"On what little things does happiness depend!" wrote Oscar Wilde in the Nightingale and the Rose. He was referring to the heartbreak endured by a student who needed to get a red rose to impress a professor's daughter. Actually it turned out that the professor's daughter was a bloody idiot and didn't deserve the red rose that was only secured through the agonising death of a lovely nightingale; he should've just written a request for fellatio on the back of a bus ticket and stuck it to her forehead - and insisted on the return of the ticket.

Thus Russell Brand, in the Guardian newspaper. His louche autobiography is entitled "My Booky Wook", though for some reason he doesn't apply the same baby-linguistic titling approach to his blog or website ("My Blogy... no! No! Career death!"). For there are things these jokers take very, very seriously: banknotes.

The Teflon coating on his deadly bullets of vulgarity is a trifling pretension to verbal and literary sophistication. And it's happening all around, and so very well rewarded.

Of course, the next generation is past TV. So what are your children playing on the Internet? Here's some of the games I've seen ten-year-olds chuckling at in the last fortnight:

Stair Fall

The Torture Game

The Last Stand 2

And as fast as you block these entertainments, new routes to them appear via new game compendium sites. And more and more new games, most of them free of charge.

But the work of psychic corruption must proceed, so we must be inoculated against notions of censorship by tendentious TV biopics of well-meaning moral campaigners like Mary Whitehouse, who was of course not nearly so posh, sophisticated, well-breeched and well-connected as the moguls she took on. So smart are we that she is to be condemned as much for her eyewear as for her lower-middle-class status and dowdy profession (schoolteaching - art and sex education).

I think we must wait for the University rebels of the late Sixties to retire or die before we can start the salvage operation.

Sunday, June 15, 2008

In the paper shop

6.30 a.m. today. An elderly man is poring over the pink Lottery result printout in the newsagent's. He's had four numbers come up.

"Drinks are on you, then," I say.

"I've spent £35,000 since the Lottery started, and had five back," he says.

He'd come to the shop at six, having forgotten that it opens at half-past. He thinks he's in the early stages of Alzheimer's.

__________________________________

Here's some lines of comment that could come out of this, but you can easily expand them yourself, I'm sure:

"Drinks are on you, then," I say.

"I've spent £35,000 since the Lottery started, and had five back," he says.

He'd come to the shop at six, having forgotten that it opens at half-past. He thinks he's in the early stages of Alzheimer's.

__________________________________

Here's some lines of comment that could come out of this, but you can easily expand them yourself, I'm sure:

- Mathematics - the Lottery gives back 45% in prizes, but averaging-out could take forever

- What is a Government doing, making gambling so easy and readily available (and it started under the Tories)?

- How much would this man have had, if he'd saved £208 per month since 1994?

- Now that insurance salesmen have disappeared, what has happened to savings among the C2/D classes? Has financial consumer protection (after the pensions mis-selling compensation and regulation bonanza) indirectly impoverished them and made them more dependent on the State?

I expect you can come up with more, and better.

And then there's drink, from allowing supermarkets to sell it along with your groceries, to 24-hour booze licensing.

Are misguided arguments for liberty being used to enslave people to their weaknesses? Should heavily-capitalised businesses be allowed to batten on those flaws?

Saturday, June 14, 2008

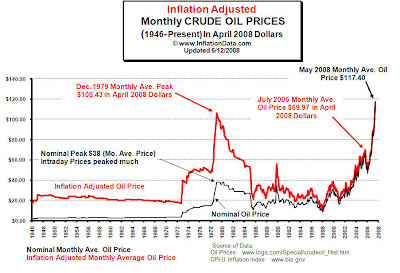

Oil: back to the Seventies

Found on InflationData.com

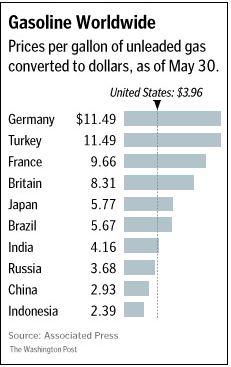

Unbidden, The Time Warp came to me (though I had thought the word "shimmy" appeared in the lyrics). And, of course, as usual, the Brits manage to get themselves into a worse pickle:

Found on Mish's.

Fasten your seatbelts

"Chervil" (author of the Australian Green Living blog) has kindly directed me to this article in the Sydney Morning Herald, which refers to ideas about economic long cycles:

David Hackett Fischer has studied the behaviour and historical meaning of inflation not just over the last decade, or the last century, but over the last 800 years. He sees the world positioned in a dangerous moment of possibility, on the rearing crest of the fourth great wave of inflation in eight centuries.

I would still be grateful for any information about what I shall call "sim economics" - potentially so much more useful than other simulation games.

Anybody able to help, please?

David Hackett Fischer has studied the behaviour and historical meaning of inflation not just over the last decade, or the last century, but over the last 800 years. He sees the world positioned in a dangerous moment of possibility, on the rearing crest of the fourth great wave of inflation in eight centuries.

I would still be grateful for any information about what I shall call "sim economics" - potentially so much more useful than other simulation games.

Anybody able to help, please?

Friday, June 13, 2008

Help required: economic modelling

Following reported opinion from Marc Faber and others that we may expect sell-offs in commodities, bonds, equities and real estate, and given concerns about the quality of our currencies, the question arises, where should we hold our cash?

It seem that in the USA and UK, we are holding down interest rates to avoid crippling homeowners, the home-loan-based economy, and what's left of our industries, and also in the hope that we can repay our debts to foreigners with devalued cash. On the other side, countries like China and Japan seem to be trying to prevent their currencies from appreciating, so as to preserve their trading advantage.

So one party is letting their currencies sink, and the other is trying to stop theirs rising. To this amateur, the world's foreign exchange system looks like a bunch of corks tied to an unchained anchor and flung into the sea. Will the string on the corks hold, or break under the strain, or be abruptly cut?

Is there any computer- or board-game-based model of the world economic system, that might make it clear to me how this wretched thing works?

And how is the ordinary person to save money and preserve its value in real terms, without having to be super-sophisticated? I know something about American TIPS and British NS&I Index-Linked Savings Certifcates, but I'm leery of handing the government what little money they haven't already extracted from me in taxes. And I don't trust them to define inflation fairly.

Does anybody know how this boneshaker of a contraption actually operates, so we can make sensible decisions?

It seem that in the USA and UK, we are holding down interest rates to avoid crippling homeowners, the home-loan-based economy, and what's left of our industries, and also in the hope that we can repay our debts to foreigners with devalued cash. On the other side, countries like China and Japan seem to be trying to prevent their currencies from appreciating, so as to preserve their trading advantage.

So one party is letting their currencies sink, and the other is trying to stop theirs rising. To this amateur, the world's foreign exchange system looks like a bunch of corks tied to an unchained anchor and flung into the sea. Will the string on the corks hold, or break under the strain, or be abruptly cut?

Is there any computer- or board-game-based model of the world economic system, that might make it clear to me how this wretched thing works?

And how is the ordinary person to save money and preserve its value in real terms, without having to be super-sophisticated? I know something about American TIPS and British NS&I Index-Linked Savings Certifcates, but I'm leery of handing the government what little money they haven't already extracted from me in taxes. And I don't trust them to define inflation fairly.

Does anybody know how this boneshaker of a contraption actually operates, so we can make sensible decisions?

Speaker or silencer?

I now read in The Grumbler that David Davis was prevented by the Speaker of the House of Commons from delivering his resignation speech to the House, and had to go outside the building to say it to journalists instead. Words fail.

Thursday, June 12, 2008

What oil hike?

The Mogambo Guru (too long absent from these pages) points out that a major factor in the increase in the price of oil, is simply the decline in the dollar. We here in the UK don't see it, because the pound is staring the dollar in the eye as both go screaming parachuteless towards the ground.

At least Richard Daughty is one who will not go gentle into that good night.

Now, isn't this what happened in the Seventies? Only we were conned into thinking it was down to wicked Arabs, when really the story was increased monetary inflation for some years pre-1974.

At least Richard Daughty is one who will not go gentle into that good night.

Now, isn't this what happened in the Seventies? Only we were conned into thinking it was down to wicked Arabs, when really the story was increased monetary inflation for some years pre-1974.

Subscribe to:

Comments (Atom)