Perhaps I should feel flattered that anyone from stockbroking or banking pays me any attention; or maybe it's just a naming coincidence. Nevertheless, here is my reply: you experts can be both right and wrong at the same time.

I'd like to have made a graph for the FTSE over the period I think we should be looking at, but that index only started in 1984. Besides, ours is a mixed economy, doing the hokey-cokey between privatisation and nationalisation, so it's very difficult to discern the reality underlying all the fudge.

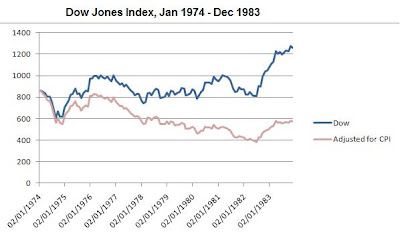

So instead, here's the history of the US stockmarket "boom" of 1974. The blue line is the nominal index, and then I reinterpret the figures in the light of the Consumer Price Index. We start at the beginning of 1974 and continue for 10 years.

*"a systemic risk that could have really serious consequences is the possibility of a major failure in the mortgage and credit markets, which could then roll on to the banking sector." - 31 July 2007

*"a systemic risk that could have really serious consequences is the possibility of a major failure in the mortgage and credit markets, which could then roll on to the banking sector." - 31 July 2007DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

3 comments:

it was meant as a slight tease, but only complimentary, and of course, there is Bob the bear too who I referred to in one of the links

Nice of you to respond, CU. I don't know, but I feel that whether via inflation or deflation, we will in time see a reduction in stockmarket valuations in real terms. What do you think?

Sackerson - your analyses remind me of the young man I met in 1980, a time of very high inflation here in the US. He was a drywall finisher, and told me that he hadn't had a raise in 6 years. I commented that he had to be broke, but he told me that he still had cost-of-living adjustments, he just hadn't had a 'raise'. Since then, of course, it has become much worse for the unskilled and semi-skilled, concealed only by easily-accessible credit.

It isn't hard. Sooner or later, you have to pay the bills. However, the top 1% have siphoned off the necessary capital. We live in interesting times indeed.

Post a Comment