George Soros is

retiring, closing his fund to outside investors and returning their money.

Some say it's because he's become old (81) and cautious, other suggest it's to avoid being regulated by the Securities and Exchange Commission, but he himself has said “I find the current situation much more baffling and much less predictable than I did at the time of the height of the financial crisis.”

Stanley Druckenmiller, one of Soros' former fund managers, also threw in the towel last year, and he's only 58.

Closing hedge funds is a trend, and the issue now even has its own website:

The Hedge Fund Implode-O-Meter. I see this as further confirmation that it is no longer "business as usual" in the investment world. It is, perhaps, like that stage in WWII when senior officials on the losing side prepared fake IDs and packed gold and art treasures for their flight; that is, it's no longer about gain, but about hanging on to what you've taken.

This, I think, is part of what's behind the current US budget crisis. Agreed, public spending is out of control, but that has been so for a very long time. What's forcing us towards disaster is the overall level of debt, of which much the greater part is private credit. Players in finance and politics colluded to encourage the housing and credit bubbles, which disguised the failure to nurture domestic production and balance imports with exports. Fees, interest and selling securitised debt, plus capital gains on inflated assets in a booming economy, made many people rich, and some super-rich; and they bought the government and regulators.

The ordinary Joe's real wages stalled for 30 years and more, but loading him with easy credit (and sending his wife out to work) kept the show on the road. Now, it seems, the objective is to get him to pay for everything, without asking his masters for any of the money they made out of the game.

If the elite succeed, they keep their extraordinary wealth and Joe suffers. Actually, it looks as though they cannot lose, since most cash, bonds and equities are owned by the top 1% of the population. Even their houses will tend to retain most of their value, since the only people who can aspire to buy them are other people with lots of money.

Inflation would hit cash and bonds, but the rich also have most of the equities and nice houses. Deflation would amplify the power of cash and (provided there is no default) attractiveness of bonds, and the rich have most of that, too.

So why do we feel that we're at some break point? I think it's because the balance of opportunity and threat has altered significantly.

Firstly, there's nothing much more to steal; expansion is no longer a prospect.

Second, the economy may not rebalance without an increase in taxation, and I should think some of the wealthy are on the lookout for the possible imposition of capital controls that would prevent them from fleeing abroad with their money. The more far-sighted are already

renouncing their US citizenship.

Third, if the system cannot survive without some redistribution of wealth, but those who have it hold on too hard, there may be a breakdown in the social order. Last year, Marc Faber and Ron Paul were each predicting such problems, Faber recommending moving out of cities because they are such easy targets for attack.

I agree with them. I think that when irrational greed and resentful desperation meet, there can be no good outcome. We are planning to move soon to somewhere pleasanter, but also, we hope, safer. We are beyond knowing what to do with our savings, other than to diversify so that we don't lose everything, and not to entrust it all to third parties.

Looks like the super-rich hedge fund managers think the same way.

INVESTMENT DISCLOSURE: None. Still in cash, and missing all those day-trading opportunities.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

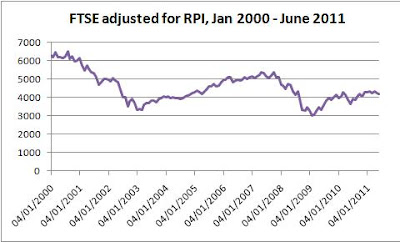

The FTSE closed Friday 49.4% higher than 29 months ago; the Dow, 74.8% higher.

The FTSE closed Friday 49.4% higher than 29 months ago; the Dow, 74.8% higher.