Monday, March 01, 2010

Democracy: why bother?

Salami-slicing the franchise

A brief discussion from the blog of Chris Whiteside, Conservative Parliamentary candidate for Whiteside, Cumbria:

A brief discussion from the blog of Chris Whiteside, Conservative Parliamentary candidate for Whiteside, Cumbria:At today's Conservative conference David Cameron promised real action in six key areas to help get Britain back on its feet

[...]

6: Change politics

Reduce the number of MPs, cut Whitehall and quangos by a third, and let taxpayers see where their money is being spent.

_________________________________________________

Comments to the above:

At 8:32 AM, Sackerson said...

6. Isn't reducing the number of MPs another step in the de-democritization of the UK?

At 1:53 AM, Chris Whiteside said...

Sackerson: a 10% reduction in the number of MPs won't have that effect, no.

At 8:38 AM, Rolf said...

Chris: thanks for your courtesy in responding. I have to disagree: a 10% reduction in MPs is an 11% increase in constituency voter numbers and so a corresponding decrease in the value of my individual vote. And where will it end?

KING LEAR

Ourself, by monthly course,

With reservation of an hundred knights, by you to be sustain'd,

Shall our abode make with you by due turns.

GONERIL (Murmurs to Regan) He may enguard his dotage with their powers,

And hold our lives in mercy.

(To King Lear) It is not well! Dismissing half your train, come then to me.

KING LEAR (To Goneril) What, fifty of my followers at a clap!

REGAN I entreat you to bring but five and twenty:

To no more will I give place or notice.

KING LEAR What, must I come to you with five and twenty, Regan? Said you so?

REGAN Speak't again, my lord; no more with me.

KING LEAR (To Goneril) I'll go with thee:

Thy fifty yet doth double five and twenty, and thou art twice her love.

GONERIL What need you five and twenty

REGAN or ten!

GONERIL or five!

REGAN What need one?

(For those who attended school after the educational reforms of the 1980s, Shakespeare was an English writer and used to be regarded as an essential element of our cultural heritage. Yes, a bit like Carol Ann Duffy, as you say, Blenkinsop Minor; but only a bit.)

Sunday, February 28, 2010

Daniel Hannan and the EU

Should we have paid-off everyone's mortgage?

Probably not. Sudden and simplistic measures can be horribly destructive. But can we permit a system to continue, that is built on inflating (or maintaining the absurdly high level of) the cost of our dwellings? In cartoon-mythical ancient times, all a tribe of cavemen had to do was get rid of the bear - all in a day's work - and now the right to live in your own space takes years and years of toil.

Back to Thoreau and Walden?

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this bl

og.

og.

Big market fall expected, over several years

This from "Jesse", a sober and savvy commentator who deplores the schadenfreude crowd. Do read the rest.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Saturday, February 20, 2010

Matt Taibbi on the reinflated bubble

Slashing interest rates to get us through the emergency has made ordinary savings accounts unproductive and forced money into investments instead, even when analysis says stay out:

"One trader, who asked not to be identified, recounts a story of what happened with his hedge fund this past fall. His firm wanted to short — that is, bet against — all the cr*p toxic bonds that were suddenly in vogue again. The fund's analysts had examined the fundamentals of these instruments and concluded that they were absolutely not good investments.

"So they took a short position. One month passed, and they lost money. Another month passed — same thing. Finally, the trader just shrugged and decided to change course and buy.

""I said, '**** it, let's make some money,'" he recalls. "I absolutely did not believe in the fundamentals of any of this stuff. However, I can get on the bandwagon, just so long as I know when to jump out of the car before it goes off the damn cliff!"

"This is the very definition of bubble economics — betting on crowd behavior instead of on fundamentals. It's old investors betting on the arrival of new ones, with the value of the underlying thing itself being irrelevant. And this behavior is being driven, no surprise, by the biggest firms on Wall Street."

It takes nerve to stay out of the market when it's rising and when you think you may lose value on your cash held at bank. But unless you're confident that you'll be able to "jump out of the car before it goes off the cliff" (and remember, you don't have access to instant dealing like the City pros), maybe sitting on your hands is the thing to do.

And if price inflation worries you, don't forget, both the US and UK governments still sell guaranteed inflation-proofed investments of their own.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

"Consumer choice" and liberty

Sir: Your editorial (“People Power”, 20 February) welcomes Conservative proposals to extend consumer choice in schools and hospitals, and I hope this will open a wider debate about these imperfect and possibly outdated reifications of learning and health. For example, might we see less bureaucratic resistance to, and more financial support for home education?

But if the Conservatives have rediscovered their appetite for freedom and democracy, why, as Greece, fons et origo of those principles, lies tormented on the Procrustean metanarrative of the EU, are we denied a voice in the ultimate political question, that of national self-determination? Absent a referendum on membership of the Romantic and revolutionary project, we shall be limited-list libertarians, like council house dwellers selecting the hue of their front doors from officially-compiled colour charts.

Are we to be consulted, or must we refuse to vote at all in the coming General Election?

Friday, February 19, 2010

Jerking the chain: China preparing a proxy US bond dump?

In response to a comment, I suggested that the reason for this supposed system of proxy purchases was to allay the fears of the American public.

It occurs to me now, belatedly, that the recent reduction in direct Chinese holdings, coupled with the increase in holding by the UK, may be a preparation for a self-protective (or even punitive) dump of Treasuries using the same intermediaries. If their direct holdings remained relatively unchanged, the Chinese could (if their nominees stayed quiet) deny responsibility and forestall a backlash from American public opinion.

The Beginning of the End?

I laughed, until I started an on-line exchange with an instructor at a private college. I learned that there is a new breed of teacher, coming mostly from colleges of education. They use phrases such as 'training life-long learners', 'having students take charge of their education', 'learning to use the correct tools, rather than learning how to do things', 'cite sources, rather than memorizing' and 'communicating with podcasts, instead of writing'.

I have seen these methods tried in mathematics and science education, and they simply do not work. Even if they do work in other subjects (doubtful), the bad training carries over to the technical fields, hampering the learning anyway. That should be the end of the matter, except that these ideas are dangerously attractive:

Weak or lazy students like them, since they can get good grades without actually mastering anything. They also get the comfortable illusion of learning, without the pain.

Administrators like the idea, since they can then eliminate or reduce the cost of libraries and textbooks, and replace experts in subject matter with general 'communicators'. All teaching is then a higher art, being removed from 'mere content delivery'. This last is a phrase that I heard used by a colleague in our college of education.

Lastly, parents and politicians love the idea, since education costs can be brought down, and performance is way up, at least on paper. Never mind that the Pacific Rim countries, still using the 'old-fashioned' techniques, are outperforming us, year after year.

How much longer until we have the world of Ray Bradbury's 'Fahrenheit 451', when books are actually banned, because reading makes some people feel inferior?

Thursday, February 18, 2010

A dire warning

Whether or not gold is the right prescription, I am very much afraid that he may be making the right diagnosis and prognosis. Do have a look.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

A dire warning

Whether or not gold is the right prescription, I am very much afraid that he may be making the right diagnosis and prognosis. Do have a look.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

What use are news organisations?

The readers of the Boston Evening Transcript

Sway in the wind like a field of ripe corn.

T.S. Eliot

What goes up...

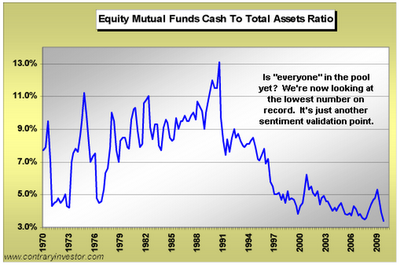

Reading "Jesse", I see an interesting graph (reproduced right). This looks at what proportion of US mutual fund (UK: think unit trust) money is held in cash. According to the graph, funds are more nearly "fully invested" than at any point since 1970.

Reading "Jesse", I see an interesting graph (reproduced right). This looks at what proportion of US mutual fund (UK: think unit trust) money is held in cash. According to the graph, funds are more nearly "fully invested" than at any point since 1970.So, where will the money come from to power further gains on the index? Or is it (as I fear) a sign that the private investor is trustingly holding the baby, just as the institutional investor (who only holds 20% of total US shares) is about to "pop out to get something, he'll be back in a bit"?

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Wednesday, February 17, 2010

Why inflation is bad

7Q. Who benefits from inflation?

7A. Inflation benefits those with first access to money, the banks and the already wealthy. It is a stealth tax on the middle class and poor whose wages never keep up with inflation. That problem is compounded by rising property taxes, sales taxes, etc, that eats consumers alive. Those at the bottom end of the totem pole get hit even harder. Their wages do not rise and they have no assets to inflate.

Absolutely spot-on. The theorists who say increasing the money supply doesn't matter because the effects spread throughout the system, overlook the point I've highlighted above. It's a grab.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The advance of totalitarian ideals continues

In a well-publicised and suspiciously originated piece of research conducted on behalf of MiniJust, doubt is thrown on the "efficient" working of juries. Far better, you may think, ladies and gentlemen of the jury, to leave it all to us and not worry your pretty little heads about it.

Meanwhile, the case against Cossor Ali, in which she is being tried for not acting as a police informer against her husband (despite not knowing exactly what he was going to do), continues.

Also, support for killing the terminally ill grows, according to a poll conducted by YouGov, perhaps not entirely coincidentally well-timed to announce its results just before well-loved author Terry Pratchett was permitted to use his fame and the (exceptionally-well-publicised this year) platform of the BBC's annual Richard Dimbleby Lecture to air his euthanistic views. YouGov is not, officially, a politically-sponsored organisation, but was founded in May 2000 by Stephan Shakespeare (ne Kukowski), a former Socialist Worker and Conservative Party candidate who owns some prominent political websites including ConservativeHome. He may not be directly controlled by any party (though how far do they differ these days?), but oh, for his contacts book!

An old Nazi writes:

"What is all this nonsense of wives not reporting their criminal husbands? In my day, children could inform on their parents, and quite right, too. I trust the Cossor Ali case will set a valuable precedent.

"It is refreshing to see that after the unpleasantness of the late 1930s and early 1940s, and the vilification of us and our ideas in the decades since then, the principles of right-thinking people are finally being rediscovered and properly valued. Gratifyingly, British political parties have been drawing together for decades, forming a consensus on which the New Society can be built. Once the people have asserted their power to deal with all the fleas that multiply on their backs and weaken them, we shall become clean and healthy again.

"A vital first step was the establishment of the right to make the problem of inconvenient children go away. Some 7 million such problems have been solved in the UK since 1968, the overwhelming majority on legal ground C ("The continuance of the pregnancy would involve risk, greater than if the pregnancy were terminated, of injury to the physical or mental health of the pregnant woman"). You will note, of course, that the "injury" does not have to be grave, and can therefore be interpreted to mean as little as a mild social or financial embarrassment.

"The killing of unborn cripples is covered by ground E, and I see that a fruitful extension of this principle has been called for by doctors as lately as 2006, so that newborns may be included in your cost-effective program. Quite rightly, these doctors draw attention to the interests of the family as a whole, and this offers a promising route to including the needs of society at large, especially when so many families are supported by public funds.

"Crime is another kind of disorder in which society most definitely has an interest, and Freakonomics author Steven Levitt famously argued that abortion has been a great boon in this regard. There are those who say his research is fatally flawed, but even if the details are wrong, surely he was on the right lines. The poor are a great burden, and their lives are so messy.

"But you cannot always tell in advance when someone will turn out to be one of Life's failed experiments. Once we have established postnatal abortion, pre-decline "mercy killings" and the execution by thirst of those in a persistent vegetative state, we should be in a position to reformulate the fundamental principles on which society operates.

"How much longer, for example, must felons be spared - so weakly, so expensively, so anomalously - their worthless and destructive lives? Why should the guilty not share the fate of the troublesome innocents you dispatch in such numbers? This is so illogical of you British; but then, my people used to proud of their ability to think. As Menzel said, "Das sinnige deutsche Volk liebt es zu denken und zu dichten, und zum Schreiben hat es immer Zeit." Only connect, ja?

"Before that becomes possible, (and now, it seems, may be the time) we will have to address the unreliability of courts, juries and the appeals system. I confidently expect the evolution of a form of Volksgerichthof in due course, though before that you may need to reeducate public opinion. Perhaps a first step would be revisionist histories on TV to neutralize the pernicious legacies of Magna Carta, 1688, Common Law, natural justice, equity etc. All this blether about historical rights causes nothing but delay and frustration, and comes from undesirable elements of the community. If the people come together, guided by prominent figures and facilitated by mass communication, and shout long and loudly enough, all such divisive opposition will vanish. We live and work today for a bright, efficient, socially harmonious tomorrow, not for a superstitious and contradictory past."

Tuesday, February 16, 2010

China extending secret support for USA

China NOT withdrawing support from the US?

______________________________________________"Foreign demand for US Treasury securities falls by record amount as China reduces holdings"

... That's the AP news story as relayed by the Drudge Report. But is all as it seems?

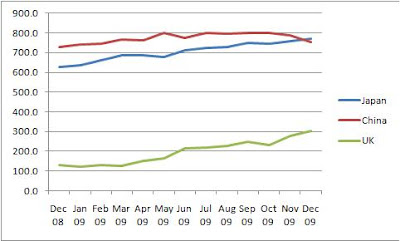

Looking at the data published by the US Treasury, China's holdings dropped by $34.2 billion between November and December 2009; but at the same time, the UK's holdings increased by $24.9 billion, and Hong Kong's increased by $6.7 billion. (The AP reporter quotes a total drop in foreign holdings of $53 billion that month , but that's for T-bills alone, NOT Treasury securities as a whole, which ROSE by $16.9 billion.)

Back in January 2009, Brad Setser analysed purchases of US Treasuries and Agencies, and concluded that the UK (and, to a lesser extent, Hong Kong) was making proxy purchases on behalf of China.

Here is the picture of US Treasury holdings by Japan, China and the UK between Dec 2008 and Dec 2009 (figures are in billions of US dollars):

Now, here is the same information, but aggregating holdings by China and the UK:

Now, here is the same information, but aggregating holdings by China and the UK:

... both have risen by 23% over the 13 months to the end of 2009 - like two horses under one yoke. (Total foreign holdings of US Treasury securities increased by 17%).

Far from "China's pulling out", the story might be read as "All hands to the pump, or we'll all sink".

UPDATE: Jake at Econompic concurs.

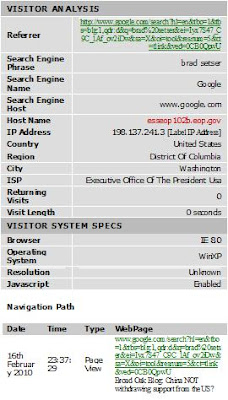

SECOND UPDATE: It seems one of POTUS' interns is also interested in this issue, to judge by a fleeting visit to this blog:

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Should a bomb-plotter's wife turn supergrass?

This is a tricky one for libertarians and all others who no longer have a naive trust in the State. Should a wife be expected to act as an informer against her husband?

I thought that under English law, a wife is not a compellable witness against her husband in most criminal cases, although a change in the law of Scotland was proposed in 2006. If she cannot be forced to testify against him, why should she be expected to act as a spy or agente provocateuse?

Is this another way in which the State can use a hard case to make a bad law? Is this part of a general modern assault on the natural law of family, so that the State (and, eventually, the Party) will reign supreme in all things?

Swindon twins with Disney

Sunday, February 14, 2010

It's Inevitable

Subjects were given a skills test. Without knowing the results, they were asked to evaluate their own performance. They were then shown someone else's test, and asked to re-evaluate.

The consistent result was that the worst performers consistently evaluated themselves as much better than average, and even upped that evaluation when shown the other paper. The complete opposite was true for the over-achievers.

US students have close to the worst performance in mathematics in the industrialized world, yet rate themselves as 'A'. The South Koreans, who are the best, rate themselves as 'C'.

My own experience with students and faculty supports this. Poor students usually assume that they are doing well. The most educated of my colleagues are hesitant outside their areas of expertise.

That feeling of inadequacy of the best and brightest drives them to excellence. I always think of M.C.Escher, and his quote that 'I wish I could draw better'. Many other famous scientists and artists expressed similar sentiments, and produced wonders.

The fact that our brains appear to be hard-wired to equate confidence with leadership means that we are much more likely to pick our managers and politicians on the basis of self-assurance, rather than ability. This is supported by other studies, showing that taller and better-looking people earn more money and are promoted more often.

This habit of choosing confident 'feel-good' individuals over hesitant problem-solvers goes a long way to explain why US voters overwhelmingly rejected President Carter in favour of Ronald Reagan.