Reportedly, young Greeks are suffering especially badly in the economic collapse: 51.1% of youth were unemployed in December. (Spain is even worse than Greece, according to Zero Hedge.) But how are these percentages calculated, and which young people are we looking at?

The first tweak is age brackets. Across Europe, the statistical comparison takes into account youngsters aged 15 - 24, but here in the UK, since ROSLA (the Raising of the School Leaving Age) in 1972, our youth are only officially in the employment market from age 16 onwards.

Continuing with the UK, should we look at who is employed, or who is unemployed? As this ONS video explains, only 50% of UK 16-24s are employed,

which implies that the other 50% are unemployed. This is where sub-categories play a part: 36% of youth are "economically inactive" (not looking for work), leaving a mere 14% who are looking for a job but don't have one. However, the "unemployment rate" excludes the economically inactive and is expressed as the number of unemployed divided by (number unemployed plus employed), i.e. about 14/(14+50) = 22.2% in the last quarter of 2011.

The "economically inactive" category includes students in further and higher education. So one factor worsening the "unemployment rate" is the growing trend for youngsters to stay on in education and become economically inactive. One way to improve the rate is through apprenticeship schemes. This has helped Austria's unemployment rate stay at only 7.3% and Germany's at 8.5%. Hence, I suppose, the recent British Government ad campaign for apprenticeships.

How much difference does education make? Let's look what proportion of all British 24-year-olds who left the education system at different stages, are unemployed: 13% of those with only GCSEs, 7% of those who only got A-levels, and 5% of those who obtained degrees. So A-levels seem to make a difference, but is it worth staying economically inactive for a further 3 years after that, taking on an average £53,000 of student debt?

Now, back to Europe and especially Greece.

Comparing across Europe, the Office of National Statistics says our youth unemployment RATE (15 -24) is 21.8% as against an EU average of 21.5%; we're better off than Spain, Ireland, Italy or France, seen in this way. However, if we look at youth unemployment PROPORTION or RATIO (that is, number of young unemployed divided by total number of young people), the figures are lower but the ranking changes: the EU average is 9.1%, and the UK's figure is 12.7%. Spain's is far worse, at 19.5%

but Ireland, France and Italy are better than the UK.

The difference in "rate" and "ratio" is stark in Greece, also: in 2010 the rate was 32.9% but the ratio was 10%. I decode that as meaning that out of every 100 young Greeks, 10 were unemployed, c. 20 employed and almost 70% economically inactive. The rate in Q3 2011 rose to 45.8%, which if the numbers of economically inactive remained the same would mean an unemployment ratio of some 14%, i.e. one in seven youngsters, not half of them. Maybe it's one in six, now.

We need the raw data, not just dodgy, headline-grabbing percentages.

For example, the Hellenic Statistical Authority's latest release, covering the whole labour force as at December 2011, shows (a) 3,899,319 employed, (b) 1,033,507 unemployed and (c) 4,424,562 "inactive". That means an unemployment rate - a/(a+b) - of 21%, but an unemployment ratio of 11%.

Year on year - Dec 2010 to Dec 2011 - the numbers of unemployed increased by 40.9%, but the number of employed decreased by only 7.9%. Plenty of room for spin there, negative or positive as one pleases. ("Inactives" increased by only 1.6%.)

In the case of the young, one would expect there to be a significant element of "inactives" aged 15-24, simply because of the numbers staying on in further and higher education. So although "inactives" account for some 47% of the whole labour market, they constitute (as I estimated above) about 70% of the 15-24 age group.

According to the same release, the youth unemployment rate for December in the years 2006 - 2009 were as follows: 28.4%, 24.5%, 26.3%, 28.9%. In December 2010 it jumped to 39.0% and by December 2011 it was 51.1%; so most of the damage has been done in the last two years.

Let's assume, for the sake of argument, that the number of 15-24-year olds and the percentage of young "inactives" has remained constant since 2006. Using the assumptions derived from the 10% ratio / 32.9% rate figures above, we get the following breakdown of the Greek youth labour market ratios:

Dec 2009: (a) employed 21.6%, (b) unemployed 8.8% and (c) inactive 69.6%

Dec 2011: (a) employed 14.9%, (b) unemployed 15.5% and (c) inactive 69.6%

... in other words, as I guessed earlier, one in six young people is unemployed.

Now if there is an increase in youngsters opting for further education to ride out the recession, the proportion of inactives increases and this worsens the unemployment rate. Similarly, if young people who are employed leave the country for better-paid work abroad, the total actively wanting work within Greece decreases and this enhances the proportion of unemployed.

As a general point, perhaps looking at the wrong figures leads us to make the wrong policy decisions. Using education to skew employment statistics has a dynamic balance of contradictory effects, as we have seen; and education post 18 is both costly and questionable in terms of cost-effectiveness.

To what extent should education be seen as a gateway to employment, as opposed to a consumer luxury? Wouldn't Shaw's Eliza Doolittle be better off setting up her flower shop, or teaching elocution, than getting an arts degree and a monster student loan?

Shouldn't we simply measure our success by how many young people are actually in work? I can see why policymakers don't, but shouldn't we?

Sunday, March 11, 2012

Monday, March 05, 2012

Why America has a future

I always enjoy reading James Howard Kunstler, and I'm sure he's right in saying - as he does again, today - that we're looking at a future in which basic food production will become a more significant part of the economy.

But America does have a future.

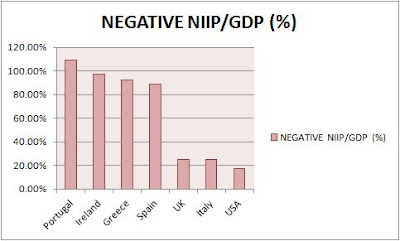

Everybody knows that the USA has by far the largest economy on the planet. And although her debts are huge, so are her assets. Seen in the context of net international investment position, America is in much less trouble than the PIGS, and a little less than the UK or Italy.

And here's the picture where population and food production are concerned:

I've just been watching a TV programme about the development of a new Chinese city 1,000 miles west of Beijing, and wondering why there is such a rush to urbanise, especially when it means building on productive farmland. It seems to me that one consequence must ultimately be an extra incentive to look for more resources in other people's countries.

But the USA still has enormous resources - land, capital, people and skills. So does Europe. If we can reform and wrest power from the greedy and incompetent uberclass, there is time to recalibrate without horrible disaster, at least for ourselves.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

But America does have a future.

Everybody knows that the USA has by far the largest economy on the planet. And although her debts are huge, so are her assets. Seen in the context of net international investment position, America is in much less trouble than the PIGS, and a little less than the UK or Italy.

And here's the picture where population and food production are concerned:

I've just been watching a TV programme about the development of a new Chinese city 1,000 miles west of Beijing, and wondering why there is such a rush to urbanise, especially when it means building on productive farmland. It seems to me that one consequence must ultimately be an extra incentive to look for more resources in other people's countries.

But the USA still has enormous resources - land, capital, people and skills. So does Europe. If we can reform and wrest power from the greedy and incompetent uberclass, there is time to recalibrate without horrible disaster, at least for ourselves.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Sunday, March 04, 2012

Drugs: et tu, "Brute"?

I note that Bruce Anderson wants to legalise drugs. The usual arguments: the war on them has failed, and we could have all sorts of safeguards if we legalised them (I'm reminded of the New Labour stock phrase, "make sure").

Then the commenters weigh in: hey, just look at the damage done by alcohol and tobacco. They skate over the fact that the damage with A&T occurs despite all the ostensible safeguards.

Besides, the war on every crime has failed. Except possibly body-snatching.

Back in 2009, I reproduced an article by a doctor who really knows about drugs and alcohol, and addiction, and who is far from sure that legalisation would increase our liberty. I was even promised a reply / rebuttal by "Charon QC", who I'm sorry to say (he's a courteous man and argues fairly) never got around to it.

So here's the challenge: don't answer me - answer Anthony Daniels' arguments. Here they are, yet again.

Or at least explain the real agenda. Because I've yet to be convinced decriminalization would (taking all effects into account) save money, cause less inconvenience or improve health or productivity. We might like to think so, but it's funny how reality differs from our expectations.

Will somebody on the libertarian side please, finally, take the debate seriously?

Then the commenters weigh in: hey, just look at the damage done by alcohol and tobacco. They skate over the fact that the damage with A&T occurs despite all the ostensible safeguards.

Besides, the war on every crime has failed. Except possibly body-snatching.

Back in 2009, I reproduced an article by a doctor who really knows about drugs and alcohol, and addiction, and who is far from sure that legalisation would increase our liberty. I was even promised a reply / rebuttal by "Charon QC", who I'm sorry to say (he's a courteous man and argues fairly) never got around to it.

So here's the challenge: don't answer me - answer Anthony Daniels' arguments. Here they are, yet again.

Or at least explain the real agenda. Because I've yet to be convinced decriminalization would (taking all effects into account) save money, cause less inconvenience or improve health or productivity. We might like to think so, but it's funny how reality differs from our expectations.

Will somebody on the libertarian side please, finally, take the debate seriously?

Education's secret revolution

Peter Hitchens' column today includes, as side issue, the following:

"So millions of people can’t do simple sums? Of course they can’t. This is because so many snotty teachers, who think proper education is ‘authoritarian’ and ‘learning by rote’, refuse to make children chant their times tables.

I am no mathematician, but got every single one of the test questions right with ease, simply by using my tables."

I am no mathematician, but got every single one of the test questions right with ease, simply by using my tables."

I have submitted this comment for approval:

Re times tables: children ARE now taught to recite times

tables - but in a different, and much less useful way. What follows may seem a

little petty but there are, I think, wider implications.

In the bad old days, if asked "six sevens?" you'd

reply "forty-two" straightaway, because the times table chant

included the line "six sevens are forty-two". Simple association: say

"Ant and..." and you get "Dec".

Now, the children I see have been trained in a sort of

stepladder routine, climbing laboriously up all the rungs: "7, 14, 21, 28,

35, 42". Not only does this take longer, but they only have to misremember

one of the rungs and it'll become "... 29, er, 36, er, 43". Or not

infrequently, a petering out into a defeated silence.

This is partly to do with not enough practice: the item will

have been ticked off the teacher's planning (as in "we cover the apostrophe in Y4 Spring

Term Week 5 Day Three"). God forbid you should bore children with dull, repetitive

learning. But without anything else to link to, it's just a list of numbers

with no obvious connexion - it may as well be the combination to a safe.

The child may also sometimes climb correctly but go past the

required answer because in this painfully slow recital he's lost count of how

many rungs you've asked him to climb.

I'm not certain why we didn't simply reinstate the ancient

method, but I have a suspicion that it might be something to do with not

admitting that we've been wrong about this since somewhere in the 1970s; like

phonics, grammar exercises, precis, comprehension and so on. Whatever is

brought back is reinstated not only late, slowly and grudgingly, but in some

revised form so that crusty teachers and grandparents can't say "I told

you so."

I know of one case in the 70s where a departing secondary

Head of English burned the department's coursebooks in a skip in the

playground, to ensure that the bad old ways could never return; and I've heard

of two others who did the same. We have had a revolution; and the

revolutionaries (many now leading lights or self-employed consultants) are just

now beginning to fade from the scene.

Tuesday, February 28, 2012

Equitable Life: climbing back up?

Equitable Life, the British mutual insurance company that burned its fingers very badly by offering high guaranteed annuity rates (in the period 1956 - 1988) as a marketing incentive to prospective pension investors, has announced a deal that will help it off the hook.

Canada Life will be offering annuities for maturing EL pensions in future (though EL will remind customers that they have the open market option also). This follows the 2006 deal in which Canada Life took over £4.6 billion-worth of existing EL annuity business.

It's not clear what Canada Life has paid or will pay EL for this linkup, or how.

EL's "intention is to stop writing Equitable Life annuities where possible" (PDF). Over time this arrangement will further reduce EL's outstanding annuity commitments and some of the freed capital is to be used to increase payouts by 12.5% on maturities and transfers.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Canada Life will be offering annuities for maturing EL pensions in future (though EL will remind customers that they have the open market option also). This follows the 2006 deal in which Canada Life took over £4.6 billion-worth of existing EL annuity business.

It's not clear what Canada Life has paid or will pay EL for this linkup, or how.

EL's "intention is to stop writing Equitable Life annuities where possible" (PDF). Over time this arrangement will further reduce EL's outstanding annuity commitments and some of the freed capital is to be used to increase payouts by 12.5% on maturities and transfers.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Occupy St Paul's finally evicted, life to return to normal

Leave those poor bankers alone; haven't they suffered enough? Harry Mount seems to think so, at any rate: those oiks fair spoiled the view, so they did.

Of course, the modern thing is for the bankers to scourge the protestors. And since they're on the Board controlling St Paul's, they can. And a jolly good thing, too.

Sunday, February 26, 2012

The news media: the cock crows on the dunghill

I think it was William Morris who said that the first step in literacy was being able to read a newspaper, and the second was not to read one.

Liz Jones gives cause why in the Mail on Sunday: fashion "journalists" at London Fashion Week are given seats of honour, or pent-up "some several hundred feet above the action", according to their willingness to toady; but a vengeful article by the victim gets results: "I was couriered a fabulous gift of perfume, shower gel, body lotion and chocolates (vegan, hopefully), and a handwritten note from Stella herself. Was this an apology? Or a bribe so I would play nicely next time?" (Both, obviously.) Sir Philip Greed gives her a light touch of the whip, saying he would have sent her a lovely olive coat for her review of TopShop - until he read the last para. Designer houses mark coverage by the glossies on a points system - nil for blacks and fatties - and so on, in a litany of bribery, schmoozing, banning and sacking. I think Jones is one to watch: when she finally tears her gaze away from her navel in the back pages of You magazine (there is a hopeful reticence about her human relationships this week), she might yet prove a Samson and bring the whole unholy edifice crashing down.

Meanwhile, Toby Young has taken the Murdoch shilling - as he boasts in the Spectator - and dutifully produced some wallpaperese in the new Sun on Sunday. His bet's on education sec Gove for PM, the free-schooler opines, entirely without any consideration of how (one of) his interests might in any way be congruent with Gove's (or Rupe's). Like so many of our modern celebs, Young has recognized the power of brazenness, adopting "@toadmeister" as his Twitter ID. And like former transport minister Stephen Byers, he's a "bit like a sort of cab for hire", only it's more acceptable in journalism, or so he seems to think: "(Go on Private Eye, stick me in Order of the Brown Nose. See if I care)", sez 'e in the Speccie, a magazine I now read principally because of Jeremy Clarke's luminous column (shame they let go Christopher Fildes and Mark Steyn, among other talent).

Young's is the authentic voice of the new Fourth Estate establishment: offensively triumphalist. Like the bankers who've ruined us, the yacht-visiting politicians who've sold us out, the rich who've looted us. These have learned how to manage news and opinion: dining with, leaking to, treating, flattering and employing the writers who (like the ancient bards) can foster or wither reputation. By and large, the newshounds have been luxuriously tamed, their necks enclosed in velvet collars with silver chains. There are exceptions, like Peter Hitchens, serving but to prove the rule; as "Anastasia" in his latest piece on Russia says, "The only rational conclusion is despair."

Sunday, February 19, 2012

Tyler Durden, Greek bonds and "odious debt"

Here, Tyler Durden discusses at length issues around the process of restructuring Greek debt.

It seems that we have to take into account the difference between bonds issued under Greek law and those issued under don-domestic law. One of the technical points is whether all holders of the debt have to agree to a new deal, and whether or not a minority can hold the majority to ransom by refusing to agree.

If, in desperation, Greece is driven to outright default whatever its creditors might think, this tears up the rule book and anything could happen. Other European nations are also severely distressed by debt and might try to follow suit. The very rule of international law would be challenged.

But there is an angle that Durden has not explored in his essay: the principle of "odious debt". There is precedent for a country repudiating damaging obligations, e.g. Mexico after the fall of the Emperor Maximilian, and the USA itself in relation to Cuban debt incurred under the previous Spanish regime.

Could Greeks be justified in arguing that bailouts imposed by their new, undemocratic government are not binding on the people? Could this argument also apply to debts incurred previously, directly and indirectly and consequently, in the process of acquiring EU membership, which it now transpires was based on fraud, assisted by bent accounting by Goldman Sachs and quite possibly connived at by the other EU states?

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

It seems that we have to take into account the difference between bonds issued under Greek law and those issued under don-domestic law. One of the technical points is whether all holders of the debt have to agree to a new deal, and whether or not a minority can hold the majority to ransom by refusing to agree.

If, in desperation, Greece is driven to outright default whatever its creditors might think, this tears up the rule book and anything could happen. Other European nations are also severely distressed by debt and might try to follow suit. The very rule of international law would be challenged.

But there is an angle that Durden has not explored in his essay: the principle of "odious debt". There is precedent for a country repudiating damaging obligations, e.g. Mexico after the fall of the Emperor Maximilian, and the USA itself in relation to Cuban debt incurred under the previous Spanish regime.

Could Greeks be justified in arguing that bailouts imposed by their new, undemocratic government are not binding on the people? Could this argument also apply to debts incurred previously, directly and indirectly and consequently, in the process of acquiring EU membership, which it now transpires was based on fraud, assisted by bent accounting by Goldman Sachs and quite possibly connived at by the other EU states?

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Wednesday, February 15, 2012

Greek debt: talks continue

Hercules slaying Augeas for non-payment of debt - the promised fee for cleaning the Augean stables. The statue, by Lorenzo Mattielli, stands outside the Hofburg Palace in Vienna.

At least Hercules had an excuse, having done some honest work, though to my eyes this particular depiction makes him seem simply a violent fat thug. What, by contrast, have the EU, international banking and the lucrative intermediation of Goldman Sachs done for Greece, aside from shoehorn the country into a club it should never have been allowed to join?

Euro MP and UKIP leader Nigel Farage has just told it straight yet again, to a parliament in which notable figures pointedly chat to each other while he berates them: the EU has driven poor Hellas to desperation and worse is to follow.

This chaos was foreseeable; my wife and I were in Corfu in May 2010 - the month in which three innocent Athenian bank employees were burned to death - and the goldsmith at Roda told us there would be a revolution within a year. Now, a whole government has been removed by outsiders and democracy is, apparently, merely an optional extra for peripheral nations.

Anyone who know the Greeks knows they have a historical memory like the Irish. This will go deep and will not be forgiven.

Saturday, February 11, 2012

Loathing corner

The Daily Mail reports its libel victory over the Lizard People. But looking at them, why are our politicians and financiers so unimpressive?

There is Oleg Deripaska, reminiscent of a toxic marmot, flanked (left) by millionaire Nat Rothschild looking like one of the people who stand behind John McCririck on Channel 4 Racing and seemingly nerving himself up to raise his thumb at the camera, and (right) by Peter Mandelson, rigidly relaxed and posing as a wannabe extra for a Blue Oyster club scene from "Police Academy".

If you must be star-struck, boys, at least don't worship a dark star.

I'm holding out for the Hollywood version, it'll be so much more credible. To quote Sir Philip Sidney, these people's "world is brazen, the poets only [i.e. only artists] deliver a golden".

International debt, in context

Data gets turned to the commentator's angle on it. Discussion of debt too often focuses on what government owes and ignores private liabilities, hence the crisis (which most professional economists failed to anticipate) that faces us now.

In its turn, debt is only a part of the picture. Watching the Greek economy implode, it's easy to run around panicking like Chicken Little about our own situation.

So let's look at the net international investment position of the PIIGS, USA and UK to see the problem through a wider-angle lens:

Yes, even in this wider definition of net obligations, we're all debtors; but the ratio of debt to GDP varies greatly, and if there is to be a domino effect, remember that one of the dominoes in the top graph is more like a skyscraper and much less easy to tip over.

Everything that makes up the above data is subject to change: what will bonds and equities be worth next year? How much could GDP change? How is the structure of the largest economies different from that of the small ones? Are we comparing whales and jellyfish?

And how much could the big help out the small? I'm reminded of the story of two men at their place of worship, praying for cash to get them out of a jam. "I need fifty thousand, Lord, or I'm going to lose this deal," begs a blue-suit, but keeps being interrupted by his ill-dressed neighbour calling "A hundred, Lord, a hundred for my family's rent and food". Finally, the businessman reaches into his pocket, pulls out $100 and gives it to the other, saying "Here, now shut up, he's listening to me."

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

In its turn, debt is only a part of the picture. Watching the Greek economy implode, it's easy to run around panicking like Chicken Little about our own situation.

So let's look at the net international investment position of the PIIGS, USA and UK to see the problem through a wider-angle lens:

Yes, even in this wider definition of net obligations, we're all debtors; but the ratio of debt to GDP varies greatly, and if there is to be a domino effect, remember that one of the dominoes in the top graph is more like a skyscraper and much less easy to tip over.

Everything that makes up the above data is subject to change: what will bonds and equities be worth next year? How much could GDP change? How is the structure of the largest economies different from that of the small ones? Are we comparing whales and jellyfish?

And how much could the big help out the small? I'm reminded of the story of two men at their place of worship, praying for cash to get them out of a jam. "I need fifty thousand, Lord, or I'm going to lose this deal," begs a blue-suit, but keeps being interrupted by his ill-dressed neighbour calling "A hundred, Lord, a hundred for my family's rent and food". Finally, the businessman reaches into his pocket, pulls out $100 and gives it to the other, saying "Here, now shut up, he's listening to me."

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Friday, February 03, 2012

UK back into slump

Since my previous post, the UK M4 bank lending figures in the quarter to end December have finally come in: negative 6.7% annualised, following on from negative 8.7% ending September.

Since the start of the credit crunch in 2007, UK M4 has done this:

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Since the start of the credit crunch in 2007, UK M4 has done this:

That's 5 negative quarters out of the last 7 - the five lowest (and the only five negatives) since 1963.

This thing isn't over, and the air of normality and control is, I fear, fake.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Sunday, January 29, 2012

Is money-lending approaching its tipping point?

Chartists are always trying to scry a pattern in markets. Here's one that doesn't seem too difficult to discern: the long-term deceleration in bank lending to the UK private sector.

It looks like a cycle of around 18 years, but rather than simply repeating, the pattern is progressive: lower peaks each time, and lower lows. And for the first time since 1963 (which is as far as the online BoE data goes), we are in negative territory. Previous highs of c. 35%, 25% and 15% suggest that the next peak will be more of a hillock, at 5%.

Or maybe there will be a phase shift, into some disorderly deflation. Australian Economist Steve Keen has attempted to model macroeconomic change as debt increases, and one curious feature is that the model predicts an apparent tendency towards a moderate point, followed by a catastrophic breakdown in wages and profits - see for example the graphs on pages 43 and 44 of his paper entitled "Are we 'It' Yet?".

The economy is not a machine, of course. It is more like a game played with ever-varying rules, like Calvinball. But the value of Keen's observations is in showing that there must, in fact, be a change in the rules at some point, simply because without it the game breaks down altogether.

Currently, our counters are cash notes, bank deposit statements, share certificates, bonds, Treasury promises and property deeds - plus the derivative contracts that outweigh everything else. Whether they will be freely accepted by all players in the next version of the game remains to be seen; perhaps they will suffer the fate of Continental and Confederate currency.

No wonder that many thinking persons are converting to tangible assets of various types, even if they seem overpriced according to the present system of reckoning.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Wednesday, January 25, 2012

Libertarians should consider commercial tyranny as well as political

I've just happened on a documentary screened on Russia TV (Freeview here in the UK), about the battle between a small Canadian farmer and Monsanto.

I think the fight for freedom is no longer solely against Big Brother. Libertarians should consider Big MD/Big CEO as a major threat, especially since multinational corporations are more powerful than many governments.

And I don't think I'm alone in feeling that patenting life itself is in some way an outrage.

I think the fight for freedom is no longer solely against Big Brother. Libertarians should consider Big MD/Big CEO as a major threat, especially since multinational corporations are more powerful than many governments.

And I don't think I'm alone in feeling that patenting life itself is in some way an outrage.

Sunday, January 22, 2012

The Royal Yacht and the pig-ignorant commentariat

Even Sunday Times journalists can be stunningly ignorant and stupid, it seems. Camilla Long ("never 'eard of 'er", as Harry Hill would say) opines - well, no, read the crap yourself, if you can stand it. The arch title is pretty much a précis of the whole article: "A yacht? Wouldn’t the Queen prefer a really nice soap?"

Perhaps it's the Murdoch connection, I don't know. But this anti-monarchical drivel is of a piece with the sniggering on Radio 4's News Quiz, which I heard driving home yesterday. The panel are usually OK making funnies about animals and human foibles, but when it comes to politics and economics they don't know sh*t.

Has it not occurred to all the pseudo-sophisticates in the media that

(a) The Queen is the Head of State (something Tony Blair was liable to forget).

(b) Show matters. If you don't understand the importance of symbol and pageantry, get out of the commenting game. The soi-disant Labourites understand, all right - why else would TB attempt to get himself a "Blair Force One", and Brown find a way to refuse it him?

(c) When the Royal Yacht was operational, before the Inglorious Revolution of 1997, it was not only a status symbol for our country, but a roving, floating venue for discreet diplomacy and business dealing - and may I suggest, rather less demimondaine than Oleg Deripaska's (the Queen K). Or Murdoch's own Rosehearty.

F****** idiots.

Perhaps it's the Murdoch connection, I don't know. But this anti-monarchical drivel is of a piece with the sniggering on Radio 4's News Quiz, which I heard driving home yesterday. The panel are usually OK making funnies about animals and human foibles, but when it comes to politics and economics they don't know sh*t.

Has it not occurred to all the pseudo-sophisticates in the media that

(a) The Queen is the Head of State (something Tony Blair was liable to forget).

(b) Show matters. If you don't understand the importance of symbol and pageantry, get out of the commenting game. The soi-disant Labourites understand, all right - why else would TB attempt to get himself a "Blair Force One", and Brown find a way to refuse it him?

(c) When the Royal Yacht was operational, before the Inglorious Revolution of 1997, it was not only a status symbol for our country, but a roving, floating venue for discreet diplomacy and business dealing - and may I suggest, rather less demimondaine than Oleg Deripaska's (the Queen K). Or Murdoch's own Rosehearty.

F****** idiots.

Thursday, January 12, 2012

Saturday, January 07, 2012

Sack all teachers who can't answer this

"Supergravity theories are often said to be the only consistent theories of interacting massless spin 3/2 fields.

Discuss."

There. That should sort out those baaaaad teachers. Did you know only 17 were struck off for "professional incompetence" in 10 years? (Shame about the Lord Charles-like pic of Michael Gove in that article.)

Erm, how many bad teachers SHOULD there be, then?

Or is this really about the naughty larrikins not wanting a second scything of their pension rights, "at a time when the whole country is suffering"? In prosperous times, they could've switched to a different career, if they were any good, which by definition they're not; in bad times, we simply can't afford to treat them decently.

Much easier to make them keep their heads down with a steady fusillade of criticism, threats and insults. Serve them right, they forgot they were below stairs people.

Fred Goodwin is 53.

Pip pip!

Discuss."

There. That should sort out those baaaaad teachers. Did you know only 17 were struck off for "professional incompetence" in 10 years? (Shame about the Lord Charles-like pic of Michael Gove in that article.)

Erm, how many bad teachers SHOULD there be, then?

Or is this really about the naughty larrikins not wanting a second scything of their pension rights, "at a time when the whole country is suffering"? In prosperous times, they could've switched to a different career, if they were any good, which by definition they're not; in bad times, we simply can't afford to treat them decently.

Much easier to make them keep their heads down with a steady fusillade of criticism, threats and insults. Serve them right, they forgot they were below stairs people.

Fred Goodwin is 53.

Pip pip!

Friday, January 06, 2012

Tuesday, January 03, 2012

Steve Keen: Dow to drop 35%, housing 40%?

Australian economist Steve Keen has previously argued that it is far more beneficial to bail out consumers than the banks, and now has made it part of a manifesto for avoiding a worse-than-the-1930s economic depression.

As part of his analysis, he looks at the Dow:

... and the US housing market:

If his exponential trend lines are correct, stocks will have to fall by a further 35% and houses 40%, ignoring overshoot.

If that seems overly pessimistic, consider James Howard Kunstler, who revisits his "Dow 4,000" mantra and modifies it to 1,000 by 2014. Unbelievable? Only if you think tomorrow will be no worse than yesterday, and ignore how freakish the whole period from the mid-1980s has been. I had a go at reading the patterns back in February 2011 and the next Dow low looked around 4,500 - adjusted for CPI, in view of our inflation-happy leaders.

What would I know about it, you may say. Well, what does anybody know, and more pertinently, what do they know?

I have to say that I may soon need to modify my investment disclosure, as it may be prudent to begin buying physical gold in regular small quantities, against the possibility of a serious market breakdown and savaging of the value of cash. The gold price is still rather rich for my taste, but what's the alternative?

Do you really think our politicians, bankers and economists have a credible plan to sort out the problems? I like Keen's, but I'll give you long odds against it ever happening. Still, better noble failure than dishonourable compromise, I think the Japanese would agree: 判官贔屓.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

As part of his analysis, he looks at the Dow:

... and the US housing market:

If his exponential trend lines are correct, stocks will have to fall by a further 35% and houses 40%, ignoring overshoot.

If that seems overly pessimistic, consider James Howard Kunstler, who revisits his "Dow 4,000" mantra and modifies it to 1,000 by 2014. Unbelievable? Only if you think tomorrow will be no worse than yesterday, and ignore how freakish the whole period from the mid-1980s has been. I had a go at reading the patterns back in February 2011 and the next Dow low looked around 4,500 - adjusted for CPI, in view of our inflation-happy leaders.

What would I know about it, you may say. Well, what does anybody know, and more pertinently, what do they know?

I have to say that I may soon need to modify my investment disclosure, as it may be prudent to begin buying physical gold in regular small quantities, against the possibility of a serious market breakdown and savaging of the value of cash. The gold price is still rather rich for my taste, but what's the alternative?

Do you really think our politicians, bankers and economists have a credible plan to sort out the problems? I like Keen's, but I'll give you long odds against it ever happening. Still, better noble failure than dishonourable compromise, I think the Japanese would agree: 判官贔屓.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Steve Keen: Dow to drop 35%, housing 40%?

Australian economist Steve Keen has previously argued that it is far more beneficial to bail out consumers than the banks, and now has made it part of a manifesto for avoiding a worse-than-the-1930s economic depression.

As part of his analysis, he looks at the Dow:

... and the US housing market:

If his exponential trend lines are correct, stocks will have to fall by a further 35% and houses 40%, ignoring overshoot.

If that seems overly pessimistic, consider James Howard Kunstler, who revisits his "Dow 4,000" mantra and modifies it to 1,000 by 2014. Unbelievable? Only if you think tomorrow will be no worse than yesterday, and ignore how freakish the whole period from the mid-1980s has been. I had a go at reading the patterns back in February 2011 and the next Dow low looked around 4,500 - adjusted for CPI, in view of our inflation-happy leaders.

What would I know about it, you may say. Well, what does anybody know, and more pertinently, what do they know?

I have to say that I may soon need to modify my investment disclosure, as it may be prudent to begin buying physical gold in regular small quantities, against the possibility of a serious market breakdown and savaging of the value of cash. The gold price is still rather rich for my taste, but what's the alternative?

Do you really think our politicians, bankers and economists have a credible plan to sort out the problems? I like Keen's, but I'll give you long odds against it ever happening. Still, better noble failure than dishonourable compromise, I think the Japanese would agree: 判官贔屓.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

As part of his analysis, he looks at the Dow:

... and the US housing market:

If his exponential trend lines are correct, stocks will have to fall by a further 35% and houses 40%, ignoring overshoot.

If that seems overly pessimistic, consider James Howard Kunstler, who revisits his "Dow 4,000" mantra and modifies it to 1,000 by 2014. Unbelievable? Only if you think tomorrow will be no worse than yesterday, and ignore how freakish the whole period from the mid-1980s has been. I had a go at reading the patterns back in February 2011 and the next Dow low looked around 4,500 - adjusted for CPI, in view of our inflation-happy leaders.

What would I know about it, you may say. Well, what does anybody know, and more pertinently, what do they know?

I have to say that I may soon need to modify my investment disclosure, as it may be prudent to begin buying physical gold in regular small quantities, against the possibility of a serious market breakdown and savaging of the value of cash. The gold price is still rather rich for my taste, but what's the alternative?

Do you really think our politicians, bankers and economists have a credible plan to sort out the problems? I like Keen's, but I'll give you long odds against it ever happening. Still, better noble failure than dishonourable compromise, I think the Japanese would agree: 判官贔屓.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

The poisoned environment, the EU and the need for a more radical revision of democracy

"Endocrine disruptors can accentuate or inhibit the response to hormonal signals. They have been

implicated as one of the potential causes of the significant drop in male fertility observed in Europe over the last 50 years and as having negative impacts on the environment."

I'm not fond of being bossed-about, but clearly there are some matters that have to be addressed at a collective level and it seems that the EU has added this to the 2012 agenda (htp: Ian Parker-Joseph). If the science is right, then yes, I support action.

And while I also support those (especially UKIP) who resist our regional tryout of the New World Order, has anyone considered that if we did successfully disconnect from the EU political machine, we'd be left with the domestic dictators of Westminster and Whitehall, freshly energized and unshackled?

The democracy project has a lot more to do than tweak Rompuy's nose.

UPDATE: Coincidentally, Alastair Smith has just published an article in The Economist, explaining why those in power are never acting in our best interest. After an amusingly cynical analysis, he concludes:

It’s not possible to reform a system by imploring people to do the right thing. You have to know how it works. Dictators already know how to be dictators—they are very good at it. We want to point out how they do it so that it’s possible to think about reforms that can actually have meaningful consequences.

implicated as one of the potential causes of the significant drop in male fertility observed in Europe over the last 50 years and as having negative impacts on the environment."

I'm not fond of being bossed-about, but clearly there are some matters that have to be addressed at a collective level and it seems that the EU has added this to the 2012 agenda (htp: Ian Parker-Joseph). If the science is right, then yes, I support action.

And while I also support those (especially UKIP) who resist our regional tryout of the New World Order, has anyone considered that if we did successfully disconnect from the EU political machine, we'd be left with the domestic dictators of Westminster and Whitehall, freshly energized and unshackled?

The democracy project has a lot more to do than tweak Rompuy's nose.

UPDATE: Coincidentally, Alastair Smith has just published an article in The Economist, explaining why those in power are never acting in our best interest. After an amusingly cynical analysis, he concludes:

It’s not possible to reform a system by imploring people to do the right thing. You have to know how it works. Dictators already know how to be dictators—they are very good at it. We want to point out how they do it so that it’s possible to think about reforms that can actually have meaningful consequences.

A mild defense of Dawkins

This is in response to Sackerson’s piece on Richard Dawkins. It is probably not my best work, given my lack of sleep.

I have read ‘The God Delusion’, and Anthony Flew’s review of it. Most of the former is concerned with the science of why religion appears to exist, based on the scientific evidence available. In his first major point, Flew chooses to focus on Dawkins’ discussion of Einstein, in which he says:

“But (I find it hard to write with restraint about this obscurantist refusal on the part of Dawkins) he makes no mention of Einstein’s most relevant report: namely, that the integrated complexity of the world of physics has led him to believe that there must be a Divine Intelligence behind it.”

The problem for Flew is that I have read Einstein’s writings and comments on the subject. The latter explicitly said that he did not believe in a deity, and that the most that could be said is to deify the structure of the Universe itself. This is not quite what Flew implies. The rest of his review does not address the science presented.

That being dealt with, I have far more interest in the reasons for the outspoken anti-religious tactics of Richard Dawkins, Sam Harris, P.Z. Myers and Christopher Hitchens.

It is my claim that they are a product of the current social forces.

Since I moved to the US in 1978, I have seen a rise in the loudness and power of the Religious Right, who have supplanted the fiscal conservatives as the core of the Republican Party. These people are not the pleasant vicars and church-goers of my youth. For my UK readers, I note that Ian Paisley was educated at Bob Jones University, a font of wisdom for the fundamentalist community. His style is representative of many in the movement.

This rise in power can be explained in part by the political and economic uncertainty from the gradual decline in the power of the US, and from the many scientific discoveries which show that emotionally-charged deeply-held beliefs (especially ‘no evolution’) are simply not supported by reality. As any psychologist will tell you, this conflict between the frontal lobe and amygdala results in anger, directed firmly at anyone who rejects their ‘correct’ beliefs. Some have coined this the Ameritaliban.

A few people, such as Pope John Paul II and Stephen Jay Gould, tried to make peace, by showing that religion and science could live in harmony. This has also been tried by the Templeton Foundation. These efforts were roundly rejected by the anti-science crowd, who continue to vilify the former two after death, and use every tactic possible to neuter science education and research.

Faced with a call of ‘no quarter’, is it any wonder that voices like these arose on the pro-science side?

I have read ‘The God Delusion’, and Anthony Flew’s review of it. Most of the former is concerned with the science of why religion appears to exist, based on the scientific evidence available. In his first major point, Flew chooses to focus on Dawkins’ discussion of Einstein, in which he says:

“But (I find it hard to write with restraint about this obscurantist refusal on the part of Dawkins) he makes no mention of Einstein’s most relevant report: namely, that the integrated complexity of the world of physics has led him to believe that there must be a Divine Intelligence behind it.”

The problem for Flew is that I have read Einstein’s writings and comments on the subject. The latter explicitly said that he did not believe in a deity, and that the most that could be said is to deify the structure of the Universe itself. This is not quite what Flew implies. The rest of his review does not address the science presented.

That being dealt with, I have far more interest in the reasons for the outspoken anti-religious tactics of Richard Dawkins, Sam Harris, P.Z. Myers and Christopher Hitchens.

It is my claim that they are a product of the current social forces.

Since I moved to the US in 1978, I have seen a rise in the loudness and power of the Religious Right, who have supplanted the fiscal conservatives as the core of the Republican Party. These people are not the pleasant vicars and church-goers of my youth. For my UK readers, I note that Ian Paisley was educated at Bob Jones University, a font of wisdom for the fundamentalist community. His style is representative of many in the movement.

This rise in power can be explained in part by the political and economic uncertainty from the gradual decline in the power of the US, and from the many scientific discoveries which show that emotionally-charged deeply-held beliefs (especially ‘no evolution’) are simply not supported by reality. As any psychologist will tell you, this conflict between the frontal lobe and amygdala results in anger, directed firmly at anyone who rejects their ‘correct’ beliefs. Some have coined this the Ameritaliban.

A few people, such as Pope John Paul II and Stephen Jay Gould, tried to make peace, by showing that religion and science could live in harmony. This has also been tried by the Templeton Foundation. These efforts were roundly rejected by the anti-science crowd, who continue to vilify the former two after death, and use every tactic possible to neuter science education and research.

Faced with a call of ‘no quarter’, is it any wonder that voices like these arose on the pro-science side?

Sunday, January 01, 2012

Foreign demand to support the price of gold?

I start with an entertaining and informative investor newsletter: David Collum's annual personal investment report, which is worth reading in full. The prose is very sparky and the scorn and indignation laid on good and thick.

For the impatient, I can report that he begins by describing his own asset allocation:

With rebalancing achieved only by directing my savings, I changed nothing in my portfolio year over year. The total portfolio as of 12/31/11 is as follows:

Precious Metals et al.: 53%

Energy: 14%

Cash Equiv (short duration): 30%

Other: 3%

... which tells you where he stands in the bull/bear debate.

Now, here's a sweet little piece of possible future villainy:

[The Chinese] are rumored to have 1,000 tons of gold with a target of 8,000 tons. How do they buy 7,000 tons? They bid for it like everybody else. Chinese citizens have been encouraged to save using gold (a defacto gold standard and covert accumulation). Although the gold bugs in the US occasionally discuss confiscation, I think the Chinese proletariat are the ones being set up.

That is so nasty and cynical that it seems almost inevitable.

And easy:

7,000 metric tonnes of gold at current prices ($50,290.84 per kilo at time of writing) is worth a shade over $352 billion.

This IMF report from 2010 (fig. 3, p. 27) estimates Chinese household net savings at some 15% of GDP, and World Bank data estimates GDP in 2010 to be the equivalent of US $5.88 trillion. So the dollar equivalent of Chinese net household savings is around $882 billion.

So if Chinese convert merely 40% of their personal cash to gold (which David Collum seems to have done already), the target will be met. Theoretically, it's doable today. Meanwhile I still see not just one, but a number of shops offering to buy gold in my neighbourhood. Perhaps the gold is heading East, like the copper wiring from our railway signals and the wrought iron manhole covers from our streets.

It's not just China that's importing gold, of course; Indians (for example) save a third of their income in gold.

So it seems to me that the gold price won't crash back to the levels of some years ago.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

For the impatient, I can report that he begins by describing his own asset allocation:

With rebalancing achieved only by directing my savings, I changed nothing in my portfolio year over year. The total portfolio as of 12/31/11 is as follows:

Precious Metals et al.: 53%

Energy: 14%

Cash Equiv (short duration): 30%

Other: 3%

... which tells you where he stands in the bull/bear debate.

Now, here's a sweet little piece of possible future villainy:

[The Chinese] are rumored to have 1,000 tons of gold with a target of 8,000 tons. How do they buy 7,000 tons? They bid for it like everybody else. Chinese citizens have been encouraged to save using gold (a defacto gold standard and covert accumulation). Although the gold bugs in the US occasionally discuss confiscation, I think the Chinese proletariat are the ones being set up.

That is so nasty and cynical that it seems almost inevitable.

And easy:

7,000 metric tonnes of gold at current prices ($50,290.84 per kilo at time of writing) is worth a shade over $352 billion.

This IMF report from 2010 (fig. 3, p. 27) estimates Chinese household net savings at some 15% of GDP, and World Bank data estimates GDP in 2010 to be the equivalent of US $5.88 trillion. So the dollar equivalent of Chinese net household savings is around $882 billion.

So if Chinese convert merely 40% of their personal cash to gold (which David Collum seems to have done already), the target will be met. Theoretically, it's doable today. Meanwhile I still see not just one, but a number of shops offering to buy gold in my neighbourhood. Perhaps the gold is heading East, like the copper wiring from our railway signals and the wrought iron manhole covers from our streets.

It's not just China that's importing gold, of course; Indians (for example) save a third of their income in gold.

So it seems to me that the gold price won't crash back to the levels of some years ago.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Saturday, December 31, 2011

Professor Richard Dawkins and questionable standards of scholarship

It has long been my impression that Professor Dawkins' emotions override his commitment to the highest standards of scholarly argument and research, and this is stated as a clear accusation by a victim of one of his attacks, the distinguished academic philosopher and former atheist Anthony Flew:

Dawkins is not interested in the truth as such but is primarily concerned to discredit an ideological opponent by any available means. That would itself constitute sufficient reason for suspecting that the whole enterprise of The God Delusion was not, as it at least pretended to be, an attempt to discover and spread knowledge of the existence or non-existence of God but rather an attempt – an extremely successful one – to spread the author’s own convictions in this area.

For the rest of Professor Flew's article, please see here.

I am not concerned to argue the case either for or against atheism here. There are honourable people on both sides of the argument.

But I am concerned that an eminent scientist long associated with my university should lose his professional compass so grossly on a matter that deeply interests and affects millions of people.

It is also worth noting, as perhaps many do not realise, that Professor Dawkins was, in effect, sponsored by an American billionaire to ride his hobby horse. The University's website openly admits:

Simonyi Professorship was set up with the express intention that its first holder should be Richard Dawkins.

I should like to know who is (and was then) on the appointments board for the Simonyi Professorship, and the interconnexions among them and others including the successful candidate and Mr Simonyi himself. I fear that the more I come to know about this, the more I may possibly feel that the Chair and its surrounding issues might serve to lessen respect for the University and its work.

If there is any reader of this post who teaches or is attending, or has taught or attended at Oxford University and would care to join me in a letter to the University inquiring into the Simonyi Professorship, I should be obliged if he/she would get in touch with me.

Dawkins is not interested in the truth as such but is primarily concerned to discredit an ideological opponent by any available means. That would itself constitute sufficient reason for suspecting that the whole enterprise of The God Delusion was not, as it at least pretended to be, an attempt to discover and spread knowledge of the existence or non-existence of God but rather an attempt – an extremely successful one – to spread the author’s own convictions in this area.

For the rest of Professor Flew's article, please see here.

I am not concerned to argue the case either for or against atheism here. There are honourable people on both sides of the argument.

But I am concerned that an eminent scientist long associated with my university should lose his professional compass so grossly on a matter that deeply interests and affects millions of people.

It is also worth noting, as perhaps many do not realise, that Professor Dawkins was, in effect, sponsored by an American billionaire to ride his hobby horse. The University's website openly admits:

Simonyi Professorship was set up with the express intention that its first holder should be Richard Dawkins.

I should like to know who is (and was then) on the appointments board for the Simonyi Professorship, and the interconnexions among them and others including the successful candidate and Mr Simonyi himself. I fear that the more I come to know about this, the more I may possibly feel that the Chair and its surrounding issues might serve to lessen respect for the University and its work.

If there is any reader of this post who teaches or is attending, or has taught or attended at Oxford University and would care to join me in a letter to the University inquiring into the Simonyi Professorship, I should be obliged if he/she would get in touch with me.

Wednesday, December 28, 2011

Monday, December 26, 2011

Special Educational Needs and Inequality

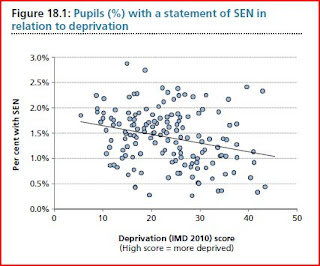

One might (perhaps) expect that less wealthy areas of England would have a higher proportion of children identified as having Special Educational Needs (SEN). Not so, according to this graph on page 103 of the NHS Atlas of Variation in Healthcare (November 2011 edition):

Using a measure called Indices of Multiple Deprivation and correlating it with the proportion of primary age children with a SEN Statement, it seems that children from poorer areas are less likely to be so diagnosed.

I don't think that's a true reflection of underlying need. There's loads of children with EBD (emotional and behavioural difficulties) and pace Mr Clegg the modern pattern of disrupted family structure really doesn't tend to help them. Perhaps schools that have more such children accept the situation as "normal"; or maybe their SENCOs (Special Educational Needs Coordinators) are simply overwhelmed. It's notable that primary age children are more likely to get excluded in Year 6, as the dreaded teacher-damning SATS exams draw near and the school finally decides that it can't afford to have a severely disruptive child in the group - was there really no such difficulty in the years before that?

But there are other kinds of need. Autism is an interesting case, and incidence of diagnosis is seemingly influenced by the social class of the family - an ASD (autistic spectrum diagnosis) expert in Birmingham LEA told us a year or two ago that the better-off quarters of Birmingham were yielding an ASD diagnosis rate some five times higher than in poorer areas. Perhaps it's because ASD doesn't carry the same potential stigma for the parent - it's genetic rather than a consequence of poor parenting skills - and perhaps also it's because it's a good way to attract extra attention and resources for your child (autism is a lifelong condition, unlike, er, "naughtiness").

Not that autism isn't real - I have taught autistic children all the way from mild cases down to the ones that can't or don't speak at all. But middle-class parents are (naturally) better at fighting their child's corner to get the diagnosis. And it strengthens their arm that the techniques and resources specifications in SEN statements are legally enforceable - such fun, as Miranda Hart's on-screen mum likes to say.

So in some ways the graph above is inadequate - it needs to be broken down into types of disability, and further into economic sub-divisions of the LEA (there is a world of difference between, say, Nechells and Hall Green). But even with the data aggregated in the way it is, there seem to be more questions to ask about inequalities in diagnosis and provision.

Using a measure called Indices of Multiple Deprivation and correlating it with the proportion of primary age children with a SEN Statement, it seems that children from poorer areas are less likely to be so diagnosed.

I don't think that's a true reflection of underlying need. There's loads of children with EBD (emotional and behavioural difficulties) and pace Mr Clegg the modern pattern of disrupted family structure really doesn't tend to help them. Perhaps schools that have more such children accept the situation as "normal"; or maybe their SENCOs (Special Educational Needs Coordinators) are simply overwhelmed. It's notable that primary age children are more likely to get excluded in Year 6, as the dreaded teacher-damning SATS exams draw near and the school finally decides that it can't afford to have a severely disruptive child in the group - was there really no such difficulty in the years before that?

But there are other kinds of need. Autism is an interesting case, and incidence of diagnosis is seemingly influenced by the social class of the family - an ASD (autistic spectrum diagnosis) expert in Birmingham LEA told us a year or two ago that the better-off quarters of Birmingham were yielding an ASD diagnosis rate some five times higher than in poorer areas. Perhaps it's because ASD doesn't carry the same potential stigma for the parent - it's genetic rather than a consequence of poor parenting skills - and perhaps also it's because it's a good way to attract extra attention and resources for your child (autism is a lifelong condition, unlike, er, "naughtiness").

Not that autism isn't real - I have taught autistic children all the way from mild cases down to the ones that can't or don't speak at all. But middle-class parents are (naturally) better at fighting their child's corner to get the diagnosis. And it strengthens their arm that the techniques and resources specifications in SEN statements are legally enforceable - such fun, as Miranda Hart's on-screen mum likes to say.

So in some ways the graph above is inadequate - it needs to be broken down into types of disability, and further into economic sub-divisions of the LEA (there is a world of difference between, say, Nechells and Hall Green). But even with the data aggregated in the way it is, there seem to be more questions to ask about inequalities in diagnosis and provision.

Thursday, December 22, 2011

How to become incredibly rich in the coming total economic collapse

You can't. And I don't want to read any more articles promising something like this.

Tuesday, December 20, 2011

China is in the same debt boat as the rest of us

Robert Wenzel reports a Roubini tweet that the real government debt-to-GDP ratio in China is 80%.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Sunday, December 18, 2011

Trust is breaking down wholesale, hoarding has begun - UPDATED 02 Jan 2012

The following started off on my grumble outlet Bearwatch, but looks like it's getting more serious:

“You can’t trust anybody and the entire system is collapsing. What’s the takeaway from this? It’s to make sure you have every penny in your pocket.”

Gerald Celente, Trends Research Institute founder, following the disappearance of his six-figure holdings at MF Global shortly before he was due to take delivery of physical gold. More here.

Update: and the chorus swells...

"It is up to you to decide how much you're willing to risk losing to a crook. If the answer is "none" or you cannot reduce the at-risk portion of your assets to what you're willing to lose to fraud then you can no longer participate in the market at all, in any form, nor even do business with a bank." - Karl Denninger.

"Now may be the time to exit all arrangements not specifically guaranteed directly by the government, and bring your money home. And better yet if no guarantees are required, and no parties standing between you and your wealth." - Jesse.

... and swells...

"Ultimately, I will not be at all surprised to see Europe’s banking system shut for days while the losses and payments issues are worked out. People forget that the term “bank holiday” was invented in the 1930’s when the banks were shut for exactly the same reason." - Dr Pippa Malmgren

"The whole system is going down. Pull your money out your Fidelity account, your Schwab account, and your ETFs." - Gerald Celente (again)

- both quoted here.

"Odds of a big market breakdown are both high and rising." - Mish.

... and balloons...

"The bottom line is that apparently some warehouses and bullion dealers are not a safe place to store your gold and silver, even if you hold a specific warehouse receipt." - Jesse (17 Dec 2011)

This gels with a recent post by David Malone, where he discusses a little-known rider to the (US) Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. The amendment concerned overrides bankruptcy protection protocols that are designed to treat creditors equally, such that if Bank A has "repo" or derivatives contract business with Bank B, and Bank B fails (or is forced into failure...), Bank A can grab the collateral straight away, not waiting for the trustee to sort out who gets what.

And if some of that collateral is money or other valuables you (an innocent third party) deposited with Bank B, hard luck, it seems.

Ostensibly, this legislation was to prevent systemic collapse as Bank B's failure could make Bank A insolvent, then subsequently Banks C and D etc. But, as Malone points out, it's also potentially an invitation to stronger (or at least, public-money-supported) banks to tip weaker ones into insolvency and grab assets, leaving other creditors to sue for their return (if they can afford to do so). Possession is nine points of the law, as the adage goes. Apparently, this deadly revision is written into banking legislation beyond America's shores.

In turn, that reminds me of something Malone wrote back in October, reporting what a top Irish banker said to him, off the record:

"According to this very senior banker it was now known that the plan was all but agreed to re-capitalize all the banks but to the very minimum degree. France and Germany were agreed on this. As I wrote before I left, there has been a bidding war looking for the lowest amount.

"The horse trading and arguing is of a quite different nature.What is being thrashed out is a list, for use after this across the board, minimum bail out, of which banks will be saved and which will be left to die when they next have a problem. The horse trading is over who will be saved and who damned.

"In other words the decision has been reached that this is the last pan-Europe, all bank bail out attempt. After this it is recognized that Europe and the IMF cannot save all the banks. And so only the most systemically vital are going to be saved and the rest will be allowed to save themselves if they can or die if they cannot."

It's possible that a vicious internecine cannibalism is about to commence in the international banking industry, and plenty of innocent bystanders could suddenly find they're hurt.

Little wonder, then that even bankers have started to hoard food.

Further update (27 December - hat-tip to Jesse): Gonzalo Lira writes...

Now, question: When is there ever a panic? When is there ever a run on a financial system?

Answer: When enough participants no longer trust the system. It is the classic definition of a tipping point. It’s not that all of the participants lose faith in the system or institution. It’s not even when most of the participants lose faith: Rather, it’s when a mere some of the participants decide they no longer trust the system that a run is triggered.

And though this is completely subjective on my part—backed by no statistics except scattered anecdotal evidence—but it seems to me that MF Global has shoved us a lot closer to this theoretical run on the system.

As I write this, a lot of investors whom I know personally—who are sophisticated, wealthy, and not at all the paranoid type—are quietly pulling their money out of all brokerage firms, all banks, all equity firms. They are quietly trading out of their paper assets and going into the actual, physical asset.

Note that they’re not trading into the asset—they’re simply exchanging their paper-asset for the real thing.

Why? MF Global.

More... 2 January: James Howard Kunstler's 2012 forecast...

There are signs that a lot of people who still have something resembling money invested in various funds will go to cash in the weeks ahead, including under-the-mattress style. The distrust and paranoia is palpable now, with the frenzies of Yuletide bygone for another year. After all, why trust banks, especially the TBTF monsters. Such a mass move could take the starch even out of highly manipulated equity markets.

___________________________________________________________________________

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

“You can’t trust anybody and the entire system is collapsing. What’s the takeaway from this? It’s to make sure you have every penny in your pocket.”

Gerald Celente, Trends Research Institute founder, following the disappearance of his six-figure holdings at MF Global shortly before he was due to take delivery of physical gold. More here.

Update: and the chorus swells...

"It is up to you to decide how much you're willing to risk losing to a crook. If the answer is "none" or you cannot reduce the at-risk portion of your assets to what you're willing to lose to fraud then you can no longer participate in the market at all, in any form, nor even do business with a bank." - Karl Denninger.

"Now may be the time to exit all arrangements not specifically guaranteed directly by the government, and bring your money home. And better yet if no guarantees are required, and no parties standing between you and your wealth." - Jesse.

... and swells...

"Ultimately, I will not be at all surprised to see Europe’s banking system shut for days while the losses and payments issues are worked out. People forget that the term “bank holiday” was invented in the 1930’s when the banks were shut for exactly the same reason." - Dr Pippa Malmgren

"The whole system is going down. Pull your money out your Fidelity account, your Schwab account, and your ETFs." - Gerald Celente (again)

- both quoted here.

"Odds of a big market breakdown are both high and rising." - Mish.

... and balloons...

"The bottom line is that apparently some warehouses and bullion dealers are not a safe place to store your gold and silver, even if you hold a specific warehouse receipt." - Jesse (17 Dec 2011)

This gels with a recent post by David Malone, where he discusses a little-known rider to the (US) Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. The amendment concerned overrides bankruptcy protection protocols that are designed to treat creditors equally, such that if Bank A has "repo" or derivatives contract business with Bank B, and Bank B fails (or is forced into failure...), Bank A can grab the collateral straight away, not waiting for the trustee to sort out who gets what.

And if some of that collateral is money or other valuables you (an innocent third party) deposited with Bank B, hard luck, it seems.

Ostensibly, this legislation was to prevent systemic collapse as Bank B's failure could make Bank A insolvent, then subsequently Banks C and D etc. But, as Malone points out, it's also potentially an invitation to stronger (or at least, public-money-supported) banks to tip weaker ones into insolvency and grab assets, leaving other creditors to sue for their return (if they can afford to do so). Possession is nine points of the law, as the adage goes. Apparently, this deadly revision is written into banking legislation beyond America's shores.

In turn, that reminds me of something Malone wrote back in October, reporting what a top Irish banker said to him, off the record:

"According to this very senior banker it was now known that the plan was all but agreed to re-capitalize all the banks but to the very minimum degree. France and Germany were agreed on this. As I wrote before I left, there has been a bidding war looking for the lowest amount.

"The horse trading and arguing is of a quite different nature.What is being thrashed out is a list, for use after this across the board, minimum bail out, of which banks will be saved and which will be left to die when they next have a problem. The horse trading is over who will be saved and who damned.

"In other words the decision has been reached that this is the last pan-Europe, all bank bail out attempt. After this it is recognized that Europe and the IMF cannot save all the banks. And so only the most systemically vital are going to be saved and the rest will be allowed to save themselves if they can or die if they cannot."

It's possible that a vicious internecine cannibalism is about to commence in the international banking industry, and plenty of innocent bystanders could suddenly find they're hurt.

Little wonder, then that even bankers have started to hoard food.

Further update (27 December - hat-tip to Jesse): Gonzalo Lira writes...

Now, question: When is there ever a panic? When is there ever a run on a financial system?

Answer: When enough participants no longer trust the system. It is the classic definition of a tipping point. It’s not that all of the participants lose faith in the system or institution. It’s not even when most of the participants lose faith: Rather, it’s when a mere some of the participants decide they no longer trust the system that a run is triggered.