Here, Tyler Durden discusses at length issues around the process of restructuring Greek debt.

It seems that we have to take into account the difference between bonds issued under Greek law and those issued under don-domestic law. One of the technical points is whether all holders of the debt have to agree to a new deal, and whether or not a minority can hold the majority to ransom by refusing to agree.

If, in desperation, Greece is driven to outright default whatever its creditors might think, this tears up the rule book and anything could happen. Other European nations are also severely distressed by debt and might try to follow suit. The very rule of international law would be challenged.

But there is an angle that Durden has not explored in his essay: the principle of "odious debt". There is precedent for a country repudiating damaging obligations, e.g. Mexico after the fall of the Emperor Maximilian, and the USA itself in relation to Cuban debt incurred under the previous Spanish regime.

Could Greeks be justified in arguing that bailouts imposed by their new, undemocratic government are not binding on the people? Could this argument also apply to debts incurred previously, directly and indirectly and consequently, in the process of acquiring EU membership, which it now transpires was based on fraud, assisted by bent accounting by Goldman Sachs and quite possibly connived at by the other EU states?

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Sunday, February 19, 2012

Wednesday, February 15, 2012

Greek debt: talks continue

Hercules slaying Augeas for non-payment of debt - the promised fee for cleaning the Augean stables. The statue, by Lorenzo Mattielli, stands outside the Hofburg Palace in Vienna.

At least Hercules had an excuse, having done some honest work, though to my eyes this particular depiction makes him seem simply a violent fat thug. What, by contrast, have the EU, international banking and the lucrative intermediation of Goldman Sachs done for Greece, aside from shoehorn the country into a club it should never have been allowed to join?

Euro MP and UKIP leader Nigel Farage has just told it straight yet again, to a parliament in which notable figures pointedly chat to each other while he berates them: the EU has driven poor Hellas to desperation and worse is to follow.

This chaos was foreseeable; my wife and I were in Corfu in May 2010 - the month in which three innocent Athenian bank employees were burned to death - and the goldsmith at Roda told us there would be a revolution within a year. Now, a whole government has been removed by outsiders and democracy is, apparently, merely an optional extra for peripheral nations.

Anyone who know the Greeks knows they have a historical memory like the Irish. This will go deep and will not be forgiven.

Saturday, February 11, 2012

Loathing corner

The Daily Mail reports its libel victory over the Lizard People. But looking at them, why are our politicians and financiers so unimpressive?

There is Oleg Deripaska, reminiscent of a toxic marmot, flanked (left) by millionaire Nat Rothschild looking like one of the people who stand behind John McCririck on Channel 4 Racing and seemingly nerving himself up to raise his thumb at the camera, and (right) by Peter Mandelson, rigidly relaxed and posing as a wannabe extra for a Blue Oyster club scene from "Police Academy".

If you must be star-struck, boys, at least don't worship a dark star.

I'm holding out for the Hollywood version, it'll be so much more credible. To quote Sir Philip Sidney, these people's "world is brazen, the poets only [i.e. only artists] deliver a golden".

International debt, in context

Data gets turned to the commentator's angle on it. Discussion of debt too often focuses on what government owes and ignores private liabilities, hence the crisis (which most professional economists failed to anticipate) that faces us now.

In its turn, debt is only a part of the picture. Watching the Greek economy implode, it's easy to run around panicking like Chicken Little about our own situation.

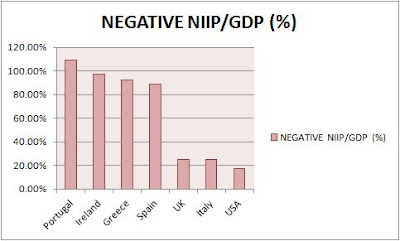

So let's look at the net international investment position of the PIIGS, USA and UK to see the problem through a wider-angle lens:

Yes, even in this wider definition of net obligations, we're all debtors; but the ratio of debt to GDP varies greatly, and if there is to be a domino effect, remember that one of the dominoes in the top graph is more like a skyscraper and much less easy to tip over.

Everything that makes up the above data is subject to change: what will bonds and equities be worth next year? How much could GDP change? How is the structure of the largest economies different from that of the small ones? Are we comparing whales and jellyfish?

And how much could the big help out the small? I'm reminded of the story of two men at their place of worship, praying for cash to get them out of a jam. "I need fifty thousand, Lord, or I'm going to lose this deal," begs a blue-suit, but keeps being interrupted by his ill-dressed neighbour calling "A hundred, Lord, a hundred for my family's rent and food". Finally, the businessman reaches into his pocket, pulls out $100 and gives it to the other, saying "Here, now shut up, he's listening to me."

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

In its turn, debt is only a part of the picture. Watching the Greek economy implode, it's easy to run around panicking like Chicken Little about our own situation.

So let's look at the net international investment position of the PIIGS, USA and UK to see the problem through a wider-angle lens:

Yes, even in this wider definition of net obligations, we're all debtors; but the ratio of debt to GDP varies greatly, and if there is to be a domino effect, remember that one of the dominoes in the top graph is more like a skyscraper and much less easy to tip over.

Everything that makes up the above data is subject to change: what will bonds and equities be worth next year? How much could GDP change? How is the structure of the largest economies different from that of the small ones? Are we comparing whales and jellyfish?

And how much could the big help out the small? I'm reminded of the story of two men at their place of worship, praying for cash to get them out of a jam. "I need fifty thousand, Lord, or I'm going to lose this deal," begs a blue-suit, but keeps being interrupted by his ill-dressed neighbour calling "A hundred, Lord, a hundred for my family's rent and food". Finally, the businessman reaches into his pocket, pulls out $100 and gives it to the other, saying "Here, now shut up, he's listening to me."

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Friday, February 03, 2012

UK back into slump

Since my previous post, the UK M4 bank lending figures in the quarter to end December have finally come in: negative 6.7% annualised, following on from negative 8.7% ending September.

Since the start of the credit crunch in 2007, UK M4 has done this:

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Since the start of the credit crunch in 2007, UK M4 has done this:

That's 5 negative quarters out of the last 7 - the five lowest (and the only five negatives) since 1963.

This thing isn't over, and the air of normality and control is, I fear, fake.

INVESTMENT DISCLOSURE: None. Still in cash (and index-linked National Savings Certificates), and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Sunday, January 29, 2012

Is money-lending approaching its tipping point?

Chartists are always trying to scry a pattern in markets. Here's one that doesn't seem too difficult to discern: the long-term deceleration in bank lending to the UK private sector.

It looks like a cycle of around 18 years, but rather than simply repeating, the pattern is progressive: lower peaks each time, and lower lows. And for the first time since 1963 (which is as far as the online BoE data goes), we are in negative territory. Previous highs of c. 35%, 25% and 15% suggest that the next peak will be more of a hillock, at 5%.

Or maybe there will be a phase shift, into some disorderly deflation. Australian Economist Steve Keen has attempted to model macroeconomic change as debt increases, and one curious feature is that the model predicts an apparent tendency towards a moderate point, followed by a catastrophic breakdown in wages and profits - see for example the graphs on pages 43 and 44 of his paper entitled "Are we 'It' Yet?".

The economy is not a machine, of course. It is more like a game played with ever-varying rules, like Calvinball. But the value of Keen's observations is in showing that there must, in fact, be a change in the rules at some point, simply because without it the game breaks down altogether.

Currently, our counters are cash notes, bank deposit statements, share certificates, bonds, Treasury promises and property deeds - plus the derivative contracts that outweigh everything else. Whether they will be freely accepted by all players in the next version of the game remains to be seen; perhaps they will suffer the fate of Continental and Confederate currency.

No wonder that many thinking persons are converting to tangible assets of various types, even if they seem overpriced according to the present system of reckoning.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content.

Subscribe to:

Comments (Atom)