Energy, like defence, is a topic where huge numbers of people seem to have strong views based on very little knowledge. If evidence is required, go to the Guardian’s Comment is Free website where almost any piece on an energy topic receives hundreds of comments exhibiting ignorance aplenty.

A favourite theme from the green/red camp is ‘what about Germany?’ or its close variant ‘if Denmark can do it, we can, too’. The ‘it’ in question is of course very large-scale renewable generation in both countries, which is taken to be triumphantly proving its worth there in quantities that put the UK to shame.

At the headline level, the statistics are striking. In the 1st half of 2012, renewables generated around 25% of Germany’s electricity, of which 9% was wind and 5% solar. (The balance is mostly biofuels, which greens are a bit more ambivalent about, but let that pass.) Denmark has reached 24% of electricity consumption being generated from renewables: and as a percentage of Denmark’s own generation, the figures are even more remarkable: over 40% is renewable, of which 28% is wind.

The difference between Denmark’s ‘24% of consumption’ and ‘40% of own generation’ immediately tips us off to an important additional factor – imports, or, more generally, cross-border electricity trade. Trade between interconnected countries is generally in either direction at different times, as advocates of free trade would hope and expect: wholesale electricity prices in one country will rarely be identical to those in a neighbour’s market, given different supply/demand dynamics, generation fleets, weather etc. Cross-border trade is the highly appropriate result.

In Denmark’s case the detailed pattern is complex: they do indeed export electricity some of the time but, as the figures suggest, they are generally substantial net importers. Wind turbines, of course, produce ‘intermittently’ (and relatively unpredictably): and anyone wishing to hold up Denmark’s renewables as an example for other nations should be aware that their significant amount of wind generation is only feasible because of the ease with which they are able to import the ultra-flexible hydro-power available from Norway. Attempting to balance the grid using their remaining indigenous sources - the largest of which is, yes, coal - would not be remotely economic, and in fact would probably not be feasible at any price (we will comment later on cost aspects.)

Wind plus hydro can be a feasible combination with which to satisfy electricity demand. Denmark, where this is achievable, doesn’t offer a model for countries where there is little or no hydro on tap (or, of course, some equally flexible alternative - of which there are very few indeed).

Germany’s import / export pattern is exceptionally complex, and changing all the time as the unexpected post-Fukushima decision, to shut down a significant portion of its nuclear capacity, is accommodated. But it is not hydro imports that make Germany an unconvincing model for other nations. Rather, it is the distinct possibility that Germany’s power system is not feasible at all.

Read on:

PART TWO

PART THREE

PART FOUR (CONCLUSION)

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Showing posts with label Nick Drew. Show all posts

Showing posts with label Nick Drew. Show all posts

Sunday, January 06, 2013

Thursday, January 03, 2013

Solar Power is Daylight Robbery

The UK government is very fond of claiming that its decarbonisation policy is being delivered at least cost to UK citizens. Irrespective of whether one supports the policy goal, one would at least like to believe them on the cost.

Sadly, their claim is a blatant falsehood; and we can see why this is by utilizing the government's own methodologies.

A very standard way of presenting the cost-effectiveness of measures that can reduce CO2 emissions is the Marginal Abatement Cost Curve (MACC) and we will look at some examples below. The basic concept is simple: for each measure, calculate the cost per unit of CO2 emissions reduced, and rank them from cheapest to most expensive on a bar-chart. If we pick (e.g.) a particular market segment, we can additionally plot the total absolute potential for CO2 abatement each measure can deliver in that sector (e.g. in tonnes), by making the width of each bar correspond to the amount.

Having ranked them thus, for a given target amount of reductions we can directly read off the cost of the most expensive measure required to achieve the target. And why would anyone institute measures that cost more than absolutely necessary ? Surely, they would exhaust the potential of the cheapest measures first, before proceeding to the more expensive.

Before looking at UK examples, it is interesting to note that in every MACC example one ever sees, the cheapest abatement measures are in fact profitable - that is, they pay for themselves - in some cases, handsomely so: their 'cost' is not just cheap, it is negative. (We will consider what this means in policy terms another time.) Our first example shows this aspect clearly: it comes from DECC and is the MACC of the total potential abatement identified in the UK 'non-traded' sector (the part of the economy not subject to the EU Emissions Trading Scheme), for the period 2023–27.

As can be seen, at the left-hand side there is around 90 MtCO2e abatement potential that pays for itself. We should only need to start paying for abatement if the target was in excess of that amount. The weighted average of the cost (by a complex calculation) is £43 per tonne, which coincides with an abatement potential of around 130 Mt - well over half the total. Even the most expensive measures plotted come in at under £250 per tonne.

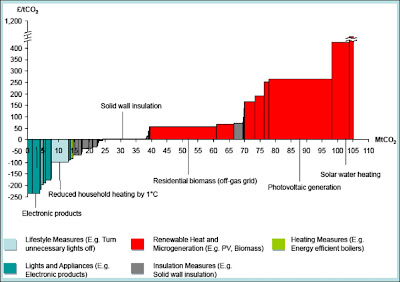

This, then, is a baseline of sorts, and certainly gives some background perspective for considering the next chart, which is the detailed MACC for abatement potential in the UK residential sector through to 2020.

Note that solar power (PV generation) is well to the right of the curve, with a cost that towers over most of the measures available. (Solar water-heating is even worse.) Secondly, at £265 per tonne it is more expensive than any of the measures from the previous MACC.

A very obvious conclusion must surely be that solar power should not be receiving public money (via whatever mechanism) until the vastly greater potential that is available at very much less cost has been comprehensively exploited. Needless to say, the opposite is the case: residential solar power installations are heavily subsidized via our electricity bills, while huge amounts of cheaper - much cheaper - abatement potential lies dormant.

No end of sophistry is offered to defend this state of affairs. Costs of PV are falling all the time; many jobs have been created (mostly in China, of course); we need to create a level playing-field for all technologies (whatever that means). And there are all manner of nuances relating to the interpretation of MACCs - as DECC is keen to tell us (Box B5 here).

No amount of ratiocination, however, can deflect the accusation that subsidizing solar PV in the UK is indefensible from a cost perspective. And in straightened times, costs matter.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Sadly, their claim is a blatant falsehood; and we can see why this is by utilizing the government's own methodologies.

A very standard way of presenting the cost-effectiveness of measures that can reduce CO2 emissions is the Marginal Abatement Cost Curve (MACC) and we will look at some examples below. The basic concept is simple: for each measure, calculate the cost per unit of CO2 emissions reduced, and rank them from cheapest to most expensive on a bar-chart. If we pick (e.g.) a particular market segment, we can additionally plot the total absolute potential for CO2 abatement each measure can deliver in that sector (e.g. in tonnes), by making the width of each bar correspond to the amount.

Having ranked them thus, for a given target amount of reductions we can directly read off the cost of the most expensive measure required to achieve the target. And why would anyone institute measures that cost more than absolutely necessary ? Surely, they would exhaust the potential of the cheapest measures first, before proceeding to the more expensive.

Before looking at UK examples, it is interesting to note that in every MACC example one ever sees, the cheapest abatement measures are in fact profitable - that is, they pay for themselves - in some cases, handsomely so: their 'cost' is not just cheap, it is negative. (We will consider what this means in policy terms another time.) Our first example shows this aspect clearly: it comes from DECC and is the MACC of the total potential abatement identified in the UK 'non-traded' sector (the part of the economy not subject to the EU Emissions Trading Scheme), for the period 2023–27.

|

| Source: DECC |

This, then, is a baseline of sorts, and certainly gives some background perspective for considering the next chart, which is the detailed MACC for abatement potential in the UK residential sector through to 2020.

|

| Source: Committee on Climate Change |

A very obvious conclusion must surely be that solar power should not be receiving public money (via whatever mechanism) until the vastly greater potential that is available at very much less cost has been comprehensively exploited. Needless to say, the opposite is the case: residential solar power installations are heavily subsidized via our electricity bills, while huge amounts of cheaper - much cheaper - abatement potential lies dormant.

No end of sophistry is offered to defend this state of affairs. Costs of PV are falling all the time; many jobs have been created (mostly in China, of course); we need to create a level playing-field for all technologies (whatever that means). And there are all manner of nuances relating to the interpretation of MACCs - as DECC is keen to tell us (Box B5 here).

No amount of ratiocination, however, can deflect the accusation that subsidizing solar PV in the UK is indefensible from a cost perspective. And in straightened times, costs matter.

* * * * *

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Wednesday, August 19, 2009

The energy crisis

There's much talk of looming energy problems - it's a staple of Nick Drew's blogging and even The Economist has now turned its attention to it. Today I see Brian Gongol has netted a story about battery development and how it could support the energy infrastructure.

But how much could we still do in the way of more efficient use, and non-use, of energy? According to this DTI report based on 2001 stats, the home uses 31% of the nation's energy (see Chart 1.3 on page 9). Chart 1.6 shows that in 2000, space heating accounted for 40% of all non-transport energy consumption.

More woolly pullies?

But how much could we still do in the way of more efficient use, and non-use, of energy? According to this DTI report based on 2001 stats, the home uses 31% of the nation's energy (see Chart 1.3 on page 9). Chart 1.6 shows that in 2000, space heating accounted for 40% of all non-transport energy consumption.

More woolly pullies?

Tuesday, September 23, 2008

Bear market rally blues

Dow 18 Sept: 11,019.69

Dow 19 Sept: 11,388.44

Dow 22 Sept: 11,015.69

Dow 23 Sept: 10,854.17

Inspired by Nick Drew's bardic effusions, I offer a pastiche of Lonnie Donegan:

Dow 19 Sept: 11,388.44

Dow 22 Sept: 11,015.69

Dow 23 Sept: 10,854.17

Inspired by Nick Drew's bardic effusions, I offer a pastiche of Lonnie Donegan:

Does your equity lose its value

On the market overnight?

If your broker says don’t do it

Do you buy loads more in spite?

Can you hedge it with short selling?

Can you get the timing right?

Does your equity lose its value

On the market overnight?

On the market overnight?

If your broker says don’t do it

Do you buy loads more in spite?

Can you hedge it with short selling?

Can you get the timing right?

Does your equity lose its value

On the market overnight?

Sunday, June 01, 2008

Oil speculation?

Pace Nick Drew's comment on the previous post, Jim in San Marcos reckons there is indeed influential speculation in the oil market.

But Karl Denninger reckons it's just money looking for a home, like the boll weevil, and ultimately deflation caused by credit writedowns should reverse the trend.

But Karl Denninger reckons it's just money looking for a home, like the boll weevil, and ultimately deflation caused by credit writedowns should reverse the trend.

Saturday, May 24, 2008

The Oil Controversy

Tom Bower pooh-poohs "Peak Oil" claims in the Daily Mail, saying there's several times more to come out of the ground than has ever yet been extracted. His book on the subject is due out soon.

I should like to see what energy commentators like Nick Drew wish to say to this. From what I've read, remaining oil stocks are likely to be of lesser quality and will cost far more to extract than God's gift to the Saudis (which, I understand, is already being exploited at a rate that is damaging the field).

Granted, oil is massively over-taxed. Americans would head for their gun rooms if they had to pay £5 a gallon.

Meanwhile, the FTSE continues to float cheerily above 6,000 and the Dow above 12,000 - for how much longer?

I should like to see what energy commentators like Nick Drew wish to say to this. From what I've read, remaining oil stocks are likely to be of lesser quality and will cost far more to extract than God's gift to the Saudis (which, I understand, is already being exploited at a rate that is damaging the field).

Granted, oil is massively over-taxed. Americans would head for their gun rooms if they had to pay £5 a gallon.

Meanwhile, the FTSE continues to float cheerily above 6,000 and the Dow above 12,000 - for how much longer?

Subscribe to:

Posts (Atom)