Data gets turned to the commentator's angle on it. Discussion of debt too often focuses on what government owes and ignores private liabilities, hence the crisis (which most professional economists failed to anticipate) that faces us now.

In its turn, debt is only a part of the picture. Watching the Greek economy implode, it's easy to run around panicking like

Chicken Little about our own situation.

So let's look at the

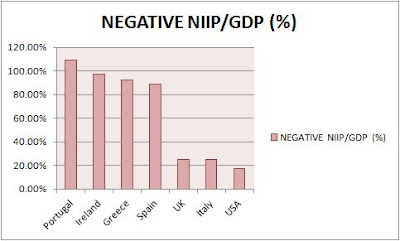

net international investment position of the PIIGS, USA and UK to see the problem through a wider-angle lens:

Yes, even in this wider definition of net obligations, we're all debtors; but the ratio of debt to GDP varies greatly, and if there is to be a domino effect, remember that one of the dominoes in the top graph is more like a skyscraper and much less easy to tip over.

Everything that makes up the above data is subject to change: what will bonds and equities be worth next year? How much could GDP change? How is the structure of the largest economies different from that of the small ones? Are we comparing whales and jellyfish?

And how much could the big help out the small? I'm reminded of the story of two men at their place of worship, praying for cash to get them out of a jam. "I need fifty thousand, Lord, or I'm going to lose this deal," begs a blue-suit, but keeps being interrupted by his ill-dressed neighbour calling "A hundred, Lord, a hundred for my family's rent and food". Finally, the businessman reaches into his pocket, pulls out $100 and gives it to the other, saying "Here, now shut up, he's listening to me."

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.