For someone propelled into the political spotlight, Nick Clegg is an oddity. Unlike Blair, who treated attention like a sunlamp, Clegg seems oddly uncomfortable - not just with his situation, but with himself. Many photographs show his head tilted forward slightly, as though manfully resisting the urge to look down; after making key points in the pseudo-Presidential TV debates, his eyes would flick to the floor; and if you cover the top part of the face, look at the mouth - all wrong, somehow.

Like Baroness Ashton (Europe's first High Representative For Foreign Affairs), he looks like a natural loser who's won the Lottery, but is going to have it all taken away from him at some point. True, both are winners in a sense now, but the European setup that gave Clegg his first major political position as an MEP (after some years of service with the European Commission), and Ashton (I think) her last, has carefully arranged matters so that you have a big group of nonentities in a mock-Parliament, while all the real power is vested in the Council of Ministers. In short, these two are perfect stooges and the light of publicity does not flatter them.

It is, I think, significant that Clegg's postgraduate learning included a spell at the College of Europe in Bruges, an outfit whose purpose was described by postwar Euro-idealist Henri Brugmans as "to train an elite of young executives for Europe." I read that as a sort of McKinsey for pliable idiots. Other British Isles alumni include former Tory MP Nigel Forman, Neil Kinnock's sprog Stephen, LD stiff Simon Hughes, ScotNat MEP Alyn Smith (how a nationalist and a federalist? explain!), and Irish-born ex-Gen Sec of the European Commission David O'Sullivan.

Now, for a short spell, Clegg's playing with the big boys, and they're going to have his marbles and the bag they came in. Nothing will persuade any Labour or Conservative leader to agree to PR, a system that would guarantee perpetually recurring crises of governance like the present one. The Single Transferable Vote as some describe it (preference ranking within conflated groupings of constituencies) would tend to a squeeze of minor parties in favour of the largest two; tweaked versions of the Alternative Vote are obvious political fudges designed to include cosy dunroamin deadend spots for loyal, clapped-out Party hacks or political chessmen in search of a sinecure (I believe AV+ was Roy Jenkins' brainchild, if so the connection doesn't surprise).

The best that can be hoped for by LibDems is constituency-level Alternative Vote, and it's by no means certain that AV would prove greatly helpful to them. In habitually Conservative seats, many LD voters may be slightly disenchanted Tories who will return to the fold if they feel threatened by some Lib-Lab combination; in Labour seats, the same situation in reverse; and some Liberal seats could be threatened by odd tactical combinations of their enemies, questioning LD policies on e.g. nuclear disarmament, Eurointegration, immigration.

The best that can be hoped for by Nick Clegg, I think, is to do a Blair: sell out to powerful interests who will springboard him into some position less vulnerable to the people's franchise. Perhaps the reward for his long service to Europe will be a seat on the European Commission (maybe he still speaks to David O'Sullivan and friends - see above). He, and ultimately his descendants, will be accepted into that modern equivalent of the Hapsburg dynasty that is the nascent power support structure of the EU.

Or maybe he'll stand his ground, and watch his party get whittled away back down to six seats, a fate David Steel vividly remembers.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Monday, May 10, 2010

Sunday, May 09, 2010

It's the Tories who fear voting reform - and the LibDems who should fear it

Watching William Hague and Danny Alexander speak to the Press outside the Cabinet Office, it was obvious to me how shtum they were keeping about electoral reform.

There's a good reason, I think: a truly representative voting system would probably mean there would never again be a Conservative government.

Let's say that we had some form of nationwide Alternative Vote. The votes for the very small parties would likely pass on about equally between the Tories and Labour - maybe a little more Right than Left. The key would be how the LD votes would split, and I'd guess it would be not less than 80:20 in favour of a left of centre Labour party. Even now, that would mean an outright majority for Labour.

Just as American politics is basically a choice between two sides that from a British perspective seem right-wing, British politics under "fair voting" would be a choice between two left of centre parties, for to have any hope of power the Tories would have to share even more in "progressive" political values than they have done in many years. Indeed David Cameron's electoral sales pitch already reflects this, to some extent.

But if we go down this road, then we might be better off with a truly Presidential system, because the two candidates could be assessed not only on general policy direction but on character. We're mutating into a leader-driven system as it is, thanks in major part to the mass media, especially TV. At least a national direct election for the country's leadership would winnow out callow, jumped-up backroom boffins like Milliband - or so I'd hope.

It's much more difficult to judge what would happen if we retained the territorial constituency system but adopted the Alternative Vote. I don't have the time, the psephological database or the specialised computer programs and theoretical assumptions to study 650 constituencies and play out the permutations. But this is what Gordon Brown is rumoured to be offering the LibDems, and forming a coalition to get AV may be better than going for PR with the Tories and eventually ending up with a FrankenLeft party that swallows the LibDems whole.

If Clegg and co. come to a deal with the Conservatives without electoral reform, I think it'll be the end for Clegg; if they get PR, it could be the end of the third force in British politics. Yet Labour haven't enough to go on, even with the LibDems' support.

Perhaps the upshot will be another General Election, even sooner than the 12 - 18 months people are talking about. And that could fracture both Labour and the Conservatives, as Peter Hitchens has long suggested and wished.

We do live in interesting times.

There's a good reason, I think: a truly representative voting system would probably mean there would never again be a Conservative government.

Let's say that we had some form of nationwide Alternative Vote. The votes for the very small parties would likely pass on about equally between the Tories and Labour - maybe a little more Right than Left. The key would be how the LD votes would split, and I'd guess it would be not less than 80:20 in favour of a left of centre Labour party. Even now, that would mean an outright majority for Labour.

Just as American politics is basically a choice between two sides that from a British perspective seem right-wing, British politics under "fair voting" would be a choice between two left of centre parties, for to have any hope of power the Tories would have to share even more in "progressive" political values than they have done in many years. Indeed David Cameron's electoral sales pitch already reflects this, to some extent.

But if we go down this road, then we might be better off with a truly Presidential system, because the two candidates could be assessed not only on general policy direction but on character. We're mutating into a leader-driven system as it is, thanks in major part to the mass media, especially TV. At least a national direct election for the country's leadership would winnow out callow, jumped-up backroom boffins like Milliband - or so I'd hope.

It's much more difficult to judge what would happen if we retained the territorial constituency system but adopted the Alternative Vote. I don't have the time, the psephological database or the specialised computer programs and theoretical assumptions to study 650 constituencies and play out the permutations. But this is what Gordon Brown is rumoured to be offering the LibDems, and forming a coalition to get AV may be better than going for PR with the Tories and eventually ending up with a FrankenLeft party that swallows the LibDems whole.

If Clegg and co. come to a deal with the Conservatives without electoral reform, I think it'll be the end for Clegg; if they get PR, it could be the end of the third force in British politics. Yet Labour haven't enough to go on, even with the LibDems' support.

Perhaps the upshot will be another General Election, even sooner than the 12 - 18 months people are talking about. And that could fracture both Labour and the Conservatives, as Peter Hitchens has long suggested and wished.

We do live in interesting times.

Should we fear proportional representation?

There are vested interests opposing electoral reform. One of their subtler strategies is to propose pantomime-horse variants on the Single Transferable Vote (AV+ etc) , I suspect to muddy the waters sufficiently so that people will say change isn't worth it.

The fact is, under the present system 95.5% of the seats went to the three major parties; if seats had been allocated in proportion to votes cast, the top three would still have had 88.3%. Between them, quite enough to vote down everyone else.

Yes, some of the "wrong types" (e.g. the BNP) would have got a voice in Parliament; but actually, the fourth biggest party would have been UKIP, with 20 seats - and under a different system, UKIP might have gained switch-support from those who voted BNP because of concerns about national sovereignty and the economic and social effects of relatively uncontrolled (yet disproportionately locally concentrated) immigration; leaving the race-haters fuming in an even tinier corner. Some other minorities would have even fewer seats than they have now, and we'd have some fresh voices on the benches. Is it really necessary to uphold a flawed existing arrangement merely because it gags mouths that might offend us?

Another objection is that the LibDems would be the kingmakers, the masters of the seesaw. Not necessarily: how many of those who voted LD tactically last week, would have voted directly for Labour or Conservative if they had thought their vote would count as much as anyone else's?

PR would break the link between an MP and his/her constituency, say some. Yet it seems that so much voting is simply for the rosette, and we have just seen a General Election campaign fought on presidential terms, without our having the right to elect the President.

In 26 years, I've been doorstepped twice by Parliamentary candidates - both them in the last month, because thanks to boundary changes I'm now in a marginal constituency. Before then, I had two Labour bods in succession, each obviously taking the view that they needn't make any effort because the seat was usually bombproof under First-Past-The-Post. (I have a sneaking - perhaps totally unfair - suspicion that the boundary was altered partly to shut out Respect, who were threatening to do well in this part of Birmingham.)

I'm not a fan of the party list kind of PR, because that takes away the voters' right to reject individuals they consider unsuitable - but the Single Transferable Vote (STV) would give a voice to us voiceless people, and we might be heard from time to time among the hubbub.

I give below a list of seats actually won, and another showing how brutally simple national PR would have allocated them; what it can't show is how votes would have been cast if people knew every vote counted absolutely equally, nationwide; or how the picture would change if you could express 2nd and 3rd choices in constituency-based STV voting.

The fact is, under the present system 95.5% of the seats went to the three major parties; if seats had been allocated in proportion to votes cast, the top three would still have had 88.3%. Between them, quite enough to vote down everyone else.

Yes, some of the "wrong types" (e.g. the BNP) would have got a voice in Parliament; but actually, the fourth biggest party would have been UKIP, with 20 seats - and under a different system, UKIP might have gained switch-support from those who voted BNP because of concerns about national sovereignty and the economic and social effects of relatively uncontrolled (yet disproportionately locally concentrated) immigration; leaving the race-haters fuming in an even tinier corner. Some other minorities would have even fewer seats than they have now, and we'd have some fresh voices on the benches. Is it really necessary to uphold a flawed existing arrangement merely because it gags mouths that might offend us?

Another objection is that the LibDems would be the kingmakers, the masters of the seesaw. Not necessarily: how many of those who voted LD tactically last week, would have voted directly for Labour or Conservative if they had thought their vote would count as much as anyone else's?

PR would break the link between an MP and his/her constituency, say some. Yet it seems that so much voting is simply for the rosette, and we have just seen a General Election campaign fought on presidential terms, without our having the right to elect the President.

In 26 years, I've been doorstepped twice by Parliamentary candidates - both them in the last month, because thanks to boundary changes I'm now in a marginal constituency. Before then, I had two Labour bods in succession, each obviously taking the view that they needn't make any effort because the seat was usually bombproof under First-Past-The-Post. (I have a sneaking - perhaps totally unfair - suspicion that the boundary was altered partly to shut out Respect, who were threatening to do well in this part of Birmingham.)

I'm not a fan of the party list kind of PR, because that takes away the voters' right to reject individuals they consider unsuitable - but the Single Transferable Vote (STV) would give a voice to us voiceless people, and we might be heard from time to time among the hubbub.

I give below a list of seats actually won, and another showing how brutally simple national PR would have allocated them; what it can't show is how votes would have been cast if people knew every vote counted absolutely equally, nationwide; or how the picture would change if you could express 2nd and 3rd choices in constituency-based STV voting.

Saturday, May 08, 2010

Will Cameron support the breakup of the UK?

Scotland has 59 seats in the British Parliament, of which 41 voted Labour in this week's General Election, and only one voted Conservative.

David Cameron proposes to reduce the number of MPs by 10%, i.e. 65 out of 650.

On the GE results, giving Scotland her "independence" (within the European Empire, of course) would mean the Conservatives having 305 seats out of 591, a 9-seat majority. The DUP in Northern Ireland could add the support of another 8 seats, at a price.

Or the Conservatives could drop the Unionist part of their party's title altogether, and cut Northern Ireland and Wales "free" as well. Only 9 of the 117 constituencies in the quasi-Celtic countries voted Tory. This would leave an English-only Parliament (eagerly desired by some on the interwebs) of 533 seats, 297 of them Conservative - a 30-seat majority for the Tories, even on the latest disappointing showing. Central Office could then simply relocate to Buckingham Palace to begin a thousand-year reign.

The political temptation to assist the European fragmentarian project must be immense.

And then there is the financial side. Comparing revenue and expenditure, how much do Northern Ireland, Scotland and Wales cost the British government?

David Cameron proposes to reduce the number of MPs by 10%, i.e. 65 out of 650.

On the GE results, giving Scotland her "independence" (within the European Empire, of course) would mean the Conservatives having 305 seats out of 591, a 9-seat majority. The DUP in Northern Ireland could add the support of another 8 seats, at a price.

Or the Conservatives could drop the Unionist part of their party's title altogether, and cut Northern Ireland and Wales "free" as well. Only 9 of the 117 constituencies in the quasi-Celtic countries voted Tory. This would leave an English-only Parliament (eagerly desired by some on the interwebs) of 533 seats, 297 of them Conservative - a 30-seat majority for the Tories, even on the latest disappointing showing. Central Office could then simply relocate to Buckingham Palace to begin a thousand-year reign.

The political temptation to assist the European fragmentarian project must be immense.

And then there is the financial side. Comparing revenue and expenditure, how much do Northern Ireland, Scotland and Wales cost the British government?

Stockmarkets: don't join the crooked card game

UPDATE:

It may be worse than at first we thought. The savage drop could have been (this says it was) deliberately engineered by Goldman Sachs as a shot across the bows, warning legislators not to mess with them!

_______________________________________

Nathan Martin makes the point that Thursday's 1,000-point drop on the Dow Jones Index unveiled the truth: the current high valuation of the market is because of money thrown into it by banks and hedge funds, not ordinary private investors. The drop happened when the insiders stopped trading.

The question is, how much longer can the illusion be maintained? Why are they doing it? Is it to tempt investors back into the market so that they can suffer all the financial losses when the banks pull out?

This is an age when cynicism comes easily.

It may be worse than at first we thought. The savage drop could have been (this says it was) deliberately engineered by Goldman Sachs as a shot across the bows, warning legislators not to mess with them!

_______________________________________

Nathan Martin makes the point that Thursday's 1,000-point drop on the Dow Jones Index unveiled the truth: the current high valuation of the market is because of money thrown into it by banks and hedge funds, not ordinary private investors. The drop happened when the insiders stopped trading.

The question is, how much longer can the illusion be maintained? Why are they doing it? Is it to tempt investors back into the market so that they can suffer all the financial losses when the banks pull out?

This is an age when cynicism comes easily.

Thursday, May 06, 2010

Right, it's UKIP then

When even a major political party is encouraging us to vote tactically, you know the system is cracking. Good.

It's not about Britain's economic difficulties: disaster is pretty much assured whoever gets in. But we've been poor before; so what? Liberty is harder to recover than wealth.

First we have to get the power back from Europe, then we have to get it back from our venal and treacherous domestic politicians.

There is no system that will make people good and happy; that revolution is in the heart. The bureaucratic reification of good intentions becomes the slave of its own power and protocols.

We need some freedom to act. I shall do my tiny, practically insignificant bit to clear a little space so that those who have good will can practise it.

A vote for UKIP, this "contemptible little army", may encourage those elsewhere with a better chance - perhaps in the South West - to keep pushing back, to resist the Black Hole.

UPDATE

Some discussion of the deficiencies of Proportional Representation on Hatfeld Girl's site. I've submitted the following comment:

PR no, Alternative Vote (what I used to know as the Single Transferable Vote) yes. The latter is basically the same as First Past The Post but with AV the post stands at 50% of votes cast.

I don't see how this would necessarily lead to hung Parliaments, coalitions and weirdo fringe MPs, indeed I think it would help avoid them. You'd get more of a fight for the centre ground, but you'd get an MP that was more likely to have reflected some level of your choice so you wouldn't feel disenfranchised. And I think you'd get more examination of policies to determine 2nd and 3rd choices.

Turnout this time in the national elections was reportedly 65%, less than at any time in the 75 years from 1922-1997. And that's after market panic, credit crunch, the near destruction of the banking system, general hoo-ha, fedupness with Brown (how much of the vote depends on emotional spasm?) and Sam Cam's bump.

The present system is effectively useless and corrupt, which is why it will continue. I expect David Cameron to offer a Royal Commission and then do nothing, since the current arrangement suits Tweedledum and Tweedledee.

It's not about Britain's economic difficulties: disaster is pretty much assured whoever gets in. But we've been poor before; so what? Liberty is harder to recover than wealth.

First we have to get the power back from Europe, then we have to get it back from our venal and treacherous domestic politicians.

There is no system that will make people good and happy; that revolution is in the heart. The bureaucratic reification of good intentions becomes the slave of its own power and protocols.

We need some freedom to act. I shall do my tiny, practically insignificant bit to clear a little space so that those who have good will can practise it.

A vote for UKIP, this "contemptible little army", may encourage those elsewhere with a better chance - perhaps in the South West - to keep pushing back, to resist the Black Hole.

UPDATE

Some discussion of the deficiencies of Proportional Representation on Hatfeld Girl's site. I've submitted the following comment:

PR no, Alternative Vote (what I used to know as the Single Transferable Vote) yes. The latter is basically the same as First Past The Post but with AV the post stands at 50% of votes cast.

I don't see how this would necessarily lead to hung Parliaments, coalitions and weirdo fringe MPs, indeed I think it would help avoid them. You'd get more of a fight for the centre ground, but you'd get an MP that was more likely to have reflected some level of your choice so you wouldn't feel disenfranchised. And I think you'd get more examination of policies to determine 2nd and 3rd choices.

Turnout this time in the national elections was reportedly 65%, less than at any time in the 75 years from 1922-1997. And that's after market panic, credit crunch, the near destruction of the banking system, general hoo-ha, fedupness with Brown (how much of the vote depends on emotional spasm?) and Sam Cam's bump.

The present system is effectively useless and corrupt, which is why it will continue. I expect David Cameron to offer a Royal Commission and then do nothing, since the current arrangement suits Tweedledum and Tweedledee.

Tuesday, May 04, 2010

It's not the ship, it's the tide that matters

The great problem for investors in today's environment is that there is no return on short-term, safe assets yet the higher risk levels on longer-term, higher return assets are too uncomfortable for most people...

John Mauldin

The only winning strategy "for the long haul" is to be fully committed to the market when it is rising and economic fundamentals support that direction, and to be entirely out at all other times.

Karl Denninger

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The centerpiece of our own strategy [...] is understanding liquidity flows. They are the single most important force driving investment markets both up and down. Contracting liquidity caused the crash in 2008-2009 and dramatically expanding liquidity since March 2009 has triggered one of the greatest bull markets in U.S. history. The next bear market will also be driven, at some point, by a contraction in liquidity flows. However, as long as the great reflation is doing its work, that day can be postponed. [...] The music is playing again. People are back out on the dance floor. But, if the great reflation is as artificial as we believe, then this is still musical chairs. When the music stops, there won't be a chair for everyone, just like the last time.

John Mauldin

The only winning strategy "for the long haul" is to be fully committed to the market when it is rising and economic fundamentals support that direction, and to be entirely out at all other times.

Karl Denninger

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The current investment conundrum, in a nutshell

The great problem for investors in today's environment is that there is no return on short-term, safe assets yet the higher risk levels on longer-term, higher return assets are too uncomfortable for most people...

John Mauldin

The only winning strategy "for the long haul" is to be fully committed to the market when it is rising and economic fundamentals support that direction, and to be entirely out at all other times.

Karl Denninger

The centerpiece of our own strategy [...] is understanding liquidity flows. They are the single most important force driving investment markets both up and down. Contracting liquidity caused the crash in 2008-2009 and dramatically expanding liquidity since March 2009 has triggered one of the greatest bull markets in U.S. history. The next bear market will also be driven, at some point, by a contraction in liquidity flows. However, as long as the great reflation is doing its work, that day can be postponed. [...] The music is playing again. People are back out on the dance floor. But, if the great reflation is as artificial as we believe, then this is still musical chairs. When the music stops, there won't be a chair for everyone, just like the last time.

John Mauldin

The only winning strategy "for the long haul" is to be fully committed to the market when it is rising and economic fundamentals support that direction, and to be entirely out at all other times.

Karl Denninger

Monday, May 03, 2010

Could Norway be a safe haven?

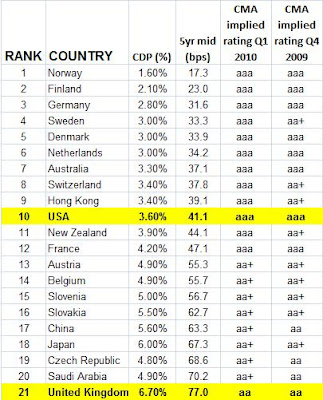

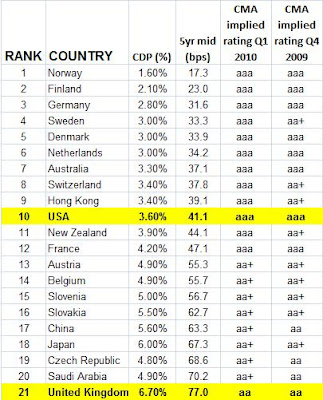

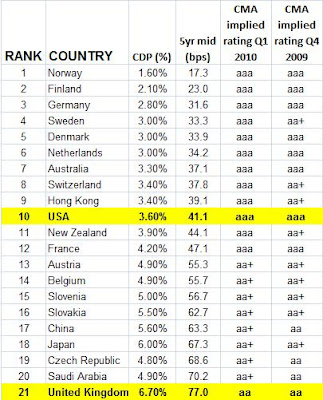

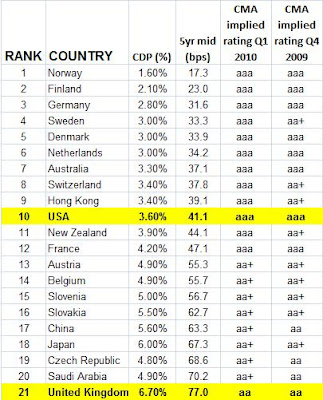

A few weeks ago, I looked at national credit ratings and Norway was the clear leader. So I wondered how strong the Norwegian Kroner might be if other currencies began to unravel.

Could the past give us a clue? No doubt those of you who have access to more sophisticated financial software and databases can do better - this is just a starting point for discussion.

Here's the 10-year history (O&A data, interbank rate, annually on 3rd May each year, rebased to 100% against the Kroner in 2000).

And in graphic form:

And in graphic form:

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Could the past give us a clue? No doubt those of you who have access to more sophisticated financial software and databases can do better - this is just a starting point for discussion.

Here's the 10-year history (O&A data, interbank rate, annually on 3rd May each year, rebased to 100% against the Kroner in 2000).

And in graphic form:

And in graphic form:DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Should we go for Norwegian cash, bonds and shares?

A few weeks ago, I looked at national credit ratings and Norway was the clear leader. So I wondered how strong the Norwegian Kroner might be if other currencies began to unravel.

Could the past give us a clue? No doubt those of you who have access to more sophisticated financial software and databases can do better - this is just a starting point for discussion.

Here's the 10-year history (O&A data, interbank rate, annually on 3rd May each year, rebased to 100% against the Kroner in 2000).

And in graphic form:

And in graphic form:

Could the past give us a clue? No doubt those of you who have access to more sophisticated financial software and databases can do better - this is just a starting point for discussion.

Here's the 10-year history (O&A data, interbank rate, annually on 3rd May each year, rebased to 100% against the Kroner in 2000).

And in graphic form:

And in graphic form:Sunday, May 02, 2010

A house is a home, not an investment

A Nationwide Building Society press release (29 April) says the average house is now worth £167,802. Prices rose by 10.5% in the past year. Perhaps we should be in a hurry to buy again.

All the previous three sentences are misleading.

First, “average” is hard to define. According to nethouseprices.com, in 2010 a semi-detached house in Sheldon, Birmingham sold for £10,000 while another in Harborne changed hands for £470,000. During the same period in London, semis sold for between £130,000 and £10 million (93 other semis went for over £1 million).

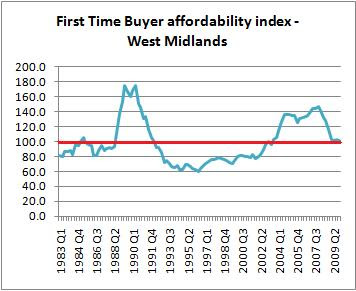

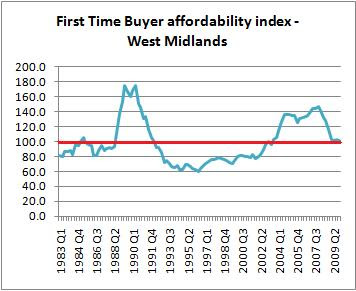

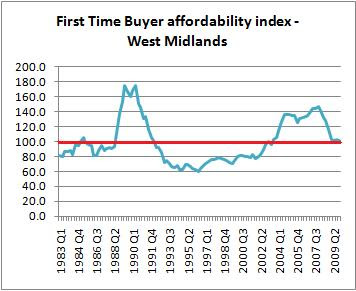

Second, as the Nationwide report admits, house prices are still 10% below the peak reached in October 2007. The good news is that they are more affordable now: using the Nationwide’s online database, here is a graph of first-time buyer mortgage costs as a proportion of average take-home pay in the West Midlands (the most typical region in the country):

Third, we face a long period of economic difficulty, with the threat of high unemployment. A falling pound could result in higher food and energy costs, and if the UK’s credit rating drops interest rates could rise. Each of these factors could easily depress property prices.

You have to live somewhere, but don’t think of it as a money-maker.

All the previous three sentences are misleading.

First, “average” is hard to define. According to nethouseprices.com, in 2010 a semi-detached house in Sheldon, Birmingham sold for £10,000 while another in Harborne changed hands for £470,000. During the same period in London, semis sold for between £130,000 and £10 million (93 other semis went for over £1 million).

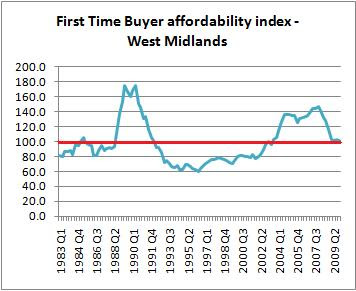

Second, as the Nationwide report admits, house prices are still 10% below the peak reached in October 2007. The good news is that they are more affordable now: using the Nationwide’s online database, here is a graph of first-time buyer mortgage costs as a proportion of average take-home pay in the West Midlands (the most typical region in the country):

The bad news is, the graph is affected by record low interest rates; the actual amount borrowed is much higher than it used to be. As late as 1998, new mortgages averaged £60,000; now, according to thisismoney.co.uk (25 February), the average new loan is £140,000 – 5 ½ times the median wage, far above the long-term trend (3 ½ times earnings).

Third, we face a long period of economic difficulty, with the threat of high unemployment. A falling pound could result in higher food and energy costs, and if the UK’s credit rating drops interest rates could rise. Each of these factors could easily depress property prices.

You have to live somewhere, but don’t think of it as a money-maker.

Friday, April 30, 2010

More on houses

A Nationwide Building Society press release (29 April) says the average house is now worth £167,802. Prices rose by 10.5% in the past year. Perhaps we should be in a hurry to buy again.

All the previous three sentences are misleading.

First, “average” is hard to define. According to nethouseprices.com, in 2010 a semi-detached house in Sheldon, Birmingham sold for £10,000 while another in Harborne changed hands for £470,000. During the same period in London, semis sold for between £130,000 and £10 million (93 other semis went for over £1 million).

Second, as the Nationwide report admits, house prices are still 10% below the peak reached in October 2007. The good news is that they are more affordable now: using the Nationwide’s online database, here is a graph of first-time buyer mortgage costs as a proportion of average take-home pay in the West Midlands (the most typical region in the country):

Third, we face a long period of economic difficulty, with the threat of high unemployment. A falling pound could result in higher food and energy costs, and if the UK’s credit rating drops interest rates could rise. Each of these factors could easily depress property prices.

You have to live somewhere, but don’t think of it as a money-maker.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

All the previous three sentences are misleading.

First, “average” is hard to define. According to nethouseprices.com, in 2010 a semi-detached house in Sheldon, Birmingham sold for £10,000 while another in Harborne changed hands for £470,000. During the same period in London, semis sold for between £130,000 and £10 million (93 other semis went for over £1 million).

Second, as the Nationwide report admits, house prices are still 10% below the peak reached in October 2007. The good news is that they are more affordable now: using the Nationwide’s online database, here is a graph of first-time buyer mortgage costs as a proportion of average take-home pay in the West Midlands (the most typical region in the country):

The bad news is, the graph is affected by record low interest rates; the actual amount borrowed is much higher than it used to be. As late as 1998, new mortgages averaged £60,000; now, according to thisismoney.co.uk (25 February), the average new loan is £140,000 – 5 ½ times the median wage, far above the long-term trend (3 ½ times earnings).

Third, we face a long period of economic difficulty, with the threat of high unemployment. A falling pound could result in higher food and energy costs, and if the UK’s credit rating drops interest rates could rise. Each of these factors could easily depress property prices.

You have to live somewhere, but don’t think of it as a money-maker.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Tuesday, April 27, 2010

Heads down

May I draw your attention to an interview with Dr Marc Faber on CNBC on 21st April (see videos on sidebar in Broad Oak Blog)?

Dr Faber is a highly respected commentator and his predictions of economic disaster, though cheerily delivered, are perfectly serious (he has a European way of giving bad news with an ironic smile).

He believes - and has done for a long time - that governments will try to inflate their way out of the long-developing overspending mess, and that eventually all "fiat" money (currencies not backed by anything that restricts the growth of the money supply) will become worthless. Then there will be a crash of epochal proportions, and the social consequences will be very painful (which is why his website is called GloomBoomDoom.com).

As he says in this interview, his view is that gold and silver are not to be considered as commodities like oil and corn, but as a form of money that governments cannot multiply as they do with their sovereign currencies. He advises (please remember that I cannot advise you here on this blog) investors to build up their holdings of physical gold and silver - "physical" because there is much speculation in this market and many times more in contracts than can be actually delivered. After that, maybe some investment in precious metal exploration companies.

Given Dr Faber's view of the real practical consequences of economic collapse, I think it is not irrelevant that he lives in Chiang Mai, northern Thailand, an area that can provide the needs of life locally and that is close to several international borders.

We may still have time - Dr Faber thinks that with continued monetary inflation, we could still see markets go up for quite a period; but from all that he says, and all that I have thought (and said) for years now, we appear to be facing a prolonged period of high volatility and the danger of sudden and savage reverses in valuations. Until inflation takes off, it can be good to hold cash; but if Dr Faber is correct, ultimately cash will be the worst possible investment.

I would also say that before considering your investment portfolio, there may be other issues to resolve - where you should live, what work you should do, what skills you should acquire, security precautions you should take, emergency provisions you should stock up with. Even if disaster does not strike with full force, big rises in fuel costs would transform the conditions of our daily life.

It is curious that we are now expected to be exercised by climate change issues, yet the media have yet to come to grips with our economic climate. It is still not generally known that the good old days (as remembered) of the Conservative boom in the 1980s (and mid-90s) was because of excessive bank lending, which caused both housing and the stockmarket to become heavily overvalued. This process of inflating the economy until it pops (as it must, one day, but who knows exactly when), has being going on for decades.

I've tried to get the message across to the public; perhaps I should spend my time quietly advising my clients, instead. Anyhow, I've told you, now.

Dr Faber is a highly respected commentator and his predictions of economic disaster, though cheerily delivered, are perfectly serious (he has a European way of giving bad news with an ironic smile).

He believes - and has done for a long time - that governments will try to inflate their way out of the long-developing overspending mess, and that eventually all "fiat" money (currencies not backed by anything that restricts the growth of the money supply) will become worthless. Then there will be a crash of epochal proportions, and the social consequences will be very painful (which is why his website is called GloomBoomDoom.com).

As he says in this interview, his view is that gold and silver are not to be considered as commodities like oil and corn, but as a form of money that governments cannot multiply as they do with their sovereign currencies. He advises (please remember that I cannot advise you here on this blog) investors to build up their holdings of physical gold and silver - "physical" because there is much speculation in this market and many times more in contracts than can be actually delivered. After that, maybe some investment in precious metal exploration companies.

Given Dr Faber's view of the real practical consequences of economic collapse, I think it is not irrelevant that he lives in Chiang Mai, northern Thailand, an area that can provide the needs of life locally and that is close to several international borders.

We may still have time - Dr Faber thinks that with continued monetary inflation, we could still see markets go up for quite a period; but from all that he says, and all that I have thought (and said) for years now, we appear to be facing a prolonged period of high volatility and the danger of sudden and savage reverses in valuations. Until inflation takes off, it can be good to hold cash; but if Dr Faber is correct, ultimately cash will be the worst possible investment.

I would also say that before considering your investment portfolio, there may be other issues to resolve - where you should live, what work you should do, what skills you should acquire, security precautions you should take, emergency provisions you should stock up with. Even if disaster does not strike with full force, big rises in fuel costs would transform the conditions of our daily life.

It is curious that we are now expected to be exercised by climate change issues, yet the media have yet to come to grips with our economic climate. It is still not generally known that the good old days (as remembered) of the Conservative boom in the 1980s (and mid-90s) was because of excessive bank lending, which caused both housing and the stockmarket to become heavily overvalued. This process of inflating the economy until it pops (as it must, one day, but who knows exactly when), has being going on for decades.

I've tried to get the message across to the public; perhaps I should spend my time quietly advising my clients, instead. Anyhow, I've told you, now.

Very uncertain times

May I draw your attention to an interview with Dr Marc Faber on CNBC on 21st April (see videos on sidebar)?

Dr Faber is a highly respected commentator and his predictions of economic disaster, though cheerily delivered, are perfectly serious (he has a European way of giving bad news with an ironic smile).

He believes - and has done for a long time - that governments will try to inflate their way out of the long-developing overspending mess, and that eventually all "fiat" money (currencies not backed by anything that restricts the growth of the money supply) will become worthless. Then there will be a crash of epochal proportions, and the social consequences will be very painful (which is why his website is called GloomBoomDoom.com).

As he says in this interview, his view is that gold and silver are not to be considered as commodities like oil and corn, but as a form of money that governments cannot multiply as they do with their sovereign currencies. He advises (please remember that I cannot advise you here on this blog) investors to build up their holdings of physical gold and silver - "physical" because there is much speculation in this market and many times more in contracts than can be actually delivered. After that, maybe some investment in precious metal exploration companies.

Given Dr Faber's view of the real practical consequences of economic collapse, I think it is not irrelevant that he lives in Chiang Mai, northern Thailand, an area that can provide the needs of life locally and that is close to several international borders.

We may still have time - Dr Faber thinks that with continued monetary inflation, we could still see markets go up for quite a period; but from all that he says, and all that I have thought (and said) for years now, we appear to be facing a prolonged period of high volatility and the danger of sudden and savage reverses in valuations. Until inflation takes off, it can be good to hold cash; but if Dr Faber is correct, ultimately cash will be the worst possible investment.

I would also say that before considering your investment portfolio, there may be other issues to resolve - where you should live, what work you should do, what skills you should acquire, security precautions you should take, emergency provisions you should stock up with. Even if disaster does not strike with full force, big rises in fuel costs would transform the conditions of our daily life.

It is curious that we are now expected to be exercised by climate change issues, yet the media have yet to come to grips with our economic climate. It is still not generally known that the good old days (as remembered) of the Conservative boom in the 1980s (and mid-90s) was because of excessive bank lending, which caused both housing and the stockmarket to become heavily overvalued. This process of inflating the economy until it pops (as it must, one day, but who knows exactly when), has being going on for decades.

I've tried to get the message across to the public; perhaps I should spend my time quietly advising my clients, instead. Anyhow, I've told you, now.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Dr Faber is a highly respected commentator and his predictions of economic disaster, though cheerily delivered, are perfectly serious (he has a European way of giving bad news with an ironic smile).

He believes - and has done for a long time - that governments will try to inflate their way out of the long-developing overspending mess, and that eventually all "fiat" money (currencies not backed by anything that restricts the growth of the money supply) will become worthless. Then there will be a crash of epochal proportions, and the social consequences will be very painful (which is why his website is called GloomBoomDoom.com).

As he says in this interview, his view is that gold and silver are not to be considered as commodities like oil and corn, but as a form of money that governments cannot multiply as they do with their sovereign currencies. He advises (please remember that I cannot advise you here on this blog) investors to build up their holdings of physical gold and silver - "physical" because there is much speculation in this market and many times more in contracts than can be actually delivered. After that, maybe some investment in precious metal exploration companies.

Given Dr Faber's view of the real practical consequences of economic collapse, I think it is not irrelevant that he lives in Chiang Mai, northern Thailand, an area that can provide the needs of life locally and that is close to several international borders.

We may still have time - Dr Faber thinks that with continued monetary inflation, we could still see markets go up for quite a period; but from all that he says, and all that I have thought (and said) for years now, we appear to be facing a prolonged period of high volatility and the danger of sudden and savage reverses in valuations. Until inflation takes off, it can be good to hold cash; but if Dr Faber is correct, ultimately cash will be the worst possible investment.

I would also say that before considering your investment portfolio, there may be other issues to resolve - where you should live, what work you should do, what skills you should acquire, security precautions you should take, emergency provisions you should stock up with. Even if disaster does not strike with full force, big rises in fuel costs would transform the conditions of our daily life.

It is curious that we are now expected to be exercised by climate change issues, yet the media have yet to come to grips with our economic climate. It is still not generally known that the good old days (as remembered) of the Conservative boom in the 1980s (and mid-90s) was because of excessive bank lending, which caused both housing and the stockmarket to become heavily overvalued. This process of inflating the economy until it pops (as it must, one day, but who knows exactly when), has being going on for decades.

I've tried to get the message across to the public; perhaps I should spend my time quietly advising my clients, instead. Anyhow, I've told you, now.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Very uncertain times

May I draw your attention to an interview with Dr Marc Faber on CNBC on 21st April (see videos on sidebar)?

Dr Faber is a highly respected commentator and his predictions of economic disaster, though cheerily delivered, are perfectly serious (he has a European way of giving bad news with an ironic smile).

He believes - and has done for a long time - that governments will try to inflate their way out of the long-developing overspending mess, and that eventually all "fiat" money (currencies not backed by anything that restricts the growth of the money supply) will become worthless. Then there will be a crash of epochal proportions, and the social consequences will be very painful (which is why his website is called GloomBoomDoom.com).

As he says in this interview, his view is that gold and silver are not to be considered as commodities like oil and corn, but as a form of money that governments cannot multiply as they do with their sovereign currencies. He advises (please remember that I cannot advise you here on this blog) investors to build up their holdings of physical gold and silver - "physical" because there is much speculation in this market and many times more in contracts than can be actually delivered. After that, maybe some investment in precious metal exploration companies.

Given Dr Faber's view of the real practical consequences of economic collapse, I think it is not irrelevant that he lives in Chiang Mai, northern Thailand, an area that can provide the needs of life locally and that is close to several international borders.

We may still have time - Dr Faber thinks that with continued monetary inflation, we could still see markets go up for quite a period; but from all that he says, and all that I have thought (and said) for years now, we appear to be facing a prolonged period of high volatility and the danger of sudden and savage reverses in valuations. Until inflation takes off, it can be good to hold cash; but if Dr Faber is correct, ultimately cash will be the worst possible investment.

I would also say that before considering your investment portfolio, there may be other issues to resolve - where you should live, what work you should do, what skills you should acquire, security precautions you should take, emergency provisions you should stock up with. Even if disaster does not strike with full force, big rises in fuel costs would transform the conditions of our daily life.

It is curious that we are now expected to be exercised by climate change issues, yet the media have yet to come to grips with our economic climate. It is still not generally known that the good old days (as remembered) of the Conservative boom in the 1980s (and mid-90s) was because of excessive bank lending, which caused both housing and the stockmarket to become heavily overvalued. This process of inflating the economy until it pops (as it must, one day, but who knows exactly when), has being going on for decades.

I've tried to get the message across to the public; perhaps I should spend my time quietly advising my clients, instead. Anyhow, I've told you, now.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Dr Faber is a highly respected commentator and his predictions of economic disaster, though cheerily delivered, are perfectly serious (he has a European way of giving bad news with an ironic smile).

He believes - and has done for a long time - that governments will try to inflate their way out of the long-developing overspending mess, and that eventually all "fiat" money (currencies not backed by anything that restricts the growth of the money supply) will become worthless. Then there will be a crash of epochal proportions, and the social consequences will be very painful (which is why his website is called GloomBoomDoom.com).

As he says in this interview, his view is that gold and silver are not to be considered as commodities like oil and corn, but as a form of money that governments cannot multiply as they do with their sovereign currencies. He advises (please remember that I cannot advise you here on this blog) investors to build up their holdings of physical gold and silver - "physical" because there is much speculation in this market and many times more in contracts than can be actually delivered. After that, maybe some investment in precious metal exploration companies.

Given Dr Faber's view of the real practical consequences of economic collapse, I think it is not irrelevant that he lives in Chiang Mai, northern Thailand, an area that can provide the needs of life locally and that is close to several international borders.

We may still have time - Dr Faber thinks that with continued monetary inflation, we could still see markets go up for quite a period; but from all that he says, and all that I have thought (and said) for years now, we appear to be facing a prolonged period of high volatility and the danger of sudden and savage reverses in valuations. Until inflation takes off, it can be good to hold cash; but if Dr Faber is correct, ultimately cash will be the worst possible investment.

I would also say that before considering your investment portfolio, there may be other issues to resolve - where you should live, what work you should do, what skills you should acquire, security precautions you should take, emergency provisions you should stock up with. Even if disaster does not strike with full force, big rises in fuel costs would transform the conditions of our daily life.

It is curious that we are now expected to be exercised by climate change issues, yet the media have yet to come to grips with our economic climate. It is still not generally known that the good old days (as remembered) of the Conservative boom in the 1980s (and mid-90s) was because of excessive bank lending, which caused both housing and the stockmarket to become heavily overvalued. This process of inflating the economy until it pops (as it must, one day, but who knows exactly when), has being going on for decades.

I've tried to get the message across to the public; perhaps I should spend my time quietly advising my clients, instead. Anyhow, I've told you, now.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The credit crunch revisited

The elegant presentation above is via Wolfie, slightly over a year ago. It needs updating: interest rates now down to zero in the USA, the banks bailed out by vast amounts of taxpayer cash, and houses still dropping in value. It seems to me like trying to inflate a ripped hot air balloon, or maybe this old cartoon from Punch magazine (click to enlarge):

Power to the people

A couple of days ago I referred to "rootless business magnates"; and a couple of years ago I said "Big MD (or Big CEO) will have his arm around the shoulders of Big Brother". Now, the Daily Mail runs a feature about how the super-rich are taking over our economy, just as the super-powerful are whipping democratic control from our hands.

They cannot stop themselves. And, I fear, it may end in tyranny, revolution or anarchy.

... and since writing this, I see Warren Pollock's latest presentation is about capture of law and regulation in the USA by powerful interests.

They cannot stop themselves. And, I fear, it may end in tyranny, revolution or anarchy.

... and since writing this, I see Warren Pollock's latest presentation is about capture of law and regulation in the USA by powerful interests.

Monday, April 26, 2010

Sunday, April 25, 2010

Invest defensively

Investment expert Jeremy Grantham gives his views via Financial Times video:

- the UK and Australia are still experiencing bubbles in housing

- there are potential bubbles in commodities and emerging markets

- savers are being tempted (I'd say almost forced) into speculating when they should be cautious

- the US stockmarket is generally overpriced, but...

- investors should be more interested in big, boring, robust companies such as Coca-Cola, Microsoft and Johnson & Johnson

Safety first

Investment expert Jeremy Grantham gives his views via Financial Times video:

- the UK and Australia are still experiencing bubbles in housing

- there are potential bubbles in commodities and emerging markets

- savers are being tempted (I'd say almost forced) into speculating when they should be cautious

- the US stockmarket is generally overpriced, but...

- investors should be more interested in big, boring, robust companies such as Coca-Cola, Microsoft and Johnson & Johnson

Inflation vs deflation

This article in The Economic Voice echoes what I've been saying for quite some time: the inflation issue is subject to market segmentation. Basics are costing more, luxuries are being sold at a discount. Though I suspect that luxuries of the very rich are another segment altogether.

Similarly, housing is segmented: the cost of basic stock in average income areas will, I think, decline in real terms, but the nicest property in the wealthiest areas may hold up OK. We're like different species in the sea, each with its optimum depth-habitat and ecosystem.

Similarly, housing is segmented: the cost of basic stock in average income areas will, I think, decline in real terms, but the nicest property in the wealthiest areas may hold up OK. We're like different species in the sea, each with its optimum depth-habitat and ecosystem.

Crime, compulsion and rescue

I recently read this outrageous confessional by super-successful pump-and-dumper Jordan Belfort.

I recently read this outrageous confessional by super-successful pump-and-dumper Jordan Belfort.I'm not particularly sold on sorry-for-criminals (The Godfather, The Sopranos and all the rest of that genre); I think it's an emotional con that salves our conscience for being imaginatively complicit in the crimes.

But I do think Belfort is a victim as well as a perpetrator; a driven, a hag-ridden man. How much of history has been shaped by these out-of-control types? Mao saw himself as a destructive natural force; Stalin wondered why people had always helped him.

One feature of Belfort's story that sticks in my mind is how he used the louche, high-burn lifestyle at Stratton-Oakmont as a means to enslave his employees. As he explained (p.86) to his financially prudent father during a row about expenses:

"There's a method to my madness, especially when it comes to the spending. It's important to keep these guys chasing the dream. And it's even more important to keep them broke. Look at them; as much money as they make, every last one of them is broke! They spend every dime they have, trying to keep up with my lifestyle. But they can't, because they don't make enough. So they end up living paycheck to paycheck on a million bucks a year. It's hard to imagine, considering how you grew up, but, nevertheless, it is what it is.

"Anyway, keeping them broke makes them easier to control. Think about it: virtually every last one of them is leveraged to the hilt, with cars and homes and boats and all the rest of that crap, and if they miss even one paycheck they're up shit's creek. It's like having golden handcuffs on them. I mean, the truth is I could afford to pay them more than I do. But then they wouldn't need me as much. But if I paid them too little, then they would hate me. And as long as they need me they'll always fear me."

Belfort is plenty clever enough to play the repentant sinner - his book makes clear his manipulative approach to loved ones as well as employees - but it may well be that a part of him wanted to be stopped. The addictive, compulsive pleasuring is a whirring of hind legs scrambling to get away from the edge of what Clarissa Dickson-Wright calls "the abyss", to which even death is preferable. His permanently overactive mind required daily stunning with Quaaludes, because he didn't know how else to slow it down.

Returning to Stalin, another who could control everything except himself, I recall a TV programme about concert pianist Maria Yudina, who dared to write to him in frank terms that one would have thought were certain to get her shot or sent to Siberia. I have tried to find a transcript but this is the best I can do - though I clearly remember she referred not to his soul, but his "black heart". She had a courage almost insane. And yet he spared her. Was there a speck of gold left in the Stygian recesses of his spirit? I think so. When anticlericals have finished railing against bells and smells, there will still be the issue of the abyss and the light.

Lloyd Blankfein

Save the young

We speak of the fecklessness and selfishness of the young, but overlook the much greater selfishness of their elders. You'd think that in an ageing population and with a declining ratio between those of working age and the retired, there'd be no end of work available. Not so.

As this article from Business Insider shows, the under-25s are far worse off, financially and careerwise, than their elders. Also today, Liz Jones takes a break from reflecting on her train-wreck of a life to consider the plight of bright, aspiring youngsters in a job market that either won't give them a chance or takes them on as unpaid interns for "experience" that still won't get them any closer to earning a living afterwards.

Vampire squid? That's us.

As this article from Business Insider shows, the under-25s are far worse off, financially and careerwise, than their elders. Also today, Liz Jones takes a break from reflecting on her train-wreck of a life to consider the plight of bright, aspiring youngsters in a job market that either won't give them a chance or takes them on as unpaid interns for "experience" that still won't get them any closer to earning a living afterwards.

Vampire squid? That's us.

Bile

"All these moments will be lost, like tears in rain". I have submitted the following comments to a post on Hatfield Girl's elegant column; I hope to be wrong.

Unfortunately, the disparities of wealth in the global economy are fostering the growth of rootless business magnates, to the detriment of the social stability of developed industrial economies.

These magnates have realized (as Rockefeller did, long before) that ownership of distribution is even more powerful than ownership of the means of production; especially when it is accompanied by ownership of the means of communication, as "Chinese" Murdoch understands.

The Fourth Estate's weakness is compounded by the suborning of academia: 20,000 professional economists, of whom only 0.06% understood the significance of debt and foresaw the present crisis, act as berobed yes-men to the sultans of international trade.

Our political representatives have been exposed as venal careerists heavily incentivised to foster the acquis communautaire. In the General Election, we are offered a choice of one, in three avatars. Stick a pin in the roll of MPs and you are more likely than not to hit Lord Jim.

Once Western economies have been mined-out and markets in the East have evolved to a size capable of absorbing their own output, the East will have little further use for us and our freshly-printed toy money.

We shall also discover that, in practice, the vaunted fraternal benevolence of international Communism comes a very long way second to national self-interest and genetic similarity.

Unfortunately, the disparities of wealth in the global economy are fostering the growth of rootless business magnates, to the detriment of the social stability of developed industrial economies.

These magnates have realized (as Rockefeller did, long before) that ownership of distribution is even more powerful than ownership of the means of production; especially when it is accompanied by ownership of the means of communication, as "Chinese" Murdoch understands.

The Fourth Estate's weakness is compounded by the suborning of academia: 20,000 professional economists, of whom only 0.06% understood the significance of debt and foresaw the present crisis, act as berobed yes-men to the sultans of international trade.

Our political representatives have been exposed as venal careerists heavily incentivised to foster the acquis communautaire. In the General Election, we are offered a choice of one, in three avatars. Stick a pin in the roll of MPs and you are more likely than not to hit Lord Jim.

Once Western economies have been mined-out and markets in the East have evolved to a size capable of absorbing their own output, the East will have little further use for us and our freshly-printed toy money.

We shall also discover that, in practice, the vaunted fraternal benevolence of international Communism comes a very long way second to national self-interest and genetic similarity.

Wednesday, April 21, 2010

Wall Street vs Main Street

... one of the reasons why, when a country suffers economic problems, the latter may not be reflected in the performance of shares on that country's stock exchange (htp: Wall Street Pit).

... one of the reasons why, when a country suffers economic problems, the latter may not be reflected in the performance of shares on that country's stock exchange (htp: Wall Street Pit).But if the fate of big business is now less closely intertwined with the good of its host country, perhaps the nature of their relationship could turn from symbiotic to parasitic.

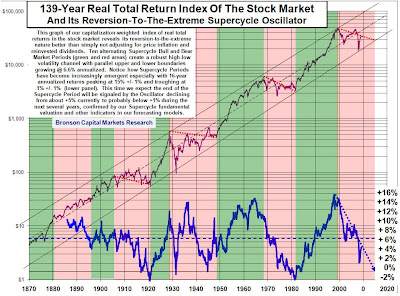

... and down we go-ooo

I've written recently about cash being boring, but safe until inflation gets going. Now, Charles Hugh Smith thinks the tipping point may be very close:

Stockmarket fall imminent?

I've written recently about cash being boring, but safe until inflation gets going. Now, Charles Hugh Smith thinks the tipping point may be very close:

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Tuesday, April 20, 2010

Repeal the 1832 Reform Act

I have just caught the tail end of a celebrity edition of "Who Wants

To Be A Millionaire?", in which Andi Peters and Emma Forbes were asked where the 1381Peasants' Revolt took place. Peters was strongly drawn to Scotland, they used 50:50 and were left with England and Ireland. Forbes phoned a friend who has a history degree; the latter hesitated and then named England, "but it's just a guess".

The next question was, in which book does the following saying appear: "Four legs good, two legs bad?" Forbes remembered that Animal Farm was by George Orwell, because she'd done it for 'O' level; but was so uncertain that this successful media pair agreed to leave the question and take the money they'd already won.

We approach a General Election of historic significance, and (I still cannot believe it) within five years we will see the death of our constitution. Seemingly, only a tiny fringe party called UKIP and a few others know what is going to happen, and why it is so important.

Was the extension of the franchise over the last 170 years such a good idea? Or am I too pessimistic, and do the people have a better understanding of themselves than is implied by the astounding ignorance of tremendously well-paid and fussed-over limelight-hoggers?

To Be A Millionaire?", in which Andi Peters and Emma Forbes were asked where the 1381Peasants' Revolt took place. Peters was strongly drawn to Scotland, they used 50:50 and were left with England and Ireland. Forbes phoned a friend who has a history degree; the latter hesitated and then named England, "but it's just a guess".

The next question was, in which book does the following saying appear: "Four legs good, two legs bad?" Forbes remembered that Animal Farm was by George Orwell, because she'd done it for 'O' level; but was so uncertain that this successful media pair agreed to leave the question and take the money they'd already won.

We approach a General Election of historic significance, and (I still cannot believe it) within five years we will see the death of our constitution. Seemingly, only a tiny fringe party called UKIP and a few others know what is going to happen, and why it is so important.

Was the extension of the franchise over the last 170 years such a good idea? Or am I too pessimistic, and do the people have a better understanding of themselves than is implied by the astounding ignorance of tremendously well-paid and fussed-over limelight-hoggers?

King of the Beggars

In Totnes, even the panhandlers have style. Actually, Graham Walker is not a beggar but a Big Issue seller, and when we met him he was dressed like a Victorian entertainer in top hat and long coat, selling his personal broadsheet called the Big Tissue - far better than the regular magazine, in my opinion. He had a stuffed dog and a notice asking us not to feed it.

Graham is clever and witty and has written a book which I shall order, called "Unsettled: In a hole, climbed a mountain". (Cheque or P.O. for £7.99 payable to "K. Walker", 48 Thornleigh Road, Horfield, Bristol BS7 8PH). He also has a blog (http://bigtissue.blogspot.com/) which currently just has a video sidebar including the YouTube thing here, which tells his story in brief and is well worth watching.

Graham has raised large amounts for charity - the poor are the most generous to the poor.

What I ate on my holidays

Monday, April 19, 2010

Planes and weather

All planes grounded and we get several straight days of lovely sunny weather. Any connection between high-altitude aviation-related waste products and vapour trails on the one hand, and cold nights/hot days? Does "clear the skies" = clear skies?

Wednesday, April 14, 2010

Hyperinflation or bust (actually, both)

Sprott Asset Management's chief investment strategist, John Embry, spelt it out back in November, in the investor newsletter voted the world's best: if the stimulus stops, the economy collapses; if it continues, first we get hyperinflation, and then a collapse. The price of gold is being held down to make it look as though all is well, but the manipulation can't hold out much longer (I've read elsewhere that for every ounce of real physical gold, there's 100 ounces in promises to deliver) - and then gold-you-can-touch will reach "a dramatic inflexion point." Silver, too.

These considerations, useful for the wealthy investor, will matter less to the ordinary person, who will be too busy coping with a suddenly unpredictable world of goods, services and employment.

These considerations, useful for the wealthy investor, will matter less to the ordinary person, who will be too busy coping with a suddenly unpredictable world of goods, services and employment.

A letter to UKIP

Dear Lord Pearson

Economic mismanagement of the UK by both Conservative and Labour governments

First, please accept my congratulations to yourself and your colleagues on your distinguished manifesto launch – clear policies, frank answers (“We’re skint” resonates) and vigorous rebuttals.

If your aim and hope is a hung (or “balanced”) Parliament, so that the voice of the people may briefly be heard at this critical juncture in our history, may I draw your attention to a point which may help deflate Conservative triumphalism? The Tories are now letting it be understood how well they managed the economy in the Nineties – you may have seen the egregious praise heaped on Ken Clarke by David Dimbleby in the 1st April edition of “Question Time”. Clarke himself damned George Osborne with perfunctory praise and clearly expects to be given a second run at the job sometime.

But I would argue that New Labour did not inherit a thriving economy in 1997; they inherited a booming economy. This led inevitably to the stockmarket bust starting January 2000, which was turned round from 2003 on by the same disastrous trick as was played under the Conservatives, namely an increase in the money supply at a rate generally far above the growth of GDP. For detail, please see the enclosed copy of a letter sent recently to the Guardian’s economics editor, Larry Elliott.

Finally, I note that you said UKIP would consider not standing against a LibDem candidate with proven Eurosceptic views. Would John Hemming MP (for Birmingham Yardley) qualify, as he was one of the signatories to Bob Spink’s EDM 20 (18.11.2009), which called for a referendum on the EU?

Best wishes

CC: Mr Nigel Farage, Mr David Campbell Bannerman

Economic mismanagement of the UK by both Conservative and Labour governments

First, please accept my congratulations to yourself and your colleagues on your distinguished manifesto launch – clear policies, frank answers (“We’re skint” resonates) and vigorous rebuttals.

If your aim and hope is a hung (or “balanced”) Parliament, so that the voice of the people may briefly be heard at this critical juncture in our history, may I draw your attention to a point which may help deflate Conservative triumphalism? The Tories are now letting it be understood how well they managed the economy in the Nineties – you may have seen the egregious praise heaped on Ken Clarke by David Dimbleby in the 1st April edition of “Question Time”. Clarke himself damned George Osborne with perfunctory praise and clearly expects to be given a second run at the job sometime.

But I would argue that New Labour did not inherit a thriving economy in 1997; they inherited a booming economy. This led inevitably to the stockmarket bust starting January 2000, which was turned round from 2003 on by the same disastrous trick as was played under the Conservatives, namely an increase in the money supply at a rate generally far above the growth of GDP. For detail, please see the enclosed copy of a letter sent recently to the Guardian’s economics editor, Larry Elliott.

Finally, I note that you said UKIP would consider not standing against a LibDem candidate with proven Eurosceptic views. Would John Hemming MP (for Birmingham Yardley) qualify, as he was one of the signatories to Bob Spink’s EDM 20 (18.11.2009), which called for a referendum on the EU?

Best wishes

CC: Mr Nigel Farage, Mr David Campbell Bannerman

Tuesday, April 13, 2010

Hoo-ha

Monday, April 12, 2010

Had enough of teaching (or other job)?

Below is an article I wrote for the Times Educational Supplement in 1997. The Teachers' Pension Scheme has altered significantly since then, but I think many of the general points are still valid.

_____________________________________

Can you really afford to quit?

Article Published in The TES on 21 November, 1997 By: Rolf Norfolk

First work out the cost. The job might not seem so bad after all - or there may turn out to be other solutions, says Rolf Norfolk

Are you fed up and dreaming of the days when early retirement was much easier to obtain? If so, first you have to decide whether you really have a problem with your job or if it is just a grumble. If you do have a serious worry, it may help to review the following options and consider whether you are prepared to meet the cost of changing your situation.

1. If your promoted post has become too much for you, ask for a demotion. Think twice about this, as it involves a pay cut and it is hardly a recommendation for re-promotion later. Regardless of current regulatory proposals, a step-down is already provided for in your pension scheme so long as it is in the interest of the efficient running of the school and your new post is with the same employer.

You have two options: first, you can split the pension account, so that service in the higher-paid post is preserved (and increased in line with inflation), and then there is a separate calculation for the new job, based on the lower salary and the remaining period served. At retirement, the two figures are added together. Alternatively, you can carry on paying pension contributions as though the demotion hadn't happened, and have all your service relate to your old salary. The potential drawback is that the notional salary is fixed, not inflation-linked. Such considerations need not worry those close to retirement, since a teacher's pension relates to the best year's income in the final three years; in the past some heads have therefore returned to teaching at the age of 58.

2. If the classroom demands are too much, try teaching part-time. This does not wreck your accrued pension because although your pension depends on not only the exact time you have served but your salary at retirement, if you work part-time the notional salary on which your pension is based is what you would be earning if you were a full-timer. But obviously from then, as a part-timer, you will be adding years and days of service more slowly. New regulations are, however, now going through Parliament to improve pension calculations for part-timers.

3. If your face does not fit, move to another school. Life is too short to put up with managers who don't like you. Or you could retrain for a different sector of the education service.

4. Sell your big house and move down. Or sell your investments. Or remortgage. Use your assets to pay for a very long holiday (or to subsidise part-time or lower-paid employment) before you take your pension as of right at 60. If you can, but aren't willing, you've just found out exactly how bad the problem isn't.

5. Apply for ill-health early retirement. Occupational disability doesn't imply being half-dead. But it's not a dodge, either. You have to pass (or, more accurately, fail) medical tests, and the Government has changed the rules to make this harder. For those who get it, the really tough bit is the financial impact. With the Teachers' Superannuation Scheme, ill-health pensions relate only to actual service (plus possibly a bit extra), so even with 20 years' service you would lose at least two-thirds of your income. While you still can, you should therefore consider permanent health insurance, which pays an extra, tax-free income during incapacity. Alternatively, some critical illness insurances include a lump sum pay-out if you are diagnosed as occupationally unfit.

In recent years one in four teacher retirements has been through illness, but although this is more than in previous decades it is still only about the same as for the general population. Often the root cause is unrelated to working conditions (one client of mine is going deaf); but if you are over-stressed, you should try to solve your problem, not have a chronic illness because of it.