*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Sunday, January 04, 2009

Disaster deferred (and increased), not averted

Saturday, January 03, 2009

Murky business

Setser estimates that China owns $1.425 trillion in Treasuries and Agencies, which is equivalent to about 10% of US GDP. ("Treasuries" are debts directly owed by the US Government, "agencies" are debts of the US Government's organisations, as explained in this Federal Reserve handbook from 2004.)

He ends by calling for more transparency in British accounts of these holding - that would be most welcome all round, generally. Half our problems (and, I assume, opportunities for fatcat swindlers) stem from our not knowing the real position of the world's finances.

Pop

In this piece, Charles Biderman explains that the value of a stock is set by marginal purchases, which do not reflect what you'd get if you sold all the company's shares at the same time. He estimates that from 2003-2007 the world's equities increased in notional value by $25 trillion, on nothing more than $1.5 trillion cash, a bit of borrowing and mostly, illusion: "Market cap and money aren't necessarily related."

When the illusion goes pop, so do all the gains. First out gets the most.

htp: zgirl

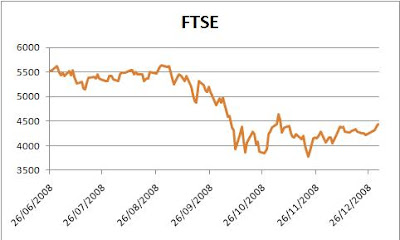

Elliot, Kondratieff, or normal service resumed?

The lows were certainly lower, and we have only recently learned just how close we came to a banking collapse. The question now is, are we where we "should" be - following a trend set by the last 25 years - or are there longer cycles due to make hay of the pattern of the last quarter-century? Elliot wavers and Kondratieff followers say yes.

My guess is that, after the steep stockmarket falls and the horrid crisis apparently averted, there will be a bounce in the next 1-2 years, then a decline in real (inflation-adjusted) terms for maybe another 5 years after that. Your guess?

By the way, I'd also be interested to know your views on why the bankers and brokers have been allowed to Get Away With It. To me, it seems like a big fat moral hazard and unless there is some real squealy punishment for all this bad behaviour, I'd advise any bright, conscienceless youngster to become a banker.

Currently, my preferred fantasy solution is to bust all the overextended banks, leave the shareholders with zilch, sack the senior bank managers and ban them from being company directors for at least 5 years, halve all mortgages, and give the book of business to more prudent operators including well-run building societies. In my view, this was never ever going to happen, because the FSA, the BoE and the government are also implicated. So, not so much "too big to fail", but too well-connected to fail.

But there's a price to pay, anyway: it's now clearly Us and Them. Perhaps, since they are immeasurably more powerful, we should give up trying to rectify the world and merely ape their cynicism and corruption. Moralists will demur; and so this is truly an age when we can say, "Affairs are now soul size".

Thursday, January 01, 2009

Am I the idiot, or are they?

It never made sense to me, especially as I saw such a transfer of wealth to those same rich people, who spent their money on luxury imported goods. Incomes for the middle and lower class barely kept pace with inflation, even as industry became ever more efficient.

Today, thanks to posts here and elsewhere, I finally realized what is wrong with the claim above: buying stocks does not 'invest in a company', unless you are buying stock directly from that same company. All it does is put money in the pockets of the stockbrokers, while you have a piece of paper that must rise in value by profit plus fees, and find another sucker to buy it. The real estate market is no different.

Nonetheless, all of the experts that I have talked with over the years insisted that I simply didn't understand, implying that I was an idiot. Am I?

Tuesday, December 30, 2008

Fun with extrapolation

Monday, December 29, 2008

Debt forgiveness, inflation and welching

In a simple handwave estimate, one might say that the debt will have to be discounted by at least half. That includes inflation and selective defaults...

... something has got to give. The givers will most likely be all holders of US financial assets, responsible middle class savers, and a disproportionate share of foreign holders of US debt.

While the debtors hold the means of payment in dollars and the power to decide who gets paid, where do you think the most likely impact will be felt?

I give below the US Treasury's data on foreign holdings of their government securities as at October 2008, but I also reinterpret it in the light of each country's GDP, to show relative potential impact (please click on image to enlarge).

Mind you, even a complete repudiation would only take care of $3 trillion. Funny how not so long ago, $1 trillion seemed a high-end estimate of the damage, and now it's something like seven times that. And that still leaves a long haul to get to Hodges' $53 tn - equivalent to, what, one year's global GDP?

Sunday, December 28, 2008

Saturday, December 27, 2008

Is gold a hedge against inflation?

(N.B. gold prices to the end of 1967 are annual averages, then monthly averages to the end of 1974, then the price is as on the first trading day of the month; all gold price figures from Kitco).

Friday, December 26, 2008

Nominal and real

Wednesday, December 24, 2008

"Efficiency" vs. survival

Robert Paterson, as quoted by London Banker.

Like I keep saying, it's about diversity, dispersion and disconnection - please click on the label below for my posts on this subject.

It's not about dinosaurs

1. The death of William Blake, 12 August 1827:

“Just before he died His Countenance became fair. His eyes Brighten'd and he burst out Singing of the things he saw in Heaven”

2. The experience of St Thomas Aquinas, 6 December 1273:

LXXIX: The witness went on to recall that while brother Thomas was saying his Mass one morning, in the chapel of St. Nicholas at Naples, something happened which profoundly affected and altered him. After Mass he refused to write or dictate; indeed he put away his writing materials. He was in the third part of the Summa, at the questions on Penance. And brother Reginald, seeing that he was not writing, said to him: 'Father, are you going to give up this great work, undertaken for the glory of God and to enlighten the world?' But Thomas replied: 'Reginald, I cannot go on.' Then Reginald, who began to fear that much study might have affected his master's brain, urged and insisted that he should continue his writing; but Thomas only answered in the same way: 'Reginald, I cannot - because all that I have written seems to me so much straw.' Then Reginald, astonished that ... brother Thomas should go to see his sister, the countess of San Severino, whom he loved in all charity; and hastening there with great difficulty, when he arrived and the countess came out to meet him, he could scarcely speak. The countess, very much alarmed, said to Reginald: 'What has happened to brother Thomas? He seems quite dazed and hardly spoke to me!' And Reginald answered: 'He has been like this since about the feast of St. Nicholas - since when he has written nothing at all.' Then again brother Reginald began to beseech Thomas to tell him why he refused to write and why he was so stupefied; and after much of this urgent questioning and insisting, Thomas at last said to Reginald: 'Promise me, by the living God almighty and by your loyalty to our Order and by the love you bear to me, that you will never reveal, as long as I live, what I shall tell you.' Then he added: 'All that I have written seems to me like straw compared with what has now been revealed to me.'

Relativism

Fasten your seatbelts

Tuesday, December 23, 2008

Democratic deficit

Vengeance is mine

UPDATE

And Jim Kunstler, too.

Every little thing's gonna be all right

Perhaps it's no coincidence that BBC is currently screening a remake of Terry Nation's gripping 1975 post-catastrophe series, "Survivors". But that series assumes that most people have died suddenly because of a virus, so the ecosystem has not been destroyed by desparate, starving victims. I don't think Survivors is the model we should use. If we are to survive, it'll be together, in our populous societies, because if society breaks down, you and I are unlikely to emerge as the last people standing. Lone heroes don't win; this is a fantasy.

I think spare supplies are a good idea, because there could be some disruption, which could affect the very young and elderly; so we need ways to keep warm, eat and have clean water in an emergency. And it's important to make your home secure against a rise in burglary, which is associated with economic downturns; and not to go out after dark without at least one or two companions. Weapons are another matter: "guns in the home are far more likely to be used against members of the household than against intruders."

Pace the doomsters, the UK and the USA will feed itself. We may end up eating more veg and less meat; and we may be using public transport instead of cars; personally, that would simply take me back to the 70s, when I was slimmer and fitter. Globally and locally, there is enough to feed the world, although not enough to overfeed it or encourage unproductive men to sire children.

Two aspects of the current crisis worry me:

1. The present method of organising resources may be replaced, not by one dreamed of by well-fed Western socialists, but by a cruel, remote, commanding elite as in North Korea or East Germany, who far from minimising scarcity will use it to get and maintain power.

2. The transition from this system to whatever replaces it, may be disorderly and involve suffering for many people.

This is why I think the underlying issue for us is to preserve and strengthen democracy, to increase the chances that both the journey and the journey's end are acceptable.

Monday, December 22, 2008

Why banks?

Satyajit Das (htp: Jesse)

Nope. Banks need destroying, as does all this bank-created debt. The mistake is to try to keep things as they are. How did we come to buy houses "on tick", then cars, and now our clothes and groceries? Why is there any lending for consumption, seeing how it only means reduced future consumption? Why should banks be kept going, requiring a significant proportion of our earnings, so that wages have to be high for us to live on what's left, making us uncompetitive with the developing world?

I am reminded of the pitiless response of the Comte d'Argenson to the satirist, Desfontaines:

Desfontaines: I must live.

D'Argenson : I do not see the necessity.

Sunday, December 21, 2008

The lesser of two weevils

In an apocalyptic - but carefully-reasoned - post, Karl Denninger says that when the deficit expansion stops, US government spending will have to be cut by 50 - 60%, unless there is to be a "general default" on debts.

I have no idea what a general default would look like, but in a closely-interwoven and distant-from-nature modern industrial society I can only fear it might prove utterly destructive. So we're back to contemplating the lesser, but still vast disaster.

I also have no idea how much worse it might be in the UK.

Someone else please read this unberobed OT prophet and tell me where he's wrong.

PS

While the Obama Administration cannot take a 'weak dollar' policy it is the only practical way to correct the imbalances brought about by the last 20 years of systemic manipulation. It is either that, or the selective default on sovereign debt, most likely through conflict, a hot or cold war.