The annual rise in council tax will this year only add to the forthcoming misery of the majority of households facing enormous rises in energy prices, NI contributions, fuel for their cars and way above the published figures for staples as anyone who goes for a weekly shop can see, never mind rises that will almost certainly be added later in the year.

Council Tax has been a bone of contention for as long as it has been charged.The problem with it is it is loaded on those who do not qualify for benefits, credits, tax handbacks etc., which today is an enormous slice of the population. It’s a dog's dinner of a charge.

I quoted some time ago that the Suffolk financial secretary. in answer to 'who pays?' (this was just after the poll tax was axed and he had recently retired), stated that only 37% of households in the county paid the full rate. That leaves nearly two-thirds who get rebates or do not pay at all. This figure obviously varies across the country but try as I might to get that information today, it has proved impossible. One can understand why: with the new rates due to come into effect in a couple of weeks that sort of information would not go down well alongside all the other costs being heaped on those that actually work for a living.

As with all these taxes it is those marginally above the benefit line who get hit hardest, and also why a fair percentage decide it is not worth working.

This request to Haringey council gives a fair indication as to how far they will go to not reveal the details. After much to-ing and fro-ing they finally revealed how many households pay full tax and how many single person households pay the reduced tax; no figures for, what was asked about, those who pay nothing or much reduced rates.

It is quite despicable that any council can hide matters concerning monies paid by the public in this way. We pay their wages and their pensions yet they deny requests for information about our money and who pays what.

However, there are plenty of published guides on how to obtain rebates. The current £150 rebate ‘help’ with the cost of living is being given to 20 million - yes, that figure is correct - households in bands A-D.

‘ 20 million households to benefit from £3 billion scheme to help with cost of living pressures

• Comes as part of a £9 billion package to help spread the cost of rising energy bills

• 4 out of 5 households will benefit including around 95% of rented properties

• Households encouraged to set up council tax direct debits to ensure payment is made automatically from April ‘

So once again the few will be paying for the many. It could be said that the rebate to help less well-off households is a sensible government measure in times like this, but as usual the government has no money; it is simply giving to an ever increasing relatively poor sector money from the ever smaller full paying sector, and since has when council tax been a conduit for fuel rebates? Council tax is supposedly for local services, which are in serious decline; it has nothing to do with energy pricing. It would have been far more equitable to simply freeze council tax rises this year; with a cost of £3 billion pounds for this scheme they are not that far off going the full Monty anyway.

Maybe with the resentment of many who pay council tax with ever diminishing returns, this is a way of putting a ‘good’ show on for the councils as they have had their grants continually cut.

Councils are landed with paying for social care, something judging by many councils' performance including my own, they really should not be doing. As with so much, councils have little knowledge of business matters and the huge amount of waste shows it: many of the cuts forced on them when the government started cutting the grants were easily accommodated, which begged the question why in the first place? Now it is a different story and the government is simply robbing Peter to pay Paul.

This is a comment from elsewhere….

"The corporate councils operating for profit like to take 30+% for their private pensions, then another 30-40% for their wages, expenses and dodgy redundancy deals, leaving approximately 30% for 'services'. Some councils are spending more on the interest on the illegal private debts (LOBO loans) than they are spending on 'services'. But they've all received millions-billions during the last 2 years of restrictions, to pay for furlough payments, extra policing, extra child stealing, extra evictions, large payments to schools for testing and jabbing, money that was created out of thin air by "borrowing" from the privately owned Bank of England, extra money in circulation that is creating rampant inflation and damaging millions of lives and businesses even further.

"But the corporate councils still have the power to write off Council Tax debt whenever it is requested and deemed appropriate."

Remember that of the amount left for services the amount for social care is included, which is significant.

The generosity shown by the nation to immigrants legal and illegal, is not unique to us, but has become a not insignificant drain on resources. You only have to look back in history and see the numbers that came into the country say in the early 1900s and compare with today to realise the enormous difference.

Again local councils open their arms and accommodate large numbers who have to be fed, housed and generally looked after using local resources and money. Like social care. this comes largely out of council tax, heaping more on to those who pay but having no effect on those who don’t, a category that has just been enlarged and continues to grow.

Governments for reasons of their own decline to admit there is a problem with immigration generally. The figures on all things migrant are to a point, as in the case of Haringey council, hidden or diluted to suit, but then it is not their money they are using to solve or rather handle the problem, so they can be casually offhand about it.

Council tax also suffered a freeze under this government, but with the brakes off some are now asking for ridiculous rises for non services. It appears that pensions are top of the list in most councils when it comes to priorities.

The tax is fast approaching the silly levels of the last days of the old rating system, in truth it is the same under a different name. The only way any fairness can be brought to tax based on property is to make it one that all householders pay as the poll tax offered. The collapse of the poll tax was not because it put an undue burden on those that would not have paid previously but on a cack-handed apportioning of the levels, but instead of revising the tax they abandoned it under pressure.

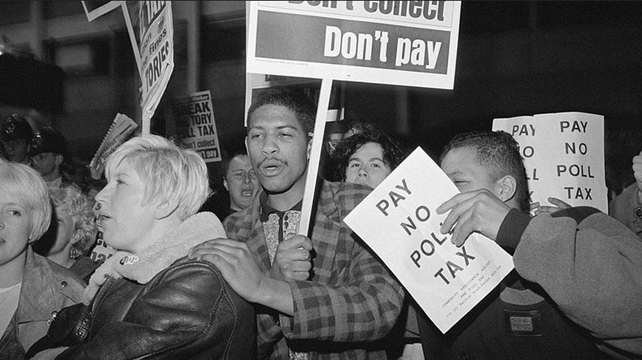

There is something very wrong when a family of any number can be paying for services the same as a single person household and using a lot more of them. The poll tax shared the costs among all who used them but sadly those who never pay caused riots which turned the whole thing around, so now we are fast approaching the out-of-control rates pricing at a time of enormous pressure on household budgets from all angles.

The single person discount is in fact a poll tax of sorts, though 25% off the full tax is hardly a fair payment if next door is in the five or more family members paying the equivalent of one member in the house.

Those that never paid protesting about maybe having to pay something!

Abandoning the poll tax was in the long term the worst thing the then current Tory party could have done, as now any suggestion of a change is met with howls of ‘poll tax’ and it rather like the NHS has become untouchable despite its obvious inequalities among those that actually pay.

Nothing was more more ridiculous than Rod Stewart making a fuss, though rightly, about the potholes outside his home making his Ferrari imprisoned in his home. Yes, he highlighted the fact that councils no longer do much that we pay them for, yet coming along two days later to do the job because a celeb made a fuss is just showing how unequal the whole tax is. Why should he get special treatment when his borough is no doubt riddled with similar potholes that will remain unfilled?

The Institute of Fiscal Studies included this among a review of inequality of tax and benefits:

‘But council tax is regressive. Even after accounting for council tax support (which reduces council tax liabilities for low income families), the poorest tenth of the population pay 8% of their income in council tax, while the next 50% pay 4-5% and the richest 40% pay 2-3%.'

That is a very simplistic way at looking at the council tax. In many cases, the council tax band you live in bears no relation to how wealthy you are: many retired people live in higher band properties but receive ever lower incomes when inflation is taken into account, many high wage earners don’t live in high council tax band properties, much depends on housing costs and areas you live in, and vice versa in places like London where house prices are high and the banding matches but the property is quite basic.

There are so many items that make the council tax not fit for purpose. There are many suggestions, such as a Labour party statement not long ago that suggests the lower bands should (though there were no figures to suggest what that change would achieve) all get a permanent lowering of their charges and the higher bands pay even more.

There have been suggestions that all properties should be revalued as they were last valued in 1991. That is a ridiculous claim as all properties have paid more annually ever since, it has no relation to the properties' current value as they all have risen during that time, so in effect the prices are static for the purposes of charging. If you have extensions or modify your home giving it a higher value then you stand the chance of being moved into a higher band anyway.

I don’t see any of the myriad changes put forward making any real difference unless a form of poll tax is revived.

The difference with the poll tax - with the usual exceptions for those who really can’t pay anything, the infirm etc. - is that everyone who is of working status will pay their bit towards services used.

Martin Lewis compiled this list of those who will get rebates or discounts, many up to 100%. The list seems endless, many are justified in a socially caring country, but all…?

It is no surprise, and I have done an extensive search to try and find figures regarding how many households actually pay the full tax and there is not a single lead I could find other than the saga to get Haringey to reveal virtually nothing it was asked. The 37% they quoted those years ago is almost certainly now on the wrong side of the truth. There appears to be an industry telling and offering people help in claiming rebates or reducing their payments, and all the time those who do pay are paying for more and more of the cake they don’t really get a bite of. I wonder if anyone will have the guts to lay out a route to the revival of a poll tax that is fairly proportioned; I won't hold my breath.

Finally, a wonderful example of not getting what you pay for. We moved last year to a no through road, the narrow road at the entrance to ours is a through road with two inclines, one at each end and both ends are heavily tree lined.

In the autumn upon returning from a shopping trip we came across notices at each end that declared “warning: slippery road ahead; 10mph.” Being new to the area I assumed the warning signs were because of impending road resurfacing, but no, it appears that these signs go up every year now because of the huge amount of leaf drop on the road which when wet and with the incline can make driving dangerous; but do they send a road sweeper, which by the way is around locally in the summer? Oh no, they now just put a sign up, the leaves stay for several months rotting away and helping to destroy the road edgings as leaves do when they rot; round of applause for the council who have just managed to get my council tax bill over the £3k mark.

This is the same council who having spent millions doing up County Hall which resembles Ceaucescu’s palace and have now admitted it was known there were structural defects going back decades which will require more millions to be spent, most people would be happy to have Fred Dibnah, if he was still around, detonating large charges and demolishing the monstrosity.