German energy policy has evolved scrappily, with unintended consequences aplenty. In particular it was (presumably) not foreseen that the very large amount of subsidised solar electricity-generation capacity would seriously distort the wholesale electricity market. This is greatly to the detriment of unsubsidised gas-fired power stations which would expect to make their money providing peak power during the middle part of the day, at prices commanding a premium over baseload (24/7) prices - a premium that has been substantially eroded by solar.

This situation could probably be sustainable if it were the end of the story. In logistical terms, after all, it is not fundamentally problematic to introduce a source of electricity that peaks at roughly the same time as demand (midday, in Germany's case). Unfortunately for German electricity consumers it is only the start of the tale. For on top of the solar capacity is another large new tranche of renewables - wind power. This is similarly subsidised and has a marginal cost close to zero. But far from having the predictable output of solar, it is of course subject to the vagaries of the wind. It has a similar distorting impact on the wholesale market as solar, but at essentially random times, creating a radically unstable market dynamic.

The purely physical aspects of the system problems caused by intermittent wind generation can generally be resolved with a combination of good engineering and operational practices, and enough money - provided the challenge is on a sufficiently limited scale. However, in Germany these problems are on a large and growing scale, and the patchwork of solutions available to grid operators is not robust.

It is fairly self-evident that a situation like this requires, inter alia, a lot of flexible power sources. The best solution is generally to access hydro-electricity. With sufficient quantities of water stored at the top of a hydro facility, it can respond literally in seconds when called upon to back up some deficiency in supply at short notice - the Danish solution (using Norwegian hydro).

Where, as in Germany, there is inadequate availability of hydro power, gas-fired plant is the obvious second-choice. It is not as flexible as hydro, but can nevertheless provide a useful contribution to flexibility requirements, albeit at sub-optimal efficiencies.

However, a market-based approach to bringing on flexible resources requires appropriate price-signals. As we have seen, for much of the time solar power undermines the key price signal, namely the premium of peak price over baseload price, by dint of which it is exactly gas-fired plant that has been rendered uneconomic. At the time of writing most German gas-fired plant lies idle; and no-one is building any more.

Imports from neighbouring countries therefore feature significantly in balancing the German grid - including hydro from Norway and Switzerland, when available, but predominantly nuclear (France), hard coal and lignite (Poland and the Czech Republic). We have noted the ironies before.

(Confusingly, Germany also sometimes exports power; and inevitably this is at times of wind and solar surges. Greens make great play of this, sometimes asserting it proves German energy policy is a roaring success. But total capacity was never the issue: it is achieving an efficient and reliable balance in the system at all times between naturally variable demand, and increasingly unpredictable supply.)

So if gas is uneconomic, and nuclear is being phased out, where will Germany source its reliable power ? Another key component in the mix (and another irony) is the large-scale building of new coal and lignite (brown coal) power plants within Germany itself. The ever-growing policy-driven renewables capacity seemingly cannot be halted: but at least the large German coal- and lignite-mining industries can support a new generation of highly efficient fossil-fuel plant. The cost of CO2-burning permits is at rock-bottom; coal is cheaper than gas and is still economic to burn; and a new plant operates at much greater efficiency and significantly lower emissions than the old coal-fired plant it replaces. Unfortunately it offers less flexibility than gas, but can make a contribution to this requirement also.

How much pleasure is derived by greens from the large programme of newbuild coal plants is anyone's guess; but it is how practical German power engineers are attempting to square the circle.

There is no guarantee they will succeed. The final piece in this series will consider the effects and the costs of dysfunctional German energy policy - and a warning to the rest of us.

READ ON:

PART FOUR (CONCLUSION)

PREVIOUS:

PART ONE

PART TWO

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Keyboard worrier

Thursday, January 17, 2013

Wednesday, January 16, 2013

Nick Drew: "Green" initiatives have contradictory effects

See our energy expert's latest squib here.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Nick Drew: "Green" initiatives have contradictory effects

See our energy expert's latest squib here.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Tuesday, January 15, 2013

The Only Solution Is My Solution

The following Grauniad headline gets my prize for best of 2013 so far:

Rogue geoengineering could 'hijack' world's climate

"Determining causation and quantifying impacts would be a massive challenge" !! Are they reading what they are writing ?

This piece first appeared on Capitalists@Work

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Rogue geoengineering could 'hijack' world's climate

"The deployment of independent, large-scale "geoengineering" techniques aimed at averting dangerous warming warrants more research because it could lead to an international crisis with unpredictable costs to agriculture, infrastructure and global stability, said the Geneva-based WEF in its annual Global Risks report"Haha ! They don't like it up 'em, Captain Mainwaring. But aside from 'independent' not fitting with 'dictated by the green lobby', what exactly is the problem ? Let's turn to the report:

"A long series of ethical, legal and scientific questions quickly arises about countless knock-on effects that might be much more difficult to assess ... Almost any change in weather and climate patterns is likely to create winners and losers, but determining causation and quantifying impacts on any given region or country would be a massive challenge."What, unintended consequences ? Well, b****r me ! That would be like, err, when you subsidise biofuels and discover that entire forests are being felled, and food-stocks diverted, for use as fuel ? Or when you subsidise solar power and find that your electricity grid can't cope ? Or when you implement 'green' policies and find that your CO2 emissions are rising ?

"Determining causation and quantifying impacts would be a massive challenge" !! Are they reading what they are writing ?

This piece first appeared on Capitalists@Work

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Saturday, January 12, 2013

Ancient underground city in Turkey!

Seen on Nourishing Obscurity: a fantastic, multi-level underground city that housed up to 10,000 people in siege times, a thousand years ago. Discovered only in 1963, when a Turkish man demolished an interior wall in his dwelling. Don't miss it!

Part 1

Part 2

Part 1

Part 2

Wednesday, January 09, 2013

Green energy can be a killer

When it comes to ecology, there are debates about evidence, and how reliable it may be.

Michael Crichton's 2004 sci-fi novel "State of Fear", which I read recently, shows how scientific data can be misleading or contradictory. For example, historic air temperature measurements in New York City seem to prove that the atmosphere is heating up; but figures over the same period from an instrument in rural New York State show the opposite. Some of the scientists in the book start with a quasi-religious belief in global warming and bend or discount counter-evidence. By the end of the story I was certainly more skeptical than when I started it, though that doesn't mean I was necessarily persuaded to "cross the floor". There's plenty still to argue about; for example, this internet essay offers a reexamination of some of the science in Crichton's book.

In fact, Crichton himself adds an author's note at the end, in which he gives his view that global warming probably is happening, and that human activity is probably contributing to it. His real point (other than entertainment) is to have us examine evidence more critically, and to watch out for the influence of a scientist's more personal motives - grants for research, career progression, public attention.

There are also debates to be had about competing values.

Most of the world's nations have ratified the 1997 Kyoto Protocol on "greenhouse gas" emissions reduction (in force eight years come next Wednesday). We're trying to do our bit to "save the planet": as part of the UK's 2011 Carbon Plan and 2009 Renewable Energy Strategy the Government has initiated the Renewable Heat Incentive. This encourages the burning of waste as a way of providing heat as well as disposing of rubbish. Sounds good, and there happens to be recently-contructed incinerator only a couple of miles away from me, in south Birmingham.

But it's not purely beneficial, as the readers' letters pages in The Oldie magazine point out. In response to TV personality Johnny Ball's lately-expressed support for incinerators, Michael Ryan of Shrewsbury (January 2013 issue) used ONS data to suggest a link between incinerator emissions and increased infant mortality. In the February issue (just out), Chris Butler of Borough Green in Kent writes in to say that the Public Health Observatory blames atmospheric particulates for 5.6% of mortality in England. (That's not to say that all the particles come from incinerators; nor that we'd live forever if the air was clean. But this London website quotes the same PHO figure and says it's worse in London: 6 - 9% of mortality so attributable.)

Mr Butler makes a second reference in the same letter, this time to the DECC's own July 2012 impact assessment of the Renewable Heat Incentive. This attempts to quantify in monetary terms the pros and cons of (a) doing nothing about incinerators' emissions and (b) introducing stricter rules. If the sums are right, the cost of extra regulation discounted back to today would be £420 million, but the benefits in terms of better health and reduced mortality are estimated at nearly £3 billion. (How are exactly are these figures calculated? What happens if the discount rate used (3.5%) is higher or lower? One can imagine the money-debate rattling on.)

And it can be very hard to apply money to values. How do we price health and life per se, apart from the cost of medical interventions, social security costs for the sick and so on? What counts as the best solution depends so much on what kind of, and the degree to which, "negative externality" is internalized into the calculation, if at all. For example, one of the externalities not assessed in this report is the impact on the ecosystem (see paragraph 33).

And one option is simply not to care at all. Stalin's view on externality was brutally simple: no man, no problem.

Not all particulates are equally hazardous, but none is deemed safe: "the World Health Organisation advise that there is no safe exposure level to P(articulate) M(atter)," says the DECC's report. The danger is not uniform in time, either, e.g. more dioxins are emitted at operational startup and shutdown than in mid-burn.

The damage caused by other pollutants is not yet completely known, and there are many of them: "Incinerator emissions are a major source of fine particulates, of toxic metals and of more than 200 organic chemicals, including known carcinogens, mutagens, and hormone disrupters," says this 2008 report by the British Society for Ecological Medicine. Perhaps the chemtrail conspiracy-hunters should turn their attention from the skies to their local waste tip.

What are the facts, then, and what are the relevant facts, and what values should we use in relation to them? There's so much uncertainty and room for disagreement that the precautionary principle might save us much ill-tempered controversy as well as, possibly, harm to life and health: let's simply make less waste in the first place.

Now to put out two large bags of washed plastic bottles, for tomorrow's binmen.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Michael Crichton's 2004 sci-fi novel "State of Fear", which I read recently, shows how scientific data can be misleading or contradictory. For example, historic air temperature measurements in New York City seem to prove that the atmosphere is heating up; but figures over the same period from an instrument in rural New York State show the opposite. Some of the scientists in the book start with a quasi-religious belief in global warming and bend or discount counter-evidence. By the end of the story I was certainly more skeptical than when I started it, though that doesn't mean I was necessarily persuaded to "cross the floor". There's plenty still to argue about; for example, this internet essay offers a reexamination of some of the science in Crichton's book.

In fact, Crichton himself adds an author's note at the end, in which he gives his view that global warming probably is happening, and that human activity is probably contributing to it. His real point (other than entertainment) is to have us examine evidence more critically, and to watch out for the influence of a scientist's more personal motives - grants for research, career progression, public attention.

There are also debates to be had about competing values.

Most of the world's nations have ratified the 1997 Kyoto Protocol on "greenhouse gas" emissions reduction (in force eight years come next Wednesday). We're trying to do our bit to "save the planet": as part of the UK's 2011 Carbon Plan and 2009 Renewable Energy Strategy the Government has initiated the Renewable Heat Incentive. This encourages the burning of waste as a way of providing heat as well as disposing of rubbish. Sounds good, and there happens to be recently-contructed incinerator only a couple of miles away from me, in south Birmingham.

But it's not purely beneficial, as the readers' letters pages in The Oldie magazine point out. In response to TV personality Johnny Ball's lately-expressed support for incinerators, Michael Ryan of Shrewsbury (January 2013 issue) used ONS data to suggest a link between incinerator emissions and increased infant mortality. In the February issue (just out), Chris Butler of Borough Green in Kent writes in to say that the Public Health Observatory blames atmospheric particulates for 5.6% of mortality in England. (That's not to say that all the particles come from incinerators; nor that we'd live forever if the air was clean. But this London website quotes the same PHO figure and says it's worse in London: 6 - 9% of mortality so attributable.)

Mr Butler makes a second reference in the same letter, this time to the DECC's own July 2012 impact assessment of the Renewable Heat Incentive. This attempts to quantify in monetary terms the pros and cons of (a) doing nothing about incinerators' emissions and (b) introducing stricter rules. If the sums are right, the cost of extra regulation discounted back to today would be £420 million, but the benefits in terms of better health and reduced mortality are estimated at nearly £3 billion. (How are exactly are these figures calculated? What happens if the discount rate used (3.5%) is higher or lower? One can imagine the money-debate rattling on.)

And it can be very hard to apply money to values. How do we price health and life per se, apart from the cost of medical interventions, social security costs for the sick and so on? What counts as the best solution depends so much on what kind of, and the degree to which, "negative externality" is internalized into the calculation, if at all. For example, one of the externalities not assessed in this report is the impact on the ecosystem (see paragraph 33).

And one option is simply not to care at all. Stalin's view on externality was brutally simple: no man, no problem.

Not all particulates are equally hazardous, but none is deemed safe: "the World Health Organisation advise that there is no safe exposure level to P(articulate) M(atter)," says the DECC's report. The danger is not uniform in time, either, e.g. more dioxins are emitted at operational startup and shutdown than in mid-burn.

The damage caused by other pollutants is not yet completely known, and there are many of them: "Incinerator emissions are a major source of fine particulates, of toxic metals and of more than 200 organic chemicals, including known carcinogens, mutagens, and hormone disrupters," says this 2008 report by the British Society for Ecological Medicine. Perhaps the chemtrail conspiracy-hunters should turn their attention from the skies to their local waste tip.

What are the facts, then, and what are the relevant facts, and what values should we use in relation to them? There's so much uncertainty and room for disagreement that the precautionary principle might save us much ill-tempered controversy as well as, possibly, harm to life and health: let's simply make less waste in the first place.

Now to put out two large bags of washed plastic bottles, for tomorrow's binmen.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

What Lessons From Germany and Denmark? [2]

If the Danish electricity sector is an unrepresentative model for most other nations to follow, by dint of its hard-to-replicate access to ultra-flexible hydro electricity from Norway, the Danes do at least seem to have a feasible (if expensive) structure in place. The same cannot be said of Germany, that other favourite exemplar of red/green advocates of renewable energy, which upon examination is a very odd model for them to be eulogising.

To summarise: Germany barely got through 2012 without serious blackouts; voltage has become highly unreliable in many parts of their complex grid system; heavily subsidised renewables have trashed the German wholesale power market; neighbouring markets are also suffering as a result of unpredictable surges of German wind-power exports; Germany is building a large number of big new coal- and lignite-fired power stations to cope; in the interim, they have become dependent on large-scale imports from some very dirty old lignite plants in Eastern Europe; and to crown it all, their CO2 emissions are increasing!

How has this come to pass?

On major issues like energy, German policy is generally framed by big, set-piece legislation that lays down what is in effect a national plan. The last coherent German energy plan dates back to the 1980s, and more recent policies have been layered on top in an ad hoc fashion. That's how it's often done in the UK and other countries, but for methodical Germany it is anomalous: and intelligent Germans view the resultant mess as inevitable.

The most recent nonsense was the sequence of on-off-on-off nuclear decisions, culminating in a post-Fukushima bombshell: the summary closure of a large part of the nuclear fleet. This was always going to leave a big gap to fill in a hurry - hence the immediate increase in imports, which naturally come from neighbours with surplus capacity: France (nuclear, of course), Poland and the Czech Republic (coal, some of it dreadfully polluting lignite). The ironies are obvious, and one hopes the anti-nuke greens are proud of themselves.

But the subtler and even less tractable issue is the unforeseen impact of large amounts of 'must take' wind- and solar-power, financed by whopping subsidies. (The electricity doesn't even need to be generated - the producer merely needs to install the plant. There are many windfarms in northern Germany that are completed but not connected to the grid - the system cannot accommodate them, and they lie idle - getting paid anyway.)

Key to the situation is that the marginal cost of wind- and solar-power is close to zero. Unsurprisingly, at times of the day when large quantities of zero-cost power are being fed into the grid (foisted on utilities who must take it, irrespective of its market value), the impact on the wholesale market price is to reduce it substantially - not just to zero, it sometimes actually goes negative, so that people are being paid to take power off the system

The timing of wind generation is notoriously unpredictable, but solar is straightforward: it peaks around noon. In Germany (though not in all countries) this at least coincides with peak demand. The impact on wholesale prices is clear.

One cannot fail to notice (a) demand rising to maximum at midday ('Volume' on the chart) which would 'normally' coincide with the highest hourly prices: but (b) a midday collapse in hourly price, which at 1pm is lower than at midnight ! The market price for 'peak' electricity as defined in the German/Austrian market (9 am to 8 pm) is now barely greater than for baseload (24-hour), meaning inter alia that no-one will see any incentive to build or run a plant designed to offer flexibility. In particular, it fundamentally undermines the economics of flexible gas-fired plant, which - since no subsidies are on offer to fossil fuels - needs a 'normal', undistorted day-time price to pay its way. And yet that is the very plant needed to balance the vagaries of wind generation !

Why this was not foreseen is a matter for conjecture. (Personally, I reckon - and have offered evidence elsewhere - that many Germans who should know better genuinely do not understand how markets work.) But of this we may be sure: its impact is highly destabilising.

READ ON:

PART THREE

PART FOUR (CONCLUSION)

PREVIOUS: PART ONE

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

To summarise: Germany barely got through 2012 without serious blackouts; voltage has become highly unreliable in many parts of their complex grid system; heavily subsidised renewables have trashed the German wholesale power market; neighbouring markets are also suffering as a result of unpredictable surges of German wind-power exports; Germany is building a large number of big new coal- and lignite-fired power stations to cope; in the interim, they have become dependent on large-scale imports from some very dirty old lignite plants in Eastern Europe; and to crown it all, their CO2 emissions are increasing!

How has this come to pass?

On major issues like energy, German policy is generally framed by big, set-piece legislation that lays down what is in effect a national plan. The last coherent German energy plan dates back to the 1980s, and more recent policies have been layered on top in an ad hoc fashion. That's how it's often done in the UK and other countries, but for methodical Germany it is anomalous: and intelligent Germans view the resultant mess as inevitable.

The most recent nonsense was the sequence of on-off-on-off nuclear decisions, culminating in a post-Fukushima bombshell: the summary closure of a large part of the nuclear fleet. This was always going to leave a big gap to fill in a hurry - hence the immediate increase in imports, which naturally come from neighbours with surplus capacity: France (nuclear, of course), Poland and the Czech Republic (coal, some of it dreadfully polluting lignite). The ironies are obvious, and one hopes the anti-nuke greens are proud of themselves.

But the subtler and even less tractable issue is the unforeseen impact of large amounts of 'must take' wind- and solar-power, financed by whopping subsidies. (The electricity doesn't even need to be generated - the producer merely needs to install the plant. There are many windfarms in northern Germany that are completed but not connected to the grid - the system cannot accommodate them, and they lie idle - getting paid anyway.)

Key to the situation is that the marginal cost of wind- and solar-power is close to zero. Unsurprisingly, at times of the day when large quantities of zero-cost power are being fed into the grid (foisted on utilities who must take it, irrespective of its market value), the impact on the wholesale market price is to reduce it substantially - not just to zero, it sometimes actually goes negative, so that people are being paid to take power off the system

The timing of wind generation is notoriously unpredictable, but solar is straightforward: it peaks around noon. In Germany (though not in all countries) this at least coincides with peak demand. The impact on wholesale prices is clear.

|

| Source: EPEX |

Why this was not foreseen is a matter for conjecture. (Personally, I reckon - and have offered evidence elsewhere - that many Germans who should know better genuinely do not understand how markets work.) But of this we may be sure: its impact is highly destabilising.

READ ON:

PART THREE

PART FOUR (CONCLUSION)

PREVIOUS: PART ONE

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Sunday, January 06, 2013

What Lessons from Germany and Denmark? [1]

Energy, like defence, is a topic where huge numbers of people seem to have strong views based on very little knowledge. If evidence is required, go to the Guardian’s Comment is Free website where almost any piece on an energy topic receives hundreds of comments exhibiting ignorance aplenty.

A favourite theme from the green/red camp is ‘what about Germany?’ or its close variant ‘if Denmark can do it, we can, too’. The ‘it’ in question is of course very large-scale renewable generation in both countries, which is taken to be triumphantly proving its worth there in quantities that put the UK to shame.

At the headline level, the statistics are striking. In the 1st half of 2012, renewables generated around 25% of Germany’s electricity, of which 9% was wind and 5% solar. (The balance is mostly biofuels, which greens are a bit more ambivalent about, but let that pass.) Denmark has reached 24% of electricity consumption being generated from renewables: and as a percentage of Denmark’s own generation, the figures are even more remarkable: over 40% is renewable, of which 28% is wind.

The difference between Denmark’s ‘24% of consumption’ and ‘40% of own generation’ immediately tips us off to an important additional factor – imports, or, more generally, cross-border electricity trade. Trade between interconnected countries is generally in either direction at different times, as advocates of free trade would hope and expect: wholesale electricity prices in one country will rarely be identical to those in a neighbour’s market, given different supply/demand dynamics, generation fleets, weather etc. Cross-border trade is the highly appropriate result.

In Denmark’s case the detailed pattern is complex: they do indeed export electricity some of the time but, as the figures suggest, they are generally substantial net importers. Wind turbines, of course, produce ‘intermittently’ (and relatively unpredictably): and anyone wishing to hold up Denmark’s renewables as an example for other nations should be aware that their significant amount of wind generation is only feasible because of the ease with which they are able to import the ultra-flexible hydro-power available from Norway. Attempting to balance the grid using their remaining indigenous sources - the largest of which is, yes, coal - would not be remotely economic, and in fact would probably not be feasible at any price (we will comment later on cost aspects.)

Wind plus hydro can be a feasible combination with which to satisfy electricity demand. Denmark, where this is achievable, doesn’t offer a model for countries where there is little or no hydro on tap (or, of course, some equally flexible alternative - of which there are very few indeed).

Germany’s import / export pattern is exceptionally complex, and changing all the time as the unexpected post-Fukushima decision, to shut down a significant portion of its nuclear capacity, is accommodated. But it is not hydro imports that make Germany an unconvincing model for other nations. Rather, it is the distinct possibility that Germany’s power system is not feasible at all.

Read on:

PART TWO

PART THREE

PART FOUR (CONCLUSION)

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

A favourite theme from the green/red camp is ‘what about Germany?’ or its close variant ‘if Denmark can do it, we can, too’. The ‘it’ in question is of course very large-scale renewable generation in both countries, which is taken to be triumphantly proving its worth there in quantities that put the UK to shame.

At the headline level, the statistics are striking. In the 1st half of 2012, renewables generated around 25% of Germany’s electricity, of which 9% was wind and 5% solar. (The balance is mostly biofuels, which greens are a bit more ambivalent about, but let that pass.) Denmark has reached 24% of electricity consumption being generated from renewables: and as a percentage of Denmark’s own generation, the figures are even more remarkable: over 40% is renewable, of which 28% is wind.

The difference between Denmark’s ‘24% of consumption’ and ‘40% of own generation’ immediately tips us off to an important additional factor – imports, or, more generally, cross-border electricity trade. Trade between interconnected countries is generally in either direction at different times, as advocates of free trade would hope and expect: wholesale electricity prices in one country will rarely be identical to those in a neighbour’s market, given different supply/demand dynamics, generation fleets, weather etc. Cross-border trade is the highly appropriate result.

In Denmark’s case the detailed pattern is complex: they do indeed export electricity some of the time but, as the figures suggest, they are generally substantial net importers. Wind turbines, of course, produce ‘intermittently’ (and relatively unpredictably): and anyone wishing to hold up Denmark’s renewables as an example for other nations should be aware that their significant amount of wind generation is only feasible because of the ease with which they are able to import the ultra-flexible hydro-power available from Norway. Attempting to balance the grid using their remaining indigenous sources - the largest of which is, yes, coal - would not be remotely economic, and in fact would probably not be feasible at any price (we will comment later on cost aspects.)

Wind plus hydro can be a feasible combination with which to satisfy electricity demand. Denmark, where this is achievable, doesn’t offer a model for countries where there is little or no hydro on tap (or, of course, some equally flexible alternative - of which there are very few indeed).

Germany’s import / export pattern is exceptionally complex, and changing all the time as the unexpected post-Fukushima decision, to shut down a significant portion of its nuclear capacity, is accommodated. But it is not hydro imports that make Germany an unconvincing model for other nations. Rather, it is the distinct possibility that Germany’s power system is not feasible at all.

Read on:

PART TWO

PART THREE

PART FOUR (CONCLUSION)

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Max Keiser and George Galloway: a deafening silence in the media

On 20th November, Max Keiser addressed a large audience in the Grand Committee Room in the Houses of Parliament, as the guest of George Galloway MP.

Galloway pointed out that this was the second largest public room in Parliament (the first had already been booked) and all MPs had been invited in writing, twice - yet none of them had turned up.

In some ways this is understandable: Galloway is "colourful" and, to me, something of an enigma, and his fellow Parliamentarians must have considered the risk of tainting by association.

Or worse, reputational entrapment: for although Keiser had strong criticisms to make of Gordon Brown's gold sale (1999 - 2002), which he said is the moment when Britain's independence was surrendered, he also laid the blame for the present crisis on the monetary expansion that began under Reagan and Thatcher. Additionally, he had harsh words to say about George Osborne and David Cameron, whom he sees as fighting for corrupt City interests. In the circumstances, MPs on both sides must have seen little political advantage in attending.

Yet there wasn't that much else on in Parliament on the evening of 20th November. The House of Commons Order of Business after 7 p.m. was a handful of decisions to be made without debate, plus the presentation of a petition and the Adjournment Debate. Granted, many MPs would be heading home for the weekend - but another hour or so, of worthwhile economic instruction, might have done them some good.

And it's surprising that, try as I may, I can find no mainstream media report of Keiser's speech. Remember that he is possibly the most-watched TV journalist in the world, talking on a subject of the utmost importance in the very heart of London. This, perhaps deliberate neglect plays into the growing public cynicism about our political elite and the Fourth Estate.

Regular Keiser-watchers will have heard much of his material before, many times, though it may be news to some that the reason he's shifted his base of operations to London is that he wants a ringside seat to cover what he sees as the coming, full-blown disaster of historic proportions, and expects our poor country to be the epicentre.

He also says that Germany will use its gold hoard and massive Eurobond issuance to establish its advantage over the City; Frankfurt will become the centre of banking and trading in Europe, he feels. Britain, having allowed its financial sector to swell to over 10% of national GDP, has set itself up for a terrible fall.

According to Keiser, only raising interest rates sharply - as Paul Volcker did in the USA (20% by 1981) - can cleanse the speculation and malpractice from the system; and he doesn't see us doing that.

Also interesting in this film, is the naivety of questions, underlining Keiser's (and George Osborne's) observations about the financial illiteracy of the British public.

Like Nigel Farage (another ex-financial trader), Keiser is loud, brash and fast-talking (he starts more sentences than he finishes); and both are also, in my assessment, completely sincere in their concern and indignation.

The film lasts slightly more than an hour, but you can simply listen to it while doing something else, as I did. I think you'll find it worth your while.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Galloway pointed out that this was the second largest public room in Parliament (the first had already been booked) and all MPs had been invited in writing, twice - yet none of them had turned up.

In some ways this is understandable: Galloway is "colourful" and, to me, something of an enigma, and his fellow Parliamentarians must have considered the risk of tainting by association.

Or worse, reputational entrapment: for although Keiser had strong criticisms to make of Gordon Brown's gold sale (1999 - 2002), which he said is the moment when Britain's independence was surrendered, he also laid the blame for the present crisis on the monetary expansion that began under Reagan and Thatcher. Additionally, he had harsh words to say about George Osborne and David Cameron, whom he sees as fighting for corrupt City interests. In the circumstances, MPs on both sides must have seen little political advantage in attending.

Yet there wasn't that much else on in Parliament on the evening of 20th November. The House of Commons Order of Business after 7 p.m. was a handful of decisions to be made without debate, plus the presentation of a petition and the Adjournment Debate. Granted, many MPs would be heading home for the weekend - but another hour or so, of worthwhile economic instruction, might have done them some good.

And it's surprising that, try as I may, I can find no mainstream media report of Keiser's speech. Remember that he is possibly the most-watched TV journalist in the world, talking on a subject of the utmost importance in the very heart of London. This, perhaps deliberate neglect plays into the growing public cynicism about our political elite and the Fourth Estate.

Regular Keiser-watchers will have heard much of his material before, many times, though it may be news to some that the reason he's shifted his base of operations to London is that he wants a ringside seat to cover what he sees as the coming, full-blown disaster of historic proportions, and expects our poor country to be the epicentre.

He also says that Germany will use its gold hoard and massive Eurobond issuance to establish its advantage over the City; Frankfurt will become the centre of banking and trading in Europe, he feels. Britain, having allowed its financial sector to swell to over 10% of national GDP, has set itself up for a terrible fall.

According to Keiser, only raising interest rates sharply - as Paul Volcker did in the USA (20% by 1981) - can cleanse the speculation and malpractice from the system; and he doesn't see us doing that.

Also interesting in this film, is the naivety of questions, underlining Keiser's (and George Osborne's) observations about the financial illiteracy of the British public.

Like Nigel Farage (another ex-financial trader), Keiser is loud, brash and fast-talking (he starts more sentences than he finishes); and both are also, in my assessment, completely sincere in their concern and indignation.

The film lasts slightly more than an hour, but you can simply listen to it while doing something else, as I did. I think you'll find it worth your while.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Saturday, January 05, 2013

Looking for a widget!

Help wanted! We thought we'd found a multiple blog widget so you can follow all pages in one simple device, but the one we got can't be installed by readers. Anyone out there know a good one?

Friday, January 04, 2013

Airbrushing out The Queen

My wife asked me what this was, on the back of a pound coin:

... and on further investigation it seems that ever since this little metal thing was introduced into our system of exchange, the Royal Arms have been omitted (except for the 1988 design) in favour of a cycle of images from the regions.

Doubtless we'll be told not to take it too seriously, but it seems to me that the 1.5 billion pound coins are being used as yet another method to condition us to accept the "inevitable" breakup of the Union.

Another subliminal point, maintains the wife of a friend, is that the change from a banknote to a small coin was to help us not to expect so much for our money.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

It's the Arms of the City of London:

... and on further investigation it seems that ever since this little metal thing was introduced into our system of exchange, the Royal Arms have been omitted (except for the 1988 design) in favour of a cycle of images from the regions.

Doubtless we'll be told not to take it too seriously, but it seems to me that the 1.5 billion pound coins are being used as yet another method to condition us to accept the "inevitable" breakup of the Union.

Another subliminal point, maintains the wife of a friend, is that the change from a banknote to a small coin was to help us not to expect so much for our money.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Thursday, January 03, 2013

Nick Drew: Solar power the worst option for reducing carbon emissions

See The Energy Page for an industry expert's assessment.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Nick Drew: Solar fad a waste of money

Energy expert and journalist Nick Drew has written a new piece for The Energy Page on cost-effective ways to reduce carbon dioxide emissions. Turns out that the fashion for roof-mounted solar panels is just about the worst possible option - read the full story here.

Nick is a regular contributor to the Capitalists@Work blog.

************

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Solar Power is Daylight Robbery

The UK government is very fond of claiming that its decarbonisation policy is being delivered at least cost to UK citizens. Irrespective of whether one supports the policy goal, one would at least like to believe them on the cost.

Sadly, their claim is a blatant falsehood; and we can see why this is by utilizing the government's own methodologies.

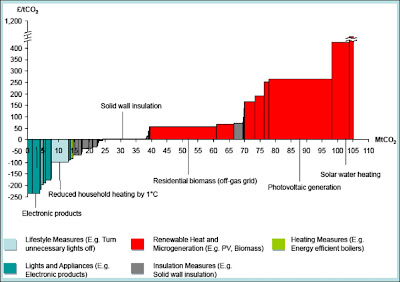

A very standard way of presenting the cost-effectiveness of measures that can reduce CO2 emissions is the Marginal Abatement Cost Curve (MACC) and we will look at some examples below. The basic concept is simple: for each measure, calculate the cost per unit of CO2 emissions reduced, and rank them from cheapest to most expensive on a bar-chart. If we pick (e.g.) a particular market segment, we can additionally plot the total absolute potential for CO2 abatement each measure can deliver in that sector (e.g. in tonnes), by making the width of each bar correspond to the amount.

Having ranked them thus, for a given target amount of reductions we can directly read off the cost of the most expensive measure required to achieve the target. And why would anyone institute measures that cost more than absolutely necessary ? Surely, they would exhaust the potential of the cheapest measures first, before proceeding to the more expensive.

Before looking at UK examples, it is interesting to note that in every MACC example one ever sees, the cheapest abatement measures are in fact profitable - that is, they pay for themselves - in some cases, handsomely so: their 'cost' is not just cheap, it is negative. (We will consider what this means in policy terms another time.) Our first example shows this aspect clearly: it comes from DECC and is the MACC of the total potential abatement identified in the UK 'non-traded' sector (the part of the economy not subject to the EU Emissions Trading Scheme), for the period 2023–27.

As can be seen, at the left-hand side there is around 90 MtCO2e abatement potential that pays for itself. We should only need to start paying for abatement if the target was in excess of that amount. The weighted average of the cost (by a complex calculation) is £43 per tonne, which coincides with an abatement potential of around 130 Mt - well over half the total. Even the most expensive measures plotted come in at under £250 per tonne.

This, then, is a baseline of sorts, and certainly gives some background perspective for considering the next chart, which is the detailed MACC for abatement potential in the UK residential sector through to 2020.

Note that solar power (PV generation) is well to the right of the curve, with a cost that towers over most of the measures available. (Solar water-heating is even worse.) Secondly, at £265 per tonne it is more expensive than any of the measures from the previous MACC.

A very obvious conclusion must surely be that solar power should not be receiving public money (via whatever mechanism) until the vastly greater potential that is available at very much less cost has been comprehensively exploited. Needless to say, the opposite is the case: residential solar power installations are heavily subsidized via our electricity bills, while huge amounts of cheaper - much cheaper - abatement potential lies dormant.

No end of sophistry is offered to defend this state of affairs. Costs of PV are falling all the time; many jobs have been created (mostly in China, of course); we need to create a level playing-field for all technologies (whatever that means). And there are all manner of nuances relating to the interpretation of MACCs - as DECC is keen to tell us (Box B5 here).

No amount of ratiocination, however, can deflect the accusation that subsidizing solar PV in the UK is indefensible from a cost perspective. And in straightened times, costs matter.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Sadly, their claim is a blatant falsehood; and we can see why this is by utilizing the government's own methodologies.

A very standard way of presenting the cost-effectiveness of measures that can reduce CO2 emissions is the Marginal Abatement Cost Curve (MACC) and we will look at some examples below. The basic concept is simple: for each measure, calculate the cost per unit of CO2 emissions reduced, and rank them from cheapest to most expensive on a bar-chart. If we pick (e.g.) a particular market segment, we can additionally plot the total absolute potential for CO2 abatement each measure can deliver in that sector (e.g. in tonnes), by making the width of each bar correspond to the amount.

Having ranked them thus, for a given target amount of reductions we can directly read off the cost of the most expensive measure required to achieve the target. And why would anyone institute measures that cost more than absolutely necessary ? Surely, they would exhaust the potential of the cheapest measures first, before proceeding to the more expensive.

Before looking at UK examples, it is interesting to note that in every MACC example one ever sees, the cheapest abatement measures are in fact profitable - that is, they pay for themselves - in some cases, handsomely so: their 'cost' is not just cheap, it is negative. (We will consider what this means in policy terms another time.) Our first example shows this aspect clearly: it comes from DECC and is the MACC of the total potential abatement identified in the UK 'non-traded' sector (the part of the economy not subject to the EU Emissions Trading Scheme), for the period 2023–27.

|

| Source: DECC |

This, then, is a baseline of sorts, and certainly gives some background perspective for considering the next chart, which is the detailed MACC for abatement potential in the UK residential sector through to 2020.

|

| Source: Committee on Climate Change |

A very obvious conclusion must surely be that solar power should not be receiving public money (via whatever mechanism) until the vastly greater potential that is available at very much less cost has been comprehensively exploited. Needless to say, the opposite is the case: residential solar power installations are heavily subsidized via our electricity bills, while huge amounts of cheaper - much cheaper - abatement potential lies dormant.

No end of sophistry is offered to defend this state of affairs. Costs of PV are falling all the time; many jobs have been created (mostly in China, of course); we need to create a level playing-field for all technologies (whatever that means). And there are all manner of nuances relating to the interpretation of MACCs - as DECC is keen to tell us (Box B5 here).

No amount of ratiocination, however, can deflect the accusation that subsidizing solar PV in the UK is indefensible from a cost perspective. And in straightened times, costs matter.

* * * * *

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Wednesday, January 02, 2013

Does the stockmarket correlate with energy usage?

I've suggested recently that not only does modern money fail to act as a store of value, it is failing as a unit of account because of central bank/government interference in its quantity and distribution. It's an elastic ruler and its unreliable measurements are a factor in unsatisfactory decisions (misallocation of resources, as the monetarists say). So we look for alternative ways to assess relative advantage.

One more scientific-seeming (but complex) measure is energy. Professor Charles Hall adapted the notion of energy return on (energy) investment (EROI, or EROEI) from the biological sphere (where he began his studies) to human social-economic systems. This appears to be a promising method for analysing different forms of commercial energy production.

However, the entry linked above goes on to claim a correlation between the stockmarket and energy usage:

... a century's market and energy data shows that whenever the Dow Jones Industrial Average spikes faster than US energy consumption, it crashes: 1929, 1970s, the dot.com bubble, and now with the mortgage collapse.

I'm not so sure, and I've had a look for the evidence. So far, I've come across a study by the US Energy Information Administration of oil futures vs stock and other indices, and over the admittedly fairly short period covered, the correlation with the Dow is not uniformly high, though it has increased since the Credit Crunch:

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

One more scientific-seeming (but complex) measure is energy. Professor Charles Hall adapted the notion of energy return on (energy) investment (EROI, or EROEI) from the biological sphere (where he began his studies) to human social-economic systems. This appears to be a promising method for analysing different forms of commercial energy production.

However, the entry linked above goes on to claim a correlation between the stockmarket and energy usage:

... a century's market and energy data shows that whenever the Dow Jones Industrial Average spikes faster than US energy consumption, it crashes: 1929, 1970s, the dot.com bubble, and now with the mortgage collapse.

I'm not so sure, and I've had a look for the evidence. So far, I've come across a study by the US Energy Information Administration of oil futures vs stock and other indices, and over the admittedly fairly short period covered, the correlation with the Dow is not uniformly high, though it has increased since the Credit Crunch:

Granted, energy usage and energy prices are not necessarily tightly bound together, but does the above tend to disprove or prove the assertion that the Dow cannot long outrun energy use?

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Monday, December 31, 2012

Proud to be a bear

The Yorkshire vet "James Herriot" wrote of a rich farmer whose principle was, "When all the world goes one way, I go t'other."

Barry Ritholtz publishes a report by James Bianco saying that the Investor's Intelligence survey of investment newsletters shows bearishness at its lowest since 1963.

When nearly everyone agrees, nearly everyone's wrong. The system hasn't been fixed yet and we haven't yet had to face up to the full cost of the consequences. I'm not an active trader - how can you beat the City gunslingers? - so instead of trying to predict the waves I look for the tide.

Until the British Government withdrew Index-Linked Savings Certificates, I'd have settled for them, since I'm more interested in not losing than in making a killing. Now, and until money velocity levels out and QE leads to serious inflation, it's cash for me, plus, reluctantly at these prices, gold.

I agree with Mish:

_____________________

_____________________

Proud to be a 5%-er, then.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Barry Ritholtz publishes a report by James Bianco saying that the Investor's Intelligence survey of investment newsletters shows bearishness at its lowest since 1963.

When nearly everyone agrees, nearly everyone's wrong. The system hasn't been fixed yet and we haven't yet had to face up to the full cost of the consequences. I'm not an active trader - how can you beat the City gunslingers? - so instead of trying to predict the waves I look for the tide.

Until the British Government withdrew Index-Linked Savings Certificates, I'd have settled for them, since I'm more interested in not losing than in making a killing. Now, and until money velocity levels out and QE leads to serious inflation, it's cash for me, plus, reluctantly at these prices, gold.

I agree with Mish:

_____________________

- Gold has been sinking, as it should, if Congress is fiscally prudent.

- Government Should be Prudent

- Government Won't Be Prudent

_____________________

Proud to be a 5%-er, then.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Sunday, December 30, 2012

Why fracking - and other energy alternatives - won't save us completely

The discovery of large reserves of shale oil and gas has raised hopes that our economies may be rescued by a new energy bonanza. But this is not a rerun of the 1970s North Sea Oil boom that gave the UK economic relief for decades afterwards.

Attention is focused on the quantities of reserves, but the missing factor in the analysis is what it costs to exploit the energy source. What we should be looking at is "net energy profit", also known as the "energy profit ratio" or "energy return on investment (EROI)". The "profit" is accounted for not in dollars but in energy - what is put in, versus what is made available to the end user.

The table below is taken from an August 2010 article by Roger Blanchard of Lake Superior State University. It shows that the energy profit from shale oil is a mere 10% of what was obtainable from 1970s conventional oilfield production.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Attention is focused on the quantities of reserves, but the missing factor in the analysis is what it costs to exploit the energy source. What we should be looking at is "net energy profit", also known as the "energy profit ratio" or "energy return on investment (EROI)". The "profit" is accounted for not in dollars but in energy - what is put in, versus what is made available to the end user.

The table below is taken from an August 2010 article by Roger Blanchard of Lake Superior State University. It shows that the energy profit from shale oil is a mere 10% of what was obtainable from 1970s conventional oilfield production.

Other energy sources are even worse. For example, corn ethanol barely covers its energy costs and is controversial because it harms the poor: a May 2012 study concludes that the price of corn has tripled in Mexico because of this additional demand and associated financial speculation.

Wikipedia offers this EROI comparison of energy sources:

Corn ethanol is even worse than solar, and that's saying something.

Of the renewables, wind turbines look promising, though they are also stigmatised by some as noisy, unsightly bird-chopping machines. And the estimated EROI on them varies startlingly, according to this graph from a 2007 article in "Encyclopedia of the Earth" (updated 2011):

Accounting for every scrap of energy in the process - from the production of equipment to its ultimate decommissioning - must be hideously complex, leaving the debate open to skewing by a variety of competing commercial interests and pressure groups (including, no doubt, the publishers of the above).

But accounting in financial terms is also biased by subsidies and permissions granted at the whim of governments swayed by industry lobbyists or trying to earn political credit with environmentally-minded voters. Money has already lost one of its three functions - as a store of value - and thanks to official interference in its quantity and distribution, is now rapidly losing another - its value as a unit of account, to inform decisions. Otherwise we would be unlikely to see so many British homes festooned with solar panels - an enthusiasm that has waned dramatically since the subsidy was cut this year.

Renewables will only go a small way towards replacing fossil and nuclear fuels, and shale fuels cannot promise "business as usual" in the meantime. Energy is not going to run out soon, but it will become more expensive, and our focus in the next few decades should be on restructuring the way we live. We didn't do that when North Sea oil was gushing. Shale is pricey and will be attended by inconvenience and controversy, but it may be our last chance to adapt without even more catastrophic disruption to normal life.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Saturday, December 29, 2012

Why moneylenders MUST be busted

The equivalent of one US dollar invested on the night of Christ's birth at less than 4 per cent per annum, would today be worth more than the Earth's weight in gold.

Here's the math:

a. The Earth's mass is estimated at (5.9722 times 10 to the power 24) kilograms

b. According to goldprice.org, a kilo of gold today costs $53,235.21

c. a*b = $(3.17931 times 10 to the power 29)

d. $1.03434 to the power 2012 = $(3.18127 times 10 to the power 29)

e. d>c.

Yes, you say, but what about tax?

Let's assume that interest over the last two-millenia-and-a-bit was taxed every year at the outrageous rate of 50%. All that does, by reducing the effective interest rate to 1.7% p.a., is defer the date at which the goal is reached; in this case, the year 4030.

The same argument applies to inflation, as long as it's significantly less than the interest rate.

So in the long run, the lender must end up owning everything - provided he can always find borrowers and especially, always have his capital safe.

Our governments, by bailing out the banks, have ensured that capital security.

Better still, under the present arrangement banks hardly need their own capital at all. If the Federal Reserve conjures up a billion dollars and lends it to a bank at zero interest, and the bank uses the money to buy safe government securities (albeit at a low yield), then the bank is being drip-fed free cash. Inflation doesn't matter - there's no bank capital to erode, so all inflation does is reduce the value of the guaranteed profit.

Give the lender complete security of capital, and real interest after expenses, taxes and inflation, and you will in time give him the Earth.

Which is why there must be a reset, or Jubilee.

There is no such thing as a perpetual motion machine, or a safe paper-based solution to a broken economy in which a minority increasingly takes ownership of their fellows. Sooner or later, the gathering of wealth by materially unproductive means must end.

Here's the math:

a. The Earth's mass is estimated at (5.9722 times 10 to the power 24) kilograms

b. According to goldprice.org, a kilo of gold today costs $53,235.21

c. a*b = $(3.17931 times 10 to the power 29)

d. $1.03434 to the power 2012 = $(3.18127 times 10 to the power 29)

e. d>c.

Yes, you say, but what about tax?

Let's assume that interest over the last two-millenia-and-a-bit was taxed every year at the outrageous rate of 50%. All that does, by reducing the effective interest rate to 1.7% p.a., is defer the date at which the goal is reached; in this case, the year 4030.

The same argument applies to inflation, as long as it's significantly less than the interest rate.

So in the long run, the lender must end up owning everything - provided he can always find borrowers and especially, always have his capital safe.

Our governments, by bailing out the banks, have ensured that capital security.

Better still, under the present arrangement banks hardly need their own capital at all. If the Federal Reserve conjures up a billion dollars and lends it to a bank at zero interest, and the bank uses the money to buy safe government securities (albeit at a low yield), then the bank is being drip-fed free cash. Inflation doesn't matter - there's no bank capital to erode, so all inflation does is reduce the value of the guaranteed profit.

Give the lender complete security of capital, and real interest after expenses, taxes and inflation, and you will in time give him the Earth.

Which is why there must be a reset, or Jubilee.

There is no such thing as a perpetual motion machine, or a safe paper-based solution to a broken economy in which a minority increasingly takes ownership of their fellows. Sooner or later, the gathering of wealth by materially unproductive means must end.

Cause for outrage: what bankers and traders have done to "the people"

"When floodwaters cover our homes, we expect that FEMA workers with emergency checks and blankets will find us. There is no moral or substantive difference between a hundred-year flood and the near-destruction of the global financial system by speculators immune from consequence. But if you and your spouse both lose your jobs and assets because of an unprecedented economic cataclysm having nothing to do with you, you quickly discover that your society expects you and your children to live malnourished on the streets indefinitely. "

- From "The Sharp, Sudden Decline of America's Middle Class" by Jeff Tietz, Rolling Stone magazine. The article details the harrowing experience of recession victims, many of whom have done "all the right things" and never been unemployed before.

Inequality is starkly worse in the USA than in other "developed" countries, as shown in the graph below (source):

"The Gini Index for the United States in the 2011 ACS (0.475) was significantly higher than in the 2010 ACS (0.469). This increase suggests more income inequality across the country."

_________________________________

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

- From "The Sharp, Sudden Decline of America's Middle Class" by Jeff Tietz, Rolling Stone magazine. The article details the harrowing experience of recession victims, many of whom have done "all the right things" and never been unemployed before.

Inequality is starkly worse in the USA than in other "developed" countries, as shown in the graph below (source):

That uses data from 2010, but according to the official Census it's getting worse:

_________________________________

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Cause for outrage: what bankers and traders have done to "the people"

"When floodwaters cover our homes, we expect that FEMA workers with emergency

checks and blankets will find us. There is no moral or substantive difference

between a hundred-year flood and the near-destruction of the global financial

system by speculators immune from consequence. But if you and your spouse both

lose your jobs and assets because of an unprecedented economic cataclysm having

nothing to do with you, you quickly discover that your society expects you and

your children to live malnourished on the streets indefinitely. "

- From "The Sharp, Sudden Decline of America's Middle Class" by Jeff Tietz, Rolling Stone magazine. The article details the harrowing experience of recession victims, many of whom have done "all the right things" and never been unemployed before.

Inequality is starkly worse in the USA than in other "developed" countries, as shown in the graph below (source):

"The Gini Index for the United States in the 2011 ACS (0.475) was significantly higher than in the 2010 ACS (0.469). This increase suggests more income inequality across the country."

- From "The Sharp, Sudden Decline of America's Middle Class" by Jeff Tietz, Rolling Stone magazine. The article details the harrowing experience of recession victims, many of whom have done "all the right things" and never been unemployed before.

Inequality is starkly worse in the USA than in other "developed" countries, as shown in the graph below (source):

That uses data from 2010, but according to the official Census it's getting worse:

Sunday, December 02, 2012

Why buy gold?

Gold is a condensed way to hold your wealth.

Currently the most popular US gold coin, the American Gold Eagle, retails for around $1,800. A recent Federal Reserve survey says that the median US family had a net worth of $126,400 in 2007. Today, that would buy 70 gold eagles and some change. Everything you have, in two handfuls: two 4-inch-long rolls, weighing 43 ounces each.

Actually, less: the same Fed survey shows the average family net worth was down to $77,300 in 2010. That's 41 gold eagles and change; or, a handful of coins 4.63 inches long and weighing less than 50 ounces. It doesn't rust or rot, and although the value will vary, it'll never be worthless.

But there you are, gold in hand, standing in the street. You can't eat or wear the stuff, it won't cover your heads or cook your food. It doesn't earn interest, and unlike farm animals, it doesn't breed. And it doesn't protect you and your loved ones. Your 50-ounce stash against a 40-ounce, fully-loaded 1911 Colt 45? You'd be lucky to walk away empty-handed.

It preserves wealth, but not necessarily for you. Three years ago in central Britain, a man with a metal detector discovered a hoard of well over a thousand intricately-worked gold items. Together they weigh some 6.3 kilos - worth a third of a million dollars in scrap value (but over $5 million because of their history and artistry). The magnificent Anglo-Saxon treasure dates from the 7th or 8th century.

The key point is, whoever buried it didn't come back.

Gold doesn't ensure your survival if society breaks down altogether, but it can help protect you from the wipeout that happens when paper money becomes worthless. However, remember how the hungry Esau sold his inheritance to his brother Jacob in exchange for a bowl of stew: it's not enough to have gold, you need someone to sell it to, and at a fair price.

So ignore the apocalyptic prophets; gold is for troubled times, not for utter disaster, and it's not the only thing you should have. As Eric Sprott said recently, "most ... experts say that you should have 5% or 10% of your money in gold".

The question is, how to hold it.

Via a broker? MF Global held gold in a client account (effectively, as trustee) for investor Gerald Celente, yet the holding was seized by the firm's creditors when it collapsed in 2011.

Via a depository? Congressman Ron Paul has tried to get the Federal Reserve to open its vaults to auditors to find out how much is actually there; we're still waiting, and Germany is getting worried about its holding in the US. It is even rumoured that China has "lost" 80 tons from its own national treasury. Attractive stuff, is gold.

How else? An August 2012 article in Investors Chronicle looks at other ways: gold funds, gold bars, coins. Even then, you need to be confident that the fund holds 100% of its stock, 24/7 - you'll recall that fractional reserve banking began among gold dealers who took advantage of the fact that their customers usually didn't all want access to their metal at the same time. And it's worth noting that some outright physical fraud is now going on: tungsten has the same density and is far cheaper, so selling a gold-wrapped bar of tungsten represents a fat profit for criminals.

In these times of weakened trust, perhaps you could accumulate some gold coins from a reputable dealer, and keep them safe somehow - and don't tell those who don't need to know.

________________________________________

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Currently the most popular US gold coin, the American Gold Eagle, retails for around $1,800. A recent Federal Reserve survey says that the median US family had a net worth of $126,400 in 2007. Today, that would buy 70 gold eagles and some change. Everything you have, in two handfuls: two 4-inch-long rolls, weighing 43 ounces each.

Actually, less: the same Fed survey shows the average family net worth was down to $77,300 in 2010. That's 41 gold eagles and change; or, a handful of coins 4.63 inches long and weighing less than 50 ounces. It doesn't rust or rot, and although the value will vary, it'll never be worthless.

But there you are, gold in hand, standing in the street. You can't eat or wear the stuff, it won't cover your heads or cook your food. It doesn't earn interest, and unlike farm animals, it doesn't breed. And it doesn't protect you and your loved ones. Your 50-ounce stash against a 40-ounce, fully-loaded 1911 Colt 45? You'd be lucky to walk away empty-handed.

It preserves wealth, but not necessarily for you. Three years ago in central Britain, a man with a metal detector discovered a hoard of well over a thousand intricately-worked gold items. Together they weigh some 6.3 kilos - worth a third of a million dollars in scrap value (but over $5 million because of their history and artistry). The magnificent Anglo-Saxon treasure dates from the 7th or 8th century.

The key point is, whoever buried it didn't come back.

Gold doesn't ensure your survival if society breaks down altogether, but it can help protect you from the wipeout that happens when paper money becomes worthless. However, remember how the hungry Esau sold his inheritance to his brother Jacob in exchange for a bowl of stew: it's not enough to have gold, you need someone to sell it to, and at a fair price.

So ignore the apocalyptic prophets; gold is for troubled times, not for utter disaster, and it's not the only thing you should have. As Eric Sprott said recently, "most ... experts say that you should have 5% or 10% of your money in gold".

The question is, how to hold it.

Via a broker? MF Global held gold in a client account (effectively, as trustee) for investor Gerald Celente, yet the holding was seized by the firm's creditors when it collapsed in 2011.