Jesse extrapolates the Dow and sees it heading for 2,000 points:

As my select and distinguished readers now know, I'm an optimist (by the standards of unfolding reality), and I say, not so. I say, maybe 4,000 - 5,000, adjusted for CPI.

The comparison I'd urge is not with 1929-32 (stockmarket deflation exacerbated by monetary strictness), but (in inflation-adjusted terms) from January 1966 to July 1982: stockmarket deflation prolonged and partially disguised by monetary inflation; I said so

here and

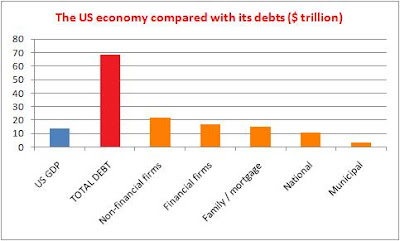

here, last month. I maintain that the bear market began in 2000 and the symptoms were masked by the terrible extra debts taken on over the last 8 years.

Karl Denninger showed us yesterday that these debts account for all the US GDP growth since the New Millennium, plus $9 trillion.

The debate about inflation and deflation continues, though from a British perspective we've seen practically the whole of the rest of the world become one-third more expensive in sterling terms, in only five months. However, Einstein's theory of relativity rejects the notion of any absolute standpoint, and we shall see next year which other currencies mimic sterling's vertiginous fall.

In these shifting times, it becomes very hard to discern real value; but however hard to measure, it exists nevertheless. There is a real bill to pay for our excesses, and I think 2008 will be seen in retrospect as the year that the global balance of power underwent a sudden tectonic shift, from West to East. Yes, the East will suffer for a while, too, but it has long been acquiring the means of production and developing its local markets, and will emerge from the crisis ahead of us.

And there will also - must also - be an intergenerational shift of power, within our Western societies. As globalization continues and real income and real house prices decline, existing debt (set in fixed terms) will become proportionately greater, until the weight is too great to bear; and the worst of it falls on the people who are also struggling to raise families and save something, however inadequate, for their old age. They cannot be crucified in this way. How can savers be taxed at 20% and workers at (effectively, on margin, including National Insurance) 40%? Real wealth must flow from one to the other, just to maintain civilization. I think either savings must be taxed more (perhaps the removal of tax exemption for some savings products will be the start), or inflation must come, though I don't know how long the play will go on before the denouement.

We did have another option, and I was only half-joking: cancel mortgage debts on a massive scale (bankrupting the banks and the bankers, and serve them right). Then, with our productive populace relatively unencumbered, it would be possible to let Western wages and prices fall to much nearer Eastern levels, and we could begin to compete.

I prefer Alexander's handling of the Gordian knot, to Gordon Brown's. For me, debt forgiveness is the way; but that's too radical, it seems. Instead, inflation will have to diminish the real value of debt, but jerkily, as the debt-holders periodically jack up interest rates in a fighting retreat. All to hide from reality. "Oh, what a tangled web we weave..."

In other words, if America had no such debts, she would have $1.45 trillion more per year to spend on other things.

In other words, if America had no such debts, she would have $1.45 trillion more per year to spend on other things.