Sunday, December 18, 2011

Trust is breaking down wholesale, hoarding has begun - UPDATED 02 Jan 2012

“You can’t trust anybody and the entire system is collapsing. What’s the takeaway from this? It’s to make sure you have every penny in your pocket.”

Gerald Celente, Trends Research Institute founder, following the disappearance of his six-figure holdings at MF Global shortly before he was due to take delivery of physical gold. More here.

Update: and the chorus swells...

"It is up to you to decide how much you're willing to risk losing to a crook. If the answer is "none" or you cannot reduce the at-risk portion of your assets to what you're willing to lose to fraud then you can no longer participate in the market at all, in any form, nor even do business with a bank." - Karl Denninger.

"Now may be the time to exit all arrangements not specifically guaranteed directly by the government, and bring your money home. And better yet if no guarantees are required, and no parties standing between you and your wealth." - Jesse.

... and swells...

"Ultimately, I will not be at all surprised to see Europe’s banking system shut for days while the losses and payments issues are worked out. People forget that the term “bank holiday” was invented in the 1930’s when the banks were shut for exactly the same reason." - Dr Pippa Malmgren

"The whole system is going down. Pull your money out your Fidelity account, your Schwab account, and your ETFs." - Gerald Celente (again)

- both quoted here.

"Odds of a big market breakdown are both high and rising." - Mish.

... and balloons...

"The bottom line is that apparently some warehouses and bullion dealers are not a safe place to store your gold and silver, even if you hold a specific warehouse receipt." - Jesse (17 Dec 2011)

This gels with a recent post by David Malone, where he discusses a little-known rider to the (US) Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. The amendment concerned overrides bankruptcy protection protocols that are designed to treat creditors equally, such that if Bank A has "repo" or derivatives contract business with Bank B, and Bank B fails (or is forced into failure...), Bank A can grab the collateral straight away, not waiting for the trustee to sort out who gets what.

And if some of that collateral is money or other valuables you (an innocent third party) deposited with Bank B, hard luck, it seems.

Ostensibly, this legislation was to prevent systemic collapse as Bank B's failure could make Bank A insolvent, then subsequently Banks C and D etc. But, as Malone points out, it's also potentially an invitation to stronger (or at least, public-money-supported) banks to tip weaker ones into insolvency and grab assets, leaving other creditors to sue for their return (if they can afford to do so). Possession is nine points of the law, as the adage goes. Apparently, this deadly revision is written into banking legislation beyond America's shores.

In turn, that reminds me of something Malone wrote back in October, reporting what a top Irish banker said to him, off the record:

"According to this very senior banker it was now known that the plan was all but agreed to re-capitalize all the banks but to the very minimum degree. France and Germany were agreed on this. As I wrote before I left, there has been a bidding war looking for the lowest amount.

"The horse trading and arguing is of a quite different nature.What is being thrashed out is a list, for use after this across the board, minimum bail out, of which banks will be saved and which will be left to die when they next have a problem. The horse trading is over who will be saved and who damned.

"In other words the decision has been reached that this is the last pan-Europe, all bank bail out attempt. After this it is recognized that Europe and the IMF cannot save all the banks. And so only the most systemically vital are going to be saved and the rest will be allowed to save themselves if they can or die if they cannot."

It's possible that a vicious internecine cannibalism is about to commence in the international banking industry, and plenty of innocent bystanders could suddenly find they're hurt.

Little wonder, then that even bankers have started to hoard food.

Further update (27 December - hat-tip to Jesse): Gonzalo Lira writes...

Now, question: When is there ever a panic? When is there ever a run on a financial system?

Answer: When enough participants no longer trust the system. It is the classic definition of a tipping point. It’s not that all of the participants lose faith in the system or institution. It’s not even when most of the participants lose faith: Rather, it’s when a mere some of the participants decide they no longer trust the system that a run is triggered.

And though this is completely subjective on my part—backed by no statistics except scattered anecdotal evidence—but it seems to me that MF Global has shoved us a lot closer to this theoretical run on the system.

As I write this, a lot of investors whom I know personally—who are sophisticated, wealthy, and not at all the paranoid type—are quietly pulling their money out of all brokerage firms, all banks, all equity firms. They are quietly trading out of their paper assets and going into the actual, physical asset.

Note that they’re not trading into the asset—they’re simply exchanging their paper-asset for the real thing.

Why? MF Global.

More... 2 January: James Howard Kunstler's 2012 forecast...

There are signs that a lot of people who still have something resembling money invested in various funds will go to cash in the weeks ahead, including under-the-mattress style. The distrust and paranoia is palpable now, with the frenzies of Yuletide bygone for another year. After all, why trust banks, especially the TBTF monsters. Such a mass move could take the starch even out of highly manipulated equity markets.

___________________________________________________________________________

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Saturday, December 17, 2011

Even bankers are hoarding food

‘It is not “crazies” buying this,’ says James Blake, whose company Emergency Food Storage specialises in freeze-dried foods. ‘We get a lot of high-powered business people as customers. Most people buy insurance for their health, their house or their life — this is food insurance.

‘Of course, we hope it never happens, but if there is a major catastrophe, then money is not going to be worth much after a couple of days. It will be food that becomes the most needed thing.’

Dave Hannah and his company B-Prep sell similar products. He says a number of his customers are bankers. Their average spend is £3,000.

Tuesday, December 13, 2011

The bank runs are starting

Weekend rumours that Swedbank was facing legal and liquidity problems in Estonia and Sweden sent thousands of Latvians to bank machines on Sunday, with some lines reaching as many as 50 people."

"... the outflow of funds from Greek bank accounts has been accelerating rapidly. At the start of 2010, savings and time deposits held by private households in Greece totalled €237.7 billion -- by the end of 2011, they had fallen by €49 billion. Since then, the decline has been gaining momentum. Savings fell by a further €5.4 billion in September and by an estimated €8.5 billion in October -- the biggest monthly outflow of funds since the start of the debt crisis in late 2009."

Quoted in The Economic Collapse Blog (see point 16 in that post)

This combination of distrust of banks with raids on savings to support normal expenditure is reflected here in the UK. I know of a British financial journalist who is starting to hoard cash, and ING's third quarter report on savings shows that the ordinary person's cash reserves are continuing to decline:

In a technical article (which I confess I find difficult to fathom - draw me a picture, somebody!), Tyler Durden looks at desperate attempts by the Federal Reserve and others to pump money into the economy as fast the "shadow banking" system is losing it.

We appear to be in a mighty conflict between the forces of deflation and inflation. A miscalculation one way will give us full-scale economic depression, and the other way will result in hyperinflation (followed closely by economic depression). The balance has to be got exactly right, and if our leaders, bankers and economists were clever enough to achieve that we wouldn't be in this situation in the first place.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Monday, December 12, 2011

Down with France, says Chinese rating agency

Sunday, December 11, 2011

Why David Cameron deserves no credit whatever for his EU veto

Blinded by their doctrinaire EU-federalism, they failed to see that they were pushing the British PM into a place where he simply cannot go. His Party has been split for decades on the Europe issue and even the Opposition Labour Party is divided (though at pains to conceal this so as to increase the Conservatives' fratricidal anguish), much of the electorate that has sufficient education and intelligence to take an interest is in favour of leaving the EU altogether, and thanks to the financialisation of our economy, we need the City because taxing its thieves is what is keeping our gunwales above the waterline.

When the French and German Sir Humphreys are finally allowed to talk some sense into their masters' hot heads, there will be another deal offered. My guess is a temporary derogation for the City from the proposed tighter regulations - perhaps five years, or until some round-figure year such as 2020.

Or, if the French wish to get in another dig, 18th June 2015. The rationalists of the Revolution are more superstitious than the religious they despise, and the bicentenary of Waterloo would afford them a satisfying symbolic revenge. It would be like Hitler's decision to have the French sign the second armistice at Compiègne in 1940, in the same railway carriage where the Germans had to sign their surrender in 1918.

This regulostice would allow time for our pinstriped crooks either to filch what's needed for a comfortable early retirement, or to find positions on the Bourse, the Börse and (of course) the Far Eastern (and maybe Australian) exchanges where all the exciting action of the future will be centred. And the British politicians and their placemen will doubtless reap their Quisling rewards in Brussels and Strasbourg.

At any rate, cancel the flags, bunting and bands.

Sunday, November 27, 2011

CONFIRMED: America turns fascist, 200 years of history is tipped into the harbour - UPDATED

UPDATE: looks like it's really going to happen.

Congress seems set to do what King George would dearly have loved to be able to do.

If "government of the people, by the people, for the people" shall "perish from the earth", then never mind Britain becoming the 51st State, let the US become Britain's 87th county - its largest, but who cares, neither of us has been a democracy for a while now, so it's not as though your puny vote makes a difference. And you don't understand tea any more, so the tax shouldn't matter, either.

You are now ruled by a wealthy aristocracy who regard most of you as servants, mendicants or gallows-fodder. Whenever you look like causing trouble you are sent overseas to busy yourselves in armed conflict. The rich delegate the running of their estates to ruthless managers and spend their time in fashionable salons close to power, where they lobby for yet more liberty for themselves and the enslavement of all others.

Just like us. And just like the eighteenth century.

Esau, you fool.

Saturday, November 26, 2011

Gender, obedience and the education system

There is a famous experiment by the Yale psychologist Stanley Milgram, who wanted to test whether the Holocaust criminals' excuse "I was only obeying orders" was a true reflection of their feelings at the time. In 1961, he got volunteers to administer what they believed to be electric shocks of increasing intensity, to a human victim (who was merely acting). Disturbingly, some two-thirds of volunteers ultimately inflicted the highest-voltage "shock", despite misgivings, when reassured or ordered by an authority figure wearing a white coat.

I knew about that, but not until tonight, reading Richard Wiseman's "Quirkology", did I learn of a follow-up experiment, conducted some 10 years later. A flaw in the first test was that some participants may have correctly suspected that the man being given shocks was an actor; so researchers Charles Sheridan and Richard King repeated the experiment, using a live puppy. The results, reported in 1972 in a paper entitled "Obedience to authority with an authentic victim", were equally disturbing, with a fresh twist: slightly over half the male volunteers had been willing to use the maximum voltage, but 100% of the women complied, even though some of the latter burst into tears.

Back to schools. Primary schoolchildren have long been taught mostly by female teachers, but now women make up 87.5% of the staff, and 28% of state primaries have no men teachers at all; and though when I started teaching men were the majority in secondaries, by 2008 the balance had shifted so that 59% the teaching staff there were women.

Some questions:

- How valid was the 1971 experiment, bearing in mind the small sample (26 people)?

- Has society changed since, so that the results would be very different if the same experiment were carried out today?

- Would it now make a difference depending on the gender of the white-coated superior? And would the results be affected by the whether or not the "boss" was the same gender as the volunteer?

- If women are indeed more obedient to authority than men, does this affect their expectations of obedience from the children, and how they react to a child's disobedience (or initiative)?

- Are male children equally obedient as female children? Should they be expected to be?

- Is men teachers' approach to obedience and conformity different from that of women teachers?

- Should the gender of the teacher be matched (or opposite) to the gender of the pupils, in single-sex classes?

- Is one gender better than another for teaching mixed-sex classes? And how about age groups?

- Do you, too, think it's better to keep your children from the hidden curriculum of schools?

What exactly is freedom?

I had a look at the US Prohibition story some time ago and it told quite a different story from what I'd always thought. I absolutely condemn these attempts at enforcement, but that's a story about the wickedness of power generally. As (I think) Charles Lamb said, "Governments are as bad as they dare to be."

But we are between Scylla and Charybdis. There is the power of government, and in resisting its excesses we may be tempted to assist the power of large corporations (which now appear to be growing mightier than the State and the People). The enemy of your enemy is not your friend - and in any case, corporations and the government are not mutually inimical after all: a career in politics often seems to be followed (if not accompanied at the time) by very lucrative dealings with the commercial sector.

And I have some doubts about Sartre-type definitions of freedom (he was very upset by Freud's theory of the unconscious). So here's some questions I want to repeat, from my comments over at the fine and idealistic people (no irony) at Orphans of Liberty:

- Is it freedom to fall victim to addictions?

- Or to allow powerful vested commercial interests to increase temptation and opportunity?

- Are we free if we merely act out compulsions, and other scripts written into our subconscious?

And bearing in mind that, as I said there, black people I know reckon the Establishment’s soft on drugs because it keeps the blacks down:

4. Is freedom just freedom for me, me, me or should Robinson Crusoe respect Man Friday, too?

Sartre thought there was no such thing as collective freedom, until the Paris student riots of 1968, and then suddenly he did think it. But that's what happens when a first-class brain is faced with more than one thing it wants to believe.

Friday, November 25, 2011

Sir Philip Green and homing chickens

However, if, in the economic downturn, turnover and profits are savaged, and tangible assets decline sharply in value, and Arcadia becomes very weak, or even goes bust, what will Peston say then? Arcadia Group employs 27,000 people; was it really OK, other than in a strictly legal sense, to put such a heavy yoke around its neck? Had the dividend not been paid - and especially, not been funded by humungous bank loans - what more might the group have achieved?

This "value-skimming" was the subject of adverse comment at the time, by The Independent newspaper.

Now, S'Philip threatens to close up to 260 shops and throw thousands out of work. He ascribes the problems to a number of factors, including "the climate". Richard Littlejohn is sceptical; anyone else feel the same way?

Where could Arcadia have got to today, without all those rocks in its panniers? It's still carrying £444.5 million of debts, according to the last accounts (which were reported in so upbeat a manner).

And as ever in our modern financial world, what A does, B suffers for. When the chickens come home to roost, it's not Sir Philip's head they'll be pooping on.

Nice place, Jersey (where wife Tina's Taveta Investments holding company is based); not so sure about Monaco, whose Monte Carlo district is described by AA Gill as "the sort of slum that rich people build when they lack for nothing except taste and a sense of the collective good" and where Tina is, technically, "domiciled". Where the physical Tina and her husband actually spend most of their time I can't say, but when it all turns sour I'm sure they won't be able to smell it.

Tuesday, November 22, 2011

Monday, November 21, 2011

Why I've been holding cash, for years - UPDATED - AGAIN... AND AGAIN!

Gerald Celente, Trends Research Institute founder, following the disappearance of his six-figure holdings at MF Global shortly before he was due to take delivery of physical gold. More here.

Update: and the chorus swells...

"It is up to you to decide how much you're willing to risk losing to a crook. If the answer is "none" or you cannot reduce the at-risk portion of your assets to what you're willing to lose to fraud then you can no longer participate in the market at all, in any form, nor even do business with a bank." - Karl Denninger.

"Now may be the time to exit all arrangements not specifically guaranteed directly by the government, and bring your money home. And better yet if no guarantees are required, and no parties standing between you and your wealth." - Jesse.

... and swells...

"Ultimately, I will not be at all surprised to see Europe’s banking system shut for days while the losses and payments issues are worked out. People forget that the term “bank holiday” was invented in the 1930’s when the banks were shut for exactly the same reason." - Dr Pippa Malmgren

"The whole system is going down. Pull your money out your Fidelity account, your Schwab account, and your ETFs." - Gerald Celente (again)

- both quoted here.

"Odds of a big market breakdown are both high and rising." - Mish.

... and balloons...

"The bottom line is that apparently some warehouses and bullion dealers are not a safe place to store your gold and silver, even if you hold a specific warehouse receipt." - Jesse (17 Dec 2011)

This gels with a recent post by David Malone, where he discusses a little-known rider to the (US) Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. The amendment concerned overrides bankruptcy protection protocols that are designed to treat creditors equally, such that if Bank A has "repo" or derivatives contract business with Bank B, and Bank B fails (or is forced into failure...), Bank A can grab the collateral straight away, not waiting for the trustee to sort out who gets what.

And if some of that collateral is money or other valuables you (an innocent third party) deposited with Bank B, hard luck, it seems.

Ostensibly, this legislation was to prevent systemic collapse as Bank B's failure could make Bank A insolvent, then subsequently Banks C and D etc. But, as Malone points out, it's also potentially an invitation to stronger (or at least, public-money-supported) banks to tip weaker ones into insolvency and grab assets, leaving other creditors to sue for their return (if they can afford to do so). Possession is nine points of the law, as the adage goes. Apparently, this deadly revision is written into banking legislation beyond America's shores.

In turn, that reminds me of something Malone wrote back in October, reporting what a top Irish banker said to him, off the record:

"According to this very senior banker it was now known that the plan was all but agreed to re-capitalize all the banks but to the very minimum degree. France and Germany were agreed on this. As I wrote before I left, there has been a bidding war looking for the lowest amount.

"The horse trading and arguing is of a quite different nature.What is being thrashed out is a list, for use after this across the board, minimum bail out, of which banks will be saved and which will be left to die when they next have a problem. The horse trading is over who will be saved and who damned.

"In other words the decision has been reached that this is the last pan-Europe, all bank bail out attempt. After this it is recognized that Europe and the IMF cannot save all the banks. And so only the most systemically vital are going to be saved and the rest will be allowed to save themselves if they can or die if they cannot."

It's possible that a vicious internecine cannibalism is about to commence in the international banking industry, and plenty of innocent bystanders could suddenly find they're hurt.

Little wonder, then that even bankers have started to hoard food.

Sunday, November 20, 2011

It's not about the banks

Not all banks have misbehaved, but many of the largest now appear to be ruined enterprises, determined to take rest of us down with them. I cannot explain why our politicians have poured resources into these colanders, except in terms of self-interest as current or future workers for the money establishment.

The banks' self-absorption is assisted by news media such as the BBC, with e.g. their latest interactive infographic on the Eurodebt nexus. Here are some of the results, recast as a table - ranked by external debt to GDP:

The pundits' talk is of the PIIGS, yet after Ireland the next worst case - by a long way - is the UK.

The pundits' talk is of the PIIGS, yet after Ireland the next worst case - by a long way - is the UK.Something is wrong here. It's not the facts (though in a fiat currency world, I'm not quite sure what a financial fact is), it's the perspective: we're forgetting to look at the balance sheet, i.e. the net international investment position (NIIP). Leslie Cuadra did this on Financial Sense at the end of August, and it paints a rather different picture. Of the 40 major countries he surveyed, the US is at the bottom, and Spain next up. Greece's position is much better, scarcely worse than that of France. Hmmm...

Let's widen the view a bit further. Here are Cuadra's figures, reinterpreted in the light of the IMF's data on GDP (click to enlarge):

This arrangement chimes better with our level of concern, at least with four of the PIIGS; yet it leaves us wondering why democracy has suddenly been abolished in Italy. And why are we worrying about Japan, when she looks so good on these rankings?

This arrangement chimes better with our level of concern, at least with four of the PIIGS; yet it leaves us wondering why democracy has suddenly been abolished in Italy. And why are we worrying about Japan, when she looks so good on these rankings?It would seem that there is no one picture that tells the whole story. And that, I would suggest, is because there are many stories, many competing agendas. There's a sort of economic Great Game going on, with a full cast of tyrants, traitors, spies, revolutionaries and dumb foot-soldiers pepper-spraying harmless women. It is a time of great and unpredictable change, which is why gold has soared and the people are stocking their cellars and buying ammo faster than it can be made.

An increasing concern, for me at least, is that the system (if it is a system) may not be able to contain this degree of instability, or at least, some parts of it are more vulnerable to fluctuation than others . If I may offer a pictorial analogy?

Equilibrium can be achieved at many different energy levels, and this has implications for the participants. If one of the mice hops off, there may be no effect at all, given the friction in a real-life device. But if Jumbo dismounts abruptly, Nellie will be lucky to avoid a broken leg, not to mention a possible smashed plank. And if Jumbo then playfully steps on one end of seesaw A, we're looking at a mouse in temporary low orbit, which is pretty much what happened in Iceland, Ireland and Greece.

Equilibrium can be achieved at many different energy levels, and this has implications for the participants. If one of the mice hops off, there may be no effect at all, given the friction in a real-life device. But if Jumbo dismounts abruptly, Nellie will be lucky to avoid a broken leg, not to mention a possible smashed plank. And if Jumbo then playfully steps on one end of seesaw A, we're looking at a mouse in temporary low orbit, which is pretty much what happened in Iceland, Ireland and Greece.Similarly, economic interconnectedness carries asymmetric potential perils, as shown in the table below, which uses the latest NIIP figures from the IMF's database (click to enlarge). For a small economy like Greece, a trifling sum such as $100 billion (a mere seventh of a TARP) represents around a third of national GDP, whereas the same sum is only about 3% of Germany's - chump change, almost. So it would be very easy for rich countries to forgive quite a lot of the debts of poor ones, and very beneficial for the recipients, especially those who have liabilities far exceeding their assets.

It would also be interesting to know to what degree, and in what ways, countries like Germany have benefited from tying peripheral European nations into the Eurozone. Perhaps it would be incautious of them to overplay, or over-rely on, the Protestant work ethic story in accounting for their dominance.

But the international web of finance has a further danger, for large and small economies alike. Those who are balancing mice, such as Russia (or even China, come to that) would not suffer a massive alteration to their NIIP/GDP ratio if asset or liability valuations changed by a few per cent; whereas a 10% valuation change for the UK means a boost or hit of two-thirds of GDP. Compare that with Austria, which has about the same negative NIIP in GDP terms, but which is balancing smaller figures.

One invests to get a return, and unless it's an in-and-out speculation the return is in the form of interest, dividends or rent. If your assets suddenly shrink - say because of relative movements in currencies - your income stream is pinched; if your liabilities swell, your outgoings become more burdensome. Clearly, Britain is exceptionally vulnerable to exchange rate fluctuations; but to a lesser extent, so are other countries such as Germany.

With share speculation, the growing volatility in the system can be insanely profitable for the gamblers - whose activities, far from being part of the steadying mechanism, may instead become a feedback loop that ends up smashing the engine. Andrew Haldane's July 2011 presentation to the Bank of England ("The race to zero") warned that as program trading in equities develops it will, mathematically, lead to more and worse "flash crashes".

But the bond market is much bigger, and the derivatives market is maybe 20 times world GDP. Never mind elephants, this is more like balancing two pods of blue whales. There's no room for error and there must be a political will to de-escalate. Sadly, I don't see it happening, yet. And it won't, so long as we think that the banks must be saved at all costs, together with their trading rooms.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Saturday, November 19, 2011

Three cheers for Western democracy - CORRECTED

A naughty trespasser gets what's coming to her.http://www.newser.com/story/133682/police-pepper-spray-occupy-portland-protester-elizabeth-nichols.html

A naughty trespasser gets what's coming to her.http://www.newser.com/story/133682/police-pepper-spray-occupy-portland-protester-elizabeth-nichols.htmlCORRECTION: ... is offered a sample of a "food product"

43 years earlier...

But we have made progress. So many more channels these days. X Factor or Strictly, love?

Tuesday, November 15, 2011

Concentration camp liberation

Monday, November 14, 2011

Economic treason, zombies and village idiots

This, despite targets being set for lending to small businesses. I've just heard an interview on the News at One (Radio 4) with someone from one of the zombie UK banks, Lloyds. Under February's "Merlin project" agreement, gross lending to business was supposed to increase by £190 billion this year; the banks are on target to do so, but are not meeting their quota for small enterprises.

And there's fudging going on. The smart R4 interviewer said there are rumours that banks have been cancelling existing loans early and replacing them with fresh ones, so as to appear to comply with gross targets; the Lloyds spokesman dodged that point with a weak assertion that net lending had increased (he didn't specify by how much). And that's net lending to businesses, not net lending to the private market overall, so I shall be interested to see the M4 figures to December, when they are released.

Meanwhile today Marc Faber gave an interview on Bloomberg (see below), in which he said that current US policy is to keep interest rates at rock bottom until the unemployment rate drops below 7.5%. Faber cast doubt on this plan, observing that America now has a very large pool of unskilled people and that there may be a long-term 10% unemployment rate. He compared this to the Middle Ages, when there were economically-dependent "village idiots" all over the place.

(I give the link below, because the embedded video autoplays, which is irritating.)

http://bloom.bg/sI9WmW#ooid=xzZzgwMzouQa6FhZ4bE4b-YoI7IO8ztG

This is where the calculations of politicians have gone wrong. Imported un/semi-skilled labour (often exploited and brutalised, from what I read about the UK food industry) and foreign-outsourced industrial labour may have benefited the businesses concerned, but keeping large numbers of our fellows unemployed has rotted their skillsets, morale and work habituation, not to mention their health and family relationships. There is also a growing element of the service sector devoted to patching the damage - policing, law, social services, benefit payments, health services, special education for the children and so on.

There is a level of incompetence that is criminal; and if some of these effects were reasonably foreseeable, it could be argued that some of our leaders should be impeached for economic treason, under the category of "high crimes and misdemeanours".

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Could we see a Chinese Welfare State introduced as a demand-booster?

Karl Gerth

http://bostonglobe.com/ideas/2011/11/05/from-made-china-bought-china/BmgUYiFGqPpEUgTntPZG6H/story.html

Was China's money turned down by the EU because of IP worries?

http://www.dailymail.co.uk/debate/article-2054888/Eurozone-debt-crisis-Cosy-China-EU-bailout-peril.html

China already has a hard-working, increasingly skilled and very cheap workforce, has bought in or built up factories and tools, and is securing industrial supplies around the world, especially in Africa. Once she has all the important know-how of the West, I have no idea what our people will live on.

This is why we must purge debt on a massive scale, so that the rebalancing between world workforces will not be absolutely catastrophic.

Sunday, November 13, 2011

History: the testosterone cycle

I'm not going to get too numerological about this - the average age at marriage and/or first live birth varies over time - but I do wonder whether one important element in history is human physiology.

It's also odd that we speak of a "generation", as though humans bred en masse in seasons separated by many years, like cicadas. But I guess there's a certain age span between those just too young to have taken part in the last bash, and those just old enough to want to get into gangs and rumble in the next one.

Maybe Occupy Wall Street, St Paul's, Thessaloniki etc are just the pubertal stirrings of the next revolution, the quasi-Aldermaston-March preludes to the next mass mania.

2014, is my guess.

Tuesday, November 08, 2011

The money-lender's pleasant dream

Germany, Germany above everything,

Above everything in the world,

When, for protection and defence, it always

takes a brotherly stand together.

From the Meuse to the Memel,

From the Adige to the Belt,

Germany, Germany above everything,

Above everything in the world!

German women, German loyalty,

German wine and German song

Shall retain in the world

Their old beautiful chime

And inspire us to noble deeds

During all of our life.

German women, German loyalty,

German wine and German song!

Unity and justice and freedom

For the German fatherland!

For these let us all strive

Brotherly with heart and hand!

Unity and justice and freedom

Are the pledge of fortune;

Flourish in this fortune's blessing,

Flourish, German fatherland!

US Congress and insider dealing

I'm not sure whether it's the same situation in the UK Parliament. Insider trading only became illegal in Britain with the passage of the Companies Act (1980), but I don't know whether MPs themselves are allowed to use nonpublic information to enrich themselves.

Thursday, November 03, 2011

Harvard student rebellion

This may seem a bit abstruse, pipe-sucking and sock-suspendered, but until the world starts to work with a different model we're likely to make the same mistakes again.

Link: http://www.debtdeflation.com/blogs/2011/11/03/harvard-starts-its-own-paecon-against-mankiw/

(Blogger continues to disappoint in the matter of hyperlinks and general post editing.)

Wednesday, November 02, 2011

Greece: CMA predicted 68% haircut a month ago

http://www.cmavision.com/images/uploads/docs/CMA_Global_Sovereign_Credit_Risk_Report_Q3_2011.pdf

UKIP leader Nigel Farage interprets the latest move by Papandreou as putting pressure on the EU to agree to a shorter haircut:

"He himself is in favour of the package but has no option but to offer this vote.

"If he failed to do so he would be railroading the Greek people into a situation where he will have mortgaged their democracy, their liberties and their freedom. He cannot do that without their permission. He must also be hoping that his brinkmanship will result in a better deal from Brussels. The calculation is clear."

http://www.ukipmeps.org/news_383_Aristotle-had-a-word-for-it.html

If so, it's a shrewd move, since (as Farage says) the EU has a long history of paying over the odds to realise and preserve their dream.

(Apologies for giving link addresses below quotes - Blogger has continuing problems which I hope they will sort soon.)

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Tuesday, November 01, 2011

Overheard in France

- Tais-toi, Nicolas, tu te fais du mal...

- This is not a f—ing democracy! How’d you say that in Greek?

- It is politics, surely you understand...

- I understand he’s got to be here right now!

- Sois raisonnable, Nicolas, arrangements will have to be made, it takes time.

- Eh bien, Cannes tomorrow, or else!

Will the truth about the "anti-capitalists" be heard? - Part 4

The latter was looking distinctly uncomfortable as he addressed the protesters in the last day or two (intimating that he shared their concerns but not their methods), and this is understandable when (reportedly) it was he who closed the doors of the Cathedral on "health and safety" grounds. I saw this as a PR ploy to put media pressure on the people outside, and I suggested the bluff should be called. Well, it's backfired anyhow, what with the Archbishop of Canterbury giving feline-subtle hints of support for the erstwhile Canon and leaving the Dean somewhat exposed.

Other spin may also bear re-examination: an audience member on BBC1's Question Time (Thursday night) challenged the media-spread allegation that most of the tents were empty at night, saying that the heat sensors were merely picking up the heat from tents that had gas burners going, and missing the body heat of other campers.

Have we - especially we bloggers - forgotten why the blogosphere has become such a significant forum? It's because of the biased, uncritical, gullible, lazy and perhaps even sometimes corrupt news reporting establishment.

Have we forgotten why the protestors are outside St Paul's, rather than Parliament, Downing Street or Threadneedle Street? It's because the might of the law is being used to squeeze dissent out of public spaces, with the - yes, I'd say it - evil misuse of legislation ostensibly introduced to combat organised criminal gangs and terrorists. Remember Brian Haw.

The subtext of mass reporting is that protest is OK as long as it's unobtrusive, out of the way and unheard. The more prominent element of the Fourth Estate has largely failed us, now that so many of them live in grand style and sup with the rich and powerful.

Thursday, October 27, 2011

European banking crisis news

Karl Denninger points out that if CDS contracts don't pay as and when expected, that uncertainty will be built into the price in future.

Marc Faber says that the fudging will continue until sovereign nations bust themselves. The delay will simply make things worse in the end.

Charles Hugh Smith agrees, and compares the "rescue" to a lifebuoy made of plutonium - lethally heavy and poisonous.

Austerity is not the solution, says David Malone, recalling an Irish TV programme host who embarrassed Minister of State Brian Hayes by comparing Ireland's 14% unemployment rate with Iceland's 7% rate. But crisis is coming anyway: the blogger says he has seen a document from ECFIN (the European Directorate for Economic Affairs), which forecasts that the Irish Treasury will run out of cash in March 2012 and so desperately needs the next instalment of the IMF/EU bailout.

In a separate post, Malone says a top Irish banker has told him that this Europe-wide general banking bailout is the last, and next time round selected banks will be saved and others allowed to go bust. I suppose the financial industry will place its bets accordingly, so watch for high volatility in bank shares in due course.

A propos, Reggie Middleton declares Bank of America (BAC) doomed. He also discusses moves by BAC derivatives traders to transfer contracts to a subsidiary that has a lot of depositors' cash, so if/when there is a major loss it will become a liability for the Federal Deposit Insurance Corporation. The FDIC won't have enough to cover and so Congress will be forced to commit more taxpayers' money, so the public will be on the hook again.

Matt Taibbi brilliantly and passionately maintains that it is this kind of outrageous cheating and cronyism, not inequality per se, that has caused people to occupy Wall Street and other places around the world.

Back to austerity, and profligacy as its supposed cause. Marshall Auerback and Rob Parenteau say it's not Greece's overspending that have caused their problem, but the failure to collect taxes, especially from the top 20%, the legacy of a deal between the rich and the military junta that ran the country not so very long ago. That sort of cosy arrangement between society's winners might ring a bell with Americans.

However, if we go down the deflationary route, it may not be quite so bad as feared, according to Ralph Musgrave, who says that a major component of consumer costs in a country is the cost of labour in that same country. So if wages are cut, prices will come down. And, he continues, international wage differentials aren't everything: is it not, perhaps, better to work shorter hours in Greece, than long hours in Germany?

That's not quite how I think things will go. As governments around the world are locked into asymmetric trading arrangements, the exporters have a strong incentive to keep their currencies pegged to those of the debtor countries, and meanwhile the debtors keep multiplying their stock of money in order to finance their health and welfare systems. Apparently there is not much relative currency movement, then.

But that is like skydivers linking hands as they fall. What cannot be increased at the same rate as the monetary base, is commodities,which is why Alasdair Macleod says "Commodity prices are reflecting the increased quantities of paper money and credit." He argues, as so many do now, for sound money. However, it's how you get there that matters. At the speed we're going, it will not be a blessing that the ground breaks our fall.

In the long run, as Faber and others have said so many times, fiat currencies tend to zero value. The path has many twists and I fear there may be a sharp banking dislocation before then, so as well as considering what physical things to put what cash we have into (and worrying about the degree to which their price is too high because of others' speculation), I also have to consider the merits of continuing to hold cash - and perhaps, a sensible supply of it outside the banking system.

The 1933 Congressional Finance Committee hearings, chaired by Senator Reed Smoot, heard testimony from Marriner S. Eccles, soon to become Chairman of the Federal Reserve. Eccles showed that the stock of money had declined, not merely because people had begun to hoard it but also (and even more so) because of a decline in the velocity of its circulation in the economy.

We are experiencing another such decline in velocity,which deficit the authorities are trying to supply by injections of extra liquidity. This is not working, partly because (Australian economist Steve Keen maintains, with the help of his computer model) giving it to the banks is far (by two-thirds) less effective than giving it directly to debtors.

Another reason for the failure is the very different circumstances in which we now find ourselves. In the 1930s, rafts of US banks had been allowed to go bust, yet there was plenty that needed doing and plenty of people and resources to do it. And there wasn't a huge overseas workforce that was set up to undercut any bid by local labour.

As far back as 1993, Sir James Goldsmith perceived that GATT put the West into the jaws of a trap, as he explained in a book with that title. He argued the case in a TV interview against a complacent Laura d'Andrea Tyson; much good it did him, or us, though she's still going strong, it seems. Goldsmith advocated a sort of regionalised protectionism, to allow the West to survive while the developing world caught up by trading with its peers.

Instead, the world market has been opened up rapidly, and (maybe this is why it was allowed to happen) made some almost inconceivably wealthy while withering so many others. By the way, this process is not necessarily good for the developing economies, either. And it may be the worse for the latter when the system unravels.

We're hearing much at present about Occupy Wall Street - and St Paul's in London, and more. As I've suggested in the previous post, it may be that people are beginning to understand (however fuzzily) that the emerging economies have been used as an instrument in the process of transferring wealth, not so much from West to East, as from below to above within the developed world. It's not the embassies they're picketing.

Economics is becoming politics. If there is not an honest debate soon, we are contemplating a class war begun from above, a struggle that mad, hate-filled Communists used to welcome because of the magically wonderful millenial age that would follow it - a theory to which I in no way subscribe.

If the world is to remain open, then wage rates will have to tend towards some global mean, and that will only be possible if vast quantities of debt are purged from the system. You cannot have sharply reduced wages while attempting to sustain high liabilities fixed in nominal terms. Unless inflation does the job for us; creditors will resist that vigorously, so it has to be debt forgiveness (or default, it doesn't matter). In a world where personal indebtedness hugely outweighs government debt, official austerity measures will, in my view, be either ineffective or (because of effects on consumer demand, welfare costs and tax revenues) actually counterproductive.

Since this consumer slump appears to coming our way faster than the emerging economies can develop regional demand to replace it, I think the East is in for at least as hard a landing as the West.

However, they have come so far in such a short time that they may be able to cope psychologically with the material setback. And with all the tools, factories and industrial knowhow we sold them, the sources of essential raw materials they have secured in e.g. Africa, and the skills base they have developed, I think the East will be the first to pick themselves up and that is when the balance of world economic power will be seen to have shifted suddenly and decisively.

Goodness knows what our 1% will do then, or the 99%.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

The West is eating itself

I think it's time to review who's really benefiting from globalisation. As I have said on that site:

Of course there's going to be widening inequality if the working class is undercut by foreign labour. This would happen even if the 1% didn't get richer.

But the dirty secret, I suspect, is not the economic destruction of the US (and UK, and just watch Europe) by outsiders, but the way that most of the international wealth transfer from globalisation has ended up where the money started.

James Kynge's book "China Shakes The World" says that only 15% of the end price goes to the Chinese manufacturers, the rest is captured by the middlemen - the importers, dealerships and supermarket owners.

America is cannibalising itself and throwing the bones abroad.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Wednesday, October 26, 2011

Will the truth about the "anti-capitalists" be heard? - Part 2

Yesterday's article by Matt Taibbi of Rolling Stone magazine says it all and more for the Occupy Wall Street protestors.

When you take into consideration all the theft and fraud and market manipulation and other evil shit Wall Street bankers have been guilty of in the last ten-fifteen years, you have to have balls like church bells to trot out a propaganda line that says the protesters are just jealous of their hard-earned money.

And then he goes on to detail what the protestors have reason to protest about. Truly a tour de force.

Please use the link above, or copy and paste this into your browser: http://www.rollingstone.com/politics/blogs/taibblog/owss-beef-wall-street-isnt-winning-its-cheating-20111025

Monday, October 24, 2011

Will the truth about the "anti-capitalists" be heard? - Part 1

The mainstream news media often seem to me like boastful, lying Rumour at the start of Shakespeare's Henry IV Part II:

The mainstream news media often seem to me like boastful, lying Rumour at the start of Shakespeare's Henry IV Part II: Open your ears; for which of you will stop

The vent of hearing when loud Rumour speaks?

I, from the orient to the drooping west,

Making the wind my post-horse, still unfold

The acts commenced on this ball of earth.

Upon my tongues continual slanders ride,

The which in every language I pronounce,

Stuffing the ears of men with false reports.

I speak of peace while covert enmity,

Under the smile of safety, wounds the world...

"St Paul's Cathedral, seat of the Bishop of London and the site of state funerals and other national celebrations, is a powerful top-down organisation. A tourist attraction charging an adult entry fee of £14.50, it takes around £16,000 a day from visitors. It has a hierarchy of clerical and non clerical staff and its trustees are a roll call of what are so often called 'the great and the good'. That many of them are bankers and financiers might be seen as more than a little unfortunate in the present stand-off."

This site gives details of the Chairman and Board of Trustees. It also gives a link to the 2010 accounts, where we find two further individuals who resigned last December: Barry Bateman, vice-chairman of Fidelity International Limited and a benefactor of Exeter University; and a Nigel Kirkup, who has moved on to the St George's Chapel at the royal castle of Windsor and about whom it is proving intriguingly difficult to find out much more.

The land on which the protestors have erected their tents belongs to St Paul's and in an interesting display of Christian anti-authoritarianism, Canon Giles Fraser told the police to move on. The Dean (who is on the Board of Trustees) felt forced "with a heavy heart" to close the Cathedral on Friday, and Canon Fraser seems to concur, while still maintaining that "financial justice is a gospel imperative."

This business of closing a world landmark because of "health and safety" considerations may be, on the face of it, not necessarily entirely apolitical - from either side.

I should like to see the protestors call that bluff - putting up red velvet ropes so that visitors could pass safely in and out of the Cathedral, which survived the Blitz and surely cannot be seriously threatened by the proximity of a few polythene tents.

In addition, perhaps the members of the Board of Trustees could be approached individually, to give their views on modern capitalism and how it has, or has not, benefited the community?

There's a smell about this, and it's not coming from the unwashed in their tepees.Why am I reminded of Brian Haw, who spent the last 10 years of his life shaming Parliament with his anti-war protest. Even more shamefully, the authorities tried various dodges in retaliation: Westminster Council claimed he was an obstruction, and the Speaker of the House tried to invoke mediaeval laws guaranteeing the "safe" passage of MPs. The then Home Secretary David Blunkett announced he would outlaw "permanent encampments" outside Parliament as well as the use of megaphones.

So the - may I call them swine? - attempted to get him under the fresh draconian legislation of the Serious Organised Crime and Police Act 2005, only to find that it didn't apply to Haw since his protest had started before that Act. But it does apply to any of us who might try the same kind of protest. Anything, anything is fair to spare those in power the slightest embarrassment.

This thing is the tip of an iceberg. There is a great battle joined for democracy against corrupt, wealthy tyrants, and these protestors are, perhaps, among the first of our "contemptible little army".

Saturday, October 22, 2011

Libya and the failure of British news

Am I alone in thinking that the West has just done things illegal and immoral in Libya, on the basis of lies and and half-truths told to us? Last night's BBC News had Jeremy Bowen and I-forget-who chatting away comfortably on location and the only question seemed to be whether getting Gadaffi killed had been (a) a good thing or (b) a very good thing.

These two gossiped agreeably like a latter-day Huntley and Brinkley. It would have been good to see the BBC fulfil its brief on balance and impartiality, for example by having one question the other's assertion that Lockerbie had been a Libya plot, rather than (say) an Iranian one, and asking why victim-father Jim Swire and Professor Emeritus of Scots Law Robert Black QC FRSE both feel that Abdelbaset Ali Mohmed Al-Megrahi is innocent and his trial a travesty of justice. Also, how a UN resolution to protect rebels in Misrata developed into NATO bombing raids on Sirte.

And why we got involved. EU empire-building? Securing Western oil supplies? Scaring the Saudis into withdrawing their support of Wahabi terrorism?

And what's going to happen next. Democracy? That's what Iranian students thought they'd get when they helped overthrow the Shah; instead they got a far harsher, fundamentalist government and Teheran's blood-fountain.

And why are we pretending to foster democracy abroad, in a week when all three major UK political parties are planning to instruct our Parliamentary representatives to vote against holding a referendum on the EU?

Saturday, October 08, 2011

Money velocity, not quantity, caused the boom'n'bust

Reading "Extreme Money", the acclaimed new book by Satyajit Das, has highlighted for me the importance of money velocity.

As Das so clearly demonstrates (pp. 78-80), the banks altered their mortgage lending model in recent years. Instead of lending money and then holding that mortgage to maturity, they would sell it on for a sum that included the discounted value of future interest payments. This returned bank capital and depositors' money more quickly, which made it available for a new loan. Turning the money over faster massively increased the ratio of net profit to bank capital, so that the yield on banking activities outstripped other, one might say more productive, forms of enterprise. It became almost the only game in town, so that the economy has been skewed towards sterile financial hocus-pocus, instead of providing and exchanging useful goods and services.

The system created a boom, which could only be sustained as long as borrowers could absorb the increased quantity of loaned money. Asset prices boomed as fools sold on to bigger fools, and poorer-quality borrowers were suckered into joining. But we seem to have reached the limit of this pyramid scheme, and having run out of expansion room, the velocity of money is dropping and attention then turns to quantity instead.

The question now being asked - again, since we are in the throes of QE3 - is whether pumping extra cash into banks will balance the equation. If Wikipedia (see "money velocity" link above) quotes him accurately, I think the answer was given more than sixty years ago, by Paul Anthony Samuelson:

In terms of the quantity theory of money, we may say that the velocity of circulation of money does not remain constant. “You can lead a horse to water, but you can’t make him drink.” You can force money on the system in exchange for government bonds, its close money substitute; but you can’t make the money circulate against new goods and new jobs.

Banks have been given contradictory instructions: lend more, and build up your reserves. No wonder they take government support cash and buy safe, interest-earning government bonds with it. Effectively, the government is funding the gradual repair of bank balance sheets; it would be quicker and more honest if Uncle Sam and John Bull simply gave them enough cash to do the job.

But even that might not get the banks lending again. Would you, in their position?

Let's assume for a moment, sophisticated investor, that you have decided to stop day-trading because there's an increasing probability in this shark market that the bigger fool may turn out to be you. What longer-term investment might act as a safe haven for your gains?

- Western manufacturing industry, with its high costs of labor and regulation?

- Eastern manufacturing industry, so dependent on the once-profligate but now financially distressed Western consumer?

- Industrial commodities, which have soared in the busy economic boom but also because of leveraged speculation?

- Western real estate? Yes, the price-to-income ratio is dropping - but we haven't yet seen the drop in incomes that will continue the downward trend in nominal terms - especially as the borrower finds more of his limited income going on food and energy bills.

- Emerging markets real estate? One for the specialists, such as Marc Faber.

- Bank shares and sovereign debt? Junk bonds? Isn't that what got us into this mess?

- Agriculture? Maybe.

- Gold? Maybe - but what a rise it's seen in the last few years.

- Cash? Inflation isn't hitting everything - big-ticket items have gotten cheaper in real terms for decades. Here in the UK my first new compact car cost me £6,000 in 1989 and I could get another for that price now, with higher specifications. If you can pay your living expenses from income, maybe cash isn't such a crazy option.

For the way our governments (US/UK) are seeking to shore up the system doesn't look destined to work. The increased quantity of money, now used so cautiously and unproductively by the banks, is not going to offset the drop in velocity.

Later, if that money stays around and is not withdrawn quickly enough, then when we revive economic activity there will be a rush of general price inflation; but not, I think, for some years yet. Such inflation as we're seeing now has different causes and effects from the type we saw before, and has more to do with physical supply and demand rather than monetary expansion.

So some experts are predicting "troubles ahead", "unprecedented velocity collapse", a "double dip recession", or even a breakdown that will make us envy simpler, more sustainable societies.

I don't go with that last, but then again, I don't expect my house to burst into flame and yet I still have smoke detectors and fire insurance; so I do think it's good to build up easily-accessible emergency reserves against the possibility of temporary disruption.

There is no royal road to predicting economic developments. All the charts in the world are no use when the powers that be decide something different really has to be done. The system is not a machine but a poker game, and a crooked one at that. So I expect the course of events to be determined by a negotiation between the interests of the powerful, which in our democracies also (to some small extent) includes us, the ordinary people.

For now, I'm still holding cash and government inflation-linked bonds, but if the consequences of deflation are too painful for the populace, then the rules may well alter. Maybe, in time, we will indeed get hyperinflation, even though these days the currency is managed in a very different way from that of Germany in 1923. Dr Faber noted recently that gold and bonds rose together, a counterintuitive phenomenon he analysed as arising from fear of systemic collapse. This fear may also explain why India and China (among others) are boosting their holdings of physical gold, which is supporting the price even as other commodities deflate.

But that time of game-changing crisis is not, I think, with us yet.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Saturday, October 01, 2011

Why "black swans" and "fat tails" happen more often than expected

The more system dynamics are repressed, the more likely it becomes that "improbable" events occur and "highly probable" trends dissolve or reverse.

What are the chances of frozen peas being embedded in your kitchen ceiling? Vanishingly small - unless one of them gets stuck in the escape valve of your pressure cooker, as happened to a neighbour of ours, years ago.

Tuesday, September 27, 2011

Anatomy of a Hedge Fund

That lead me to the following analysis:

A typical hedge fund manager gets a 20%/2% to run the fund, which means 20% of the annual profit, and 2% of the value of the fund.

Assume no tax dodges, so that the investors (including the manager) pay 15% Capital Gains tax on the annual gains (directly from the fund).

Being confident in his own abilities, the manager invests his after-tax income in the fund.

At the start of a year, the investors have $M_old in the fund, the manager has $m_old, and the fund gains r%.

Capital Gains tax on the investor money is $0.15*r*M_old, 20% of the after-tax gain goes to the manager, and remainder gets rolled into the investor funds. The manager then gets 2% of the total.

For the manager, his share of the fund increases by $r*m_old, of which $0.15*r*m is Capital Gains tax. He also gains the 20% of the after-tax investor gains, and 2% of the fund, on which he pays a 35% tax rate.

Thus, we have

M_new = (0.98)*(1+(0.8)*(0.85)*r)*M_old

m_new = (1+(0.85)*r)*m_old+(0.2)*(0.85)*r*M_old+(0.65)*(0.02)*(1+(0.8)*(0.85)*r)*M_old

What is the result?

If the fund gains 20% per year, it only takes 16 years for more than half of the money in the fund to belong to the manager. At 10%, it takes 23 years.

Christine Lagarde's alter ego

Viewers of ITV's Dickinson's Real Deal will have been struck by the similarity between Chelsea antiques dealer and former drag queen Ian Towning, and the recently-appointed Head of the IMF, Christine Lagarde. Are they perhaps related?

Monday, September 26, 2011

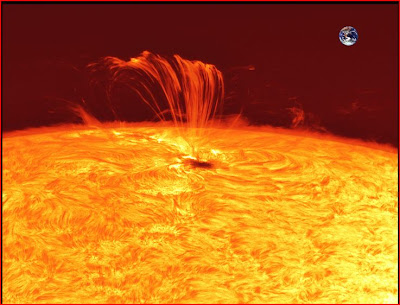

Solar Flare Warning - world leaders go into hiding?

This would not be without precedent: in 1859, the strongest recorded solar storm, known as the "Carrington Event", caused telegraph systems to fail or be shut down. But the world then did not have electronics, and water and power supplies did not depend on electrically-operated and computer-controlled machinery.

The facts of the sun's storm and ejection of vast quantities of charged particles appear to be corroborated by the amateur heliological website solarham.com:

... and elsewhere, e.g. spaceweather.com, and pictures of the flare from 22 September here (example below):

Implications:

Should we avoid going outside? Not clear: according to this Wiki article, ultraviolet light replenishes the ozone layer by splitting O2, so it is when the sun is "quiet" that the layer thins and more UV light penetrates to the Earth's surface. But there may be more UV health risk if you live in high northern latitudes, where the ozone layer is already thin or holed.

Indirectly, health and safety could be compromised by the failure of electrical systems that govern and provide for so much in our urban lives. Should we lay up extra water and cold food? It wouldn't hurt.

I like IPJ's idea of cowardy-custard politicians cowering in underground shelters; let's hope nobody superglues the locks.

Saturday, September 24, 2011

Humour: how the stockmarket works

CityUnslicker reproduces the following story; the earliest version online I can find is from 1st February 2001, but that references "Felix", which appears not to be the same-name student newspaper of Imperial College, London:

Once upon a time in a place overrun with monkeys, a man appeared and announced to the villagers that he would buy monkeys for $10 each. The villagers, seeing that there were many monkeys around, went out to the forest, and started catching them.

The man bought thousands at $10 and as supply started to diminish, they became harder to catch, so the villagers stopped their effort.

The man then announced that he would now pay $20 for each one. This renewed the efforts of the villagers and they started catching monkeys again. But soon the supply diminished even further and they were ever harder to catch, so people started going back to their farms and forgot about monkey catching.

The man increased his price to $25 each and the supply of monkeys became so sparse that it was an effort to even see a monkey, much less catch one.

The man now announced that he would buy monkeys for $50! However, since he had to go to the city on some business, his assistant would now buy on his behalf.

While the man was away the assistant told the villagers. 'Look at all these monkeys in the big cage that the man has bought. I will sell them to you at $35 each and when the man returns from the city, you can sell them to him for $50 each.'

The villagers rounded up all their savings and bought all the monkeys. They never saw the man nor his assistant again and once again there were monkeys everywhere.

Now you have a better understanding of how the stock market works.

______________________________________________

If you think this is an overly cynical view of the investment establishment, remember that it has been re-posted by a City insider.

Also, at an Oxford college reunion some years ago, long before the credit crunch, I was talking to a fellow graduate who was "something in the City" about my bearish views and my thought that the East might eventually take over the business of the Western exchanges. He boasted that the City was adept at swindling foreigners and would manage to do so for years to come.

I'm just putting that on record. Hubris?

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.