Just out of interest, I thought I'd do the same trend-spotting exercise for the Dow Jones as I did yesterday for the FTSE, i.e. extrapolating the highs and lows in the late 80s and early 90s.

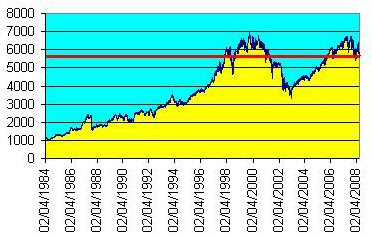

Just out of interest, I thought I'd do the same trend-spotting exercise for the Dow Jones as I did yesterday for the FTSE, i.e. extrapolating the highs and lows in the late 80s and early 90s.The results are very different. October 2007 saw the Dow's highest-ever peak, and today, after falling over 2,000 points from that point, it still stands about where it was in the tech bubble of December 2000 (see yellow line).

And my hi-lo wedge (red lines) suggest that the Dow has been seriously above trend for most of the last 11 years. Of course, you can draw lines however you like, but I'm trying to do approximately the same as for the FTSE and the implication is that the Dow "ought" to be between 7,000 - 10,000, centring around the 8,500 mark. This chimes with what Robert McHugh predicted last year (9,000). (If you draw the "high" line to connect the '87 and '94 peaks, the hi-lo lines converge towards 7,000!)

I wonder what's keeping it up?