Sunday, April 20, 2008

Saturday, April 19, 2008

On freedom

Like a musical string, its harmony relies on bounds. It is the tension between tyranny and anarchy, a common land affording refuge from public and private oppression. It is not lawless. Liberty is to defy another's rule; freedom, to obey one's own; free doom, the "freo la3e" of La3amon's Brut. No law, no freedom.

And now, confusedly and perhaps too late, we must begin to defend our freedom. Here in the once United Kingdom, our self-rule is fragmenting and being sold piecemeal to an unlicked bear-whelp of an aggregated foreign power; in the United States, many of the people and a handful of their representatives are calling for a rally around the principles of the Constitution, while the government becomes forgetful of its foundation. In both, there is economic mismanagement and perilous concentration of wealth. The Big Brother of a political power cutting itself free from popular franchise has his arm round the shoulder of Big CEO, whose business no longer depends on the community from which it sprang. The land will be cleared or peopled at its masters' pleasure; they will move us between their pastures for their profit. The movement will show us that the earth is not ours. We shall be rootless. We shall be dispossessed, wanderers, desperate hired men, like the landless Gregora of Scotland.

This is where we were some two centuries ago. It must all be fought for again, but perhaps, like the valiant tailor, we shall again find a way to overcome the rich and powerful who ravage our lands. Long before the battle, the American Revolution began to assemble its forces among a rabble of pamphleteers, philosophers, dissident clergy, smallholders, inventors, dreamers and adventurers. Every voice, however small, adds to the chorus.

My brother became an American citizen yesterday. Part of the ceremony was a homily, in which the presiding official said (was it a quotation from Jefferson?) that liberty was not passed down to one's children by nature, but by one's actions.

Although my brother has his own views on religion, and although I feel that America has, and has always had, much to learn in its foreign relations, it is without irony that I wish a blessing on America and the American people, and my newly American family.

UPDATE

Not Jefferson:

"Freedom is never more than one generation away from extinction. We didn't pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same, or one day we will spend our sunset years telling our children and our children's children what it was once like in the United States where men were free."

Ronald Reagan 40th president of US (1911 - 2004)

Friday, April 18, 2008

Denninger calls for a borrower's strike

Hi ho-ho, hi ho-ho

For the playful, you can join the game here.

Thursday, April 17, 2008

China sponsors African dams, for minerals

Tibetology

But is it possible that some of our own museums have an agenda or two?

Big Brother has a thin skin

htp: Schadenfreude

Wednesday, April 16, 2008

Weaknesses in US depositor protection

htp: Michael Panzner's "Financial Armageddon" blog.

Saturday, April 12, 2008

And after Tibet?

Friday, April 11, 2008

Defying gravity

So it's not just my perception. Read Karl "hold cash" Denninger's latest.

Thursday, April 10, 2008

The boom that wasn't

There is only one way that home prices where they are, even today, are sustainable - that would be for wages to rise by 30% across the board. That, of course, isn't going to happen, and if it did it wouldn't do you a bit of good because prices would simply rise to the same degree, leaving us exactly where we are now!..

There never was a "boom" in earnings power for middle America. The median family income - including all quintiles - was actually down $500 or so over the last eight years. If you exclude the top quintile it was down materially - 5% or so. And that's in nominal, not constant, dollars...

We're now going to adjust spending and investment levels to incomes because there is no way for us to adjust incomes to spending levels! The big productivity gains that came from computerization are finished, and we've already offshored nearly all of our manufacturing, so there's no more "cheap labor improvement" available either...

If we can keep the government from screwing things up with more vote-buying attempts we'll get through the other end of this, although people's standards of living will change. You won't be able to afford to milk your house for the second Lexus and six plasma TVs, but is this really such a disaster? I think not.

Read the whole thing in all its beauty here.

Next task, when I have the time, is to see what happened to the middle quintiles in the UK.

Monday, April 07, 2008

It really, really is a swindle

Where are the police?

UPDATE

I've been directed (see comments) to this video, "Money as debt", by Canadian Paul Grignon:

Here are the artist's own comments; here's the dedicated website; here's his professional artist's website; and here's a link to the Idaho Observer, with a little extra detail on the making of the film - cut off the last part of the address to see more of the Observer's output.

Whether it's right or wrong, simplistic or not, I'm heartened to see practical idealism like this.

FURTHER UPDATE

Karl Denninger explains why the money-lenders won't permit inflation to run away and destroy the basis of their wealth. And why this means the economy will hit the buffers.

If history repeats itself

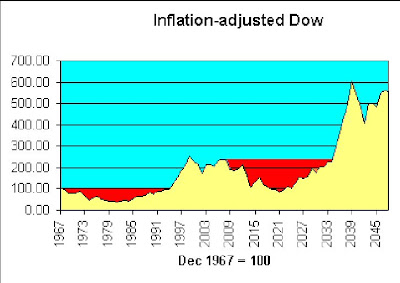

What I didn't think to do then, is to illustrate the shape of the Dow if it continues to be as volatile as in the last 40 years. So here goes - same average growth, same inflation rate etc:

It's the volatility that does you in. As Keynes said, "In the long run..."

It's the volatility that does you in. As Keynes said, "In the long run..."

Matter of fact, if history repeats itself, there's a point around 2021 where in real terms, we're behind where we were in 1967. This time, I will buy beads and wear flares. I'd still be younger than Robert Graves was last time round.

Chirpy

Here he says that America's freedom and creativity will overcome present problems, as they have in the past; here he says the housing market can't be too bad if workers are unwilling to sell their houses in a falling market; and here he claims to love America's trade deficit.

Is he right? Or just seeing affairs from the point of view of a man who's had a good dinner and is assured that, in his case, good dinners will never stop coming? I've often thought that war movies should end prematurely and at different points for a random selection among, say, 20% of the audience, to remove the Olympian perspective.

But it is nice to read someone who thinks it's not all gloom and doom.

Sunday, April 06, 2008

Banks, usury and slavery

Since 1963, the M4 money supply has grown by an average of slightly under 13.5% per year. So that would be about 11% p.a. relative to GDP.

This means that bank lending, as a proportion of GDP, doubles every 7 years.

How long can this continue? How long before we are completely robbed and enslaved? Or am I asking a fool's question?

Saturday, April 05, 2008

Awaiting the caning

Karl Denninger reports here that the Dow's price-earnings ratio may be overestimated by a factor of 4. And here, that financial institutions will have to bring Structured Investment Vehicles back onto their books within 12 months.

Karl Denninger reports here that the Dow's price-earnings ratio may be overestimated by a factor of 4. And here, that financial institutions will have to bring Structured Investment Vehicles back onto their books within 12 months.The reckoning - the painful correction - approaches.

Doug Noland (April 4) agrees:

It is my view that our economy will require a massive reallocation of resources. We will have to create much less non-productive (especially mortgage and asset-based) Credit and huge additional quantities of tradable goods. In the “services” sector, there will no choice but to “liquidate” labor and redirect its efforts. Throughout finance, there will be no alternative than to “liquidate” bad debt, labor and insolvent institutions – again in the name of a necessary redirecting of resources. After an unnecessarily protracted boom, there will be scores of enterprises that will prove uneconomic in the new financial and economic backdrop. “Liquidation” will be unavoidable.

Will our wise leaders in the UK learn from this?

P.S. How come (Denninger, here) the Dow p/e appears out of whack by 53:13, but the S&P 500 only 20:14? The latter implies only a possible 30% drop, which is a bit less apocalyptic than the 75+% of the Dow!

Generally the Dow and the S&P have followed similar trajectories over various periods, with a little widening in the last 12 months:

Friday, April 04, 2008

Thursday, April 03, 2008

Fishy business in the gold market

Does asset inflation help support stock prices?

You are right, but I believe that this time around it will be equities, rather than commodities or real estate that will provide the hedge against coming inflation. Tobin's Q will prevail due to the juxtaposition of equity prices vs. the other two asset classes (which already had their surges) and the market's increasing valuation sophistication compared to the last time we saw hyperinflation in developed economies (i.e. the 1970s). So I've been buying stocks as an inflation hedge, despite the statistical evidence that this is foolish...

Wikipedia offers an explanation of Tobin's Q here. Essentially, Q is a measure of the relationship between the value of all a company's shares, and the value of the company's assets. If Q is greater than 1, there is some reason (real or imaginary) why the company has extra value to offer; if less than 1, a share investor could buy a company's underlying assets at a discount.

In 2006, Michael Alexander wrote a series of articles for Safe Haven, about stock cycles. Below, from the second in the series, is his graph for Q in several bear markets, including the one which he suggests began in 2000:

According to this, Q was already below 1 in 2006, and since the market is now back to about where it was a couple of years ago, that would suggest that shares are now fairly valued in relation to company assets.

But if history repeats itself, the current bear market has a long way to go, since the other three lasted 15 - 20 years. And in each of the previous cycles, Q slumped below 0.4.

Another complicating factor, thanks to the lending boom, is the real estate bubble. Steve Moyer is firmly of the opinion that real estate is very heavily overvalued, even now. So a collapse in that market would push Tobin's Q back up for many companies, a technical indication that share prices would have to drop steeply to get back to fair value (let alone overshoot to below Q=0.5).

In this context, it's worth noting that one of Mike Alexander's books, published in 2000, is titled "Stock Cycles: Why stocks won't beat money markets over the next twenty years".