It has long been my impression that Professor Dawkins' emotions override his commitment to the highest standards of scholarly argument and research, and this is stated as a clear accusation by a victim of one of his attacks, the distinguished academic philosopher and former atheist Anthony Flew:

Dawkins is not interested in the truth as such but is primarily concerned to discredit an ideological opponent by any available means. That would itself constitute sufficient reason for suspecting that the whole enterprise of The God Delusion was not, as it at least pretended to be, an attempt to discover and spread knowledge of the existence or non-existence of God but rather an attempt – an extremely successful one – to spread the author’s own convictions in this area.

For the rest of Professor Flew's article, please see here.

I am not concerned to argue the case either for or against atheism here. There are honourable people on both sides of the argument.

But I am concerned that an eminent scientist long associated with my university should lose his professional compass so grossly on a matter that deeply interests and affects millions of people.

It is also worth noting, as perhaps many do not realise, that Professor Dawkins was, in effect, sponsored by an American billionaire to ride his hobby horse. The University's website openly admits:

Simonyi Professorship was set up with the express intention that its first holder should be Richard Dawkins.

I should like to know who is (and was then) on the appointments board for the Simonyi Professorship, and the interconnexions among them and others including the successful candidate and Mr Simonyi himself. I fear that the more I come to know about this, the more I may possibly feel that the Chair and its surrounding issues might serve to lessen respect for the University and its work.

If there is any reader of this post who teaches or is attending, or has taught or attended at Oxford University and would care to join me in a letter to the University inquiring into the Simonyi Professorship, I should be obliged if he/she would get in touch with me.

Saturday, December 31, 2011

Wednesday, December 28, 2011

Monday, December 26, 2011

Special Educational Needs and Inequality

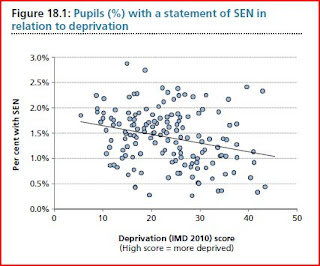

One might (perhaps) expect that less wealthy areas of England would have a higher proportion of children identified as having Special Educational Needs (SEN). Not so, according to this graph on page 103 of the NHS Atlas of Variation in Healthcare (November 2011 edition):

Using a measure called Indices of Multiple Deprivation and correlating it with the proportion of primary age children with a SEN Statement, it seems that children from poorer areas are less likely to be so diagnosed.

I don't think that's a true reflection of underlying need. There's loads of children with EBD (emotional and behavioural difficulties) and pace Mr Clegg the modern pattern of disrupted family structure really doesn't tend to help them. Perhaps schools that have more such children accept the situation as "normal"; or maybe their SENCOs (Special Educational Needs Coordinators) are simply overwhelmed. It's notable that primary age children are more likely to get excluded in Year 6, as the dreaded teacher-damning SATS exams draw near and the school finally decides that it can't afford to have a severely disruptive child in the group - was there really no such difficulty in the years before that?

But there are other kinds of need. Autism is an interesting case, and incidence of diagnosis is seemingly influenced by the social class of the family - an ASD (autistic spectrum diagnosis) expert in Birmingham LEA told us a year or two ago that the better-off quarters of Birmingham were yielding an ASD diagnosis rate some five times higher than in poorer areas. Perhaps it's because ASD doesn't carry the same potential stigma for the parent - it's genetic rather than a consequence of poor parenting skills - and perhaps also it's because it's a good way to attract extra attention and resources for your child (autism is a lifelong condition, unlike, er, "naughtiness").

Not that autism isn't real - I have taught autistic children all the way from mild cases down to the ones that can't or don't speak at all. But middle-class parents are (naturally) better at fighting their child's corner to get the diagnosis. And it strengthens their arm that the techniques and resources specifications in SEN statements are legally enforceable - such fun, as Miranda Hart's on-screen mum likes to say.

So in some ways the graph above is inadequate - it needs to be broken down into types of disability, and further into economic sub-divisions of the LEA (there is a world of difference between, say, Nechells and Hall Green). But even with the data aggregated in the way it is, there seem to be more questions to ask about inequalities in diagnosis and provision.

Using a measure called Indices of Multiple Deprivation and correlating it with the proportion of primary age children with a SEN Statement, it seems that children from poorer areas are less likely to be so diagnosed.

I don't think that's a true reflection of underlying need. There's loads of children with EBD (emotional and behavioural difficulties) and pace Mr Clegg the modern pattern of disrupted family structure really doesn't tend to help them. Perhaps schools that have more such children accept the situation as "normal"; or maybe their SENCOs (Special Educational Needs Coordinators) are simply overwhelmed. It's notable that primary age children are more likely to get excluded in Year 6, as the dreaded teacher-damning SATS exams draw near and the school finally decides that it can't afford to have a severely disruptive child in the group - was there really no such difficulty in the years before that?

But there are other kinds of need. Autism is an interesting case, and incidence of diagnosis is seemingly influenced by the social class of the family - an ASD (autistic spectrum diagnosis) expert in Birmingham LEA told us a year or two ago that the better-off quarters of Birmingham were yielding an ASD diagnosis rate some five times higher than in poorer areas. Perhaps it's because ASD doesn't carry the same potential stigma for the parent - it's genetic rather than a consequence of poor parenting skills - and perhaps also it's because it's a good way to attract extra attention and resources for your child (autism is a lifelong condition, unlike, er, "naughtiness").

Not that autism isn't real - I have taught autistic children all the way from mild cases down to the ones that can't or don't speak at all. But middle-class parents are (naturally) better at fighting their child's corner to get the diagnosis. And it strengthens their arm that the techniques and resources specifications in SEN statements are legally enforceable - such fun, as Miranda Hart's on-screen mum likes to say.

So in some ways the graph above is inadequate - it needs to be broken down into types of disability, and further into economic sub-divisions of the LEA (there is a world of difference between, say, Nechells and Hall Green). But even with the data aggregated in the way it is, there seem to be more questions to ask about inequalities in diagnosis and provision.

Thursday, December 22, 2011

How to become incredibly rich in the coming total economic collapse

You can't. And I don't want to read any more articles promising something like this.

Tuesday, December 20, 2011

China is in the same debt boat as the rest of us

Robert Wenzel reports a Roubini tweet that the real government debt-to-GDP ratio in China is 80%.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Sunday, December 18, 2011

Trust is breaking down wholesale, hoarding has begun - UPDATED 02 Jan 2012

The following started off on my grumble outlet Bearwatch, but looks like it's getting more serious:

“You can’t trust anybody and the entire system is collapsing. What’s the takeaway from this? It’s to make sure you have every penny in your pocket.”

Gerald Celente, Trends Research Institute founder, following the disappearance of his six-figure holdings at MF Global shortly before he was due to take delivery of physical gold. More here.

Update: and the chorus swells...

"It is up to you to decide how much you're willing to risk losing to a crook. If the answer is "none" or you cannot reduce the at-risk portion of your assets to what you're willing to lose to fraud then you can no longer participate in the market at all, in any form, nor even do business with a bank." - Karl Denninger.

"Now may be the time to exit all arrangements not specifically guaranteed directly by the government, and bring your money home. And better yet if no guarantees are required, and no parties standing between you and your wealth." - Jesse.

... and swells...

"Ultimately, I will not be at all surprised to see Europe’s banking system shut for days while the losses and payments issues are worked out. People forget that the term “bank holiday” was invented in the 1930’s when the banks were shut for exactly the same reason." - Dr Pippa Malmgren

"The whole system is going down. Pull your money out your Fidelity account, your Schwab account, and your ETFs." - Gerald Celente (again)

- both quoted here.

"Odds of a big market breakdown are both high and rising." - Mish.

... and balloons...

"The bottom line is that apparently some warehouses and bullion dealers are not a safe place to store your gold and silver, even if you hold a specific warehouse receipt." - Jesse (17 Dec 2011)

This gels with a recent post by David Malone, where he discusses a little-known rider to the (US) Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. The amendment concerned overrides bankruptcy protection protocols that are designed to treat creditors equally, such that if Bank A has "repo" or derivatives contract business with Bank B, and Bank B fails (or is forced into failure...), Bank A can grab the collateral straight away, not waiting for the trustee to sort out who gets what.

And if some of that collateral is money or other valuables you (an innocent third party) deposited with Bank B, hard luck, it seems.

Ostensibly, this legislation was to prevent systemic collapse as Bank B's failure could make Bank A insolvent, then subsequently Banks C and D etc. But, as Malone points out, it's also potentially an invitation to stronger (or at least, public-money-supported) banks to tip weaker ones into insolvency and grab assets, leaving other creditors to sue for their return (if they can afford to do so). Possession is nine points of the law, as the adage goes. Apparently, this deadly revision is written into banking legislation beyond America's shores.

In turn, that reminds me of something Malone wrote back in October, reporting what a top Irish banker said to him, off the record:

"According to this very senior banker it was now known that the plan was all but agreed to re-capitalize all the banks but to the very minimum degree. France and Germany were agreed on this. As I wrote before I left, there has been a bidding war looking for the lowest amount.

"The horse trading and arguing is of a quite different nature.What is being thrashed out is a list, for use after this across the board, minimum bail out, of which banks will be saved and which will be left to die when they next have a problem. The horse trading is over who will be saved and who damned.

"In other words the decision has been reached that this is the last pan-Europe, all bank bail out attempt. After this it is recognized that Europe and the IMF cannot save all the banks. And so only the most systemically vital are going to be saved and the rest will be allowed to save themselves if they can or die if they cannot."

It's possible that a vicious internecine cannibalism is about to commence in the international banking industry, and plenty of innocent bystanders could suddenly find they're hurt.

Little wonder, then that even bankers have started to hoard food.

Further update (27 December - hat-tip to Jesse): Gonzalo Lira writes...

Now, question: When is there ever a panic? When is there ever a run on a financial system?

Answer: When enough participants no longer trust the system. It is the classic definition of a tipping point. It’s not that all of the participants lose faith in the system or institution. It’s not even when most of the participants lose faith: Rather, it’s when a mere some of the participants decide they no longer trust the system that a run is triggered.

And though this is completely subjective on my part—backed by no statistics except scattered anecdotal evidence—but it seems to me that MF Global has shoved us a lot closer to this theoretical run on the system.

As I write this, a lot of investors whom I know personally—who are sophisticated, wealthy, and not at all the paranoid type—are quietly pulling their money out of all brokerage firms, all banks, all equity firms. They are quietly trading out of their paper assets and going into the actual, physical asset.

Note that they’re not trading into the asset—they’re simply exchanging their paper-asset for the real thing.

Why? MF Global.

More... 2 January: James Howard Kunstler's 2012 forecast...

There are signs that a lot of people who still have something resembling money invested in various funds will go to cash in the weeks ahead, including under-the-mattress style. The distrust and paranoia is palpable now, with the frenzies of Yuletide bygone for another year. After all, why trust banks, especially the TBTF monsters. Such a mass move could take the starch even out of highly manipulated equity markets.

___________________________________________________________________________

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

“You can’t trust anybody and the entire system is collapsing. What’s the takeaway from this? It’s to make sure you have every penny in your pocket.”

Gerald Celente, Trends Research Institute founder, following the disappearance of his six-figure holdings at MF Global shortly before he was due to take delivery of physical gold. More here.

Update: and the chorus swells...

"It is up to you to decide how much you're willing to risk losing to a crook. If the answer is "none" or you cannot reduce the at-risk portion of your assets to what you're willing to lose to fraud then you can no longer participate in the market at all, in any form, nor even do business with a bank." - Karl Denninger.

"Now may be the time to exit all arrangements not specifically guaranteed directly by the government, and bring your money home. And better yet if no guarantees are required, and no parties standing between you and your wealth." - Jesse.

... and swells...

"Ultimately, I will not be at all surprised to see Europe’s banking system shut for days while the losses and payments issues are worked out. People forget that the term “bank holiday” was invented in the 1930’s when the banks were shut for exactly the same reason." - Dr Pippa Malmgren

"The whole system is going down. Pull your money out your Fidelity account, your Schwab account, and your ETFs." - Gerald Celente (again)

- both quoted here.

"Odds of a big market breakdown are both high and rising." - Mish.

... and balloons...

"The bottom line is that apparently some warehouses and bullion dealers are not a safe place to store your gold and silver, even if you hold a specific warehouse receipt." - Jesse (17 Dec 2011)

This gels with a recent post by David Malone, where he discusses a little-known rider to the (US) Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. The amendment concerned overrides bankruptcy protection protocols that are designed to treat creditors equally, such that if Bank A has "repo" or derivatives contract business with Bank B, and Bank B fails (or is forced into failure...), Bank A can grab the collateral straight away, not waiting for the trustee to sort out who gets what.

And if some of that collateral is money or other valuables you (an innocent third party) deposited with Bank B, hard luck, it seems.

Ostensibly, this legislation was to prevent systemic collapse as Bank B's failure could make Bank A insolvent, then subsequently Banks C and D etc. But, as Malone points out, it's also potentially an invitation to stronger (or at least, public-money-supported) banks to tip weaker ones into insolvency and grab assets, leaving other creditors to sue for their return (if they can afford to do so). Possession is nine points of the law, as the adage goes. Apparently, this deadly revision is written into banking legislation beyond America's shores.

In turn, that reminds me of something Malone wrote back in October, reporting what a top Irish banker said to him, off the record:

"According to this very senior banker it was now known that the plan was all but agreed to re-capitalize all the banks but to the very minimum degree. France and Germany were agreed on this. As I wrote before I left, there has been a bidding war looking for the lowest amount.

"The horse trading and arguing is of a quite different nature.What is being thrashed out is a list, for use after this across the board, minimum bail out, of which banks will be saved and which will be left to die when they next have a problem. The horse trading is over who will be saved and who damned.

"In other words the decision has been reached that this is the last pan-Europe, all bank bail out attempt. After this it is recognized that Europe and the IMF cannot save all the banks. And so only the most systemically vital are going to be saved and the rest will be allowed to save themselves if they can or die if they cannot."

It's possible that a vicious internecine cannibalism is about to commence in the international banking industry, and plenty of innocent bystanders could suddenly find they're hurt.

Little wonder, then that even bankers have started to hoard food.

Further update (27 December - hat-tip to Jesse): Gonzalo Lira writes...

Now, question: When is there ever a panic? When is there ever a run on a financial system?

Answer: When enough participants no longer trust the system. It is the classic definition of a tipping point. It’s not that all of the participants lose faith in the system or institution. It’s not even when most of the participants lose faith: Rather, it’s when a mere some of the participants decide they no longer trust the system that a run is triggered.

And though this is completely subjective on my part—backed by no statistics except scattered anecdotal evidence—but it seems to me that MF Global has shoved us a lot closer to this theoretical run on the system.

As I write this, a lot of investors whom I know personally—who are sophisticated, wealthy, and not at all the paranoid type—are quietly pulling their money out of all brokerage firms, all banks, all equity firms. They are quietly trading out of their paper assets and going into the actual, physical asset.

Note that they’re not trading into the asset—they’re simply exchanging their paper-asset for the real thing.

Why? MF Global.

More... 2 January: James Howard Kunstler's 2012 forecast...

There are signs that a lot of people who still have something resembling money invested in various funds will go to cash in the weeks ahead, including under-the-mattress style. The distrust and paranoia is palpable now, with the frenzies of Yuletide bygone for another year. After all, why trust banks, especially the TBTF monsters. Such a mass move could take the starch even out of highly manipulated equity markets.

___________________________________________________________________________

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Saturday, December 17, 2011

Even bankers are hoarding food

Extract from an article in today's Daily Mail:

‘It is not “crazies” buying this,’ says James Blake, whose company Emergency Food Storage specialises in freeze-dried foods. ‘We get a lot of high-powered business people as customers. Most people buy insurance for their health, their house or their life — this is food insurance.

‘Of course, we hope it never happens, but if there is a major catastrophe, then money is not going to be worth much after a couple of days. It will be food that becomes the most needed thing.’

Dave Hannah and his company B-Prep sell similar products. He says a number of his customers are bankers. Their average spend is £3,000.

‘It is not “crazies” buying this,’ says James Blake, whose company Emergency Food Storage specialises in freeze-dried foods. ‘We get a lot of high-powered business people as customers. Most people buy insurance for their health, their house or their life — this is food insurance.

‘Of course, we hope it never happens, but if there is a major catastrophe, then money is not going to be worth much after a couple of days. It will be food that becomes the most needed thing.’

Dave Hannah and his company B-Prep sell similar products. He says a number of his customers are bankers. Their average spend is £3,000.

Subscribe to:

Comments (Atom)