Sunday, January 06, 2013

Max Keiser and George Galloway: a deafening silence in the media

On 20th November, Max Keiser addressed a large audience in the Grand Committee Room in the Houses of Parliament, as the guest of George Galloway MP.

Galloway pointed out that this was the second largest public room in Parliament (the first had already been booked) and all MPs had been invited in writing, twice - yet none of them had turned up.

In some ways this is understandable: Galloway is "colourful" and, to me, something of an enigma, and his fellow Parliamentarians must have considered the risk of tainting by association.

Or worse, reputational entrapment: for although Keiser had strong criticisms to make of Gordon Brown's gold sale (1999 - 2002), which he said is the moment when Britain's independence was surrendered, he also laid the blame for the present crisis on the monetary expansion that began under Reagan and Thatcher. Additionally, he had harsh words to say about George Osborne and David Cameron, whom he sees as fighting for corrupt City interests. In the circumstances, MPs on both sides must have seen little political advantage in attending.

Yet there wasn't that much else on in Parliament on the evening of 20th November. The House of Commons Order of Business after 7 p.m. was a handful of decisions to be made without debate, plus the presentation of a petition and the Adjournment Debate. Granted, many MPs would be heading home for the weekend - but another hour or so, of worthwhile economic instruction, might have done them some good.

And it's surprising that, try as I may, I can find no mainstream media report of Keiser's speech. Remember that he is possibly the most-watched TV journalist in the world, talking on a subject of the utmost importance in the very heart of London. This, perhaps deliberate neglect plays into the growing public cynicism about our political elite and the Fourth Estate.

Regular Keiser-watchers will have heard much of his material before, many times, though it may be news to some that the reason he's shifted his base of operations to London is that he wants a ringside seat to cover what he sees as the coming, full-blown disaster of historic proportions, and expects our poor country to be the epicentre.

He also says that Germany will use its gold hoard and massive Eurobond issuance to establish its advantage over the City; Frankfurt will become the centre of banking and trading in Europe, he feels. Britain, having allowed its financial sector to swell to over 10% of national GDP, has set itself up for a terrible fall.

According to Keiser, only raising interest rates sharply - as Paul Volcker did in the USA (20% by 1981) - can cleanse the speculation and malpractice from the system; and he doesn't see us doing that.

Also interesting in this film, is the naivety of questions, underlining Keiser's (and George Osborne's) observations about the financial illiteracy of the British public.

Like Nigel Farage (another ex-financial trader), Keiser is loud, brash and fast-talking (he starts more sentences than he finishes); and both are also, in my assessment, completely sincere in their concern and indignation.

The film lasts slightly more than an hour, but you can simply listen to it while doing something else, as I did. I think you'll find it worth your while.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Galloway pointed out that this was the second largest public room in Parliament (the first had already been booked) and all MPs had been invited in writing, twice - yet none of them had turned up.

In some ways this is understandable: Galloway is "colourful" and, to me, something of an enigma, and his fellow Parliamentarians must have considered the risk of tainting by association.

Or worse, reputational entrapment: for although Keiser had strong criticisms to make of Gordon Brown's gold sale (1999 - 2002), which he said is the moment when Britain's independence was surrendered, he also laid the blame for the present crisis on the monetary expansion that began under Reagan and Thatcher. Additionally, he had harsh words to say about George Osborne and David Cameron, whom he sees as fighting for corrupt City interests. In the circumstances, MPs on both sides must have seen little political advantage in attending.

Yet there wasn't that much else on in Parliament on the evening of 20th November. The House of Commons Order of Business after 7 p.m. was a handful of decisions to be made without debate, plus the presentation of a petition and the Adjournment Debate. Granted, many MPs would be heading home for the weekend - but another hour or so, of worthwhile economic instruction, might have done them some good.

And it's surprising that, try as I may, I can find no mainstream media report of Keiser's speech. Remember that he is possibly the most-watched TV journalist in the world, talking on a subject of the utmost importance in the very heart of London. This, perhaps deliberate neglect plays into the growing public cynicism about our political elite and the Fourth Estate.

Regular Keiser-watchers will have heard much of his material before, many times, though it may be news to some that the reason he's shifted his base of operations to London is that he wants a ringside seat to cover what he sees as the coming, full-blown disaster of historic proportions, and expects our poor country to be the epicentre.

He also says that Germany will use its gold hoard and massive Eurobond issuance to establish its advantage over the City; Frankfurt will become the centre of banking and trading in Europe, he feels. Britain, having allowed its financial sector to swell to over 10% of national GDP, has set itself up for a terrible fall.

According to Keiser, only raising interest rates sharply - as Paul Volcker did in the USA (20% by 1981) - can cleanse the speculation and malpractice from the system; and he doesn't see us doing that.

Also interesting in this film, is the naivety of questions, underlining Keiser's (and George Osborne's) observations about the financial illiteracy of the British public.

Like Nigel Farage (another ex-financial trader), Keiser is loud, brash and fast-talking (he starts more sentences than he finishes); and both are also, in my assessment, completely sincere in their concern and indignation.

The film lasts slightly more than an hour, but you can simply listen to it while doing something else, as I did. I think you'll find it worth your while.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Saturday, January 05, 2013

Looking for a widget!

Help wanted! We thought we'd found a multiple blog widget so you can follow all pages in one simple device, but the one we got can't be installed by readers. Anyone out there know a good one?

Friday, January 04, 2013

Airbrushing out The Queen

My wife asked me what this was, on the back of a pound coin:

... and on further investigation it seems that ever since this little metal thing was introduced into our system of exchange, the Royal Arms have been omitted (except for the 1988 design) in favour of a cycle of images from the regions.

Doubtless we'll be told not to take it too seriously, but it seems to me that the 1.5 billion pound coins are being used as yet another method to condition us to accept the "inevitable" breakup of the Union.

Another subliminal point, maintains the wife of a friend, is that the change from a banknote to a small coin was to help us not to expect so much for our money.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

It's the Arms of the City of London:

... and on further investigation it seems that ever since this little metal thing was introduced into our system of exchange, the Royal Arms have been omitted (except for the 1988 design) in favour of a cycle of images from the regions.

Doubtless we'll be told not to take it too seriously, but it seems to me that the 1.5 billion pound coins are being used as yet another method to condition us to accept the "inevitable" breakup of the Union.

Another subliminal point, maintains the wife of a friend, is that the change from a banknote to a small coin was to help us not to expect so much for our money.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Thursday, January 03, 2013

Nick Drew: Solar power the worst option for reducing carbon emissions

See The Energy Page for an industry expert's assessment.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Nick Drew: Solar fad a waste of money

Energy expert and journalist Nick Drew has written a new piece for The Energy Page on cost-effective ways to reduce carbon dioxide emissions. Turns out that the fashion for roof-mounted solar panels is just about the worst possible option - read the full story here.

Nick is a regular contributor to the Capitalists@Work blog.

************

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Solar Power is Daylight Robbery

The UK government is very fond of claiming that its decarbonisation policy is being delivered at least cost to UK citizens. Irrespective of whether one supports the policy goal, one would at least like to believe them on the cost.

Sadly, their claim is a blatant falsehood; and we can see why this is by utilizing the government's own methodologies.

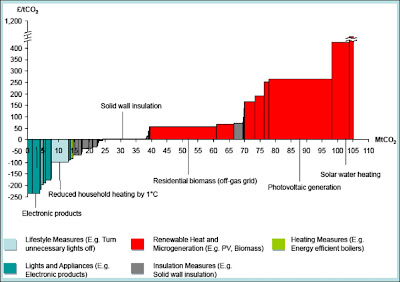

A very standard way of presenting the cost-effectiveness of measures that can reduce CO2 emissions is the Marginal Abatement Cost Curve (MACC) and we will look at some examples below. The basic concept is simple: for each measure, calculate the cost per unit of CO2 emissions reduced, and rank them from cheapest to most expensive on a bar-chart. If we pick (e.g.) a particular market segment, we can additionally plot the total absolute potential for CO2 abatement each measure can deliver in that sector (e.g. in tonnes), by making the width of each bar correspond to the amount.

Having ranked them thus, for a given target amount of reductions we can directly read off the cost of the most expensive measure required to achieve the target. And why would anyone institute measures that cost more than absolutely necessary ? Surely, they would exhaust the potential of the cheapest measures first, before proceeding to the more expensive.

Before looking at UK examples, it is interesting to note that in every MACC example one ever sees, the cheapest abatement measures are in fact profitable - that is, they pay for themselves - in some cases, handsomely so: their 'cost' is not just cheap, it is negative. (We will consider what this means in policy terms another time.) Our first example shows this aspect clearly: it comes from DECC and is the MACC of the total potential abatement identified in the UK 'non-traded' sector (the part of the economy not subject to the EU Emissions Trading Scheme), for the period 2023–27.

As can be seen, at the left-hand side there is around 90 MtCO2e abatement potential that pays for itself. We should only need to start paying for abatement if the target was in excess of that amount. The weighted average of the cost (by a complex calculation) is £43 per tonne, which coincides with an abatement potential of around 130 Mt - well over half the total. Even the most expensive measures plotted come in at under £250 per tonne.

This, then, is a baseline of sorts, and certainly gives some background perspective for considering the next chart, which is the detailed MACC for abatement potential in the UK residential sector through to 2020.

Note that solar power (PV generation) is well to the right of the curve, with a cost that towers over most of the measures available. (Solar water-heating is even worse.) Secondly, at £265 per tonne it is more expensive than any of the measures from the previous MACC.

A very obvious conclusion must surely be that solar power should not be receiving public money (via whatever mechanism) until the vastly greater potential that is available at very much less cost has been comprehensively exploited. Needless to say, the opposite is the case: residential solar power installations are heavily subsidized via our electricity bills, while huge amounts of cheaper - much cheaper - abatement potential lies dormant.

No end of sophistry is offered to defend this state of affairs. Costs of PV are falling all the time; many jobs have been created (mostly in China, of course); we need to create a level playing-field for all technologies (whatever that means). And there are all manner of nuances relating to the interpretation of MACCs - as DECC is keen to tell us (Box B5 here).

No amount of ratiocination, however, can deflect the accusation that subsidizing solar PV in the UK is indefensible from a cost perspective. And in straightened times, costs matter.

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Sadly, their claim is a blatant falsehood; and we can see why this is by utilizing the government's own methodologies.

A very standard way of presenting the cost-effectiveness of measures that can reduce CO2 emissions is the Marginal Abatement Cost Curve (MACC) and we will look at some examples below. The basic concept is simple: for each measure, calculate the cost per unit of CO2 emissions reduced, and rank them from cheapest to most expensive on a bar-chart. If we pick (e.g.) a particular market segment, we can additionally plot the total absolute potential for CO2 abatement each measure can deliver in that sector (e.g. in tonnes), by making the width of each bar correspond to the amount.

Having ranked them thus, for a given target amount of reductions we can directly read off the cost of the most expensive measure required to achieve the target. And why would anyone institute measures that cost more than absolutely necessary ? Surely, they would exhaust the potential of the cheapest measures first, before proceeding to the more expensive.

Before looking at UK examples, it is interesting to note that in every MACC example one ever sees, the cheapest abatement measures are in fact profitable - that is, they pay for themselves - in some cases, handsomely so: their 'cost' is not just cheap, it is negative. (We will consider what this means in policy terms another time.) Our first example shows this aspect clearly: it comes from DECC and is the MACC of the total potential abatement identified in the UK 'non-traded' sector (the part of the economy not subject to the EU Emissions Trading Scheme), for the period 2023–27.

|

| Source: DECC |

This, then, is a baseline of sorts, and certainly gives some background perspective for considering the next chart, which is the detailed MACC for abatement potential in the UK residential sector through to 2020.

|

| Source: Committee on Climate Change |

A very obvious conclusion must surely be that solar power should not be receiving public money (via whatever mechanism) until the vastly greater potential that is available at very much less cost has been comprehensively exploited. Needless to say, the opposite is the case: residential solar power installations are heavily subsidized via our electricity bills, while huge amounts of cheaper - much cheaper - abatement potential lies dormant.

No end of sophistry is offered to defend this state of affairs. Costs of PV are falling all the time; many jobs have been created (mostly in China, of course); we need to create a level playing-field for all technologies (whatever that means). And there are all manner of nuances relating to the interpretation of MACCs - as DECC is keen to tell us (Box B5 here).

No amount of ratiocination, however, can deflect the accusation that subsidizing solar PV in the UK is indefensible from a cost perspective. And in straightened times, costs matter.

* * * * *

Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog; or for unintentional error and inaccuracy. The blog author may have, or intend to change, a personal position in any stock or other kind of investment mentioned.

Subscribe to:

Comments (Atom)