, in the sixteenth century, European prices began to rise some time before the imports of gold and silver from the New World could have made a difference.

His idea is that inflation-waves are "autogenous" (don't academics love this kind of label?), by which he means that people make decisions based on current circumstances and their personal predictions for the future, and that helps shape the next set of circumstances. It's like watching a football game unfold, each player adjusting his movements according to his perception of the others.

Fischer thinks that one important factor in the price-wave of the Middle Ages was a trend towards marrying earlier and having more children, which put pressure on natural resources at the same time as altering the ratio of working adults to dependant children. Perhaps this has modern echoes in the growing longevity and reducing mortality rate in the developing world, plus the increasing numbers of dependant elderly in most places.

At any rate, inflation in the West is likely to become less susceptible to control by adjusting the interest rate. What will the Monetary Policy Committee do then?

Perhaps it might help if we established some control over the actual amounts pumped into the economy by the banks (and other creditors). I can dimly remember the news in the 60s, about limits on how much you could borrow to buy fridges, washing machines etc - apparently a minimum deposit was a requirement of the Hire Purchase Act 1964.

However (it seems), Japanese manufacturers found ways to get round this and offer (in effect) 100% loans, and then came the pandemic of credit cards, starting with "your flexible friend" Access (1972). Telegram Sam the drug dealer is always friendly, at first.

________________

(*) Unless, of course, the discrepancy is accounted for by (a) the need for the monetary base to expand each year to cover interest on loans already made, and (b) much extra money being locked-up in real estate - an awful lot of building and rebuilding took place as the postwar economy recovered.

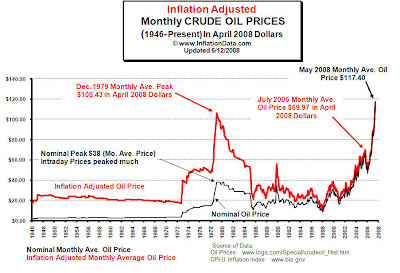

Investment, inflation and market collapses

If you're an active investor, you may start thinking about opportunities. Look at the red zones. Draw a line from a deep points to a high one, and feel the greed; but draw lines from a temporary rally to another low, and feel the disappointment. You do need to get your timing right.

If you're an active investor, you may start thinking about opportunities. Look at the red zones. Draw a line from a deep points to a high one, and feel the greed; but draw lines from a temporary rally to another low, and feel the disappointment. You do need to get your timing right.Crime and punishment

Henry Wallis: "The Stone Breaker" (1857)

Henry Wallis: "The Stone Breaker" (1857)In a country with proper justice, nobody would dare intimidate a witness.

In such a country, wrongdoers are afraid of the law. They'd know that such a crime would certainly be prosecuted and that they'd end up doing at least 15 years breaking rocks.

... says Peter Hitchens in today's Sunday Grumbler.

"Pitee renneth sone in gentil herte," said Chaucer, sometimes ironically. The worthy compassion shown to unfortunates by the Victorians has, gone too far, some argue.

But there are now different reasons to pity. Prisons do not punish the wrongdoer in the old-fashioned ways, but the incarcerated man is no longer protected against bullying, beating, buggery and theft. In how many movies do we hear the police threaten a criminal with what his fellows will do to him in prison? Judge Mental does not put on his black cap and say, "You will be taken from here to a place of detention where you will have your arm forced up your back and..."

Then there's life outside, for the neglected underclass. "Theodore Dalrymple", a doctor who has dealt with many prisoners in Birmingham (UK), used to note in the Spectator magazine that prisoners' health improved considerably in prison, because of no (or reduced) access to drugs. Read the good doctor here on how the liberal approach to mind-altering substances is pretty much a sentence of death (prolonged and degrading). Here's an extract on alcohol:

I once worked as a doctor on a British government aid project to Africa. We were building a road through remote African bush. The contract stipulated that the construction company could import, free of all taxes, alcoholic drinks from the United Kingdom...

Of course, the necessity to go to work somewhat limited the workers’ consumption of alcohol. Nevertheless, drunkenness among them far outstripped anything I have ever seen, before or since. I discovered that, when alcohol is effectively free of charge, a fifth of British construction workers will regularly go to bed so drunk that they are incontinent both of urine and feces. I remember one man who very rarely got as far as his bed at night: he fell asleep in the lavatory, where he was usually found the next morning. Half the men shook in the mornings and resorted to the hair of the dog to steady their hands before they drove their bulldozers and other heavy machines (which they frequently wrecked, at enormous expense to the British taxpayer); hangovers were universal. The men were either drunk or hung over for months on end.

Our soft-handedness on crime and drugs, is really an extreme hard-heartedness.

Saturday, June 28, 2008

The economy is like a rainforest

In the rainforest, there are places that are light or dark, hot or cool, high or low, wet or dry. In the economy, there are savers, borrowers, amateur and professional investors, crooks, marks, young bold, cautious old, workers, shirkers and berserkers.

So centralised economic policy is enormously difficult. An intervention that helps one part, may hurt another, and further action is implied. It's like the tablets for hypertension that give you gout, which means you need tablets for the gout, which are likely to harm the lining of your stomach. Some might say, throw the lot away and have a glass of sherry before bedtime.

Or, in rainforest terms, let each species find its niche and organise its own survival strategies.

But I don't think this is an argument for complete liberal laissez-faire. To extend the analogy, maybe it's better to prevent harm than to seek to do good; the forest guardians need to control the rubber and banana companies, the clear-cutting loggers and polluting miners.

Friday, June 27, 2008

Dow Jones - worse bubble than the FTSE?

Just out of interest, I thought I'd do the same trend-spotting exercise for the Dow Jones as I did yesterday for the FTSE, i.e. extrapolating the highs and lows in the late 80s and early 90s.

Just out of interest, I thought I'd do the same trend-spotting exercise for the Dow Jones as I did yesterday for the FTSE, i.e. extrapolating the highs and lows in the late 80s and early 90s.The results are very different. October 2007 saw the Dow's highest-ever peak, and today, after falling over 2,000 points from that point, it still stands about where it was in the tech bubble of December 2000 (see yellow line).

And my hi-lo wedge (red lines) suggest that the Dow has been seriously above trend for most of the last 11 years. Of course, you can draw lines however you like, but I'm trying to do approximately the same as for the FTSE and the implication is that the Dow "ought" to be between 7,000 - 10,000, centring around the 8,500 mark. This chimes with what Robert McHugh predicted last year (9,000). (If you draw the "high" line to connect the '87 and '94 peaks, the hi-lo lines converge towards 7,000!)

I wonder what's keeping it up?

Stockmarket crash - a golden opportunity

We could be approaching a once-in-a-generation Templeton opportunity, a financial fire-and-forget that could richly reward those who save very hard right now. Give the rifle another pull-through, hitch up your belt, and wait...

Thursday, June 26, 2008

The FTSE - semi-wild guesses about fair value

Using these parameters, the late 90s and early 00s were well above trend, whereas last year's highs only just peeped above the upper line and the current value is hovering a little above the centre of the hi-lo wedge.

The implications are that the next low, if it comes soon, shouldn't be worse than around 4,500, and by 2010 (when I'm guessing the tide will turn) the bracket would be in the 4,700 - 7,000 bracket, with a midpoint of c. 5,850.

Taking the market at close yesterday and extrapolating to that 5,850 midpoint, would imply a future return (ignoring dividends) over the next 16 months, of c. 2.5% p.a. - not nearly as good as cash, especially in an ISA. On the same assumptions, to achieve an ex-dividend return of 6% p.a. would require entry into the market at c. 5,400.

On this tentative line of reasoning, we should be looking for a re-entry opportunity somewhere in the 4,500 - 5,400 level, say 5,000. Shall we wait for the next shoe to drop?

Inflation vs deflation - the iTulip debate

Wednesday, June 25, 2008

How much of the crash is behind us?

The FTSE is closing somewhere around 5,666.10 today. It closed at 5,709.50 on 17 February 1998, which was the first time the market had breached today's level.

The FTSE is closing somewhere around 5,666.10 today. It closed at 5,709.50 on 17 February 1998, which was the first time the market had breached today's level. Tuesday, June 24, 2008

Littlejohn vs Toynbee

"... do you think about global warming when you're flying to your villa in Italy?"

A sought-after moment, I believe.

Investment in agriculture sparkles

Of course, the poor are being hit badly (not the poor here, who aren't really poor). Hendry argues that rising food prices will encourage more (and much-needed) investment in agriculture.

Monday, June 23, 2008

Taking a line for a walk

Timothy McMahon at FinTrend reckons we should be looking to buy into US stocks this summer, using the rate of return graph above.

Timothy McMahon at FinTrend reckons we should be looking to buy into US stocks this summer, using the rate of return graph above.How far should we heed the chartists? Like cardsharps fleecing marks on a sinking Mississippi paddlewheeler, are they better at short-term plays, but inattentive to catastrophe?

Does freedom from self-destruction need a nudge?

As it happens, this is the thesis of a new book, "Nudge", by Richard Thaler and Cass Sunstein. It is critically reviewed by David Gordon here on the Mises website.

We are already being heavily nudged by our tax-greedy government and large commercial concerns, to gamble and drink away our wealth and future security. Surely there are ways in which we might diminish the temptation a little, to increase the possibility of rational, self-beneficial choice.

Comparisons are odious

Sunday, June 22, 2008

Plodding On

Of course, there's always foot patrols. Peter Hitchens has often pointed out the usefulness of walking the beat in preventing crime. It all went wrong in the Sixties. As J. B. Morton wrote in his fantasy-satirical "Beachcomber" column in the Daily Express at that time:

"A Dictionary For Today

...FLYING SQUAD: A special contingent of police whose business is to arrive at the scene of a crime shortly after the departure of all those connected with it."

So much for the pale blue Ford Anglia and the comical attempt to imitate American cops as portrayed in shows like "The Streets of San Francisco."

I had to trawl around to find what I remembered as the origin of the term "bobby on the beat", but here we are at last:

"A standard piece of police equipment from the 1830's to the 1880's was the rattle for raising the alarm, most operated like the standard football rattle, when twirled round it made a distinctive sound. In the 1880's the police began using a whistle in place of the rattle, early versions used the 'pea' type (still used by football referees) but in about 1910 the more familiar tubular 'air whistle' was invented. The whistle was carried inside the front of the tunic or jacket attached to a silver chain which was fastened to a button on the front of the tunic. When breast pockets appeared the whistle moved to the right hand pocket with a silver chain still attached to the jacket button. In practice the whistle was found to have limited range and a bobby calling for assistance would often beat his truncheon on the pavement to alert nearby colleagues. Police personal radios appeared in the 1970's and some forces had lost their whistles by the 1990's but other forces felt it was a part of the uniform and have retained it."

(Source)

And it worked. So instead of moving forward to the world of "1984" or re-creating the secret police of the Austro-Hungarian Empire, why don't we build on the notion of "Police Community Support Officers" (or "The Ankh-Morpork Watch" as my wife calls them) and revive the Watch as it was up until the early nineteenth century? The roots of our police force are in the citizens' right and duty to maintain order in their own communities. As motorised mobility for the peasantry declines, crime, its detection and punishment may well become localised again.

And a reduction in sophistication would be appropriate. The old police recruitment poster said "Can you Read? Can you write? Can you fight?" - not, "Can you gobble the punter's biscuits and swill his tea while expressing sympathy for his unfortunate experience and sharing his frustration at the powerlessness of the criminal justice system?"

Saturday, June 21, 2008

Handy-dandy, which is which?

The result in one case was declared unsatisfactory by the ruling party and an order given that the issue be readdressed within three months.

Robert Mugabe has yet to declare his candidacy for the Presidency of the European Parliament.

Grasping the nettle

I suppose it's a dangerous question to ask, but is assassination always morally wrong? Was the life of Nikolai Yezhov really worth the lives of 3 million of his victims?

This article justifies it in the context of Israeli national self-defence (no spittle-flecked anti-Semitic comments, please, the same arguments can be expressed using other contexts), but what if the enemy is within one's own society? For example, was Stauffenberg correct in his attempt to blow up Hitler, his leader?

I suppose this must lead to the question of whether right and wrong actions receive their due in another world, rather than this one, where villains appear much safer, live much longer, than the innocent. Mao, Stalin, Pol Pot, Idi Amin...

Why has Bill Gates stepped off now?

What I've read about business moghuls suggests that, however rich, they never want to give up. They can always try to get bigger and outdo, or do in, a business rival. Robert Maxwell's downfall was his obsessive competition with Rupert Murdoch, which got down to the personal. For example, learning that Murdoch had flown to New York for a business dinner at a swanky restaurant, Maxwell immediately got on Concorde and shot across the Atlantic, so he could be at a neighbouring table.

And these people will compete in the smallest way. I read an article which said in passing that while his chauffeur-driven car was waiting at a red light, Maxwell saw next to him a very nice sports car (possibly a Ferrari). He leaned out of his window and helpfully informed the neighbouring driver that his rear tyre was flat, so that as the man glanced back, Maxwell's car could be first through the intersection when the lights changed.

So why is Gates, such a fierce competitor that his employees refer to themselves as "Microserfs", "retiring" at 52? Is it because he is smart enough to know when his business has peaked, and seeing a rival in Google (and a challenge from freeware) that he can't beat (despite his firm's attempt to purchase Yahoo!), he's withdrawn before defeat is clear? In which case, what are the implications for investors in Microsoft?

Friday, June 20, 2008

Shut down the EU Parliament

Thursday, June 19, 2008

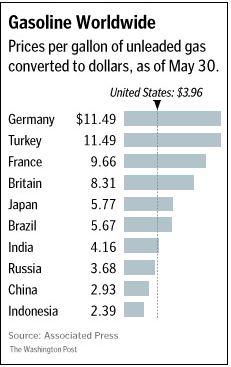

Disaster, illustrated

htp: Michael Panzner, quoting the Washington Post.

Sackerson's challenge

When I was advising clients on pensions etc, I'd go through the usual regulatory rigmarole on affordability, and on paper they would only be able to do £20 or £50 per month. I'd be putting myself at risk recommending more than they could "afford".

But in many cases, next time I saw them, they'd done one of the following: (a) bought a new car on credit; (b) allowed their partner to give up work, and/or started a family; (c) moved house and massively increased their mortgage. It's amazing what you can afford, when you're motivated.

So while taking a benevolent interest in the government's mishandling of the economy, why don't we get radical? "Action direct": get out of debt and save money for the challenges, and opportunities, to come.

My challenge: if you're in a steady job now, what percentage of your gross income could you save, if absolutely necessary? For if my hunch about deflation now, and inflation later, proves right, you could make an absolute killing in the next 10 years.

Wednesday, June 18, 2008

Ouroboros and the Left

Gramsci therefore argued for a strategic distinction between a "war of position" and a "war of manoeuvre". The war of position is a culture war in which anti-capitalist elements seek to gain a dominant voice in mass media, mass organizations, and educational institutions to heighten class consciousness, teach revolutionary analysis and theory, and inspire revolutionary organization. Following the success of the war of position, communist leaders would be empowered to begin the war of manoeuvre, the actual insurrection against capitalism, with mass support.

Is it too much to say that in British schools at least, there has been a "war of position"? Hymns in assembly, RE, British history, the cane, the authority of the teacher - all in the bin. And all since, oh, I would say the mid-80s*. Now, the teacher is a kind of Lyons nippy, swiftly and attentively addressing every need of every child, and with no expectation of a tip.

And as the revolution approaches its moment of crisis, the Government (members of which have assisted with the first phase) has sealed itself into its Downing Street compound, like the East German rulers before their fall. Gordon Brown, formerly the student Rector of Edinburgh University, learned early how the power system had loopholes and having exploited them, is closing them. So the surrounding area is legally a protest-free zone and our new Stasi is set on harmless teenage student demonstrators.

Despite these efforts, and like Kronos, the Revolution may eat its children. Yet Zeus survived because Kronos was given a Rock to eat instead...

* after first flutterings with the William Tyndale affair (1974), Chris Searle's "Classrooms of Resistance"(1975) and other inputs.

Tuesday, June 17, 2008

Chicks up front!

Now, in London, near the Mother of Parliaments, a 17-year-old girl can be arrested, charged, taken to a police station and regularly woken up at the low point of her circadian rhythm in order to tempt her to make a statement without the benefit of legal representation. All this, simply for carrying a placard. My country shames me.

Anybody reading, who has any influence with the powers that be, please communicate our shame, chagrin and anger.

*corroborated here - and either inspired by, or inspiring, the Viet Cong according to "DreadPirateRoberts" (see his April 30, 2008 5:04 pm comment here)

MSM: news suppression service

The Daily Mail first learned of the bank's secret plans in January but, after a late night call from Mr Darling, was begged not to publish.

(From this morning's Grumbler.)

Has the Press become an arm of Government?

Monday, June 16, 2008

Off licence alcohol purchases - minimum age 21

Michael White confuses matters by yoking this good horse to a bad one (morning-after pills for the underaged). Nevertheless, I wonder if we might make progress in this direction, as with smoking, but perhaps in a different way. as it's not just the young who have drink problems.

I think availability is a key factor. Imagine having a beer (or other tipple of your choice) tap next to each cold-water tap in the home - who could resist? Yet alcohol is nearly as accessible these days - supermarkets, post offices, even petrol stations. Rather than try to enforce an age limit (another pile of arrest records to write), let's try to remove some of the temptation: let's reduce the number of off-licences.

My preferred solution would be not to renew the liquor licence for a supermarket if there is an alternative outlet within a certain distance. Supermarket shelving has a narrative all its own - and booze is near the end so we can say to ourselves or our partners, "Shall we?" "Go on, then." It's a cunningly-positioned add-on to household shopping, encouraging the potentially dangerous habit of steady home drinking.

No stagnation, but a house price crash

The alternative (house prices stagnate, allowing inflation to achieve the same result more slowly) has become unsustainable because of fears respecting the stability of the banks.

Sunday, June 15, 2008

Drink is the curse of the post-working classes

... from Alcohol, Youth, and the State by Nicholas Dorn (RKP, 1983)

Taking on the supermarkets now would be like eradicating the Taliban. Remember how they took on the government and won easily, e.g. in 1991? So much for the rule of law.

Licensing Act 1964 - legal summary

2003 Licensing Act - summary

On the coarsening of British culture

Thus Russell Brand, in the Guardian newspaper. His louche autobiography is entitled "My Booky Wook", though for some reason he doesn't apply the same baby-linguistic titling approach to his blog or website ("My Blogy... no! No! Career death!"). For there are things these jokers take very, very seriously: banknotes.

The Teflon coating on his deadly bullets of vulgarity is a trifling pretension to verbal and literary sophistication. And it's happening all around, and so very well rewarded.

Of course, the next generation is past TV. So what are your children playing on the Internet? Here's some of the games I've seen ten-year-olds chuckling at in the last fortnight:

Stair Fall

The Torture Game

The Last Stand 2

And as fast as you block these entertainments, new routes to them appear via new game compendium sites. And more and more new games, most of them free of charge.

But the work of psychic corruption must proceed, so we must be inoculated against notions of censorship by tendentious TV biopics of well-meaning moral campaigners like Mary Whitehouse, who was of course not nearly so posh, sophisticated, well-breeched and well-connected as the moguls she took on. So smart are we that she is to be condemned as much for her eyewear as for her lower-middle-class status and dowdy profession (schoolteaching - art and sex education).

I think we must wait for the University rebels of the late Sixties to retire or die before we can start the salvage operation.

In the paper shop

"Drinks are on you, then," I say.

"I've spent £35,000 since the Lottery started, and had five back," he says.

He'd come to the shop at six, having forgotten that it opens at half-past. He thinks he's in the early stages of Alzheimer's.

__________________________________

Here's some lines of comment that could come out of this, but you can easily expand them yourself, I'm sure:

- Mathematics - the Lottery gives back 45% in prizes, but averaging-out could take forever

- What is a Government doing, making gambling so easy and readily available (and it started under the Tories)?

- How much would this man have had, if he'd saved £208 per month since 1994?

- Now that insurance salesmen have disappeared, what has happened to savings among the C2/D classes? Has financial consumer protection (after the pensions mis-selling compensation and regulation bonanza) indirectly impoverished them and made them more dependent on the State?

I expect you can come up with more, and better.

And then there's drink, from allowing supermarkets to sell it along with your groceries, to 24-hour booze licensing.

Are misguided arguments for liberty being used to enslave people to their weaknesses? Should heavily-capitalised businesses be allowed to batten on those flaws?

Saturday, June 14, 2008

Oil: back to the Seventies

Found on InflationData.com

Fasten your seatbelts

David Hackett Fischer has studied the behaviour and historical meaning of inflation not just over the last decade, or the last century, but over the last 800 years. He sees the world positioned in a dangerous moment of possibility, on the rearing crest of the fourth great wave of inflation in eight centuries.

I would still be grateful for any information about what I shall call "sim economics" - potentially so much more useful than other simulation games.

Anybody able to help, please?

Friday, June 13, 2008

Help required: economic modelling

It seem that in the USA and UK, we are holding down interest rates to avoid crippling homeowners, the home-loan-based economy, and what's left of our industries, and also in the hope that we can repay our debts to foreigners with devalued cash. On the other side, countries like China and Japan seem to be trying to prevent their currencies from appreciating, so as to preserve their trading advantage.

So one party is letting their currencies sink, and the other is trying to stop theirs rising. To this amateur, the world's foreign exchange system looks like a bunch of corks tied to an unchained anchor and flung into the sea. Will the string on the corks hold, or break under the strain, or be abruptly cut?

Is there any computer- or board-game-based model of the world economic system, that might make it clear to me how this wretched thing works?

And how is the ordinary person to save money and preserve its value in real terms, without having to be super-sophisticated? I know something about American TIPS and British NS&I Index-Linked Savings Certifcates, but I'm leery of handing the government what little money they haven't already extracted from me in taxes. And I don't trust them to define inflation fairly.

Does anybody know how this boneshaker of a contraption actually operates, so we can make sensible decisions?

Speaker or silencer?

Thursday, June 12, 2008

What oil hike?

At least Richard Daughty is one who will not go gentle into that good night.

Now, isn't this what happened in the Seventies? Only we were conned into thinking it was down to wicked Arabs, when really the story was increased monetary inflation for some years pre-1974.

Marc Faber, cash and Cambodia

Stocks, Real Estate and Oil Are Overvalued, Marc Faber Says

Why rising inflation will trigger a bond market rout

Cambodia Starts to Beckon Private Equity

For investors, Cambodia could be the next Vietnam

The last is interesting. I have suspected for some time that Dr Faber lives in northern Thailand, not simply to hide in Shangri-La but to be nearer to the places where real bargains may be found, and so that his hunches can be informed by personal networking and under-the-radar experience. Quirky and fast-moving, he would not be the man to manage a large institutional fund: I think his lightning ex-ski champ reflexes demand more challenge.

An after-thought: if you do think cash is best, there's still the question of which currency.

Is it OK to have principles?

UPDATE

Someone put the text of Mr Davis' speech as a comment to Michael White's piece. Here are a couple of extracts:

This Counter Terrorism Bill will in all likelihood be rejected by the House of Lords... But because the impetus behind it is political, the government will be tempted to use the Parliament Act...

It has no democratic mandate to do this...

... I am just a piece in this chess game.

Folly? Vanity? My eye (and Betty Martin).

Are free trade and small government the answer?

But what would happen to the poorest if we really did move towards laissez-faire capitalism? I don't mean the poor in India and China, who are currently benefiting from open markets; I mean the poorest in the USA and UK. Would things really sort themselves out to the good of all?

Or would we find that we'd leapt from the frying pan into the fire?

Tuesday, June 10, 2008

An appetite for investment risk?

Just curious.

Monday, June 09, 2008

Cashhhhhhh... don't tell anybody

... reports Ambrose Evans-Pritchard in the Telegraph (I must start to read the big-words papers). Anyhow, this is what Marc Faber said months ago. Short-term, I have a feeling DE is still on for the 'flation hors d'oeuvre, with IN as the entree.

By the way, are any managers of collective investment funds actually saying the type of thing Wilmot is saying, to their clients (not the big, favoured ones, the others, the Moms 'n' Pops)?

(htp: Karl Denninger)

Sunday, June 08, 2008

Please read this man

That way, I may have more time to sell my house at current ridiculous market prices, which for personal reasons I can't yet.

Does State expenditure inflate the market?

... even if it is a wonderful idea to pay Mr Ross roughly 30 times more (annualised) than the Prime Minister and 20 times more than the Governor of the Bank of England out of what is, after all, tax, it is obvious rubbish that this does not push up the market. If the BBC were not competing in this field, Mr Ross’s price to commercial channels would plummet.

Deplorably, Mr Ross is unbelievably coarse, which sends a message to his (relatively) young audience. Peter Hitchens suspects that this crassness is a cynically avaricious pretence:

Ross talks on TV in an arrogant sort of loutspeak.

I wonder if he talks like that when he’s dealing with his lawyers and his accountants.

Now that would be a fly-on-the-wall documentary to screen next to Ross' show.

So, celeb wages inflated and manners undermined by spendthrift public services.

Meanwhile, Liz Jones takes a very laudable interest in the young, especially those rotting away in the complex trap of social security benefits. And again, a market may be distorted by public money:

Her room is damp, sparsely furnished, has a stinking, threadbare carpet, and Paris mostly sits on her bed, terrified to walk to the shared bathroom in case one of the boys who slouches around outside harasses her.

Drugs are dealt openly in the corridors. Each week, ‘the council’ (I’ve never heard her use the words ‘government’, ‘Labour’ or ‘Gordon Brown’) pays the £330 rent (yes, that is £1,430 a month, more than my mortgage repayments) for her box room direct to the private landlord; on top of that, Paris is given £47 a week to live on.

That is, she was, until the council got wind she had got off her backside and found a job, just three days a week, in a clothes shop in Oxford Street (she would have loved, she told me once, to have been a fashion designer).

Although her pay is less than her rent, she has been bombarded with letters and forms, too complicated for anyone, let alone someone with dyslexia, to fill in, demanding six months’ back rent.

She is now being threatened with eviction.

The negative reinforcement is too obvious to summarise, but look at this young girl's rent as a proportion of her total "income": 87.5%!

Compare that with this, from the Guardian in December 2007:

The CML said a typical first-time buyer paid 20.6% of their income to service their mortgage in October, up from 20.4% in September, while for those moving house it rose to 17.6% from 17.5%. The figures are the highest recorded since 1991 and 1992.

There are now very many people (about 4 million) on some form of housing benefit. Is it not possible that rents, and consequently housing valuations, have been grossly distorted by such interventions? Isn't there some other way to house people without creating opportunities for modern Rachman types?

For the record - a British MP speaking in Parliament on the EU's legislative control of the UK

3 Jun 2008 : Column 644

Members of Parliament (Pay and Responsibilities)

3.35 pm

Mr. Peter Lilley (Hitchin and Harpenden) (Con): I beg to move, That leave be given to bring in a Bill to require the Senior Salaries Review Body to take account of transfers of powers between Parliament and European Union institutions when making recommendations on the pay of Members of Parliament; and for connected purposes.

In virtually every occupation, it is recognised that pay should reflect responsibilities. If people receive more responsibilities, they get higher pay. If they move to a post with fewer responsibilities, they expect to receive lower pay. The same should be true of Parliament. If, as is contemplated under the Bill that deals with the European constitutional treaty, this House hands over more of its powers to European institutions, MPs’ remuneration should reflect that diminution of their responsibilities. If, on the other hand, as my right hon. Friend the Leader of the Opposition has promised, Parliament regains some powers, such as those over social and employment policies that were conceded in the Amsterdam treaty, that should be reflected positively when MPs’ pay is assessed.

This issue is important because Parliament is considering transferring a significant slice of its powers on energy, foreign policy, immigration and several other areas to European institutions under the Lisbon treaty. A substantial transfer of powers has already occurred under previous treaties, and this House has ceded powers on a lesser scale to devolved Parliaments and to the judiciary under the Human Rights Act 1998. The German Government estimate that more than 80 per cent. of German laws are now decided at a European level. Our own Trade Minister has admitted that

“around half of all UK legislation with an impact on business, charities and the voluntary sector stems from legislation agreed by Ministers in Brussels.”—[ Official Report, House of Lords, 29 June 2006; Vol. 683, c. WA184.]

I have heard hon. Members claim that only 10 per cent. of our laws are made in Brussels—a figure that they attribute to a Library paper, but that paper says no such thing. It remarks that the number of statutory instruments laid under the European Communities Act 1972 amounts to about 10 per cent. of all the statutory instruments passed by the House, but points out that EU statutory instruments typically enact a whole directive, which is often the equivalent of an Act of primary legislation, whereas domestic statutory instruments implement regulations. To compare the two is like comparing apples and pears, or rather pumpkins and pears given the disparity in their size. It also ignores the most plentiful fruit that comes from the European orchard—regulations, most of which are never considered by this House and which hon. Members find difficult even to obtain.

The total scale of EU legislation is enormous. Last year, the EU passed 177 directives, which are more or less equivalent to our Acts of Parliament, and 2,033 regulations, which become directly enforceable in this place, not to mention 1,045 decisions. Even that huge tally ignores the extent to which our powers are diminished by our inability to do things that we would like to do because they would conflict with European law. When I was a Minister, officials would frequently say, “No, Minister, you can’t do that”, because something was within the exclusive competence of the European Union.

If the Lisbon treaty goes through, a further salami slice of powers will be transferred to the European institutions. The hon. Member for Birmingham, Edgbaston (Ms Stuart), who served with distinction on the European constitutional convention and who knows more about the implications of the Lisbon treaty than almost anyone else in the House, except for my right hon. Friend the Member for Wells (Mr. Heathcoat-Amory), recently told the Fabian Society:

“If the Treaty of Lisbon is ratified and devolution...continues apace, in fifteen to twenty years this House of Commons will have only two functions...to raise taxes and...to authorise war”.

She went on to say that we are making “fewer and fewer decisions that matter” to people’s daily lives, and that she could not tell her constituents that the buck stops here.

Admittedly, declaring wars kept Parliament pretty busy under the previous Prime Minister, as does raising taxes under the current incumbent of No. 10. However, our constituents want us to wage fewer wars, raise fewer taxes and focus on the huge range of issues that affect their daily lives, over which they assume and hope that we retain the powers that they pay us to exercise on their behalf.

Few voters, or even Members of this House, fully realise how many powers have been, or are about to be, transferred elsewhere. There are three reasons for this. The first is that Governments of all persuasions deny that any significant powers are being transferred. The second is that, once powers have been transferred, Ministers engage in a charade of pretence that they still retain those powers. Even when introducing measures that they are obliged to bring in as a result of an EU directive, they behave as though the initiative were their own.

Indeed, Ministers often end up nobly accepting responsibility for laws that they actually opposed when they were being negotiated in Brussels. They took the rap for costly and troublesome home improvement packs—which have added to the woes of the housing market—even though they were actually mandated by a Brussels directive. Similarly, they took the rap for fortnightly bin collections, hospital reconfiguration and a number of other measures, even though they had all been triggered by directives from Brussels. At first sight, it is odd that Ministers—who, in this Government, are not normally slow to blame others—should nobly defend and accept responsibility for Brussels’ legislative progeny, in whose conception they have often played little part. They prefer to claim paternity rather than admit impotence—the fate of the cuckold across the ages.

The third reason is that the transfer of power occurs not all in one go but by a process of salami-slicing, and it is easy to close our eyes to what is happening. As a result, there is a danger of Parliament sleepwalking into becoming little more than a provincial assembly. If that is what is happening, we should be paid accordingly—just as district councillors get less than county councillors, and county councillors get less than Members of the devolved Assemblies.

I do not have a masochistic desire to see MPs’ pay cut, but I want still less to see our powers diminish. The best way to prevent the latter might be to link pay to responsibilities. I do not know any Member of Parliament who entered Parliament to become financially better off. None the less, just as the prospect of being hanged in the morning concentrates the mind wonderfully, so the prospect of finding our pockets a bit emptier at the end of the month—and having to justify that to our spouses—might wake up those who have shut their eyes to what is happening. If we do not face up to what is happening, we will find ourselves being progressively relegated to what Bagehot called the dignified part of the constitution. As Tony Benn once rhetorically asked:

“I wonder how long it took for the yeomen of the guard to realise that they were no longer part of the regular army.”

My Bill is designed to provide a wake-up call whenever we risk going further down that route, although I accept that it has little chance of becoming law in this Parliament. Those who support the transfer of power from here to supranational institutions should logically accept that our pay should reflect the diminution of our responsibilities. But, strangely, all the Euro-enthusiasts whom I asked to sponsor the Bill declined to do so without explaining why. Too many Members are happy to avert their eyes from what is happening, so long as they retain the prestige and emoluments that were appropriate to a fully sovereign Parliament. Turkeys do not vote for Christmas.

If any Labour Members oppose the Bill, I hope that they will come out and object to it here and now, rather than trying to dispose of it by subterfuge one Friday morning. I look forward to hearing them argue for having their cake and eating it. I doubt that they would convince many of their constituents that, unlike any in other occupation, MPs’ pay should be divorced from their responsibilities.

Hugh Bayley (City of York) (Lab): We have just heard a witty and amusing speech. I was not aware that this issue was going to be raised today, but I was sitting in the Chamber listening to Transport questions and suddenly the right hon. Member for Hitchin and Harpenden (Mr. Lilley) rose to his feet and made this proposal. He said that he had asked a number of Euro-enthusiasts to back his Bill; I regard myself as a Euro-enthusiast, but he did not ask me. Had he done so, he would have given me advance notice that he was going to make this nonsensical proposal, and I would have been able to prepare a better speech. However, I shall certainly try to rise to the challenge that he has thrown across the Chamber.

The right hon. Gentleman argues that the volume of legislation to be considered by the House will decline as more and more powers are passed across to the European Parliament, but he knows as well as any other Member that the volume of legislation considered by this House continues to increase year by year. We have never suggested that that is an argument for increasing Members’ pay pro rata—

Stephen Pound (Ealing, North) (Lab): That is a good idea.

Hugh Bayley: I note what my hon. Friend says. Nor should the passing of some legislative powers from this House to Europe be an argument for moving in the opposite direction.

I must say seriously to Members of the House that I do not think that the European Union provides a good model for the remuneration of Members of Parliament. I have just checked with my hon. Friend the Member for Birmingham, Edgbaston (Ms Stuart), who is a sponsor of the Bill and well versed in EU matters, and she tells me that EU spend is about 0.5 per cent. of EU wealth. The spend of our national Government is probably about 40 per cent. of our national wealth, which is 50 or 60 times as much as the EU spend.

If the right hon. Gentleman is arguing that there is a serious transfer of financial responsibility from the House to Europe, that is just not based on fact. The Lisbon treaty not only does not change that fact, but it delegates some powers back to national Parliaments. The public want to see more information about MPs’ pay and allowances, but they would get less information if our pay was tied into and buried under bureaucracy from Europe. Surprisingly to my way of thinking, the Bill is proposed by a staunch opponent of Europe whom I would have thought could see that point himself.

The right hon. Gentleman is making a political point about Europe, not a serious proposal for greater transparency in the pay of Members of Parliament and greater accountability to the public for Members of this Parliament. I hope that the Bill does not receive its First Reading.

Question put, pursuant to Standing Order No. 23 (Motions for leave to bring Bills and nomination of Select Committees at commencement of public business), and agreed to.

Bill ordered to be brought in by Mr. Peter Lilley, Mr. Michael Ancram, Mr. Peter Bone, Mr. Graham Brady, Mr. Frank Field, Mr. James Gray, Mr. David Heathcoat-Amory, Mr. Edward Leigh, Mr. John Redwood, Ms Gisela Stuart and Mr. Charles Walker.

Members of Parliament (pay and Responsibilities)

Mr. Peter Lilley accordingly presented a Bill to require the Senior Salaries Review Body to take account of transfers of powers between Parliament and European Union institutions when making recommendations on the pay of Members of Parliament; and for connected purposes: And the same was read the First time; and ordered to be read a Second time on Friday 17 October, and to be printed [Bill 113].

Saturday, June 07, 2008

Stock up your larder

I believe the Mormons have a rule that members of their church must have 12 months' security set up for their families - I remember an old colour supplement article with a picture of a Mormon sitting on a year's supply of baked beans. Doesn't seem so daft now - and it's worth remembering why landlocked Utah is the Seagull State.

More generally, there is now a feeling that the government has failed to prepare for material and financial shocks. Genesis 41 has been obscurely referenced by George Osborne ("Our competitors used the fat years to prepare for the lean years"), though back in 2002 Treasury Committee member Dr Nick Palmer was using the same analogy, but in Gordon Brown's favour ("in the first years [Gordon Brown] repaid a lot of government debt so as to give us a really strong basis for difficult times as and when they arose").

On the financial front, I think the government cracked in 2003, when extra liquidity (simplified graph here) began to be released into the system, over-hydrating the housing market. Radix malorum est cupiditas, and that applies here if you interpret "cupiditas" in the general sense of over-attachment to worldly things, especially to power and its accompaniments.

Buffett eyes Europe

- Buffett's got $35 billion in cash to go a-shopping, and thinks Europe is more promising than the emerging markets - partly because Europe is already in recession.

- Have European companies endured because many have remained family-owned? Is the Anglo-Saxon model of capitalism too erratic and destructive?

- How important are hunches in investing? Lynn says, "Buffett doesn’t believe in extended due diligence or complex financial models. He chooses his investments based on what he feels about the people in charge, and whether he likes their products." And recently, George Soros said that for all his research, he pays attention to his own psychosomatic backaches.

- How much vital business information is conveyed - or betrayed - by tone of voice and body language? Mark McCormack said that he liked to go to meetings on his own, so that he wouldn't have to worry about unconscious non-verbal signals given away by an underling's reactions. For the same reason, he loved the opposition to come with company. Is the most important bit of investment reserach the site visit?

Thursday, June 05, 2008

How many trillions?

There comes a point when it gets so dire it starts to become funny. Ah well, time to clean house.