Where's safe for your money? It's like a minefield: we seem to be zig-zag running between financial explosions. Housing? Overpriced, full of bad debt. The stockmarket? Due to drop when earnings revert to the mean. The commodity market? Distorted by speculation and manipulation.

How about bonds? Clive Maund thinks US Treasuries are due for a pasting as yields rise to factor-in inflation; but Karl Denning is still firmly of the DE-flation persuasion and thinks a stockmarket fall may be our saviour:

The Bond Market no likey what's going on. The 10 is threatening to break out of a bullish (for rates) flag, which presages a potential 4.20% 10 year rate. This will instantaneously translate into higher mortgage and other "long money" rates, destroying what's left of the housing industry.

There is only one way to prevent this, and that's for the stock market to blow up so that people run like hell into bonds, pushing yields down!

He also gives his own theory as to why the Fed stopped reporting M3 money supply rates:

The moonbats claim that The Fed discontinued M3 because they're trying to hide something. In fact they discontinued M3 because it didn't tell you the truth; it was simply NOT capturing any of the "shadow" credit creation caused by all the fraud (and undercapitalized "insurance" which, in fact, is worth zero), but it sure is capturing the forcible repatriation into bank balance sheets when there is no other when it comes to access to capital for companies and governments.

So, two elephants are riding the bond seesaw: fear of inflation, and fear of losing one's capital. I hope the plank doesn't snap. Antal Fekete reckons the bond market can take all the money you can throw at it - but what goes up will come down.

Cash still doesn't seem like such a bad thing, to me.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Friday, February 15, 2008

Thursday, February 14, 2008

A secular bear market in housing?

It's now generally accepted that houses are overpriced. I think valuations will not only go down, but (notwithstanding bear market rallies) stay down for at least a generation.

Here's some reasons, some having a longer-term effect than others:

A market goes up when more people want to buy, than those that want to sell. Well, all of these first time home buyers have no spare cash for the Stock Market. The Baby Boomers, sometime in the future are going to want to sell. The question arises, "Sell to Whom?"

Returning to houses, there are still those who think valuations will continue to be supported by the tacit encouragement of economic migration to the UK.

Now, although this helps keep down wage rates at the lower end (where is the Socialist compassion in that?), the government is pledging the future for a benefit which is merely temporary, if it exists at all. Once an incoming worker has a spouse and several children, how much does he/she need to earn to pay for the social benefits consumed now and to come later? State education alone runs at around £6,000 ($12,000) per annum per child.

And then there's the cost of all the benefits for the indiginous worker on low pay, or simply unemployed and becoming steadily less employable as time passes. And his/her children, learning their world-view in a family where there is no apparent connection between money and work. The government makes get-tough noises, but in a recessionary economy, I don't think victimising such people for the benefit of newspaper headlines will be any use. I seem to recall (unless it was an Alan Coren spoof) that in the 70s, Idi Amin made unemployment illegal in Uganda; not a model to follow.

So to me, allowing open-door economic migration to benefit the GDP and hold up house prices doesn't work in theory, let alone in practice.

Besides, I maintain that in the UK, we don't have a housing shortage: we have a housing misallocation. There must be very many elderly rattling around alone in houses too large and expensive for them to maintain properly. This book says that as long ago as 1981, some 600,000 single elderly in owner-occupied UK property had five or more rooms; the ONS says that in 2004, some 7 million people were living alone in Great Britain. Then there's what must be the much larger number of people who live in twos and threes in houses intended for fours and fives. Before we build another million houses on flood-plains, let's re-visit the concept of need.

Maybe we'll see the return of Roger the lodger - if he's had a CRB check, of course.

Would I buy a second home now? No. Would I sell the one I live in? I'd certainly think about it - in fact, have been considering that for some years.

Here's some reasons, some having a longer-term effect than others:

- house prices are now a very high multiple of earnings, choking the first-time buyer market.

- presently, there is increasing economic pessimism, which will further inhibit buyers.

- the mortgage burden now lies in the amount of capital to be repaid, rather than the interest rate; that's much harder to get out of, and will prolong the coming economic depression, either through the enduring impact on disposable income, or through the destruction of money by mortgage defaults on negative-equity property - and as valuations fall, there will be more and more of the latter.

- fairly low current interest rates allow little room to drop rates further to support affordability - and at worst, rate drops could sucker even more people into taking on monster mortgage debt. But interest rate reductions are unlikely to benefit borrowers anyway. The banks have survived for centuries on the fact that while valuations are variable, debt is fixed. They got silly with sub-prime, but by George they will remain determined to get all they can of their capital back, and preserve its value. The people who create money literally out of nothing - a mere account-ledger entry - are now tightening lending criteria and will continue to press for high interest rates; for now, they will content themselves with not fully passing on central bank rate cuts, so improving the differential for themselves, as compensation for their risk.

- food and fuel costs are rising, and given declining resources (including less quality arable land annually), a growing world population and the relative enrichment of developing countries, demand will continue to soar, cutting into what's left of disposable income.

- our economy is losing manufacturing capacity and steadily turning towards the service sector, where wages are generally lower.

- the demographics of an ageing population mean that there will be proportionately fewer in employment, and taxation in its broadest sense will increase, even if benefits are marginally reduced.

- the growing financial burden on workers will further depress the birth rate, which in turn will exacerbate the demographic problem.

A market goes up when more people want to buy, than those that want to sell. Well, all of these first time home buyers have no spare cash for the Stock Market. The Baby Boomers, sometime in the future are going to want to sell. The question arises, "Sell to Whom?"

Returning to houses, there are still those who think valuations will continue to be supported by the tacit encouragement of economic migration to the UK.

Now, although this helps keep down wage rates at the lower end (where is the Socialist compassion in that?), the government is pledging the future for a benefit which is merely temporary, if it exists at all. Once an incoming worker has a spouse and several children, how much does he/she need to earn to pay for the social benefits consumed now and to come later? State education alone runs at around £6,000 ($12,000) per annum per child.

And then there's the cost of all the benefits for the indiginous worker on low pay, or simply unemployed and becoming steadily less employable as time passes. And his/her children, learning their world-view in a family where there is no apparent connection between money and work. The government makes get-tough noises, but in a recessionary economy, I don't think victimising such people for the benefit of newspaper headlines will be any use. I seem to recall (unless it was an Alan Coren spoof) that in the 70s, Idi Amin made unemployment illegal in Uganda; not a model to follow.

So to me, allowing open-door economic migration to benefit the GDP and hold up house prices doesn't work in theory, let alone in practice.

Besides, I maintain that in the UK, we don't have a housing shortage: we have a housing misallocation. There must be very many elderly rattling around alone in houses too large and expensive for them to maintain properly. This book says that as long ago as 1981, some 600,000 single elderly in owner-occupied UK property had five or more rooms; the ONS says that in 2004, some 7 million people were living alone in Great Britain. Then there's what must be the much larger number of people who live in twos and threes in houses intended for fours and fives. Before we build another million houses on flood-plains, let's re-visit the concept of need.

Maybe we'll see the return of Roger the lodger - if he's had a CRB check, of course.

Would I buy a second home now? No. Would I sell the one I live in? I'd certainly think about it - in fact, have been considering that for some years.

Sunday, February 10, 2008

Reversion to mean

Echoing recent comments by Vitaliy Katsenelson (also on Barron's), Jeremy Grantham thinks profit margins will decline towards normal and the Standard & Poor's 500 will head from its current c. 1334 to 1100 in the year 2010 - a drop of about 18%.

Grantham is emphatic that borrowed money is not a stimulant to the economy:

I have an exhibit that shows the 30 years prior to 1982 when the debt-to-gross domestic product ratio was completely flat at 1.2 times. Total debt is defined as government debt, personal debt, corporate debt and financial debt. Then in the 25 years after 1982, the flat line goes up at a 45 degrees angle from 1.2 times to 3.1 times GDP. Massive. In the first 30 years, when debt is flat, annual GDP growth is its usual battleship, growing at 3.5% and hardly twitching. After the massive increase in debt, GDP, far from accelerating, grew at 3%. So debt in the aggregate does not drive the economy. The economy is driven by education, man-hours worked, capital investment and technology.

That last sentence is really pregnant. I'm not sure about the man-hours (the closer we approach peasanthood, the harder we'll work), but I think that on both sides of the Atlantic, we've been falling down on the other three.

In Britain, our government has failed to distinguish between investing in education, and managing it - and where it has tried to do the latter, has pursued a Romantic-heritage political agenda. Capital investment? Going abroad. Technology? Ditto - and eagerly taken up (if not positively filched) by our Eastern trading partners.

I live in what used to be Car City; now, the vast Longbridge site is being redeveloped for housing and shops - in other words, open prison for the new ex-industrial underclass.

But Rome, too, kept control of its plebs with bread and circuses for a couple more centuries, before it fell.

Grantham is emphatic that borrowed money is not a stimulant to the economy:

I have an exhibit that shows the 30 years prior to 1982 when the debt-to-gross domestic product ratio was completely flat at 1.2 times. Total debt is defined as government debt, personal debt, corporate debt and financial debt. Then in the 25 years after 1982, the flat line goes up at a 45 degrees angle from 1.2 times to 3.1 times GDP. Massive. In the first 30 years, when debt is flat, annual GDP growth is its usual battleship, growing at 3.5% and hardly twitching. After the massive increase in debt, GDP, far from accelerating, grew at 3%. So debt in the aggregate does not drive the economy. The economy is driven by education, man-hours worked, capital investment and technology.

That last sentence is really pregnant. I'm not sure about the man-hours (the closer we approach peasanthood, the harder we'll work), but I think that on both sides of the Atlantic, we've been falling down on the other three.

In Britain, our government has failed to distinguish between investing in education, and managing it - and where it has tried to do the latter, has pursued a Romantic-heritage political agenda. Capital investment? Going abroad. Technology? Ditto - and eagerly taken up (if not positively filched) by our Eastern trading partners.

I live in what used to be Car City; now, the vast Longbridge site is being redeveloped for housing and shops - in other words, open prison for the new ex-industrial underclass.

But Rome, too, kept control of its plebs with bread and circuses for a couple more centuries, before it fell.

Saturday, February 09, 2008

Will monetary inflation be absorbed by the bond market?

In the previous post, I looked at the expectation that interest rates will rise. But it seems that freaky things can happen if the government tries to stimulate the economy by progressively cutting interest rates and pumping more money into the system.

Professor Antal E Fekete thinks that in a deflationary environment, governmental attempts to reflate by introducing more money will be thwarted by the ability of the bond market to soak up the excess liquidity. Higher bond yields result in lower bond valuations, so reducing interest rates inflates the price of bonds. Fekete says that halving the rate doubles the bond price, and since mathematically you can halve a number indefinitely, the bond market can absorb all the fiat money you can create. Therefore, you can have hyperinflation and economic depression at the same time.

This trap is possible because the abandonment of the gold-and-silver standard means that the dollar has no limit to its expansion. And bond speculators have their risk covered by the need of the government to return to the market for renewed borrowing. If the Professor is right, it would be a nasty trap indeed.

But maybe our conclusion should be that this explains why interest rates must rise.

A quibble on style: especially in England, money is regarded as dull. So financial commentators try hard to add flavour, and in the Professor's case, too hard - it has been difficult for me to detect the meat of the argument under its many-spiced similes. Byron's Don Juan comes to mind:

And Coleridge, too, has lately taken wing,

But like a hawk encumber'd with his hood,

Explaining Metaphysics to the nation--

I wish he would explain his Explanation.

Professor Antal E Fekete thinks that in a deflationary environment, governmental attempts to reflate by introducing more money will be thwarted by the ability of the bond market to soak up the excess liquidity. Higher bond yields result in lower bond valuations, so reducing interest rates inflates the price of bonds. Fekete says that halving the rate doubles the bond price, and since mathematically you can halve a number indefinitely, the bond market can absorb all the fiat money you can create. Therefore, you can have hyperinflation and economic depression at the same time.

This trap is possible because the abandonment of the gold-and-silver standard means that the dollar has no limit to its expansion. And bond speculators have their risk covered by the need of the government to return to the market for renewed borrowing. If the Professor is right, it would be a nasty trap indeed.

But maybe our conclusion should be that this explains why interest rates must rise.

A quibble on style: especially in England, money is regarded as dull. So financial commentators try hard to add flavour, and in the Professor's case, too hard - it has been difficult for me to detect the meat of the argument under its many-spiced similes. Byron's Don Juan comes to mind:

And Coleridge, too, has lately taken wing,

But like a hawk encumber'd with his hood,

Explaining Metaphysics to the nation--

I wish he would explain his Explanation.

Warren Buffett's misleading optimism

Jonathan Chevreau reports Warren Buffett's bullishness on the US economy, long-term; but the real gem in this piece is the extensive, but cogent and crunchy comment by Andrew Teasdale of The TAMRIS Consultancy, who analyses Buffett's real approach to equity valuations.

Teasdale points out that although interest rates hit 21% in 1982, there was less debt, higher disposable income and lower valuations: relative to disposable income, debt is a bigger burden today than it was 25 years ago. He summarises his position pithily:

It is also worthwhile remembering that not everyone holds a Buffet portfolio and not everyone has the luxury of a 220 year investment horizon. If I was a long term investor with no financial liabilities arising over the next 15 years equities would be my preferred asset class relative to cash and bonds, but I would be mindful of valuations in determining where I put my money.

Not all the bad debt has yet surfaced, and as Karl Denninger comments, even at this stage Citibank has recently been forced to borrow foreign money at 14%, and other banks at over 7%, in preference to the 3% Federal Funds rate, presumably to keep the scale of their insolvency in the dark.

Inflation is increasing, therefore money-lenders are going to want more income to compensate for risk and the erosion of the real value of their capital. For the yield to rise, the capital value of bonds has to fall.

So I read Teasdale's summary as implying that for now, it's cash rather than either bonds or equities.

Teasdale points out that although interest rates hit 21% in 1982, there was less debt, higher disposable income and lower valuations: relative to disposable income, debt is a bigger burden today than it was 25 years ago. He summarises his position pithily:

It is also worthwhile remembering that not everyone holds a Buffet portfolio and not everyone has the luxury of a 220 year investment horizon. If I was a long term investor with no financial liabilities arising over the next 15 years equities would be my preferred asset class relative to cash and bonds, but I would be mindful of valuations in determining where I put my money.

Not all the bad debt has yet surfaced, and as Karl Denninger comments, even at this stage Citibank has recently been forced to borrow foreign money at 14%, and other banks at over 7%, in preference to the 3% Federal Funds rate, presumably to keep the scale of their insolvency in the dark.

Inflation is increasing, therefore money-lenders are going to want more income to compensate for risk and the erosion of the real value of their capital. For the yield to rise, the capital value of bonds has to fall.

So I read Teasdale's summary as implying that for now, it's cash rather than either bonds or equities.

Thursday, February 07, 2008

The Golden Compass doesn't work

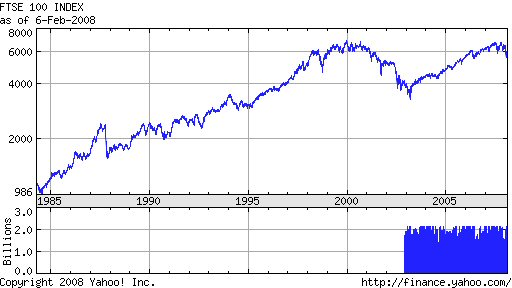

FTSE closed today down at 5,724.10, a point first reached (travelling the other way) in December 1998. The longer-term chart above suggests to me a glass ceiling. Or flogging a dead horse (I can't tell you how some ten-year-olds I know misheard that last saying recently, or how their conversation continued. That generation appears to be developing backwards from middle age.)

FTSE closed today down at 5,724.10, a point first reached (travelling the other way) in December 1998. The longer-term chart above suggests to me a glass ceiling. Or flogging a dead horse (I can't tell you how some ten-year-olds I know misheard that last saying recently, or how their conversation continued. That generation appears to be developing backwards from middle age.)Adjusted for inflation, the line would look worse, of course. I think my gut feeling was right ten years ago: essentially, we've been going down since the late nineties.

But what inflation measure to use? Gold seems to go down together with equity sell-offs, rather than seesawing against them. And unlike with the Dow, there doesn't seem to be an easily accessible index of the FTSE priced in gold terms; but GATA last week went very public with their theory that gold is being held down by surreptitious selling - and has been quietly disappearing from central bank vaults. This is something I've touched on a number of times before, and MoneyWeek gives its take on it here. Meanwhile, here's the ad:

Tuesday, February 05, 2008

The New World Order: a philosophical objection

A deep essay by Christopher Quigley here, but one I intend to re-read. Marxist philosophy always made my eyes water, practically instantly, as I have little tolerance for prolonged abstract multisyllabic holy-rolling, but I'll steel myself because we have to have some understanding of the madness that seems to have seized our modern conspiratorial ruling class. "Affairs are now soul-size".

Subscribe to:

Posts (Atom)