Several Bloghounds members have been offering musical selections. Try listening to the Al Andaluz Project - seven of their tracks are available to click on. I heard something by them on R3's "World Routes" a fortnight ago.

From the same programme I heard Marko Markovitch's tremendously vibrant jazz band. You can't get it on iPlayer but here's a site with samples, and here's "Romany wedding" which would make even the lame dance.

BOBAN MARKOVIC-RROMANO BIJAV-LA BELLEVILLOISE

Uploaded by aceituna11. - Watch more music videos, in HD!

Saturday, August 28, 2010

A response to "Capitalists@Work"

"City Unslicker" has posted a feelgood piece and entitled it "Bearwatch". If this is intended as a tease, looking sideways at my first blog which started three years ago and forewarned of the credit crunch*, banking collapse etc, then it's worked. Not that I claim any wisdom, but a strong gut feeling got me looking around for sources of information other than the useless Press.

Perhaps I should feel flattered that anyone from stockbroking or banking pays me any attention; or maybe it's just a naming coincidence. Nevertheless, here is my reply: you experts can be both right and wrong at the same time.

I'd like to have made a graph for the FTSE over the period I think we should be looking at, but that index only started in 1984. Besides, ours is a mixed economy, doing the hokey-cokey between privatisation and nationalisation, so it's very difficult to discern the reality underlying all the fudge.

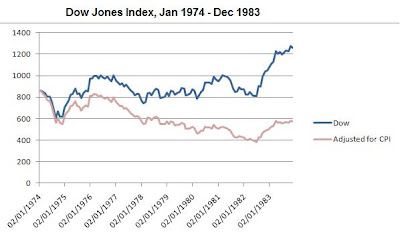

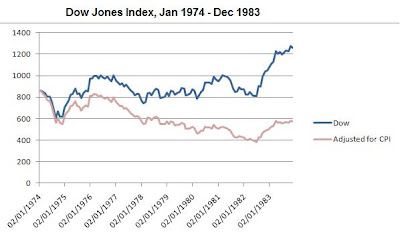

So instead, here's the history of the US stockmarket "boom" of 1974. The blue line is the nominal index, and then I reinterpret the figures in the light of the Consumer Price Index. We start at the beginning of 1974 and continue for 10 years.

*"a systemic risk that could have really serious consequences is the possibility of a major failure in the mortgage and credit markets, which could then roll on to the banking sector." - 31 July 2007

*"a systemic risk that could have really serious consequences is the possibility of a major failure in the mortgage and credit markets, which could then roll on to the banking sector." - 31 July 2007

Perhaps I should feel flattered that anyone from stockbroking or banking pays me any attention; or maybe it's just a naming coincidence. Nevertheless, here is my reply: you experts can be both right and wrong at the same time.

I'd like to have made a graph for the FTSE over the period I think we should be looking at, but that index only started in 1984. Besides, ours is a mixed economy, doing the hokey-cokey between privatisation and nationalisation, so it's very difficult to discern the reality underlying all the fudge.

So instead, here's the history of the US stockmarket "boom" of 1974. The blue line is the nominal index, and then I reinterpret the figures in the light of the Consumer Price Index. We start at the beginning of 1974 and continue for 10 years.

*"a systemic risk that could have really serious consequences is the possibility of a major failure in the mortgage and credit markets, which could then roll on to the banking sector." - 31 July 2007

*"a systemic risk that could have really serious consequences is the possibility of a major failure in the mortgage and credit markets, which could then roll on to the banking sector." - 31 July 2007DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Friday, August 27, 2010

A green query

Are designer eco-homes more environmentally friendly than not building them?

As Scott Adams says:

The greenest home is the one you don't build. If you really want to save the Earth, move in with another family and share a house that's already built. Better yet, live in the forest and eat whatever the squirrels don't want. Don't brag to me about riding your bicycle to work; a lot of energy went into building that bicycle. Stop being a hypocrite like me.

I prefer a more pragmatic definition of green. I think of it as living the life you want, with as much Earth-wise efficiency as your time and budget reasonably allow.

Is the well-heeled greenie not unlike Marie Antoinette, tending her washed (and "heavily perfumed") sheep in a sylvan fantasy?

I'm only jealous, of course. I can't wait to join the middle-class lotus eaters, as soon as my Lotto ticket pays out the Big One.

As Scott Adams says:

The greenest home is the one you don't build. If you really want to save the Earth, move in with another family and share a house that's already built. Better yet, live in the forest and eat whatever the squirrels don't want. Don't brag to me about riding your bicycle to work; a lot of energy went into building that bicycle. Stop being a hypocrite like me.

I prefer a more pragmatic definition of green. I think of it as living the life you want, with as much Earth-wise efficiency as your time and budget reasonably allow.

Is the well-heeled greenie not unlike Marie Antoinette, tending her washed (and "heavily perfumed") sheep in a sylvan fantasy?

I'm only jealous, of course. I can't wait to join the middle-class lotus eaters, as soon as my Lotto ticket pays out the Big One.

Underneath the headlines, debt continues to increase

There's much argument on the wires about the issue of inflation vs deflation. As James Quinn points out, the mainstream media aren't helping much because if they comment at all, they may still misunderstand what they're reporting. The official figures appear to show that debt in the US is reducing, but this needs to be reinterpreted in the light of write-offs:

If consumer debt was $13.8 trillion at the end of 2008 and the banks have since written off 5.66% of that debt, total write-offs were $800 billion. If total consumer debt now sits at $13.5 trillion, then consumers have actually taken on $500 billion of additional debt since the end of 2008. The consumer hasn’t cut back at all. They are still spending and borrowing. It is beyond my comprehension that no one on CNBC or in the other mainstream media can do simple math to figure out that the deleveraging story is just a Big Lie.

Reading around, it seems that a lot of credit card debt has been written-off, but better-risk customers may be increasing their usage, especially business owners (perhaps finding a way around the dearth in other forms of bank lending):

Credit cards are now the most common source of financing for America’s small-business owners. (Source: National Small Business Association survey, 2008)

44 percent of small-business owners identified credit cards as a source of financing that their company had used in the previous 12 months —- more than any other source of financing, including business earnings. In 1993, only 16 percent of small-businesses owners identified credit cards as a source of funding they had used in the preceding 12 months. (Source: National Small Business Association survey, 2008)

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

If consumer debt was $13.8 trillion at the end of 2008 and the banks have since written off 5.66% of that debt, total write-offs were $800 billion. If total consumer debt now sits at $13.5 trillion, then consumers have actually taken on $500 billion of additional debt since the end of 2008. The consumer hasn’t cut back at all. They are still spending and borrowing. It is beyond my comprehension that no one on CNBC or in the other mainstream media can do simple math to figure out that the deleveraging story is just a Big Lie.

Reading around, it seems that a lot of credit card debt has been written-off, but better-risk customers may be increasing their usage, especially business owners (perhaps finding a way around the dearth in other forms of bank lending):

Credit cards are now the most common source of financing for America’s small-business owners. (Source: National Small Business Association survey, 2008)

44 percent of small-business owners identified credit cards as a source of financing that their company had used in the previous 12 months —- more than any other source of financing, including business earnings. In 1993, only 16 percent of small-businesses owners identified credit cards as a source of funding they had used in the preceding 12 months. (Source: National Small Business Association survey, 2008)

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Gold up, shares down?

Hot on the heels of China, which has recently increased its gold hoard to over 1,000 tonnes and intends to accumulate far more, comes Russia, which has acquired an extra 10% in the last seven months.

This is at a time when the wealthy are turning pessimistic about the economy again. As I said two years ago, generally I now see newspapers as useless, except for tidbits like that: "Other than weather forecasts, the last usable information I can remember is from the summer of 1987, when I learned that Sir James Goldsmith had sold all his shares on the Paris Bourse, which confirmed my feelings about the way the market was going - but that item came from Private Eye magazine." The current pessimism is reflected not only in last night's close on the Dow (now below 10,000 again), but also in a surge in demand for safe government bonds, as "Jesse" reports.

I said a few days ago that the price of gold was well above its inflation-adjusted trend, but the interest of foreign countries, bearish millionaires and speculative funds boosted by cheaply borrowed money may keep the market buoyant for some time yet.

And I'm sure we'll all be watching the stockmarket with some interest this autumn.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

This is at a time when the wealthy are turning pessimistic about the economy again. As I said two years ago, generally I now see newspapers as useless, except for tidbits like that: "Other than weather forecasts, the last usable information I can remember is from the summer of 1987, when I learned that Sir James Goldsmith had sold all his shares on the Paris Bourse, which confirmed my feelings about the way the market was going - but that item came from Private Eye magazine." The current pessimism is reflected not only in last night's close on the Dow (now below 10,000 again), but also in a surge in demand for safe government bonds, as "Jesse" reports.

I said a few days ago that the price of gold was well above its inflation-adjusted trend, but the interest of foreign countries, bearish millionaires and speculative funds boosted by cheaply borrowed money may keep the market buoyant for some time yet.

And I'm sure we'll all be watching the stockmarket with some interest this autumn.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Gold up, shares down?

Hot on the heels of China, which has recently increased its gold hoard to over 1,000 tonnes and intends to accumulate far more, comes Russia, which has acquired an extra 10% in the last seven months.

This is at a time when the wealthy are turning pessimistic about the economy again. As I said two years ago, generally I now see newspapers as useless, except for tidbits like that: "Other than weather forecasts, the last usable information I can remember is from the summer of 1987, when I learned that Sir James Goldsmith had sold all his shares on the Paris Bourse, which confirmed my feelings about the way the market was going - but that item came from Private Eye magazine." The current pessimism is reflected not only in last night's close on the Dow (now below 10,000 again), but also in a surge in demand for safe government bonds, as "Jesse" reports.

I said a few days ago that the price of gold was well above its inflation-adjusted trend, but the interest of foreign countries, bearish millionaires and speculative funds boosted by cheaply borrowed money may keep the market buoyant for some time yet.

And I'm sure we'll all be watching the stockmarket with some interest this autumn.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

This is at a time when the wealthy are turning pessimistic about the economy again. As I said two years ago, generally I now see newspapers as useless, except for tidbits like that: "Other than weather forecasts, the last usable information I can remember is from the summer of 1987, when I learned that Sir James Goldsmith had sold all his shares on the Paris Bourse, which confirmed my feelings about the way the market was going - but that item came from Private Eye magazine." The current pessimism is reflected not only in last night's close on the Dow (now below 10,000 again), but also in a surge in demand for safe government bonds, as "Jesse" reports.

I said a few days ago that the price of gold was well above its inflation-adjusted trend, but the interest of foreign countries, bearish millionaires and speculative funds boosted by cheaply borrowed money may keep the market buoyant for some time yet.

And I'm sure we'll all be watching the stockmarket with some interest this autumn.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Thursday, August 26, 2010

Don't look at the FTSE, all is NOT well here

Gary Dorsch points out that the UK bond market is a better indicator of local economic conditions than the UK stockmarket:

FTSE-100 companies equal about 85% of the market capitalization of the London Stock Exchange, and nearly half the companies are headquartered outside the UK. Roughly one-third of the FTSE is concentrated in the natural resource sector. Thus, the Footsie is viewed as a global bellwether rather than a reflection of the state of the British economy.

Right now the sharp downward trajectory of UK gilt yields is flashing warning signals of a sharp downturn in the British economy, which could trigger deflation in wages and UK home prices.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

FTSE-100 companies equal about 85% of the market capitalization of the London Stock Exchange, and nearly half the companies are headquartered outside the UK. Roughly one-third of the FTSE is concentrated in the natural resource sector. Thus, the Footsie is viewed as a global bellwether rather than a reflection of the state of the British economy.

Right now the sharp downward trajectory of UK gilt yields is flashing warning signals of a sharp downturn in the British economy, which could trigger deflation in wages and UK home prices.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Subscribe to:

Comments (Atom)