(the percentages are annualised equivalents) Source: Bank of England

(the percentages are annualised equivalents) Source: Bank of EnglandSaturday, April 12, 2008

Friday, April 11, 2008

Defying gravity

"...the equity markets are simply not acting in a rational manner given the underlying issues in the economy and credit markets"

So it's not just my perception. Read Karl "hold cash" Denninger's latest.

So it's not just my perception. Read Karl "hold cash" Denninger's latest.

Thursday, April 10, 2008

The boom that wasn't

Karl Denninger just gets better - it's one of the advantages of sticking to your theme and endlessly rehearsing your arguments, as politicians know.

There is only one way that home prices where they are, even today, are sustainable - that would be for wages to rise by 30% across the board. That, of course, isn't going to happen, and if it did it wouldn't do you a bit of good because prices would simply rise to the same degree, leaving us exactly where we are now!..

There never was a "boom" in earnings power for middle America. The median family income - including all quintiles - was actually down $500 or so over the last eight years. If you exclude the top quintile it was down materially - 5% or so. And that's in nominal, not constant, dollars...

We're now going to adjust spending and investment levels to incomes because there is no way for us to adjust incomes to spending levels! The big productivity gains that came from computerization are finished, and we've already offshored nearly all of our manufacturing, so there's no more "cheap labor improvement" available either...

If we can keep the government from screwing things up with more vote-buying attempts we'll get through the other end of this, although people's standards of living will change. You won't be able to afford to milk your house for the second Lexus and six plasma TVs, but is this really such a disaster? I think not.

Read the whole thing in all its beauty here.

Next task, when I have the time, is to see what happened to the middle quintiles in the UK.

There is only one way that home prices where they are, even today, are sustainable - that would be for wages to rise by 30% across the board. That, of course, isn't going to happen, and if it did it wouldn't do you a bit of good because prices would simply rise to the same degree, leaving us exactly where we are now!..

There never was a "boom" in earnings power for middle America. The median family income - including all quintiles - was actually down $500 or so over the last eight years. If you exclude the top quintile it was down materially - 5% or so. And that's in nominal, not constant, dollars...

We're now going to adjust spending and investment levels to incomes because there is no way for us to adjust incomes to spending levels! The big productivity gains that came from computerization are finished, and we've already offshored nearly all of our manufacturing, so there's no more "cheap labor improvement" available either...

If we can keep the government from screwing things up with more vote-buying attempts we'll get through the other end of this, although people's standards of living will change. You won't be able to afford to milk your house for the second Lexus and six plasma TVs, but is this really such a disaster? I think not.

Read the whole thing in all its beauty here.

Next task, when I have the time, is to see what happened to the middle quintiles in the UK.

Monday, April 07, 2008

It really, really is a swindle

I am grateful to James Higham for directing me to this article by a very distinguished economist, explaining the scam of fractional reserve banking. Even when you understand how it works, you find it difficult to believe; it's a bit like finding out how babies are made, looking at your parents, and... naaaaah!

Where are the police?

UPDATE

I've been directed (see comments) to this video, "Money as debt", by Canadian Paul Grignon:

Here are the artist's own comments; here's the dedicated website; here's his professional artist's website; and here's a link to the Idaho Observer, with a little extra detail on the making of the film - cut off the last part of the address to see more of the Observer's output.

Whether it's right or wrong, simplistic or not, I'm heartened to see practical idealism like this.

FURTHER UPDATE

Karl Denninger explains why the money-lenders won't permit inflation to run away and destroy the basis of their wealth. And why this means the economy will hit the buffers.

Where are the police?

UPDATE

I've been directed (see comments) to this video, "Money as debt", by Canadian Paul Grignon:

Here are the artist's own comments; here's the dedicated website; here's his professional artist's website; and here's a link to the Idaho Observer, with a little extra detail on the making of the film - cut off the last part of the address to see more of the Observer's output.

Whether it's right or wrong, simplistic or not, I'm heartened to see practical idealism like this.

FURTHER UPDATE

Karl Denninger explains why the money-lenders won't permit inflation to run away and destroy the basis of their wealth. And why this means the economy will hit the buffers.

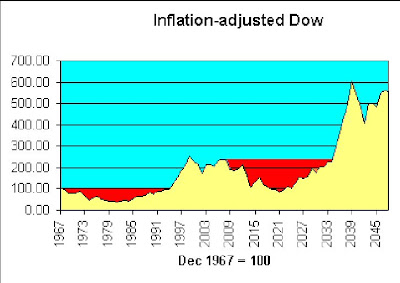

If history repeats itself

A few days ago, I looked at the Dow over the past 40 years and concluded that, on average, the real growth rate was very close to the very long-term historical norm.

What I didn't think to do then, is to illustrate the shape of the Dow if it continues to be as volatile as in the last 40 years. So here goes - same average growth, same inflation rate etc:

What I didn't think to do then, is to illustrate the shape of the Dow if it continues to be as volatile as in the last 40 years. So here goes - same average growth, same inflation rate etc:

It's the volatility that does you in. As Keynes said, "In the long run..."

It's the volatility that does you in. As Keynes said, "In the long run..."

Matter of fact, if history repeats itself, there's a point around 2021 where in real terms, we're behind where we were in 1967. This time, I will buy beads and wear flares. I'd still be younger than Robert Graves was last time round.

Chirpy

Don Boudreaux is an economist, yet although an expert in the "dismal science", he is an optimist, which makes a very nice change. He claims it's because he's a professional in the field.

Here he says that America's freedom and creativity will overcome present problems, as they have in the past; here he says the housing market can't be too bad if workers are unwilling to sell their houses in a falling market; and here he claims to love America's trade deficit.

Is he right? Or just seeing affairs from the point of view of a man who's had a good dinner and is assured that, in his case, good dinners will never stop coming? I've often thought that war movies should end prematurely and at different points for a random selection among, say, 20% of the audience, to remove the Olympian perspective.

But it is nice to read someone who thinks it's not all gloom and doom.

Here he says that America's freedom and creativity will overcome present problems, as they have in the past; here he says the housing market can't be too bad if workers are unwilling to sell their houses in a falling market; and here he claims to love America's trade deficit.

Is he right? Or just seeing affairs from the point of view of a man who's had a good dinner and is assured that, in his case, good dinners will never stop coming? I've often thought that war movies should end prematurely and at different points for a random selection among, say, 20% of the audience, to remove the Olympian perspective.

But it is nice to read someone who thinks it's not all gloom and doom.

Sunday, April 06, 2008

Banks, usury and slavery

In the UK, GDP is said to trend long-term to an increase of around 2.5% per year, hence also the Monetary Policy Committee's figure for inflation target-setting.

Since 1963, the M4 money supply has grown by an average of slightly under 13.5% per year. So that would be about 11% p.a. relative to GDP.

This means that bank lending, as a proportion of GDP, doubles every 7 years.

How long can this continue? How long before we are completely robbed and enslaved? Or am I asking a fool's question?

Since 1963, the M4 money supply has grown by an average of slightly under 13.5% per year. So that would be about 11% p.a. relative to GDP.

This means that bank lending, as a proportion of GDP, doubles every 7 years.

How long can this continue? How long before we are completely robbed and enslaved? Or am I asking a fool's question?

Subscribe to:

Comments (Atom)