Below is an article I wrote for the Times Educational Supplement in 1997. The Teachers' Pension Scheme has altered significantly since then, but I think many of the general points are still valid._____________________________________Can you really afford to quit?Article Published in The TES on 21 November, 1997 By: Rolf Norfolk

First work out the cost. The job might not seem so bad after all - or there may turn out to be other solutions, says Rolf NorfolkAre you fed up and dreaming of the days when early retirement was much easier to obtain? If so, first you have to decide whether you really have a problem with your job or if it is just a grumble. If you do have a serious worry, it may help to review the following options and consider whether you are prepared to meet the cost of changing your situation.

1. If your promoted post has become too much for you, ask for a demotion. Think twice about this, as it involves a pay cut and it is hardly a recommendation for re-promotion later. Regardless of current regulatory proposals, a step-down is already provided for in your pension scheme so long as it is in the interest of the efficient running of the school and your new post is with the same employer.

You have two options: first, you can split the pension account, so that service in the higher-paid post is preserved (and increased in line with inflation), and then there is a separate calculation for the new job, based on the lower salary and the remaining period served. At retirement, the two figures are added together. Alternatively, you can carry on paying pension contributions as though the demotion hadn't happened, and have all your service relate to your old salary. The potential drawback is that the notional salary is fixed, not inflation-linked. Such considerations need not worry those close to retirement, since a teacher's pension relates to the best year's income in the final three years; in the past some heads have therefore returned to teaching at the age of 58.

2. If the classroom demands are too much, try teaching part-time. This does not wreck your accrued pension because although your pension depends on not only the exact time you have served but your salary at retirement, if you work part-time the notional salary on which your pension is based is what you would be earning if you were a full-timer. But obviously from then, as a part-timer, you will be adding years and days of service more slowly. New regulations are, however, now going through Parliament to improve pension calculations for part-timers.

3. If your face does not fit, move to another school. Life is too short to put up with managers who don't like you. Or you could retrain for a different sector of the education service.

4. Sell your big house and move down. Or sell your investments. Or remortgage. Use your assets to pay for a very long holiday (or to subsidise part-time or lower-paid employment) before you take your pension as of right at 60. If you can, but aren't willing, you've just found out exactly how bad the problem isn't.

5. Apply for ill-health early retirement. Occupational disability doesn't imply being half-dead. But it's not a dodge, either. You have to pass (or, more accurately, fail) medical tests, and the Government has changed the rules to make this harder. For those who get it, the really tough bit is the financial impact. With the Teachers' Superannuation Scheme, ill-health pensions relate only to actual service (plus possibly a bit extra), so even with 20 years' service you would lose at least two-thirds of your income. While you still can, you should therefore consider permanent health insurance, which pays an extra, tax-free income during incapacity. Alternatively, some critical illness insurances include a lump sum pay-out if you are diagnosed as occupationally unfit.

In recent years one in four teacher retirements has been through illness, but although this is more than in previous decades it is still only about the same as for the general population. Often the root cause is unrelated to working conditions (one client of mine is going deaf); but if you are over-stressed, you should try to solve your problem, not have a chronic illness because of it.

6. For young teachers: create your own early retirement account. If you invest the same as your pension contribution (6 per cent) from ages 22 to 55, you will have enough to sustain you for five years on about 40 per cent of salary, until your pension at 60 (additional voluntary contributions are not likely to be appropriate for this, since they can't be deliberately exhausted in five years). Those anticipating unwaged child-rearing years should save more (say 7 per cent) when they can.

7. Resign half-way through your career. This is drastic. Very few teachers can do this and earn the same money elsewhere. Besides, your job is not threatened by Third World competition or the microchip - not many others can say that. And thinking of retirement, only a minority of the public can hope to retire as early (60 is still relatively young) and as securely-provided for as a teacher.

Are you giving up to do something better, or running away from a problem you have failed to address? If the latter, turn and defeat the monster.

As H G Wells's Mr Polly discovered, if you don't like your life, you can change it.

Rolf Norfolk is an independent financial adviser working in the Midlands. He is a former secondary teacher.

This article is not intended as personal advice. Anyone interested in the points raised should consult a financial adviser.

.jpg) (Source: http://economicedge.blogspot.com/2010/03/most-important-chart-of-century.html)

(Source: http://economicedge.blogspot.com/2010/03/most-important-chart-of-century.html) DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

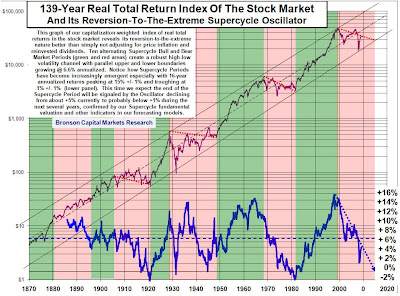

The above chart from here (htp: Global Perspectives) is another of those attempts to perceive underlying order in the apparently random movement of the market and the economy. I've tried the same myself and suggested that the period from 2000 on may be like 1966 - 1982 (the last top and bottom of the market when adjusted for inflation). The interesting thing about the above picture is that the c. 16-year cycle appears to work over a much longer time - starting with the later part of the nineteenth century.

The above chart from here (htp: Global Perspectives) is another of those attempts to perceive underlying order in the apparently random movement of the market and the economy. I've tried the same myself and suggested that the period from 2000 on may be like 1966 - 1982 (the last top and bottom of the market when adjusted for inflation). The interesting thing about the above picture is that the c. 16-year cycle appears to work over a much longer time - starting with the later part of the nineteenth century. The above chart from here (htp: Global Perspectives) is another of those attempts to perceive underlying order in the apparently random movement of the market and the economy. I've tried the same myself and suggested that the period from 2000 on may be like 1966 - 1982 (the last top and bottom of the market when adjusted for inflation). The interesting thing about the above picture is that the c. 16-year cycle appears to work over a much longer time - starting with the later part of the nineteenth century.

The above chart from here (htp: Global Perspectives) is another of those attempts to perceive underlying order in the apparently random movement of the market and the economy. I've tried the same myself and suggested that the period from 2000 on may be like 1966 - 1982 (the last top and bottom of the market when adjusted for inflation). The interesting thing about the above picture is that the c. 16-year cycle appears to work over a much longer time - starting with the later part of the nineteenth century.