A succinct article by Weamein Yee in Banks.com (Friday), on what to do in inflationary times:

It’s almost like everyone is holding their breath to see what happens next.

As we know, Marc Faber recently suggested we might wish to stand on the platform rather than board any of the asset trains.

Stocks will tend to fall in anticipation of higher interest rates to combat rising inflation. The price of long term bonds will fall as investors will demand higher yields in an inflationary environment.

Yee says that the investor may be forced to consider choices that would normally be regarded as rather risky or sophisticated: commodities, precious metals and shares in foreign (less inflation-prone) countries. This is the paradox: taking a risk may be the best form of playing safe.

But before that, perhaps we could increase our holdings of government-backed inflation-linked savings bonds, something Yee doesn't mention. A lot depends on how the government defines inflation for the purpose of calculating our returns, but it should be fairly reasonable, one would hope.

The writer points out a final irony: low interest rates and high inflation support real estate prices.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Sunday, November 04, 2007

That's the way to do it (not)

An interesting article by Tim Wood in SafeHaven yesterday, in which he argues that the market is too big to manipulate. According to him, interest rates and market movements are largely unrelated and operate on separate cycles.

Much to discuss

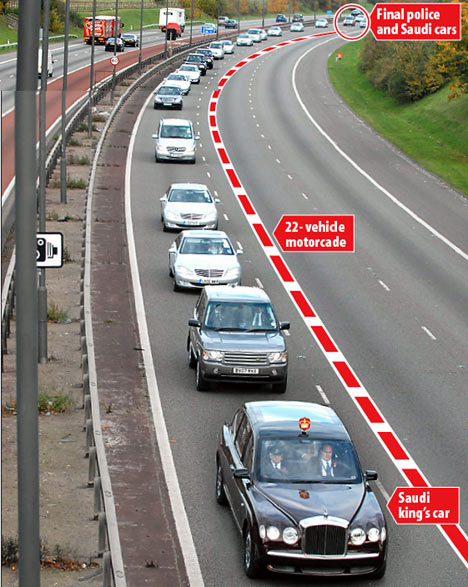

"Business was off the agenda" said the Telegraph yesterday, about the Saudis' visit to Britain. I'm not so sure: somewhere in that 22-car convoy there may be a Saudi who had quiet talks with his opposite number about economic matters, while King Abdullah distracted the cameras.

Alex Wallenwein in SafeHaven yesterday reminds us that a month ago, the Saudis refused to cut rates to match the US. He sees the dollar's resistance to collapse as having bought time for European and Eastern economies, and the Euro currency, to strengthen their position. Soon, it may be takeover time, and contrarians who expect the dollar to bounce back may find that the trampoline has been whisked away.

Saturday, November 03, 2007

Veneroso: up to half the gold has gone

GoldSeek (November 1) relays Frank Veneroso's assessment that central banks may have disposed of up to 50% of their gold bullion:

... The manipulation of gold prices was first noticed in the 1990s by Frank AJ Veneroso, one of the world’s top investment strategists. As more gold bullion came onto the market depressing the price of gold, Veneroso believed the central banks were its source.

When queried, central banks denied Veneroso’s assertions. Central bank records, in fact, showed their gold reserves to be stable. But Veneroso was right and the central banks were lying. The gold moving onto the markets was indeed coming from central banks via their co-conspirators in capping gold, the investment banks.

Investment banks were borrowing central bank gold at 1 %, selling it thereby depressing gold’s price and investing the proceeds in higher yielding government debt; and, as long as the price of gold moved lower, the profits of investment banks increased (see The Manipulation of the Gold Market, http://www.gata.org/node/11).

The International Monetary Fund was complicit in this deceit as IMF regulations allowed central banks to count gold “swapped” or “loaned” as still being on deposit in their vaults. Veneroso now believes that up to 50 % of gold reserves claimed by central banks have already been sold—a fact that will be instrumental in our collective bet against central banks in their house of cards...

... Veneroso believes central banks sold 10,000–15,000 tons, equal to 320,000,000 to 500,000,000 ounces of gold over the last 20 years. Just imagine how high the price of gold would be if the central banks had not sold this staggering amount.

Today’s $800/oz. gold is a bargain—as is $2,000/oz. or $3,000 oz. gold—a bargain that exists only because central banks literally sold thousands of tons of our gold onto the market in their attempts to prove gold a poorer alternative to debt-based paper currencies.

Over a year ago, Veneroso estimated central banks had less than three years supply left to cap gold’s price. He also predicted the central banks would capitulate before then, keeping what little gold they had left. When this happens, the central bank subsidy of gold will end and the price of gold will skyrocket.

On the same site, Adrian Ash (November 2) looks at gold's disadvantages and decides that it is best defined not as a commodity, but as a currency:

Given that gold doesn't pay you anything in yield, interest or dividends – and that it does not have any real industrial value – the "investment motive" for gold can only be explained as desire to quit other assets. Or at least, to hold an asset entirely free from what drives other asset markets up and down.

... perhaps the gold market says investors are looking for protection against falling bond, real estate and equity values – as well as a falling US Dollar and slumping US economy.

So they are buying protection ahead of time. And to do that, they're buying gold – a wholly different asset from everything else.

One for the speculators. Meanwhile, perhaps the non-rich among us should take the precaution of paying off overdrafts, credit card debts and any other loans that can be called in at short notice.

... The manipulation of gold prices was first noticed in the 1990s by Frank AJ Veneroso, one of the world’s top investment strategists. As more gold bullion came onto the market depressing the price of gold, Veneroso believed the central banks were its source.

When queried, central banks denied Veneroso’s assertions. Central bank records, in fact, showed their gold reserves to be stable. But Veneroso was right and the central banks were lying. The gold moving onto the markets was indeed coming from central banks via their co-conspirators in capping gold, the investment banks.

Investment banks were borrowing central bank gold at 1 %, selling it thereby depressing gold’s price and investing the proceeds in higher yielding government debt; and, as long as the price of gold moved lower, the profits of investment banks increased (see The Manipulation of the Gold Market, http://www.gata.org/node/11).

The International Monetary Fund was complicit in this deceit as IMF regulations allowed central banks to count gold “swapped” or “loaned” as still being on deposit in their vaults. Veneroso now believes that up to 50 % of gold reserves claimed by central banks have already been sold—a fact that will be instrumental in our collective bet against central banks in their house of cards...

... Veneroso believes central banks sold 10,000–15,000 tons, equal to 320,000,000 to 500,000,000 ounces of gold over the last 20 years. Just imagine how high the price of gold would be if the central banks had not sold this staggering amount.

Today’s $800/oz. gold is a bargain—as is $2,000/oz. or $3,000 oz. gold—a bargain that exists only because central banks literally sold thousands of tons of our gold onto the market in their attempts to prove gold a poorer alternative to debt-based paper currencies.

Over a year ago, Veneroso estimated central banks had less than three years supply left to cap gold’s price. He also predicted the central banks would capitulate before then, keeping what little gold they had left. When this happens, the central bank subsidy of gold will end and the price of gold will skyrocket.

On the same site, Adrian Ash (November 2) looks at gold's disadvantages and decides that it is best defined not as a commodity, but as a currency:

Given that gold doesn't pay you anything in yield, interest or dividends – and that it does not have any real industrial value – the "investment motive" for gold can only be explained as desire to quit other assets. Or at least, to hold an asset entirely free from what drives other asset markets up and down.

... perhaps the gold market says investors are looking for protection against falling bond, real estate and equity values – as well as a falling US Dollar and slumping US economy.

So they are buying protection ahead of time. And to do that, they're buying gold – a wholly different asset from everything else.

One for the speculators. Meanwhile, perhaps the non-rich among us should take the precaution of paying off overdrafts, credit card debts and any other loans that can be called in at short notice.

Put your fingers in your ears

Doug Noland at Prudent Bear (November 2) agrees that bigger bangs are coming:

... as an analyst I must contemplate the likelihood we have entered a uniquely unstable monetary environment. In short, the backdrop exists where incredible dollar liquidity flows could be released (from myriad sources) upon key things (notably energy, food, metals and commodities) already in severe supply and demand imbalance. Again, how much are the Chinese willing to pay for energy? The Russians for food? The Indians for commodities? How much will investors be willing to pay for precious metals as a store of value? How aggressively will the speculators "front run" all of them? Can the Fed afford to fuel this bonfire?

... The least bad course for the Federal Reserve at this point would have a primary focus on supporting the dollar and global financial stability.

Secondary explosion

Ty Andros (Financial Sense, Friday) repeats the point made by Jim Puplava (which we reported earlier this summer), that the credit agencies' re-rating of subprime packages have ignited an explosion inside the banking system, but this may only be the detonator that sets off the main charge:

Whereas the big banks and investment houses can hide behind tier three and pray for a market recovery, the investing community cannot. Pension funds, institutions and money market funds, have fiduciary investment covenants which direct them to sell securities which are below certain ratings levels. Once an investment falls into the lower rungs on the investment scales they are bound by their own investing rules to divest the assets.

Tens of billions of dollars of securities have been downgraded since the beginning of October and this will require that they be sold in a timely manner. Once those securities hit the markets we will know their true value, and it won’t be pretty. The super SIV will quickly become an exercise in wishful thinking as their “high quality” paper becomes junk in the maelstrom of liquidation which increases every time a security is downgraded. The super SIV’s whole reason for being was to prevent fire sales and price discovery.

Whereas the big banks and investment houses can hide behind tier three and pray for a market recovery, the investing community cannot. Pension funds, institutions and money market funds, have fiduciary investment covenants which direct them to sell securities which are below certain ratings levels. Once an investment falls into the lower rungs on the investment scales they are bound by their own investing rules to divest the assets.

Tens of billions of dollars of securities have been downgraded since the beginning of October and this will require that they be sold in a timely manner. Once those securities hit the markets we will know their true value, and it won’t be pretty. The super SIV will quickly become an exercise in wishful thinking as their “high quality” paper becomes junk in the maelstrom of liquidation which increases every time a security is downgraded. The super SIV’s whole reason for being was to prevent fire sales and price discovery.

Stuffed at both ends

I overheard a classroom assistant talking about her monster mortgage and how it's gone up another £300 a month - just as the Council is planning to cut the pay of thousands of workers in order to tackle its huge budget deficit. Should she sell? Just as everybody else is considering the same course of action?

We look at our situation and grumble that we're stuffed, but Dr Housing Bubble (Financial Sense, yesterday) demonstrates how we're force fed with credit and high prices at the front end, too.

The figures will differ from one person to another. Do your own math, and work out what you should do - soon.

Subscribe to:

Posts (Atom)