Tuesday, April 27, 2010

The credit crunch revisited

The elegant presentation above is via Wolfie, slightly over a year ago. It needs updating: interest rates now down to zero in the USA, the banks bailed out by vast amounts of taxpayer cash, and houses still dropping in value. It seems to me like trying to inflate a ripped hot air balloon, or maybe this old cartoon from Punch magazine (click to enlarge):

Power to the people

A couple of days ago I referred to "rootless business magnates"; and a couple of years ago I said "Big MD (or Big CEO) will have his arm around the shoulders of Big Brother". Now, the Daily Mail runs a feature about how the super-rich are taking over our economy, just as the super-powerful are whipping democratic control from our hands.

They cannot stop themselves. And, I fear, it may end in tyranny, revolution or anarchy.

... and since writing this, I see Warren Pollock's latest presentation is about capture of law and regulation in the USA by powerful interests.

They cannot stop themselves. And, I fear, it may end in tyranny, revolution or anarchy.

... and since writing this, I see Warren Pollock's latest presentation is about capture of law and regulation in the USA by powerful interests.

Monday, April 26, 2010

Sunday, April 25, 2010

Invest defensively

Investment expert Jeremy Grantham gives his views via Financial Times video:

- the UK and Australia are still experiencing bubbles in housing

- there are potential bubbles in commodities and emerging markets

- savers are being tempted (I'd say almost forced) into speculating when they should be cautious

- the US stockmarket is generally overpriced, but...

- investors should be more interested in big, boring, robust companies such as Coca-Cola, Microsoft and Johnson & Johnson

Safety first

Investment expert Jeremy Grantham gives his views via Financial Times video:

- the UK and Australia are still experiencing bubbles in housing

- there are potential bubbles in commodities and emerging markets

- savers are being tempted (I'd say almost forced) into speculating when they should be cautious

- the US stockmarket is generally overpriced, but...

- investors should be more interested in big, boring, robust companies such as Coca-Cola, Microsoft and Johnson & Johnson

Inflation vs deflation

This article in The Economic Voice echoes what I've been saying for quite some time: the inflation issue is subject to market segmentation. Basics are costing more, luxuries are being sold at a discount. Though I suspect that luxuries of the very rich are another segment altogether.

Similarly, housing is segmented: the cost of basic stock in average income areas will, I think, decline in real terms, but the nicest property in the wealthiest areas may hold up OK. We're like different species in the sea, each with its optimum depth-habitat and ecosystem.

Similarly, housing is segmented: the cost of basic stock in average income areas will, I think, decline in real terms, but the nicest property in the wealthiest areas may hold up OK. We're like different species in the sea, each with its optimum depth-habitat and ecosystem.

Crime, compulsion and rescue

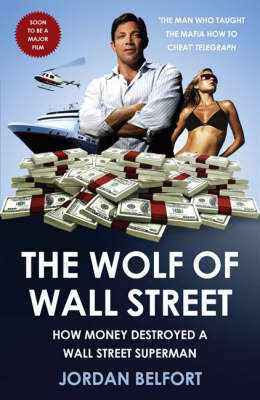

I recently read this outrageous confessional by super-successful pump-and-dumper Jordan Belfort.

I recently read this outrageous confessional by super-successful pump-and-dumper Jordan Belfort.I'm not particularly sold on sorry-for-criminals (The Godfather, The Sopranos and all the rest of that genre); I think it's an emotional con that salves our conscience for being imaginatively complicit in the crimes.

But I do think Belfort is a victim as well as a perpetrator; a driven, a hag-ridden man. How much of history has been shaped by these out-of-control types? Mao saw himself as a destructive natural force; Stalin wondered why people had always helped him.

One feature of Belfort's story that sticks in my mind is how he used the louche, high-burn lifestyle at Stratton-Oakmont as a means to enslave his employees. As he explained (p.86) to his financially prudent father during a row about expenses:

"There's a method to my madness, especially when it comes to the spending. It's important to keep these guys chasing the dream. And it's even more important to keep them broke. Look at them; as much money as they make, every last one of them is broke! They spend every dime they have, trying to keep up with my lifestyle. But they can't, because they don't make enough. So they end up living paycheck to paycheck on a million bucks a year. It's hard to imagine, considering how you grew up, but, nevertheless, it is what it is.

"Anyway, keeping them broke makes them easier to control. Think about it: virtually every last one of them is leveraged to the hilt, with cars and homes and boats and all the rest of that crap, and if they miss even one paycheck they're up shit's creek. It's like having golden handcuffs on them. I mean, the truth is I could afford to pay them more than I do. But then they wouldn't need me as much. But if I paid them too little, then they would hate me. And as long as they need me they'll always fear me."

Belfort is plenty clever enough to play the repentant sinner - his book makes clear his manipulative approach to loved ones as well as employees - but it may well be that a part of him wanted to be stopped. The addictive, compulsive pleasuring is a whirring of hind legs scrambling to get away from the edge of what Clarissa Dickson-Wright calls "the abyss", to which even death is preferable. His permanently overactive mind required daily stunning with Quaaludes, because he didn't know how else to slow it down.

Returning to Stalin, another who could control everything except himself, I recall a TV programme about concert pianist Maria Yudina, who dared to write to him in frank terms that one would have thought were certain to get her shot or sent to Siberia. I have tried to find a transcript but this is the best I can do - though I clearly remember she referred not to his soul, but his "black heart". She had a courage almost insane. And yet he spared her. Was there a speck of gold left in the Stygian recesses of his spirit? I think so. When anticlericals have finished railing against bells and smells, there will still be the issue of the abyss and the light.

Subscribe to:

Comments (Atom)