IMPORTANT: Please note the disclaimer below before continuing!Matters are coming to a head in the financial markets.

The yields on Spanish and Italian government bonds recently exceeded 6% for a while; at 7%,

it is estimated, Italian public borrowing becomes unsustainable and Italy then joins Greece in the category of countries doomed to at least partially default on their obligations.

On the other hand, it's possible that the 7% point will not be reached, or if it is, not for long. So much depends on market confidence and as is well known, fear may trigger a crisis that is otherwise avoidable.

But so can the greed of speculators. While Britain's 1992 "Black Wednesday" made George Soros a reported USD $1 billion, the cost to the UK of its attempts to support the pound against his and others' shorting

is estimated at over £3 billion sterling. He has since developed a reputation as a philanthropist; we could wish for a less expensive way to fund a benefactor. *

The difficulties in Europe come at a most unfortunate time for the USA, since there is now a showdown between President Obama and Congress over raising the debt ceiling for American public borrowing. The President

has indicated that a deal needs to be struck by this Friday to give time for enactment by the August 2 deadline, which I guess will really mean more last-minute hard negotiating over this weekend. Brinkmanship is a dangerous game to play: it nearly blew up the world in the Cuban Missile Crisis of 1962, and then as now, everything depends on both sides remaining sane.

It's ironic that a financial elite, having looted the economy for decades and left it pretty much unworkable, then blames the losers and expects them to pay all the costs of putting things right, and that without delay. What nonsense:

America's problem is private debt, which over the last 30 years has so enriched some of these born-again pecuniary Puritans. Yes, public sector workers have enjoyed great salaries and pensions compared to the

People of Walmart (

though please, say nothing about the top 10 hedge fund managers whose average earnings are $1.75 billion); but what fortunes have been made on the back of arranging mortgages on their increasingly crazily-priced houses? It takes two to tango; and the same number to quarrel, as we now see.

Well, the reckoning is coming, even if some won't pay their fair share of the bill. As

"Mish" reported yesterday, the yield on the US Treasury 30-year bond is increasing and he is predicting a bond market revolt "sooner than anyone thinks".

And, scarcely believably, here come the speculators again. They made money packaging debt, making sausages with as much old roadkill as fresh meat in them; then they made governments pay for the consequences; now they gamble on which countries will go bust as a result.

Last month, Martin Hutchinson reminded us that he'd warned in 2008 about credit default swaps, especially the ones that are "naked", i.e. insure events that would not in themselves result in any loss to the investor. This simply gambling, and it makes a bad situation worse; it did so, he argues, with Lehman Brothers and others, and will do so with Greek debt, where the loss on default will have added to it the cost of an estimated $100 billion in side bets.

Now there are those who will argue that the CDS market, though enormous ($60 trillion in 2008, half that now), isn't a dangerous one, exactly because it's a gambling operation. Loser pays winner, so it's a zero-sum game.

But it's not.

Firstly, there's the question of mispriced risk. Hutchinson explains: "Wall Street's risk management looks at normal price fluctuations and then assesses the maximum possible risk as a modest multiple of the daily fluctuation, it was completely inadequate in measuring the risk of a CDS book. That, in a nutshell, is why AIG went bust and had to be bailed out with $170 billion of taxpayer money."

Then there's the interaction between the speculators and the authorities. Goldmans Sachs was compensated by the taxpayer for losses on AIG debt, in addition to claiming on its CDS on the same. It's like getting paid twice on an auto repair job. Rather questionable, that.

And there's the risk of outright fraud, which is how rogue trader

Nick Leeson destroyed Barings, Britain's oldest investment bank: he hid his losses in a secret account and increased his bets to try to recoup them. That put Barings' capital at stake in a way that the naive, old-fashioned management failed to foresee.

Which leads us to the problem of contagion. Banks can go bust, but their depositors are protected (subject to limits) by the

FDIC. Not only does that puts the taxpayer on the hook, but the FDIC, being a corporation with limited assets, may itself become insolvent if the scale of losses is too great (in fact,

that was the position only two years ago). We then have either partially-busted depositors, or (if politics forces it) a further burden on what under the circumstances is likely to be an already-distressed public budget.

And what if insurance and pension funds have to pay out on CDS contracts? As Hutchinson points out, banks have limited balance sheets, but the funds that represent security for the nation's savers have much more to place at risk in contracts that many of the fund managers won't properly understand or calculate - which made them such suckers for packaged debt (CDOs and variants). "Fool me once, shame on you; fool me twice, shame on me." Hutchinson, who ran a derivatives desk in the 1980s, assessed CDS as a "sophisticated scam". So I should like to know the total downside of CDS for pension and life companies. Could this result in massive extra welfare support for retirees?

Derivatives are the fourth horseman in Michael Panzner's apocalypse, or "

Financial Armageddon" as his March 2007 book titled it (reviewed

here in May of that year). The market,

recently estimated at $601 trillion,

is worth some 8.75 times the world's GDP (or nearly 40 times that of the US), so a relatively small percentage imbalance as per some of the ways illustrated above, represents a huge potential problem. The subsector including interest rate and CD swaps is expected to grow by 10% within a couple of years,

according to Citigroup (itself a name to conjure with,

in the light of recent history).

Will the Dodd-Frank Act prevent all problems in future? Not, I'd have thought, with many of the nation's brightest brains employed on Wall Street and perpetually looking for ways to game the system. I don't know the loopholes and weaknesses, but I'm betting on that talent, human nature and the fabulous scale of the incentives involved, to find them out.

One way or the other, the money looks as though it's going to run short. This will lead to increased reluctance on the part of lenders, and so raise interest rates and tank the market in existing bonds. Coming back to Martin Hutchinson, he wrote on Seeking Alpha

at the beginning of this month, predicting an "epic" crash in September or December, though if things go wrong in current budget negotiations that date could come sharply forward. It seems inevitable that such a crash would also impact on equities, what with deleveraging and the depressing effect on demand of a severe deflation.

Will a mooted QE3 help? I'm not sure. What did QE2 do? The banks got a raft of money from government, couldn't find anyone who they wanted to lend it to and parked it at the Fed to get safe interest. In effect, the State is rebuilding the banks' reserves for them, on the drip. But as real estate continues to dwindle in price, the bank reserve ratios may actually worsen despite all this help. And whatever the outcome of current budget negotiations, the private debt ceiling seems to have been reached already, so the frightened consumer is hardly likely to shore up the economy with extra demand.

I cannot envisage how this can continue for much longer*, unless the government takes back from the Federal Reserve the right to issue money, in which case rip-roaring inflation is a possibility, followed by a total reset, as in Germany in 1923. But avoiding that is surely the point of a central banking system: not to have a Chancellor Havenstein operating 2,000 presses 24/7 printing currency with face values in the billions, truckloads of which were still waiting to move out on the day he died. Dropping dollars by helicopter might work in this terrible way (though C-5s would be more commodious); shoving money into the banks hasn't done so.

Perhaps the strategy will be debt default, but again I can't somehow picture the virtuous depositors being allowed to keep their dollars and see them multiply in spending power, even though at least one New Yorker appears to

hold $100 million in a checking account. Is that a vote for cash as the best asset?*

Hutchinson's

latest post advocates gold (an each way bet if you think deflation ends with a currency crisis), buying a house (even though he thinks it'll go down in value) and finally, a put option on Treasuries. Like me, he's struggling, really: gold is above its long-term inflation-adjusted trend, houses seems to be a bad investment for ready cash (unless you're one of the growing number of bottom-fishers snapping up distressed properties at 40% off) and options carry counterparty risk, which is where we came in.

In the event of a full-scale disaster, all bets are off. All I can suggest is diversification among all assets, plus holding some away from banks and other fiduciary institutions. And, of course, hope. ________________________

*Though I'm confused, it seems I'm in good company here:"...even such "legendary" hedge funds as Soros' $25 billion Quantum are about as clueless as everyone else. Bloomberg reports that "the fund is about 75 percent in cash as it waits for better opportunities, said the people, who asked not to be identified because the firm is private."

The reason: "“I find the current situation much more baffling and much less predictable than I did at the time of the height of the financial crisis,” Soros, 80, said in April at a conference at Bretton Woods organized by his Institute for New Economic Thinking. “The markets are inherently unstable. There is no immediate collapse, nor no immediate solution."

-

Zero Hedge____________________________

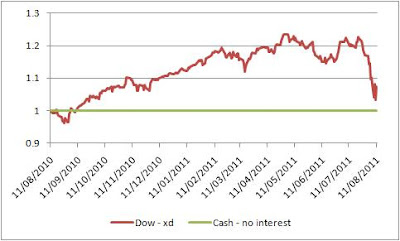

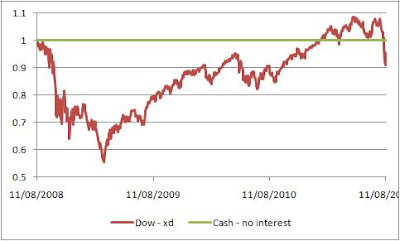

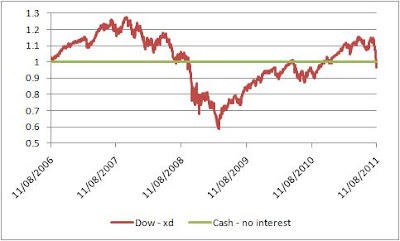

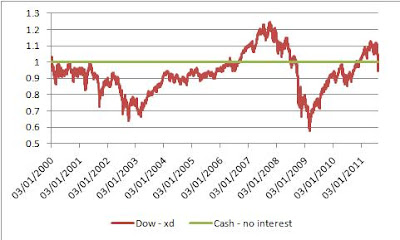

INVESTMENT DISCLOSURE: None, except for (UK) NS&I Index-Linked Savings Certificates (similar to US TIPS). Otherwise, still in cash, and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The mainstream news media often seem to me like boastful, lying Rumour at the start of Shakespeare's Henry IV Part II:

The mainstream news media often seem to me like boastful, lying Rumour at the start of Shakespeare's Henry IV Part II: