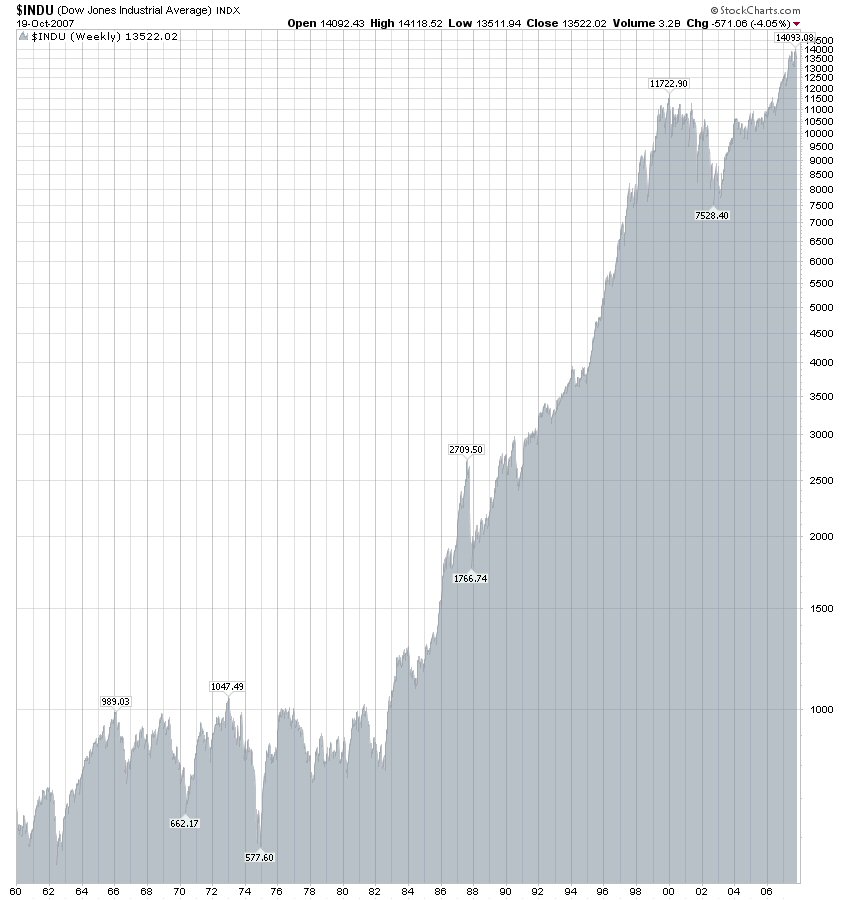

My brother sent me this. Just imagine what it would look like if the chart wasn't using a logarithmic scale. Which way from here?

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Tuesday, October 30, 2007

Monday, October 29, 2007

Vote early, vote often

... as the Irish used to say. One more day to go on the Wall of Worry poll and the optimists are winning. Can this be so? If you have votes to cast, prepare to cast them now.

Volume - shares and gold

David Yu (Safe Haven, yesterday) comments on the unusually high volume of trade on the NASDAQ recently, and so expects a fallback sometime.

Peter Degraaf (GoldSeek, Friday) thinks gold can't be shorted or held down forever. He reminds us of the extraordinary volumes of bullion traded in 1967-68, and the explosive rise in the price when the containment attempt finally failed. Degraaf believes Frank Veneroso's theory that central banks are surreptitiously dumping gold again today, playing the same game - and expects the same result.

Faber: why the dollar may bounce back

The International Herald Tribune ( October 24) reports a mechanism by which the dollar may recover some lost ground:

Faber said if bubbles in emerging markets deflated, the dollar may rebound from all-time lows against the euro as fund managers who have invested in emerging markets shift investments to the United States.

Faber said if bubbles in emerging markets deflated, the dollar may rebound from all-time lows against the euro as fund managers who have invested in emerging markets shift investments to the United States.

China: a positive view - and a challenge to India

An old (Jan 2006) interview on Financial Sense with George Gu gives some more hopeful signs: progress towards the rule of law (as we in the West slide into bureaucratic authoritarianism); opening up the economy to outsiders; a reducing role for the military.

Like James Kynge, Gu makes the point that the big profits are made by the multinationals - the cheap labour input from China is only a small factor. (Surely this shows that there is a very strong incentive for China to develop its own marketing and management class.)

Gu explains that although India's labour costs are even lower than China's, India hasn't yet developed its supply chain and infrastructure to the same degree:

... China, over the last 26 years has gotten all of them in one place. For example, in consumer electronics you can set up your shop in Guangdong, then you get more than 10,000 component makers.

So, the gauntlet is thrown at India's feet.

Like James Kynge, Gu makes the point that the big profits are made by the multinationals - the cheap labour input from China is only a small factor. (Surely this shows that there is a very strong incentive for China to develop its own marketing and management class.)

Gu explains that although India's labour costs are even lower than China's, India hasn't yet developed its supply chain and infrastructure to the same degree:

... China, over the last 26 years has gotten all of them in one place. For example, in consumer electronics you can set up your shop in Guangdong, then you get more than 10,000 component makers.

So, the gauntlet is thrown at India's feet.

Rapid fire

Duff McDonald in New York Magazine (Saturday) goes through various doomsters' scenarios. How many bullets can we dodge, especially when the system is becoming automated?

By the way, he says CNBC calls Peter Schiff "Dr Doom" - surely that would be Marc Faber?

... and the brakes have been greased

Further systemic risk. Jim in San Marcos comments on changes at the New York Stock Exchange, which has completed its conversion to electronic trading and has now removed some safety checks that were designed to reduce volatility in extreme conditions.

He says that a change in sentiment (perhaps initially caused by an error) could now lead to a much more rapid drop on the markets, since pension funds and investment companies are also using programmed trading.

Subscribe to:

Posts (Atom)