John Rubino's 19 August article in GoldSeek supports my contention that since credit works like money, a credit contraction destroys money, and this undermines our ability to make sound financial assessments:

"Prudent Bear’s Doug Noland has for years been pointing out that one of the drivers of the credit bubble has been the ever-broadening definition of money. As the global economy expanded without a hic-up, more and more instruments came to be used as a store of value or medium of exchange or even a standard against which to value other things—in other words, as money."

Now that lenders are pulling in their horns, central banks are creating more cash to replace the "loss", and the result must be a dilution of value in the currency.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Thursday, August 23, 2007

Wednesday, August 22, 2007

UK debts mounting

And Rob Mackrill in today's email edition of The Daily Reckoning reveals that Britain has problems that, relative to the size of our economy, stand comparison with America's:

UK consumer debt now weighs in at £1,345bn - a sum that exceeds our entire output of goods and services, according to accountants Grant Thornton in a note this morning.

Official receivers and trustees in bankruptcy generally seem to do rather well out of this kind of mess - perhaps rather too well.

I had some clients who wound up their firm but pulled out all the stops to collect all debts and pay creditors as much as possible themselves; both clients and creditors benefited far, far more than if they had yielded to the usual arrangements - which I saw in other cases. Ordinary people are shaved going into debt and skinned coming out.

UK consumer debt now weighs in at £1,345bn - a sum that exceeds our entire output of goods and services, according to accountants Grant Thornton in a note this morning.

Official receivers and trustees in bankruptcy generally seem to do rather well out of this kind of mess - perhaps rather too well.

I had some clients who wound up their firm but pulled out all the stops to collect all debts and pay creditors as much as possible themselves; both clients and creditors benefited far, far more than if they had yielded to the usual arrangements - which I saw in other cases. Ordinary people are shaved going into debt and skinned coming out.

Safety first

Dan Denning comments on the recent rush for cash and safe bonds in The Daily Reckoning Australia today. He also repeats Marc Faber's point about an "earnings bubble" that skews p/e ratios:

Be careful about using low P/E ratios as a buying indicator. We read in this morning's paper that the average P/E on the ASX 200 is the lowest its been in 12 months. That doesn't automatically mean stocks are "good value." In fact, in the past, low P/E ratios have been a sign of the market top. Why?

At the height of an economic cycle, corporate earnings are high. When earnings rise faster than share prices, the P/E ratio will look low, flashing a "buy" signal. But this may be just the time that earnings themselves have peaked. That's definitely not the time to buy a stock.

And even commodity shares have to be chosen with care, when you factor-in rising costs.

Be careful about using low P/E ratios as a buying indicator. We read in this morning's paper that the average P/E on the ASX 200 is the lowest its been in 12 months. That doesn't automatically mean stocks are "good value." In fact, in the past, low P/E ratios have been a sign of the market top. Why?

At the height of an economic cycle, corporate earnings are high. When earnings rise faster than share prices, the P/E ratio will look low, flashing a "buy" signal. But this may be just the time that earnings themselves have peaked. That's definitely not the time to buy a stock.

And even commodity shares have to be chosen with care, when you factor-in rising costs.

Twang money

Richard Daughty (aka The Mogambo Guru) writes in The Daily Reckoning (21 August):

The big, big problem with the whole subprime/CDO/Armageddon market thing is that while the values on these assets can go down, the debts incurred to buy the assets don't.

Quite so. And since much of our money has been created ex nihilo by banks, then presumably it can also be reduced quickly by a credit crunch, so we have potential volatility in the money supply as in other things. Assessing things in money terms now seems to be like going to a tailor who makes all his measurements with an elastic band.

The big, big problem with the whole subprime/CDO/Armageddon market thing is that while the values on these assets can go down, the debts incurred to buy the assets don't.

Quite so. And since much of our money has been created ex nihilo by banks, then presumably it can also be reduced quickly by a credit crunch, so we have potential volatility in the money supply as in other things. Assessing things in money terms now seems to be like going to a tailor who makes all his measurements with an elastic band.

David Tice bearish on commodities

Prudent Bear's boss is cautious about natural resources - though still in the market for energy and precious metals (see page 2) - Institutional Investor article dated 14 August.

Marc Faber profile

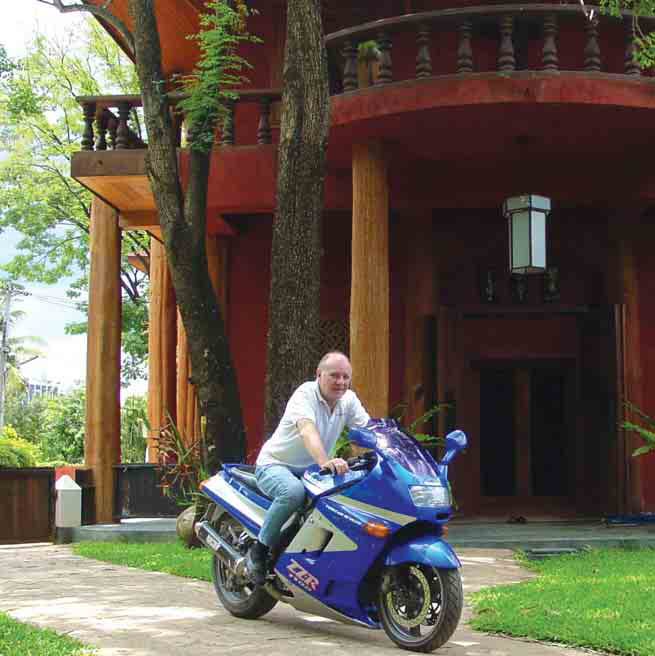

Marc Faber at home in Chiangmai, Thailand (from Asia Inc profile - see below)

Marc Faber at home in Chiangmai, Thailand (from Asia Inc profile - see below)Marc Faber is a very highly respected financial analyst and commentator. Listed below are some items by him, or about him, that may help you to get a sense of his character, outlook and opinions. I shall update this page from time to time.

SELECTED ARTICLES & INTERVIEWS

BIOGRAPHIES AND PROFILES

Tuesday, August 21, 2007

REFERENCE SECTION

Home

CARRY TRADE, THE

May 22, 2007: Professor Antal E. Fekete (exchange of letters in The Market Oracle)

CHARITIES

September 30, 2007: World Children's Fund - questions about value for money

CHINA

Sept 25, 2007: China's growing class of advertising and media professionals

Sept 23, 2007: China may use its trade surplus for political/military advantage

Aug 09, 2007: Growing inequality of income in China

Aug 06, 2007: China's near-$1 trillion ownership of US assets

July 18, 2007: James Kynge (my review of his book, "China Shakes The World")

June 19, 2007: James Kynge (article in The Alchemist, November 2004)

May 23, 2007: Intellectual property rights in China

May 21, 2007: China's sovereign wealth fund

CURRENCIES / MONETARY INFLATION

Aug 31, 2007: Maastricht provisions for the European Central Bank, post-EMU

Aug 16, 2007: The weakness of the British pound, in gold terms

Aug 15, 2007: The German DM stronger than the dollar, in gold terms

Aug 14, 2007: The weakness of the dollar compared to gold

Aug 03, 2007: The Euro as a possible international reserve currency

July 31, 2007: Mike Hewitt (article on global money supply in The Market Oracle)

May 28, 2007: Richard Duncan (interview on BusinessInAsia.com)

May 11, 2007: Peter Schiff (my review of his book, "Crash Proof")

May 10, 2007: Michael Panzner (my review of his book, "Financial Armageddon")

DEPOSITOR PROTECTION

Aug 30, 2007: Federal Deposit Insurance Corporation (USA)

Aug 23, 2007: Financial Services Compensation Scheme (UK)

DERIVATIVES

July 31, 2007: Richard Bookstaber (interview on Financial Sense, July 21 2007)

ECONOMIC CYCLES & PATTERNS

Sept 16, 2007: Jim Puplava sees crisis in 2009: Peak Oil and other factors

July 27, 2007: Kress cycles

June 28, 2007: Hindenburg omens

May 23, 2007: Olduvai theory

May 16, 2007: the Kondratieff cycle

GLOBALISATION / NEW GROWTH THEORY

Sept 23, 2007: My view that Western economies are facing inflation and recession

Aug 09, 2007: Globalisation and competition from the Far East

July 28, 2007: Thomas Friedman (interview on Yale Global Online, 18 April 2005)

July 28, 2007: Paul Romer (interview on Reason Online, 2001)

July 27, 2007: Wikipedia / Gladys We on New Growth Theory, aka Endogenous Growth Theory July 07, 2007: Thomas Friedman (Edward Leamer's critique)

May 20, 2007: Jim Willie on unemployment caused by globalisation

GOLD

Sept 27, 2007: Marc Faber sees bubbles everywhere, but recommends gold

Sept 25, 2007: More from Frank Veneroso on gold reserves and speculation

Sept 24, 2007: Frank Veneroso thinks speculation has created a bubble in gold

Aug 16, 2007: Mike Hewitt's essay on the global money supply, and gold

Aug 15, 2007: The surreptitious depletion of central bank gold reserves

Aug 07, 2007: The case for owning gold

Aug 02, 2007: The postwar rise and fall of central bank reserves of gold

LEGAL

Aug 24, 2007: Enduring Power of Attorney / Lasting Power of Attorney

MORTGAGES

September 29, 2007: Mortgage lending a key factor in high property costs

PERSONALITY PROFILES

Faber, Marc (Dr)

RISK ASSESSMENT & REDUCTION

Aug 09, 2007: Tips from the Daily Reckoning on defensive investment

June 21, 2007: Nassim Taleb's "Black Swans"

June 15, 2007: Harold Markowitz (inventor of Modern Portfolio Theory)

June 06, 2007: Asset classes

May 11, 2007: Peter Schiff (my review of his book, "Crash Proof")

May 10, 2007: Michael Panzner (my review of his book, "Financial Armageddon")

SOVEREIGN WEALTH FUNDS

Sept 26, 2007: Sovereign wealth funds expected to boost markets - but a threat to Western economies

Sept 22, 2007: Creditor economies switching from bonds to equities

May 21, 2007: China's sovereign wealth fund

STOCKMARKET VOLATILITY

Aug 31, 2007: Robert McHugh's "Dow 9,000" prediction - with updates

Aug 09, 2007: Is the Dow more overvalued than the FTSE?

June 20, 2007: Dow and FTSE past falls

Home

CARRY TRADE, THE

May 22, 2007: Professor Antal E. Fekete (exchange of letters in The Market Oracle)

CHARITIES

September 30, 2007: World Children's Fund - questions about value for money

CHINA

Sept 25, 2007: China's growing class of advertising and media professionals

Sept 23, 2007: China may use its trade surplus for political/military advantage

Aug 09, 2007: Growing inequality of income in China

Aug 06, 2007: China's near-$1 trillion ownership of US assets

July 18, 2007: James Kynge (my review of his book, "China Shakes The World")

June 19, 2007: James Kynge (article in The Alchemist, November 2004)

May 23, 2007: Intellectual property rights in China

May 21, 2007: China's sovereign wealth fund

CURRENCIES / MONETARY INFLATION

Aug 31, 2007: Maastricht provisions for the European Central Bank, post-EMU

Aug 16, 2007: The weakness of the British pound, in gold terms

Aug 15, 2007: The German DM stronger than the dollar, in gold terms

Aug 14, 2007: The weakness of the dollar compared to gold

Aug 03, 2007: The Euro as a possible international reserve currency

July 31, 2007: Mike Hewitt (article on global money supply in The Market Oracle)

May 28, 2007: Richard Duncan (interview on BusinessInAsia.com)

May 11, 2007: Peter Schiff (my review of his book, "Crash Proof")

May 10, 2007: Michael Panzner (my review of his book, "Financial Armageddon")

DEPOSITOR PROTECTION

Aug 30, 2007: Federal Deposit Insurance Corporation (USA)

Aug 23, 2007: Financial Services Compensation Scheme (UK)

DERIVATIVES

July 31, 2007: Richard Bookstaber (interview on Financial Sense, July 21 2007)

ECONOMIC CYCLES & PATTERNS

Sept 16, 2007: Jim Puplava sees crisis in 2009: Peak Oil and other factors

July 27, 2007: Kress cycles

June 28, 2007: Hindenburg omens

May 23, 2007: Olduvai theory

May 16, 2007: the Kondratieff cycle

GLOBALISATION / NEW GROWTH THEORY

Sept 23, 2007: My view that Western economies are facing inflation and recession

Aug 09, 2007: Globalisation and competition from the Far East

July 28, 2007: Thomas Friedman (interview on Yale Global Online, 18 April 2005)

July 28, 2007: Paul Romer (interview on Reason Online, 2001)

July 27, 2007: Wikipedia / Gladys We on New Growth Theory, aka Endogenous Growth Theory July 07, 2007: Thomas Friedman (Edward Leamer's critique)

May 20, 2007: Jim Willie on unemployment caused by globalisation

GOLD

Sept 27, 2007: Marc Faber sees bubbles everywhere, but recommends gold

Sept 25, 2007: More from Frank Veneroso on gold reserves and speculation

Sept 24, 2007: Frank Veneroso thinks speculation has created a bubble in gold

Aug 16, 2007: Mike Hewitt's essay on the global money supply, and gold

Aug 15, 2007: The surreptitious depletion of central bank gold reserves

Aug 07, 2007: The case for owning gold

Aug 02, 2007: The postwar rise and fall of central bank reserves of gold

LEGAL

Aug 24, 2007: Enduring Power of Attorney / Lasting Power of Attorney

MORTGAGES

September 29, 2007: Mortgage lending a key factor in high property costs

PERSONALITY PROFILES

Faber, Marc (Dr)

RISK ASSESSMENT & REDUCTION

Aug 09, 2007: Tips from the Daily Reckoning on defensive investment

June 21, 2007: Nassim Taleb's "Black Swans"

June 15, 2007: Harold Markowitz (inventor of Modern Portfolio Theory)

June 06, 2007: Asset classes

May 11, 2007: Peter Schiff (my review of his book, "Crash Proof")

May 10, 2007: Michael Panzner (my review of his book, "Financial Armageddon")

SOVEREIGN WEALTH FUNDS

Sept 26, 2007: Sovereign wealth funds expected to boost markets - but a threat to Western economies

Sept 22, 2007: Creditor economies switching from bonds to equities

May 21, 2007: China's sovereign wealth fund

STOCKMARKET VOLATILITY

Aug 31, 2007: Robert McHugh's "Dow 9,000" prediction - with updates

Aug 09, 2007: Is the Dow more overvalued than the FTSE?

June 20, 2007: Dow and FTSE past falls

Home

The chef eats his own cooking

News: Indochina Capital Vietnam Holdings Limited is the largest (and LSE quoted) managed fund of Indochina Capital, whose non-executive chairman is Dr Marc Faber. It has just announced that it bought 60,000 of its own shares on Friday. That looks like putting your money where your mouth is.

Monday, August 20, 2007

More on Faber and Vietnam

Marc Faber is, it seems, chairman of a company called Indochina Capital and this report of a meeting in Ho Chi Minh City in April quotes him as saying, "Among emerging economies, Vietnam has the most potential for development."

In an edition of his GloomBoomDoom report dated May 2003 he remarked, "Vietnam... is developing rapidly and will, in my opinion, with its 80 million very hard-working and thrifty people, overtake Thailand economically within the next ten years or so." For those who may be considering subscribing to his newletters, it's interesting to see an example of his reporting style.

In an edition of his GloomBoomDoom report dated May 2003 he remarked, "Vietnam... is developing rapidly and will, in my opinion, with its 80 million very hard-working and thrifty people, overtake Thailand economically within the next ten years or so." For those who may be considering subscribing to his newletters, it's interesting to see an example of his reporting style.

Marc Faber comments on Fed rate cut

Bloomberg today reports on Friday's 0.5% cut in the discount rate, and quotes Marc Faber saying "...it's an intervention... that is not justified [and will] create an additional set of problems at a later date.''

I'm mildly curious to see he was in Danang, Vietnam. And for Faber-watchers, there's news of a new channel featuring his interviews and predictions, on http://www.barreloworld.com/.

UPDATE:

See here for Marc Faber's interview on MoneyControl.com. He, too, recommends selling-out on the ups and staying in cash.

Sunday, August 19, 2007

Another bearish opinion

"The Contrarian Investor" (on Saturday - see sidebar) says sell, too:

"Anyway, we believe that Friday’s stock market rally (in the US) is a good opportunity to liquidate any existing holdings of stocks."

"Anyway, we believe that Friday’s stock market rally (in the US) is a good opportunity to liquidate any existing holdings of stocks."

Doug Casey goes to Argentina

This is getting very 1920s/1930s - Argentina as the home for the jet set. Here's Doug Casey:

...we're at the end of a 25-year boom. It's gone on more than a full generation now. And I'll tell you how it's going to end: It's going to end with a depression, and not just a depression; not just another Great Depression; it's going to be the Greater Depression...

I think what you ought to have is your citizenship in one country, your bank account in another country, your investments in a third, and live in a fourth. You've got to internationalize yourself...

What am I doing about this? I've been all over the world. I guess I've lived in 12 countries now. And out of 175, I've been to most of them, numerous times actually. What am I doing, where do I want to go, where am I living? Well, in New Zealand.... But... the currency has doubled and the real estate within that currency has doubled at least. So I'm getting out of New Zealand. Where am I going now? I'm going to Argentina...

I wouldn't touch Europe with a ten-foot pole...

...everything in Argentina costs between 10% to 30% of what it costs in North America. That's correct. It's that cheap... So you're getting a massive immigration from rich Europeans that can see the handwriting on the wall and like it down there. And I really like it down there. It's just a great society, great society, great place to hang out, prices are right. I mean this can solve most of your investment problems right there, just by transplanting yourself, if you've got some capital.

This may sound like it's only for the really rich, but I have had perfectly ordinary clients sell up their over-priced ordinary British homes and move permanently to the Far East. For personal reasons, I can't be a globe-trotter, but international relocation is happening on a much bigger scale than London to Provence. For a while, I subscribed to one magazine, "International Living", that looks for bargain locations to spend the rest of your life - Panama appears to be a good one, if you dress conservatively and mind your own business.

So although Mr Casey talks dramatically in a non-Brit sort of way, he is backing his judgement with his considerable money; and ordinary types like ourselves currently have options that we could scarcely have dreamed of before WWII. Whether we will always have such options, is another question.

...we're at the end of a 25-year boom. It's gone on more than a full generation now. And I'll tell you how it's going to end: It's going to end with a depression, and not just a depression; not just another Great Depression; it's going to be the Greater Depression...

I think what you ought to have is your citizenship in one country, your bank account in another country, your investments in a third, and live in a fourth. You've got to internationalize yourself...

What am I doing about this? I've been all over the world. I guess I've lived in 12 countries now. And out of 175, I've been to most of them, numerous times actually. What am I doing, where do I want to go, where am I living? Well, in New Zealand.... But... the currency has doubled and the real estate within that currency has doubled at least. So I'm getting out of New Zealand. Where am I going now? I'm going to Argentina...

I wouldn't touch Europe with a ten-foot pole...

...everything in Argentina costs between 10% to 30% of what it costs in North America. That's correct. It's that cheap... So you're getting a massive immigration from rich Europeans that can see the handwriting on the wall and like it down there. And I really like it down there. It's just a great society, great society, great place to hang out, prices are right. I mean this can solve most of your investment problems right there, just by transplanting yourself, if you've got some capital.

This may sound like it's only for the really rich, but I have had perfectly ordinary clients sell up their over-priced ordinary British homes and move permanently to the Far East. For personal reasons, I can't be a globe-trotter, but international relocation is happening on a much bigger scale than London to Provence. For a while, I subscribed to one magazine, "International Living", that looks for bargain locations to spend the rest of your life - Panama appears to be a good one, if you dress conservatively and mind your own business.

So although Mr Casey talks dramatically in a non-Brit sort of way, he is backing his judgement with his considerable money; and ordinary types like ourselves currently have options that we could scarcely have dreamed of before WWII. Whether we will always have such options, is another question.

More on Marc Faber and the bear market

From Friday's Daily Reckoning:

"Excerpts from CNBC-TV18's exclusive interview with Marc Faber:

Q: How do you read the events as they have unfolded in the past fortnight? How do you think this might shape up?

A: Basically as you know, the US market went up until July 16. The Dow peaked out on July 17 above 14,000 and then it started to slide, mainly driven by financial stocks and by what people call a crisis in the subprime lending sector and the CDO and the BS markets. The question obviously is where do we go from here? Is it like 1998, where we dropped first and then recovered strongly towards the end of the year or is it something more serious? I think it's something more serious.

Q: If you had to predict - since your view is bearish, what percentage fall would you expect in emerging market equities over the next foreseeable period?

A: The S&P has a very good chance to decline by 20-30% and the emerging economy stock markets could drop by 40%. That may not mean that the bull market in emerging markets is over for good, because in 1987 we had drops in Taiwan of 50% and then the market went up another four times, so you can have a big correction and still be in the bull market.

But if someone came to me and said what is the upside on the S&P? We had 1,452 where the high was 1,555. I would say the upside and the big resistance in the market is between 1,520 and 1,530 so the upside is limited. But what about the risk?

What I noticed is investors are far more concerned about missing the next leg in the bull market on the upside, than about the risk of losing a lot of money. And I think, gradually this will change and that would mean lower equity prices and also prices of other assets such as commodities can go down substantially and obviously home prices around the world.

Dear Daily Reckoning readers should be aware...this is a downturn that COULD be extremely long and severe."

"Excerpts from CNBC-TV18's exclusive interview with Marc Faber:

Q: How do you read the events as they have unfolded in the past fortnight? How do you think this might shape up?

A: Basically as you know, the US market went up until July 16. The Dow peaked out on July 17 above 14,000 and then it started to slide, mainly driven by financial stocks and by what people call a crisis in the subprime lending sector and the CDO and the BS markets. The question obviously is where do we go from here? Is it like 1998, where we dropped first and then recovered strongly towards the end of the year or is it something more serious? I think it's something more serious.

Q: If you had to predict - since your view is bearish, what percentage fall would you expect in emerging market equities over the next foreseeable period?

A: The S&P has a very good chance to decline by 20-30% and the emerging economy stock markets could drop by 40%. That may not mean that the bull market in emerging markets is over for good, because in 1987 we had drops in Taiwan of 50% and then the market went up another four times, so you can have a big correction and still be in the bull market.

But if someone came to me and said what is the upside on the S&P? We had 1,452 where the high was 1,555. I would say the upside and the big resistance in the market is between 1,520 and 1,530 so the upside is limited. But what about the risk?

What I noticed is investors are far more concerned about missing the next leg in the bull market on the upside, than about the risk of losing a lot of money. And I think, gradually this will change and that would mean lower equity prices and also prices of other assets such as commodities can go down substantially and obviously home prices around the world.

Dear Daily Reckoning readers should be aware...this is a downturn that COULD be extremely long and severe."

Marc Faber: India rather than the USA

Here is a quote from Marc Faber and a bit of bio info, extracted from INR News:

"If a gun were put to my head and I was asked to choose between two options - putting all my assets into the US or into India - I would choose Indian equities, Indian real estate, and Indian art. The reason behind this choice is partly my strong conviction that US assets will continue to decline relative to assets overseas, and partly because I can see that India may be at the beginning of a lasting economic take-off phase" ...

...From 1978 to February 1990, Marc Faber was the Managing Director of Drexel Burnham Lambert (HK) Ltd. In June 1990, he set up his own business, MARC FABER LIMITED which acts as an investment advisor and fund manager.(Marc Faber - A Simpleton's Guide to Economics and Investment Markets, part II )

By INRnews Correspondent

Dr Faber's comments on Indian urbanisation, the need for new infrastructure, and comparison with China, are also very interesting.

"If a gun were put to my head and I was asked to choose between two options - putting all my assets into the US or into India - I would choose Indian equities, Indian real estate, and Indian art. The reason behind this choice is partly my strong conviction that US assets will continue to decline relative to assets overseas, and partly because I can see that India may be at the beginning of a lasting economic take-off phase" ...

...From 1978 to February 1990, Marc Faber was the Managing Director of Drexel Burnham Lambert (HK) Ltd. In June 1990, he set up his own business, MARC FABER LIMITED which acts as an investment advisor and fund manager.(Marc Faber - A Simpleton's Guide to Economics and Investment Markets, part II )

By INRnews Correspondent

Dr Faber's comments on Indian urbanisation, the need for new infrastructure, and comparison with China, are also very interesting.

Saturday, August 18, 2007

Weathering the storm

Now that we know the opposition's strategy, what do we do? My guess is, hold cash, wait for further crises of confidence, and buy tangible assets, or assets backed by tangibles, at bargain prices.

That's why I think Buffett and Soros have been so clever in acquiring more rail stock in recent months. Railways are a natural Benjamin Graham choice: mature, income-producing investments. There are big barriers to entry - think of nineteenth-century land speculation and skulduggery, and add-in eco protests, modern politics and the unavailability of coolie labour. Rail has advantages over road, especially as so much freight now is containerised and port-to-city; but from an investor's perspective it is also solidly thing-based.

I think we'll be back to putting money into things we can understand.

Friday, August 17, 2007

Following the markets today

As I hoped and more than half expected, the major Western markets are recovering from some of their fright. The FTSE has passed 6,000 again and at the time of writing, the Dow is back above 13,000. Those chest pains will eventually be laughed off as a bout of indigestion, and it'll be back to the fags and booze after a while.

The subprime mess was well-telegraphed, if ignored by many, and although we still don't know the full cost, it seems that yet again, the central banks are willing to pump money into the system, rather than reform it. Marc Faber's view that the crisis should be allowed to burn through and eliminate some of the players, is too gritty for the banking establishment.

My take on this is that it's an opportunity for those still in the market to quietly come out without panicking everybody else. The rise of the dollar and the temporary sharp falls in precious metals, are reminders that in a crisis, cash is king; though given Ben Bernanke's statement about dropping dollars from helicopters, maybe king for a day.

Risk avoidance leads to stronger dollar

That's the analysis of Kathy Lien at DailyFX.com yesterday:

These days, cash is a valuable commodity since a liquidity crisis means a lack of cash. The sharpness of recent moves and the lack of liquidity have probably pushed more traders to liquidate positions than to add funds. Flight to safety continues to send the dollar higher against every major currency with the exception of the Japanese Yen as more victims of the subprime and liquidity crisis surface.

There's a possibility of an interest rate reduction:

...the biggest question on everyone’s mind is when the Federal Reserve will cut interest rates. The market is current pricing 75bp of easing by the end of the year. There has also been speculation of an intermeeting rate cut.

But:

Like many central banks around the world, the Fed has been reluctant to lower rates because they feel that the markets need to be punished for their excessive risk appetite. Furthermore, they have said that they need to see market volatility have a “real impact” on the economy.

This, she thinks, is becoming apparent:

With major losses and bankruptcies reported throughout the financial sector, we expect companies to layoff staff left and right. [...] For the people in the “real economy,” their 401ks have taken a harsh beating while their mortgage interest payments are on the rise. It is only a matter of time when we see economics reflect that. The bad news is already pouring in with housing starts hitting a 10 year low and manufacturing activity in the Philadelphia region stagnating. Since the beginning of the year, the weak dollar has provided a big boom to the manufacturing sector. Now that the dollar has strengthened significantly, activity in the manufacturing sector should also begin to slow.

These days, cash is a valuable commodity since a liquidity crisis means a lack of cash. The sharpness of recent moves and the lack of liquidity have probably pushed more traders to liquidate positions than to add funds. Flight to safety continues to send the dollar higher against every major currency with the exception of the Japanese Yen as more victims of the subprime and liquidity crisis surface.

There's a possibility of an interest rate reduction:

...the biggest question on everyone’s mind is when the Federal Reserve will cut interest rates. The market is current pricing 75bp of easing by the end of the year. There has also been speculation of an intermeeting rate cut.

But:

Like many central banks around the world, the Fed has been reluctant to lower rates because they feel that the markets need to be punished for their excessive risk appetite. Furthermore, they have said that they need to see market volatility have a “real impact” on the economy.

This, she thinks, is becoming apparent:

With major losses and bankruptcies reported throughout the financial sector, we expect companies to layoff staff left and right. [...] For the people in the “real economy,” their 401ks have taken a harsh beating while their mortgage interest payments are on the rise. It is only a matter of time when we see economics reflect that. The bad news is already pouring in with housing starts hitting a 10 year low and manufacturing activity in the Philadelphia region stagnating. Since the beginning of the year, the weak dollar has provided a big boom to the manufacturing sector. Now that the dollar has strengthened significantly, activity in the manufacturing sector should also begin to slow.

US economy over-dependent on housing sector

The Daily Reckoning Australia summarises Dr Kurt Richebacher's analysis: the US economy depends on the housing sector to a dangerous degree, so even a stall in housing will have a big effect.

"...property bubbles have historically been the regular main causes of major financial crises. During its bubble years in the late 1980s, Japan had rampant bubbles in both stocks and property. While the focus is always on the more spectacular equity bubble, hindsight leaves no doubt that the following economic disaster was mainly rooted in the property bubble. Both bubbles burst in the end, but the property deflation has continued for 13 years now, with calamitous effects on the banking system."

I suspect we have a similar problem here in the UK.

Thursday, August 16, 2007

Here is tomorrow's news

An online newspaper from the Northern Marianas (south-east from Japan), dated Friday, gives some quotes from Peter Schiff, including this startling (and measurable) one:

An online newspaper from the Northern Marianas (south-east from Japan), dated Friday, gives some quotes from Peter Schiff, including this startling (and measurable) one:"People call us the biggest economy in the world but it’s false, we’ll be lucky to be in the top 20 in two years’ time."

According to the World Bank and ranked by 2006 GDP, the 20th country is Switzerland; by purchasing power parity, it's Iran; by Gross National Income (Atlas method) it's Turkey. Doesn't look likely, so far.

But by gross national income per capita, on a purchasing power parity method, the 20th country is Belgium; and by GNP per capita (Atlas method), it's Germany. Maybe we're getting somewhere now.

In this list of countries by external debt, the USA comes top (over $10 trillion), with the UK in second place (over 8 trillion), and I'm sure we'd rather swap places here with Greece in 20th position ($301.9 billion); but that doesn't take into account the relative sizes of our economies. I'm still searching for a list of countries by net external debt, related to GDP. Help would be appreciated!

On a list of public debt to GDP, the USA is in 32nd place (64.7%), and the UK is in 61st place (42.2%). The Lebanon (209%) and Japan (175.5%) are the top two on this sinner's list.

As they say, comparisons are odious.

More on Dow stock valuation

Further to the assertion that stocks are reasonably valued, and Marc Faber's answer that we have an "earnings bubble" that is skewing p/e (share price compared to earnings, i.e. dividends) calculations, here is an essay by David Leonhardt in the International Herald Tribune (14 August) on historical p/e ratios.

A couple of extracts:

...the stocks in the Standard & Poor's 500 have an average P/E ratio of about 16.8, which by historical standards is normal. Since World War II, the average ratio has been 16.1. During the bubbles of the 1920s and the 1990s, the ratio shot above 30...

Graham and Dodd argued that P/E ratios should compare stock prices to "not less than five years, preferably seven or ten years" of profits...

Based on average profits over the past 10 years, the P/E ratio has been hovering around 27 recently. That's higher than it has been at any other point during the past 130 years, except for the great bubbles of the 1920s and the 1990s. The stock run-up of the 1990s was so big, in other words, that the market may still not have fully worked it off...

In the long term, the stock market will almost certainly continue to be a good investment. But the next few years do seem to depend on a more rickety foundation than Wall Street's soothing words suggest.

A drop from a p/e ratio of 27 down to 16.8 would imply a share price drop of 37%.

Thanks to Michael Panzner for spotting this and putting it onto his Financial Armageddon site.

A couple of extracts:

...the stocks in the Standard & Poor's 500 have an average P/E ratio of about 16.8, which by historical standards is normal. Since World War II, the average ratio has been 16.1. During the bubbles of the 1920s and the 1990s, the ratio shot above 30...

Graham and Dodd argued that P/E ratios should compare stock prices to "not less than five years, preferably seven or ten years" of profits...

Based on average profits over the past 10 years, the P/E ratio has been hovering around 27 recently. That's higher than it has been at any other point during the past 130 years, except for the great bubbles of the 1920s and the 1990s. The stock run-up of the 1990s was so big, in other words, that the market may still not have fully worked it off...

In the long term, the stock market will almost certainly continue to be a good investment. But the next few years do seem to depend on a more rickety foundation than Wall Street's soothing words suggest.

A drop from a p/e ratio of 27 down to 16.8 would imply a share price drop of 37%.

Thanks to Michael Panzner for spotting this and putting it onto his Financial Armageddon site.

Subscribe to:

Posts (Atom)