We're not really poor if we're drinking bottled water.

When I was advising clients on pensions etc, I'd go through the usual regulatory rigmarole on affordability, and on paper they would only be able to do £20 or £50 per month. I'd be putting myself at risk recommending more than they could "afford".

But in many cases, next time I saw them, they'd done one of the following: (a) bought a new car on credit; (b) allowed their partner to give up work, and/or started a family; (c) moved house and massively increased their mortgage. It's amazing what you can afford, when you're motivated.

So while taking a benevolent interest in the government's mishandling of the economy, why don't we get radical? "Action direct": get out of debt and save money for the challenges, and opportunities, to come.

My challenge: if you're in a steady job now, what percentage of your gross income could you save, if absolutely necessary? For if my hunch about deflation now, and inflation later, proves right, you could make an absolute killing in the next 10 years.

Thursday, June 19, 2008

Wednesday, June 18, 2008

Ouroboros and the Left

"Ryan" makes reference in a comment on my previous post, to the "Gramscian left". I was too busy in the 70s, trying to get a degree, to look at yawn-inducing Marxist theory, but perhaps I was wrong. For following up this reference I find Wikipedia explaining Gramsci's notion of "cultural hegemony" and how to subvert it:

Gramsci therefore argued for a strategic distinction between a "war of position" and a "war of manoeuvre". The war of position is a culture war in which anti-capitalist elements seek to gain a dominant voice in mass media, mass organizations, and educational institutions to heighten class consciousness, teach revolutionary analysis and theory, and inspire revolutionary organization. Following the success of the war of position, communist leaders would be empowered to begin the war of manoeuvre, the actual insurrection against capitalism, with mass support.

Is it too much to say that in British schools at least, there has been a "war of position"? Hymns in assembly, RE, British history, the cane, the authority of the teacher - all in the bin. And all since, oh, I would say the mid-80s*. Now, the teacher is a kind of Lyons nippy, swiftly and attentively addressing every need of every child, and with no expectation of a tip.

And as the revolution approaches its moment of crisis, the Government (members of which have assisted with the first phase) has sealed itself into its Downing Street compound, like the East German rulers before their fall. Gordon Brown, formerly the student Rector of Edinburgh University, learned early how the power system had loopholes and having exploited them, is closing them. So the surrounding area is legally a protest-free zone and our new Stasi is set on harmless teenage student demonstrators.

Despite these efforts, and like Kronos, the Revolution may eat its children. Yet Zeus survived because Kronos was given a Rock to eat instead...

* after first flutterings with the William Tyndale affair (1974), Chris Searle's "Classrooms of Resistance"(1975) and other inputs.

Gramsci therefore argued for a strategic distinction between a "war of position" and a "war of manoeuvre". The war of position is a culture war in which anti-capitalist elements seek to gain a dominant voice in mass media, mass organizations, and educational institutions to heighten class consciousness, teach revolutionary analysis and theory, and inspire revolutionary organization. Following the success of the war of position, communist leaders would be empowered to begin the war of manoeuvre, the actual insurrection against capitalism, with mass support.

Is it too much to say that in British schools at least, there has been a "war of position"? Hymns in assembly, RE, British history, the cane, the authority of the teacher - all in the bin. And all since, oh, I would say the mid-80s*. Now, the teacher is a kind of Lyons nippy, swiftly and attentively addressing every need of every child, and with no expectation of a tip.

And as the revolution approaches its moment of crisis, the Government (members of which have assisted with the first phase) has sealed itself into its Downing Street compound, like the East German rulers before their fall. Gordon Brown, formerly the student Rector of Edinburgh University, learned early how the power system had loopholes and having exploited them, is closing them. So the surrounding area is legally a protest-free zone and our new Stasi is set on harmless teenage student demonstrators.

Despite these efforts, and like Kronos, the Revolution may eat its children. Yet Zeus survived because Kronos was given a Rock to eat instead...

* after first flutterings with the William Tyndale affair (1974), Chris Searle's "Classrooms of Resistance"(1975) and other inputs.

Tuesday, June 17, 2008

Chicks up front!

In the 60s/70s, a fellow trainee teacher told me, the tactic at demos when the police arrived was to call "Chicks up front!"* and have the girls form a protective cordon for the male hairies. The assumption was that the police wouldn't beat up girls (not a safe bet in France, I think).

Now, in London, near the Mother of Parliaments, a 17-year-old girl can be arrested, charged, taken to a police station and regularly woken up at the low point of her circadian rhythm in order to tempt her to make a statement without the benefit of legal representation. All this, simply for carrying a placard. My country shames me.

Anybody reading, who has any influence with the powers that be, please communicate our shame, chagrin and anger.

*corroborated here - and either inspired by, or inspiring, the Viet Cong according to "DreadPirateRoberts" (see his April 30, 2008 5:04 pm comment here)

Now, in London, near the Mother of Parliaments, a 17-year-old girl can be arrested, charged, taken to a police station and regularly woken up at the low point of her circadian rhythm in order to tempt her to make a statement without the benefit of legal representation. All this, simply for carrying a placard. My country shames me.

Anybody reading, who has any influence with the powers that be, please communicate our shame, chagrin and anger.

*corroborated here - and either inspired by, or inspiring, the Viet Cong according to "DreadPirateRoberts" (see his April 30, 2008 5:04 pm comment here)

MSM: news suppression service

... But the draft documents reveal how close the [Northern] Rock was to a virtual wipe-out.

The Daily Mail first learned of the bank's secret plans in January but, after a late night call from Mr Darling, was begged not to publish.

(From this morning's Grumbler.)

Has the Press become an arm of Government?

The Daily Mail first learned of the bank's secret plans in January but, after a late night call from Mr Darling, was begged not to publish.

(From this morning's Grumbler.)

Has the Press become an arm of Government?

Monday, June 16, 2008

Off licence alcohol purchases - minimum age 21

At last, some small attempt to rein-in the alcoholisation of the young, even if only in Scotland.

Michael White confuses matters by yoking this good horse to a bad one (morning-after pills for the underaged). Nevertheless, I wonder if we might make progress in this direction, as with smoking, but perhaps in a different way. as it's not just the young who have drink problems.

I think availability is a key factor. Imagine having a beer (or other tipple of your choice) tap next to each cold-water tap in the home - who could resist? Yet alcohol is nearly as accessible these days - supermarkets, post offices, even petrol stations. Rather than try to enforce an age limit (another pile of arrest records to write), let's try to remove some of the temptation: let's reduce the number of off-licences.

My preferred solution would be not to renew the liquor licence for a supermarket if there is an alternative outlet within a certain distance. Supermarket shelving has a narrative all its own - and booze is near the end so we can say to ourselves or our partners, "Shall we?" "Go on, then." It's a cunningly-positioned add-on to household shopping, encouraging the potentially dangerous habit of steady home drinking.

Michael White confuses matters by yoking this good horse to a bad one (morning-after pills for the underaged). Nevertheless, I wonder if we might make progress in this direction, as with smoking, but perhaps in a different way. as it's not just the young who have drink problems.

I think availability is a key factor. Imagine having a beer (or other tipple of your choice) tap next to each cold-water tap in the home - who could resist? Yet alcohol is nearly as accessible these days - supermarkets, post offices, even petrol stations. Rather than try to enforce an age limit (another pile of arrest records to write), let's try to remove some of the temptation: let's reduce the number of off-licences.

My preferred solution would be not to renew the liquor licence for a supermarket if there is an alternative outlet within a certain distance. Supermarket shelving has a narrative all its own - and booze is near the end so we can say to ourselves or our partners, "Shall we?" "Go on, then." It's a cunningly-positioned add-on to household shopping, encouraging the potentially dangerous habit of steady home drinking.

No stagnation, but a house price crash

A carefully-reasoned post by "Alice Cook" on UK Housing Bubble concludes that house prices will drop 25% quickly (by the end of next year).

The alternative (house prices stagnate, allowing inflation to achieve the same result more slowly) has become unsustainable because of fears respecting the stability of the banks.

The alternative (house prices stagnate, allowing inflation to achieve the same result more slowly) has become unsustainable because of fears respecting the stability of the banks.

Sunday, June 15, 2008

Drink is the curse of the post-working classes

The main change in the structure of capital during this century has been the relative stagnation of industrial capital and the growth of the service sector of the economy. This trend, which has been most marked in the south of England, has had consequences for inner city working class areas: de-industrialisation, mobility of labour, and post-war rehousing policies have combined to dislocate the pattern of community based upon local work and extended families and associated cultural traditions (Cohen, 1972). Population has been decanted to the New Towns, and more generally, to the suburbs, where social life has focussed upon the nuclear family, and the home is increasingly regarded as a place of leisure, recreation and consumption. It is in this context that off-licence sales have become more important. The 1961 Licensing Act relaxed restrictions on the opening of off-licences, and the 1964 Licensing Act facilitated supermarket sales. By the late 1970s, most beer was still sold in public houses, but one third of all wine and half of spirits were consumed at home (Thurman, 1981; 4).

... from Alcohol, Youth, and the State by Nicholas Dorn (RKP, 1983)

Taking on the supermarkets now would be like eradicating the Taliban. Remember how they took on the government and won easily, e.g. in 1991? So much for the rule of law.

Licensing Act 1964 - legal summary

2003 Licensing Act - summary

... from Alcohol, Youth, and the State by Nicholas Dorn (RKP, 1983)

Taking on the supermarkets now would be like eradicating the Taliban. Remember how they took on the government and won easily, e.g. in 1991? So much for the rule of law.

Licensing Act 1964 - legal summary

2003 Licensing Act - summary

On the coarsening of British culture

"On what little things does happiness depend!" wrote Oscar Wilde in the Nightingale and the Rose. He was referring to the heartbreak endured by a student who needed to get a red rose to impress a professor's daughter. Actually it turned out that the professor's daughter was a bloody idiot and didn't deserve the red rose that was only secured through the agonising death of a lovely nightingale; he should've just written a request for fellatio on the back of a bus ticket and stuck it to her forehead - and insisted on the return of the ticket.

Thus Russell Brand, in the Guardian newspaper. His louche autobiography is entitled "My Booky Wook", though for some reason he doesn't apply the same baby-linguistic titling approach to his blog or website ("My Blogy... no! No! Career death!"). For there are things these jokers take very, very seriously: banknotes.

The Teflon coating on his deadly bullets of vulgarity is a trifling pretension to verbal and literary sophistication. And it's happening all around, and so very well rewarded.

Of course, the next generation is past TV. So what are your children playing on the Internet? Here's some of the games I've seen ten-year-olds chuckling at in the last fortnight:

Stair Fall

The Torture Game

The Last Stand 2

And as fast as you block these entertainments, new routes to them appear via new game compendium sites. And more and more new games, most of them free of charge.

But the work of psychic corruption must proceed, so we must be inoculated against notions of censorship by tendentious TV biopics of well-meaning moral campaigners like Mary Whitehouse, who was of course not nearly so posh, sophisticated, well-breeched and well-connected as the moguls she took on. So smart are we that she is to be condemned as much for her eyewear as for her lower-middle-class status and dowdy profession (schoolteaching - art and sex education).

I think we must wait for the University rebels of the late Sixties to retire or die before we can start the salvage operation.

Thus Russell Brand, in the Guardian newspaper. His louche autobiography is entitled "My Booky Wook", though for some reason he doesn't apply the same baby-linguistic titling approach to his blog or website ("My Blogy... no! No! Career death!"). For there are things these jokers take very, very seriously: banknotes.

The Teflon coating on his deadly bullets of vulgarity is a trifling pretension to verbal and literary sophistication. And it's happening all around, and so very well rewarded.

Of course, the next generation is past TV. So what are your children playing on the Internet? Here's some of the games I've seen ten-year-olds chuckling at in the last fortnight:

Stair Fall

The Torture Game

The Last Stand 2

And as fast as you block these entertainments, new routes to them appear via new game compendium sites. And more and more new games, most of them free of charge.

But the work of psychic corruption must proceed, so we must be inoculated against notions of censorship by tendentious TV biopics of well-meaning moral campaigners like Mary Whitehouse, who was of course not nearly so posh, sophisticated, well-breeched and well-connected as the moguls she took on. So smart are we that she is to be condemned as much for her eyewear as for her lower-middle-class status and dowdy profession (schoolteaching - art and sex education).

I think we must wait for the University rebels of the late Sixties to retire or die before we can start the salvage operation.

In the paper shop

6.30 a.m. today. An elderly man is poring over the pink Lottery result printout in the newsagent's. He's had four numbers come up.

"Drinks are on you, then," I say.

"I've spent £35,000 since the Lottery started, and had five back," he says.

He'd come to the shop at six, having forgotten that it opens at half-past. He thinks he's in the early stages of Alzheimer's.

__________________________________

Here's some lines of comment that could come out of this, but you can easily expand them yourself, I'm sure:

"Drinks are on you, then," I say.

"I've spent £35,000 since the Lottery started, and had five back," he says.

He'd come to the shop at six, having forgotten that it opens at half-past. He thinks he's in the early stages of Alzheimer's.

__________________________________

Here's some lines of comment that could come out of this, but you can easily expand them yourself, I'm sure:

- Mathematics - the Lottery gives back 45% in prizes, but averaging-out could take forever

- What is a Government doing, making gambling so easy and readily available (and it started under the Tories)?

- How much would this man have had, if he'd saved £208 per month since 1994?

- Now that insurance salesmen have disappeared, what has happened to savings among the C2/D classes? Has financial consumer protection (after the pensions mis-selling compensation and regulation bonanza) indirectly impoverished them and made them more dependent on the State?

I expect you can come up with more, and better.

And then there's drink, from allowing supermarkets to sell it along with your groceries, to 24-hour booze licensing.

Are misguided arguments for liberty being used to enslave people to their weaknesses? Should heavily-capitalised businesses be allowed to batten on those flaws?

Saturday, June 14, 2008

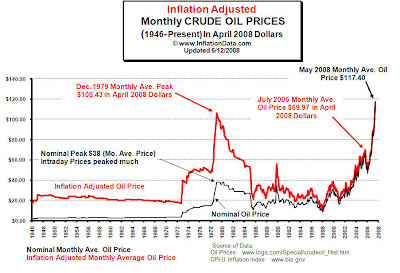

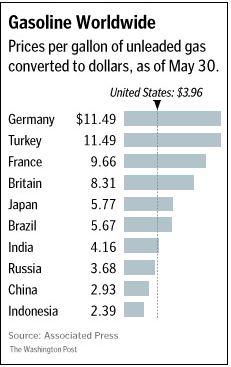

Oil: back to the Seventies

Found on InflationData.com

Unbidden, The Time Warp came to me (though I had thought the word "shimmy" appeared in the lyrics). And, of course, as usual, the Brits manage to get themselves into a worse pickle:

Found on Mish's.

Fasten your seatbelts

"Chervil" (author of the Australian Green Living blog) has kindly directed me to this article in the Sydney Morning Herald, which refers to ideas about economic long cycles:

David Hackett Fischer has studied the behaviour and historical meaning of inflation not just over the last decade, or the last century, but over the last 800 years. He sees the world positioned in a dangerous moment of possibility, on the rearing crest of the fourth great wave of inflation in eight centuries.

I would still be grateful for any information about what I shall call "sim economics" - potentially so much more useful than other simulation games.

Anybody able to help, please?

David Hackett Fischer has studied the behaviour and historical meaning of inflation not just over the last decade, or the last century, but over the last 800 years. He sees the world positioned in a dangerous moment of possibility, on the rearing crest of the fourth great wave of inflation in eight centuries.

I would still be grateful for any information about what I shall call "sim economics" - potentially so much more useful than other simulation games.

Anybody able to help, please?

Friday, June 13, 2008

Help required: economic modelling

Following reported opinion from Marc Faber and others that we may expect sell-offs in commodities, bonds, equities and real estate, and given concerns about the quality of our currencies, the question arises, where should we hold our cash?

It seem that in the USA and UK, we are holding down interest rates to avoid crippling homeowners, the home-loan-based economy, and what's left of our industries, and also in the hope that we can repay our debts to foreigners with devalued cash. On the other side, countries like China and Japan seem to be trying to prevent their currencies from appreciating, so as to preserve their trading advantage.

So one party is letting their currencies sink, and the other is trying to stop theirs rising. To this amateur, the world's foreign exchange system looks like a bunch of corks tied to an unchained anchor and flung into the sea. Will the string on the corks hold, or break under the strain, or be abruptly cut?

Is there any computer- or board-game-based model of the world economic system, that might make it clear to me how this wretched thing works?

And how is the ordinary person to save money and preserve its value in real terms, without having to be super-sophisticated? I know something about American TIPS and British NS&I Index-Linked Savings Certifcates, but I'm leery of handing the government what little money they haven't already extracted from me in taxes. And I don't trust them to define inflation fairly.

Does anybody know how this boneshaker of a contraption actually operates, so we can make sensible decisions?

It seem that in the USA and UK, we are holding down interest rates to avoid crippling homeowners, the home-loan-based economy, and what's left of our industries, and also in the hope that we can repay our debts to foreigners with devalued cash. On the other side, countries like China and Japan seem to be trying to prevent their currencies from appreciating, so as to preserve their trading advantage.

So one party is letting their currencies sink, and the other is trying to stop theirs rising. To this amateur, the world's foreign exchange system looks like a bunch of corks tied to an unchained anchor and flung into the sea. Will the string on the corks hold, or break under the strain, or be abruptly cut?

Is there any computer- or board-game-based model of the world economic system, that might make it clear to me how this wretched thing works?

And how is the ordinary person to save money and preserve its value in real terms, without having to be super-sophisticated? I know something about American TIPS and British NS&I Index-Linked Savings Certifcates, but I'm leery of handing the government what little money they haven't already extracted from me in taxes. And I don't trust them to define inflation fairly.

Does anybody know how this boneshaker of a contraption actually operates, so we can make sensible decisions?

Speaker or silencer?

I now read in The Grumbler that David Davis was prevented by the Speaker of the House of Commons from delivering his resignation speech to the House, and had to go outside the building to say it to journalists instead. Words fail.

Thursday, June 12, 2008

What oil hike?

The Mogambo Guru (too long absent from these pages) points out that a major factor in the increase in the price of oil, is simply the decline in the dollar. We here in the UK don't see it, because the pound is staring the dollar in the eye as both go screaming parachuteless towards the ground.

At least Richard Daughty is one who will not go gentle into that good night.

Now, isn't this what happened in the Seventies? Only we were conned into thinking it was down to wicked Arabs, when really the story was increased monetary inflation for some years pre-1974.

At least Richard Daughty is one who will not go gentle into that good night.

Now, isn't this what happened in the Seventies? Only we were conned into thinking it was down to wicked Arabs, when really the story was increased monetary inflation for some years pre-1974.

Marc Faber, cash and Cambodia

I said on Monday that Marc Faber was, by and large, in favour of keeping his money in his pocket, and a quick Google News trawl shows that his mind hasn't changed:

Stocks, Real Estate and Oil Are Overvalued, Marc Faber Says

Why rising inflation will trigger a bond market rout

Cambodia Starts to Beckon Private Equity

For investors, Cambodia could be the next Vietnam

The last is interesting. I have suspected for some time that Dr Faber lives in northern Thailand, not simply to hide in Shangri-La but to be nearer to the places where real bargains may be found, and so that his hunches can be informed by personal networking and under-the-radar experience. Quirky and fast-moving, he would not be the man to manage a large institutional fund: I think his lightning ex-ski champ reflexes demand more challenge.

An after-thought: if you do think cash is best, there's still the question of which currency.

Stocks, Real Estate and Oil Are Overvalued, Marc Faber Says

Why rising inflation will trigger a bond market rout

Cambodia Starts to Beckon Private Equity

For investors, Cambodia could be the next Vietnam

The last is interesting. I have suspected for some time that Dr Faber lives in northern Thailand, not simply to hide in Shangri-La but to be nearer to the places where real bargains may be found, and so that his hunches can be informed by personal networking and under-the-radar experience. Quirky and fast-moving, he would not be the man to manage a large institutional fund: I think his lightning ex-ski champ reflexes demand more challenge.

An after-thought: if you do think cash is best, there's still the question of which currency.

Is it OK to have principles?

Shadow Home Secretary David Davis resigns his Parliamentary seat to fight a by-election on the issue of civil liberty in Britain, and Michael White in the Guardian plays the sneering curmudgeon; parti pris?

UPDATE

Someone put the text of Mr Davis' speech as a comment to Michael White's piece. Here are a couple of extracts:

This Counter Terrorism Bill will in all likelihood be rejected by the House of Lords... But because the impetus behind it is political, the government will be tempted to use the Parliament Act...

It has no democratic mandate to do this...

... I am just a piece in this chess game.

Folly? Vanity? My eye (and Betty Martin).

UPDATE

Someone put the text of Mr Davis' speech as a comment to Michael White's piece. Here are a couple of extracts:

This Counter Terrorism Bill will in all likelihood be rejected by the House of Lords... But because the impetus behind it is political, the government will be tempted to use the Parliament Act...

It has no democratic mandate to do this...

... I am just a piece in this chess game.

Folly? Vanity? My eye (and Betty Martin).

Are free trade and small government the answer?

Liberal economists argue consistently for free trade, libertarians argue constantly for smaller government. We can easily see the faults of over-regulation and the centralisation of power.

But what would happen to the poorest if we really did move towards laissez-faire capitalism? I don't mean the poor in India and China, who are currently benefiting from open markets; I mean the poorest in the USA and UK. Would things really sort themselves out to the good of all?

Or would we find that we'd leapt from the frying pan into the fire?

But what would happen to the poorest if we really did move towards laissez-faire capitalism? I don't mean the poor in India and China, who are currently benefiting from open markets; I mean the poorest in the USA and UK. Would things really sort themselves out to the good of all?

Or would we find that we'd leapt from the frying pan into the fire?

Tuesday, June 10, 2008

An appetite for investment risk?

How does the quote from Jonathan Wilmot in the previous post sit with the new Risk Appetite Investable Index fund his firm launched last month?

Just curious.

Just curious.

Monday, June 09, 2008

Cashhhhhhh... don't tell anybody

"There is now the distinct possibility of a simultaneous sell-off in global bonds, equities and commodities," said Jonathan Wilmot from Credit Suisse.

... reports Ambrose Evans-Pritchard in the Telegraph (I must start to read the big-words papers). Anyhow, this is what Marc Faber said months ago. Short-term, I have a feeling DE is still on for the 'flation hors d'oeuvre, with IN as the entree.

By the way, are any managers of collective investment funds actually saying the type of thing Wilmot is saying, to their clients (not the big, favoured ones, the others, the Moms 'n' Pops)?

(htp: Karl Denninger)

... reports Ambrose Evans-Pritchard in the Telegraph (I must start to read the big-words papers). Anyhow, this is what Marc Faber said months ago. Short-term, I have a feeling DE is still on for the 'flation hors d'oeuvre, with IN as the entree.

By the way, are any managers of collective investment funds actually saying the type of thing Wilmot is saying, to their clients (not the big, favoured ones, the others, the Moms 'n' Pops)?

(htp: Karl Denninger)

Sunday, June 08, 2008

Please read this man

David Parsley writes in today's Sunday Express, a piece titled "Homes Panic Is A Bank Ploy" (not yet available on the Net for free, but look for it again soon). The content is self-evident, but please, read and believe him. Spread the word. Find more such pieces by optimistic counter-contrarians, and publicise them. Blow away all that negative thinking.

That way, I may have more time to sell my house at current ridiculous market prices, which for personal reasons I can't yet.

That way, I may have more time to sell my house at current ridiculous market prices, which for personal reasons I can't yet.

Subscribe to:

Posts (Atom)