*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Monday, June 16, 2008

Off licence alcohol purchases - minimum age 21

Michael White confuses matters by yoking this good horse to a bad one (morning-after pills for the underaged). Nevertheless, I wonder if we might make progress in this direction, as with smoking, but perhaps in a different way. as it's not just the young who have drink problems.

I think availability is a key factor. Imagine having a beer (or other tipple of your choice) tap next to each cold-water tap in the home - who could resist? Yet alcohol is nearly as accessible these days - supermarkets, post offices, even petrol stations. Rather than try to enforce an age limit (another pile of arrest records to write), let's try to remove some of the temptation: let's reduce the number of off-licences.

My preferred solution would be not to renew the liquor licence for a supermarket if there is an alternative outlet within a certain distance. Supermarket shelving has a narrative all its own - and booze is near the end so we can say to ourselves or our partners, "Shall we?" "Go on, then." It's a cunningly-positioned add-on to household shopping, encouraging the potentially dangerous habit of steady home drinking.

No stagnation, but a house price crash

The alternative (house prices stagnate, allowing inflation to achieve the same result more slowly) has become unsustainable because of fears respecting the stability of the banks.

Sunday, June 15, 2008

Drink is the curse of the post-working classes

... from Alcohol, Youth, and the State by Nicholas Dorn (RKP, 1983)

Taking on the supermarkets now would be like eradicating the Taliban. Remember how they took on the government and won easily, e.g. in 1991? So much for the rule of law.

Licensing Act 1964 - legal summary

2003 Licensing Act - summary

On the coarsening of British culture

Thus Russell Brand, in the Guardian newspaper. His louche autobiography is entitled "My Booky Wook", though for some reason he doesn't apply the same baby-linguistic titling approach to his blog or website ("My Blogy... no! No! Career death!"). For there are things these jokers take very, very seriously: banknotes.

The Teflon coating on his deadly bullets of vulgarity is a trifling pretension to verbal and literary sophistication. And it's happening all around, and so very well rewarded.

Of course, the next generation is past TV. So what are your children playing on the Internet? Here's some of the games I've seen ten-year-olds chuckling at in the last fortnight:

Stair Fall

The Torture Game

The Last Stand 2

And as fast as you block these entertainments, new routes to them appear via new game compendium sites. And more and more new games, most of them free of charge.

But the work of psychic corruption must proceed, so we must be inoculated against notions of censorship by tendentious TV biopics of well-meaning moral campaigners like Mary Whitehouse, who was of course not nearly so posh, sophisticated, well-breeched and well-connected as the moguls she took on. So smart are we that she is to be condemned as much for her eyewear as for her lower-middle-class status and dowdy profession (schoolteaching - art and sex education).

I think we must wait for the University rebels of the late Sixties to retire or die before we can start the salvage operation.

In the paper shop

"Drinks are on you, then," I say.

"I've spent £35,000 since the Lottery started, and had five back," he says.

He'd come to the shop at six, having forgotten that it opens at half-past. He thinks he's in the early stages of Alzheimer's.

__________________________________

Here's some lines of comment that could come out of this, but you can easily expand them yourself, I'm sure:

- Mathematics - the Lottery gives back 45% in prizes, but averaging-out could take forever

- What is a Government doing, making gambling so easy and readily available (and it started under the Tories)?

- How much would this man have had, if he'd saved £208 per month since 1994?

- Now that insurance salesmen have disappeared, what has happened to savings among the C2/D classes? Has financial consumer protection (after the pensions mis-selling compensation and regulation bonanza) indirectly impoverished them and made them more dependent on the State?

I expect you can come up with more, and better.

And then there's drink, from allowing supermarkets to sell it along with your groceries, to 24-hour booze licensing.

Are misguided arguments for liberty being used to enslave people to their weaknesses? Should heavily-capitalised businesses be allowed to batten on those flaws?

Saturday, June 14, 2008

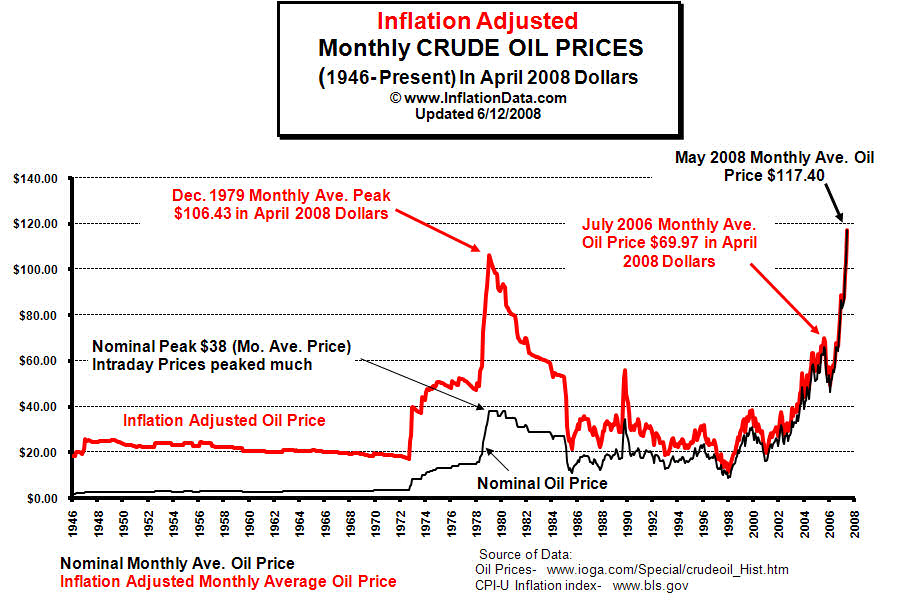

Oil: back to the Seventies

Found on InflationData.com

Fasten your seatbelts

David Hackett Fischer has studied the behaviour and historical meaning of inflation not just over the last decade, or the last century, but over the last 800 years. He sees the world positioned in a dangerous moment of possibility, on the rearing crest of the fourth great wave of inflation in eight centuries.

I would still be grateful for any information about what I shall call "sim economics" - potentially so much more useful than other simulation games.

Anybody able to help, please?

Friday, June 13, 2008

Help required: economic modelling

It seem that in the USA and UK, we are holding down interest rates to avoid crippling homeowners, the home-loan-based economy, and what's left of our industries, and also in the hope that we can repay our debts to foreigners with devalued cash. On the other side, countries like China and Japan seem to be trying to prevent their currencies from appreciating, so as to preserve their trading advantage.

So one party is letting their currencies sink, and the other is trying to stop theirs rising. To this amateur, the world's foreign exchange system looks like a bunch of corks tied to an unchained anchor and flung into the sea. Will the string on the corks hold, or break under the strain, or be abruptly cut?

Is there any computer- or board-game-based model of the world economic system, that might make it clear to me how this wretched thing works?

And how is the ordinary person to save money and preserve its value in real terms, without having to be super-sophisticated? I know something about American TIPS and British NS&I Index-Linked Savings Certifcates, but I'm leery of handing the government what little money they haven't already extracted from me in taxes. And I don't trust them to define inflation fairly.

Does anybody know how this boneshaker of a contraption actually operates, so we can make sensible decisions?

Speaker or silencer?

Thursday, June 12, 2008

What oil hike?

At least Richard Daughty is one who will not go gentle into that good night.

Now, isn't this what happened in the Seventies? Only we were conned into thinking it was down to wicked Arabs, when really the story was increased monetary inflation for some years pre-1974.

Marc Faber, cash and Cambodia

Stocks, Real Estate and Oil Are Overvalued, Marc Faber Says

Why rising inflation will trigger a bond market rout

Cambodia Starts to Beckon Private Equity

For investors, Cambodia could be the next Vietnam

The last is interesting. I have suspected for some time that Dr Faber lives in northern Thailand, not simply to hide in Shangri-La but to be nearer to the places where real bargains may be found, and so that his hunches can be informed by personal networking and under-the-radar experience. Quirky and fast-moving, he would not be the man to manage a large institutional fund: I think his lightning ex-ski champ reflexes demand more challenge.

An after-thought: if you do think cash is best, there's still the question of which currency.

Is it OK to have principles?

UPDATE

Someone put the text of Mr Davis' speech as a comment to Michael White's piece. Here are a couple of extracts:

This Counter Terrorism Bill will in all likelihood be rejected by the House of Lords... But because the impetus behind it is political, the government will be tempted to use the Parliament Act...

It has no democratic mandate to do this...

... I am just a piece in this chess game.

Folly? Vanity? My eye (and Betty Martin).

Are free trade and small government the answer?

But what would happen to the poorest if we really did move towards laissez-faire capitalism? I don't mean the poor in India and China, who are currently benefiting from open markets; I mean the poorest in the USA and UK. Would things really sort themselves out to the good of all?

Or would we find that we'd leapt from the frying pan into the fire?

Tuesday, June 10, 2008

An appetite for investment risk?

Just curious.

Monday, June 09, 2008

Cashhhhhhh... don't tell anybody

... reports Ambrose Evans-Pritchard in the Telegraph (I must start to read the big-words papers). Anyhow, this is what Marc Faber said months ago. Short-term, I have a feeling DE is still on for the 'flation hors d'oeuvre, with IN as the entree.

By the way, are any managers of collective investment funds actually saying the type of thing Wilmot is saying, to their clients (not the big, favoured ones, the others, the Moms 'n' Pops)?

(htp: Karl Denninger)

Sunday, June 08, 2008

Please read this man

That way, I may have more time to sell my house at current ridiculous market prices, which for personal reasons I can't yet.

Does State expenditure inflate the market?

... even if it is a wonderful idea to pay Mr Ross roughly 30 times more (annualised) than the Prime Minister and 20 times more than the Governor of the Bank of England out of what is, after all, tax, it is obvious rubbish that this does not push up the market. If the BBC were not competing in this field, Mr Ross’s price to commercial channels would plummet.

Deplorably, Mr Ross is unbelievably coarse, which sends a message to his (relatively) young audience. Peter Hitchens suspects that this crassness is a cynically avaricious pretence:

Ross talks on TV in an arrogant sort of loutspeak.

I wonder if he talks like that when he’s dealing with his lawyers and his accountants.

Now that would be a fly-on-the-wall documentary to screen next to Ross' show.

So, celeb wages inflated and manners undermined by spendthrift public services.

Meanwhile, Liz Jones takes a very laudable interest in the young, especially those rotting away in the complex trap of social security benefits. And again, a market may be distorted by public money:

Her room is damp, sparsely furnished, has a stinking, threadbare carpet, and Paris mostly sits on her bed, terrified to walk to the shared bathroom in case one of the boys who slouches around outside harasses her.

Drugs are dealt openly in the corridors. Each week, ‘the council’ (I’ve never heard her use the words ‘government’, ‘Labour’ or ‘Gordon Brown’) pays the £330 rent (yes, that is £1,430 a month, more than my mortgage repayments) for her box room direct to the private landlord; on top of that, Paris is given £47 a week to live on.

That is, she was, until the council got wind she had got off her backside and found a job, just three days a week, in a clothes shop in Oxford Street (she would have loved, she told me once, to have been a fashion designer).

Although her pay is less than her rent, she has been bombarded with letters and forms, too complicated for anyone, let alone someone with dyslexia, to fill in, demanding six months’ back rent.

She is now being threatened with eviction.

The negative reinforcement is too obvious to summarise, but look at this young girl's rent as a proportion of her total "income": 87.5%!

Compare that with this, from the Guardian in December 2007:

The CML said a typical first-time buyer paid 20.6% of their income to service their mortgage in October, up from 20.4% in September, while for those moving house it rose to 17.6% from 17.5%. The figures are the highest recorded since 1991 and 1992.

There are now very many people (about 4 million) on some form of housing benefit. Is it not possible that rents, and consequently housing valuations, have been grossly distorted by such interventions? Isn't there some other way to house people without creating opportunities for modern Rachman types?

For the record - a British MP speaking in Parliament on the EU's legislative control of the UK

3 Jun 2008 : Column 644

Members of Parliament (Pay and Responsibilities)

3.35 pm

Mr. Peter Lilley (Hitchin and Harpenden) (Con): I beg to move, That leave be given to bring in a Bill to require the Senior Salaries Review Body to take account of transfers of powers between Parliament and European Union institutions when making recommendations on the pay of Members of Parliament; and for connected purposes.

In virtually every occupation, it is recognised that pay should reflect responsibilities. If people receive more responsibilities, they get higher pay. If they move to a post with fewer responsibilities, they expect to receive lower pay. The same should be true of Parliament. If, as is contemplated under the Bill that deals with the European constitutional treaty, this House hands over more of its powers to European institutions, MPs’ remuneration should reflect that diminution of their responsibilities. If, on the other hand, as my right hon. Friend the Leader of the Opposition has promised, Parliament regains some powers, such as those over social and employment policies that were conceded in the Amsterdam treaty, that should be reflected positively when MPs’ pay is assessed.

This issue is important because Parliament is considering transferring a significant slice of its powers on energy, foreign policy, immigration and several other areas to European institutions under the Lisbon treaty. A substantial transfer of powers has already occurred under previous treaties, and this House has ceded powers on a lesser scale to devolved Parliaments and to the judiciary under the Human Rights Act 1998. The German Government estimate that more than 80 per cent. of German laws are now decided at a European level. Our own Trade Minister has admitted that

“around half of all UK legislation with an impact on business, charities and the voluntary sector stems from legislation agreed by Ministers in Brussels.”—[ Official Report, House of Lords, 29 June 2006; Vol. 683, c. WA184.]

I have heard hon. Members claim that only 10 per cent. of our laws are made in Brussels—a figure that they attribute to a Library paper, but that paper says no such thing. It remarks that the number of statutory instruments laid under the European Communities Act 1972 amounts to about 10 per cent. of all the statutory instruments passed by the House, but points out that EU statutory instruments typically enact a whole directive, which is often the equivalent of an Act of primary legislation, whereas domestic statutory instruments implement regulations. To compare the two is like comparing apples and pears, or rather pumpkins and pears given the disparity in their size. It also ignores the most plentiful fruit that comes from the European orchard—regulations, most of which are never considered by this House and which hon. Members find difficult even to obtain.

The total scale of EU legislation is enormous. Last year, the EU passed 177 directives, which are more or less equivalent to our Acts of Parliament, and 2,033 regulations, which become directly enforceable in this place, not to mention 1,045 decisions. Even that huge tally ignores the extent to which our powers are diminished by our inability to do things that we would like to do because they would conflict with European law. When I was a Minister, officials would frequently say, “No, Minister, you can’t do that”, because something was within the exclusive competence of the European Union.

If the Lisbon treaty goes through, a further salami slice of powers will be transferred to the European institutions. The hon. Member for Birmingham, Edgbaston (Ms Stuart), who served with distinction on the European constitutional convention and who knows more about the implications of the Lisbon treaty than almost anyone else in the House, except for my right hon. Friend the Member for Wells (Mr. Heathcoat-Amory), recently told the Fabian Society:

“If the Treaty of Lisbon is ratified and devolution...continues apace, in fifteen to twenty years this House of Commons will have only two functions...to raise taxes and...to authorise war”.

She went on to say that we are making “fewer and fewer decisions that matter” to people’s daily lives, and that she could not tell her constituents that the buck stops here.

Admittedly, declaring wars kept Parliament pretty busy under the previous Prime Minister, as does raising taxes under the current incumbent of No. 10. However, our constituents want us to wage fewer wars, raise fewer taxes and focus on the huge range of issues that affect their daily lives, over which they assume and hope that we retain the powers that they pay us to exercise on their behalf.

Few voters, or even Members of this House, fully realise how many powers have been, or are about to be, transferred elsewhere. There are three reasons for this. The first is that Governments of all persuasions deny that any significant powers are being transferred. The second is that, once powers have been transferred, Ministers engage in a charade of pretence that they still retain those powers. Even when introducing measures that they are obliged to bring in as a result of an EU directive, they behave as though the initiative were their own.

Indeed, Ministers often end up nobly accepting responsibility for laws that they actually opposed when they were being negotiated in Brussels. They took the rap for costly and troublesome home improvement packs—which have added to the woes of the housing market—even though they were actually mandated by a Brussels directive. Similarly, they took the rap for fortnightly bin collections, hospital reconfiguration and a number of other measures, even though they had all been triggered by directives from Brussels. At first sight, it is odd that Ministers—who, in this Government, are not normally slow to blame others—should nobly defend and accept responsibility for Brussels’ legislative progeny, in whose conception they have often played little part. They prefer to claim paternity rather than admit impotence—the fate of the cuckold across the ages.

The third reason is that the transfer of power occurs not all in one go but by a process of salami-slicing, and it is easy to close our eyes to what is happening. As a result, there is a danger of Parliament sleepwalking into becoming little more than a provincial assembly. If that is what is happening, we should be paid accordingly—just as district councillors get less than county councillors, and county councillors get less than Members of the devolved Assemblies.

I do not have a masochistic desire to see MPs’ pay cut, but I want still less to see our powers diminish. The best way to prevent the latter might be to link pay to responsibilities. I do not know any Member of Parliament who entered Parliament to become financially better off. None the less, just as the prospect of being hanged in the morning concentrates the mind wonderfully, so the prospect of finding our pockets a bit emptier at the end of the month—and having to justify that to our spouses—might wake up those who have shut their eyes to what is happening. If we do not face up to what is happening, we will find ourselves being progressively relegated to what Bagehot called the dignified part of the constitution. As Tony Benn once rhetorically asked:

“I wonder how long it took for the yeomen of the guard to realise that they were no longer part of the regular army.”

My Bill is designed to provide a wake-up call whenever we risk going further down that route, although I accept that it has little chance of becoming law in this Parliament. Those who support the transfer of power from here to supranational institutions should logically accept that our pay should reflect the diminution of our responsibilities. But, strangely, all the Euro-enthusiasts whom I asked to sponsor the Bill declined to do so without explaining why. Too many Members are happy to avert their eyes from what is happening, so long as they retain the prestige and emoluments that were appropriate to a fully sovereign Parliament. Turkeys do not vote for Christmas.

If any Labour Members oppose the Bill, I hope that they will come out and object to it here and now, rather than trying to dispose of it by subterfuge one Friday morning. I look forward to hearing them argue for having their cake and eating it. I doubt that they would convince many of their constituents that, unlike any in other occupation, MPs’ pay should be divorced from their responsibilities.

Hugh Bayley (City of York) (Lab): We have just heard a witty and amusing speech. I was not aware that this issue was going to be raised today, but I was sitting in the Chamber listening to Transport questions and suddenly the right hon. Member for Hitchin and Harpenden (Mr. Lilley) rose to his feet and made this proposal. He said that he had asked a number of Euro-enthusiasts to back his Bill; I regard myself as a Euro-enthusiast, but he did not ask me. Had he done so, he would have given me advance notice that he was going to make this nonsensical proposal, and I would have been able to prepare a better speech. However, I shall certainly try to rise to the challenge that he has thrown across the Chamber.

The right hon. Gentleman argues that the volume of legislation to be considered by the House will decline as more and more powers are passed across to the European Parliament, but he knows as well as any other Member that the volume of legislation considered by this House continues to increase year by year. We have never suggested that that is an argument for increasing Members’ pay pro rata—

Stephen Pound (Ealing, North) (Lab): That is a good idea.

Hugh Bayley: I note what my hon. Friend says. Nor should the passing of some legislative powers from this House to Europe be an argument for moving in the opposite direction.

I must say seriously to Members of the House that I do not think that the European Union provides a good model for the remuneration of Members of Parliament. I have just checked with my hon. Friend the Member for Birmingham, Edgbaston (Ms Stuart), who is a sponsor of the Bill and well versed in EU matters, and she tells me that EU spend is about 0.5 per cent. of EU wealth. The spend of our national Government is probably about 40 per cent. of our national wealth, which is 50 or 60 times as much as the EU spend.

If the right hon. Gentleman is arguing that there is a serious transfer of financial responsibility from the House to Europe, that is just not based on fact. The Lisbon treaty not only does not change that fact, but it delegates some powers back to national Parliaments. The public want to see more information about MPs’ pay and allowances, but they would get less information if our pay was tied into and buried under bureaucracy from Europe. Surprisingly to my way of thinking, the Bill is proposed by a staunch opponent of Europe whom I would have thought could see that point himself.

The right hon. Gentleman is making a political point about Europe, not a serious proposal for greater transparency in the pay of Members of Parliament and greater accountability to the public for Members of this Parliament. I hope that the Bill does not receive its First Reading.

Question put, pursuant to Standing Order No. 23 (Motions for leave to bring Bills and nomination of Select Committees at commencement of public business), and agreed to.

Bill ordered to be brought in by Mr. Peter Lilley, Mr. Michael Ancram, Mr. Peter Bone, Mr. Graham Brady, Mr. Frank Field, Mr. James Gray, Mr. David Heathcoat-Amory, Mr. Edward Leigh, Mr. John Redwood, Ms Gisela Stuart and Mr. Charles Walker.

Members of Parliament (pay and Responsibilities)

Mr. Peter Lilley accordingly presented a Bill to require the Senior Salaries Review Body to take account of transfers of powers between Parliament and European Union institutions when making recommendations on the pay of Members of Parliament; and for connected purposes: And the same was read the First time; and ordered to be read a Second time on Friday 17 October, and to be printed [Bill 113].

Saturday, June 07, 2008

Stock up your larder

I believe the Mormons have a rule that members of their church must have 12 months' security set up for their families - I remember an old colour supplement article with a picture of a Mormon sitting on a year's supply of baked beans. Doesn't seem so daft now - and it's worth remembering why landlocked Utah is the Seagull State.

More generally, there is now a feeling that the government has failed to prepare for material and financial shocks. Genesis 41 has been obscurely referenced by George Osborne ("Our competitors used the fat years to prepare for the lean years"), though back in 2002 Treasury Committee member Dr Nick Palmer was using the same analogy, but in Gordon Brown's favour ("in the first years [Gordon Brown] repaid a lot of government debt so as to give us a really strong basis for difficult times as and when they arose").

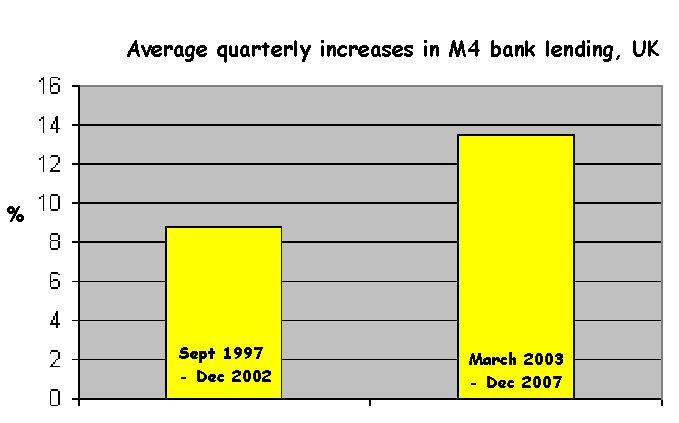

On the financial front, I think the government cracked in 2003, when extra liquidity (simplified graph here) began to be released into the system, over-hydrating the housing market. Radix malorum est cupiditas, and that applies here if you interpret "cupiditas" in the general sense of over-attachment to worldly things, especially to power and its accompaniments.

Buffett eyes Europe

- Buffett's got $35 billion in cash to go a-shopping, and thinks Europe is more promising than the emerging markets - partly because Europe is already in recession.

- Have European companies endured because many have remained family-owned? Is the Anglo-Saxon model of capitalism too erratic and destructive?

- How important are hunches in investing? Lynn says, "Buffett doesn’t believe in extended due diligence or complex financial models. He chooses his investments based on what he feels about the people in charge, and whether he likes their products." And recently, George Soros said that for all his research, he pays attention to his own psychosomatic backaches.

- How much vital business information is conveyed - or betrayed - by tone of voice and body language? Mark McCormack said that he liked to go to meetings on his own, so that he wouldn't have to worry about unconscious non-verbal signals given away by an underling's reactions. For the same reason, he loved the opposition to come with company. Is the most important bit of investment reserach the site visit?

Thursday, June 05, 2008

How many trillions?

There comes a point when it gets so dire it starts to become funny. Ah well, time to clean house.

Tuesday, June 03, 2008

A splendid rant

Democracy - a cut flower

I put the above comment about the British system on the ever-elegant Angels in Marble. Is it too cynical?

What does democracy mean here? What should it be like?

Is democracy the best system, or should we turn to authoritarianism, which seems to be working for the Russians and Chinese, as an increasing number of opinion-formers seem to be suggesting?

Is that happening anyway? Are the people watching the bottom rung of the ladder of power rise out of reach?

Monday, June 02, 2008

Why interest rates should increase - and (IMO) probably won't

Willem Buiter gives a beautifully clear and concise view of the factors affecting inflation and argues for an increase in lending rates.

But the hard, narrow path upward is often avoided, especially in "democracies" where the governing party feels its hold on power slipping.

Besides, a depreciating pound is helping maintain orders for what remains of our manufacturing industry. Why halt the pound's fall?

Maybe we should start doing our FTSE charts in Euros, so we can see the real effect of rotting currency. Like Alice and the Red Queen, when the stockmarkets stand still, they are actually falling back, once you price them against the rest of the world's money.

I note that Mish used the Red Queen's Race analogy two years ago, and presciently outlined the monetary and economic dilemma for the USA - and, I suspect, the UK:

Bernanke is trapped in "Wonderland" but unlike Alice has no way out.Bernanke gets to choose between hyperinflation and deflation. The moment he can not run fast enough, the US economy will implode. If he runs too fast, the value of the US dollar as well as the FED's power will both come to a very abrupt stop.

Sunday, June 01, 2008

A long way to go yet

These and other observations recently from Morgan Stanley's Teun Draaisma are reported here in FT Alphaville.

The return of the gods

Yes, rule us as you wish, as long as our kettles and TVs work, as long as there is petrol for our cars and the trains run on time. What we want is broth for our bellies, now, like Esau.

We may have to re-learn our lessons the hard way, as Kipling warned... and Cavafy:

Without consideration, without pity, without shame

they have built big and high walls around me.

And now I sit here despairing.

I think of nothing else: this fate gnaws at my mind;

for I had many things to do outside.

Ah, why didn’t I observe them when they were building the walls?

But I never heard the noise or the sound of the builders.

Imperceptibly they shut me out of the world.

Oil speculation?

But Karl Denninger reckons it's just money looking for a home, like the boll weevil, and ultimately deflation caused by credit writedowns should reverse the trend.

Saturday, May 24, 2008

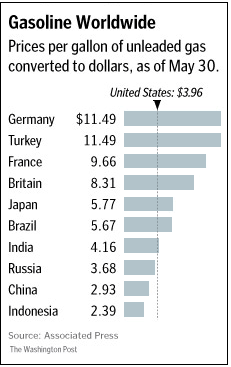

The Oil Controversy

I should like to see what energy commentators like Nick Drew wish to say to this. From what I've read, remaining oil stocks are likely to be of lesser quality and will cost far more to extract than God's gift to the Saudis (which, I understand, is already being exploited at a rate that is damaging the field).

Granted, oil is massively over-taxed. Americans would head for their gun rooms if they had to pay £5 a gallon.

Meanwhile, the FTSE continues to float cheerily above 6,000 and the Dow above 12,000 - for how much longer?

Sunday, May 18, 2008

It's going to be bad...

We in the UK will not be immune from the general economic malaise to follow, even if unregulated immigration and a slower past housebuilding program help keep our housing assets from falling quite so far.

Saturday, May 17, 2008

Any room for dissent?

And with a disgraceful click, the supposedly diverse panel closed ranks behind China, despite some attempt by the chairman to generate at least a little debate. We heard that we have been indulging in "China-bashing" lately, and now that this earthquake has happened, we should stop all this nonsense about China's human rights and/or ecological violations.

I began to wonder whether there might be some business and party-political interests to declare, for I've rarely heard such a combination of unanimity and superficial reasoning. The message seemed to be, "Stop talking about Tibet, look at this crisis instead."

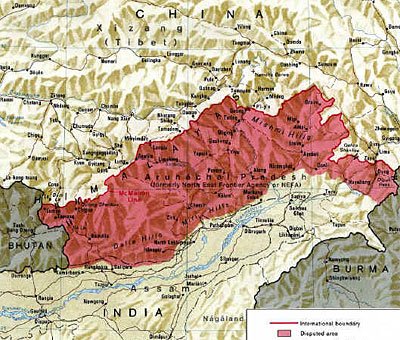

That's imposing a false perspective. China's own news media currently reckon the death toll from this terrible quake to be under 29,000; but "According to various estimates, up to 1.2 million Tibetans have died due to the Chinese occupation and various political campaigns since the Dalai Lama fled his homeland in March 1959." So in cold mathematical terms, Tibet has suffered a death toll 40 times as great - and far more avoidable. Why should a recent misfortune be the pretext for ignoring a long-standing injustice?

And as for rubbishing ecological concerns, there will come a time (and quite soon) when we have forgotten in which year this quake happened, but we will be dealing with the multifarious fallout of China's economic, demographic and ecological problems. For China is a distressed giant thrashing about in the small house of this world.China's population last year was estimated at about 1.3 billion, and in the next ten years or so is expected to increase by maybe another 100 million. Over the last 60 years, life expectancy has more than doubled and infant mortality has reduced. So despite the one-child-per-family policy (not universally applied in China), the population continues to grow.

And, as time goes by, it is becoming a demographically unbalanced population. Thanks to the preference for sons, there is a disparity between male and female. Should China decide to become warlike in the conventional manner, she will have an almost limitless supply of expendable single men. (Meanwhile, Russia's population threatens to decline to such a degree that reversing the trend was "a key subject of Vladimir Putin's 2006 state of the nation address".)

Less frightening for us, but surely very worrying for the Chinese, must be the growing imbalance of numbers between young and old. Imagine a young Chinese couple who have their one child, but face supporting four elderly parents. And when that child grows up, perhaps up to 6 parents-cum-grandparents (up to 12, after marriage). And the healthcare costs!

And with a smaller proportion of girls surviving to breeding age, the demographic waist will be pinched further. Perhaps the one-child policy will eventually be abandoned.

Meanwhile, China's burgeoning populace must be fed, but how? Changes in diet and the progressive loss of arable land, and reducing yields from such land as is still fertile, have been a serious concern for a long time (see e.g. here).

Then there's the demand for water, and energy, and how to have breathable air while exploiting China's giant coal reserves and rapidly expanding heavy industry.

It's far too simple to make China into a villainess, but she faces enormous difficulties on the road away from her past abject poverty and suffering. These translate into mighty pressures that the rest of the world will feel. We must find a way to assist China in the solution of her problems - but self-censoring discussion of her external relations will not help us find realistic answers.

Check your bank deposit security

Wednesday, May 14, 2008

Sunday, May 11, 2008

The sky is dark, wings are flapping

Karl Denninger notes that in both the US and Japan, there are moves to force full disclosure of the banks' poor-grade assets; Jim in San Marcos reprises some observations of what happens when mutual funds (collective investments) are told by worried investors to "switch to cash" or simply pay out.

Look out for a hole in the henhouse roof, and a cloud of feathers.

Saturday, May 10, 2008

Nationalism and internationalism

I don't think nationalism will be confined to losers in the game, or rejected by those who claim to love all mankind. Once there was Bukharin/Stalin's "Socialism in one country"; soon it'll be "China first". I can't blame the latter - they have worked so hard for what they've got, and won't understand why we think we can whinge it all back from them.

Speaking as the man in the street, my perception is that we have had a long period in which global businesses and a carpetbagging international managerial class developed and made fortunes. The liberal economists say this system is great for all of us, and should stay that way; perhaps so, if we had honest money and sound national budgets, so the correction mechanisms could steer the course of international trade more steadily.

But thanks to criminal negligence, incompetence and greed by those who could have maintained the integrity of the economic system, I think the aspirant working class and lower middle class in the developed world are paying heavily, and will pay more heavily. As they give up on their aspirations, we shall see a ballooning underclass, increasing the drag on national economic performance; but the situation may prove impossible to change for electoral reasons in a sort-of-democracy. The gap between rich and poor in our countries has widened, but will widen further: "Devil take the hindmost."

At the same time, on both sides of the Atlantic, people suspect a sell-out by the political class, which is intertwined (professionally and often maritally, or extra-maritally) with the business, media and public relations people. I have often said that I think we are seeing the reconstruction of the aristocracy in Europe. Many Americans also fear that their society is moving away from its historic and constitutional foundations.

The implications for democracy, social cohesion and international relations are worrying.

Tuesday, May 06, 2008

Bust - or false boom and mega-bust?

This also chimes with what Marc Faber said last year: the crisis should be allowed to burn through and take out some of the players. Of course, those who are in a position to "allow", are part of the club that includes the players, and there's the rub.

Monday, May 05, 2008

Still room for wonder

It's a little early but the programme should soon appear online here.

UPDATE - now online here (requires RealPlayer to view).

Quote of the day

says Mish, daringly criticising Warren Buffett, who has declared a $billion-plus loss on short bets in the market.

Sunday, May 04, 2008

The system does not care

Not all the individuals can be blamed - you can lose your job for going beyond your brief, or shortcutting protocol.

But don't expect a pantomime horse to win the Derby, and don't expect compassion and commitment from these reified functions that we used to perform for ourselves.

Maybe only embarrassment will make a difference. Please pass on the link to Callum's site.

http://calumcarr.blogspot.com/2008/05/those-who-read-yesterdays-post-nhs-mega.html

Saturday, May 03, 2008

Brummies

First, I think the affected contempt for Brummies is a displaced scorn for industrial labour perhaps impermissible to express so baldly in relation to Yorkshiremen and Lancastrians. Imagine such contempt shown for miners!

This is not universal: German engineers put Ing. in front of their names, and may have a kudos similar to that of the medical profession; but British engineers are treated with patrician condescension. Think squaddies in oil-stained Khakis. No place for officers there.

Or picture Repton-educated (though expelled) Jeremy Clarkson, cheerfully displaying his ignorance as he drives the latest wonder constructed by "four blokes bashing metal in an industrial unit". Decades of regarding going into industry as the wooden spoon in life's competition, has brought Britain to our current sorry pass.

Thickos associated with Birmingham include Matthew Boulton, James Brindley, Sir Arthur Conan Doyle, JRR Tolkien, John Baskerville, Sir Edward Burne-Jones etc.

But mostly, Birmingham was too busy making its own and the nation's prosperity - the "cheap tin trays" of Masefield's "Cargoes". Ugh, the proles. Who also made the chain, the anchors, the presses, the lathes and so on that liberated us from guarding sheep as we read our Bibles with frozen fingers.

There may be a London-centric jealousy because Birmingham is not Britain's Second City, but, technically speaking, its first in geographical area and population. It is the largest local authority by a country mile (the "Mayor of London" controls a larger budget, but that "London" is an sort of urban conglomeration imprecisely related to the City of London, the surrounding boroughs, and other local authorities in the greater metropolitan area).

As to accents, few outsiders could pass for Brummies. Attempts to imitate the accent usually sound like a Scouser being strangled; and what is often thought of as a Brummie accent (say, Timothy Spall's Barry in "Auf Wiedersehen, Pet", or Julie Walters' Mrs Overall in "Acorn Antiques") is more like West Bromwich.

The Black Country abounds in accents; when I first came to Birmingham a Black Country-born history teacher told me that it was once possible to identify by his speech not only the village of the interlocutor, but sometimes even his street.

My personal preference is Sedgley, an exceptionally musical tone. Their pronunciation of the word "flowers" makes me think there must indeed have been a Golden Age in which men sang rather than spoke.

Pay up, or default

We have recognized $300 billion of losses but it has all been derivative loss. The $2.5-$3 trillion in credit loss from housing is still to come, plus all the credit card and other debt that cannot be paid down, likely a couple hundred billion more - at best.

= c. 20% of US GDP.

Friday, May 02, 2008

The system is now out of control

Thursday, May 01, 2008

The pocket calculator reveals the truth

A spendidly indignant Karl Denninger explains how the $600 "stimulus cheque" sent to American taxpayers will be more - much, much more - than paid for, by higher borrowing costs.

Where are the forthright Cassandras on this side of the Atlantic? Are they silent because nobody here believes in our country?

The "little hand-mill"

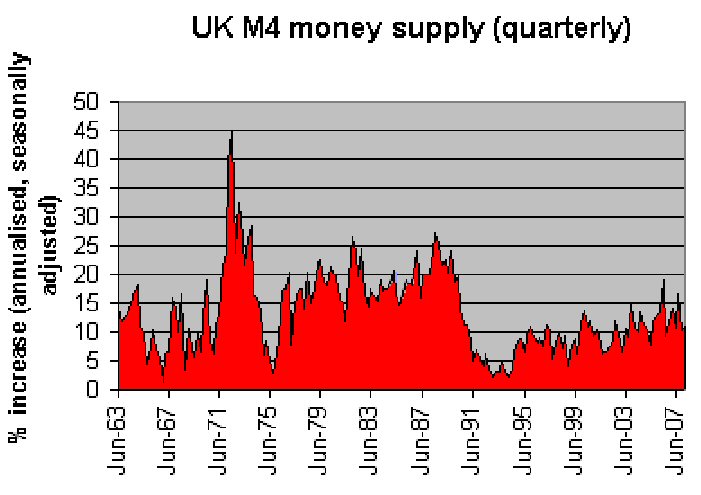

Official figures going back to 1963 show that bank lending has NEVER stopped increasing.

Official figures going back to 1963 show that bank lending has NEVER stopped increasing.Lowest: 1.1% annualised, for the quarter ending 31 December 1966.

Highest: 44.9% annualised, for the quarter ending 30 June 1972.

Median: 11.9%

Mean: 13.45%

Is it my imagination, or does the graph spike regularly before stockmarket crashes and recessions?

Original BoE data here.

In the late 60s, my school magazine carried a major bank's advert, for 16-year-old school leavers to join them. I aimed at a degree instead. Perhaps I'd have chosen differently if the ad had read "39 thieves looking to recruit trainee".

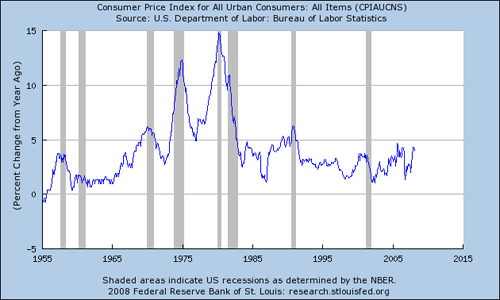

Do recessions lead to inflation?

However, this picture suggests to me that recessions follow periods of higher inflation, and maybe where that inflation continues during the recession, it could be put down to a sort of residual momentum. Why should prices fall at precisely the moment the NBER says a recession has started? Even a cut flower will maintain its bloom for a while.

However, this picture suggests to me that recessions follow periods of higher inflation, and maybe where that inflation continues during the recession, it could be put down to a sort of residual momentum. Why should prices fall at precisely the moment the NBER says a recession has started? Even a cut flower will maintain its bloom for a while.

On the other hand, it seems clear from the above graph that prices do generally seem to fall after a recession. Perhaps this is because of the recently reinforced lesson about thrift, so people become less keen to spend too much on stuff they don't need.

But it's also possible that the recession has cleansed certain inefficiencies in the use of capital - businesses that should have folded faster - and as that capital gets better employed elsewhere, it does its work of improving productivity.

Which it needs to, when people have become more cost-conscious. I recall reading about an American who found a way to sell dresses for a dollar in the Great Depression - he used a machine to stamp out the outline of 100 at a time, so only the machine sewing was needed, not the measuring and cutting. So it was still possible to buy a dress for your sweetheart when money was tight.

But the little hand-mill of monetary inflation continues to grind...

Wednesday, April 30, 2008

Tibet and China: clash of cultures

[...]

The Chinese protesters thought that, being Chinese, I should be on their side. The participants on the Tibet side were mostly Americans, who really don’t have a good understanding of how complex the situation is. Truthfully, both sides were being quite closed-minded and refusing to consider the other’s perspective. I thought I could help try to turn a shouting match into an exchange of ideas. So I stood in the middle and urged both sides to come together in peace and mutual respect. I believe that they have a lot in common and many more similarities than differences.

But the Chinese protesters — who were much more numerous, maybe 100 or more — got increasingly emotional and vocal and wouldn’t let the other side speak. They pushed the small Tibetan group of just a dozen or so up against the Duke Chapel doors, yelling “Liars, liars, liars!” This upset me. It was so aggressive, and all Chinese know the moral injunction: Junzi dongkou, bu dongshou (The wise person uses his tongue, not his fists).

Read the rest of Grace Wang's Washington Post article here.

Tuesday, April 29, 2008

GloomBoomZoom vs. GloomBoomDoom

Here it looks as though Dr Marc Faber is expecting inflation:

Dr Marc Faber has argued that even in the United States, where property prices are in decline, in an environment of high inflation he would rather own a US$1 million home than hold the same amount of cash or bonds, because the house would better preserve value.

... but here, its extreme opposite:

The view Marc is putting forward is the opposite one - that deflation will be the clear winner, dragging the whole world economy into a slump, with lower prices for commodities as well as stocks and property...

...In a real downturn, the United States (and other developed nations) would stop importing so much oil...and so much merchandise from China, which would have the consequence of reducing energy consumption by China too. Result: lower energy prices and a worldwide recession...maybe even the worst worldwide depression in history.

I think the giveaway in the first, is in the qualifying phrase "in an environment of high inflation". All I've read so far about Marc Faber indicates that his real position is represented by the second.

In my (amateur?) view, we're heading for a bust, and unless it can be avoided (which would be wonderful news), then the sooner, the better. Ideally, it would have happened in 2000 - in fact, it did, but we then got the reckless monetary reflation of 2003-2007.

Why soon? Because the longer it goes on, the more the transfer of productive capacity to the Far East, so that when recovery comes, we in the West won't be equipped to restart.

Sunday, April 27, 2008

Saturday, April 26, 2008

Cure, effect, cause

The authors say that the effect would be better if this reflation came in the form of additional direct government spending, though they acknowledge that it still wouldn't immediately halt the economic decline:

It is somewhat discouraging to see that even a relatively large stimulus plan will fail to prevent a substantial loss of output. But over the medium term, as the devaluation of the dollar and reduced spending begin to exert a moderating effect on the current account deficit, foreign trade will boost output and employment, providing the impetus for renewed growth.

Karl Denninger begs to differ (though in his case, he's still talking about transfers of money, rather than direct government expenditure):

But now we have reached the point where we need $5 in debt to create $1 worth of GDP. As debt levels rise this ratio goes parabolic and ultimately becomes impossible to sustain. That we have reached a 5:1 ratio means that the game is basically up, and the rapidly rising rate of defaults across all areas of consumer debt mean that this "engine" to fuel "growth" simply can't find any more fuel, despite the desires of the bankers and merchants to "make it so."

The Levy paper has echoes of FDR's 30s rescue, but Denninger is more concerned to compare the present mortgage bubble with the one that led to the Crash of '29:

...we've done this before... We saw, in fact, nearly the exact same pattern of practice, fraud and theft that were featured in the housing bubble during the years just before The Depression, and those "standards" in fact were a primary causative factor OF The Depression!

So maybe both parties are correct.

It's also possible that the Uk has got it wrong even worse than Uncle Sam. $600 bn is about £300 bn sterling, but adjusted for relative population size that's only equivalent to £60 bn pumped into the UK economy. We're already talking about a possible £100 bn-worth of mortgage garbage being swapped by HMG for government bonds - and our current fussing over Gordon Brown's crumbling reputation suggests that Prudence wouldn't dare try to reflate with even more direct government spending.

Besides, we are starting with a higher debt-to-GDP ratio than the USA, a State that consumes a bigger proportion of the economy, and a populace that suffers a significantly lower level of personal income on a Purchasing Power Parity basis.

Maybe that's why the pound is matching the dollar in its downward trajectory, and may even overtake it.

I've been wondering recently whether the ordinary investor of the future will be more interested to play in the foreign exchange markets, rather than stocks whose value is lied about, manipulated by rumour and sovereign wealth funds, and nibbled half to death by fees, commissions, taxes and inflation.

UPDATE - Karl Denninger is emphatic that it can't work:

Sack, no.

You can't spend $600 billion in deficits without it coming back SOMEWHERE.

Government spending is not a net positive. You can't only get to a net positive via growth in GDP.

Debt-initiated spending only returns $1 for every $5 taken on in debt.

Wednesday, April 23, 2008

Mortgage bond re-rating: reversing the rescue?

Tuesday, April 22, 2008

Second blow

Then a thought: when the recession really bites, the price war will be unrestrained. I don't know what is still manufactured in Britain, but in the second phase, when the poor become acutely cost-conscious, I can't see domestic manufacturers staying in business.

Of course, with social benefits still generous, we're not there yet (they're still buying their kids Xboxes and Lacoste trainers, while SoSecurity lay on taxis to take the tearaways to school-for-the-expelled); but wait for the tax and benefit reviews when public finances finally unravel.

And if I ever do get another new car (the Fiat Brava is kept going on a radiator refill every Saturday), maybe it's the Tata Nano for me.

I'm looking at checkmate and trying not to believe it. But that's my problem; the difference between Western waster education and Chinese school is too clear. And we'll be a sort of nationwide museum of once-were-workers. But I don't want to live in the past.

Quality down, as well as prices up

Monday, April 21, 2008

£50 billion liquidity injection - what does it mean?

In 1936, the Aga Khan was presented with his weight in gold, then 220 lb, or c. 100 kg. Gold currently sells for £14,891.58 per kilo, making the Aga Khan's weight in gold worth £1.49 million in today's prices. However, 100 kg of £50 notes is worth £3.85 million. The £50 notes would weigh as much as 13,027 Aga Khans, but would be worth 33,576"gold-priced Aga Khans".

Or, in pre-crash property terms: it is reported that Sheikh Hamad paid £100 million last year for a penthouse overlooking Hyde Park. Mervyn King has just pledged 500 "Hamads" (or over 700 "Updown Courts", if you prefer).

Or, in height terms:

1 ream of paper (500 sheets) is 5.4 cm thick. So 1 billion £50 notes would make a pile 108 kilometres, or 67.1 miles, high.

Were the Aga Khan of that time to have been the height of the average British man of today (5 ft 9 in, or 1.753 metres), £50 billion would equate to a stack of "gold-priced Aga Khans" (without shoes) almost 59 kilometres high. *

The lowest layer of the Earth's atmosphere, the troposphere, varies from 8km at the poles to 16km over the equator; the ionosphere starts at an altitude of about 80 km, and the US Air Force considers "space" to begin at 81 km.

Perhaps it would be simpler to use a new unit: the "government fudge", one box of which costs £50 billion.

By the way: hands up all those who believe the Prescott bulimia story, of which up to now there was not one breath? Now, hands up all those who have an explanation as to why this story should appear this weekend?

* I think this shows that the Aga Khan was worth twice his height in £50 notes.

Sunday, April 20, 2008

Saturday, April 19, 2008

On freedom

Like a musical string, its harmony relies on bounds. It is the tension between tyranny and anarchy, a common land affording refuge from public and private oppression. It is not lawless. Liberty is to defy another's rule; freedom, to obey one's own; free doom, the "freo la3e" of La3amon's Brut. No law, no freedom.

And now, confusedly and perhaps too late, we must begin to defend our freedom. Here in the once United Kingdom, our self-rule is fragmenting and being sold piecemeal to an unlicked bear-whelp of an aggregated foreign power; in the United States, many of the people and a handful of their representatives are calling for a rally around the principles of the Constitution, while the government becomes forgetful of its foundation. In both, there is economic mismanagement and perilous concentration of wealth. The Big Brother of a political power cutting itself free from popular franchise has his arm round the shoulder of Big CEO, whose business no longer depends on the community from which it sprang. The land will be cleared or peopled at its masters' pleasure; they will move us between their pastures for their profit. The movement will show us that the earth is not ours. We shall be rootless. We shall be dispossessed, wanderers, desperate hired men, like the landless Gregora of Scotland.

This is where we were some two centuries ago. It must all be fought for again, but perhaps, like the valiant tailor, we shall again find a way to overcome the rich and powerful who ravage our lands. Long before the battle, the American Revolution began to assemble its forces among a rabble of pamphleteers, philosophers, dissident clergy, smallholders, inventors, dreamers and adventurers. Every voice, however small, adds to the chorus.

My brother became an American citizen yesterday. Part of the ceremony was a homily, in which the presiding official said (was it a quotation from Jefferson?) that liberty was not passed down to one's children by nature, but by one's actions.

Although my brother has his own views on religion, and although I feel that America has, and has always had, much to learn in its foreign relations, it is without irony that I wish a blessing on America and the American people, and my newly American family.

UPDATE

Not Jefferson:

"Freedom is never more than one generation away from extinction. We didn't pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same, or one day we will spend our sunset years telling our children and our children's children what it was once like in the United States where men were free."

Ronald Reagan 40th president of US (1911 - 2004)

Friday, April 18, 2008

Denninger calls for a borrower's strike

Hi ho-ho, hi ho-ho

For the playful, you can join the game here.

Thursday, April 17, 2008

China sponsors African dams, for minerals

Tibetology

But is it possible that some of our own museums have an agenda or two?

Big Brother has a thin skin

htp: Schadenfreude

Wednesday, April 16, 2008

Weaknesses in US depositor protection

htp: Michael Panzner's "Financial Armageddon" blog.

Saturday, April 12, 2008

And after Tibet?

Friday, April 11, 2008

Defying gravity

So it's not just my perception. Read Karl "hold cash" Denninger's latest.

Thursday, April 10, 2008

The boom that wasn't

There is only one way that home prices where they are, even today, are sustainable - that would be for wages to rise by 30% across the board. That, of course, isn't going to happen, and if it did it wouldn't do you a bit of good because prices would simply rise to the same degree, leaving us exactly where we are now!..

There never was a "boom" in earnings power for middle America. The median family income - including all quintiles - was actually down $500 or so over the last eight years. If you exclude the top quintile it was down materially - 5% or so. And that's in nominal, not constant, dollars...

We're now going to adjust spending and investment levels to incomes because there is no way for us to adjust incomes to spending levels! The big productivity gains that came from computerization are finished, and we've already offshored nearly all of our manufacturing, so there's no more "cheap labor improvement" available either...

If we can keep the government from screwing things up with more vote-buying attempts we'll get through the other end of this, although people's standards of living will change. You won't be able to afford to milk your house for the second Lexus and six plasma TVs, but is this really such a disaster? I think not.

Read the whole thing in all its beauty here.

Next task, when I have the time, is to see what happened to the middle quintiles in the UK.

Monday, April 07, 2008

It really, really is a swindle

Where are the police?

UPDATE

I've been directed (see comments) to this video, "Money as debt", by Canadian Paul Grignon:

Here are the artist's own comments; here's the dedicated website; here's his professional artist's website; and here's a link to the Idaho Observer, with a little extra detail on the making of the film - cut off the last part of the address to see more of the Observer's output.

Whether it's right or wrong, simplistic or not, I'm heartened to see practical idealism like this.

FURTHER UPDATE

Karl Denninger explains why the money-lenders won't permit inflation to run away and destroy the basis of their wealth. And why this means the economy will hit the buffers.

If history repeats itself

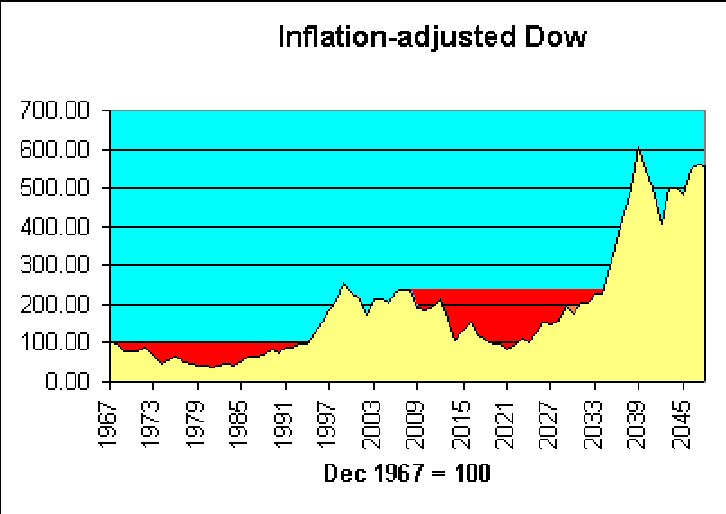

What I didn't think to do then, is to illustrate the shape of the Dow if it continues to be as volatile as in the last 40 years. So here goes - same average growth, same inflation rate etc:

It's the volatility that does you in. As Keynes said, "In the long run..."

It's the volatility that does you in. As Keynes said, "In the long run..."

Matter of fact, if history repeats itself, there's a point around 2021 where in real terms, we're behind where we were in 1967. This time, I will buy beads and wear flares. I'd still be younger than Robert Graves was last time round.

Chirpy

Here he says that America's freedom and creativity will overcome present problems, as they have in the past; here he says the housing market can't be too bad if workers are unwilling to sell their houses in a falling market; and here he claims to love America's trade deficit.

Is he right? Or just seeing affairs from the point of view of a man who's had a good dinner and is assured that, in his case, good dinners will never stop coming? I've often thought that war movies should end prematurely and at different points for a random selection among, say, 20% of the audience, to remove the Olympian perspective.

But it is nice to read someone who thinks it's not all gloom and doom.

Sunday, April 06, 2008

Banks, usury and slavery

Since 1963, the M4 money supply has grown by an average of slightly under 13.5% per year. So that would be about 11% p.a. relative to GDP.

This means that bank lending, as a proportion of GDP, doubles every 7 years.

How long can this continue? How long before we are completely robbed and enslaved? Or am I asking a fool's question?