Sunday, December 28, 2008

Saturday, December 27, 2008

Is gold a hedge against inflation?

There are problems with using gold as an insurance against inflation.

(N.B. gold prices to the end of 1967 are annual averages, then monthly averages to the end of 1974, then the price is as on the first trading day of the month; all gold price figures from Kitco).

1. Governments interfere with it - from making it the legal base of their currency, as in the US Constitution, to making it illegal to have any, as in the US in 1933; from guaranteeing the exchange rate of gold against the dollar (post WWII) to the Nixon Shock of 1971, when the gold window was closed.

2. Central banks claim to hold it, then (it is widely suspected) lend or sell it surreptitiously.

3. There is so little of it, that speculators can have a significant effect on the price, especially if (as appears to have happened in recent years), the speculation has been powered by vast amounts of borrowed money.

Below, I give three graphs, all comparing the price of gold per ounce in US dollars with inflation as measured by the Consumer Price Index (and that's another can of worms). It's clear that gold has a very volatile relationship with inflation and can spend a very long time above or below trend.

In the fourth graph I divide the Dow by the price of gold. It seems obvious that gold is a contrarian position for equity investors, rather than a simple hedge against inflation.

Currently, the Dow has come back to something like a normal ratio to gold, but past history suggests there will be an overshoot. And gold itself seems above trend over all three periods chosen; which suggests that both still have a way to fall in nominal terms, but the Dow more so.

(N.B. gold prices to the end of 1967 are annual averages, then monthly averages to the end of 1974, then the price is as on the first trading day of the month; all gold price figures from Kitco).

Friday, December 26, 2008

Nominal and real

Marc Faber's latest interviews on Bloomberg and CNBC show him estimating the recession to last "2, 5, 10 years". He also says that Asia is better placed to recover, because after the panic of 1998 they deleveraged, i.e. reduced borrowings.

So it's time for me to review my guesses about when the recovery will come for us. A key consideration is inflation, which Faber says is being stoked up for the long term by all the "stimulus" currently put in by panicky Western governments.

I've suggested that we might compare the present, not to the 1929-32 collapse, but the period 1966-1982, when inflation sometimes growled and sometimes roared. The result was that the nominal and inflation-adjusted low points are very far apart: the start-of-month level for the Dow hit bottom in September 1974, but adjusted for CPI, the real bottom was in July 1982.

So when the upturn comes, depends on your definition. I am still guessing that there will be a nominal recovery in 2010, but inflation will erode gains over time and the real turning point may not come until, say, 2016.

Wednesday, December 24, 2008

"Efficiency" vs. survival

"...we have to build back into the system Resiliency. This means that each region has to work to become largely energy, food and financially self sustaining and that each region needs to network into the others. In effect we shift from an efficient machine to a resilient network."

Robert Paterson, as quoted by London Banker.

Like I keep saying, it's about diversity, dispersion and disconnection - please click on the label below for my posts on this subject.

Robert Paterson, as quoted by London Banker.

Like I keep saying, it's about diversity, dispersion and disconnection - please click on the label below for my posts on this subject.

It's not about dinosaurs

Would you rather explain away the following, or share in it?

1. The death of William Blake, 12 August 1827:

“Just before he died His Countenance became fair. His eyes Brighten'd and he burst out Singing of the things he saw in Heaven”

2. The experience of St Thomas Aquinas, 6 December 1273:

LXXIX: The witness went on to recall that while brother Thomas was saying his Mass one morning, in the chapel of St. Nicholas at Naples, something happened which profoundly affected and altered him. After Mass he refused to write or dictate; indeed he put away his writing materials. He was in the third part of the Summa, at the questions on Penance. And brother Reginald, seeing that he was not writing, said to him: 'Father, are you going to give up this great work, undertaken for the glory of God and to enlighten the world?' But Thomas replied: 'Reginald, I cannot go on.' Then Reginald, who began to fear that much study might have affected his master's brain, urged and insisted that he should continue his writing; but Thomas only answered in the same way: 'Reginald, I cannot - because all that I have written seems to me so much straw.' Then Reginald, astonished that ... brother Thomas should go to see his sister, the countess of San Severino, whom he loved in all charity; and hastening there with great difficulty, when he arrived and the countess came out to meet him, he could scarcely speak. The countess, very much alarmed, said to Reginald: 'What has happened to brother Thomas? He seems quite dazed and hardly spoke to me!' And Reginald answered: 'He has been like this since about the feast of St. Nicholas - since when he has written nothing at all.' Then again brother Reginald began to beseech Thomas to tell him why he refused to write and why he was so stupefied; and after much of this urgent questioning and insisting, Thomas at last said to Reginald: 'Promise me, by the living God almighty and by your loyalty to our Order and by the love you bear to me, that you will never reveal, as long as I live, what I shall tell you.' Then he added: 'All that I have written seems to me like straw compared with what has now been revealed to me.'

1. The death of William Blake, 12 August 1827:

“Just before he died His Countenance became fair. His eyes Brighten'd and he burst out Singing of the things he saw in Heaven”

2. The experience of St Thomas Aquinas, 6 December 1273:

LXXIX: The witness went on to recall that while brother Thomas was saying his Mass one morning, in the chapel of St. Nicholas at Naples, something happened which profoundly affected and altered him. After Mass he refused to write or dictate; indeed he put away his writing materials. He was in the third part of the Summa, at the questions on Penance. And brother Reginald, seeing that he was not writing, said to him: 'Father, are you going to give up this great work, undertaken for the glory of God and to enlighten the world?' But Thomas replied: 'Reginald, I cannot go on.' Then Reginald, who began to fear that much study might have affected his master's brain, urged and insisted that he should continue his writing; but Thomas only answered in the same way: 'Reginald, I cannot - because all that I have written seems to me so much straw.' Then Reginald, astonished that ... brother Thomas should go to see his sister, the countess of San Severino, whom he loved in all charity; and hastening there with great difficulty, when he arrived and the countess came out to meet him, he could scarcely speak. The countess, very much alarmed, said to Reginald: 'What has happened to brother Thomas? He seems quite dazed and hardly spoke to me!' And Reginald answered: 'He has been like this since about the feast of St. Nicholas - since when he has written nothing at all.' Then again brother Reginald began to beseech Thomas to tell him why he refused to write and why he was so stupefied; and after much of this urgent questioning and insisting, Thomas at last said to Reginald: 'Promise me, by the living God almighty and by your loyalty to our Order and by the love you bear to me, that you will never reveal, as long as I live, what I shall tell you.' Then he added: 'All that I have written seems to me like straw compared with what has now been revealed to me.'

Relativism

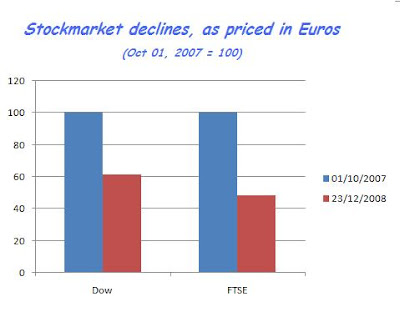

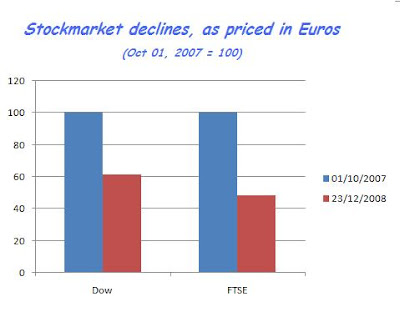

It's hard to measure what's going on, because currencies have turned out to be rulers made out of very stretchy elastic - especially for us Brits, recently.

In this article, Kurt Kasun reproduces a chart from Marc Faber's latest newsletter, showing an estimated drop of c. 50% on the world's stockmarkets - a loss of some $30 trillion.

So I've looked at the Dow and the FTSE, as priced in Euros, since the Euro appears to be more stable than either the dollar or the pound sterling (until we discover the supermassive black hole at the centre of the European financial galaxy, no doubt).

Subscribe to:

Comments (Atom)