*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Sunday, January 13, 2008

Dow 9,000 update

The Dow is now 12,606.30 and gold $894.90, so the Dow is now worth 14.09 gold ounces. It has fallen by 5.78 ounces out of the predicted 6.36, so the prediction is 90.9% fulfilled so far.

McHugh will be fully correct if, for example, the Dow remains unchanged and gold rises to $933/oz; or if gold stalls, the Dow will need to fall to 12,090.

To Gordon Brown: please remit £4bn ASAP

"U.K. Sold 395 tonnes of gold at an average price of $274.9 per ounce. The first sale at $254 caught (or caused?) the low point in a 20-year slide in the price of gold.

The losers are us, Brown's gold sales raised around $3.49 billion.."

-- Telegraph.co.uk , January 2, 2006

That was written when the price was $627 and at today’s gold price of $895 the position would be worth $11.4 billion. And - remember the reason for selling was to improve central bank returns - what did they buy with the funds?

I make that a loss of $8 billion to date, or £4bn sterling.

We hear a lot about accountability. If only politicians could be made personally financially accountable.

Or if they could be paid to go away. In recent times, it would have saved the country a fortune if each senior politician had been given £10 million to do nothing at all.

Saturday, January 12, 2008

Debt and slavery

Doug Noland sees the debt crisis spreading to the corporate sector; David Jensen writes a letter to the Governor of the Bank of Canada, including very telling graphs of mounting debt and the bubble in the financial markets; Michael Panzner discusses a piece from the Financial Times on the threat of a downgrade of America's historic AAA credit rating, and refers to the weakening of the USA's military pre-eminence; Sol Palha worries about the acquisition of Western assets by sovereign wealth funds ("Slowly but surely America and Europe are going to be owned by foreigners. The irony is that Congress is trying to keep immigrants out of this country but right in front of their eyes foreigners are slowly gobbling up huge chunks of this country.").

All this leads me to Jeffrey Nyquist's grim, but compelling latest piece. He despairs of the irrelevance of mainstream political discussion, especially as the polling process rattles on, and paints a far greater picture. I think you should read it all, but here are a few extracts:

What is happening in the news today, what is happening in the markets and in the banking system, has profound strategic implications... There are no invulnerable countries... If a government does not see ahead, make defensive preparations, establish a dialogue with citizens, lead the way to awareness and responsibility, then the nation stumbles into the next world war unarmed and psychologically unprepared.

Even worse, today's politics has become a politics of "divide and conquer" in which one constituency is played off against another: poor against rich, non-white against white, the secular against the religious. Before a positive outcome is possible, we must have unity and we must have reality.

It's more comfortable to ignore the crying of Cassandra, but maybe Nyquist is like Churchill in the pre-WWII political wilderness, trying to prepare us for the next conflict. We in Britain only just made it, and how we have paid for that struggle ever since.

But it was a price worth paying. History would have been very different, and very horrible I am sure, if Churchill had listened to some in his Cabinet in 1940 who advised him to make a deal with the Nazis. He said, “If this long island story of ours is to end at last, let it end only when each one of us lies choking in his own blood upon the ground.” It's a line that even now has tears pricking my eyes. The appeasers were silenced by the sound of deeply-moved men banging their fists on the Cabinet table in agreement and applause.

My worry is that I don't see men of that calibre now. As Lord Acton said in a letter to a bishop, "Power corrupts, and absolute power corrupts absolutely". Commenting on the House of Commons after the Great War, Stanley Baldwin remarked on the presence of "A lot of hard-faced men who look as if they had done very well out of the war". Today, the faces are softer, the hair expensively dressed, the manner relaxed and affable, but behind it all one senses cold-hearted, selfish betrayal. To be charitable, it may be that our leaders and ex-leaders don't fully realize the negative consequences of all their deals, compromises and consultancies.

As our reckless debt is progessively converted into ownership, we may find out how much we took our freedom for granted. It's a lot harder to get back.

The Bible has something to say on this, too (and no, I'm not a preacher, this is to show that the issues endure throughout history): Leviticus, Chapter 25 deals with debt, buying and redeeming slaves, and how the chosen people should be treated differently from the heathens - for the latter, enslavement is perpetual.

Friday, January 11, 2008

Gold, the dollar and the Dow

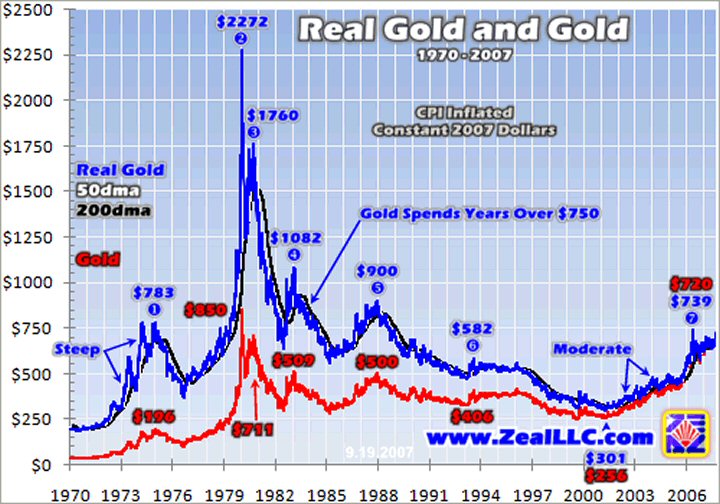

Here's a relatively recent graph of the price of gold, adjusted for inflation (admittedly, inflation can be defined in many ways):

On this chart, it looks as though gold's median price would be around $600/oz, so currently it's above trend and presumably the elevated value factors-in some economic concern.

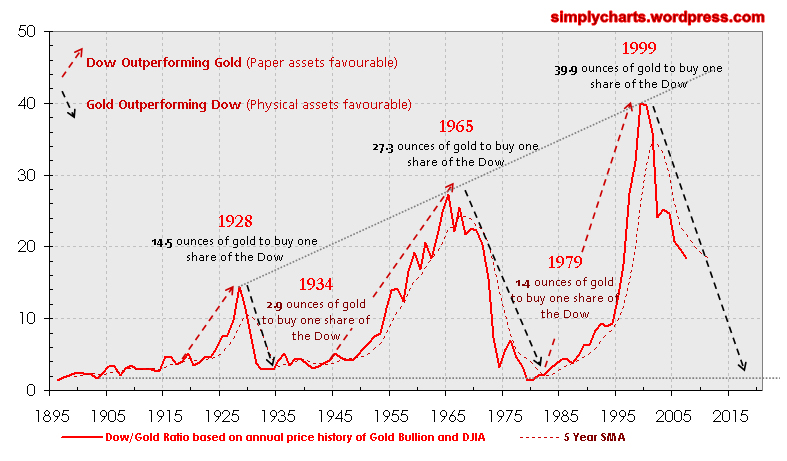

Now, here's a chart correlating the Dow and gold: It seems harder to spot an average here, since each peak is much higher than the one before. But taking the Dow as it is now (12,606.30) and the current price of gold ($894.90), the present ratio of 14.08 ounces would be in the middle range of the variation since the mid-1920s.

It seems harder to spot an average here, since each peak is much higher than the one before. But taking the Dow as it is now (12,606.30) and the current price of gold ($894.90), the present ratio of 14.08 ounces would be in the middle range of the variation since the mid-1920s.

So a purchase of gold now looks like a speculation, rather than a bargain.

Waves and tides

Thursday, January 10, 2008

Stuffed

Wednesday, January 09, 2008

Something's gotta give

It's more serious than that, of course: James Turk quotes the Comptroller General, David M Walker's estimate that total liabilities, including commitments to future social security benefits, are around $53 trillion. The government's annual revenues are only around 5% of this figure, so the credit card looks like it's pretty much fully-loaded.

However it happens, it seems something must give way under the strain. Frank Barbera reckons the Dow has plenty further to fall (and possible interim correction or not, he thinks gold looks good). Prieur du Plessis concurs, quoting Nouriel Roubini's comment that "... a lousy stock market in 2007 will look good compared to an awful stock market in 2008."

Bob Bronson thinks the downturn will be long as well as hard. He in turn quotes the chairman of the National Bureau of Economic Research: this one “could be deeper and longer than the recessions of the past.”

Boris Sobolev also looks to gold, but prefers the smaller companies because of all the money that's piled into the majors.

In case we in the UK should be tempted by schadenfreude, Ashraf Laidi predicts that sterling will accompany the US dollar's fall against other currencies. From what I read in connection with the USA, a weakening currency may provide a temporary boost to exports, but also inflate the cost of imports; so I don't suppose that our following the dollar will do us much long-term good, either.

Of course, it's possible to dismiss all this as group-think wall-of-worry stuff, but maybe that would be double-bluffing ourselves. Sometimes, things are exactly what they seem. Banks have consistently turned a profit for centuries, on the inexorability of debt.

Oil splat

In simplest terms, we are concerned that the very lifeblood of the world industrial economy—net oil export capacity—is draining away in front of our very eyes, and we believe that it is imperative that major oil importing countries like the United States launch an emergency Electrification of Transportation program--electric light rail and streetcars--combined with a crash wind power program.

That is just the tip of the iceberg, surely: residential and office heating/lighting, mechanised farming, supermarket shopping, centralised medical facilities - so much will have to be reviewed and planned.

Tuesday, January 08, 2008

Twang money, encore

In the short term, we have this contest between credit contraction and currency expansion. I'm getting the feeling it'll be the first followed by the second, which is what Michael Panzner predicts in "Financial Armageddon".

Grab your pension now, inflation-proof it?

Monday, January 07, 2008

Killer greens

... both oil and cereals are global commodity markets. If it's profitable to make food into fuel in the US, even without a subsidy, then it's profitable elsewhere also - possibly more so given lower labor costs. So the basic growth dynamics are the same. The infection just hasn't got as strong a grip on the whole globe yet, but it's growing at similar rates.

... I expect oil prices to increase in the medium term, though certainly they could go down in the short-term if the credit crunch affects the global economy enough.

... When we have a bidding war between the gas tanks of the roughly one billion middle class people on the planet, and the dinner tables of the poor, where does that reach equilibrium?

... We noted earlier that according to the UN about 800 million people are unable to meet minimal dietary energy requirements. That is 12% of the world population. [...] we can estimate that a doubling in food prices over 2000 levels might bring 30% or so of the global population below the level of minimal dietary energy requirements, and a quadrupling of food prices over 2000 levels might bring 60% or so of the global population into that situation.

Zero sum for the lower echelons

... it seems likely that the most skilled Westerners will continue to give their countries a comparative advantage against emerging markets. However, there is no guarantee that these research-intensive sectors are likely to support the entire Western population, far from it. They are highly cyclical, benefiting hugely from an active stock market and venture capital market. Further there is no evidence that innovation itself, as distinct from the fruits of recent past innovations, is significantly expanding as a percentage of output -- indeed, research expenditure has if anything declined.

... Since the majority of location-dependent jobs in Western countries are low-skill it therefore follows that if governments wish to protect local living standards, they need to discourage low-skill immigration. Except in Japan, they have not been doing so; both in the EU and the United States low-skill immigration, frequently illegal immigration, has got completely out of control and is immiserating the working classes.

... the economic histories of a high proportion of the Western population under 30, except the very highly skilled, will involve repeated bouts of unemployment, with job changes involving not a move to higher living standards but an angry acceptance of lower ones. By 2030, it is possible that the median real income in the United States and Western Europe may be no more than 50-60% of its level today.

This will expose the democratic divide between those who vote and influence the system in their favour, and the rest. The class division could sharpen as "I'm all right Jack" is replaced by "One can't complain, Piers".

Sackerson awards a Prose Prize for Hutchinson's use of the term "immiserating".

P.S.

... and presumably this will have an obvious effect on residential property prices. Who's for selling up and buying a caravan?

Gold boom, gold bust

I've reported expert comment before, about the vulnerability of gold to market manipulation and speculation. I think I'll keep on sitting out this dance.

Inflation or deflation: an expert writes

Also heartening to see my suggestion re insider jiggery-pokery echoed here:

As an aside, I still don't know what to make of the triangle / diamond in Goldman's chart (see Figure 4) other than they plan to squeeze stocks higher under the cover of low volumes over Christmas holidays in justifying their bonuses.

Sunday, January 06, 2008

A winning combination

The Daily Mail alleges a new craze called "celebrity maths", where you combine two famous faces to make a third. Who might be the third here?

The Daily Mail alleges a new craze called "celebrity maths", where you combine two famous faces to make a third. Who might be the third here?And what other political combinations would you like to see?

Gold and liberty

I watched a programme last night about how we very nearly had the Third World War in 1983. This was a time when Russia was especially paranoid about the West's military intentions - spies were even ordered to report how many lights were on in late evening at the Ministry of Defence in London, apparently not knowing that the offices were lit so the cleaners could do their work.

Then in September, a Soviet spy satellite, fooled by sunlight reflecting off high-level cloud, reported not one, but five missile launches from America. The Russian monitor on duty ignored the klaxon and flashing screen, backed his judgment and told his superiors it was a false alarm, for which he was ultimately discharged from the Army. Wikipedia says his name is Stanislav Petrov. He's certainly worth more than the $1,000 the Association of World Citizens could afford to award him. We may owe him our lives.

Looking for updates on the gold dinar, I came across this blog by a Pakistani, in which he looks to the Islamic dinar as a way of breaking the enslavement of the world by a fiat-currency banking cartel. Irrespective of whether he's justified in his analysis of the situation, or reasonable in his hopes for such a currency, we should note the victim-perception. I seem to recall a maxim (from Sun Tzu?) that you should fear a weak enemy.

Which brings us back to the economic vulnerability of the UK and USA. Weakness can invite aggression, but also makes the weak fear an attack even when it isn't coming. Worryingly for a potential aggressor, weakness may be feigned:

22. If your opponent is of choleric temper, seek to irritate him. Pretend to be weak, that he may grow arrogant. ("Laying Plans")

I don't think you can truly be free until you are strong and independent. We need to get our houses in order, so we can deal with others from a secure base - which is safer for all involved.

Iraq may have the last laugh

... prior to the war with Iraq the Dinar was $3.00+ per US Dollar.

...Today the country is almost debt free; Iraq is one of the leaders in oil, natural gas and holds a huge amount of gold in its country.

... The Company believes in the near future there will be a revalue of the Iraq Currency, it is the Company's opinion after doing its due diligence and public statements from Iraq's government officials, that the revalue could come in at between .82 and 1.00 per US Dollar.

Twang

"Examine the disappearing equity. It came from no where and is going back to no where."

That's what happens when credit becomes a form of currency, as the bullion moralists keep reminding us.

Why are banks allowed to create so much "fiduciary money"? Who does own the Fed?

Saturday, January 05, 2008

Bitter medicine

... the present crisis is already more serious than any that has occurred before in modern times.

... Our projections, taken literally, imply three successive quarters of negative real GDP growth in 2008. Spending in excess of income returns to negative territory, reaching -1.6 percent of GDP in the last quarter of 2012—a value that is very close to its “prebubble” historical average.

... while the rate of growth in GDP may recover to something like its long-term average, all our simulations show that the level of GDP in the next two years or more remains well below that of

productive capacity.

... We conclude that at some stage there will have to be a relaxation of fiscal policy large enough to add perhaps 2 percent of GDP to the budget deficit.Moreover, should the slowdown in the economy over the next two to three years come to seem intolerable, we would support a relaxation having the same scale, and perhaps duration, as that which occurred around 2001.

Our projections suggest the exciting, if still rather remote, possibility that, once the forthcoming financial turmoil has been worked through, the United States could be set on a path of balanced growth combined with full employment.

Raving sane?

The conspiracy theory here is that the Fed and other central banks are a cartel that not only inflates the money supply, but has created trillions in derivatives, partly to manipulate the investment markets. "Deepcaster" accuses this cartel of engineering drops in the gold price, just when you'd think gold should be emerging as a natural currency.

He brings in the Amero theory, too - ultimate replacement of the destroyed dollar by a new North American currency, presumably so the crooked poker game can continue with fresh cards.

Can anyone please shed light on all this? For example, who EXACTLY are the owners of the Fed?

If nobody knows or is willing to tell, perhaps one of us should claim ownership - "finders, keepers".