A $20 American Eagle gold coin from 1914

A $20 American Eagle gold coin from 1914Bill Bonner, reflecting on news from the International Herald Tribune such as this, notes yesterday that sovereign wealth funds are taking advantage of the falling dollar to buy US assets:

As the dollar goes down, Americans become poorer…and their assets become cheaper...The foreigners have huge piles of dollars which are losing value... Doesn’t it make sense for them to use the dollars to buy American assets?

The Arabs must think so... They [are] making offers on the Nasdaq…the London Stock Exchange…and the Carlyle Group, a US buyout firm.

China , meanwhile, recently took a big stake in Blackstone, another big corporate chop shop. Buying up the buyout firms is a particularly important omen, we think. It allows the foreigners to take up more and more US (and UK) assets without getting their name in the paper. And it allows Anglo-Saxons the soothing flattery of thinking that their assets are becoming more and more sought after…it takes their minds off the sour news, that foreigners are using their mountains of trashy dollars to get control over genuinely valuable assets…and that Americans will increasingly be working for foreigners…

As the dollar goes down, Americans become poorer…and their assets become cheaper...The foreigners have huge piles of dollars which are losing value... Doesn’t it make sense for them to use the dollars to buy American assets?

The Arabs must think so... They [are] making offers on the Nasdaq…the London Stock Exchange…and the Carlyle Group, a US buyout firm.

China , meanwhile, recently took a big stake in Blackstone, another big corporate chop shop. Buying up the buyout firms is a particularly important omen, we think. It allows the foreigners to take up more and more US (and UK) assets without getting their name in the paper. And it allows Anglo-Saxons the soothing flattery of thinking that their assets are becoming more and more sought after…it takes their minds off the sour news, that foreigners are using their mountains of trashy dollars to get control over genuinely valuable assets…and that Americans will increasingly be working for foreigners…

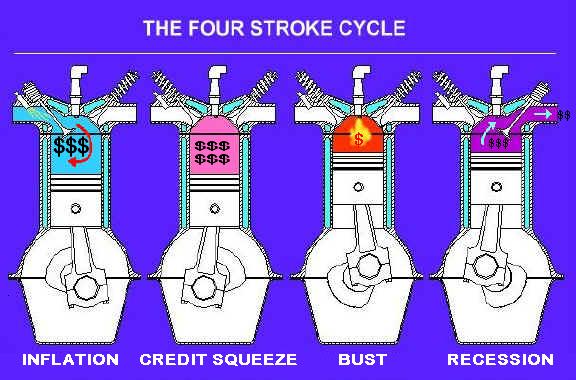

A potentially dangerous form of debt restructuring is in progress. As small businesses yield to huge corporations, increasingly foreign-owned, could Big CEO become the new Big Brother? Will the excesses of consumerism end in our descendants serving in a modern version of bonded labour?